David:

This is the BiggerPockets podcast show 602.

Marjorie:

Don’t second guess yourself in terms of the things that you know. You know a lot more than you think you do, and you don’t necessarily need to have gotten one deal under contract or anything like that. You are smart people, people out there that try and read and listen and take the advice of other people who are smart and read. I think that it’s endless in terms of what you can do. I shouldn’t say with very little knowledge, but if you feel like you can pick apart those parts of your experience where you can apply them to different deals.

David:

What’s going on, everyone? My name is David Greene, and I’m the host of the BiggerPockets Real Estate podcast. If this is your first time listening, this is where you go if you want to build wealth through real estate and you want to make less mistakes, make faster progress, and do it in a smarter way. We help you to find financial freedom through real estate by interviewing different guests that have done it themselves, as well as industry experts who give specific knowledge on elements of real estate investing that will help make you money.

David:

We’re basically real estate nerds. BiggerPockets is a company that is committed to helping others just like you build both through real estate. You can also visit our website where you can look at forums, where tons of questions are asked and answered. Ask your own question, get an answer there. Check out our incredible blog or go to biggerpockets.com/store, where there are lots of books written on different topics of real estate, several of them written by yours truly.

David:

I’m joined today by my co-host, Mr. Rob Abasolo, where we have an amazing show interviewing Marj Patton, who does a really good job of sharing how she invests in a hot market like Denver but does it with all kinds of different deals, flips, multi-family, single-family, short-term rentals, long-term rentals. She really looks at every deal individually and decides what she’s going to do with it. I think you’re going to love today’s show. Rob, what are some of your favorite parts?

Rob:

I like this one a lot, man. We had a bit of a sidebar. I didn’t intend for it to be, but then we got into the sidebar of quitting your job if you have a W-2, a full-time job, and you’re looking to become a full-time real estate investor. When is that a right decision? I think all three of us brought pretty different viewpoints, but we were all on the same page because at the end of the day when it comes to quitting your job, there’s no right or wrong. There’s just what’s right for you.

Rob:

We also talked a lot about being scared to take on new projects, just jumping into these deals and pulling from past experiences to guide your strategy, to help you be successful from a deal. So even though you haven’t necessarily tackled a niche or an asset class, we still have experience and we’re smarter than we think we are. A little compliment to you, I really liked your take on art versus science in this episode.

David:

Yeah. So you’re going to have to listen to this one in order to hear that, and additionally, we had a little bit of fun. Now, we’re trying to keep the shows a little bit shorter in length. So we actually took out some editing and threw it on the very end of the show. So make sure you listen all the way to the end and then keep listening for our insight onto some non-real estate related topics.

David:

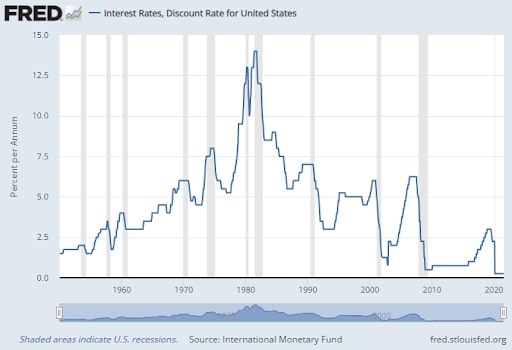

All right. Today’s quick tip is if you like following what’s going on in the news, you like a deeper analysis into specific questions regarding real estate like what’s happening with interest rates, what the supply is doing, how our relationship with China is affecting the market here, check out the new BiggerPockets Podcast On The Market. On The Market was a spinoff from the bigger news show that we do here on the Real Estate Podcast, and it’s sponsored by Fundrise, where Dave Meyer and several other BiggerPockets personalities break down what is happening in the market and on the market. So if you’re looking for a show to listen to in-between releases from this one, go check that one out and let us know what you think.

David:

Last thing I want to say before we get to the show is leave us a comment on YouTube. As you’re watching this show, tell us what you liked, what you didn’t like, what you thought was funny, what you thought was boring, and how you would like things to be different. We read those and we do our very best to incorporate that into the way the show is produced.

David:

Marj, welcome to the BiggerPockets podcast. How are you?

Marjorie:

I’m doing well. Thank you.

David:

Yeah. So we’ve had a lot of fun before we actually hit the record button here. I think our guests are in for a really cool show. Can you give us a brief background of what your portfolio looks like now? Then after that, tell us a little about yourself.

Marjorie:

Yeah. So we, we as in my partner and I, primarily invest in Denver, Colorado. We have have about seven doors. So certainly not, not little, but certainly not a lot, a lot of work to do. We do a combination, and I think that’s a lot about what I’d want to talk about today, too, which is we invest in a little bit of everything. I like to think it’s a mile wide and an inch deep. An inch seems too small, but yeah, short-term, long-term. We do flips. We’ve done private lending. We’ve done 10301. We’ve done out of state. So we’ve tried it all. It’s a little bit of a mixed bag for us and we really enjoy it.

Marjorie:

Then a little bit about me, so I am ahead of sales for a global financial technology firm. I’ve been in financial technology for decades. It feels like, but a very long time and I’ve enjoyed it. I really enjoy the sales aspect of it all in terms of getting to know clients and negotiation gets me excited. It hypes me up. I do love to negotiate, which is why real estate actually is a really good fit for me, but I also come from a background of parents who have dabbled in real estate as well. My mother and her grandfather, actually, as an immigrant, came through, started doing private mortgages, which she did a little bit of herself as well. Then my dad is pretty bullish and really enjoys triple net.

Marjorie:

We have spirited conversations about residential versus commercial. We don’t really agree for different reasons, but the conversation is always my favorite. Then, yeah, I don’t know if I mentioned this, but I’m actually right outside of Denver, Colorado. So I’ve been able to go into the BiggerPockets headquarters in Denver and I also-

David:

You’ve been to the Mecca.

Marjorie:

I’ve made pilgrimage to the Mecca. That’s right. Yes.

David:

That explains that glow coming off of you right now.

Marjorie:

Exactly. It’s also my podcast light, but I’ll take that, too, but yeah. So I’ve gotten to meet all the awesome people at BiggerPockets, and hopefully I’ll get to the point where I can tell you guys a little bit about, too, the women’s investor group that we started, which is why we started working with BiggerPockets a lot.

David:

So I 100% want to make sure we talk about the triple net versus residential debate. I own both, and I’ve had. since I bought my first triple net property, a different perspective regarding when those properties make more sense, what type of person they make more sense for.

Marjorie:

My dad is exactly that person you’re talking about. He’s perfect for triple net.

David:

Yeah, and that’s one of the things I wanted to highlight is out of this conversation, one of the things that I would like for the audience to receive from it would just be an understanding that there isn’t a right or wrong way to do it, but there is a right or wrong way for you to do it, and understanding the strengths and weaknesses, pros and cons, what type of strategy works for a property is a huge part of finding success financially. I like analogies, and basketball is one that I go to a lot because I played a lot of basketball. There are definitely teams where a specific player will thrive and look really good and other teams where they won’t, right? Your portfolio is like your team. So you’re trying to create it with synergistic qualities that work around the strengths and weaknesses of your coaching staff and the other properties that you have.

David:

So I want to get into that, but before I do, I just wanted to highlight one of the things that I really like about your story and my understanding of your investing career is you are the type who looks at every deal that comes your way, picks it up, looks at it from every single angle and says, “How could I use this?” versus “Nope, doesn’t work,” throw it off to the side and move on to the next thing. There’s a level of creativity, ingenuity, and maybe even vision. I’m romanticizing this, but I think you know what I’m saying, right?

David:

A lot of the time we teach new people, “Nope. Just look for a duplex,” we try to simplify it as much as possible. I do think for the very beginning investor, they can be overwhelmed by all of the different options, but once you start to get the fundamentals down, you can start to broaden your horizon and look at what opportunity comes your way, and that’s how I do mine like deals cross my desk and I think, “Would I want to buy it? If so, what would I do with it? If not, would it work for someone else? If not, could I list it?” There’s all these different ways that we can help somebody and then help ourselves, and the best investors take advantage of the opportunity that comes to them, which isn’t always going to fit in the same niche.

David:

So I wanted to ask you. How did you get to that point where you took this approach of looking at all of these different opportunities and deciding how to use them versus just the whole pick it up, look at it, “Doesn’t match what I want,” throw it away and repeat that 700 times?

Marjorie:

Yeah. Great question. I tend to feel like if you can use a lot of your experience, not only even if you have a W-2 job or something that you’re passionate about or did before you started to pick up real estate investing, but I feel like patterns are created, right? Patterns compound, right? So for instance, in my job right now, I negotiate contracts. I’m not a lawyer, but I negotiate alongside the lawyers at my company. So I negotiate contracts. That makes it really easy for me, for instance, to feel comfortable with maybe a long-term rental, understanding who the person is doing the background checks, even though we don’t do that with clients, but understanding what goes into a contract and making sure that I understand all of those pieces, and maybe that makes me a better person to be able to analyze a tenant and things like that.

Marjorie:

Also in my job, I negotiate, which I mentioned. I love the negotiation, right? From an early age, I loved negotiating. I love the buy and sell, and with that, that has allowed me to figure out what’s meaningful to people, right? When I am interested in a deal, I want to buy a house, I want to buy some sort of property, I really try figure out what’s attractive to that person. I’m happy to get into a little bit more actually with a deal that we just did recently, right? I think that really shined through in terms of how we tried to negotiate that because as some of you know, maybe a lot out there who invest in Denver, it is a terribly difficult market right now. It’s crazy, but I like to take a lot of the things that have influenced me that I’ve learned, not only through my job, but just through life in general.

Marjorie:

Then the other thing I said was compounding those experiences, right? So taking those and trying them, but then learning from those experiences, right? We did a rehab on a long-term rental and an opportunity for a flip came up. Well, we already did rehab. We set a budget. We found a team. We knew how many months we had to do it. We knew the type of rehab and updates we were looking for. We knew how much rent we were going to get for it. So we took that lesson and applied it to the flip. So I think that’s the example I’m giving is that you can really take these concepts. You don’t have to take them from real estate. There’s so many concepts that you understand inherently as a human being and a smart person that you can bring into these. Then once you start doing those, you’ll notice patterns of types of investing that you’re doing that you can kind of parlay into other types of investing.

Marjorie:

We did a private loan not too long ago. Everyone’s familiar with the process of underwriting unless you pay cash, and good for you. If you wouldn’t pay cash for anything, ever everything, awesome for you, but we need loans. So we’ve gotten many loans before and we know all the types of collateral that we need to deliver to an underwriter to satisfy their terms and things like that, right?

Marjorie:

So can you take that applied knowledge and then parlay that into a private loan, which we did recently, which was really successful, and it actually was twofold where we earned a little bit of money and we were able to get someone into a duplex that they want and pay cash. She’s a friend of mine, too, so that made it that much sweeter, but yeah. I would say that, in general, don’t second guess yourself in terms of the things that you know. You know a lot more than you think you do and you don’t necessarily need to have gotten one deal under contract or anything like that. You are smart people, people out there that try and read and listen and take the advice of other people who are smart and read. I think that it’s endless in terms of what you can do. I shouldn’t say with very little knowledge, but if you feel like you can pick apart those parts of your experience where you can apply them to different deals.

David:

So this is one of the reasons I try to break the mindset of what is the right way to do it like. How do I want to describe that? It’s like the engineer mindset needs a blueprint to operate off of. If they don’t have a full set of complete blueprints, they don’t know how to start building, and that makes sense in certain things in life. Maybe once you’ve acquired a property, there could be a right way to manage that apartment complex, but to get the property or to structure the deal is much more art than science. What I really like about what you’re saying is every one of us has experiences we can draw from from other things we’ve done in life, skills we’ve built from other things we’ve done in life, and real estate is not 100% independent of that.

David:

The things that we are good at from other parts of life will work within real estate investing, and you have to give yourself freedom to believe in yourself. That’s what I hear you saying is don’t assume you don’t know anything. There are some things that you know how to do. The art part of real estate is what makes it fun because it’s not an algorithm that you just follow mindlessly, right? I think the people that look at it that way are trying to remove a risk. They’re trying to remove failure. They’re trying to remove personal responsibility for how you put the thing together, and they find comfort in this understanding that there’s a right way to do it, but there’s not. There’s a right result you can get. There’s laws that have to be followed. There are principles and guidelines that we follow because we finally make it easier, but what I wanted to get out of you is what other experiences did you have in life that you applied to your real estate investing that helped you get seven units in the Denver area, which is a very difficult market to be investing in that others might not realize they could be doing too?

Marjorie:

Yeah. Here’s just an anecdotal story of how I started as someone who really enjoyed entrepreneurial, had an entrepreneurial spirit, had a very much passion for the buy and sell. It just always fascinated me. In the 2000 election, which I’m probably giving up my age a little bit here, but it was just before I could vote, and in Palm Beach County, which is obviously in Florida, they had this snafu where they did these things called butterfly ballots. It was really tricky for people to understand. So there’s a lot of people that voted for I think it was Pat Buchanan who was I think the libertarian. I forget who it was on the sheet. So they misvoted, and that is a piece of voter history.

Marjorie:

So somehow I had read something, that was the internet was all the rage, and I had read something where you could actually sell on eBay your sample ballots, right? Everyone gets a sample ballot before they actually go to the polls. So I asked my mother and father. I said, “Can I have both of your …” They both got one. So I said, “Can I have both of your sample ballots?”

Marjorie:

They said, “Sure, what do you want them for?”

Marjorie:

I was like, “Don’t worry about that.”

Marjorie:

So I put them on eBay and I got $40 for one and $50 for another. My mom was like, “That’s awesome. High five.” My dad charged me a little bit of interest on that. He wanted his cut of it. He wanted to teach me about taxes and things like that, but that’s the start that I had in terms of really just having the courage to just try things, right? Just get in there and try it. I was hooked after that, right? Some of I feel like what I’ve been able to do and with my partner as well is really get excited about deals, right?

Marjorie:

Do the research. Get into those, and I will say there is a little bit of mitigation on my end because I still do have my W-2 job, right? That is very important to me. I feel like I can take on more risk and try those things, things that I don’t know about and things that I have a little bit of research, but I haven’t tried it yet. I keep that job because of that, and not only that, but I like the diversification. So I really try to figure out a way that I can use all of my themes that I have learned, even that example of just buying and selling, where it’s like you didn’t even think about that, but all of a sudden you hear something or you see something or someone tells you something, and then you want to go a little bit deeper into that and you want to do that research and gain that knowledge.

Marjorie:

You don’t have to … People say analysis-paralysis so much, and granted, people should do analysis, but I think it’s so much more of trust in yourself, get those initial concepts together and then go for it. Take that experience that you had in the past. Take those things that you’ve learned, and it certainly helps because I look on the MLS pretty much all day every day. It’s my favorite website, even though I have favorites in terms of mobile apps, but I’m constantly looking at things. Anything that crosses my desk, it’s not a know. It’s really just a understanding of, “What does that look like? What would that look like to us? What would that look like to me? How does that mirror a deal that I’ve done in the past? Is it something that I’m knowledgeable for or I’m knowledgeable on?” and then trying to figure out, “How am I going to use all of my different strategies and all of my knowledge to go after that so that it’s the right deal for me?”

Rob:

So let’s hop into that a little bit because you talk about jumping into something that might scare you. I feel like at the very beginning of your real estate journey, every deal should scare you. For the first four or five years, everything should scare you because everything should still be pretty new. So can you give us an example of what kind of deals you jumped from and what was your confidence level going into them? Let’s start with your very first one. Maybe just walk us through how the progression of your portfolio evolved in the first three or four properties.

Marjorie:

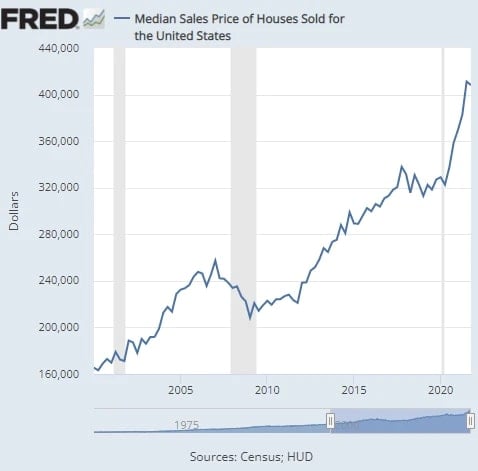

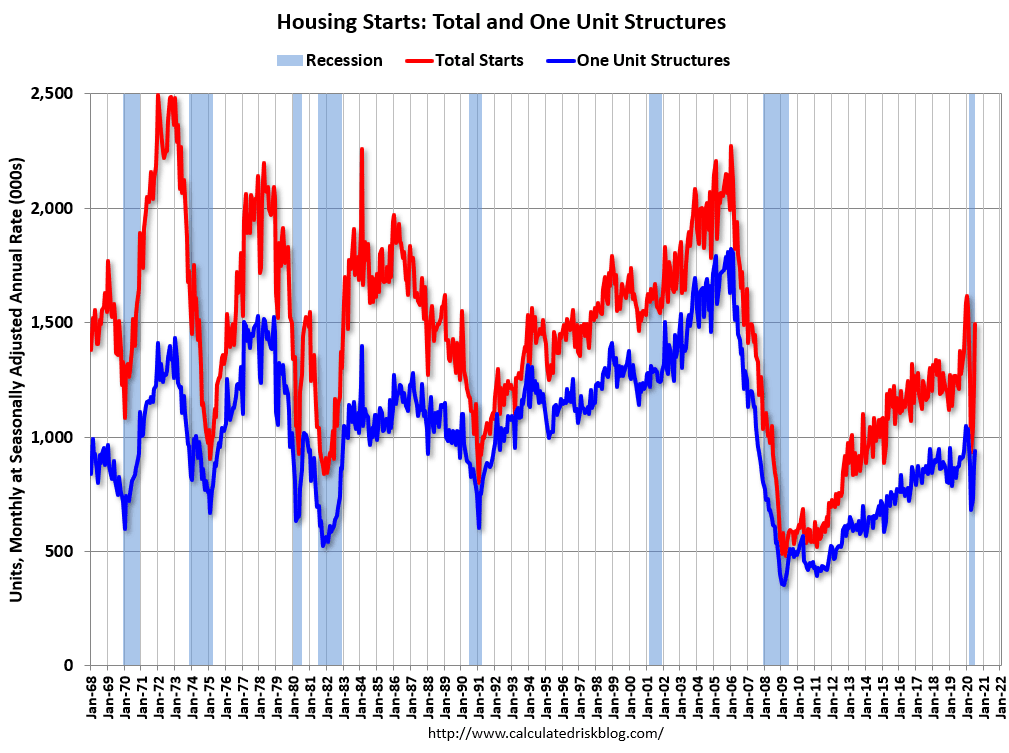

Yeah, I would love to. So I feel like I don’t know how many people have gone into it this way, but we went into it very much like, “Here is the price of the home. Here is our loan. Here’s what PITI looks like on a monthly basis. Here’s what I can get in rent. Awesome. We are killing it. We are going to make money. This is just the start of our empire.” So we had no idea really what we were doing, but I felt as though when you look historically, and you look at really these investments that are more fundamental investments, especially in the history of our economy, I look at downturns and I look at upturns. Is that a word upturns? I look at the ups and the downs. Let’s put it that way.

Rob:

It is now.

Marjorie:

It is now, but I felt very confident because when I look looked at the history of housing prices and things like that, obviously this was after 2008 and 2009, but we were already back on an upswing. When I look at the markets and things like that, I had a lot of faith in order to do this because, A, even though I didn’t calculate for reserves and things like that, which is a pretty massive mistake, honestly, because we had a main line break right after that or we had to like replace the main line. So we didn’t have reserves for that. We learned our lesson pretty quickly after that, but I just felt like my partner and I both came from backgrounds and families where they had done real estate, and that they’d done it a long time ago and it was 2008 and 2009. Now, they’re still doing it.

Marjorie:

So I think we had a little bit of some mentors, if you will, in our past or people that we could mirror ourselves off of that were never afraid to really invest in real estate because it is that really good, tangible asset with tons of exit strategies, which we’ve learned a lot about over the past few years, but we started with that single family home as a long-term rental, and we didn’t do it right, right?

Marjorie:

Looking retroactively, we didn’t do it right, but the reason that we felt so comfortable is because, A, I had a really good partner to do that with, and B, we had a very similar background as to what our thoughts were going into it. So that offset some of the risk for me as having someone else be 50/50 in that with me, but also, historically, I’d had people in my life that had invested pretty heavily in real estate, and sure, they had taken some punches and bruises here and there, but ultimately, their portfolio and the accumulation of wealth had been, cumulatively, it had been up.

Marjorie:

So I just really wasn’t afraid. I couldn’t imagine that getting into this piece of real would really … Maybe I was too optimistic, but I couldn’t imagine that it would really go to a place where I would be in big trouble and then, “Could I sell it? Okay. Even if it takes a 20% hit, okay, that’s what my loan-to-value was 80%.” I was not really afraid because I felt like I had a lot of barriers around that and historically, a lot of confidence that this would just be a good investment, and even if it wasn’t, “Okay. That’s all right. I have a W-2 job. I can take on that risk. I sell it immediately.” There’s a lot of ways to get out of those investments, especially your first ones if it really goes poorly. So I just felt like it wasn’t actually a huge risk when you really looked at it holistically.

Rob:

Sure. So now that you’ve learned the lesson of the reserves on your first deal, how much do you typically keep in reserves? What did you actually learn tactically from that mistake that you called it one of your first big mistakes? How has that set up the procedure for managing reserves in any new investment that you do now?

Marjorie:

Yeah. We had zero reserves, nothing. We didn’t think anything was going to go wrong with the 1960s house like, “How could we have been wrong?”

Rob:

“What could go wrong with a 70-year-old house?”

Marjorie:

“What could go wrong? What could go wrong?” So once we had to replace the main line, which that’s all whole other story about a guy we hired, and then he ran off with some of our deposit, we had to hire someone else. So we got all the lessons in the first one, really. We got them all out of the way. So it was actually a blessing in disguise when you think about it retroactively, but when it was at that point, we were like, “Well, crap. We messed this up, but let’s keep going.”

Marjorie:

We still knew underneath it all that it was a good deal, but now, when we look at properties and whatnot, a lot of what we did on that first one, I never thought about it, but we did a lot of work to that first one. Actually, a lot of people say, “Just buy a place where you only need to update the aesthetics.” When we actually bought it, we were just like, “Okay. We just have money. We know we’re going to update it, but a lot of what we needed to update was the utilities, the functionality of the house.

Marjorie:

So we updated hot water heater. We updated the furnace. Denver has things called swamp coolers, which are synonymous with air conditioners. We updated a lot of those things. So in retrospect, I, in the beginning, was like, “Wow! I spent a lot of my money on things that people are not going to increase the price I get for rent,” and I was upset about that, but then when I think back about it, it’s like, “Well, my reserves actually could be lower because I’ve really fixed a lot of the core things that typically an operating cost would have to take care of,” something that I would have to have a reserve for because we know that plumbing is an issue. We know the electrical is an issue and we updated a lot of that.

Marjorie:

So I feel like what that taught us was we still try to look for houses now where a lot of those utilities are better so that we don’t have to have as much in reserves, but we play with it, right? We put our percentages of reserves based on how much attention that we’ve given to the utilities versus just the aesthetics of the house. So that’s not really a number per se, but I think that that’s how we think about it.

Rob:

Sure.

Marjorie:

We have found someone we really like for every mainline water inspection because in Arvada, Colorado, which is where we have that single-family, we learned that every single pipe that was built in that age range of home is clay, and I don’t know who came up with that, but that’s a terrible idea. So that’s a big one that we keep a little bit for that every single time even if it hasn’t been replaced yet. Sometimes we just say no to a house when it’s that old and it hasn’t been replaced because that’s about a $7,000 to $10,000 fix. So that’ll wipe you out for a long time.

Rob:

Oh, yeah. That could definitely crush returns there for a year. So you’ve talked about mitigating risk. You now have learned a little bit more around, yeah, what kind of reserves you want or what kind of properties you’re buying or not buying. You’re partnering up with somebody. It’s 50/50. So that mitigates that particular risk. Then you also have your W-2 job that is also bringing in the cashflow. So I actually wanted to get into that a little bit and talk about what’s your plan. As W-2 person, especially in your industry, obviously, I’m sure it’s a lucrative industry, but are you looking to seven properties starts to get to that point, especially if you have short-term rentals and everything like that where you might start considering heavying up more in the real estate side and siphoning off your W-2. What do you want? What do you plan to do here in the next few years?

Marjorie:

That’s a good question, Rob, and I feel like it changes probably every quarter, six months, a year. My partner and I like to sit down every year and go over what was our plan at the beginning and then how did it end up, and then what’s our plan for next year. I can tell you my favorite quote is that Mike Tyson quote where he says, “Everyone goes into it with a plan to get punched in the mouth.” I swear, that’s happened to us many different times, and it’s not as aggressive as being punched in the mouth. It’s just we just start to think something else or we want to go after something else.

Marjorie:

So my ideal is that I really still like working in a W-2 environment. I also like the fact that my company has a 401k match. I love the fact that I am diversifying a lot of my income and a lot of my investments through my current W-2 job, but a big reason why I got into real estate was that there was a part of that that was missing that I wanted more control over, and there was a part of that that just excited me at the same time, which is you can see across our portfolio there’s a lot of diversification in our portfolio as well.

Marjorie:

When I think about it long term, I think of it as a slow roll. I think I’m very, unlike a lot of people that I listen to on this podcast because they are about finding financial freedom, somewhat as fast as possible, I don’t quite feel that way. I feel like I get a lot out of my current job and what I understand and what I learn, and I can apply that to being better at real estate investing. So from my perspective, I agree with you. We keep saying that to one another where, “Okay. We keep getting all these properties. How are we going to continue to really figure out how to not only manage them on a day-to-day basis, but manage the bookkeeping of them, figuring out when we have to do all the due diligence around getting our accountant to do our taxes and things like that.”

Marjorie:

So I see it more as like one of those weighted scales, right? So right now, a lot of my time is very much focused on W-2 and here’s real estate because I want to put all of my focus that’s needed into W-2. I don’t want to short change my company who’s really treated me very well. Then I want to just, I think you see it, slowly transition that into potentially more real estate.

Marjorie:

So I don’t know how long that’ll take and I feel like our goals change pretty often, but I don’t feel the need to 10 properties and then I’m out the door. It doesn’t feel that way to me. It’s much more of a, if anything, I think I would take a lesser job. Some of the things that I’ve thought about are going into real estate technology because that’s an industry that is incredibly interesting to me and deserves a lot of disruption if you ask me.

Marjorie:

So yeah, I think it’s not necessarily a specific number. It’s more of a feel, “When is this getting to the point where I’m just so much more interested in real estate? We have so much more going on. I can do so much more,” and then making that shift. I don’t know that shift is going to be cold turkey. I think that shift is going to be more so cutting down a little bit more so that I can continue to mitigate that risk a little bit more with that W-2, but I don’t have to mitigate it as much.

Rob:

Totally. Yeah. I mean, I don’t think it should ever be cold turkey, personally. I mean, I always tell people, not that I’m ever offering advice on this subject to somebody, I mean, I think when it comes to quitting your W-2, your full-time job, there is no right or wrong, there’s just what’s right for you and what feels right for you, but for me, that moment came when I was working full-time job and I was also investing in properties and I was launching my YouTube channel and I couldn’t possibly do anything more. I couldn’t possibly invest in more real estate or make any more content until I gave something up, and that was going to be my W-2 job.

Rob:

For me, I probably honestly waited a little too long because I called my bosses up on a Zoom and I was started crying immediately, and they’re like, “Oh, no. What’s wrong?”

Rob:

I was like, “It’s nothing. It’s just I’m quitting.”

Rob:

They’re like, “Are you going to be okay financially? Are you okay?” Because I was a mess.

Rob:

I was like, “Yeah. I make so much more money doing the other stuff.”

Rob:

They were like, “Then what are you crying about?”

Rob:

I was like, “I don’t know. Healthcare?”

Rob:

So for me at that moment, it really was, it was the healthcare. It was the $2,000 expense of healthcare was truly holding me back from ever scaling up my real estate business or my content creation business or anything like that. So I’m curious, Dave. I mean, you’ve left behind a W-2 job. What was that moment for you? What do you recommend for people? Because, obviously, in this housing market, we’re having a lot of highs right now and a lot of success in the real estate world. So how would you navigate that?

David:

Well, YouTube both hit it on the head when you said it’s different for everyone. So my personality was I’m more conservative. So I worked that job as long as I could until my turning point was literally I had a listing and I couldn’t get it on the MLS for two days in a row because I was too busy at work. Then I was getting held over so I couldn’t get off work and do it when I got home. I just realized in my gut I’m not doing right by the client. I need to quit the job and focus on real estate, but there’s also the people who don’t have to quit their job but want to quit their job. That’s probably where I would want to put some advice right now.

David:

In a market that we tend to make decisions when we’re investing in real estate or in a lot of things that are opposite of what you see happening, so if you’re in a jujitsu match and someone’s pushing you, you want to pull them. You don’t want to push against them. You’d get tired. So when the market’s hot, we tend to pull, pull back. Don’t buy as much. Be more conservative. Have stricter rules that you’re going to be investing by. When there’s a down market, we want to be more aggressive. Do what you got to do. Borrow some more money. We’re doing things that are traditionally riskier, but because you’re at the bottom of the market, that risk is mitigated by cheaper prices and rising values.

David:

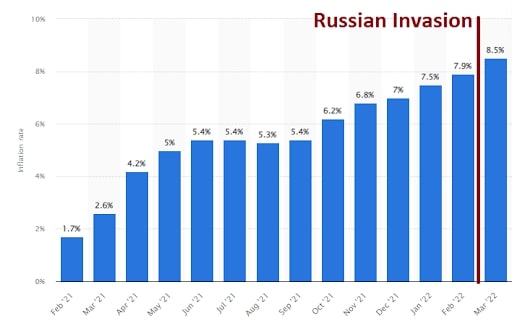

The market we’re in right now, we don’t know if we’re in the bottom or the top. That’s what is so confusing is prices are higher than they have ever been, but every indication says they’re going to keep increasing. So that traditional way of looking at it got a lot of people just arguing right now. There’s people that say you need to be buying, it’s going to run, and there’s people that are saying you be a fool to do that, you’re at the top, you need to hold back.

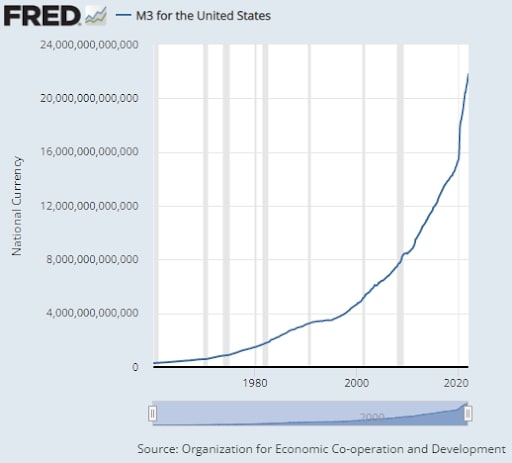

David:

So my response to that is to say I can’t tell which one of those is going to happen. I can’t predict the future. I tend to be in the camp of I think we’re going to keep printing and we’re going to keep driving up asset prices and so buying in the better cities, the better areas and the better properties is going to make you a winner, but I don’t know that.

David:

So where I pull back would be this is not the time to go live a life of luxury because you got some cashflow coming in from properties. This is not the time to quit your job out of luxury as opposed to necessity. What you two are describing is, Rob, you said, “I couldn’t work anymore. I was losing opportunity. I had to quit,” and, Marj, you’re saying, “I’m not at that point yet, so I don’t see that happening.” I think that’s the wise advice. When we don’t know what direction the real estate market is going to take, I want additional of income that are completely unrelated to real estate.

David:

So if we are at the top, I’m okay, I have money coming in, and if we’re at the bottom, I just lost a little bit of time and effort, but I didn’t actually lose money. So my advice to people is if you’re thinking about quitting your job, if it’s because you can make more money doing something else, that’s okay. Make sure that platform is going to be solid and the bottom’s not going to drop out from underneath you because that is a possibility. If you don’t have to quit your job, don’t.

David:

I know that that’s different than what every single other real estate investing influencer tells you. They’re all trying to convince you, “Quit your job and let me be the one to help you do it,” right? I’m way more into supplement your job. Okay? Fortify your financial position. Build up fortress around your job with rental properties and with flipping properties and with additional sources of income. Don’t look at it like, “Do I have to do one or the other?”

David:

With what we’ve seen changing in the pandemic, so many people are allowed to work from home, you do have more flexibility in many cases than ever before to make additional income, to do a side hustle. So that would be my two cents. Until I know what’s happening with our crazy market, I’m saying get a job and not only have a job, but build a skillset within that job so you’re solid. If they’re going to make layoffs, it’s not going to be you, and if your company does go under, you can get another job that makes more money or even try to make more money within your job.

David:

So I don’t have the crystal ball, but that doesn’t mean I’m not doing anything. So I’m in that same boat. I’m still buying a lot of rental properties. I’m still buying a lot of real estate, but I’m still working. I’m still earning money through these other businesses because I don’t know what’s going to happen.

Rob:

I think just having one stream of income is risky, right? For me, I try to have as many streams of income as possible, preferably a lot of different streams of income from real estate, from different asset classes, which, Marj, that’s what you talked about. I mean, you have a mixture of long-term rentals, short-term rentals. So yeah, I mean, I think that’s the only way to really mitigate risk is just to give yourself more options because for me at that time, it was actually risky, just for me personally, to keep my job because it was actually costing me money on my other businesses, and that was the turning point for me, but I agree. I think you should be really busting at the seams and spread pretty thin with your nine-to-five job and the other stuff you’re doing before you ever quit.

Rob:

I don’t think it should be like, “Yeah. I think I don’t want to do this. I don’t want to work a W-2. I want to just go all in on real estate.” Well, you still need the money. You still need to pay the bills. So I think it’s a tough call for a lot of people, but yeah. I mean, obviously, it’s case by case.

Marjorie:

Yeah. I mean, if you look at some of the largest founders of some of the biggest companies in the world, I mean, they all held their jobs, right? I mean, Steve Jobs or was it Steve Bosniac? I mean, they all kept their jobs before they really went off and put themselves 100% into these large companies. I don’t know, Malcolm Gladwell, I mean, a lot of people read him. I really enjoy all his books. In the Originals, he didn’t invest in Warby Parker when they came to him because he was like, “Well, they’re still holding onto their jobs. They’re not going in full steam, which means they’re not dedicated to this,” and he lost out on probably millions of dollars worth of profit on his investment.

Marjorie:

So I don’t know. I think it’s really just how you look at it and I thought you guys described it perfectly, right? It’s to each their own eye of beholder do what’s right for you. It does not mean you need to … I read a lot of the podcasts or listen to a lot of the podcasts, read a lot of the forums and people are like, “How can I do this immediately?” For those people, that might be right, but I think there’s a lot of people that almost look at it like, “Should I leave because everyone else wants to leave?” That’s the key to a happy life. I think you have to figure that out for yourself.

David:

Now, what about what we talked about earlier when we discussed looking at different deals or different opportunities in different asset classes and making the decision if this is right for you? Can you share your philosophy on your approach to looking at all kinds of different stuff?

Marjorie:

Yeah. I mean, I hate to say that it’s unscientific, but it’s probably slightly unscientific. I mean, I do a lot of it through word of mouth, and I can talk a little bit about this, too, but about three years ago, especially when I was getting interested in real estate and I didn’t really know really necessarily what to do and where to go to get the information, I hadn’t even found bigger pockets yet, and I looked on meetup, which I think a lot of people do to see if there was some real estate group and there wasn’t one.

Marjorie:

So I created one. It’s called Rocky Mountain Women Invest. It’s local to Denver. We started with 30 members. Now, we’re up to over 300. So pretty proud of that, but I will say a lot of the things that I start to get interested in is listening to speakers that come in and hearing about different people talk about things. We had to meetup last night and a woman was telling me, “Yeah, I buy land in Fort Collins. I buy land and I put like yurts and domes on it.” She said, “One of the most highly searched things on Google search engine is unique Airbnbs,” and she does really well.

Marjorie:

I just think it’s very unscientific how it comes to me, but then I get a little bit more scientific in terms of doing my research. So I mean, the ideas for things like that, they come and it’s about talking to a lot of people, and we have speakers that it’s so much about just hearing a soundclip or a soundbite of someone that’s doing something different and saying, “Oh, that’s interesting. Would that be something I’d be interested in? Let me look a little bit more into that.”

Marjorie:

Sometimes people come up to me and they ask me questions where I can’t confidently answer them and we’d never done a private loan before, but a friend of mine was like, “I want to have this duplex, and I’m only going to buy it if I really have cash to buy it with.”

Marjorie:

We said, “Okay. Let’s start looking at it.”

Marjorie:

So I don’t know that we try super hard. I’m not sitting over at my computer saying, “This is what I should be doing. I need to go for that.” I think it’s more so I pick up on a lot of it from podcasts and talking to people and certainly the investor meetup and things like that. How it comes to me is very unscientific, but how I research them and things like that I think is where the effort really needs to come in to feel comfortable to actually move forward.

Rob:

Yeah. So do you think you could really just clarify here? When you said that you were the private lender, give us the nuts and bolts of this. Were you actually lending out of your pocket to a friend to fund their deal?

Marjorie:

Correct. Yeah, definitely. So she had a duplex in Tampa, Florida. She actually owned the duplex right next door to it. She had found out that they were potentially ready to sell it, and she was hoping it wouldn’t go on the market. Then once it did, her strategy needed to change. So they had some offers, and she knew that she was not going to get it unless she had cash. So she came to my partner and I and she said … She had some other source of income too, but she couldn’t get that person to give her the full source. So she needed another partner to fill in the rest.

Marjorie:

She said, “I don’t need it for that long. It’s only a few months.”

Marjorie:

Actually, the woman I’m talking about is my co-lead at the investor meetup. So I knew her very well, felt very comfortable. She said, “I need X amount. I only need it for X amount of time, and here’s the percentage that I’m willing to give,” which is pretty standard. We were not planning to do another investment in the short term. Sure, having that money is great if you need to jump on something, but I really wanted to try private lending and I really wanted her to get this property.

Marjorie:

So she asked us for a certain amount. We agreed on a rate. My partner’s father is a retired lawyer, so that’s helpful. So he helped us make sure that we drafted up a good contract, and then I was able to really understand it too and help out and work alongside him because I had negotiated contracts before, but it gave me all the education as to all the things that he was thinking about that I just had never thought about.

Marjorie:

She was able to get that property, and then she just paid us back with interest a couple weeks ago, actually. So she only held the money for maybe three months and she HELOCed the property. So she was able to get that loan essentially to cover the amount and then pay us back. So it worked out really well. We did a bunch of just understanding. She’s super organized. She did all of her due diligence. We reviewed all of it just like we would when an underwriter comes to us and asks a bunch of questions, maybe not that in depth, but we understood. She already had a property right next door. She knew very well the value of the property, which made me feel very comfortable.

Marjorie:

We had my partner’s dad help us with the legal agreement. So that not only saved us money, but we got an education around that. Then I just trusted her in general because I’d worked with her for two years now. So I knew what she was doing. I knew the type of investing that she did and all the signs, all the bright lights of “Should you do this? Should you not do it?” were all pointed to yes. She had shown us all the opportunity that she would have with the HELOC and all the numbers and things like that she would have no problem getting that loan to pay us back. So it all worked out and all signs pointed to yes, and we pulled the trigger and it worked out really well.

Rob:

So if I wanted to go out and lend money to somebody, let’s say David, what are some of the things that we actually need to do? Is it as simple as a promissory note, and is it simple interest, compounding interest? How do the mechanics of something like that come together?

Marjorie:

Yeah. Again, ours was not super scientific. We agreed on a rate. That was what she felt that she could pay. She knew how long she would need that loan for. I think some people might not have done that because is it worth giving? It was about 100 grand, and is it giving 100 grand for X amount of time with that percentage? I think some people might not think the juice isn’t worth the squeeze kind of, right? So they might not do it. So we agreed on that. I think that was the biggest, which was to us, is it worth the opportunity cost of some deal came in? I’m not sure necessarily that I have a yes or no feeling around that, but we looked at what the property was. She already had her property right next door valued so we knew what the value of that was.

Marjorie:

When we went to do the loan or went to do the contract for it, there were a couple different ways that you could do it, right? Something that stands up in court that says you have a lien on this property so we would have to get paid essentially or there’s also the other opportunity where we could have actually had her sign over X amount percent of that property should she default. So there was different opportunities to do that. I felt very comfortable with having something written that basically said we have a lie on the property because you owe us this money. So we would essentially be able to bring that to court should anything have gone wrong and say we own X percent of that property because we paid for it and we’re entitled to that.

Marjorie:

So I don’t know if that’s enough of the specifics per se, but-

Rob:

Yeah. I think so.

Marjorie:

… we locked it up pretty confidently and a lot of that reason is because we had my partner’s dad who had negotiated contracts like this in the past. So we learned about it, but overall, more than anything, and I hate to say this because trust is very important, but obviously in the letter of the law, it’s not important, right? Just having a trust and a hope and a wish is not really anything, but we felt like we had enough information in that contract, which there are many good lawyers to work with that, can put together a contract like that for you.

Marjorie:

We’ve had some speak at the Rocky Mountain Women Invest. So I think you should always have a contract and a lock tight contract and agree on how long it’s going to take this person to pay you back, and then what happens when they don’t pay you back after that amount of time. Agree on a rate. What happens if they don’t pay you that rate? Do you want them to pay you monthly? Do you want them to pay you all at the end? These are all the types of stipulations that you need to review with this person if you’re going to loan them money.

Marjorie:

Again, trust that person, right? Get to know that person aside from just putting the numbers together. I don’t know. I don’t know that I would blindly loan to someone I didn’t really know. That’s not my main business, and if I do it again, it will definitely have to be with someone who can provide me all those numbers, and that I know them because it feels better to me.

Rob:

Sure. So I guess what you’re saying is don’t just lend your money out to strangers, which I think is a pretty good tip. I think that might be our quick tip for today’s podcast, but obviously, when you’re putting together these promissory notes and these contracts, they have to go on some fancy stationery. So I’m curious, do you have any tips for using fancy stationeries whenever you’re curating some of these contracts?

Marjorie:

I have never used stationery except for one specific time, and it was to ask someone to sell me their house off market. So no, everything was digital for that contract, but if that’s your lead into this flip conversation, that is a perfect lead in because-

Rob:

It sure is.

Marjorie:

… yeah, I have stationery. I’m pretty sure that was from college. That was given to me by an aunt or something like that, and I’ve never used it, but I’ve always kept it because I was like, “Someday this will come in handy,” and that was, I think, a big reason how I got an off market property, actually.

Rob:

So yeah, tell us about this deal.

Marjorie:

Yeah. So this deal was in the best location possible, and when I say it was in the best location possible, it was in the best location because it was across the street from us. So it was across the street from our primary residence. We actually didn’t really know these neighbors very well, but another neighbor who I was very friendly with had said that this couple was moving out of state. They were retiring, they were moving out of state.

Marjorie:

I said, “Wow! Do you think they might want to sell their house to me?”

Marjorie:

She said, “I don’t know. Go ahead and ask.”

Marjorie:

So I was outside getting the mail, doing something, and I saw her. Her name is Wendy, going to start walking the dogs. I walked up to her and I said, “I hear you’re leaving us.”

Marjorie:

She said, “Yup. We’re we’re flying the coop. We’re going to retire in Northern Idaho.”

Marjorie:

I said, “Wow! Are you guys going to list your house soon?”

Marjorie:

She said, “Yeah, I think so. We haven’t really decided what to do with that.”

Marjorie:

I said, “Well, listen. We have a couple rental properties in the area. We’re familiar with buying and selling real estate, and we would love to make you a really competitive offer to sell.” I said, “We have a friend of ours who’s an agent and so you would actually have to pay no commission because she would come in and partner with us. So we’d save you on that. You wouldn’t have to go and get your house in a good state for sale,” because they had three dogs. So I know that they did not want to have to shuttle these dogs in and out to do showings and things like that.

Marjorie:

I realized, too, in talking with her that she also really didn’t want to do a lot of work to the house, and the house did need some work. They did a good job keeping it up, but they hadn’t made any aesthetic updates. They hadn’t really done any large scale updates that probably might have needed to some deferred maintenance that needed to be done.

Marjorie:

I said, “Think of us. Let me know what you think. If you want to talk with your husband, we’re certainly willing, and there’s no time frame for us. So we can be as flexible as you guys need to be.”

Marjorie:

She said, “Thanks.”

Marjorie:

So I went back into the house and didn’t think anything more about it, right? I’m going to shoot my shot and see what happens, but I did want to memorialize the conversation. So I took that really pretty purple stationery. I don’t like pink and purple. That’s not my color, but I took that pretty purple stationery and I wrote a very nice note on it just to memorialize our conversation and say, “Wendy, we would love to do all these things. Here are the things that I think would be really beneficial to you. Let me know if that works for you guys.”

Marjorie:

Got the mail. She had waved one time when I was driving away and said, “We got your mail. Thanks,” blah, blah. Still thought nothing of it. A month later, she caught me as I was doing something outside and said, “I think we want to go with you guys.”

Marjorie:

This is after we had just finished stabilizing another long-term rental. So we were exhausted. We were very tired. So I called my partner on the phone and I said, “Hey, so good news? We got another property.”

Marjorie:

She was like, “I thought we promised ourselves that we were going to take a little bit of a break.”

Marjorie:

I was like, “Nope. This is too good of a deal. Let’s do it.”

Marjorie:

So anyway, it was a flip across the street. So we did get 30-year mortgage for it. So we knew we were going to have some carrying costs, but I think the magical thing about this was that we brought in an investor, a friend of ours who’s actually an agent because I do not have my real estate license and neither does my partner. So a big opportunity for getting this under contract I think was that the seller did not have to use. They didn’t have to have a representation.

Marjorie:

So our agent, our friend, our investor acted as a transacting broker. So she was representing the seller and she was representing the buyer. I think the nice part about this whole thing was that we actually hugged after we got to the contracting table. They were so happy. I think in a lot of ways you think that you’re taking advantage of people. They were so happy that we were doing this for them. They were so happy because they were building a house in Northern Idaho. We were giving them cash immediately. We did a rent back for her because she had a little bit of a retirement party that she was going to. So I feel like both sides really got something really good out of this. I think a lot of times people feel like, “Oh, you got a house off market. You must have tricked them,” or “You’ve done something,” or “You offered them something, and that wasn’t right.” No, this was fantastic. Both sides were equally happy about this.

Marjorie:

So in terms of the numbers, which I’m looking at right now, but in terms of the numbers, so we paid 460 for the flip and we felt like that was actually pretty good. We thought we could actually spend all the way up to probably about 500 or a little over 500 and still make the money that we wanted to make. Aside from the acquisition cost in terms of rehab costs and carrying costs, we paid about 95,000 combined, and then we wanted to list. So we got ourselves into the 550 range. We had assumed that we wanted to make about a 100K. So we were going to list it at about 650 if I’m just creating simple math, and because the market just exploded while we were doing this, we already thought we would do well because we saw some of the comps, but we ended up listing for 645 and we sold it for 741.

Marjorie:

So like I said earlier that Denver’s a hot market, Denver is a hot market, but to some of the stuff that we were talking about earlier, this is where I just couldn’t say no to this deal. We had never done a flip before, but you just knew inherently by knowing different things about the deals you had done previously. We had talked to so many renters that were going to rent some of our properties and telling us what the rentals look like, how they had to rent because they couldn’t buy a house.

Marjorie:

So we ingested all that knowledge somewhat ominously in terms of we just knew it was a good deal because we had been in this space, we had seen what the numbers were doing, we had friends that had told us what was going on. Rocky Mountain Women Invest speakers had also told us. So it was just through osmosis that we had understood that when we looked at this deal and we looked at all the numbers, we were like, “Yeah.” We already had a crew to do the rehab, and we have a fantastic crew. I mean this, our contractor is like our older brother. He’s amazing. It just ended up really, really well. We nailed it and I’m so happy that we went forward with the deal.

Rob:

Congratulations. Well, I think that’s a very rare circumstance where you want to hug the opposite party at the end of a transaction. I’m waiting for that day where I want to hug the opposite side of that because it’s always a little tense there at the end. So that sounds like a really good deal. Congratulations. So what was the exact profit on that after you listed it and you said it went for 741?

Marjorie:

Yeah. So splitting it three ways across the three of us, everyone got about 55,000 each. So in terms of return on investment, it was about 75%.

Rob:

Really nice. Congratulations. So then obviously, you took your 55,000 and bought a nice car?

Marjorie:

Do you mean that we put that money into the house that we just closed on this week because we’re gluttons for punishment and we can’t stop. We’re just real estate junkies.

David:

I don’t know how much punishment that is making $55,000 three ways.

Rob:

Oh, man. I hate making 55,000.

David:

Yeah. I was just really tired from the last deal and I didn’t know if I wanted to. I just gritted my teeth. Real estate’s horrible.

Marjorie:

So here’s the other problem where in the beginning of the story I said it was the best possible location. It’s actually the worst possible location, too, because now you have neighbors that know that you were the ones that did this work because all your other neighbors saw it. So I don’t feel badly. We did a really good job on that house, but I think it was somewhat serendipitous that we got this other place and we’re actually moving into to it.

David:

Well, you made those neighbors a lot of money is what you did. Their houses are all worth quite a bit more after that.

Marjorie:

That’s right. We had some realtors on the street that had been looking, and I was looking across the street through the window and we had some other neighbors looking through it and I was like, “We must have done something well. They’re so curious.” So they were very happy.

David:

All right. So you’re clearly good at making money on deals. We want to hear about another deal that you’ve done. We’re going to move into the next segment of our show, The Deal Deep Dive. All right. Marj, in this segment of the show, we are going to dive deep into one particular deal you’ve done, Rob and I will alternate asking you questions and you can fire right back at us. Question number one, what kind of property are we going to be talking about?

Marjorie:

We are talking about a multi-family property. It is a triplex.

Rob:

Question number two, how did you find it?

Marjorie:

So like I said, we can’t stop ourselves from looking on the MLS. I’m on Redfin all of the time. I think that they have the best mobile app experience, actually. So when I have a little bit of a break or I’m waiting for someone to join a Zoom, I am constantly looking on the MLS to see what’s going on, if not for a property, to see what other houses look like and what the price is and things like that. I’m just ultimately curious about every single house that gets listed.

Marjorie:

So we saw this one. It probably was on the market for I think less than an hour when it it listed and I shot it over to my partner immediately. I was like, “This is really interesting. Please look at this.” So they came into my office and they said, “What are we going to do? This is interesting.”

David:

How much was it?

Marjorie:

The price, it was listed at 1.4 million.

David:

Okay, and then how much did you buy it for?

Marjorie:

So I’m very prideful of how we got this deal because we actually decided to go into it. We just directly called the seller’s agent and we introduced ourselves and said what our intent was, “We’re investors in the area. This is a really interesting property. We want to live here. What’s your comfort level in terms of being a transacting broker?” Come to learn now, he is a commercial broker. He’s not a residential agent. So I think in general, he works with the guy that owns this, who owns a lot of commercial real estate. I don’t know if I can say this, but it’s actually an NHL player that we’re buying this property from. He actually used to be part of the Colorado Avalanche, but I guess it’s all public records so it doesn’t matter.

Marjorie:

So we started talking with him and presenting ourselves in a way that we thought that he would be very interested. When we started to talk with him more and more and ask questions, the place was fully furnished. The seller didn’t want to deal with furnishings. The seller was out of state. This guy being the seller’s agent was going to have to do everything, right? He was going to have to work on the staging. He was going to have to get the mobile notary. He was going to have to do everything.

Marjorie:

We said, “We’ll do all that for you. You don’t have to worry about the furniture. You don’t have to do any of that stuff.”

Marjorie:

The other thing I think he was pretty nervous about was that this was a very funky property in the sense that it’s surrounded by a lot of single-family homes in that price range. I think he wanted someone to take it on that understood that type of real estate and that wasn’t afraid to take on something along those lines because I think when people think about paying $1.4 million, they want an amazing single-family home and this was not. This was not the same thing.

Marjorie:

So we really presented ourselves as someone who really understood what he was asking for. We would do everything, and then we would not bring a buyer’s agent so that he could figure out with his client. He could save his client some money. He could also negotiate his commission with his client because they have a long-term relationship. So he could come out looking really well, too, and then he could really have more control over the deal as well.

Rob:

That sounds basically how you negotiated it. How did you fund it?

Marjorie:

So we funded it through a majority of the profit that we made off of the flip and then we had done a cash out refi on our primary residents. One of the speakers that I listened to at the Rocky Mountain Women Invest had said to me once, “When you have equity in your home, you’re not earning equity on your equity. You’re earning that because you bought the house to begin with and that house itself is earning the equity, but if you took that money out, you’d still be earning the same amount on that house. So you’re essentially just having money sit there and do nothing for you.”

Marjorie:

So we ended up taking money out of our primary residence. So we used a combination of that and a combination of the profit from the flip, and that was what we were able to use as a down payment, but it was a residential loan so we did 20% off of that, and we offered through talking with this agent who did accept being the transacting broker and talked to the client and they were all comfortable, we talked with him and said, “What is going to get this deal done so that no one else goes and sees it?” because when I called I was pushy and I was like, “Just let us see it. I know it’s not staged or cleaned. Just let us see it. We don’t care. We don’t care at all. Please just don’t,” and he didn’t have any appointments till Saturday. We made an offer with a expiration of Friday night. So we made an offer of 1.5. So we went 100K because we were like, “We’re done with this. We know how hot the market is. We know what the opportunity is for this property. We’re just going to go for it.”

Marjorie:

So we were out Friday night, got a text from the agent who said, “You got yourself a deal.” So no one else even saw this property. It was ours. They took it off the market immediately.

David:

How did you fund this deal?

Marjorie:

So we funded them through a 30-year fixed mortgage, and we put 20% down because it was a residential property because we would be living in it. So we didn’t have to pay the extra 25 or the extra 5% that you would with more of a standard loan on investment property, which would allow us to outfit this property in a way that we were okay living in a multi-family because we haven’t lived in one before.

David:

I’m curious, how did you find whatever lender you ended up using?

Marjorie:

So lender we used is actually a woman that had spoken at the investor meetup, who I invited to speak and she’s fantastic. I’ve actually used her for almost all of our deals. I know that people shop around for a lot of different rates and whatnot, but because a majority of our income and debt and things like that are in real estate, I really feel comfortable with her because she’s very creative in terms of how she can get the underwriter to understand what our assets are, that rentals are not necessarily debt but they’re assets.

Marjorie:

So she does a really good job of helping us and being creative to get not only good rates, but also get us under contract. So it was a lender that we had worked with. I think she’s done all of our rental properties at this point.

Rob:

Awesome. What did you do with it? Flip, BRRRR, rental, all of the above?

Marjorie:

I would say it’s still pending, but we will be moving out of our primary residence in Arvada. This house is in Denver. So we’re moving out of our primary residence. We will be occupying … So it’s a three-unit in the sense that there is an ADU, a brand new ADU in the backyard, so an accessory dwelling unit in the backyard. We will be living in that. Then there is a front house to this on the same property that has an upstairs unit and a downstairs unit. So like the theme of this entire podcast, we’re going to try our hands at something new again. This is our first multi multifamily, but it’s also going to be our first short-term rental. So we’re going to short term rent the basement unit while we’re there. So we’re trying another one.

Marjorie:

The nice part about this deal, too, is that in terms of what we were paying for our mortgage on our primary residents to get into this house, obviously more money down, but to get into this house, it doesn’t really increase our mortgage at all. So we’re going to be able to offset quite a bit of the cost of this with renting out the front unit upstairs and downstairs and then get over ourselves an education on Airbnb as well because that’s the next thing that I really want to learn more about.

Rob:

I wonder if there’s anyone that could help you with that.

David:

Something I want to highlight about what you mentioned is you bought a much more expensive house but your payment did not go up. I like to bring this up because a lot of people associate higher price with more risk. It’s like this leap of faith. You have to take, in many cases, higher price equals less risk. You get into better neighborhoods. You get better tenants, especially when interest rates were lower. Now, you’ve got several units that you can be renting out. So you’ve diversified income streams. It’s less risky than when you’re buying at a lower price point in a worse neighborhood or a worse property. So that can be tricky when you’re making your way through real estate and you’re getting into bigger and bigger deals. They feel scarier, but that doesn’t mean that they are, and you also answered the question about what was the outcome. So last question will be, what lessons did you learn from this deal?

Marjorie:

I learned, I think, how to communicate with my partner and encourage them to live in a multi-family deal with me because there’s some no-nos that we have in our relationship, which is I’m not going to live in an eight-unit apartment complex. Craig Curelop always says, “The more money you make based on the more uncomfortable you are,” and we’re not okay with all of that uncomfortability. So I feel like we found the perfect property to figure out how we both could live in this and feel good and have it be a good investment, but also a comfortable space for us to live in.

Marjorie:

So I feel like that was a milestone in our relationship, which is trying to figure out what is our limit or what can we do from utilizing or leveraging our own ability to live in these properties that we want to invest in. So I think that was a win and that doesn’t seem like much, but actually, I think with people who are spouses and things like that or have partners, it’s actually good to figure out that common ground of where you can be.

Marjorie:

Then I think in terms of that outcome, I’m excited to learn something new. I’ve talked with a lot of people that do Airbnb, but we’ve never done it ourselves. I feel as though it’s somewhat a less risky way of getting into that being that you’re right there, which could be a good thing, could be a bad thing, but I think while we live there, it’s great and our exit strategy can always be we could rent the whole thing. We could rent long term upstairs and downstairs. So lots of different exit strategies. I think it’s just another notch in our education process to help us continue to want to invest in different types of opportunities, but also different types of real estate investments.

Rob:

For sure. Well, for the record, I do think that being there is definitely the least risky way to do it. If you’re there, you can pretty much handle any situation instantly. Whereas if you start investing a little bit farther out, you got to depend on your team more than on yourself. So I think you’re doing it right.

David:

All right. That will bring us to the last section of the show. It is the world famous-

Speaker 4:

Famous four.

David:

In this segment of the show, we are going to ask you the same four questions we ask every guest every episode. Question number one, what is your favorite real estate-related book?

Marjorie:

Real estate-related? I’m currently reading Brandon Turner’s Multifamily Millionaire, which I think people like to have these obscure ones and things like that, but that one is just so dead on, just really easy to understand. Multi-family, I think for some people it’s intimidating, but the concepts that he uses in there, it’s like I can hear Brandon talking to me and narrating this book because it’s so in Brandon Turner speak, but he makes it so incredibly simple that I feel like he’s just beating me over the head with these concepts, and if I can’t get at them, then I don’t think anyone can get them, hopefully. I don’t consider myself such an amazingly smart person, but I think it’s so well done and it breaks it down so easily that it’s a two part book. This one’s the smaller multi-family and then there’s another instance of it.

Marjorie:

So I don’t know if I would say it’s my favorite, but that’s what I’m reading right now. I tend to read books that are not necessarily as much real estate-related. So that’s what I’m reading right now. I’m enjoying it, and if you want to learn about multifamily, I feel like that is a really good, concise, easy to pick up and easy to read book.

Rob:

Awesome. Okay. Question number two, favorite business book.

Marjorie:

Okay. This is the one that I was excited for, but everyone has those turning point books in their lives. My turning point book, and it actually was one that I heard another guest on the podcast talk about, which I got it for networking, honestly, and it ended up being conceptually so much of what I live my life by, but the book is Give and Take by Adam Grant, which I’m sure other people have talked about on this podcast, but I just think the good of it is just so amazing, and a lot of what it talks about is really around that giving, it makes you so successful in so many areas of your life, business, relationships, networking, everything.

Marjorie:

It’s really what I think about when I do any deal, whether that’s in real estate or in my W-2 job or in my relationship or in a friendship and just it’s amazing to me if you are a kind person that gives back, you will ultimately be successful. There’s so many ways that that can infiltrate your life. So I highly recommend. I don’t even know if it’s so much business, but it’s just such a good book. The person that I got that from, he was a master networker, and he thought that book was really good and helped him. I would say yes in networking, but every single area of your life. So I really highly recommend it, and I think it makes me very much a better negotiator. It’s giving back to the community with Rocky Mountain Women Invest, but highly, highly recommend.

David:

Yeah. We interviewed Adam Grant on our podcast episode 467. So if anyone was curious to learn more about old Adam, you can check him out where Brandon and I interviewed him. I also recently think he made cameo on HBO series Billions. I’m pretty sure I saw him on there. It’s a really quick scene, but if anybody out there has any access to the production team of Billions, let them know that Rob and I would be a very good asset to bring in for a real estate-related role. All right. Back to regularly scheduled.

Rob:

We are willing to be ascendants also, just if you’re just looking for that.

David:

Rob, you could probably play my butt double, I suppose. You mean do a couple months of squats, make sure I look good, but yeah, I can see that.

Rob:

We’ll negotiate off camera. Question number three, outside of taking on really crazy real estate projects that scare you and that you’re willing to take on head first, no, that’s not, take on head on, there we go, what are some of your hobbies?

Marjorie:

I love sports. I’m a highly competitive person, which makes me a really good fit for a sales role, but also, I’m a big car enthusiast. It was how my dad and I bonded I think a lot as a kid. So there’s a guy I follow who invests in Northern Colorado, Mark Ferguson, if you guys have heard of him, and he’s a 95%-

David:

He talks about his Lamborghini every now and then, doesn’t he?

Marjorie:

Just a moderate amount, just a moderate amount, but I like his theory on it because I think it aligns well with mine, which is he’s also open to alternative investments, which you could. It is classified that real estate investing is an alternative investment, but cars are also alternative investments. So I try to though just like him find cars that are unique enough that they appreciate and value because it’s a little bit of a bad habit in terms of opportunity cost sinking money into that versus real estate. So I try to keep it at a point where my partner and I both agree that it’ll hold its value or it will appreciate, and that I don’t go and sink something into a car that’s just going to just tank right off the lot or something along those lines. So you can find me definitely at some car meetups because I do love that.

David:

All right. Last question for me. In your opinion, what sets apart successful investors from those who give up, fail or never get started?

Marjorie:

I think looking at every deal. I think know your bounds, but anything that fits into your bounds always say, “Yes, I’m at least going to review this.” Try something new. From my perspective, I think once you get dead set in doing something, you have blinders on to other opportunities that might come up. I think it’s great to get very specialized, but don’t, I guess, negate the opportunity to listen to a new deal or someone’s experience or something like that, and then go research it for yourself. Try it. There’s so many different ways and so many different people that can help you figure that out, and don’t be afraid to take on the risk.

Rob:

Well said. Well, final here, not a question, but, Marj, earlier you were telling us you had 300 followers on Instagram and we got to pump up those numbers. So can you tell us a little bit more about where people can find out more about you, where they can follow you on the socials?

Marjorie:

Yeah. David and I were talking about those. I have a terrible Instagram name, but if you want to follow me, I sometimes posts there. My Instagram is TheeMarjPatton. So T-H-E-E. Terrible, but I am much more active on our Rocky Mountain Women Invest Instagram. So it is just like it sounds, Rocky Mountain Women Invest except the Mountain is spelled MTN, and you guys should absolutely come if you are in the Denver area or if you’re just going to be here sometime if you are a female or a woman looking to get more, find a community, network with people, listen to really good speakers. We’re trying to grow this thing and it’s just one of my favorite things. So I’m always happy to talk and certainly talk about this podcast and you can tell me if it actually was helpful or not helpful, whatsoever. So I to totally welcome it, but yeah, look forward to that.

Rob:

That’s awesome. Did you say that your Instagram handle is thee like T-H-E-E?

Marjorie:

Oh, yes. Embarrassingly, yes.

Rob:

Very proper. I love it. David, I think we just figured out the solution to your TikTok problem, TheeDavidGreene.

David:

Because you do copy Zerber so it fits with the sir thing.

Rob:

Yeah.

David: