Our Blog

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

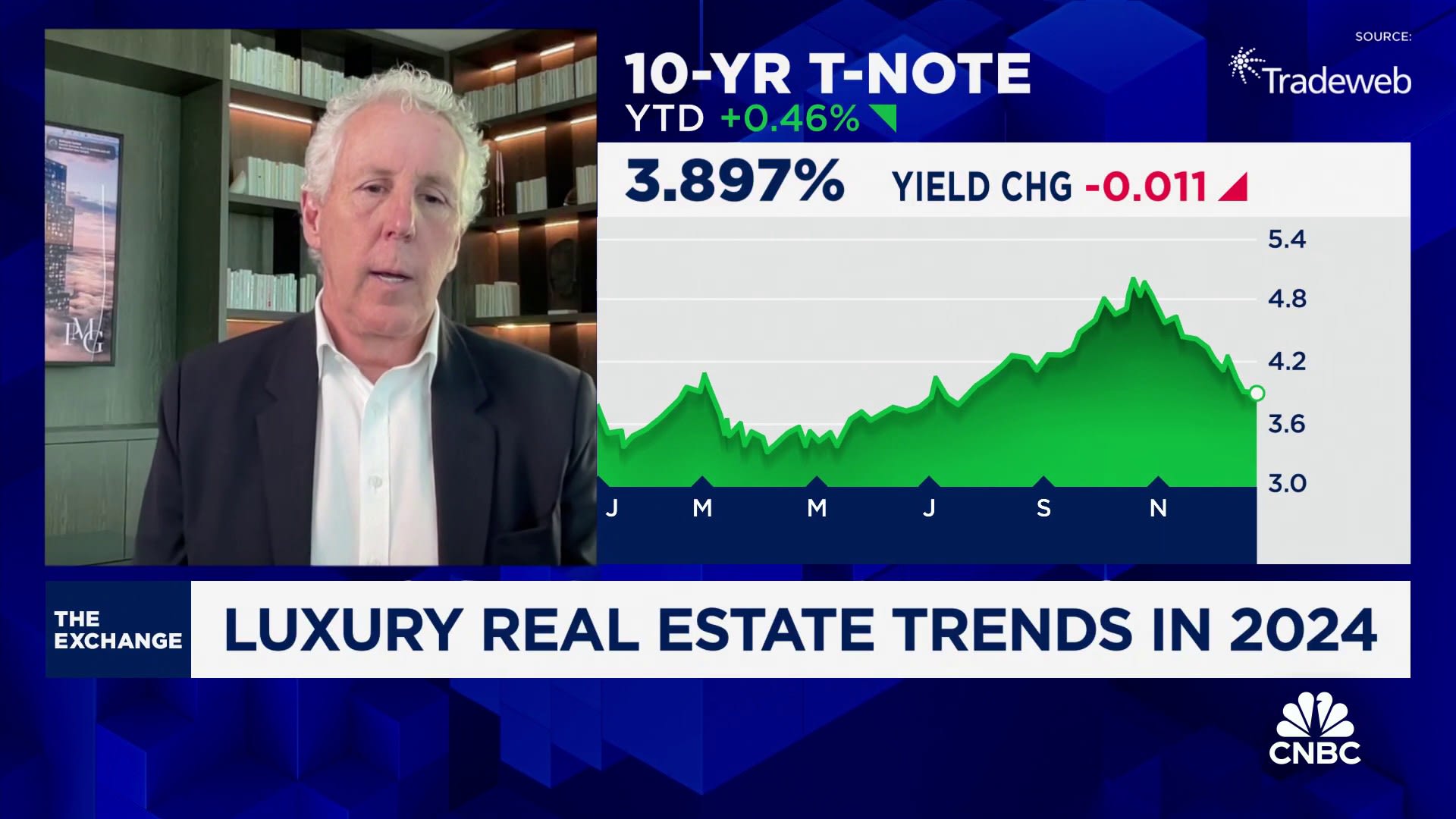

PMG CEO on luxury real estate, top housing markets and supply and demand

ShareShare Article via FacebookShare Article via TwitterShare Article via LinkedInShare Article via EmailKevin Maloney, Property Markets Group CEO, joins ‘The Exchange’ to discuss real estate, top housing markets and outlook.03:55Tue, Dec 26 20232:47 PM EST Source link

Low-Cost Properties Are Actually the Most Expensive

In this article Low-cost properties are appealing because you can acquire and generate income with less initial capital. However, they are actually the most expensive way to achieve and maintain financial freedom. Here’s why. What Determines Prices and Rents? Real estate prices and rents are driven by supply and demand. When the number of sellers […]

Homebuyers always respond to lower interest rates, says NAR’s Lawrence Yun

ShareShare Article via FacebookShare Article via TwitterShare Article via LinkedInShare Article via Email Lawrence Yun, National Association of Realtors chief economist, joins ‘Squawk Box’ to discuss the state of the housing market, how mortgage rates impacted the housing market, and more. 03:08 Wed, Dec 27 20238:13 AM EST Source link

The “Rolling Recession” Has a New Target in 2024

Americans have been waiting for a recession to kick in for the past year. With consumer sentiment down and debt piling up, it’s understandable why so many feel like the worst is yet to come. But what if the “hard landing” everyone was so afraid of already happened without us even noticing it? Could a […]

Housing expectations for 2024: What you need to know

CNBC's Diana Olick joins 'Squawk Box' to break down the housing expectations for 2024 and more. Source link

Rents Show Biggest Decline in 3 Years—Should Landlords Panic?

In this article Redfin’s November rent report is out, showing that median rent prices declined by 2.1% year over year. This is the biggest decline since 2020, and renters nationwide will breathe a sigh of relief. Landlords and investors? Perhaps not so much, although there are regional variations that are worth exploring if you’re planning […]

There will be an increase in lending in 2024, says ConnectOne Bank CEO

ShareShare Article via FacebookShare Article via TwitterShare Article via LinkedInShare Article via Email Squawk on the Street Frank Sorrentino, ConnectOne Bank CEO, joins ‘Squawk on the Street’ to discuss the housing sector and more. 04:51 Wed, Dec 27 202311:00 AM EST Source link

How to Start Thinking, Acting, and Investing Like the Rich

Everyone wants to know how to get rich. And here’s the truth: getting rich might be much easier than you think. While most people would assume the wealthy grind their way to success, this isn’t always the case. In fact, rich people are FAR lazier than you think, and we’re not saying that in a […]

Home prices are expected to be flat in 2024, says Zillow’s Skylar Olsen

ShareShare Article via FacebookShare Article via TwitterShare Article via LinkedInShare Article via Email Money Movers Skylar Olsen, Zillow chief economist, joins ‘Money Movers’ to discuss her outlook for housing in 2024 and more. 04:35 Wed, Dec 27 202311:24 AM EST Source link