Our Blog

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

What to Look for When Buying a Rental Property (7 Considerations)

In this article Knowing what to look for when buying a rental property will save you time and money while reducing stress. In this article, we outline seven considerations that you can’t afford to overlook. Consideration 1: Location Location, location, location is consideration No. 1 when buying a rental property. Is the property close to […]

The U.S. is short 4.5 to 5 million homes, says Re/Max CEO Nick Bailey on housing demand

ShareShare Article via FacebookShare Article via TwitterShare Article via LinkedInShare Article via Email Nick Bailey, Re/Max CEO, joins ‘Closing Bell Overtime’ to talk housing prices, the state of the real estate market, what’s ahead for 2024 and more. 03:50 Wed, Dec 27 20235:30 PM EST Source link

How to Make Even MORE Cash Flow Off Your Rental Properties

Want to make multiple streams of income? Well, guess what? You DON’T need to buy more properties to do it. Instead, you can turn an existing rental property into a cash cow…but it has to meet the right qualifications. This is precisely what today’s first guest, Stacie, is looking for. She’s got multiple properties, and […]

November pending home sales unchanged, despite lower mortgage rates

Pending home sales in November were unchanged compared with October and 5.2% lower than November of last year, according to the National Association of Realtors. The reading, which is based on signed contracts during the month, is a forward-looking indicator of closed sales as well as the most current look at what potential homebuyers are […]

These Markets Are Most (and Least) Vulnerable to Housing Declines

In this article Every real estate investor wants to know if there’ll be a housing market downturn in 2024. But perhaps a better question to ask, now and always, is: “Which local markets are most at risk of a downturn?” Regional variations consistently play a part in any housing market analysis or forecast. And now […]

CBRE Hong Kong discusses property market

ShareShare Article via FacebookShare Article via TwitterShare Article via LinkedInShare Article via Email Marcos Chan, head of research at CBRE Hong Kong, says demand for residential property will nevertheless pick up, and a “couple of percentage points up” in prices is possible. Source link

How Much Does an Airbnb Host Make? (9 Factors)

In this article Are you considering listing your property on Airbnb? Understanding how much an Airbnb host can make before listing your property as a short-term rental (STR) is crucial. Factors affecting profitability include Airbnb fees, property maintenance, occupancy rates, and location. With fierce competition in the Airbnb rental market, understanding these factors is crucial […]

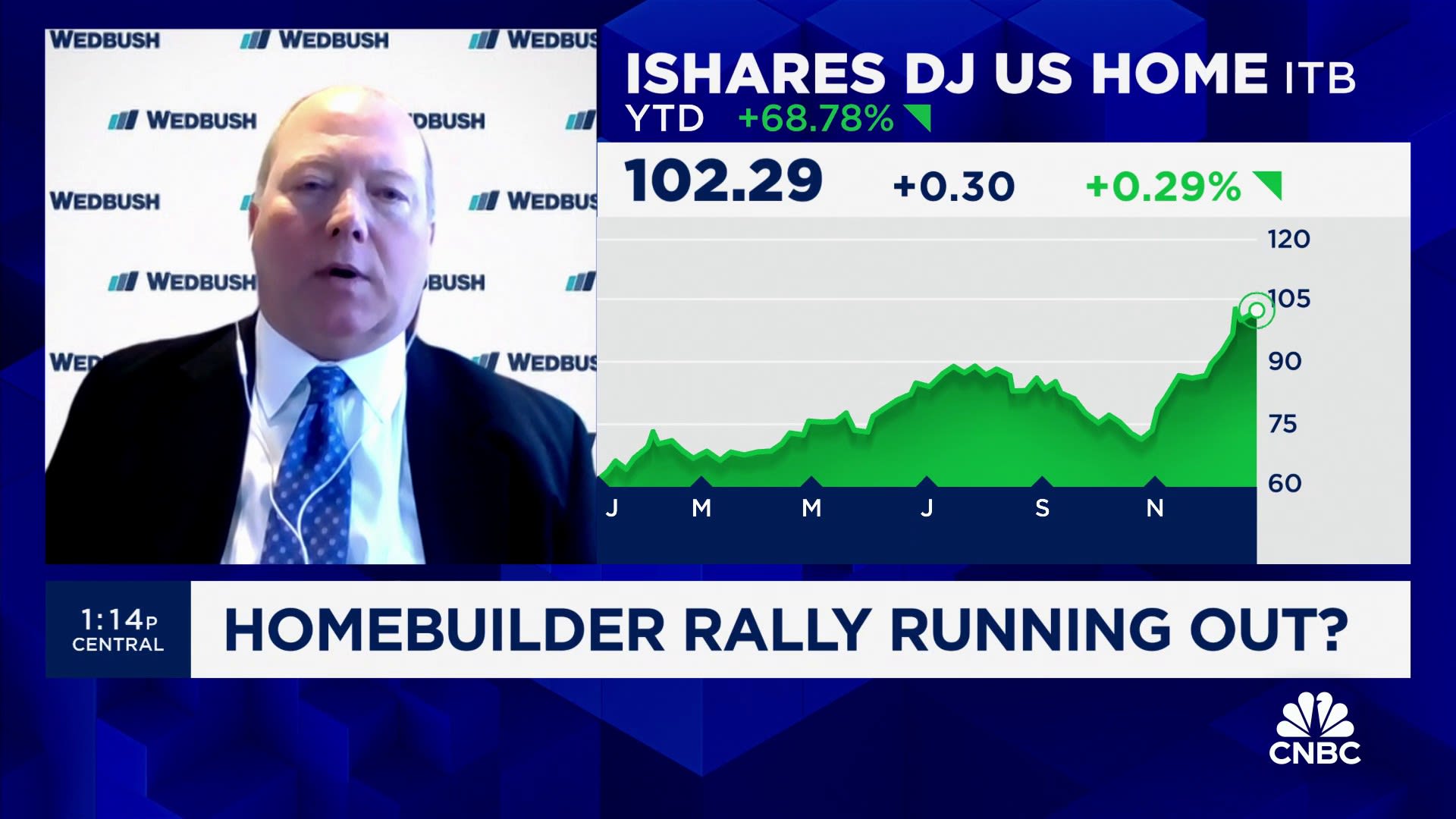

The housing supply may not be able to keep up with demand next year, says Wedbush's Jay McCanless

Jay McCanless, Wedbush housing analyst, joins 'Power Lunch' to discuss the housing sector. Source link

The “Buy Box” for Buying BIG Properties

For the past year, commercial real estate has been the disappointing big brother of rental properties. As housing prices went up, commercial real estate prices went down. When primary mortgage rates were high, commercial mortgage rates were even higher. With record-setting vacancy rates in areas like office and less reliance on retail, many investors thought […]