David:

This is the BiggerPockets podcast show 610.

Cliff:

Now we’re little in over our heads. This is my first one, so it’s the rookie nightmare sort of speak. But everybody hears about why they don’t get into it. So I’m trying to wonder, “Do we sell it? Do we keep it? Just chip away at the debt over time. Is there other options on what we can do? How do I bounce back from this? And what do I do to continue investing in real estate even with this big item hanging on my back here?”

David:

What’s up, everybody? This is David Greene. And I’m your host of the BiggerPockets real estate podcast, the best real estate podcasts on the planet and also, the number one most downloaded podcast.

David:

I’m here today with my buddy, Henry Washington, and we have a fantastic show for everybody. In today’s show, we are going to be interviewing different investors who have different questions regarding a jam that they caught themselves in, direction that they’re unsure to take, or just overall phobias, fears, flaws, things that worry us and stop us from moving forward. And Henry and I dive into this and help get them unstuck and send them on their way.

David:

It does feel like that when you’re like, “Oh, look, it’s like a little squirrel that’s trapped and if I could just get his foot free, he could run off and find nuts,” and we get to play that role.

Henry:

I love it, man.

Henry:

It’s super encouraging to be able to lift people up, uplift people. You are an expert at reading someone in their situation and providing them not just practical advice but also giving them the encouragement to keep moving forward because you and I both know that this real estate investment journey is one that it helps create not just wealthier people but better people.

Henry:

And so I love the way you uplift people and give them life to keep going, man.

David:

Well, thank you. When you’re born with a face for radio like I am, you got to find some way to compensate for that. So I appreciate you calling out that skill of mine, man, I appreciate that. Okay.

Henry:

Absolutely.

David:

So, in today’s episode, make sure you listen to all the way to the end because Henry and I have a very impressive young man who calls in from another country with questions about severe long distance real estate investing and that was very cool.

David:

If you’re not watching this on YouTube, I would encourage you to just switch over briefly and do so because you’ll notice that I have a green background, Henry has the purple background that he always has, and together we look like a real estate Barney. So visually speaking, it’s incredibly impressive and you’re going to be singing that Barney theme song in your head for the entire show.

Henry:

I do love you.

David:

All right, for… I appreciate that. We love each other and we love you the BiggerPockets audience.

David:

And that leads us into today’s quick tip. Look, if you’re listening to this whether it’s on iTunes, on Spotify, on SoundCloud, on Stitcher, on Youtube, it doesn’t matter. You’re part of our community and we don’t want ninja members of the community. We want to interact with you, we want you to be included. This whole thing only works when you’re actually tied into the community.

David:

You’re not a spectator. You feel like one when you’re just listening from the outside but when you start commenting, when you get onto the BiggerPockets website and check out the forum or the blogs, when you start reaching out to us on social media or you start leaving comments on the YouTube channel, we can actually respond to you and you will start to get included in this and all of a sudden real estate just feels less scary and intimidating. So we want to bring you in.

David:

Also, when this podcast is done, if there’s not another one to listen to, I would encourage you to check out Henry’s show, On The Market. Now, Henry is part of a incredibly impressive ensemble of real estate experts.

David:

Henry, who’s on the show with you?

Henry:

We have Kathy Fettke, Jamil Damji, James Dainard, and it’s hosted by the other Dave, Dave Meyer.

David:

Dave Meyer. That’s right. It’s a very fun crew, right? This is not brand muffin real estate. We’re like, “Oh, I know it’s good for me, but I don’t want to eat it.” We got a little bit of icing sprinkled on to this muffin-

Henry:

That’s right, that’s right.

David:

… of good information. You got a little bit of… It’s like a healthy Pop-Tart is probably the analogy that I would use.

David:

So please consider checking out that Pop-Tart of a podcast On The Market and let us know what you think there.

David:

All right, without any more ado, Henry, anything you want to say before we get into the show?

Henry:

Yeah, man. I really, really enjoyed the segment of the show where we talk to the young rookie investor who bought his first deal out of state and ran into all the nightmares that everybody gets so scared of. But I encourage you to listen to that all the way through because you’re going to learn that this doesn’t have to be as scary as people make it up in their minds and that there is light at the end of the tunnel and you can fall on your face when you get started and still keep pushing.

David:

That is such a good point. This is an example of someone who literally did every single thing wrong. All right, maybe not say wrong, but everything went wrong that could go wrong and he’s going to be just fine. So if you can survive what I think, it was Cliff goes through, you’ll be fine. So don’t make the mistakes yourself, learn from Cliff’s mistakes, help him understand that he’s helping the community, shout out to Cliff, give him a little bit of love, and then you should feel a lot less scared after hearing that story. So let’s bring in our first guest.

David:

Kathryn, welcome to the show. How are you today?

Kathryn:

I’m doing great. Thanks so much for taking my question.

David:

Glad to hear it. And by the way, you’re being such a trooper doing this while you have a cold. We appreciate you fighting through that for us.

Kathryn:

Thanks. I will certainly do my best.

David:

So what’s your question?

Kathryn:

All right. So my husband and I just started real estate investing last fall. So we’ve started with three new builds going up in Florida, South Florida, and those seem to be going very smoothly, everything has been really great to work with as far as the team down there and we expect those to be done by the end of the year.

Kathryn:

So we did take a trip down to Florida, got to meet everybody in person, property management, realtor, builders, everybody that’s on the team down there. And we feel just really good about everybody that we’re working with and we got to talking about short term rentals, they seem very knowledgeable about just how to make those successful, they know which location to put them up in, all the details to make those successful. So we’re really interested in building one of those as well. And the thought would be that we would call it a vacation home so that we can just put 10% down.

Kathryn:

And the issue that we’re running into is with the financing because the price range we’re looking at including the land would probably be in the range of 550,000 to 750,000, maybe half of that would be the lot, because it’ll be a water lot. So what I didn’t know going into this was it seems like it’s unusual to try to finance land. What we’re hearing from all the lenders that I’ve talked to so far is that we would probably need to own the land outright. So if we’re talking this is a $300,000 lot, that creates an obstacle.

Kathryn:

The best that I’ve heard so far is that we could finance the whole thing potentially but it would require 15% down rather than 10% down. And on a property of this value, that’s another 30, 40,000 downpayment. So I’m just looking for any advice, any insight you have as far as how to go about this. If you’ve got any ideas for us, I’d appreciate it.

David:

All right. So what I’m hearing you say is your concern with how to finance land. That’s one thing that you’re thinking about. And then you mentioned the 10% down vacation home but you said you’re buying three of them. So were you originally under the impression that you’re going to be able to get three vacation homes? Is that what you were thinking?

Kathryn:

No. The three that we’re building right now, those are long term rentals. So those are already good to go. Those are under contract. We’ve got the land for those. They’re being built. We want one short term rental.

David:

Okay, so you’re talking… This is in addition to those three? Yeah. Fourth property that you want to buy as a vacation home, but you are wanting to build it and so you’re wanting to finance the land.

Kathryn:

Yep, exactly.

David:

Okay, Henry, I’ll let you take first shot at it. What are you thinking?

Henry:

Man, I was just going to kick this one back to you because I’ve never financed land and built before. So I have bought land that had a dwelling on it that we’ve torn down and we’re going to go back and build and so financing for that was a little easier.

Henry:

I also use small local regional banks and they don’t have a problem financing land if I need it so I can finance land and then get a construction loan to build. No sweat with a small local bank, but they are typically going to want 15% down so that doesn’t solve your downpayment problem from that approach. But I know David’s the lending master so maybe he’s got an idea for you.

David:

I don’t know if I’m the lending master. But I do dabble in a little bit of real estate. And here’s what the problem with building new constructions in general.

David:

So I remember at one point, Kathryn, I was just like you were I was like, “Screw it. The markets item’s going to build my own stuff.” And it can work. It just always sounds much better in principle than when you get into actual practice because it is a ton of headache. This is…

David:

Once you start trying to build something as you probably are learning from the three that you’re building, if you have a good construction crew that knows how to work with the city, knows how to get permits, and you’re in an area where that municipality wants to build, they make it easy for you. Many municipalities in the country are just against building more homes. I don’t know. They may even be against people making money off of real estate so they make it incredibly difficult to be able to create new housing supply which is a huge reason why we’re in this crisis.

David:

Now, Florida, obviously a great place to go, especially South Florida. They’re welcoming this. That’s a great place if you’re trying to pull this off.

David:

But here’s what people don’t recognize, like you said, you’re not going to get a 30-year fixed rate on land. No bank is going to give you that money because if you can’t make the payment and they have to take it back, what do they do with it? Banks don’t know how to sell land, they barely can sell a house that’s on land so they’re never going to give you those loans. There has to be some form of an improvement.

David:

And not only does there have to be an improvement, but the property has to be in livable condition or habitable condition. So that’s another thing people don’t realize when they go after a hardcore fixer upper, needs a ton of work. A bank will not give you a loan on it if you can’t live in it. If it’s got major foundation issues, if it’s been ripped apart and gutted, you also can’t get a loan on those. So the principle here is to recognize that you can only get the best loans when there is a house on the land that is in habitable condition.

David:

Now, you can still do it, but you can’t do it the way that you’ve been describing. You can get that 10% down vacation home deal once it’s finished.

David:

So you got to think about this like a BRRRR but instead of buying a fixer upper and making it worth more, you’re… Part of your rehab process is actually building the thing on the property itself. So it’s by the land with hard money, with private money or with your money, just like if we were going to go buy a BRRR in cash, you have to do it the same way.

David:

Then you’re going to probably get some form of a construction loan to build the property itself and you’re going to need your contractor to have experienced dealing with the city because there’s going to be tons of things that pop up that you never could have anticipated, they’re going to slow you down, they’re going to make that loan that you took out, the hard money loan or whatever it was, to buy this land much more expensive. And then once it’s finished, you can refinance it into a 30-year fixed rate loan.

David:

And the good news is you’re going to be able to borrow 90% if it’s going to be a vacation home. Most likely. Don’t hold me to this. But most likely, you’re going to get 90% out of it. So it’s going to be easier to hit your numbers. You probably will pull more money out of it than you put into it especially with the way the value of real estate is going up in Florida right now.

David:

So hearing that, is there any questions you have that we can clarify this for you?

Kathryn:

Well, one thing I’ve considered up to this point, once the new builds, the three houses that are going to be long term rentals, once those are completed, they’re appreciating the models just like them that are being completed right now. They’re appreciating well above what we went under contract for so we should walk into a ton of equity. So one thought would be I think we could potentially pull out $100,000 in a cash out refinance on each of those houses which would give us 300,000.

Kathryn:

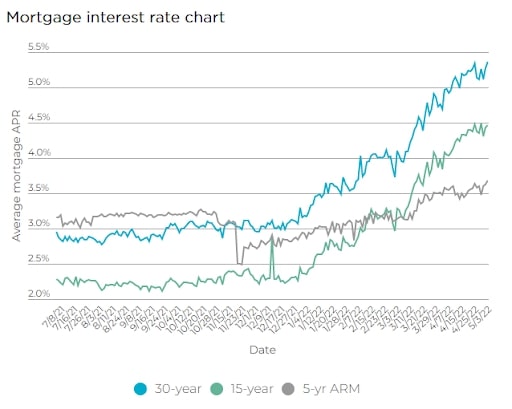

I guess my biggest concern is waiting that long and I do have some hesitation about even the building process at this point anyway since it’s probably going to set us out a year or more before it’s completed. We don’t know what interest rates are going to be like at that point. So are we better off just trying to find something that’s on the market? But because they’re so hard to come by. It’s easier to find land than it is to find a house. But the interest rate thing does scare me not knowing a year and a half from now when we lock into a 30-year mortgage, what’s that going to be?

Henry:

Yeah. [inaudible 00:13:42]-

Kathryn:

So I don’t know. Is that a good idea? Bad idea? To try to pull out cash once these three are completed.

Henry:

Yeah. My question to you was, and you touched on it a little bit, is why build a vacation rental versus purchased a vacation rental because when you’re talking vacation rental numbers, it’s a little easier to find something on the market especially in a place like Florida where vacation rentals are popular, where you can probably meet similar numbers.

Henry:

I would do the math on purchasing something existing in a neighborhood where you feel like you can get great returns as a vacation rental versus going through and building and seeing what your ROI is for both and it might make sense to not have to deal with the headache of building.

David:

Here’s something psychological about… Well, you know what? Before I go psychological, I’ll go practical.

David:

When it comes to your question about borrowing the money at… Should I pull 100,000 out of each property? It’s a good question to ask. Where I see people get this wrong is they look at how much money they put in the deal and they use that as a baseline to determine how much they should borrow against the asset.

David:

So what that means is, well, if I put 500,000 in and then I borrow 600,000, I’m over leveraged. Why are you over leveraged? Because I pulled out more than I put in. That’s risky. They just make this assumption along those lines. And even experienced people will often think this way. I’ll hear this come out of people’s mouths.

David:

The question to ask is not how much did you put in and can you borrow more, it’s how much is the asset worth because I don’t know any lender right now that’s letting you borrow 100% of what it’s worth. You may get 100% of what you put in but that is not the same as being over leveraged. And then how much debt service can you safely afford to take on.

David:

So if borrowing an extra 100,000 puts you at a point where you’re not cash flowing or you’re barely cash flowing, everything has to go perfect, I would say probably don’t do it unless you’re just tons of money sitting in reserves.

David:

But if the property is performing so well that it’s bringing in way more revenue than you expected just like it’s worth more than you expected, then borrowing the extra 100,000 is not risky in that scenario. So don’t fall into that line of thinking where people say, “Oh, to borrow is inherently risky.” Well, not if it’s cash flowing super strong. In that case, it’s actually not. So that’s the first piece of advice.

David:

Then… Oh, shoot. I forgot where I was going with the practical or the psychological thing. Where were we… Oh, I remember now.

David:

When people are building something, they often look at like, “I don’t want to have to spend…” Or they’re going to buy something, let’s go there. “I don’t want to spend $40,000 over asking price. That’s insane. I’m getting ripped off.” And it’s so offensive to them to consider doing that, that they start thinking along the lines of, “Well, I’ll just build it myself and I won’t have to pay 40,000 over.”

David:

But they don’t realize that when you’re doing that you’re taking out a hard money loan at a very high interest rate and you’re having holding costs that go really high and your rehab is going to be higher than what you were thinking and the contractor is going to give you a change order because of supply chain issues and things are more expensive than they thought.

David:

And by the way, what they have to pay their guys to get the job done goes up so they’re going to pass it on to you in the form of a change order. A lot of people took on projects that made sense at the time not understanding that the contingency they needed that they should have been in place, it’d be way, way bigger than what they actually did and they ended up way underwater on these projects, often to the tune of much more than the 40,000 that they didn’t want to pay over asking price.

David:

Okay. So in one sense, I want people to understand that no one likes to pay over asking price but the alternative is often way worse, trying to do this thing on your own and never having done it, you’re going to make a ton of mistakes.

David:

And on the other hand, I’d rather pay 40,000 over asking price at a four, five, six percent interest rate, then 40,000 of money that I had to pay a hard money rate of 10 to 12% on and may never get out of. Not everyone’s thinking about the cost of capital because 40,000 in one scenario is not the exact same as it is in another scenario.

David:

And there’s also risk where it might be more than 40,000 or you might be paying that 10% a lot longer than what you thought versus if you’re paying over asking price. It sucks but you know what you’re getting. You can plan around it. You can make a plan.

David:

So it’s just one of the pieces of advice when someone’s in your position and basically have a fork in the road and you’re like, “Well, do I just say, ‘Screw this hot market.’ I’m going to build it myself,” which is cool or “Do I play by these rules that I don’t really like and pay more than I wanted to for the property?”

David:

In general, my advice is typically, if you’re a builder or if you know a builder, if you have an in into that world, it’s okay to go the route of building yourself if you know what you’re getting into. If you don’t, don’t do it.

David:

It’s the same as people that say, “Well, I don’t want to have to pay that much for a lawyer. Maybe I should just represent myself in court.” Okay, is your best friend a lawyer that can give you really good advice and are the stakes low? Or are you talking about going to jail for 10 to 15 years if you lose this case?

David:

Anyone can learn how to do anything, you could learn how to be a doctor and operate on your friends because they don’t want to pay money. You can learn anything, it just doesn’t always make sense to do that.

Kathryn:

Okay. Just to recap what you guys said, it sounds like if we want to do this, we probably either need a hard money loan to buy the land if we build or Henry, you said if we go through a local bank that 15% is probably going to be the minimum and it sounds like you’d probably suggest just trying to build or sorry, trying to buy rather than build.

Henry:

I’d at least compare your ROI, one versus the other, because one gets you there a whole lot quicker versus having to build and one gets you there with a whole lot less headache. If you’re going to make one, 2% less ROI but you get there a whole lot quicker, is that a better deal? That’s something I think you should consider looking at.

David:

And there’s less variables that can go wrong when you buy something that’s already built. When you’re building something, when people sit down and work out their numbers, they’re only working out what they know they have to pay. You can’t account for what you don’t know you’re going to have to pay and experience is what teaches you what you don’t know that can go wrong.

David:

All of us, real estate investors, we know when we run cash flow on a property, “What’s my mortgage? What’s my taxes? My insurance?” There’s a whole buttload of things that pop up that you did not account for.

David:

That’s one of the reasons that your first couple years of owning a property, the cash flow is never what you thought it would be. It’s similar when you’re building.

David:

There are so many extra variables that mean things can go wrong that I would only advise you to go that route if you have some competitive advantage. Your family does this, you’ve done it before you know someone really well, you have an absolute rockstar they can tell you like, “Well, if something goes wrong, I’ll eat it on my end. I’m not going to pass it on to you,” to where you actually have a firm understanding of what your costs are going to be because you have that firm understanding when you’re buying something that’s already built.

Kathryn:

Okay. Yeah, I appreciate that perspective because I hadn’t really looked at it that way. I was more thinking I liked the idea of a new construction because I know that I shouldn’t have CapEx expenses the first couple of years and just from that perspective, it seems like there’s less to go wrong. But in the building process, yeah, that does make sense. There’s a lot that could go wrong before it’s completed.

David:

Yes. And sometimes you run out of money when that’s happening. And if you have a house that’s 90% done or 95% done, it might as well be 0% done. The revenue it brings in is exactly the same. So that’s an extra risk.

David:

Now the one thing going for you is the state you’re doing this in would make it… I would give someone a hard no if they were in a state like New York right now.

Kathryn:

Yeah.

David:

Right? It is not worth doing unless you’ve just got really big pockets. Shameless plug right there. [inaudible 00:21:21].

David:

Florida makes me feel a little bit better about doing it. But it’s still like make sure you are extra, extra, extra careful because it’s always what you don’t see coming that ends up costing somebody money.

Kathryn:

Okay. Awesome.

David:

All right. Thanks, Kathryn.

Kathryn:

Thanks so much.

Henry:

Thank you.

Kathryn:

I appreciate your advice.

David:

We appreciate you. Hope to see you again.

David:

All right, Cliff, welcome to the show.

Cliff:

Thank you so much. I’m happy to be here.

David:

Yeah. So what’s on your mind today?

Cliff:

All right. So I’m a rookie investor. I listen to almost all your podcasts beginning in 2020 and tried to listen to the pretty much all the BiggerPockets podcast as well. Loved it. Family doesn’t come from money so I know this is a great way for me to build some wealth. I’ve done accounting and I love seeing how the numbers flow and how this stuff works together so I’m very interested in getting into this.

Cliff:

I did start investing September of last year. I bought a rental out of state using the BRRRR method. When I did this, I couldn’t find any investors so I used a personal line of credit which happened to be just a bunch of credit cards, turned them into a wire.

Cliff:

And I was told that the ARV of this house was double the purchase price to do and there’s a few issues with it, a roof, things like that I could fix, got them done instantly. And when we went to go do that, we had a hard money loan, got it done. Everything that’s… Got a tenant in there. Got the 1.8% roll on the first one. Felt pretty good about it.

Cliff:

Our appraisal came in only about 20,000 above purchase price and we had to find more debt to cover those closing costs, cover the difference in the hard money loan and the new mortgage.

Cliff:

And then, right after that, we found out that there was actually a bunch of items that had to be fixed as well, HVAC went out, furnace went out, water heater needed to be replaced, windows were really bad, small items around the place as well. I’m aware that my [inaudible 00:23:31] needs to be fixed up a little bit because we had a bunch of people walk through there. Nobody ever told me about this. I was told to wait the inspection on this pay purchase price. So I wasn’t expecting these items from what I was told and the videos I’ve seen of the house, pictures I’ve seen of the house as well.

Cliff:

And now we’re little in over our heads. This is my first one. So it’s the rookie nightmare sort of speak that everybody hears about. Why they don’t get into it? So I’m trying to wonder, “Do we sell it? Do we keep it? Just chip away at the debt over time. Is there other options on what we can do? How do I bounce back from this and what do I do to continue investing in real estate even with this big item hanging on my back here?”

Henry:

Yeah, man. Where are you located? And where’s the property located?

Cliff:

I’m in Denver, Colorado, and the property is in Ohio.

Henry:

In Ohio. Okay and so let me make sure I understand.

Henry:

So you bought the property, you leverage credit cards, and then to do the renovations you use the hard money loan?

Cliff:

We used hard money loan for the purchase and most of the renovations, the closing cost, and then the downpayment of 10% was used on the credit cards.

Henry:

Okay.

Cliff:

And then the refinance, we had to do the difference between the two loans and the new closing costs on the credit card as well.

Henry:

Okay, so what are you on the hook for now? And…

Cliff:

It’s about 50,000 in credit cards.

Henry:

And the property appraised for 20 grand over what you purchased it for?

Cliff:

Correct.

Henry:

And how much have you put into repair so far?

Cliff:

Out of pocket or cash, it’s been about seven and then it was about 16 or 17 on the hard money loan.

Henry:

Okay. So you’re not much over purchase and asking price all in right now.

Cliff:

Purchase was 90. We have the closing costs so then everything would be about 50 that…

Henry:

And how much more do you have to go renovation wise in a dollar amount?

Cliff:

In a dollar amount, I think about 12, and very conservative.

Henry:

12,000?

Cliff:

Yes.

Henry:

Okay. And the property, what is it anticipated to rent for?

Cliff:

1650.

Henry:

1650, you’ll be all in at what? 150? 140?

Cliff:

Yeah, about 150 I think.

Henry:

So you’d be all in at 150, it’s going to rent for 1650. Those aren’t terrible numbers. They’re not great numbers. Right? But it’s not terrible numbers.

Henry:

Now, if you’re getting 1650 and if you can get the property done, so if you can find the money, the 12 that you need to finish the property, well, that’s 1600 cover your debt service. Will you be able to pay back your loans in a timely fashion?

Cliff:

We’ll be able to pay for the mortgage and all that kind of stuff that goes associated with that. For the credit card and other stuff that we have to put money into it after all the items for the rental, we get some money to pay off those credit cards but then we have to put more in.

Henry:

Right. Okay. So I was just trying to get a sense of what are all the numbers, what’s everything mean once it’s all said and done. And so like I said, you’re not looking at terrible numbers, but you still have debt service to pay back and you’re probably going to have to come out of your pocket to do that.

Henry:

So if I were in your shoes before I looked to liquidate, I would probably be looking at is there another method that might bring me some more cash flow. Can I do short term rentals maybe for traveling nurses or Airbnb? I don’t know the neighborhood that that’s in. It may not be a realistic solution for you.

Henry:

But I would look at those options before I looked to just completely dump the property because even selling the property, you’re still going to be left holding a bag of something that you need to pay back. And so either option leaves you having to pay something. And so I would try to go with the option that still leaves me the asset because cash flow isn’t the only benefit to owning real estate. Obviously, you’re going to get some debt paid down from the tenant, you’re going to get tax benefits from owning the property.

Henry:

And so if I’ve got to pay back these lenders, either way I look at it, I’m going to try to keep the assets. So I would probably look at what short term rental options can I look at to bring in more cash flow, is there a garage or something separate that I could rent out separately to a tenant that generates more cash flow. And so I would be looking at little ways that might be able to help bring a little more cash flow in and then looking at ways that you would be able to try to pay down that debt as you keep it now.

Henry:

And then I’d also look at if you sell it, potentially, what could you sell it for, how much does that leave you on the hook for, and can you afford those payments. You don’t want to put yourself in a more uncomfortable financial situation.

Henry:

But I’d always tell you, and I know you’re learning a ton of lessons in this, I think a lot of the times when people get started investing at a state for some reason as they’re doing their due diligence and their analysis and building their team, for some reason people don’t think, “Just let me pay a couple 100 bucks for a plane ticket and go put eyes on the things myself.” Because at the end of the day, this is your asset and you’re on the hook. A grand or so to take a trip in the grand scheme of things might have saved a lot of headache.

Henry:

So as a new investor investing out of state is the option that a lot of people need to choose depending on the market that they’re in and so I get looking at estate.

Henry:

But man, go put your boots on the ground for your next one and make sure that you are comfortable with what you’re buying. Does that make sense?

Cliff:

Yeah, definitely. And that’s something… We’ve learned, as you were saying, on the lessons. It’s like I think the next one will be out there. We’ll be going into the weeds with whoever is on our team at the moment and trying to make sure that we question everything they do.

David:

So let me see if I can simplify your situation.

David:

There’s three things that when you’re doing this you have to take into consideration. The first is the finished product cash flow. Is it going to cash flow when I’m done?

David:

The second is the equity situation, especially on a BRRR. Am I going to be able to get enough money on the refinance? Will I be able to pay off all of the people that I borrowed money from or pay back myself? Because it’s normal in a BRRR to have to leave some money in the deal. But you’re just trying to figure out like, “Do I have enough money myself to leave a little bit in there?”

David:

And then the third thing is the traditional phrase cash flow, which I’m just going to call capital because it’s confusing. But the real phrase cash flow typically refers to any business, how much money is coming in versus how much is going out. That’s where cash flow comes from.

David:

It’s the flow of cash like a contractor that has to pay their guys, buy the supplies, manage the crew, and they’re spending money all the time, well, then they have income receivable coming in, that’s actual cash flow. But in real estate, we use the phrase cash flow to mean, “I have more money leftover at the end of the month than what I had to spend on the property.” So we’re just going to call that capital for this conversation.

David:

Your real estate cash flow sounds like it’s good. If you’re going to have 150,000 into this thing and you’re going to be bringing in 1650, you’re well over the 1% rule so can we assume we’re good on that sense? This property will cash flow once it’s refinanced.

Cliff:

Okay. It’s already been refinanced.

David:

Okay. So what was… I might have missed something. What was the issue when it comes to paying people back?

Cliff:

So we’re having trouble just with… We have to keep putting money into this property and things are still breaking. We still need to put money into it.

David:

Okay. So it’s not cash flowing from that perspective because you have to keep sinking more money into this than you thought you were going to have to. But it’s not like a situation-

Cliff:

Even after it’s rented.

David:

So this isn’t a situation where you’re afraid if I refinance, I can’t pay back all my debtors. That’s what I originally thought you’re saying.

Cliff:

Correct.

David:

Okay. So what you’re trying to figure-

Cliff:

[inaudible 00:32:04].

David:

… is you’ve got a money pit basically. Things keep breaking and you got to keep fixing it and you’re like, “Where do I come up with the capital to make these repairs?” Is that accurate?

Cliff:

Yeah.

David:

Okay.

Cliff:

Yeah.

David:

How long ago did you refinance it?

Cliff:

Months ago.

David:

Okay. So it doesn’t have a ton of equity where you can take some money out from there.

David:

You’ve got a couple of ways that you can solve this problem quickly. The first would be you could bring in a partner. So how much did it appraise for when you refinanced it?

Cliff:

112.

David:

All right. And then what is your loan on it right now?

Cliff:

Almost 90, 89,600.

David:

And where’d that 150,000 number come from?

Cliff:

That was the purchase price combined with the credit cards.

David:

Okay. So you’re into it for 150-

Cliff:

All of-

David:

… but it’s worth 112?

Cliff:

Correct.

David:

All right. So then my original idea was you could bring in a partner and have them bring some cash into the deal and give them some equity in it. But that’s going to be tough if the property’s worth less than what it appraised for.

David:

Now my guess is what went wrong here was when you looked at the comps and you said, “Well, what’s it going to appraise for?” You found the best comps possible and maybe there’s two or three, but you missed the eight or nine that were lower. Do you think that’s what happened?

Cliff:

Yeah, the ARV I was given was, I think, way too high and when I… Rookie wasn’t sure what I was exactly looking at, so…

David:

Got you. So that’s a problem of having the wrong core four. You had a person who said, “Oh, this is what it’s going to be,” and they had no skin in the game so they had no problem lying to you or at least being incompetent, not checking their work.

David:

And this does suck when you just take somebody else’s advice which is not that uncommon in our business because of many things in life like if you’re going to Foot Locker, the person there isn’t going to say, “Oh, this shoe is great.” If it’s not great, there’s no reason for them to do that. But in real estate, there’s a lot of people that will do that to you.

David:

So I see now why… Well, you’re basically saying, “Hey, this could work but I have to put money to fixing it up.” What things don’t need to be fixed up right away? Is there anything that has to be done in order for this place to generate revenue?

Cliff:

I believe it’s electrical and the windows. I think that’s the last items we have to fix. And those are…

David:

So why did the windows have to be fixed?

Cliff:

The frame around, it’s rotting out.

David:

Yeah, that’s not too expensive. You get a handyman to go in there and put up some new wood, right?

Cliff:

Yeah, well, the windows are falling. They’re breaking as well. Glass pieces are falling out.

David:

The glass is breaking because the frames are bad. Okay. So they’re terrible, terrible, terrible, right?

Cliff:

Yes.

David:

I would make some phone calls to find out what windows supply company will let you pay for windows on credit. There are companies that will do that where you don’t have to pay the cash upfront. You’re like, “Hey, can I finance this situation?” Right?

David:

And then I would look someone to do the labor that wasn’t the window companies recommended person to go do the work. You’re going to need to do a little bit of legwork to find someone who wants a job, who’s pretty handy that can just fix rotting wood. That’s one of the easier problems to fix is dry rot because you don’t have to be super skilled labor to do this. [inaudible 00:35:06] electrician.

David:

Henry?

Henry:

Yeah. You may also look into your electric companies or the city to see if there’s any credits or rebates for putting new windows in your houses. That might save you a little bit of cash.

David:

Now, the electrical is a little bit more of a touchy thing. Do you know how bad the electrical problem is? Or is it like… I’m sure you were told you need to rewire the whole house or something major, but do you know where the problems are coming from?

Cliff:

The load is not strong enough for the new modern appliances.

David:

So is it just not working like circuit breakers keep flipping or what?

Cliff:

Yeah, they keep flipping and when appliances are on they keep flipping. The outside is exposed so that one definitely has to go.

David:

Okay. So when someone gave you a quote on basically… What did they tell you they wanted to up the voltage to?

Cliff:

From I think it was 100 to 200.

David:

Okay, and how much did they say it was going to cost to put in the new system?

Cliff:

This was from the property management maintenance I think it said 6000.

David:

Okay. I bet you could beat that. If you can find somebody that knows how to do electrical work on houses, this is one where you should talk to other investors in your area. 100%, this is when you want to go to the meetups.

David:

Whenever you’re trying to find the deal, investors don’t want to give up their deal source, especially when it’s a really tricky market. But stuff like this, their electrician, their lender, or their property manager, they never mind telling you that information. So if you just start talking to everyone you know, “Do you know electrician?” “Do you know electrician?” And then you talk to electrician and say, “I’m trying to figure out the cheapest way that I can get this from 100 to 200 amp.” See what those people come back and say. That’s one way that you can solve that problem. I bet it would be less than $6000.

David:

Now, the other issue would just be capital in general. Have you changed anything in your personal life to take on more pressure so that you can start earning some more money?

Cliff:

I did recently-

David:

Like a second job, a side hustle.

Cliff:

Recently switched jobs which allows me to get good pay and they cover more benefits. I get more coming home every month. And then my wife’s looking at getting another job and then I’m selling on Amazon at the same time and we opened up new services for her business as well trying to bring in-

David:

Were you going to make all these same moves if you didn’t have this problem with the house?

Cliff:

No.

David:

Okay. This is a thing I want to highlight that’s never fun. Nobody wants to hear this. But I think it’s worth saying.

David:

This problem of the house created pressure, like financial pressure. Most people look at, “Well, there’s all this pressure coming. It’s coming into the house, I got to sell the house to alleviate the pressure.” We’re talking about practical things within the actual house itself that you can do to fix the problem. But that’s always assuming the only way to alleviate pressure is through the house.

David:

You just mentioned three things you’re doing to bring in more money, your wife’s considering getting a job, you went and got a better job, and now you’re selling on Amazon.

David:

Selling on Amazon is going to teach you skills that you didn’t have before. It’s going to teach you a lot about business. Even if you don’t make money right away, it’s going to make you a better person. Definitely going to make you a better business person, gain you some knowledge, help you get out of your comfort zone, and you’re going to have more confidence and more boldness coming out of this because you did that. That is a good thing.

David:

Stepping up your own job. Probably. I don’t know this, but I would guess, Cliff, something that you’ve been kicking around for a couple years. “I really need to get a better job.” “I’m not really happy where I’m at.” “I know I could be doing more. I know I could be making more.” But there wasn’t enough pressure, you were comfortable. Now, this house situation happens, bit of a debacle, you feel that pressure, what do you know? You went and got yourself a raise. That’s a form of cash flow, too. It comes from more than just the house, right?

David:

And then maybe you and your wife were talking and she didn’t want to go to work or I don’t know how that situation worked with you guys. But that pressure definitely got her in a situation where she’s going to go to work and that could be really good for her in a lot of ways too. It might help with her own confidence. Now she’s contributing and she’s learning new things and she’s going to understand your situation better because she’s back in the workforce and maybe your wife ends up doing the same thing where she gets raises and you end up making more from that than the house even made you.

David:

I just want to highlight that these things don’t exist in compartmentalized little modules like, “I’ve got my work and I’ve got my house and I’ve got my relationship.” They are all connected. So by taking a swing, which you did, and you admit you made some mistakes, which is okay, because everyone does, those mistakes created pressure that helped benefit you in other areas of your life.

David:

And then the stronger version of you and your wife that you become from this will affect your real estate investing too. You’ll make better decisions, you’ll screen people better. Maybe part of the reason that you trusted the ARVs you got that weren’t good where you just didn’t like conflict at the time. You’re like, “I just don’t want to tell this person they’re full of it.” Well, after doing what you’re doing over here, maybe conflict isn’t as scary and it makes you better.

David:

So this is why we say if you stick with it, this is how people get better. It just always happens in ways you can’t predict and so it doesn’t get talked about.

Henry:

I love it, David. That’s a phenomenal point. I just love the way you sum that up.

Henry:

Because, Cliff, think about this, right? So David said and I said it, if you’re all in at 150 even though it’s worth 112, it’s rented for 1650, those are decent numbers. You don’t feel too bad about that. But with every test comes a testimony and now you’ve got these lessons that you’ve learned.

Henry:

And you said it, when you first started talking to us, you said, “Hey, I hit this rookie nightmare,” and instead of folding, you’re on here asking questions, getting information, trying to figure out because what I hear is you want to keep the house so you’re here trying to learn, “How do I keep this so that I can continue investing in real estate?”

Henry:

That mindset alone is powerful because a lot of people would have did just what David talked about the beginning and say, “Hey, this house created pressure. I’m getting rid of the house. Real estate investment is terrible. I knew that I shouldn’t have done it.”

Henry:

And so now you’ve learned a ton of lessons, you’ve made yourself a better person. Sounds like your wife is improving as well. So your whole family dynamic’s improving, plus, you still got this asset.

Henry:

And yeah, it’s a headache and I get it. When you got a property that’s kicking your butt, man, every time you get an email about it or something, your stomach turns just because, “I’m stuck here. I don’t want it.” I get it. But it’s making you a better person and it’s making you a better investor. It’s still going to provide you benefits of taxes and appreciation and debt pay down.

Henry:

It’s not all bad is what I’m trying to tell you and now you’re going to have this testimony that you’ll be able to share with other people when they come to you and say, “Hey, I’m thinking about real estate investing, man, but I just heard some horror stories and I’m just afraid I can’t recover.” And you’ll be able to say, “No. No, you can, because I did.”

David:

I love that.

David:

It’s going to make your life better in ways you didn’t predict. And I’m about to go into a jiu jitsu analogy, but you could use this for anything.

David:

There’s a guy in my jiu jitsu class who’s in his mid 40s, maybe upper 40s. He’s been a corporate guy. He flies around the country. I think he works for Safeway or something. He’s pretty high up in the company and I think he looks at the different places where they want to open a location and he’s involved in making the decision if they should or shouldn’t or what type of Safeway they should open. Kind of high level stuff.

David:

So he shows up at jiu jitsu and he’s terrible just to complete spaz. Probably didn’t play… Maybe he’s played sports when he’s really young. Definitely no martial arts.

David:

And he’s been going every single day. Like insane, man. He goes probably five times as often as I do. And he lost 30 or 40 pounds in a couple months. He’s in really good shape now.

David:

Now, he did not join jiu jitsu to lose weight. He did it to learn a martial art. But in doing that, he realized, “I need to lose weight if I want to be better.” And now he has the benefit of losing weight. He also has a little bit more confidence than he had before. He said his relationship with his wife is better.

David:

So what you see is when you do hard stuff like this, that pressure leaks into other areas of your life and if you handle it positively, it will make things better. So I don’t look at this like, “You screwed up. You shouldn’t be investing.” I look at this like… This was like those… What are those paddles called when you put it onto somebody that they shock them. “Clear. Bzzzt.” You know what I’m talking about?

Henry:

Yeah. Yeah, yeah, yeah.

David:

AED, yes.

Cliff:

AED paddles.

David:

That did this to your business life in a sense. That shock does not feel good when you have it. But boom, it gets things beating, it gets a pulse going, and now you’re making progress again.

David:

So do not be discouraged by this. You cannot be discouraged by this. You did an out of state BRRR as your first deal ever. You just lined up the risk factors and all of them went wrong and it exploded in your face and now you’re working your way through it. But you’re not going to make those same mistakes again and you’re actually going to come out of this better than you were before.

David:

So I appreciate your boldness and your courage and coming on the show to talk about this. I know if you stick with this, we’re going to see you again in five years. You’re going to have multiple properties, you’ll be doing really well, you’re going to hit a groove, you’re going to have a lot of confidence, you’re going to be a completely different person than where you are right now.

Cliff:

It’s what I’m looking forward to.

David:

All right.

Henry:

Awesome, man.

David:

Thanks, Cliff. Appreciate you, man.

Cliff:

Thank you, guys.

David:

All right, Karen. Welcome to the BiggerPockets podcast. It’s nice to have you here.

Karen:

Thank you. Nice to be here.

Karen:

First, I guess I need to start by saying that I’ve spent my entire career making money for institutional and private commercial real estate investors and here I am approaching retirement and I realized I don’t have any investments for myself to make retirement actually last.

Karen:

So my question to you is, how can someone start and quickly scale when there’s not 10, 15 years to go about accumulating?

David:

All right. Well, here’s what I’ll start with that. In one sense, you feel like you’re behind the eight ball because of your age. You’re like, “Well, I don’t have a ton of time to let real estate work for me and naturally appreciate.” And as we’ve talked about before, that’s the easiest way to make wealth in real estate. Just bite early and wait. That’s one of the reasons we tell people to get started early.

David:

But in another area, you’re way ahead of everyone else, you’re probably not thinking about it and that’s knowledge and experience. And I don’t mean experience based on your age, I mean experience based on how this industry works because like you said you’ve been making money for people for years in this space.

David:

So imagine you’ve got some 25-year-old, time’s on their side, and you’re looking at them like, “Man, they could just buy a house and wait and by retirement, they’d be set.” But that 25-year-old has the knowledge and the experience and the skill set that’s going to cause them to move it two miles an hour in this industry.

David:

Well, you may be behind in that sense, but you’re going to be running at 90 miles an hour compared to them. You know how to talk to people, you know who to talk to, you know what strings have to be pulled, you know… More than just the X’s and O’s of the industry, you know who the players are and how to communicate with one of those players.

David:

If you get involved in this, you’re going to make so much more traction so much quicker than someone who’s learning for the first time.

Karen:

I know where I’m at. I guess, for me, falling into that analysis paralysis. And part of it too, though, is I’m working full time and it’s like, “Okay, how do I juggle and make the connections that I need for my personal investments versus working and not stepping over any ethical lines in my professional investments?”

David:

One thing I’d say before Henry jumps in here is… Well, let me ask you this question before I give practical advice. Are you in real estate development? Are they developing commercial properties?

Karen:

I’ve actually been in development and management and primarily management of retail, office, and industrial.

David:

So you are very confident and competent when it comes to managing a property that’s already been bought. Is that fair to say?

Karen:

Yes.

David:

Is it also fair to say you know the area that you’re in, you know what you can expect what type of tenants you can get, what to look for in a tenant? All that’s true?

Karen:

I would say yes.

David:

Okay. So what would it look like for you to go out there and beat the bushes a little bit to find one of these people that might want to sell, find a property that you think will do well, paint a picture for what it would look like to own this thing, and then go find someone in your industry with a whole bunch of money that isn’t really working super hard anymore then have them sponsor that deal.

Karen:

Yeah, I’ve actually thought about that. Like I said, it’s just I’m trying to walk a thin line because I don’t want to cross any ethical lines.

David:

Well, does the boss that you work for now buy every single deal that comes their way?

Karen:

No.

David:

Would they expect you to bring a deal to them before you bought it?

Karen:

Yes.

David:

Okay. You can work that out too.

David:

I would go sit down and have a conversation with the boss and say, “Here’s the deal. I’m looking at needing to retire at some point and I’m not prepared for it. So I need to own some property. I would like your help with doing that. On one hand, I want to go start looking for deals. If I find a deal and you buy it with your money, would you consider cutting me into it if I bring it to you? So if I did all the work of finding the deal, I want an ownership stake in the deal and then I’ll just manage it like normal. So instead of paying me a finder’s fee, you just give me a percentage of the deal in lieu of that finder’s fee.” That’s one option.

David:

The other would be, “If I bring you a deal and you don’t want it, would you give me your support as my boss to put me in touch with some of the people that I would need if I wanted to take it down?”

Karen:

That’s a good idea. I definitely think they would go for that.

David:

I want you to understand, Karen, the situation you’re in. I don’t know you at all. You could be completely making all this up. Maybe you’re a supervisor at Kmart for all we know. We don’t know each other. However, you give me the feeling that if I was… What market are you in? I don’t know if you mentioned that. But where are you operating out of?

Karen:

Charlotte, North Carolina.

David:

Oh, that’s such a good market.

David:

Okay. If I wanted to buy in Charlotte, North Carolina, you’d be my first email or phone call. “What do you think about this area? What can I expect? Do I want to be on this part or that part? What’s the play? How do I make this property work?” And I feel like you would shoot straight and direct and say, “Nope, you don’t want to do that. These are the headaches you’re going to get. You want to look in this direction instead.”

David:

And that is one of the most valuable parts of all real estate investing is having that person that knows the freaking market and can give you advice on what to do. Every one of us is looking in life for that human being especially when it comes to what we invest our money in. So you’re operating with this incredible skill set that is very valuable.

David:

First off, anyone in the Charlotte area of North Carolina, reach out to Karen. We’ll have you give your social media, Karen, at the end here so that they can get in touch with you and they can help you here.

David:

But I want you to be walking with confidence. Not cockiness. But you definitely should be operating like, “I have done this for a long time. I know what I’m freaking doing. I’m missing a couple pieces that I can put together.” And you are much more likely to make the deal work than someone who is 25 who has no idea what they’re doing, who hasn’t made the mistakes, who can’t… You’re undervaluing what you know.

David:

This is a problem I see with real estate agents all the time because we talk about real estate nonstop and we’re selling 30, 40 houses a month on my team. We assume everyone in the world knows the same things we do. They know what’s going on with interest rates, they know what’s going on with laws that are passed, they know how many offers houses are getting.

David:

And then you come across somebody who’s like, “Do you think my house would sell?” And it’s in the best neighborhood of the best areas, it’s the best house there, and they’re worried about it and it hits me like, “Oh, my God. I forget not everybody does what I do.”

David:

I promise, you’re living in that space. You have a rare and unique skill set that is incredibly valuable and you just take it for granted because you live in that space all the time.

Karen:

Thank you very much. I appreciate that advice. It kicked me in the butt and gave me some motivation.

David:

Henry, what are your thoughts?

Henry:

Yeah. David’s got a superpower of being able to point out people’s strengths and give them that kick in the butt you’re talking about.

Henry:

But look, I agree 100% with David. I get it. You feel like you’ve waited too long, you feel like you don’t have enough time. Who cares? Right? Because what matters is now you’ve realized it and now you want to do something about it. And so that situation has created motivation within you, motivation to really take off and create a better life. And so it create the retirement that you want. And so great. Now, we all know that. We know that you’ve waited, okay, so what? Now you’re ready to take action.

Henry:

And I’ll tell you, you can build wealth in… I don’t want to say a short amount of time, but you can grow and scale. I’ve only been doing this for four years and I’ve got 65, 70 doors. Now, am I saying you need to buy 70 doors in the next four years? No, absolutely not.

Henry:

But to go full Brandon Turner, everybody has a superpower and your superpower is that you’ve been in and around real estate for your entire career and something tells me you’re really good at your job so you’ve now got the relationships, as David said, to get everything done.

Henry:

You’ve got what some people consider the hard part. It sounds to me you can have a conversation and you can find the funding you need. It sounds to me like you know exactly what to invest in in your market, where to invest in it, and the returns that you’re going to get.

Henry:

I heard you said you’re in analysis paralysis but based on your experience, it doesn’t sound like it. It sounds like you know exactly what you should pay and why you should pay it and what you’re going to get out of it from a tenant perspective. All the main problems with real estate are finding the deal, funding the deal, and then managing the deal. And you already do the third.

Henry:

So it’s just a matter of leveraging the superpowers that you have and making the decision. Putting the past behind you, who cares what you didn’t do in the past, it’s already gone. If you just make the decision in your mind and say, “I am going to buy my first property within the next…” Three months, six months, 12 months, whatever that realistic timeframe is for you. If you say that in your head over and over again, if you write it down five times a day, you will start to see opportunities.

Henry:

These aren’t opportunities that weren’t there before, they’re just opportunities that your brain will now be opened up to seeing and then you’ll be able to say, “You know what? There’s that one deal that we looked at a couple of months ago and we never did anything with it. You know what? I’m going to grab that. I’m going to bring it to my boss, I’m going to tell him the situation and I’m going to see if we can get something done with that.”

Henry:

These opportunities are there for you and you’ve got the relationships to get them done, all you really have to do is put the past behind you, make that mindset shift that, “I am going to get a property under contract within the next…” 30, 60, 90 days, whatever that goal is for you and say that to yourself every day, you will be surprised how many opportunities you’re going to start to see or realize how many opportunities that you’ve already seen in the past that you can bring back.

Karen:

Thank you, Henry. That’s really encouraging. And, yeah, my goal is to try to have my first purchase by the end of this year so I’ll just do like you suggest and remind myself.

David:

I’m going to guess there’s going to be two psychological hurdles that are going to hold you back.

David:

The first is your relationship with your boss. You’re clearly a loyal person. You don’t want to step on toes. You mentioned not wanting to cross any ethical bounds. But you haven’t told us what specifics of that might be which tells me there might not be actual ethical bounds, but you’re just such a loyal person that you’re conscious is like, “I’ll be very careful.”

David:

So I’m going to give you some advice on how to navigate the relationship with him or her, I don’t know, I’m assuming your boss is a guy there. I don’t know if you said that or not.

David:

But the other one would be you getting word out that you’re looking to buy a property. There’s going to be a psychological hurdle there. You’re going to feel like an imposter like, “Why am I talking to these people?” And then it might even feel like you’re cheating on your boss to be looking at these other people.

David:

Let’s start with the boss because I am a boss so I can speak from this perspective because I’m also an employee so I see both sides of it. Your boss is going to be upset if you poach their database. So if you’re going to the people whose properties you’re currently managing and you say, “Hey, do you want to sell it to me?” That’s directly competing with your boss and that would be overstepping bounds that would not be appropriate.

David:

That’s what all of us bosses are worried about. I don’t want one of the agents on my team to go to my friend and be like, “Hey, you’re my client now. You’re not David’s client anymore.” That’s not cool. I do want the agent on my team to go to someone I’ve never met before and use everything that I taught them to get a client for the company.

David:

It’s very, very simple. People can understand this thing. Don’t play in someone else’s database. They’ve already done hard work to build that they’ve trusted you by giving you access to that database. You’re not going to take advantage of them by being lazy.

David:

But if you go out there and you talk to people your boss has never met, has never heard of, doesn’t know, he’s never going to be upset with you for doing that because it’s not taking anything away. And if you say, “If I find this deal, would you want to be in it?” You actually are bringing him something that didn’t exist at all. You’re bringing value, you’re just bringing value that you get to be a part of. Does that clicking? That makes sense to see that perspective?

Karen:

Yeah, it does. It does. Because I guess from the ethical standpoint, what I was referring to was existing investors that my company is involved with and that I managed for.

David:

That would not be cool.

David:

So imagine an admin on the David Greene Team who helps get our clients’ listings ready to go on the market that starts going to those sellers and saying, “Hey, I just got licensed. Can I sell your house instead of David?” Totally not cool. That would be you going to an existing investor and your boss would be furious because he’s paying you and trusting you to do a role in that transaction.

David:

Now, if a listing assistant took the confidence they had from working on all of our clients deals and the knowledge I gave them and the experience that they accumulated selling hundreds and hundreds of houses and they started going to places where I don’t go and meeting people I don’t know and sharing the stuff I did and bringing business into our team, I would love them. I’d kiss their feet. I would do everything I could to support that person.

David:

So if you sit down and have this talk with the boss and say, “Hey, I’m not going to stop doing what I’m doing. I just want to do more. Can I work on the sales side? Can I go look for some more deals for us to manage? And if I find it, I would expect you to make me a part of it.”

David:

I don’t see your boss saying no. That doesn’t make any sense. I wouldn’t turn down one of the listing-

Henry:

“No, I don’t like money.”

David:

… assistants on my team.

David:

Yeah, exactly. Like, “Hey, David, I got a listing?” “What? You’re supposed to only be working my listings.” Like, “Oh, well, that’s awesome.”

David:

Now, the other psychological hurdle I think that you’re going to have is just going to be in this analogy I’m painting here, the listing assistant being nervous about going to talk to people about them selling the house. That’s the reality. That’s why they don’t do it.

David:

“Is that scary? What if they ask a question I don’t know the answer to? What if I sound stupid? What…”

David:

Like, “I’m comfortable just working David’s listing. So I don’t want to step out of my comfort zone.”

David:

That is definitely going to be a challenge you’re going to have to face and you’ve done things the same way for a long time so that trench is a little bit deeper.

David:

So like Henry said, you have to be purposeful about doing this. You have to tell yourself, “This is what I’m going to do.”

David:

My advice is that if I was you I would get a list of all the people that own the type of properties that you would want to own and I would start calling them and I would just say, “Hey, are you super thrilled with your current management? Because I’m a property manager and if you don’t love the manager you have I’d like to sit down and talk and see if we could be a better fit. Maybe save you some money or maybe do a better job.” Start the relationship there.

David:

If he’s like, “Nope, I’m super happy with my management.” “That’s awesome. I’m also looking to buy a property. Is there any chance you’re interested in selling the one you have?” “No, I’m happy. But if something better came along, maybe.” Start a conversation there.

David:

But if you don’t want to cold call someone and be like, “You want to sell your house?” Use that intro of, “Well, I’m a property manager. You’re interested in new management?” To break the ice.

David:

Then get a feel for, “Well, what would make you want to sell?” ” Well, I might want to retire in a couple years. I don’t know if I want to… I might be wanting to sell it then. Or actually I want to buy something bigger, I might need to sell this and 1031 into it.” And now you’re like, “Well, what if I helped find you a bigger property? Would you let me manage the bigger property?” Now your boss is happy because you just brought an account in, “And would you let me buy the one you have so you could 1031 the bigger one?” Now the seller is happy because you just help them accomplish his goal.

David:

You got a piece of the house that you’re trying to buy and you get to manage the new one. You’re happy because you won in two ways. That is the approach I’d recommend taking.

Henry:

Boom. That was phenomenal advice.

Karen:

Yes, it was. That really hit home. Thank you.

David:

Well, that’s why you called us so I appreciate that, Karen. Make sure that you do this again. We want to see you in the future and we want to hear how things are going.

Karen:

Okay. Well, thank you very much, guys.

David:

Thanks, Karen.

Henry:

Thank you. Good luck.

Loic:

Hi, David, hi, Henry, and nice to meet you. I’m from France. I live in France just about a kilometer away from the German border. And so my question is, as I’m an 18-year-old boy from France and so a foreign citizen, how may I partner with my grandpa to invest in Texas to perform a BR deal as we are on a very long distance. It’s more than 10-hour flight.

Loic:

And David, as you’re an expert about long distance investing as I’ve read a book about it. How may I just build my core four and finding great contractor and great agents and property manager as well as the lender? And also, we were considering hiring a hard money lender because we don’t necessarily have all the cash money to buy a duplex because we’re just sticking for a 100,000 or $150,000 deal. And also, we’re planning on starting an LLC because that’s something that most lenders require for foreigners.

Loic:

And so my precise question is, should we do it or should I try maybe being on site and just fly there for a couple of days or weeks? Or should I maybe try it on my local markets with just friends? But unfortunately, it’s just not as great as the U.S. market because there’s not as many deals as we’d like to see.

Loic:

And should I look for MLS deals or maybe off market deals with an agent? And should my grandpa take the loans on his [inaudible 01:01:33] or at least as the primary investor because he holds the cash? And also, how can we just do it without a FICO score because we’re foreigners with friends’ bank accounts because that’s something that most lenders I’ve reached out to have already actually told me that I might need one.

David:

All right. Well, shoot, man. You’ve clearly read the entire Long-Distance Real Estate book.

David:

Your English is fantastic. It’s hard to believe you’re only 18.

Loic:

[inaudible 01:02:06].

David:

I see why your grandfather trusts you with his money. You seem like a special kid.

Loic:

Thank you very much.

David:

That being said what… I’m just going to shoot straight with you. Is it Loic? Is that you pronounce it? Loic?

Loic:

Yes, that’s right.

David:

Loic, your ambitions are large. Trying to find a house in one of the hottest states in America in the 100, $150,000 range without very much money, without understanding how business works in America and being that far away. You’re probably going to need to lower your expectations on some of those things because if you don’t, you’re going to end up just getting suckered into a bad deal.

David:

Henry, I think you’re probably on the same wavelength as me. Do you want to jump in and share what your thoughts are?

Henry:

No, no. I would 100% agree with you, David.

Henry:

It sounds like there’s quite a few hurdles that you’re going to have to overcome. And is it impossible? Probably not. But outside of finding the deals, the concern is going to be where’s the money going to come from? And if you’re going to have to take out loans, what hurdles are you going to have to overcome?

Henry:

I’m no expert on being a foreigner and then investing out of state, but I tell you that it’s probably going to take you time wise a lot longer than you’re expecting.

Henry:

And then what I was hearing based on your questions is you’ve got a lot of different thoughts on which strategies you might want to undertake as a new investor. Should you buy on the market? Should you buy off the market? Where are you going to buy?

Henry:

And so the first thing I would tell you to do is to get that nailed down. First, you have to know exactly what market that you’re going to invest in because the market that you’re going to invest in will dictate what’s the best way for you to go about finding properties that fit your buy box in that market.

Henry:

There are some markets where MLS shopping is totally feasible based on the exit strategy that you’re going to use and then there are some markets in the country where it’s going to be a whole lot more difficult to just find something on the MLS that’s going to hit your numbers.

Henry:

But the two things that are going to guide you to that are, A, knowing exactly what that market is and B, knowing what you want to do with those properties. And if you’ve got those things nailed down, then that will point you to whether or not you should look on the market or off the market for your deals. Does that make sense?

Loic:

Yes, it makes sense. Actually, because my grandpa isn’t an expert to real estate at all, he doesn’t even speak English, I first considered investing in San Antonio or maybe Houston and just doing a fixed rent deal actually in … I didn’t know if it’s really feasible as a foreigner because we’re just so far from the site of construction and from the property in general. And so yes, so how can I just make it?

Henry:

Yeah. So I think feasibilities are two levels. There’s feasible from a distance, but it’s feasible from what’s legally possible from a financing perspective. And so I probably let David take the latter of those two.

Loic:

[inaudible 01:05:22].

David:

Yeah, I don’t think you’re going to have as hard of a time being able to own property here as a citizen of France. Our company does this for people that are outside of America where you can still take title to a property. Owning in the U.S. is easier than owning in other countries so you should reach out to us and I’ll connect with one of the guys to tell you what would have to be done.

David:

This is more from a practical standpoint. You’re basically saying, “How do I compete at the highest level of what I’m trying to get into as a brand new person?” That’s how people you… If you’re like, “Hey, how do I go compete with all the black belts in this martial art I’ve never done?” Might be a chance you get hurt.

David:

So what we’re saying is let’s start a little bit slower here. If you were 100% committed to this, Loic, I would say take a vacation to Texas and plan to stay for a week or two. Maybe even bring your grandpa. Meet with property managers in the different areas that you’re looking at.

David:

Don’t tell them you’re from France. Even though you have an accent in America, we have tons of different people here. No one’s going to assume you live somewhere else. They’d probably… You speak very good English. I don’t think they can even tell it’s French. Don’t wear a beret and a striped shirt and [inaudible 01:06:27] all of those French stereotypes. Don’t come with a cappuccino in your hand. I’m joking here.

David:

Don’t tell them you’re from somewhere else because if they’re a bad one, they’re going to then think they can take advantage of you. And just get to know, hey, what type of… How are a lot of the people that own these properties finding them? What are the parts of town that you think you want to manage in most? If the property manager will open up to you and explain, “Hey, this is the type of properties that do best.” Now you have a target you want to go for.

David:

I would ask them, “Who are the best real estate agents that you know?” And I would meet with those same agents. Just go out to lunch with them, get to know them a little bit, talk about what you’re hoping to do. If they have a good recommendation and you have a good connection with them, now you’re halfway there. You found some agents that can look for you and you found property managers that can manage the property.

David:

With those two people, start asking like, “Hey, if I need to fix a house up, if I bought a fixer upper, do you have people you could recommend? How do you know them? How many jobs have they done for you before? How busy are they?” Ask a couple of those questions.

David:

And then the lending would be the easiest part. We could help you with that. But if you wanted to use somebody else, everybody would know a lender. This stage right now, it’s the easiest to find someone who’s going to finance your property.

David:

So I would definitely recommend doing that before you just started buying properties in Texas because from someone who doesn’t understand the different cities out here you could easily get put in the worst neighborhood of the worst city but the pictures are going to look really nice of the house and that’s what we want to avoid.

David:

So once you’ve been there and you know the market and you know the people, you don’t have to visit every single house you buy. That’s the part where you’re like, “Okay, I know the neighborhood. I know the area. I trust the people. I know what I’m getting.” But in the very beginning, I think you should come out here and you should meet the people that are going to be representing you.

Loic:

Yes. It sounds… [inaudible 01:08:11] Yes, of course.

David:

And what’s going to happen, Loic, is that it’s going to open up a whole new round of questions where you’re like, “Well, now I need to know this and now I need to know that.” But those questions are one step closer to where you’re trying to go. They’re one step further down the path that you need to be walking in.

David: