Our Blog

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

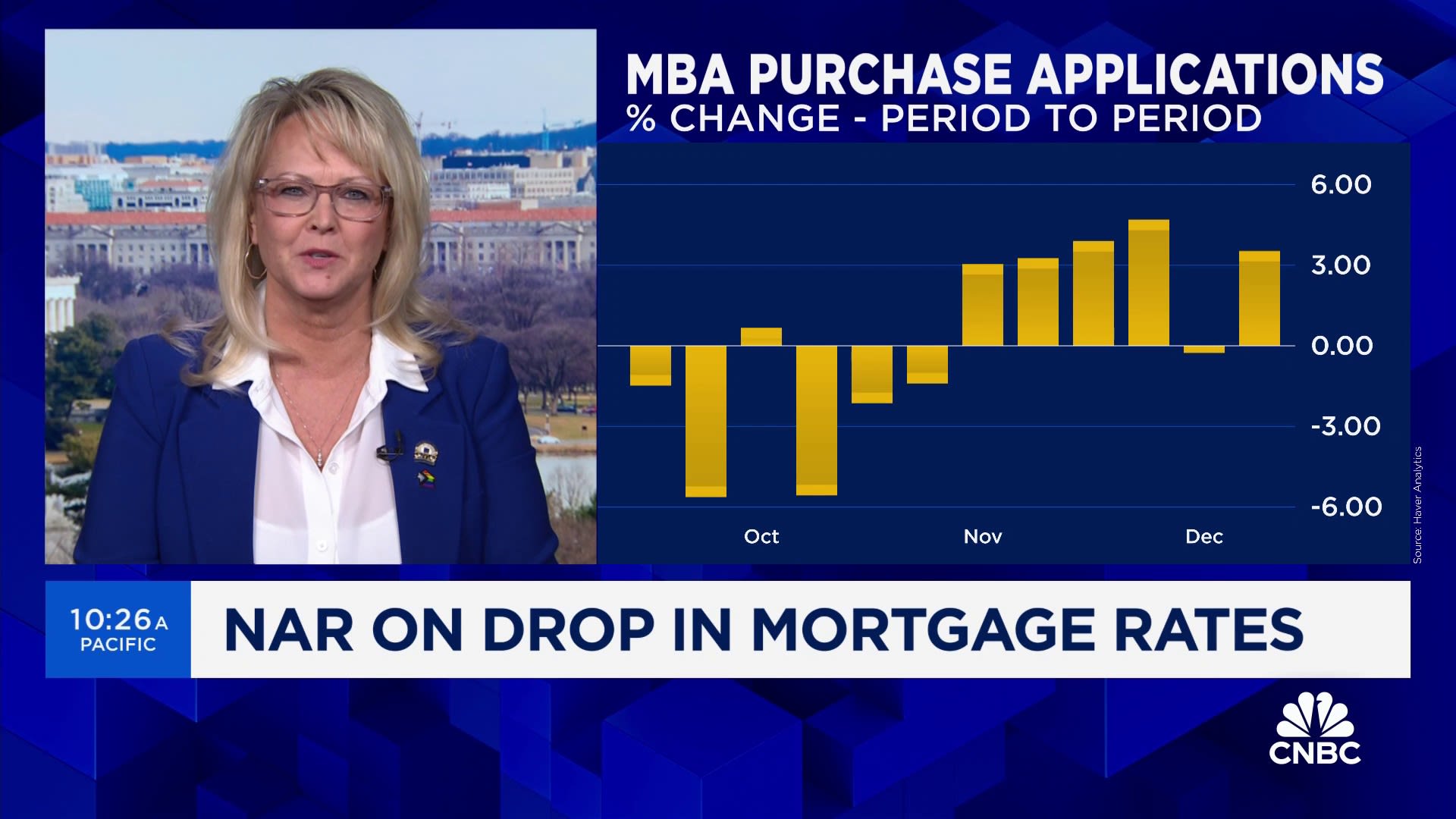

There are not enough houses to satisfy demand, says NAR’s Tracy Kasper

ShareShare Article via FacebookShare Article via TwitterShare Article via LinkedInShare Article via EmailTracy Kasper, president of the National Association of Realtors, joins ‘The Exchange’ to discuss the housing market’s outlook for 2024, the drop in mortgage rates, and more.03:07Thu, Dec 14 20232:02 PM EST Source link

Fannie Mae Expects Home Sales to Bottom Out? Here’s What the Latest Forecast Says

In this article Fannie Mae is predicting a recession in 2024 in its latest Economic Developments report. As a result, home sales are expected to bottom out next year before ultimately improving in 2025. A 2024 recession has been repeatedly predicted by think tanks, individual economists, and financial experts. Fannie Mae adds its own forecast to […]

We look for opportunities when the market is not functioning well

ShareShare Article via FacebookShare Article via TwitterShare Article via LinkedInShare Article via Email Don Peebles, The Peebles Corporation CEO and chairman, joins ‘Power Lunch’ to discuss his expectations for the commercial real estate market. 04:46 Thu, Dec 14 20232:57 PM EST Source link

8.2 Million People Moved in 2022—These Destinations Did the Best

In this article More people are moving out of state as Americans take advantage of remote and hybrid work to move across the country. In 2022 alone, 8.2 million people moved between states, according to the latest U.S. Census data. The annual American Community Survey by the bureau found that overall, in 2022, state-to-state movers made up a […]

The best European countries to buy a vacation home: Spain, Italy, France

The Spanish town of Marbella, on the country’s south coast, is popular among overseas buyers. Artur Debat | Moment | Getty Images There are three European countries that are “perennial favorites” for people to buy a vacation home, according to Kate Everett-Allen, a partner at real estate firm Knight Frank. France, Italy and Spain all […]

With Two Weeks Left in 2023, Now’s the Time To Get Your Taxes in Order

In this article With 2023 coming to a close, it’s the best time to get ahead of your taxes. Get with your tax professional, figure out where you stand, and then make some final moves that could save you big bucks when it comes to tax time in a few months. Make sure you know […]

Here’s what to expect in 2024 if you want to buy a home

Noel Hendrickson/Getty Images After a year full of record-high interest rates and home prices, experts say there are signs of improvement for the housing market in 2024. In December, the average mortgage rates dropped below 7% for the first time since August and after an 8% peak in October, which pushed housing costs to the […]

The House Flip That Fell Over

One real estate investing mistake cost house flipper James Dainard $380,000. This mistake was so bad that, in the long run, it may have cost him up to three-quarters of a million dollars. So what was the grave mistake a multi-decade veteran house flipper made that would bankrupt the average real estate investor? Stick around […]

Sub 7% mortgage rates could start a 'thaw' in housing market: Redfin's Fairweather

Hosted by Brian Sullivan, “Last Call” is a fast-paced, entertaining business show that explores the intersection of money, culture and policy. Tune in Monday through Friday at 7 p.m. ET on CNBC. Source link