Real estate can be one of the most profitable investments, but it’s also one of the most costly and complicated. Not only is a lot of money involved, but real estate tends to move in trends, for better or worse. When you decide to invest in real estate, you want to ensure that you choose a property that will pay off in the long run.

As an experienced investor, I’ve learned quite a bit along my journey. Friends and colleagues often approach me when considering investing in their first rental property.

In this article, I’m sharing the most common questions new real estate investors ask me.

Question #1: Is Now a Good Time to Invest?

Real estate is a tricky business. Knowing what’s in store for the market is extremely difficult, but there are a few key indicators to pay attention to that will give you an idea of which way the market is heading.

Those indicators are:

- Interest rates

- Tax rates

- Local market trends

In short, the answer is always yes. Now is a good time to invest.

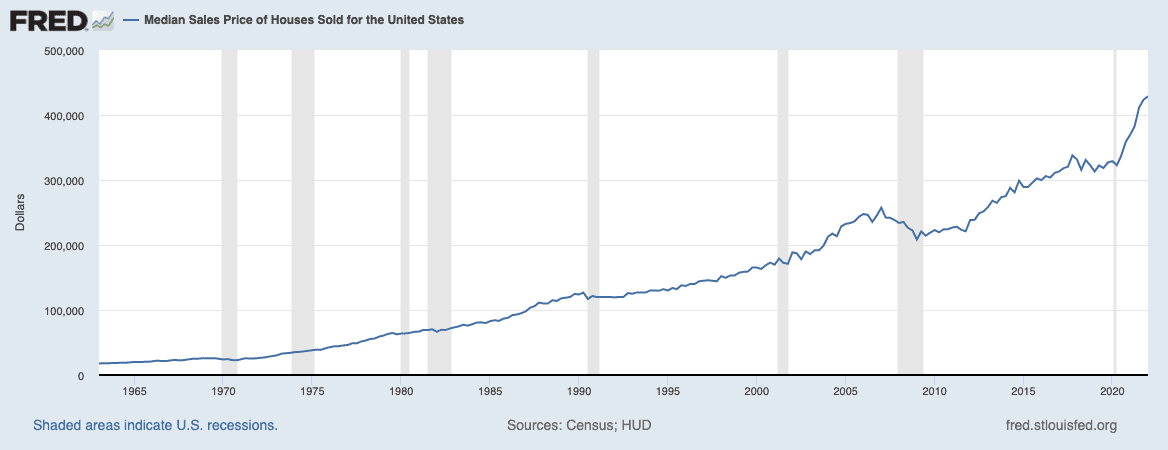

As long as you are thinking long term, any market fluctuations occurring today will typically not impact an investment property down the line. Looking at the last few decades of housing prices, you would see that home prices have consistently trended upwards.

The exception to the rule is if you are looking for a short-term real estate investment or if there is a catastrophic change to the market in one way or another. It’s impossible to predict the future, but events like regulatory changes, war, or financial busts can all dramatically and suddenly impact the real estate market.

Question #2: How Can I Get My Finances in Order?

Before purchasing any property, do the math and make sure it’s something you can afford.

You should be looking at potential profit margins, mortgage rates, and the average rental rates for the market you’re investing in. Regularly monitor your credit score and work on actively improving it if necessary. Estimate maintenance and management costs, and see how they fit in with your expenses and income.

Lastly, you should always plan for the unexpected. Build an emergency fund that you can dip into in case of property or personal emergencies that will keep you covered without rocking the financial boat.

Question #3: Should I Invest Out of State?

If your local market isn’t offering the investment opportunities you want, you might consider buying a property outside of where you live. This strategy can be lucrative, but there are hurdles to watch for.

Landlord-tenant laws vary from state to state and constantly change. You’ll also need to assemble a team to help you manage your property if you don’t plan on traveling regularly. That being said, looking for investment properties in what may be a more accessible market can provide fewer barriers to entry and help you diversify your portfolio.

So, it’s up to you to figure out if it makes sense.

Question #4: Should I Invest in Multiple Properties?

You might consider adding multiple properties to your real estate portfolio to generate income faster with larger profit margins. In addition to providing multiple streams of income, a larger real estate portfolio diversifies your risk and offers more tax benefits.

I recommend you consider paying down debt substantially on your first property before you jump into a second, third, fourth, or more. While this is a more conservative approach, it will protect you in case of a downward turn in the market. If you are confident you’ll bring in more profits than the interest on your current mortgage and ancillary expenses, you might be able to skip this step.

Treat every new property as if it’s your only source of revenue. Research your options for securing additional financing, which will vary from conventional mortgages to private loans based on your financial situation.

Question #5: Should I Invest With a Partner?

Coming up with the initial capital to cover a down payment, realtor fees, closing costs, property taxes, home maintenance, and the like can be challenging. To save on costs, many people choose to invest with a partner who can share the finances and responsibilities of owning an investment property.

If this is a path you’re considering, create a contract or written agreement before taking any official steps. Lay out clear expectations for each partner’s roles and responsibilities, break down each partner’s finances and outline how assets will be protected.

Look for a partner who complements your skill set. If you excel on the administrative side, look for someone who thrives on repairs, renovations, and maintenance.

Question #6: Is Turnkey the Way to Go?

“Turnkey” generally refers to a property for sale already in move-in condition. Tenants might already occupy it, or it is ready for occupancy without requiring any updates or renovations. A turnkey property can be an excellent investment, as it usually provides quick cash flow without any upfront costs.

I would recommend this, especially for new investors. While purchasing a fixer-upper can be a great way to save money on the purchase price, vacancies can quickly destroy your profit margins.

Question #7: Should I Buy Properties with Tenants Already?

Sometimes the best rental properties are already rental properties.

If you’re looking to invest in a property that has tenants, don’t make any final decisions until you understand the vetting process the current property owner went through. Please don’t assume that because tenants are living in the building, they are the right tenants for the property. Ask the current owner for as much information and documentation on the current tenants as possible.

Ask what criteria they used to qualify the renters? What has their rent payment history been like? Are there any existing agreements in place that you need to know about?

Final Thoughts

Good investments require analysis. Setting unrealistic rates of return on real estate is one of the main reasons new investors lose money. Put in the work to understand the different types of rental properties and the different opportunities in your market. You might decide that one successful investment property is all you need, or you might find yourself searching for the next investment.