We spend some time asking J about how we got to the current economic stage we’re in, what the economy looks like today, and how we can prepare ourselves for the future of high interest rates, falling asset prices, and real estate steals of the century. If you’re feeling anxious about investing in 2022, J Scott is the guest you should listen to.

For our due diligence portion of the show, we’ll be asking James Dainard, Jamil Damji, and Kathy Fettke all about recession prep and rebalancing your real estate portfolio. While almost everyone in our expert panel has different advice for different investing strategies, they all agree on one thing: there is still plenty of money to be made in the realm of real estate!

Dave:

Hey, everyone, welcome to On the Market. We have a different kind of show for you today that I am very excited for. First I am going to be chatting with J scott, author of Recession Proof Real Estate Investing, who’s going to give us a background on the current economic climate, the current economic cycle, where we are, where we might be going, and how we got here. Then we are going to turn the conversation over to our panel. We have Jamil, Kathy, and James here to talk about practical steps you can take to prepare for a potential recession. And then at the end, we answer some user questions about how they can handle a pending recession. It is my great pleasure to welcome the one and only J scott to On the Market. J, thanks so much for being here.

J:

Yeah, the one and only. I’m the only one stupid enough to have a one letter first name. So I’ll take, I’ll take the one and only,

Dave:

No, we are so excited to have you here. You literally wrote the book on recession proof investing and are one of the greatest… If anyone listening doesn’t know J from the Bigger Pockets forums or his many books, is one of the greatest analytical minds in real estate investing that I’ve ever encountered and super excited to have him here to talk about sort of a scary topic, but hopefully we can work through some of the fear, J, and you can help us understand how the current economic cycle and current economic situation we’re in exists in the context of the business cycle and what our listeners can do about this confusing economic time. So with that, let’s just get started. Where are we right now and how did we get here? Can you just drop some knowledge on us?

J:

Yeah, so let me step back a little bit, because a lot of economics… First of all, everybody thinks they know what they’re talking about, including the economists. And most of them are just guessing. Now some guesses are better than other guesses. People that really understand what’s going on can see the trends and look at the history and make better guesses than people who are just randomly guessing. But anything we talk about in this discussion, let’s be clear, I’m guessing. I mean, I could be talking about data and historic stuff, I’m not guessing, but any predictions I make or trends that I see coming, nobody really has any idea. So I just want to get that out of the way that I don’t want anybody to go take their 401k and put it on red because I like red.

Okay, so where are we? Let’s start with a little bit of history. When we talk about the economy, the economy works cyclically. It goes up, it goes down. I think a lot of people who are new to investing since 2008, a lot of people in their 20s and 30s, they probably don’t really remember recessions. They saw 2008, they saw 2008 was absolutely horrendous, but they’ve been conditioned to think that 2008 was an anomaly. We went a hundred years since the great depression, the market went up for a hundred years, and then 2008 happened, everything collapsed. And that’s actually not the way things work. Typically we see these cycles of boom and bust, not as bad as 2008, but still downturns every five, six, seven years. And we’ve seen that for the last 150 years.

So what typically drives these cycles is on the upside of the cycle, things are going well, people are making lots of money. Businesses are doing well. Basically everything we saw from 2014 to 2020, till COVID. Businesses are doing well, people are making a lot of money. They’re happy. Unemployment is low. And because everybody’s doing so well, what are they doing? They’re going out and they’re spending money. They’re spending money on travel. They’re spending money on luxury goods. They’re spending money on cars. They’re spending money on restaurants. And when you start spending lots of money, all the businesses that are providing these things that money is being spent on, they need to grow. Restaurants need to hire more staff and car companies need to build more manufacturing plants, and Amazon needs more warehouses and people. And all of these things cost money. So the businesses go out and they take out loans so that they can build more warehouses or buy more equipment, or they have to compete for labor so they have to spend more money to get more waiters and waitresses in the restaurant. And all of these things cost money.

Businesses, they don’t mind spending money, but they’re not going to eat that cost. They’re going to pass that cost on to consumers. So when the businesses pass those costs onto consumers, that’s called inflation, and lots of different definitions for inflation. But let’s start with the basic. Prices going up is inflation. So businesses doing well leads to inflation because they have to buy stuff and hire people. Prices go up. When prices go up, this is where are things are okay for a while. Prices go up a little bit, that’s good. Prices tend to go up. But when prices go up too much, like we’ve seen over the last couple years, when we get too high inflation, the government starts to get concerned, because if prices go up too much, people can’t afford food, people can’t afford to travel, people can’t afford baby formula, people can’t afford new cars, and that’s always a bad thing. So the government doesn’t like when we have too much inflation.

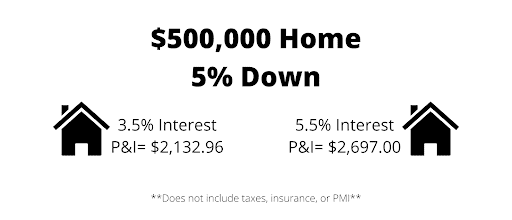

So when things really heat up in the market and we have too much inflation, the Federal Reserve steps in. One of the things the Federal Reserve can do is they can raise and lower interest rates. They will raise interest rates to slow down inflation. And the reason raising interest rates slows down inflation is because if interest rates are higher, it encourages Americans to do two things. One, it encourages us to spend less money. It costs more to get a mortgage for a house because rates are higher. It costs more to buy a car because loan rates are higher. It costs more to borrow on a credit card because credit card rates are higher. So we borrow less money because it’s more expensive. Also when rates are higher, savings account rates go up. We can get more by putting our money in the bank. So people save more money.

So by raising interest rates, the Fed encourages people to stop spending and start saving. And when people stop spending and start saving, well, what’s going to happen? The economy’s going to slow down and these businesses are going to see less profit and they’re going to have less demand for restaurants and travel and cars and all these things. And then when things slow down, now the businesses, they’ve hired all these people, they have all this debt that they use to grow, and now businesses get in trouble, businesses slow down, so they have to start laying people off because suddenly there aren’t as many people eating in the restaurant, so they have to lay off the waiters and waitresses. Or fewer people are buying books, so Amazon shuts down a warehouse. Or fewer people are buying cars, so Toyota has to shut down a manufacturing plant.

That’s basically what leads to a recession. The businesses are laying off people. They’re cutting hours. They’re cutting wages. Now suddenly consumers don’t have as much money, they don’t have as many hours at work, they can’t pay their bills, they can’t pay their mortgage. That’s the recession. We basically ride that down to the point where the government realizes, “Nope, we need to do something about this.” So what do they do? They lower interest rates. When they lower interest rates, just opposite of raising it, that encourages people to start spending again because they can get cheap debt and they no longer can get a lot of money by having their money in a savings account, so they start spending and the spending takes us up the upside of that curve again, where everything is good and the economy grows. And that’s the cycle that we’ve seen 33 or 34 times over the last 150 years.

Now, back to your question, where are we today? So the last time we had a major recession, technically we had one in 2020 during COVID. So first quarter of 2020, second quarter of 2020, economy was basically shut down. Technically that was a recession. But the last real recession that we had that was prolonged was 2008. And if you remember I said typically these things happen every five, six, seven years. Never in the history of this country. Have we gone nine, 10, 11 years without a recession, or at least not in the last 150 years since we’ve been tracking this. So the fact that between 2008 and 2020 we didn’t have a recession was pretty unprecedented. And a lot of people were predicting that in 2018, 19, even leading into 2020 that we were probably in for a recession just based on the fact that the market was heating up, the economy was heating up and it had been so long since the last one.

So here comes COVID. COVID comes along, basically the economy crashes, everybody’s thinking, “Okay, this is going to be an apocalypse,” where every people are out of work, businesses are shut down, nobody’s leaving their house. So what does the government do in spring summer of 2020? They say, “Okay, we need to fix this. We need to get people spending money no matter what it takes.” So again, they did the one thing that they’re really good at. They lowered interest rates. Suddenly people could get lots of cheap debt. I mean basically near 0% interest rates meant really cheap mortgage rates, really cheap credit card rates, really cheap everything. So that was number one. They lowered interest rates so that people were encouraged to start spending their money. Number two, they did the other thing they’re really good at is they started printing lots of money. They started putting a ton of money out in the economy so that everybody was richer. Businesses were richer. Consumers were richer. Everybody had more money to spend.

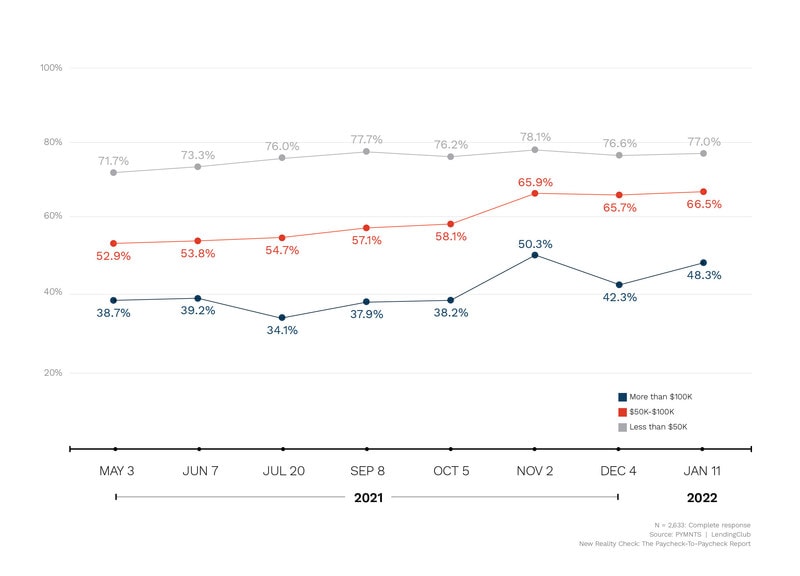

When people have money. People aren’t really good at saving money, especially, again, with really low interest rates, they spend it. So all this free money that got put out into the economy went right back into the economy. Now, people who are on the lower end of the economic spectrum, they were using that money to pay their mortgages, they were using that money to buy food, they were using that money to buy clothes. They didn’t need to use that money to pay for gas for their car because they weren’t going anywhere. Basically they were saving a bunch of money and they were using the rest of it for the things they really needed. But then there were the rest of the Americans, the 1%, the 5%, the 10%, the people that already had their clothes and their food and their housing covered. Now they have all this extra money. What are they going to do with it?

They’re going to invest it. So all this money we’re talking three trillion, four trillion dollars went from the government to the people, and the people that didn’t need that money desperately to live took that money, and where did they put it? They put it in the stock market, they put it in crypto, they put it in housing, they put it in other hard assets. So now we see all of these crazy bubbles in the market. And I don’t like that term bubble because we don’t really know something’s a bubble till after it pops, but I think it’s safe to say that what we’ve seen with the stock market, the real estate market, crypto, I mean, it’s certainly as close to a bubble as you can get. So basically today we’re at this point, or recently we were at this point where real estate is an all time high and affordability is an at an all time low. The stock market, all time high, the crypto market all, time high. Anything that people can take their money and stick it into a speculative asset or an investment is pretty much at an all time high.

So that’s where we were as of a couple months ago. And that’s how we got here. Now, there’s one other thing that we should point out. One of the big things that everybody’s been talking about in hearing about is inflation, and the number that the government’s throwing around is right now 8.3% inflation. A lot of people think the number’s higher than that. It probably is higher than that. I think it’s always been calculated in a way that disguises the real number, but regardless 8.3, 9.3, 15.3, whatever the number is, inflation’s really high right now. A lot of people are wondering why is inflation so high right now? Some people are going to blame Trump. Some people are going to blame Biden. Some people are going to blame Russia. Some people are going to blame whoever. There’s plenty of blame to go around.

But the real reason why we’re seeing so much inflation right now, there’s two reasons. Number one, after COVID, we still didn’t figure out all of our supply chain issues. We’re still having problems getting products from there to here, whether there is California to Georgia, or China to the US, or wherever to wherever. We still have these supply chain issues. We have a lot of manufacturers that haven’t fully ramped up. We have a lot of raw material providers that haven’t fully gotten their pipelines fixed. So it’s really hard to get all the things that the high demand is asking for. It’s hard to get furniture. It’s hard to get cars. It’s hard to get computer chips. It’s hard to get everything. So when supplies are constrained, simple supply and demand, lots of demand for something, very little supply for something, the prices, inflation, is going to go up. So that’s the supply side.

But there’s also a demand side issue here. So I know people say, “Yeah, we saw the same thing back in 2008.” The government printed trillions of dollars and people had lots of money to spend, but we didn’t see high inflation. Inflation was like at 2 or 3% between 2010 and 2021. So what’s the difference between what we saw in 2008 and what we’re now seeing in 2021 and 2022 with respect to inflation? The big difference there, and this is the analogy I like to use, and I’m not advocating drugs, I’m not a drug user, but it’s a good analogy. The way the government infused money into the system back in 2008 is the equivalent of getting high on secondhand smoke. They trickled that money into the system in a way that we didn’t even realize it was there, but it was still effective. And what they did was they took a whole bunch of money, trillions of dollars, they handed it to the banks and they said to the banks, “Go make more loans. Go make loans to businesses, go make loans to consumers, get the money out there.”

But it still had to go through the banks, it had to go through these intermediaries. And in a lot of cases, the banks aren’t efficient. They took years to spend that money. In a lot of cases the money stayed in the banks’ repositories or reserves forever and the banks never spent that money. So that money eventually made it into the economy, but it was relatively slowly, it was relatively inefficiently, so we didn’t have this big infusion of cash all at once. When COVID happened, the government realized that wasn’t going to work. We can’t slowly infuse this money into the economy by sticking it into the banks and telling the banks to lend. We need to get this directly into the veins or arteries of the economy. And instead of the secondhand smoke, we need to be injecting this directly into our veins. So basically instead of handing the money to the bank, what we did was we took that money and we sent checks to every American. We created this PPP loan stuff where businesses could basically fill out a form and get ridiculous amounts of money.

Lots of things. I mean, there were bailouts, both corporate bailouts and smaller business bailouts. The Fed, instead of just buying bonds, and I don’t want to get too technical, but basically they were buying equities, meaning they were directly handing cash to businesses. We infused this money not slowly but directly into the veins of the economy, and we got basically our heart beating really, really fast, our blood pressure went up and that was inflation. That’s the demand side inflation. And that’s the difference between 2008 and 2020. It’s not a different president, it’s not a different Fed, it’s not a different this, a different that. It’s how we had to inject the money into the economy in order to keep things from collapsing. And because we had to direct it so directly into the economy, literally sending checks to every American, we were able to stimulate the economy very quickly, but also very powerfully, and we didn’t let off the gas soon enough, and here we are, we’re in an economy that’s overheating, our heart’s beating too fast, our blood pressure’s too high and things are in a pretty bad situation.

Dave:

Well, this is exactly why we wanted to bring you on, J. You just gave us an economics lesson in like 15 minutes or 10 minutes, which is great. But if I could just summarize what you’re saying, it sounds like we’re in part of a normal economic cycle, but it’s sort of just been elongated in this weird way, where normally we expect to see a economics cycle last five to seven years, but coming out of the great recession, you would’ve expected to see a slow down 2015, 2016, and then we were sort of approaching the point where people were thinking like, “eh, probability wise, it’s about time to get a recession.” And then this black swan event comes, we inject all this money into the economy, at a perfect time where supply is constrained, which is the perfect storm for inflation. You have increased demand, decreased supply. That’s inflation all day.

And now we’re in this situation where we have really inflated asset prices. But in my opinion people are feeling like… Starting to think the party might be over soon. It’s starting to feel like, to use your analogy, the drugs might be wearing off a little bit. So I’m curious where you think we are right now. That was a great background, but what does this mean for the current economic situation, particularly as it pertains to investors?

J:

Let me latch onto one of the things you said, which is the drugs are wearing off. I think, unfortunately, it’s just the opposite. The drugs aren’t wearing off, and inflation, I think, is the indication that the drugs aren’t wearing off. They’re in our bloodstream and they’re taking effect, and we want them to wear off. We would love for this inflation to subside naturally, but this is where we need to bring in the medics and we need to take inventive action and we need to inject. What is that needle that they jab into your heart?

Dave:

Yeah, it’s like the epinephrine.

J:

Yeah. And literally that’s what they’re doing. That is what the Fed is doing right now.

Dave:

Isn’t that what they’re doing with raising rates. So that’s what I mean by like the drugs are wearing off is we’re seeing… I mean, crypto’s down 50% off its high, you see the NASDAQ as of this recording, I don’t know what it’s today, is 20% off its high or something like that. So it feels like while we’re… I think you’re entirely right that the sign that the drugs are out of our system is that inflation reaches that 2 to 4% range that we’re normally seeing, but it does feel like… To me, at least, it feels like we’re trending in that direction, or do you think we have a long way to go?

J:

So the conventional wisdom is that in order to reduce high inflation, you need to increase the interest rates. We talk about the thing called the federal funds rate, and that’s the lowest rate there is, that’s the rate that the Fed controls, it’s the rate that basically banks can borrow money from the government. Right now it’s at about 1%. It was near 0%. The conventional wisdom is in order to control inflation, that interest rate needs to be higher than the inflation rate. So right now, that interest rate’s at 1%, the inflation rates at 8.3 or 8.4%. So in theory, we need to raise the federal funds rate to the point that it’s over the inflation rate. Now it’s not that bad. I mean, we don’t need to raise it eight points to get to eight and a half percent.

Because as you raise the federal funds rate, you’re going to be slowing down the economy. So at the same time you’re raising the Federal funds rate. The inflation rate should be coming down, it’s taking effect, and there’s going to be some equilibrium there. There’s going to be some point where the inflation rate drops to the same point that the federal funds rate comes up and they cross over each other, and then hopefully inflation goes down to normal levels. Nobody really knows where that is. Is that 2%, is that 3%, is that 5%? So what the Fed is doing now is they’re saying, “Okay, every month or two we’re just going to raise rates. Hopefully inflation’s going to come down and we’ll see at what point we have to raise rates so that inflation comes down to normal levels,” and their definition of normal is 2 to 3%.

So when somebody asks me how high do you think they’re going to raise rates? We don’t know. They don’t know. I think it really depends on how inflation and the economy reacts to the raising of rates. Now here’s something that… I don’t want to get complicated, but I think this is really important. A lot of people talk about this idea of stagflation, this idea of basically a situation, and this is the worst case situation for an economy, it’s a situation where you have high inflation, but you also have recession. So high unemployment and just lots of bad economic conditions, but also inflation. I talked about how we typically raise interest rates to slow the economy down. If the economy’s bad, well, at least inflation’s low. But if you don’t do all of this correctly, you can get in a situation where the economy goes to hell and inflation is still high.

And this is what Japan saw from 1991 to 2005. Literally there was a decade, two decades that Japan, their entire economy was… If anybody’s interested, look up the term lost decades. And Japan went from being one of the economic superpowers in the late 80s to basically barely functioning for 20 years because they had stagflation. So how do we avoid the situation where we have persistent inflation and recession? The best way to avoid that is not to raise rates too slowly. If you raise rates too slowly, you get in a situation where you can start to spiral downward.

So I think the Fed realizes that there’s a risk in raising rates too slowly, and that’s the reason why we saw a quarter point two months ago, a half point last month, I have a feeling we’re going to see a half point again at the next Fed meeting. I wouldn’t be surprised if we see a half point after that. A lot of people are thinking, “Whoa, whoa, why are we doing things so quickly and so drastically? Let’s take our time so we don’t collapse the economy.” But I think the Fed realizes that if they do things too slowly, that they run the risk of getting into this stagflationary environment that could be much, much worse and much, much longer lasting than just a regular recession.

Dave:

Before we get out of here, I have two things to say. First, if you want to read J’s excellent, excellent book called Recession Proof Real Estate Investing… Do you have it there? You could show it off. Recession Proof Real Estate Investing. We have a 20% discount off any format. You go to biggerpockets.com/recessionbook. That’s biggerpockets.com/recessionbook. And the code is MARKETPROOF. We will put this in the show notes, or if you’re on YouTube, we’ll put it in the description below. That is one book deal. And as J mentioned, J and I co-authored a book together that is coming out.

J:

You wrote it. I just put my name on it.

Dave:

That is absolutely not true. This book was entirely your idea, and we have been working on it for, God, it feels like a decade. I don’t know. We have been working on this book for so long. But it is coming out this fall, and it is all about the fundamentals. How to understand how to be a good investor, how to understand the numbers behind any good real estate deal. So definitely check that out. J, you are such a wealth of knowledge. It is so great to have you on, and we’ll obviously have to have you back right before our book comes out to talk about some of those fundamentals.

J:

Yeah, and now that I’ve gone through like the 18 hour overview of how the economy works, next time we can just keep things light and fun.

Dave:

Yeah, let’s talk some deals next time. I want to hear what you’re up to. Well thanks, J. We will see you again real soon. We always appreciate your time.

J:

Thanks, Dave. This was a lot of fun.

Dave:

Thank you so much to J Scott, the one and only author of Recession Proof Real Estate Investing, for joining us. I now am going to turn this over to our esteemed panel. We have Kathy Feki, James Daynard, and Jamil Damji joining me today to take this from what J was talking about, which was a very helpful historical context and lesson about how we arrived in the current situation, and let’s turn this to a more practical conversation about how our listeners can prepare themselves for a recession. Of course, we don’t know exactly what will happen. Personally I think we’re heading to a recession, at least technically. Don’t know how bad it will be, we don’t know how long it’ll be, but eventually one day or another, we are going to get there. So even if it’s not for another couple of months or another couple of years, this information is still really practical. James, I’m going to start with you. I’d love to hear what you took away from this interview and how you’re thinking about preparing yourself and your portfolio for a recession.

James:

So the two things that we’re doing right now as we’re preparing for the new market, A, is access to capital. We are talking to every lender that we’ve been working with, and we’re finding out where their appetite is and where they are going to be most aggressive on where they want to lend. That tells us what kind of liquidity we need to keep on reserves, and then what’s our cost basis. As we look at our pro formas. And speaking of pro formas, that’s the other key thing that we are doing right now is we are patting everything.

So on construction, I do think inflation’s going to continue to increase. Instead of adding 10% to our construction pro formas, we’re adding 20% because we want to make sure that our walk-in margins are protected and that we have the right numbers in there. In addition to everything that we’re looking at, if it’s value add and we have a transitionary period from stabilization during the renovation, we’re adding about another half point to the current rates. So we’re at 6.5% right now on investor rates, we’re actually putting 7% in our pro formas just so we don’t get caught on the back end.

Dave:

That’s great advice. I think the pro forma’s particularly relevant to pretty much any strategy. If you could just pad your numbers right now, that makes a lot of sense given all the uncertainty. Did want to ask you, what are you hearing from your lenders? Are they still ready to lend or is credit going to tighten in the next couple months compared according to what you’re hearing?

James:

The business banks are actually… Our local banks are being pretty aggressive. I mean, one thing is they have made a ton of money these last 24 months, and they’re sitting on a lot of capital right now, and they do want to deploy it. And the moral relationships you’re building, they’re still being pretty loose with what they’re… They’re actually looking at new ventures rather than what they’ve always been lending on. They’re expanding their products right now. So rates are better in the commercial world. They’re about at point cheaper than the residential. And in addition to, the lenders are getting more creative, because they don’t want to sit on the sidelines with their money either. I mean, inflation’s also affecting them, so they’re being a little bit… Surprisingly more aggressive than I thought.

Dave:

That’s good to hear because one of the major reasons the 2008 crash was so prolonged is that credit tightened so dramatically that it took a really long time for investors or builders to get any lending. So I’m hopeful that even if there is a recession that we won’t see that severe tightening of credit that would really impede any sort of economic recovery. Kathy let’s turn to you. What are you doing to prepare yourself for a potential recession?

Kathy:

Oh my gosh, I’m going to sound so boring. We’re doing what we’ve always done. We are following jobs. I know. I wish it were creative and wow like these guys, but we’re following where the employers are going. There was a lot of lessons learned over the last couple of years and businesses learned where they can keep their businesses open, and many of those businesses are moving. So there’s never been… I don’t want to say never been. This is an incredibly exciting time to follow the jobs and follow the demographics and get there before the crowds. There’s always going to be ebbs and flows, recessions or lack of. I’m at a single family rental conference right now in Miami beach with hedge funds from all over the world. It’s never been so packed with so much money. Walk down the aisles and they’re trying to give you millions of dollars to buy homes. Problem as there aren’t any to buy it. It’s kind of wild.

And when you see the business suits in Miami beach, where I am right now, and know that so many of these bankers are moving to this area. So it’s become an international city. So much activity moving to Florida. You just have to see, it’s almost like hungry hippo, the game that’s happening right now. It’s like, “Oh, the hippo’s here and now he’s here and now…” Things are moving and you’ve got to pay attention. And if you follow it, you can really benefit from what’s happening in these growing areas, just like the last 50 years, just follow the trends, follow the demographics. That’s what we’re doing.

Dave:

So are you worried at all that in a potential recession, we might see increased unemployment? That’s almost guaranteed in a recession. Maybe there would be declines in rent or increases in vacancy. Are you concerned that will impact your business at all?

Kathy:

It just depends on where you’re invested. So right now would be a really good time to sell your lesser performing assets, because there’s probably a buyer out there for them. You might own something that you haven’t really paid attention to, but you should. Look and see what’s happening in that area and determine if this is still going to make sense over the next few years. And if it isn’t, then get into an area where it might be making more sense. Again, I’m at this conference with New York hedge fund managers who are… It was standing room only. It was thousands of people and they’re trying to buy real estate. And there was a panel of the biggest lenders who lended these guys saying, “We don’t see a recession.” Well one guy said maybe 2023, but you’re going to have to kill a lot of jobs to get there, and it’s not going to happen this year most likely.

Again, anything can happen. I mean, there’s things that can happen. We learned that two years ago. There could be a surprise. But at this time, for the Fed to try to kill 11 million jobs by raising rates, it’s not happening yet. One guy on the stage thought 2023, but it would be mild. Again, nobody knows. Nobody knows. But what they are betting on is that right now there’s 870,000… And again, I’m just talking about single family homes, there’s all kinds of ways to invest. And there’s all kinds of recessions and recessions can happen in different asset classes, and it may or may not be real estate, but I’m just going to focus on single family homes right now. There’s 870,000, approximately an inventory. Well, the peak of 2007, there was 3.7 million in inventory. Very different scenario right now. You can’t compare today to 10 years ago or 20… Everything has changed.

But what we know is that we have massive demand, gigantic population that is forming households, and there’s a fourth of what the inventory was 10 years ago for these people. So the consensus of these hedge fund managers was that it probably rents are going to continue to rise because the difference between a mortgage payment and the rent is growing. As the home prices rise and as mortgage rates rise, it’s becoming harder and harder to own a home. That means more renters and more renters fighting over the same properties. They think that rents will continue to rise.

Dave:

I do want to come back to this idea of rebalancing your portfolio and maybe selling off some things that maybe you don’t want to hold for the long term right now. But before we do that, I want to get Jamil’s opinion here, because I have a feeling he’s going to take a different view. Jamil, what are you doing to prepare for a potential recession?

Jamil:

You’re right. I am going to prepare for a potential recession, but I’ve always been preparing for a potential recession because I am fundamentally a trader. I trade homes. That’s what I do. When I got away from trading homes… This is my second time at bat. I went through the first cycle from 2002 to 2008. I made millions of dollars. I got creamed and I got creamed because I was holding. I was holding leverage. I was holding debt. I put myself in a situation where I couldn’t unravel. I didn’t have stacks of cash. I wasn’t prepared. I’m not in that situation this time. I’ve been prepared and I’ve been preparing for this since we got back to it. And that’s just sticking to the fundamentals of understanding value.

First, know what things are worth. Everybody who’s out there who’s been buying on speculation, that is not going to help you. That is not going to help you. But secondly, let’s look at the fundamentals of supply and demand. Listen to what Kathy’s saying. It’s very telling, the mood in which she’s she’s describing right now. You have all these hedge fund managers, you have all the suits hanging out in Miami. She’s describing this very, very aggressive front of Wall Street coming in and making and taking huge bets at housing. Why? Why are they doing that? And I’ll tell you exactly why. These people don’t play. They know when they’re at a table and they know what the dealer’s holding. And the dealer’s holding no inventory, no houses, because they’ve been buying it all.

So when I saw live over the weekend where a woman went out to rent a property in New York and there were a hundred people there and there was outrage because one $3,000 a month apartment had hundreds of applicants to try to rent it. When I see things like that happening, I can tell you that demand is not going away. We do not have enough inventory right now, so there’s… Stick to the fundamentals of understanding value, know how to trade, don’t hold too much. But thinking that we’re going to have this massive influx of inventory on the market is wishful, absolutely wishful.

Dave:

Totally, I sort of agree. If you actually look at new listings on a seasonally adjusted basis, it’s going the wrong direction. It’s going down. And just for people who are listening to this, if you’re seeing numbers and people saying that inventory is going up, because it went up from March to April, that happens every single year, that is called seasonality. And if you want to understand the data better, you can adjust that for seasonality. You can do this on Redfin or Zillow, they do it for you. And look at it then, because that shows you what’s supposed to happen in March to April and how it’s comparing to previous years, just as a heads up. Jamil, J Scott in his book, which I just reread, kind of timely, has put something in his discussion of peak market phase, which is, I think, where we are right now in just terms of the market cycle. He said wholesale instead of flip. Since you’re in both of those industries, pretty deep, do you agree or disagree with that advice?

Jamil:

100% agree. We are turning down our flipping activity and we’re wholesaling a lot more. If we do flip a property, when we do flip a property, because of course I’m in the world of entertainment for flipping as well, so it’s not just as a business. So these have to make sense, but why I love wholesale so much is it lets me identify the real gems, the real diamonds, the places where I can’t get hit. So when I can find these really beautiful opportunities, I flip those, I wholesale everything else. So J’s 1000% right. The way that he’s thinking, it’s moving in the same lines is how I’ve been preparing and how I think the rest of the audience needs to prepare it. Learn the fundamentals of wholesale and you can’t get burnt.

James:

Can I jump in on that, because obviously I like flipping. I’m still a flipper. I’m a wholesaler as well. But one thing that I’ve done, what that I’ve learned I’ve done really well in over the last 18 years is go where people don’t want to go. And I have noticed the general sentiment is be cautious, maybe wholesale, maybe pull your liquidity out. That creates a massive opportunity for flippers. I agree, you don’t want to buy flips that you are buying for the last 12 to 24 months, but you do want to buy the ones that are heavily discounted. Investor fatigue is a real thing and people are starting to pull out of the market and it is creating some excellent buys. In addition to wholesaling is, I agree with Jamil 100%, it is a great way to have low risk when you’re going into any sort of transitional market.

But at the same time, if the demand’s not there on the investor side, for certain types of product, your wholesale fees do get beat up a little bit at that time. You can’t charge as much to that next investor. So for me, I’m actually doubling down to get ready to flip a lot more because I like to invest where everybody is afraid to invest in. Yes, construction costs are hard to manage. Well then I got to figure it out. I can just add it into my pro forma. Flipping could be riskier. Yes, I will buy it cheaper, then. The next wholesale deal that comes through, I’m going to expect a way better margin. So I still am an active… I mean, we just bought six flips in the last two weeks, and I do think that market’s going into a trouble sometime, but we also paid 10% less than we were paying the last 24 months. I just renegotiated a deal down $120,000 during feasibility on a single family house because I said, “Hey, the data, I don’t like it anymore. Here’s where I’m at.” And the seller took it.

Dave:

Would the seller have taken that six months ago?

James:

Oh, absolutely not. Because it was in Bellevue. In Bellevue, you couldn’t… I mean the lots were trading for 1.35, and I have this house for 1.15, and because every builder got nervous, they all pulled out of the market rapidly because they had bought too many lots over the last five months. They would be very aggressive. So created this… I mean I just paid $220,000 cheaper than someone was paying 35 days ago. So as people pull out, there’s a huge opportunity. I like to buy on the dip and I’m starting to see a little bit of a dip there.

Jamil:

But are we at a dip, James? That’s the thing. Are we at the dip or are we just at the little piece after the peak? Is that a dip or is that a slip?

James:

We’re in the dip, but I think we have a further dip, too. I actually think there’s a lot of inventory coming to market. I have a different perception from maybe what you guys have because the emotional standpoint in the psyche, you can’t factor your pro forma into the data. What I do know is investors have a weak stomach a lot of times. I mean, we saw that in March of COVID. What happened? All these hedge funds that are buying all these houses, they weren’t buying in March, were they? They all shut their doors down, banks shut their doors down, hard money lenders shut their doors down. They have no stomach. We went and bought 15 homes. We just suggested our margins, so even right now, that home that I just contracted in Bellevue, we’re not paying a little bit less, we are paying nearly 20% less in a 35 day period. So as long as my margin makes sense, I can still flip that property. And honestly I’ll probably do very well in that house, but just adjust your margins. If you’re nervous, just buy cheaper.

Kathy:

Oh James, you guys, I have to jump in because I couldn’t agree more. Right now there is so much fear. As there should be, every headline is saying there’s a recession coming. This is a great time to negotiate. This is a great time to get a good deal. We are finally able to get some inventory from people who are really scared of what’s coming because they maybe haven’t researched the fundamentals of what’s really happening. They’re just reading the headlines. That’s the whole point of this show is to go behind the headlines and really give the data because the world is not paying attention to the fundamentals and the facts.

And the facts are we… Absolutely, the Federal Reserve is trying to increase inventory as it should. There isn’t enough. And by raising rates, there will be, in hopes of doubling the current inventory. That’s where we need to be at 870,000 homes on the market. You need to double it. We’re going to see that. But there’s a whole lot of people who are afraid of that because they’re going to see the headlines that say increased inventory, which is a good thing. It’s a really good thing for buyers. So if people are scared to buy, that’s good for you and me. We’re finally, finally getting deals again.

Dave:

I want to come to… So I actually had this question that we were going to save to the crowdsource section, but since it just came up, I will ask, and Jamil, I’ll start with you because you were starting to hit on this. This came from the On the Markets forum, On the Market forums on Bigger Pockets, which you should all check out if you have not been there yet. Some great conversations going on there. And this comes from Connor Olson, who asked, “Is it possible to be in an economic recession and not see that affect housing prices? Maybe supply will be so low that prices will keep going up.” And I just want to re reiterate before you turn this over to Jamil that the technical definition of recession is that GDP contracts two consecutive quarters. So the question is, could we hit that technical definition of a recession, but not see housing prices decline? Jamil, what do you think?

Jamil:

1000%. History shows us that they’re not directly related. We’ve had recessions where you have an increase in housing and… The last recession was devastating on housing, of course, but look at what got us to that. What Kathy was saying. There was an excess of like three and a half, four million homes. That was insanity. People owned three, four, five houses that shouldn’t have even owned one. That’s what caused us to have that meltdown in the first place, but I do not believe that just because we move into a recession that it’s going to hit housing. Look, stock market’s already getting creamed. Crypto’s getting creamed. So many people are absolutely feeling this already. It’s just that in real estate right now, we’re sort of pivoting, because we’re like, “Wait, it hasn’t got bad yet. What’s happening. Is everything okay? We’re fine. We’re not wet.”

And I don’t think we’re going to get wet. I think it’s going to get harder for us to make money because, again, you’ve got the 9,000 pound gorilla hanging out in Miami right now with Kathy. And the 9,000 pound gorilla is out there right now waving cash, waving cash. Do you not think that 9,000 pound gorilla was well thought out? That the reason why they’re doing what they’re doing right now with billions of dollars in spending and research? Guys, come on.

James:

These big hedge fund guys, we’ve done a lot of business with them, too, over the years, and they’re great buyers and they have a great business model, but at the end they are the 9,000 pound gorilla, but the Fed is mother nature and they will always win. No matter what, the Fed is going to control what happens, and I think they’ve been actually very clear about what they’re going to do. They’re not really hiding it. And Powell, the last time he spoke, he’s like, “Yeah, rates are going to go up.” I mean, they’re basically saying that they are purposely going to jam us into a recession. And that gorilla’s going to get wet. And the thing about the Fed in even that correlation with mother nature is you can prepare, it doesn’t matter. I can have a tornado come through right now, and as long as I got my cellar and I prepare correctly and have my food supply, I’m going to weather the storm and make it right out of that storm at that point.

But at the end of the day, money controls everything, and the Fed controls those hedge funds pockets. And if their pockets start to get a little bit more difficult, they’re going to tighten up. And again, I’m going back to the point of all those big buyers were not big buyers in March of 2018. I was laughing how quickly people shut their doors. Granted, it was a scary time, but at the end of the day, the assets were still the assets, and if they thought it was going to melt down then, we could have a meltdown now. So as soon as they have any feeling of meltdown, they pull back instantly.

And that’s why actually going back to what I was talking about with the bank market, go meet with lots of lenders right now, go talk to banks, because banks are telling me one thing today, but I have to have an arsenal banks because that’s one thing I did learn in 2008. They pulled their money back and I could not get any more of it. So talk to your lenders, put the arsenals on your banks because what they’re saying today will change tomorrow. And just have constant communication.

Kathy:

I just got to answer that question if you can have housing boom during a recession. And my answer to that is yes and no, and there isn’t a housing market. There’s a bunch of little pockets of houses all around a very, very big country. So in 2005 we were selling in a bubblelicious market. Remember one that didn’t make sense in California where prices… No average person could afford the average price. It was just crazy loans that allowed that. We sold those, and we 10-31 exchanged to Dallas where we bought right, they cash flowed, we knew there was growth, there was job growth, there was population growth, but the homes were very affordable and there was infrastructure growth. Remember that, job growth, population growth, infrastructure growth. Those properties rode through the worst housing recession since the great depression without feeling it. Because again, we bought right, in the path of progress, in affordable market, with high paid jobs.

So you could say how did anyone survive 2009? Well, if you prepared for it properly, it wasn’t that hard. You just had to get in the right current. And the current was where does it still make sense today? So it’s the same thing. There’s going to be real estate markets that get affected for sure. Right now we’ve got problems with tech stocks. And a lot of cities that have bubbled up are based on tech companies. So there’s going to be layoffs there. So some areas, maybe Austin, I don’t know, you’re Austin one last time, but right now those tech companies are hurting a little bit. There could be layoffs. There could be an impact on real estate. We don’t know. But I’m going to be careful and cautious about being in tech cities right now. And I’m going to be in markets that are more diversified. That was, again, a big lesson we learned in 2008. Be in a market that has lots of different employers so that if wind goes down, there’s plenty there to keep the market held up.

Jamil:

So is now the time to sell the castle in Malibu?

Kathy:

It could be, but I can’t. I can’t. I wish I could live somewhere else, but I can’t. And if you could find me a place where I could surf and mountain bike and rock climb and hike and… Fine, I’ll go there. But find it first.

Jamil:

It’s lifestyle. I get it. I get it.

Dave:

So earlier, Kathy, you had said something about selling things that aren’t performing, and I’ve been talking to a lot of people recently about this idea of rebalancing your portfolio, maybe by selling things that you don’t want to hold onto for more than a year or two, or maybe moving to a lower price market. Kathy, do you have any advice, like practical things about how people can go about do that? What type of markets… You just gave some good advice to that, but what types of loan products should they be looking for or what types of portfolio dynamics would you recommend in this market?

Kathy:

One of the things that I saw that I’m seeing people do right now is refinance with portfolio lenders. These are private lenders that aren’t as regulated as the the Fannie, Freddie backed loans. So you’ve got international investors looking for yield. If they stay in, I don’t know, European treasuries or… Right now Europe is heading towards recession. There’s a lot of money looking for yield. And one of the places they’re looking is lending to Americans. So you’ve got some of these funds, lending funds that are just enormous, and I’m not kidding when I say I’m walking down aisles here at this conference and there… I had one guy come up and say, “We’ll give you a 10 million credit line. Just fill this out.” It’s private money. It’s private money now. I’m not going to take it because it’s 8%. That one I’m not going to take.

So what’s the answer. Look and find out what kind of loans there are. I still think you should max out… Again, this is buy and hold one to four units. I’d max out my 10 loans that I can get from Fannie and Freddie, because it’s still pretty low. And I might get on a 7 or 10 year arm. I don’t normally do that. I like my 30 year fixed rate, but I’m still fairly comfortable with a 7 to 10 year arm. It’s fixed for those 7 or 10 years, whatever you get, and the rates are quite a bit lower. So I still think it’s great to max those out. If you’re married and you’re both working, you might each be able to get 10 of those. Again, if you’re buying that many and then you can go to the portfolio lenders that tend to be a little bit higher.

But what is weird is that some aren’t. Some of these private lenders are less than the Fannie, Freddie conventional loans. I do know some people and I’ll make sure that we have this in the show notes… I know a guy where you could… He created a website or an app where you can just type in the kind of loan you’re looking for and it’ll pop up the lenders that will do it.

Dave:

Oh, that’s great. That would be very helpful. So we’ll throw that in the show notes. I think one of the interesting dynamics is that people assume that… A lot of people, I should say, seem to think that if there is a dip in housing prices, it’s just the same exact market conditions, but with cheaper prices. But I think, James, what you were saying is lending gets harder, people get gun shy. But Jamil, I’m curious what you think. Are you seeing anything that points to better buying conditions ahead or do you think right now is the best it’s going to be for a while?

Jamil:

It’s a great question, Dave, because we transact at such a high volume across the country in wholesale. I can tell you month after month, if we see dips and what price points we’re seeing spikes or dips in, and I think there’s absolutely been a small pause for some of the higher priced inventory that we would wholesale. So I think that what that’s going to do is it’s going to create some downward pressure on sellers, it’s going to create downward pressure on wholesalers and our assignment fees are going to get chopped up a little bit and we’re going to have to start providing better value to investors. So absolutely, I think James is right in what he’s saying. I think Kathy’s correct in what she’s saying. I think we’re going to have some really select opportunities moving in the next little while, and I think understanding how to communicate that to sellers and real estate agents that you’re working with is an important thing.

Look, if a house hasn’t traded in one of the most historically heated real estate markets in the United States history, and it’s been sitting for the last six months on the MLS, there’s an opportunity there for you. There’s an opportunity to have a real conversation with someone to get value. And I think that, yes, there’s going to be real conversations, real deals to be had. And I believe that there will still be a plethora of investors who are ready to take the plunge and buy something that they find value in, as long as you’re sticking to the fundamentals of your numbers. Don’t be buying things thinking that, “Oh my God, this is going to be a great Airbnb.” This only cash flows as an Airbnb, you’re in trouble.

So be cognizant. Be cognizant of how things are going to pan out for you. But yes, buying opportunities are coming around the corner. They’re already here. Just like James. He just renegotiated 20% on his lot. That’s going to be the norm. Renegotiations are coming around. Real conversations with sellers are coming around the corner. Real conversations with agents are coming around the corner. Now is the time to really get down to the basics and start learning how to comp.

Kathy:

I want to mention that the Federal Reserve is not federal and it doesn’t have reserves. It is a private company. It’s a banking system. It’s the banks. It’s the biggest banks. They learned a lot. The big banks learned a lot in 2007, 2008. They’re not going to repeat that, guys. If you think that we’re going to go through another 2009 and have banks just give their assets away for nothing, you’re wrong. Because in 2009, those of us who were buying were taking advantage of that. It was very quick that the banks learned, “Oh, maybe this isn’t so good to give it all away.” And they started to keep those properties and fix them up, and even some went in the rental business. Or they sold them off to their buddies on Wall Street. They’ve learned. The Federal Reserve is a group of banks. Do you think they want to fail? They’re not going to fail.

Dave:

All right. This has been excellent advice from the three of you. Thank you so much. It seems that each of you have a slightly different take, different opinions on what might happen with housing prices. But generally the theme that I’m hearing is a return to fundamentals, to make sure, if you are investing right now, to really understand the value of what you’re buying, as Jamil said, to understand the fundamentals and make sure that you are buying things, not on speculation, but based on their true intrinsic value. Things that you might want to hold on for a longer period of time. And personally, this is just my advice, is not to take on any excessive risk right now. But that being said, there still are deals to be had, and if the numbers work, they work. So with that, let’s take a quick break, and after this, we will come back and give some advice to one of our crowd who is a little fearful of a recession. We’ll be back right after this.

Okay, for our crowdsourced section today, we are going to return to the Bigger Pockets forums, where we have a question from Michael Sellers who said, “Any advice for someone who feels stuck between, one, not wanting to take on a highly leveraged 203K loan,” and for anyone who doesn’t know what that is, it is a loan product that allows you to buy a house and wraps some of your rehab costs into the loan. “With so many logistical factors pointing to a recession, and two, not wanting to fall into the cliche of waiting for the correction to take action.” So Michael’s clearly feeling both sides of this debate.

He says, “This would be my first purchase and would involve a few months of renovation and construction after closing. In general, I have a pretty risk tolerant attitude, but with all the geopolitical turmoil and domestic inflation and interest rate spiking, being highly leveraged doesn’t seem like the best idea despite it being many people’s only option to break into markets they are otherwise priced out of.” All right, we only have a few minutes left in this show, but James, would love to hear quickly what your advice for Michael would be.

James:

Yeah, it really depends on what kind of asset you’re trying to buy, whether it’s a rental or a fix and flip with that 203K loan. If you’re a newer investor and you’re leveraging heavy on a fixed and flip, pad your margins. Add more in your construction budget. Make sure you have reserves too, because to get more funds from that 203K loan won’t happen. So put extra money aside just for cost overruns, and then just run your… Buy cheaper. If you’re nervous, buy cheaper. I mean, if someone’s going to sell me something that’s 60% of value right now, I’ll go buy it. I don’t care what’s going to happen in the market. And the other thing to do is to make sure, as you’re looking at things, that your rents are going to cover. You’re only over leveraged if your asset can’t pay for it. So if your asset can pay for it, you’re not overleveraging. So verify your rents, make sure it covers the cost and you’ll be fine.

Dave:

Jamil, what do you think?

Jamil:

Oh, I love everything James just said, because that’s the meat and potatoes here right now, guys. Make sure you’re buying right. Really, really, really look at the numbers, really make sure that you’ve understood where the comparables are, where you can force appreciation. And if that forced appreciation is just going to get you back to zero, great. Great. That’s okay. You worked hard, you sweated and you didn’t get anything for it. Oh, well. Guess what, you still have the asset and that will eventually work out well for you. But as long as you’re buying right. Like James said, you buy at 60 cents on the dollar right now and then you go and force some appreciation by adding value to the property, and all of a sudden we have a dip and you’re not over leveraged, you’re just perfectly leveraged. So that’s how you got to be buying, that’s how you’ve got to be playing. Get smart about it. Really, really run your numbers. That was great advice, James.

Dave:

Kathy, last word. What is your advice to Michael?

Kathy:

There’s no problem with the vehicle. It’s like saying, “Is this Ferrari dangerous or not?” Well, if you give it to a 16 year old, yeah, it’s dangerous. If you give it to a race car driver, no problem. So it’s not the vehicle at all. It’s who’s behind it. Just make sure that you know how to drive.

Jamil:

Don’t be a 16 year old behind a Ferrari.

Dave:

I think that’s really good advice because right now, if you are taking on your first major rehab, you’re hearing James, who’s been doing this, who’s done hundreds or thousands of deals, who is cautioning to really pad construction costs, renovation costs. So make sure that you are cautious on that, Michael, if you are going to take on this renovation as your first deal. All right, James, Kathy, Jamil, thank you all so much for being here as always. It is always a pleasure. If you’re listening to this, we would really appreciate if you like this show to give us a five star review on either Apple or Spotify. It does us a huge favor. We really appreciate, want to get up on those charts.

I will see you all again next week, when we are going to have an excellent show with Taylor Marr from Redfin, who’s going to be talking all about migration patterns and how they are impacting local housing markets. We’ll see you then. On the Market is created by me, Dave Meyer, and Kalin Bennett. Produced by Kalin Bennett. Editing by Joel Ascarza and Onyx Media. Copywriting by Nate Weintraub, and a very special thanks to the entire Bigger Pockets team. The content on the show On the Market are opinions only. All listeners should independently verify data points, opinions, and investment strategies.