After years of record-breaking appreciation, property values are facing their first real test since 2019, as mortgage rates rapidly rise and put downward pressure on housing prices. As such, many real estate investors are rightfully wondering if they should invest now before rates rise, or if they should wait for a possible price correction.

This is an important question for real estate investors, and luckily, we can answer it for ourselves with simple math.

In this article, I will talk you through how returns would differ if you bought now versus waiting for a “crash”. I’ll also demonstrate how you can use calculators on BiggerPockets to do these calculations yourself.

The variables

The question I’m seeking to answer is — should I invest now before rates rise further? Or should I wait for a potential price correction? There are just two variables we need to consider to answer these: interest rates and home prices.

Let’s create two scenarios. The first is buying now (mid-April 2022), where interest rates for an investor on a 30-year fixed-rate mortgage are about 5% and the median home price in the U.S. is $400,000.

The second scenario is going to be a market crash scenario, where the median home price declines by 10% to $360,000, but that doesn’t happen until the end of 2022, at which interest rates for an investor increase to about 5.75%.

To be clear, I am not saying that a crash is going to happen. I personally think the more likely scenario is that price growth starts to flatten out in the coming months, and perhaps even decline at some point within the next year or so. But, I don’t think a 10% contraction is likely.

Overall, low inventory and demographic demand will likely put upward pressure on housing prices and counteract the effect of rising interest rates. However, we’re in strange times, and the direction of the housing market is unclear.

For the purpose of this article, I am going to model what I would consider a true “crash” scenario – which is a 10% decline in home values. Of course, there are limitless scenarios we could run, but since I hear so many questions about the “crash” scenario I think it’s the most interesting one to model.

In both scenarios, I assumed rent prices of $2800/month and forecast an average of 3% appreciation post-purchase. I did this because even if prices do happen to decline a bit in the coming year or two, I expect strong appreciation in the housing market over the next 10 years. I recognize rent could go down in a “crash” scenario, but I want to limit the number of variables in the analysis, so I kept rent the same in both scenarios.

Analysis

To make this analysis as easy as possible, I am going to plug in my assumptions to the BiggerPockets rental property calculator.

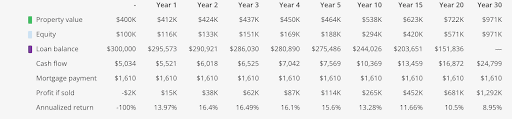

Scenario 1: Buy now

Purchase Price : $400,000

Down Payment: $100,000 (25%)

Closing Costs: $7,000 closing costs

Annual Appreciation: 3%

Loan Details: 5% interest rate, 30-year fixed rate

Rent: $2800

View Full Calculator Report Here

In Scenario 1, if I owned the property for 10 years, the value of this fictional house would increase to $538,000, and I would be earning over $10k/year in cash flow after a decade of gradual rent increases. If I went to sell the property after 10 years, I would earn a profit of $265,000, which is good for a 13.28% annualized rate of return. Solid returns!

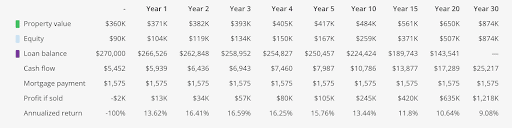

Scenario 2: Wait for a price drop (10% price correction)

Purchase Price : $360,000

Down Payment: $90,000 (25%)

Closing Costs: $7,000 closing costs

Annual Appreciation: 3%

Loan Details: 5.5% interest rate, 30-year fixed rate

Rent: $2800

You can check out the full calculator report here.

In Scenario 2, if I owned the property for 10 years, the value of this fictional house would increase to $484,000, and I would be earning almost $11k/year in cash flow. If you’re wondering why the value of the property is less, it’s due to the fact that in both scenarios I assume an average of 3% appreciation. In Scenario 2, we had a starting point of $360,000, as opposed to $400,000 for Scenario 1.

If I went to sell the property after 10 years, I would earn a profit of $245,000, which is good for a 13.44% annualized rate of return, slightly higher than Scenario 1.

Breakdown

As you can see from these two analyses, the difference between the two scenarios is not very considerable. The total profit is greater for Scenario 1 ($265,000 vs $245,000), but the rate of return is higher for Scenario 2 (13.44% vs. 13.28%). This is because you put $90,000 down to earn $245,000 in Scenario 2 whereas, in Scenario 1, you put down $100,000 to earn $265,000.

If it feels like I doctored the inputs to make the results come up similar (which I do for the purpose of explanation sometimes), I didn’t. I just came up with a market crash scenario that is within reason and this is how it played out.

Frankly, I was pretty surprised to see how similar these two scenarios worked out, and I found the results encouraging. It’s reasonable to be worried about the market and where we’re going over the next few months.

Getting the results of this analysis and finding that “investing now or in a 10% correction is about the same” made me feel more confident in my own investing strategy.

My thoughts on the market

Although this is a confusing market, I am still actively looking for deals, and here’s why.

I personally believe the market will flatten out or even go slightly negative at some point in the coming year or two. But, it is incredibly difficult to time the market. I can easily see the market appreciating more in the coming months as well. Overall, I’m not trying to time that market because I’ve done that in the past and lost.

As I said at the beginning of this article, there are two variables in this equation: interest rates, and property values. One of these variables is unclear and the other is pretty certain. In terms of property values, I have personal hypotheses about what will happen in the coming years, but those are just my personal opinions. On the other hand, mortgage rates are almost guaranteed to increase. The Fed is insistent on controlling inflation and bond yields are rising rapidly – making mortgage rates go up. Because the direction of interest rates is predictable, but property value growth isn’t, I am trying to make decisions based on the variable I can better forecast.

Even if the market does correct in the next year or two, I personally think something along the lines of a 5% correction is more likely than 10%, despite it still being a possibility. A 5% drop, which I’ll call Scenario 3, yields the worst returns of all: $244,000 in profit at a 13% annualized return. This happens because the decrease in prices is not enough to offset the rising interest rates. So, although the difference is negligible in the long run, buying now has a slight advantage over what I think most realistically will happen in the coming years.

All of these scenarios are better than what I think alternative investments offer. With inflation eating away 8% of money’s value annually right now, I feel a strong imperative to invest my money. Cash is losing value rapidly and I don’t want to let my spending power slip away. Bonds have a negative real interest rate (they don’t even keep pace with inflation) and are unattractive.

I do invest in the stock market, but I don’t think I’ll get a 13% annualized return over the next 10 years in the stock market, and I don’t know enough about crypto to put any significant portion of my net worth into that asset class. I’ll admit, I am biased toward real estate because I know it best, but I genuinely believe it will outperform all other asset classes over the next 10 years.

Of course, these are just my assumptions and feelings about the market. At the end of the day, it’s up to each individual investor to make their own forecasts of the market. In fact, BiggerPockets launched its newest podcast, On The Market, which is hosted by myself and is designed to help you form your own strategy based on changing market conditions.

Once you have a sense of where you think the market might go, run your own analyses! Use the BiggerPockets calculators like I did to determine for yourself if now is a good time to invest, or if you’re better off waiting, based on your own assumptions of where housing prices and interest rates are going.

The calculators make it super easy! So don’t be stunted by fear – run the numbers for yourself and make a data-driven informed decision about your strategy.

On The Market is presented by Fundrise

Fundrise is revolutionizing how you invest in real estate.

With direct-access to high-quality real estate investments, Fundrise allows you to build, manage, and grow a portfolio at the touch of a button. Combining innovation with expertise, Fundrise maximizes your long-term return potential and has quickly become America’s largest direct-to-investor real estate investing platform.