Last week, the Biden Administration unveiled the Housing Supply Action Plan (HSAP), a new proposal that aims to make homeownership and renting more affordable. The median home price in the United States has risen nearly 47% since April 2019, and rents have increased by over 21% over the same period, according to BiggerPockets’ internal data.

There are a lot of elements to this proposal, but together they aim to increase housing affordability by reducing the housing shortage in the country. Each piece generally falls into one of four categories: Zoning Reforms, Financing, Owner Occupancy, and Cost Controls. The plan, if enacted, would pay for such proposals with a combination of existing funding (largely taken from the bipartisan infrastructure bill passed last year, as well as Department of Transportation budgets) plus new spending proposals.

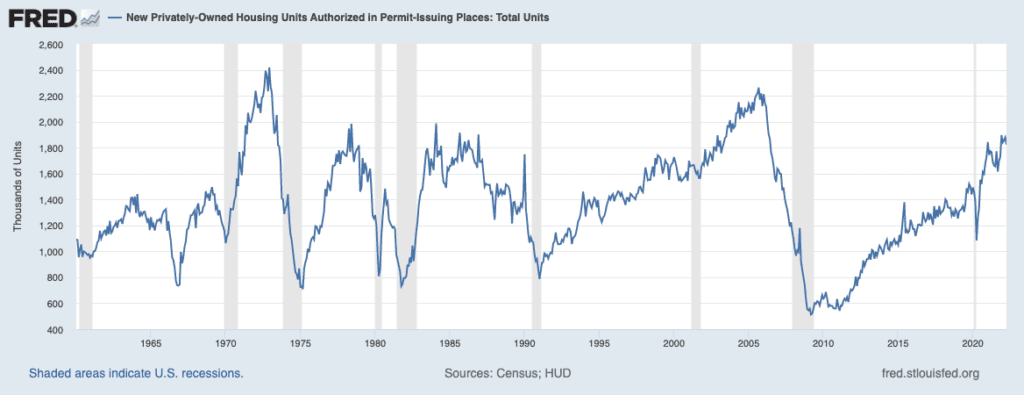

Estimates of the size of the housing shortage vary depending on the source. On the lower end, Moody’s Analytics says it’s about 1.5M units. On the other end of the spectrum, the National Association of Realtors estimates it’s about 5.5M.

Regardless of which estimate you look at, a housing shortage is a problem. First and foremost, it creates a situation where many Americans find it increasingly difficult to find a place to live, and existing housing units go up in price, straining budgets. It’s simple economics—if supply cannot meet demand, prices will rise. This dynamic has played a significant role in the rapid property value increases over the last several years.

Of course, many other factors have recently pushed up prices, such as super-low interest rates, demographic demand shifts, inflation, and low inventory. But the lack of supply is one of the long-term trends impacting the housing market since before the pandemic and is poised to continue to impact the housing market for years to come.

As a country, there simply has not been sufficient building since the Great Recession:

This proposal aims to correct that. While none of these proposals have gone into effect, and many more details are needed to understand the impact fully, we can examine the information we have so far.

Zoning Reforms

Zoning in many areas restricts the building of high-density developments. Think of places where only single-family homes can be built, where height restrictions exist, or municipalities that prevent the construction of Accessory Dwelling Units (ADUs). Any real estate developer or builder is likely very familiar with many of these restrictions that make it difficult to build a bunch of units quickly. Proposals in the Housing Supply Action Plan aim to reward municipalities that reform their zoning and land use laws to encourage more building and higher density.

As an example, some independent analysis by the Urban Institute suggests that these types of reforms, along with the improved financing proposed in the HSAP could lead to the construction of 1 million additional ADUs in the next five years. ADUs are an attractive option to boost residential density, as it allows homeowners and smaller investors the chance to add units at relatively low costs, with relatively less permitting and risk.

Financial Reforms

There are many federal programs that can help fund new housing, but the programs are disparate and difficult to navigate. The HSAP imagines streamlining these programs to make it easier to build affordable housing.

Specifically, one proposal calls for $25B to be distributed to state and local governments to create up to 500,000 housing units designed to meet the local community’s needs.

Additionally, the proposal aims to finance the building of 800k new rental units for low-income tenants and expand financing access for building ADUs.

Owner Occupants

Recent data shows that investors, mainly institutional investors, have accounted for an increasing share of home purchases. To help owner-occupants, the plan will instruct the Department of Housing and Urban Development (HUD) to sell their inventory of properties, which is estimated to be about 125,000 units, to would-be owner-occupants rather than investors. Currently, investors can buy HUD homes if no owner-occupant bids are accepted.

Cost Controls

Amid the backdrop of high inflation, the HSAP is looking to curtail the skyrocketing prices faced by builders and developers.

The first part of the plan calls for partnerships with the private sector to improve supply chain efficiency and eliminate any disruptions resulting from the COVID-19 pandemic.

The cost control proposal will promote the construction of modular and manufactured homes, which have become far more cost-effective in the last several years, and could help to bring the average cost of building a new single-family home or small multifamily down in the coming years.

Upgrade your investing today

Successful investing requires accurate, easy-to-understand information about your properties and the markets you invest in. BiggerPockets Pro gives you the information you need to find your next great deal and maximize your current investments.

Conclusion

At this point, the HSAP is just a proposal. Many elements of the plan will likely change before implementation if implemented at all. Even if these policies move forward, none of them offer a quick fix.

The plan is likely to evolve over the coming months and could take years for full implementation. The main takeaway is that there is a concerted effort in the White House to address the housing supply issue and improve affordability.

To stay on top of this news and other investing-related news, check out BiggerPockets’ newest podcast, On The Market, where Dave and a panel of expert investors debate the latest real estate trends, news, and data.