This is by no means the worst economy we’ve ever seen. But with the exception of the first few months after the beginning of COVID-19, it is almost certainly the strangest and most volatile.

Inflation is the highest it’s been since the early 1980s and will likely remain for the foreseeable future. Real estate prices have increased at a rate that exceeds the pre-2008 crash. There’s a massive housing crisis, various supply shortages, rising interest rates, an inverted yield curve, and economic growth during the first quarter of 2022 was negative.

Indeed, a recession may be upon us. Some think another housing market collapse may be coming soon.

Wherever we’re going, one clear thing is that we are in a very volatile economy where investors should proceed with caution. Nevertheless, they should still proceed.

I’m not a fan of sitting on the sidelines and “waiting for the market to correct.” I thought the market would correct around 2018. I was wrong. Had I stopped buying, I would be regretful about it. Had I sold our portfolio, I would be even more regretful.

Indeed, I’ve known people who have been saying that since 2015. Needless to say, they’re still waiting.

Prepare for a market shift

Modify your investing tactics—not only to survive an economic downturn, but to also thrive! Take any recession in stride and never be intimidated by a market shift again with Recession-Proof Real Estate Investing.

20-Mile Marching

Jim Collins is best known for his classic Good to Great, but I believe his book on how to invest in a volatile economy, Great by Choice, is even better. One of Collins’s key points is the importance of a consistent approach through both good and bad times. He refers to this as “20-mile marching,” an analogy to the famed explorer Roald Amundsen.

In 1911, Amundsen and his team faced off against Robert Falcon Scott in a competition to see who could reach the South Pole first. Scott’s team would go as far as they could on good days and then hunker down on bad days. This seems intuitive, but it didn’t work. Unfortunately, not only did Scott and his team not reach the South Pole, they didn’t make it back alive.

On the other hand, Amundsen had a dogmatic belief in preparation and consistency. As Collins writes in Great by Choice,

“Amundsen adhered to a regime of consistent progress, never going too far in good weather, careful to stay far away from the red line of exhaustion that could leave his team exposed, yet pressing ahead in nasty weather to stay on pace. Amundsen throttled back his well-tuned team to travel between 15 and 20 miles per day…When a member of Amundsen’s team suggested they could go faster, up to 25 miles a day, Amundsen said no.”

The relation to business is simple, “The 20 Mile March creates two types of self-imposed discomfort: (1) the discomfort of unwavering commitment to high performance in difficult conditions, and (2) the discomfort of holding back in good conditions.”

Collins found seven companies that beat the Dow Jones and their industry by at least 10-fold over 15 years during a turbulent environment. All seven, including Southwest Airlines, Microsoft, and Intel, followed the 20-Mile March philosophy.

Hunkering down destroys momentum and creates apathy and perhaps even paranoia about the future. No excitement comes with sitting around and waiting. If you have a staff, the best employees will probably believe that there won’t be much in the way of growth opportunities and move on.

On the other hand, expanding like crazy can create additional problems, from outgrowing your systems to overleveraging to making careless mistakes as the number of your commitments outpace the time you have to vet them properly.

Growth should be consistent, in good times and bad. More or less, this is the thought behind dollar cost averaging. Of course, you should not take this as dogma. There are times to stop expanding (for example, if multiple employees quit, or your bank won’t renew a big loan) or expand quickly (a killer deal comes around). Still, the plan should be for consistent and quality growth.

Not the Time to Reach

20-Mile Marching doesn’t specify a particular strategy, though. It doesn’t say you shouldn’t sell a property or two now if your cash is tight or cash flow is low. And it certainly doesn’t say you should reach if you cannot find a deal in a hot market like this.

Indeed, when the market appears a bit irrational (in this instance, too hot), it’s a good time to sharpen your pencil and only take deals that are certain to make sense. This might reduce the number of properties you are buying. You might not even be able to find one for a while.

But not finding a property is not the same as hunkering down. After all, you’re still looking, and sooner or later, you will find one.

Cash is King

Another key point Collins makes is that companies that held large cash reserves did substantially better than those that did not. This is because those companies have sufficient funds for a rainy day and have enough money to pounce on golden opportunities when they come around.

I made a similar point when reviewing Nicholas Nassim Taleb’s great book Antifragile in a previous article,

“Taleb believes that trying to predict such rare events is mostly a fool’s errand. Instead, one should try to become ‘antifragile.’ Antifragility doesn’t describe something that can survive disorder or even a downturn. For that, he uses the term ‘robust.’ Instead, antifragility is something that gains from disorder.”

“So whereas most companies struggle in a recession, a company that thrives in a downturn would be antifragile… Those who ‘thrive from disorder’ can often grow exponentially while others are declaring bankruptcy.”

Having money to buy assets when they’re cheap can make a real estate investor antifragile.

Of course, “have money” is not the most helpful advice. It is notoriously difficult to maintain strong cash reserves with real estate in particular. I’ve often joked that you’re not a real estate investor unless you’re cash poor.

That being said, in volatile economic conditions, it is not the time to ride the line. If refinancing or selling a property will get you some breathing room that you don’t currently have, it would be something to strongly consider.

Likewise, if you are considering quitting your job and going into real estate full time, I would make sure you have saved up a substantial rainy-day fund. If not, it may be worth holding off on that decision for the time being.

Dealing with Inflation

Of course, we are in a high inflation environment, so you don’t want to hold too much cash, or at least, you don’t want to hold too much cash as cash. Now would be a good time to look into investment vehicles that offer at least a small return to help offset inflation.

Unfortunately, these are hard to come by. A 3-month treasury bond, for example, still only provides a paltry 0.95% return as of this writing.

That being said, the nice part about holding real estate is that inflation erodes debt while assets continue to (usually) increase in value. As long as most of your wealth is in hard assets such as real estate, inflation shouldn’t hurt you too badly.

But inflation does make it more difficult to cash flow. Prices for materials, wages, insurance, and taxes all go up, making it all the more important for landlords to keep up with rent increases (at least until the market cools).

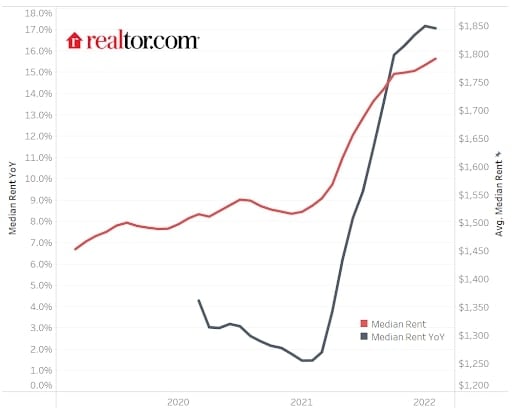

Indeed, last year, rents went up some 15%.

Yes, these are challenging times. If you can afford to offer your tenants a break, do so. But only if you’re confident you can afford to.

Otherwise, you need to be more aggressive with rent increases. Most leases are renewed annually, and locking in a below-market lease could severely affect your cash flow as prices on everything else continue to increase month over month.

In the same vein, you need to make tenant screening a priority. This should always be the case, but in volatile times, it will be the tenants on the edge who stop paying first if we tumble into a recession. Thus, it’s even more essential now to screen prospects thoroughly.

The Real vs. Nominal Distinction

In a low inflationary environment, you can take returns at face value. 8% interest is 8% interest.

In high inflationary periods, this is not the case. When inflation is high, you need to account for real vs. nominal prices. For example, if your annual return is 8% and inflation is 9%, then you really lost 1% in real terms.

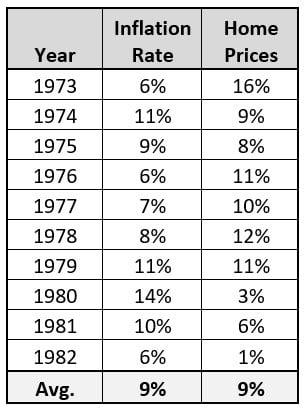

This is one reason I believe it’s unlikely that the real estate market will collapse. I do believe that in real terms, it will likely decline as real estate appreciation will fall behind price inflation. But if you look at what happened the last time there was high inflation and low growth, real estate just about kept pace with inflation:

But while this shows that real estate didn’t collapse during the stagflation of the 1970s and early 1980s, it also shows real estate didn’t do particularly well either. However, if you had looked exclusively at the appreciation rate without considering inflation, it would look like real estate did great.

Thereby it’s essential to start thinking in real terms instead of nominal.

Fixed Interest Rates

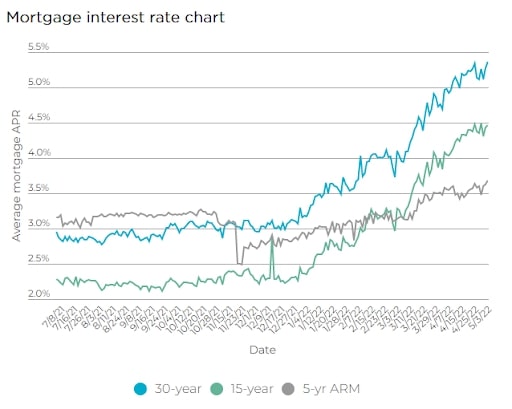

Interest rates may feel high now as the 30-year fixed mortgage just crossed 5% after hovering near an absurdly low 3% for all of 2021.

But just because it feels high doesn’t mean it is. Remember, we need to think in terms of real vs. nominal. Interest rates are still substantially below inflation, which doesn’t make much sense.

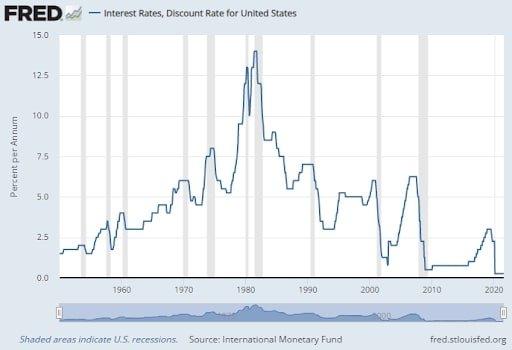

Historically speaking, the Fed’s discount rate (what it lends to banks at) is still very low, and even if it gets that rate up to 2.8 % by the end of 2023, as it says it will, it will still be at the lower end of the historical average. The discount rate is nowhere near the rates that Paul Volker brought it up to in order to “break the back of inflation” in the early 1980s.

In other words, interest rates are still low.

The more certainty you have in a volatile economy, the better. So, the moral of the story is this: No adjustable-rate mortgages right now. Make sure your loans are fixed for at least five years, 10 if possible.

And if you have loans coming up for renewal in the next year or two, I would highly consider refinancing them now (assuming the prepayment penalty is not too high) at these “high-interest rates.” Trust me, unless you have lived through the interest rates of the 1970s, 1980s, and even the 1990s, you have no idea what “high-interest rates” actually are.

Conclusion

Volatile and fragile economies can be scary, but they can also bring opportunities. It’s been extremely difficult to find properties to buy in the last couple of years. When the market starts to cool, that should change.

Indeed, the best investors often do the best during recessions or volatile economies. They don’t do so, however, by sitting on the sidelines. Instead, they keep their reserves high, adjust to the environment, sharpen their pencils, and continue 20-mile marching.