Those not living under a rock for the past year could skip these opening paragraphs as they are well aware the real estate market has been on fire. They are also aware that inflation is out of control (and likely to stay that way), having hit 9.1% in June, the highest since the early 80s. On top of that, GDP shrank 0.9% in the second quarter of 2022, meaning we have had two negative quarters in a row, i.e., the United States is in a recession.

Add the stock market being down almost 20% year-to-date, the crypto collapse, near record low consumer confidence and labor force participation, along with strong indicators that the Fed will continue to raise interest rates.

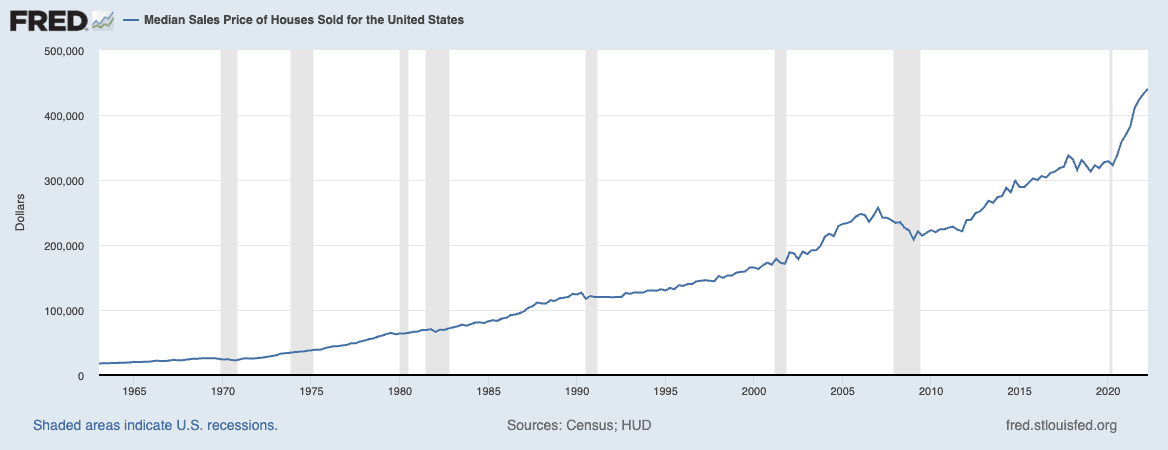

Yet, as noted, real estate prices have skyrocketed in the middle of all this economic turmoil. In June of 2022, the median list price was up 16.9% year-over-year and up 31.4% as compared to June 2020! This chart really drives that point home:

So, are we about to see the real estate market collapse like it did in 2008?

Well, for those who skipped the first few paragraphs, the short answer to whether 2008 is about to repeat itself is almost certainly not.

Why This Time is Different (Although Still Bad)

There’s a cautionary saying amongst military strategists that goes something like “armies prepare to fight their last war, rather than the next war.” Indeed, there were calvary charges at the beginning of World War I. Then the French attempted to build an impenetrable super trench called the Maginot Line to prevent a German advance if a second world war broke out. When it did, the Germans were able to simply blitzkrieg their way around it through the Netherlands and Belgium, marching their way into Paris within six weeks.

A similar effect goes on when thinking about economics. Having lived through the real estate bubble of the late 2000s and subsequent Great Recession, this is the economic calamity at the top of everyone’s mind and thereby what many believe will see itself repeated in 2022.

But our current woes bear much more resemblance to the stagflation of the 1970s and early 1980s. That “lost decade” saw low growth and high inflation throughout. And it required a pretty nasty recession in 1982 to get out of after Federal Reserve chairman Paul Volker jacked interest rates up into the teens to “break the back of inflation.”

High inflation and low growth (or even shallow recessions as we have now) are probably what we have to look forward to for the foreseeable future. But an all-out collapse, particularly in real estate, is unlikely.

For one, many of the scary headlines out there lack a lot of context. For example, as you’ve certainly seen in the news, mortgage defaults rose from 0.6% in April 2021 to 1% by the end of the year, but they are still way below what they’ve been over the last decade.

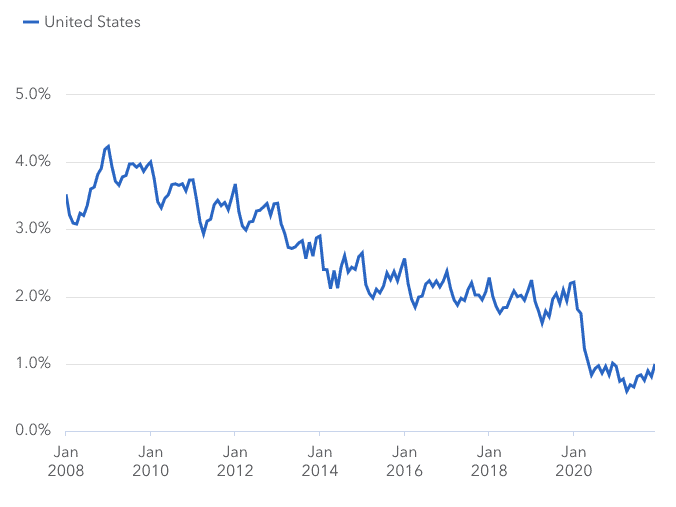

national average (January 2008 – December 2021) – Consumer Finance Protection Bureau

Property sales have also fallen 14.2% year-over-year from June 2021. But once again, starting at a date in such an extreme seller’s market is misleading. Sales are still above what they were in 2020 and about equal to 2019. The market was hot in 2019.

The real estate market was so ridiculously hot in 2021 that it had only one way to go. It literally had to cool off before prices outpaced all semblance of affordability. Fortunately, there are several major factors that should prevent any sort of collapse.

1. General Inflation

Living through the current bout of high inflation makes it as good a time as any to learn the difference between real and nominal prices. Nominal prices are just what they appear to be. Real prices take inflation into account. So, if inflation is 9% and real estate prices go up 10%, in real terms, values have only gone up 1%.

In other words, general inflation makes nominally high real estate appreciation rates less meaningful. Prior to the 2008 financial crisis, inflation rates were low. They most certainly aren’t low today.

Indeed, nominal prices for real estate were never negative during the 1973-1982 stagflation. They were, however, negative in real terms for several years and for the economically troubled decade. Overall they just about kept pace with inflation; not good by any means, but not a catastrophe either.

| Year | Inflation Rate (YoY) | Home Prices (YoY) |

|---|---|---|

| 1973 | 6% | 16% |

| 1974 | 11% | 9% |

| 1975 | 9% | 8% |

| 1976 | 6% | 11% |

| 1977 | 7% | 10% |

| 1978 | 8% | 12% |

| 1979 | 11% | 11% |

| 1980 | 14% | 3% |

| 1981 | 10% | 6% |

| 1982 | 6% | 1% |

| Average | 9% | 9% |

We’re likely to see something like this again.

And while it’s not good for home prices to grow slower than inflation, a fall in real value is better than a fall in nominal value because of the way debt works, as will be elaborated on below.

2. The Lending Environment is Different (and Better) than 2008

Everyone remembers the insanity that preceded the 2008 collapse. If you had a pulse, banks would lend to you. It was not uncommon to get 100% of the property financed with an 80/20 loan (80% LTV on the first mortgage and 20% second). Stated income loans (where you simply stated your income, verification optional) were all the rage, and the infamous NINJA loans (No Income, No Job, No Assets) were being handed out like candy.

I mean, why not? Housing always goes up, doesn’t it?

Then there were the teaser rates. Many unscrupulous lenders would offer very low starter rates for a few months or a year, and then they would rocket up four or five percentage points after that. On top of this, many loans started as interest only or were even negatively amortized, where the principal balance grew with each payment. These homeowners relied strictly on appreciation to have any equity in the home.

So, when the music stopped, they had nothing to lose.

Fortunately, with the exception of high LTV loans, most of this nonsense has stopped. The teaser rates are mostly gone and Investopedia notes, “NINJA loans largely disappeared.”

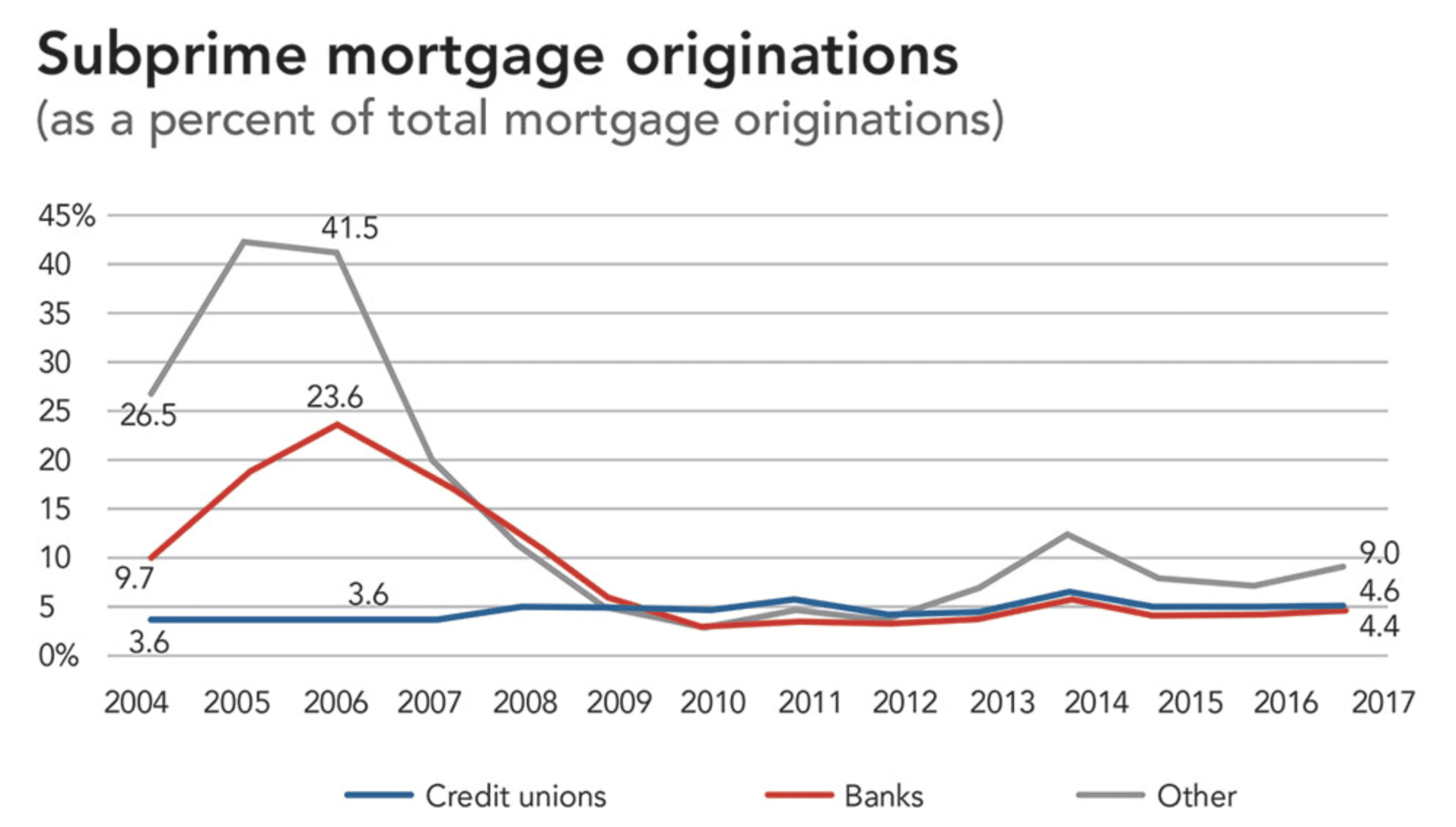

The quality of borrowers has also indisputably gotten better. Before 2008, subprime loans were being made en masse. The Credit Union National Association states, “While ‘subprime’ isn’t easily defined, it’s generally understood as characterizing particularly risky loans with interest rates that are well above market rates.”

The Credit Union National Association uses the Home Mortgage Disclosure Act data to determine how many subprime mortgages are taken out each year, and the number of such loans being made has plummeted since the crash:

Even the loan-to-value ratios aren’t as bad as before for two reasons. One, just about the most you can get is 96.5% with an FHA loan, which is at least something down. Two, given how much appreciation has occurred just in the last year, anyone who has bought a home a year or more ago has a substantial amount of equity in their property.

This means that even if the market fell 20%, the vast majority of people would still have positive equity in their homes. In 2008, with so many people having near-100% mortgages on properties that were collapsing in value, many fell “underwater,” where the property had more debt attached to it than it was worth. Thus, a vicious cycle began as many homeowners opted for “strategic defaults” because it simply didn’t make sense to pay for a property that was worth less than nothing. This caused the market to fall even further.

But as noted above, in a high inflation environment, it’s highly possible that real estate values could go down in real terms without going down in nominal terms. (For example, real estate values go up 3%, whereas inflation is 7%). Given that mortgages are unaffected by inflation, a nominal loss can make a strategic default the rationale option for homeowners. But a real loss that is still nominally positive will never make a strategic default the rationale option.

And again, we are in a high inflation environment, unlike the low inflation environment that preceded the 2008 financial crisis.

The other factor that made loans unpayable were the interest rates that shot up after the teaser rate expired. As noted above, those are mostly gone. But in addition, there are fewer adjustable-rate mortgages than there were in the years before the crash. As The Financial Samurai points out, only 4.7% of mortgages taken out in 2021 were adjustable-rate mortgages! The rest were fixed-rate.

For comparison, back in 2006, almost 35% were adjustable-rate mortgages.

Thus, if the Fed continues to raise rates as expected, it will soften the market by making it more expensive to take out a mortgage, but most current homeowners won’t be affected.

We’ve spent the past year refinancing all our investment loans with fixed-rate terms until at least 2027 to hedge against rate increases. My personal home mortgage is at 3% on a 30-year fixed rate. Obviously, I’ll never refinance that one.

Indeed, as many people now have incredibly low-interest loans fixed for 30 years and nearly every landlord’s rent increases have not kept up with rapidly increasing market rents, and more cities and states limit the amount landlords can increase rent; you have to wonder whether anyone will ever move again? But that’s a topic for another time.

The last point is that if unemployment shoots up, people won’t be able to make their payments even if they have great interest rates. This is true, and a recession would undoubtedly increase the number of foreclosures. But we’re already in a recession, and unemployment is only 3.6%. If anything, employers can’t find enough people willing to work.

That could change, but it would seem the dynamics of this recession are much different than in 2008, and reaching 10% unemployment is unlikely. But even if that were to happen, plenty of well-capitalized investors, including on Wall Street this time around, are looking to buy. And since sellers will have equity in their homes, high unemployment is unlikely to set off a spiral of foreclosures like in 2008.

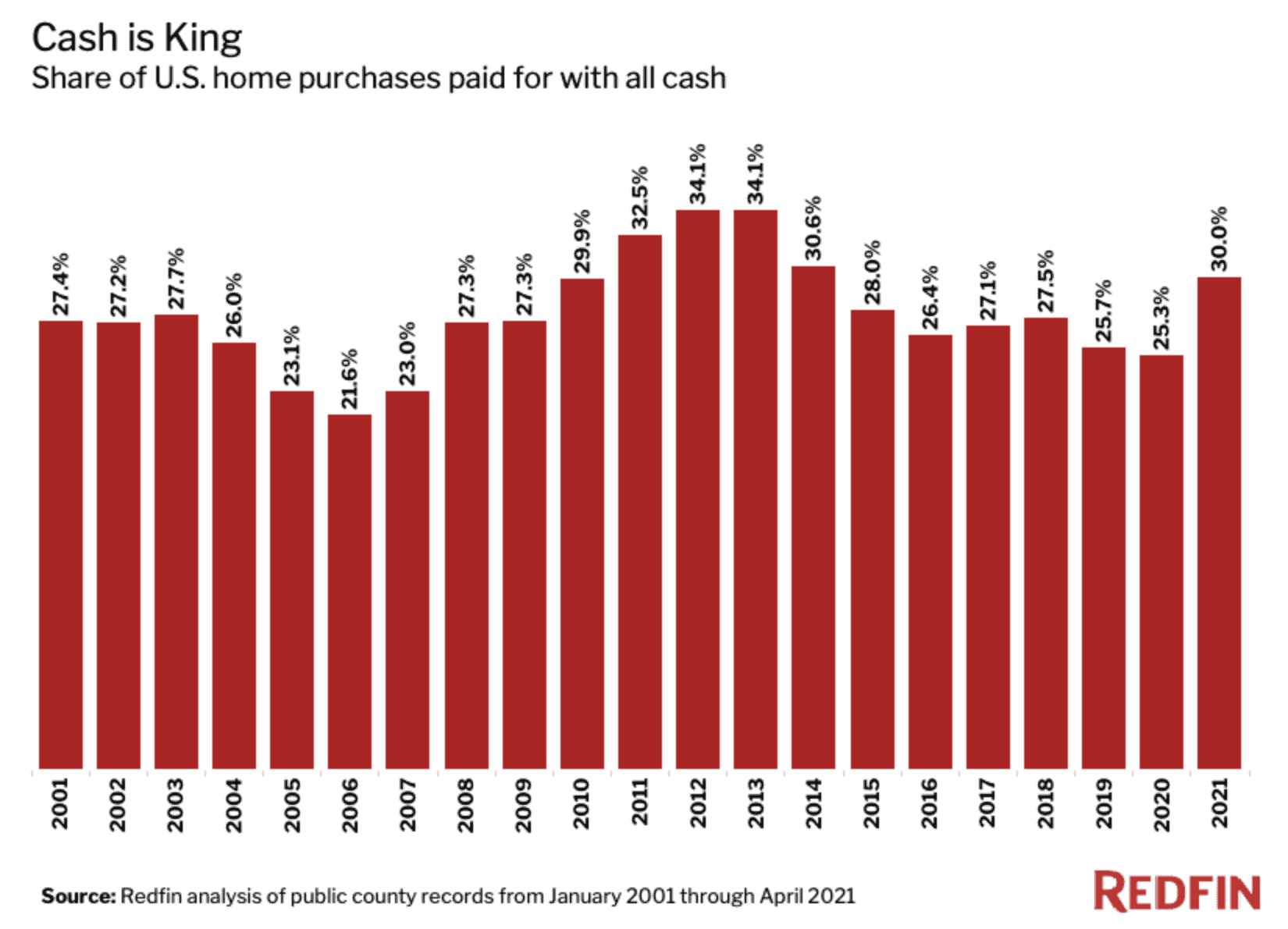

But moreover, many more property owners don’t even have mortgages to begin with. The percentage of cash buyers versus those buying with a mortgage was 30% in 2021 according to Redfin, the highest its been since 2014. In the three years preceding the 2008 crash, the rates were 23.1%, 21.6%, and 23%.

Since 2008, it’s been at least 25% each year and often over 30%.

It’s hard to get foreclosed on when you don’t have a mortgage in the first place.

3. There’s Still a Housing Crisis

However, the biggest reason a housing collapse is unlikely is because supply and demand are still undefeated.

And when it comes to housing, demand is blowing supply out of the water.

According to Freddie Mac, in 2020, the United States had a record 3.8-million-unit shortfall.

Before the 2008 Financial Crisis, the U.S. faced the opposite situation. Indeed, the country was littered with “recession ghost towns” and all-but-empty, newly built subdivisions. Nowadays, 50-plus people show up to an open house.

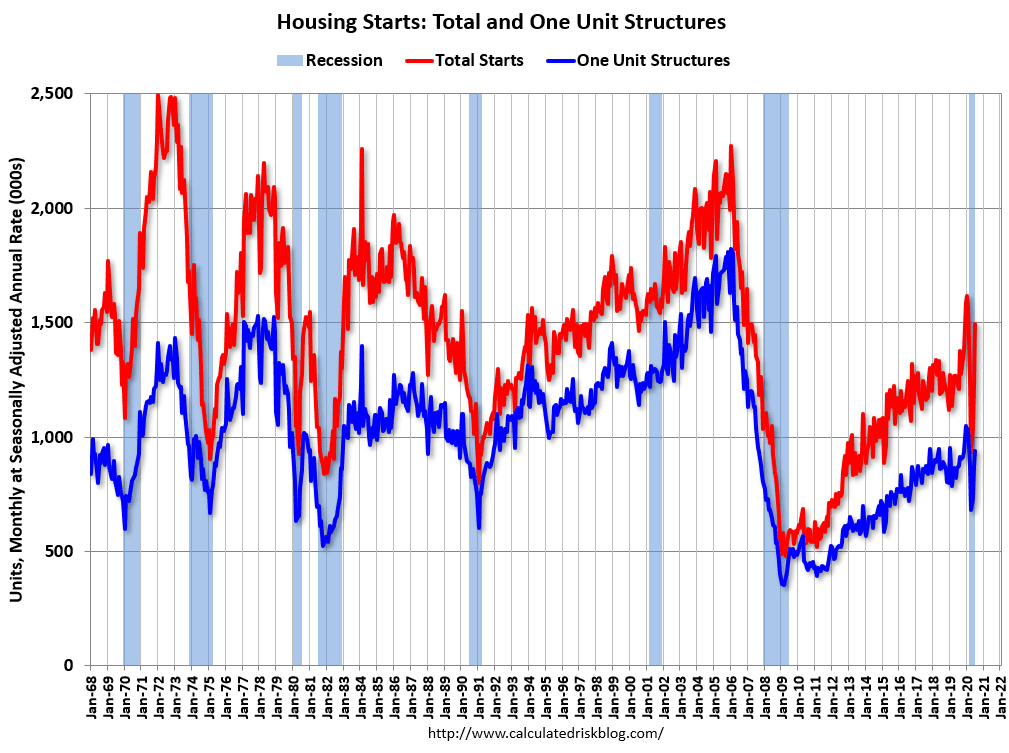

What happened was very simple; we stopped building. Prior to the 2008 crash, there were over a million housing starts each year since 1991 and over two million between 2004 and the bubble bursting.

Housing starts cratered to 500,000 in 2009 and only topped 1.5 million in 2019. Then Covid hit and virtually every project was significantly delayed.

All the while, the American population kept growing. And all those people need somewhere to live.

Unfortunately, houses and apartments can’t be wished into existence. The entire process, from permits to move-in, often takes over a year. In other words, this is not a problem that can be ended quickly.

For the housing market to collapse, it would have to collapse in spite of demand being far higher than supply. This would be an exceptionally odd thing to happen.

Closing Thoughts

We are undoubtedly reaching the limits of affordability for Americans to buy a home, especially with rising interest rates. This by itself should cool the real estate market off (which we’re already seeing) and could cause a correction.

But everything else, from lending standards to economy-wide inflation to the ratio of fixed mortgages to adjustable-rate mortgages to the still massive housing shortage make a 2008-like collapse highly unlikely.

And there’s one more factor to consider. As I noted in my previous piece, inflation will likely be around for quite some time in part because there is little political will to stop it. That’s because really putting a stop to inflation will likely throw us into a significantly deeper recession.

Right now, the political divide is as wide as it has been in many years. Washington does not want to throw fuel on this fire.

If somehow a housing crisis started anew, the evidence indicates that the political class would stomach as much inflation as necessary to prevent another collapse. In other words, expect the Fed to drop interest rates back to zero and the government to bail out homeowners and Wall Street this time around and not just Wall Street with as much quantitative easing as necessary. Also, expect banks to learn their lesson (at least partially) and do more short sales and deeds in lieu of foreclosure than last time, especially in the early going.

But alas, the evidence also indicates that such decisions won’t need to be made as a housing collapse does not appear to be around the corner.

Of course, that doesn’t mean the economy is good. It wasn’t good in the 1970s and is not good today. But it’s not 2008 either, and we can at least be thankful for that.

Prepare for a market shift

Modify your investing tactics—not only to survive an economic downturn, but to also thrive! Take any recession in stride and never be intimidated by a market shift again with Recession-Proof Real Estate Investing.

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.