Let’s face it, Seattle isn’t about to land itself on any hottest lists of affordable places to invest any time soon. But a lack of bargains doesn’t mean that there aren’t opportunities to be had. For those who own Seattle property or find a suitable investment in this area, homes attract high average rents and opportunities for consistent returns and appreciation. With single-family homes enjoying similar returns to the stock market without the same level of volatility, stable “Tier 1” markets like Seattle could be an attractive option for your portfolio.

Late last year, Redfin reported that Seattle was the fastest-cooling market in the U.S. As an already expensive city to buy into, the extra heat in the market turned out to be unsustainable as interest rates and inflation began to bite on large mortgages. The good news is that more bargaining power was finally available to those that do have the capital to get into the Emerald City.

So does it make sense to try and invest in Seattle in 2023? BiggerPockets has teamed up with Belong to bring you a snapshot of the Seattle rental market. Belong is a modern alternative to property management companies that is humanizing the rental experience and making it easier for individual homeowners to manage real estate investments in popular cities like Seattle and San Francisco.

Only you know your financial situation and what you can take on, so this report is designed to support your research with an indication of average rents and the current state of the rental market in Seattle, including:

- Are Seattle’s cooling real estate prices enough to lower the barriers to entry?

- How does the median price of homes in Seattle compare to similar Tier 1 cities?

- What kind of rental income can I expect from a property in Seattle?

- When is the best time to list a Seattle rental to achieve the highest rate?

- Will the tech downturn affect real estate in Seattle? What are the other macroeconomic factors to consider?

Are Seattle’s Cooling Real Estate Prices Enough to Lower the Barriers to Entry?

Like most Tier 1 markets, investing in Seattle can be challenging due to high entry costs, especially for those needing a mortgage. This is why the market is cooling, with debt costing twice as much as in recent years. A price reduction in a hot area should be a cause for celebration for would-be investors, but not in this instance. Even a 5% drop in prices isn’t going to make the area more affordable if you need to take out a mortgage at a 6% – 7% interest rate.

Additionally, demand exceeds supply, making Seattle a seller’s market with low inventory. Homeowners with good fixed interest rates are unlikely to sell unless necessary.

How Do Median Prices in Seattle Compare to Other Tier 1 Cities?

According to realtor.com, the Median Listing Home Price in Seattle is $780,000, with the Median Sale Price of $750,000. Most homes are selling for close to ask, indicating a seller’s market.

If you look at other Tier 1 west coast cities like San Francisco, the Median Listing Home Price is $1.3M, some $520k higher than Seattle.

Although Seattle may not offer a quick profit, it’s a viable option for investors who can’t afford other Tier 1 cities. With stable renter demand and long-term growth potential, owning a home in Seattle could be profitable, but less so for short-term cash flow.

What Kind of Rental Income Can I Expect in Seattle?

The ROI and cash flow of a Seattle property depends on mortgage expenses, appreciation, and tax benefits. Despite recent fluctuations due to the pandemic, Seattle properties have generally appreciated very well over time.

According to NeighborhoodScout, Seattle real estate has appreciated by 137% over the past 10 years, with an average annual home appreciation rate of between 5.69% and 9.02%, placing Seattle in the 10% for appreciation in the U.S.

With interest rates still climbing at the time of publication and some areas hotter than others in terms of demand, you will need to run a new cash flow analysis on any rental property or potential purchase to get an accurate view of your ROI. Below we have compiled some averages across the Seattle metro area to get an understanding of what you might expect to see.

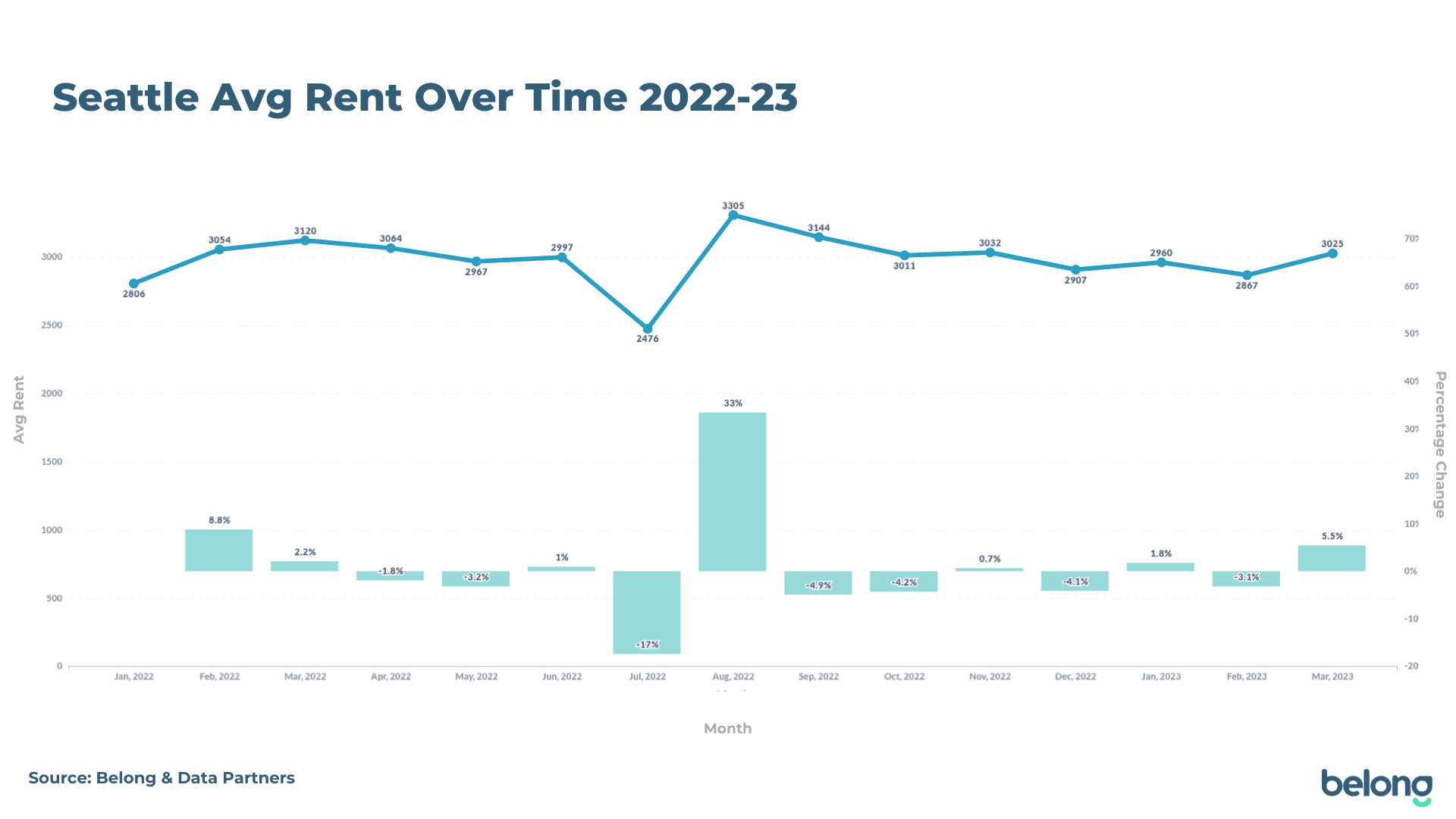

Belong, who partners with owners of single-family homes, apartments, and condos, has seen average rental rates between $2,476-$3,305/month for the Seattle market over the last 12 months.

How does this compare to other Tier 1 markets? Looking at San Francisco again, single-family homes and condos on the Belong Bay Area network rent for an average of $3,754. When you consider that the average price of a home in S.F. is around $520,000 higher than in Seattle, it highlights the favorable cap rates and potential for a strong return on investment. In the Bay Area, you would be hard-pressed to find a neighborhood with SFHs that average for less than a million dollars, whereas Seattle still has cheaper entry points around the $500k – $600k mark.

According to Belong partner, Zumper, median rents are up 6.2% YoY in March 2023, trending up from last month. The breakdown by housing type is:

- Studio: $1,477 (+14% YoY)

- 1-Bedroom: $2,021 (+7% YoY)

- 2-Bedroom: $2,795 (+4% YoY)

- 3-Bedroom: $3,330 (+0% YoY)

- 4-Bedroom: $3,700 (+6% YoY)

According to the latest U.S. Census data for Q4 2022, rental vacancy rates in the Seattle/Tacoma/Bellevue area are sitting at 4.7%, down from 5.7% in Q1. This is consistent with neighboring cities of Portland/Vancouver/Hillsboro, with a vacancy rate of 4.8%, down from a high 6.1% in Q1.

When is the Best Time to List a Seattle Rental?

Like most cities along the west coast, Seattle rental prices are seasonal. As the chaos of the pandemic cools off, we’re seeing a return to peaks and troughs of seasonal pricing that weren’t experienced during the up-and-up rent climbs.

While Seattle is famous for its rain, it’s also famed for its incredible outdoor lifestyle and walkability, which sees a peak in demand across summer when there’s plenty of sunshine and blue skies. Seattle enjoys the same peak in rental pricing around August that we witness in other Tier 1 markets across California. In fact, August is the best time to attract top dollar for your property in Seattle, according to Belong data (pictured below), with the average rent peaking at $3305. Seattle is also home to many desirable school districts, so larger family rentals in these areas attract hot competition and rents in the lead-up to Semester 1 in September.

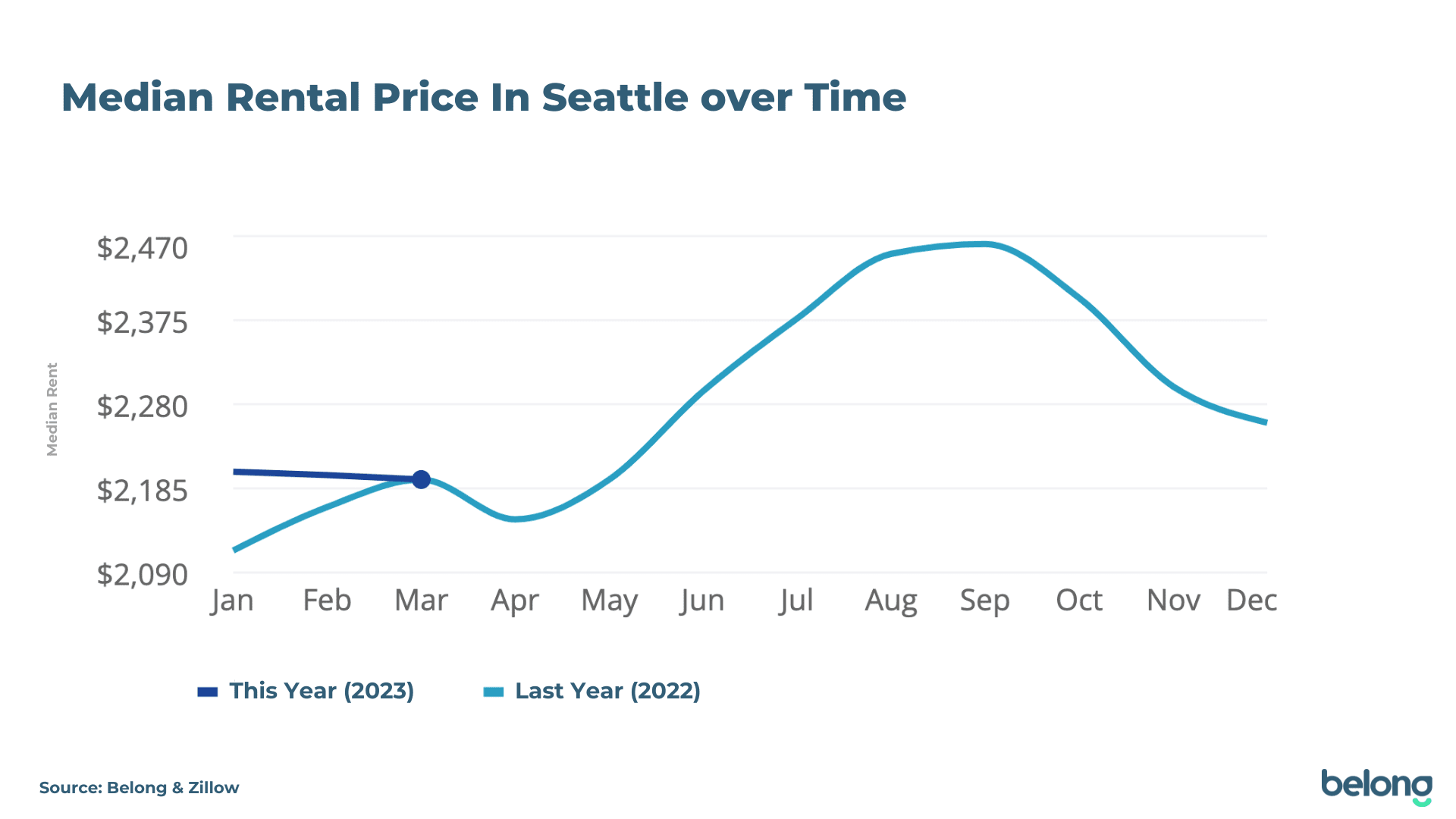

Comparing Belong’s data to a wider data source such as Zillow (which includes multifamily and apartments in their numbers), their market trends show the same peak in Summer, with average rents peaking between $2,450-$2,461 in the August/September period.

That’s not to say that investors renting out a Seattle home in winter will take a huge hit. Even as the average rate dips seasonally, Belong homeowners still get an average monthly rate of $2,500-$3,000 during low months like December.

March is also a strong month for rents, and if this trend continues, rents will remain stable before peaking in August. If you plan to enter the market, you have time to prepare and benefit from higher prices in a few months.

What are the Other Macroeconomic Factors to Consider?

Interest rates aside, what other macro factors should be considered before investing in the Seattle metro area?

The Seattle metro is:

- One of the top five cities for household income.

- A city with a low unemployment rate but is experiencing anxiety around layoffs.

- Being hit harder by inflation, with rates higher than the national average.

- Still experiencing low rates of mortgage delinquency and foreclosures.

- Investing in transportation to close gaps and improve accessibility.

Seattle is an affluent area, with residents earning a median household income of $105,391, according to the latest Census data. This ranks the city fourth among the 100 largest metro areas in the U.S.

This is largely fuelled by a lucrative job market. If you look at the Redmond area, median income jumps to $147,006—unsurprisingly, given it’s where Microsoft is headquartered. It’s hard to look at macro factors influencing the Seattle real estate market without discussing the current tech downturn. Could industry layoffs put pressure on homeowners or lead to distressed inventory on the market?

Microsoft, Amazon, Meta, Salesforce, and Google have all made employment cuts affecting Washington-based workforces. In fact, Seattle is said to have some of the highest layoff anxiety. But while tech has driven much of Seattle’s growth in recent years, the local economy isn’t vulnerable to this industry alone.

U.S. News recently examined the Seattle unemployment trends and found that the rate of unemployment in Seattle is lower than the national average and that the rate of foreclosures remains low. Only 1.5% of mortgages are reported to be delinquent in the metro area, and 0.1% have active foreclosure filings.

The Economic and Revenue Forecast Council released their March 2023 results, stating that while the overall unemployment rate began to rise earlier than anticipated in 2022, employment also increased by 16,300 in November and December—3,800 more than forecasted. They also noted that consumer price inflation in the Seattle metro area continued to exceed the national average in the year ending in February 2023, adding to the cost of living pressure for residents.

For existing landlords, this high inflation, layoff anxiety, and uncertainty in the market may cause workers in the industry to postpone trying to buy a home and rent for longer. Seattle is already home to more renters than owner-occupiers, sitting at 55% renter-occupied in the last Census. For those looking for an in, these layoffs haven’t yet created a flood of distressed housing stock on the market. That may change if economic conditions worsen, but it’s worth noting that the tech industry typically employs skilled workers and gives generous exit packages, which softens the blow to the local economy.

Another notable factor is transportation. The SoundTransit system expansion will see improved accessibility across Seattle, impacting the value of local real estate as it becomes easier for people to get into the city. Investing in real estate in these areas (such as Lynnwood, Shoreline, Everett, and Marysville, for example) before the transit system is completed could provide a lower entry point with an opportunity for higher rent and home appreciation over time as access to amenities improves. ??

How Real Estate Investors Can Keep a Pulse on the Seattle Rental Market

Whether you’re new to the real estate investing game, dealing with a problematic property management company, or burnt out on self-managing your rental home, BiggerPockets, and Belong can help.

From ebooks to podcasts, BiggerPockets offers educational resources for every level of real estate investment experience and strategy. When it comes to managing your home, Belong is not a property management company but a residential network offering industry-leading services to both homeowners and their residents.

From not charging hidden fees for the essentials to industry-first fintech solutions to manage your cash flow more effectively, to guaranteeing rent, Belong will partner with you to make owning a rental property worth it. And you’ll never need to lift a finger. Learn more and find out if your home is eligible (even if you’re mid-lease!) here!

This article is presented by Belong

Own a rental property? Say goodbye to property management and hello to Belong. Belong brings end-to-end home management services to your fingertips.

Enjoy guaranteed rental payments, vetted residents who love your home the way you do, 24/7 support for you and your residents, innovative cash flow solutions, an industry-leading mobile app, and maximized rental value.

With Belong, you can create long-term wealth while earning passive income.

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.