Our Blog

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

The BEST Rookie Investor Tips, Tricks, Hacks, and Advice of 2023

We got to talk a WHOLE lot of real estate in 2023. With topics ranging from partnerships to home renovation hacks, we covered a ton of ground this year and hope the information helped YOU on your real estate investing journey!Today, we’re taking a trip down memory lane—reflecting on all of the amazing guests and […]

Playbook and outlook for next year in housing looks similar to this year, says Oppenheimer’s Batory

ShareShare Article via FacebookShare Article via TwitterShare Article via LinkedInShare Article via Email Tyler Batory, analyst at Oppenheimer, joins ‘Squawk on the Street’ to discuss what the new rate environment does for the homebuilder stocks, what could make the Federal Reserve worried again, and more. 03:33 Thu, Dec 14 202311:18 AM EST Source link

Are the “Best Places to Live” in the US Worth Investing In?

Where are the BEST places to live in the US? Well, U.S. News & World Report just released their annual list to show which cities are worth picking up and moving to. Some of these cities are investor favorites, while others are rarely discussed within the real estate investing community. If these cities truly are […]

ECB closely monitoring the ‘suffering’ commercial real estate sector, supervisory board chair says

ShareShare Article via FacebookShare Article via TwitterShare Article via LinkedInShare Article via Email Andrea Enria, chair of the European Central Bank’s Supervisory Board, discusses the banking sector, the economic environment and the risks to commercial real estate with loans due to mature in early 2024. 08:20 Tue, Dec 19 20236:00 AM EST Source link

From Sleeping on a Dirt Floor to Making $80K/Month (in 2 Years!)

Happy holidays, BiggerPockets listeners. You’ve all been good this year, so instead of a lump of coal, you’re getting a special episode delivered on the most merry day of the year. We’ll be sharing Yamundow Camara’s unbelievable journey from dirt-poor poverty to INCREDIBLE passive income, even against all odds. If you’re unsatisfied with your holiday […]

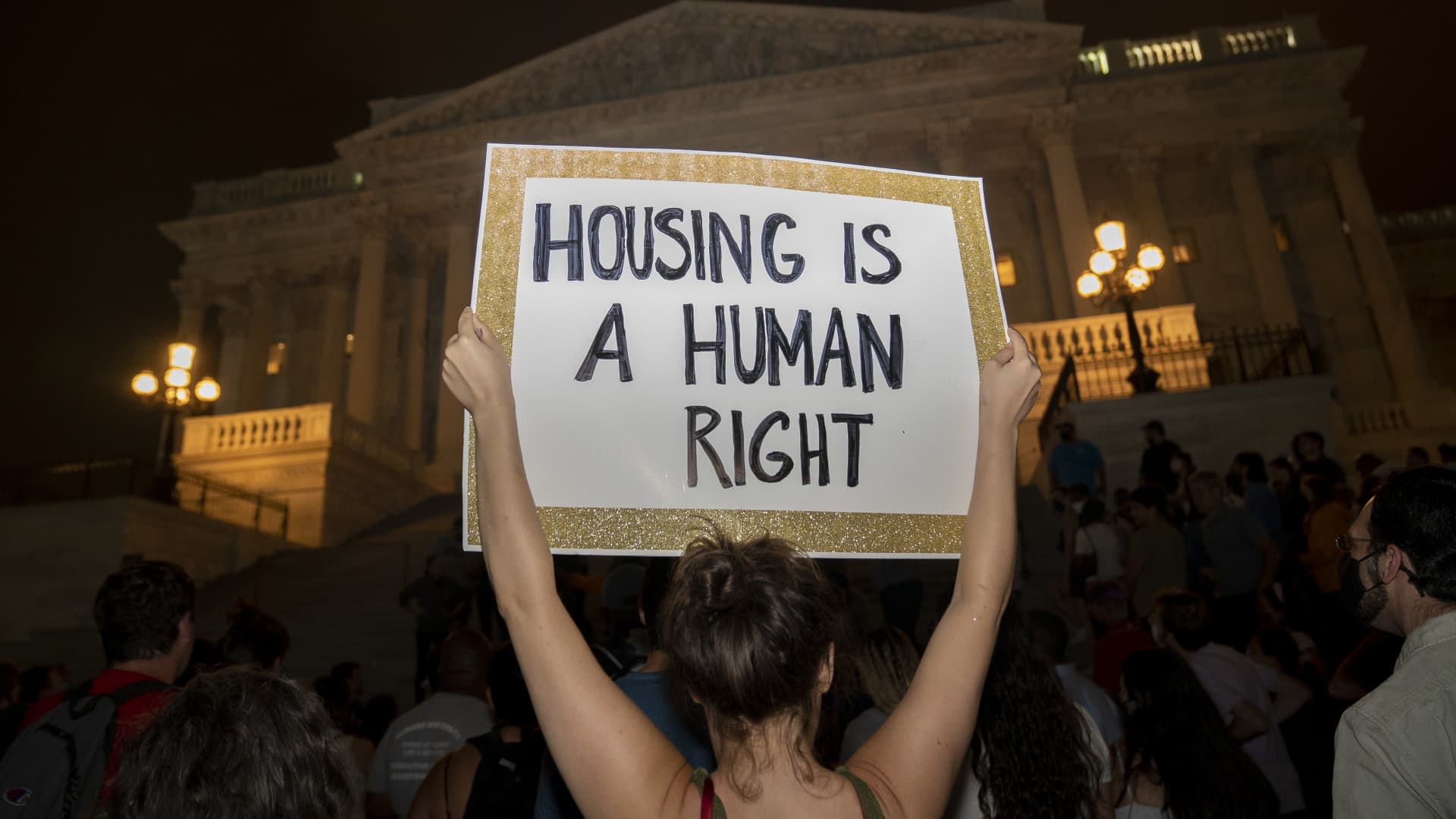

Unaffordable rents linked to premature death

Demonstrators gather during a protest against the expiration of the eviction moratorium outside of the U.S. Capitol in Washington, D.C., U.S., on Sunday, Aug. 1, 2021. Stefanie Reynolds | Bloomberg | Getty Images Renters burdened by unaffordable housing costs may be at a higher risk of dying sooner, according to a new study published in […]

What Is a Good ROI on Rental Property? (Factors & Tips)

In this article When you buy a rental property, you do so with one goal in mind: to generate a positive return on investment (ROI). So, What Is a Good ROI on Rental Property? A good ROI on rental property typically ranges from 6% to 10%, although this can vary with location, property type, and […]

2024 will be the 'golden age' of new home construction, says Howard Hughes CEO David O'Reilly

Hosted by Brian Sullivan, “Last Call” is a fast-paced, entertaining business show that explores the intersection of money, culture and policy. Tune in Monday through Friday at 7 p.m. ET on CNBC. Source link

Are We Experiencing “Transitory Mortgage Rates”? What Does That Mean For Rates?

In this article In March 2021, Federal Reserve Chairman Jerome Powell said, “[T]hese one-time increases in prices are likely to have only transient effects on inflation.” From then on, “transitory inflation” became the phrase of the year in economics, with high hopes that once the initial supply chain shocks and government stimulus after the onset […]