I fear for my fellow real estate investors.

Many of them, at least.

I fear many investors have been hypnotized by a market that went off the rails somewhere back up the tracks—a crazy train.

Case in point.

One of my friends is among the nation’s top commercial real estate syndicators and fund managers. But everyone has to suck on a lemon sometimes, and he had a sour one. His apartment deal barely cash flowed above the debt service. His experienced team worked on it for three years and failed to raise income or appraised value.

Earlier this year, he accepted an offer for about 50% more than he paid for the asset! Furthermore, my friend’s interest rate was around 2% (he’s a big player), and the buyer had bridge debt at about 5%. A rate that has probably risen significantly since the purchase.

Can someone tell me how this deal will work for this buyer and his investors?

But this was months ago. The situation has gone from bad to worse now, with interest rates rising significantly in the interim. (Note that a rise from 3% to 5% is larger than it looks. That’s a 66.7% increase!) And while we would expect property values to soften, they haven’t done so as much as the math would predict—one of many telltale signs of a real estate bubble.

We’re in the Valley of the Lag. A predictable disconnect between the market’s reality and sellers’ expectations. A time when frustrated but optimistic or naïve buyers may be tempted to overpay for assets that have avoided their grasp for years in this frenzied market.

I wrote about this in detail in my previous article. I discussed a few ideas on spotting a bubble and why we should act appropriately for where we are in the current cycle. We looked to seasoned mentors like Warren Buffett and Howard Marks for guidance.

But, I May Have Been Wrong—Sort Of

In this article, I want to present a few contrary arguments. We will ponder the possibility that we are not really on the edge of a cliff. Or, if we are, how speculators may be rescued anyway.

Specifically, I want to consider four reasons investors and speculators may be spared of disaster in this current market cycle, where we are gingerly poised on the edge of a plummet—and the factors that may provide a soft landing and a resumption of the continuing upward ascent we’ve enjoyed for the past 12+ years.

Mitigating Factor #1: Inflation

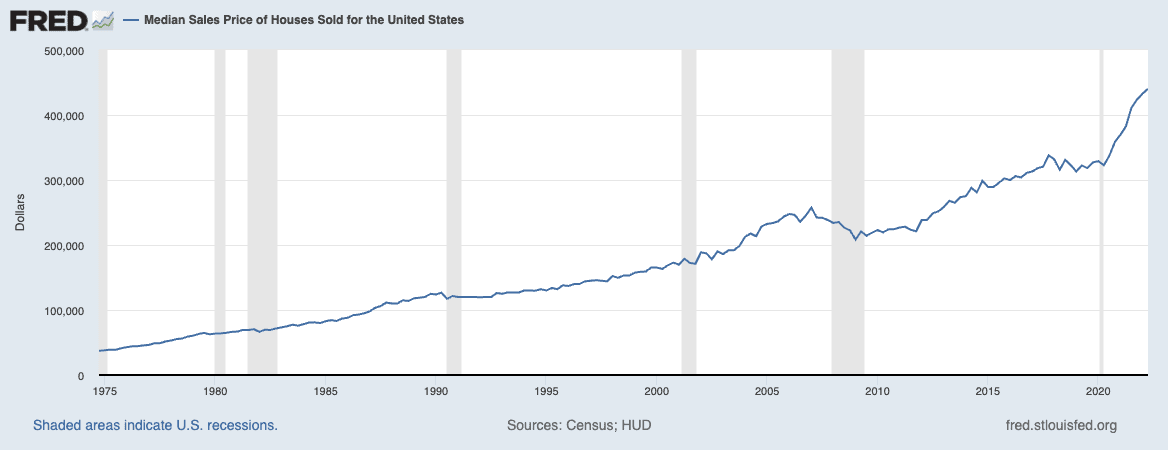

Real estate rent and value inflation are at staggering levels. According to the Federal Reserve, it took 11 years from the date I was married in 1987 to 1998 to see a 30% rise in median home sale prices. The following two rounds of 30% respectively took seven years and 15 years, ending during the heart of Covid. Note the average of 11 years again for these two periods. That’s 33 years for three 30% cycles.

Who would have dreamed the subsequent 30% rise would occur in only 18 months? Especially in the wake of a pandemic.

Rental property values are impacted negatively by rising operating costs. Increasing interest rates are one of the biggies, potentially affecting some owners and almost every buyer. Interest rates have nearly doubled in the past six months, and they’ll likely go up more before they level off and retreat.

But real estate values are positively impacted by rent inflation. At least nominally (meaning “in name only” due to eroding currency values). This results in higher revenues and net operating income. Thus, higher values.

Investors may dodge a bullet if property rent and value inflation effectively outrun increasing costs, particularly the increased costs of debt service.

Mitigating Factor #2: Quick Economic Response to Interest Rate Hikes

The Fed has hiked interest rates significantly in 2022. Their goal is to cool an economy overheated by inflation. Given the structure of our system, it seems to work quite well. It has worked every time in the past.

How quickly and completely will these interest rate hikes cool our current market? And will the cooling of the market in general (including the stock market and the economy as a whole) occur much more quickly and thoroughly than the cooling of the real estate market?

No one knows the answers to these questions. But they are good ones to consider as we keep our finger on the pulse of the real estate cycle.

If and when the Fed feels they’ve effectively doused this inflationary fire, they will halt the hikes and potentially allow many real estate investors to avoid disaster.

Mitigating Factor #3: The Federal Reserve Doesn’t Overshoot Their Target

The Fed’s target annual inflation rate is 2%. It has been running at over four times that level recently, and many feel it is actually much higher. See the chart above for housing inflation, an essential component in the total calculation.

The Fed’s goal in hiking rates is to cool the economy and force inflation to retreat to its target 2% level. But it’s a tricky balancing act, and it’s nearly impossible to hit the target perfectly without overshooting. Suppose the Federal Reserve’s hikes result in squelching the economy to a level where inflation falls below its target, even into deflationary territory. In that case, this could devastate many real estate investors. See point #1 on the role of inflation above.

Is it realistic that the Feds could overshoot their target and cause a meaningful recession? History says it is quite likely. And Federal Reserve Chairman Jerome Powell is a disciple of Paul Volcker, the chairman who oversaw rate hikes into the 20%+ range in the early 1980s when I was a mere high school lad. Like Volcker, I believe Powell will stop at nothing to squelch inflation, and if it takes a painful recession to achieve this, he will stay on this course.

Yet, it’s possible they could hit the target and retreat before causing disaster for many real estate investors.

Mitigating Factor #4: Continued Housing Demand

Two major factors can cause inflation. The first is the push from higher costs. The second is the pull from higher demand. The current runup in inflation results from both.

Increased interest rates generally target the former, hoping to lower the cost of building and operations. We are already seeing meaningful declines in the price of some building materials like lumber. I expect this will continue as the impact of rate hikes continues to work its way through the economy.

But housing demand remains at crazy levels, especially in some markets. Sunbelt and “smile” locations in the Carolinas, Georgia, Florida, Texas, and Arizona are booming. Homeowners and renters fleeing California and New York land in places like Utah, Idaho, Colorado, and many other locations.

These folks often have a lot of cash and are willing to spend it to outbid their fellow refugees. The result is continuing inflation, even in the face of higher interest rates.

Another result of interest rate hikes is a home and multifamily construction slowdown. But this just fuels even more supply and demand inequity in popular locations. Part of the current inequity results from supply never catching up from its screeching halt in the Great Financial Crisis.

So, we see that interest rate hikes play more than one role in the demand for housing. And this fourth factor – continued high demand – may result in many real estate investors dodging the bullet I predicted in my previous post.

Conclusion

So, do you agree with these four likely scenarios? Do you think I just gave you a pass on the disaster I predicted in my last article?

Please keep this in mind: if everything, especially the market and economic factors outside your control, must go right for your deals to succeed and your portfolio to prosper, you are probably a speculator.

Investing is when your principal is generally safe, and you have a chance to make a profit. Speculating is when your principal is not at all safe, and you have an opportunity to make a profit.

If you’re counting on the market to go your way to create your profit, your principal is certainly not safe. And you’re risking your financial future and that of your trusting investors.

I’m writing this as a guy in his third decade as a real estate investor who has seen and done this already. I’m hoping you won’t follow my earlier mistakes.

Question: Are there strategies you can follow to control your destiny in any market? Are there tactics you can implement to significantly improve your chances of making a profit in an up, down, or sideways real estate and economic cycle?

Yes, I believe there are. So tune in for our third installment in this series next time to hear more.

Prepare for a market shift

Modify your investing tactics—not only to survive an economic downturn, but to also thrive! Take any recession in stride and never be intimidated by a market shift again with Recession-Proof Real Estate Investing.

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.