Our Blog

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

Was Selling Waze To Google A Good Decision? Founder Of Waze answers

In June 2013, Google acquired Waze for $1.15 Billion, at the time the highest price ever paid for a consumers app and certainly a life-changing event for me, my co-founders, all of Waze employees, and the Israeli hi-tech ecosystem. People often ask me if it was the right decision and what has changed in the […]

No Money for Real Estate? 2 Side Hustles You Can Use to Fund Your First Deal

Don’t have enough funds for real estate deals? Today, there’s no excuse. Beyond strategies that allow you to invest in real estate with no money down, you can always start a profitable side hustle and put the earnings towards your next deal. In this episode of the Real Estate Rookie podcast, we’re chatting with Ava […]

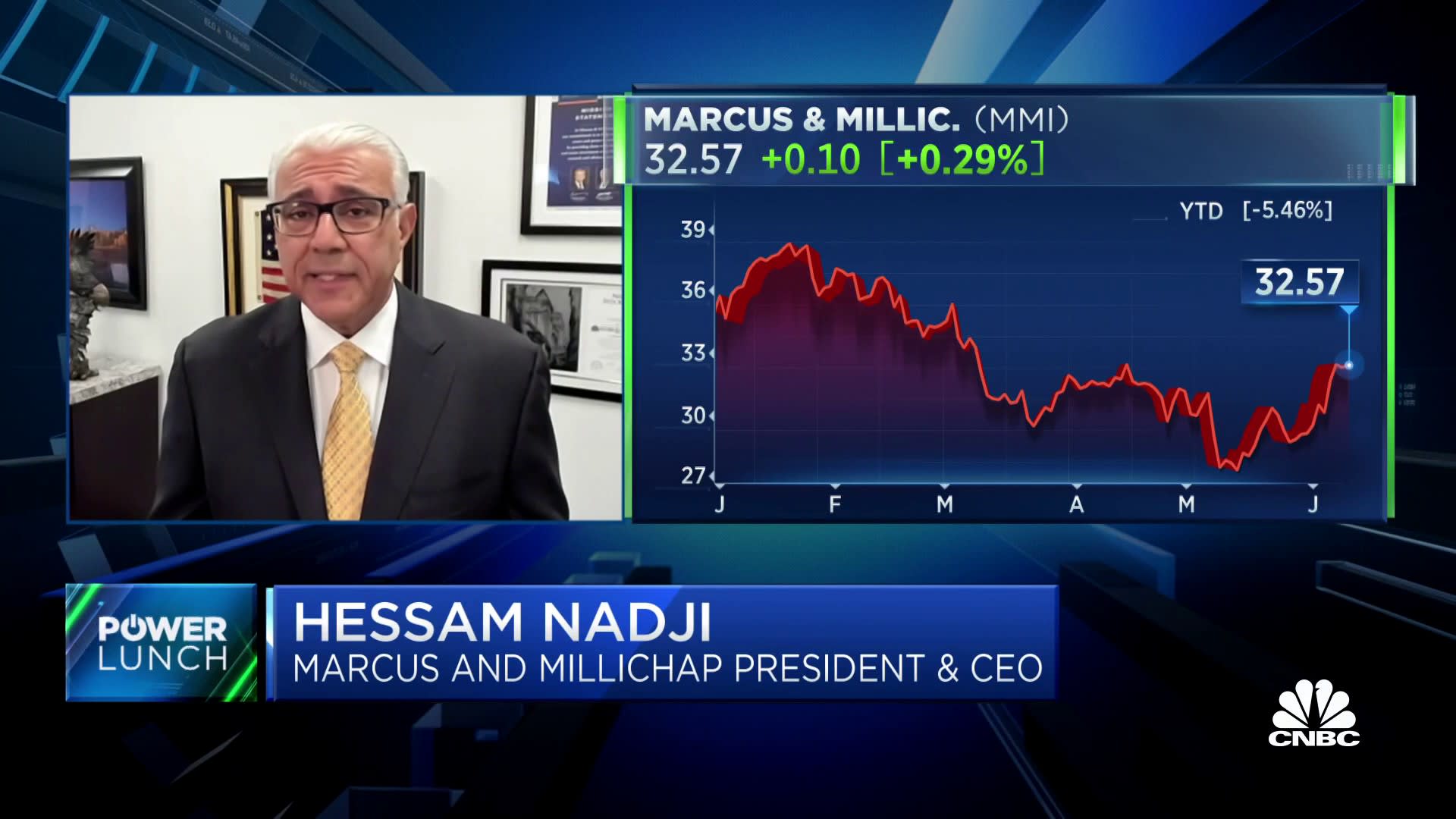

Delinquencies for commercial office spaces are going to rise, says Marcus & Millichap CEO

ShareShare Article via FacebookShare Article via TwitterShare Article via LinkedInShare Article via Email Hessam Nadji, president and CEO of Marcus & Millichap, and Tim Seymour, Seymour Asset Management CIO, join ‘Power Lunch’ to discuss a pullback in commercial real estate for offices, concerns about older property loans reaching maturity, and individual bank issues around lending. […]

How To Develop An Emotionally Resonant Digital Marketing Strategy

Team members meeting and discussing their digital strategy getty Emotional resonance is all but mandatory in today’s marketing landscape. You can’t just make a stellar product and count on buyers to come to you—you have to lure them in. And with inflation prompting customers to prioritize savings, you can’t count on brand loyalty to keep […]

Home Sales Forecast and Returning to a 1990s Housing Market

Home sales have been falling fast since interest rates rose last year. After a spree of house shopping and record-low mortgage rates, homeowners sit comfortably in 2023. They’ve got affordable monthly payments, a home that is (probably) bigger or better than their last one, and expect a potential recession sometime soon. So why would today’s […]

You underestimate China at your own peril, analyst says

ShareShare Article via FacebookShare Article via TwitterShare Article via LinkedInShare Article via Email Mattie Bekink of the Economist Intelligence Corporate Network says the country’s property sector could stabilize in the second half of the year, which could “smooth out” its uneven recovery from the Covid pandemic. Source link

4 Types Of Pitch Decks ‘Guaranteed’ To Get VC

FILE – How Elon Musk Would Get VC. (AP Photo/Refugio Ruiz, File) XaLixCo,mEXiCo,2015 Venture capital (VC) funding is highly sought after by entrepreneurs, but only about 100/ 100,000 ventures actually succeed in securing it, about 80/100 fail with it, and only about 20/100,000 ventures actually succeed after they secure it. Despite the scarcity of VC […]

Escrow: What Is It and How Does It Work?

In this article Escrow is a key part of real estate transactions and mortgage agreements, but many homebuyers and homeowners aren’t familiar with escrow and how it works. Escrow protects homebuyers, sellers, homeowners, and even lenders with real estate-related financing—it supports those parties throughout the homeownership lifecycle. Let’s break down what escrow is, its role […]

NYC overtakes Hong Kong as most expensive city in world for expats: ECA

Hong Kong has ended its four-year reign as the most expensive city globally for expatriates — surpassed by New York which took first place, according to a new survey. ECA International’s latest “Cost of Living” research ranked 207 cities based on a basket of day-to-day goods and services commonly purchased by assignees. That includes food, […]