Ashley:

This is Real Estate Rookie Episode 200.

Scott:

I actually think that’s the best thing that BiggerPockets… We have so much more work to do to help rookies, but I think that we do pretty close to a world-class job at this point of helping people get started in this business with a realistic assessment about the risks and rewards of real estate. I don’t think we sugarcoat it, you know, “Ra, ra, this is always the right thing.” I think we’re very clear about the trade offs, and the time commitment, and the leverage risk that you take here from that. We always need to do I think a better job of serving those things, but I think we have a really… What is the investor journey is probably a good question, right? What does an investor look like when they come into this world?

Ashley:

My name is Ashley Kehr, and I’m here with my co-host, Tony Robinson.

Tony:

And welcome to the Real Estate Rookie Podcast, where every week, twice a week we bring you the inspiration, information and stories you need to hear to kickstart your investing career as a real estate rookie. So, before we dive in I just want to highlight a recent review that came in. This one came from Zise D, and Zise says, “Solid show, it’s very informative and fun to listen to. This is now one of my favorite BP podcasts, along with On The Market. Keep them coming.” So Zise D, we appreciate you. And for all those rookies that are listening, if you haven’t yet please leave an honest rating and review on whatever platform it is you’re listening to. The more ratings and reviews we get the more folks we can reach, and the more folks we can reach the more folks we can help.

Tony:

And that’s our job here, is to help some folks. So Ashley Kehr, I’m excited for today’s episode, episode 200. So crazy, when I first came on the show we were at episode 37 I think was my first episode, and now we’re 100 plus episodes beyond that. So man, it’s been a fun ride, huh?

Ashley:

You guys, I can’t believe it. Episode 200, it’s really exciting, and thank you to everyone who has listened to all 200 episodes, or maybe you’re making your way through them. We greatly appreciate it, and hope you guys are learning as much as we are by all of the fabulous guests that we have onto the show. And if you think that you would be a great guest on the show, that you are a rookie listener, you’ve done less than five deals, and you want to come on and tell us not only what you have done but how you’ve done it, you can apply at biggerpockets.com/guest, and select the Rookie Podcast, and we’d love to check out your application. So, Tony here, he is actually going off to Italy tomorrow-

Tony:

I am.

Ashley:

… and is going to be gone for two weeks, and I’m already having separation anxiety from not recording for the next two weeks. So, it’s getting pretty tense between us right now knowing this is going to be our last Zoom call for two weeks, so…

Tony:

Yeah, but I’ve got a nice Photoshop…

Ashley:

I’ll have to FaceTime you a bunch of times, yeah.

Tony:

Yeah, I’ve got a nice Photoshop image of Ashley’s face I’m just going to carry around with me on all of our Italian escapades, so that way she can feel like she’s there.

Ashley:

Yeah, yeah. That’s perfect, yeah.

Tony:

But the agreement is, is only you and your crutches. So, the photo that I’m carrying around is you on your crutches, that way you’re like, crutching, and-

Ashley:

Through Italy.

Tony:

… you’ve got your little scooter. Yeah, through Italy.

Ashley:

Well, when I did go to Tennessee to see one of Tony’s short-term rentals, I did crutch through Tennessee, so…

Tony:

Your crutch, you were on your crutch, yeah.

Ashley:

My crutches have made it pretty far across the country. Through a place in Seattle, Denver, so…

Tony:

Mine made it to Coachella. I took my cast, or not my cast, my boot and my crutches to Coachella. And I would not recommend that, if you guys ever have a decision… Like if you’re ever on crutches and you have to decide about going to Coachella or not going to Coachella, highly recommend not going, because it was like the biggest pain in the butt.

Ashley:

Yeah, there’s also an Instagram video. I don’t know if it’s on Tony’s or Sarah’s Instagram of how miserable Tony was on his crutches.

Tony:

But anyway, we’re not here to-

Ashley:

We’re digging through his Instagram feed to find that.

Tony:

Yeah, but we’re not here today to talk about Coachella or crutches, we’re here to talk about Scott Trench. So, many of you may know Scott is the CEO of BiggerPockets. So, he started off as an employee like so many others, and over the last eight years he worked his way up to CEO. He’s the head honcho and visionary at BiggerPockets, but he’s also the author of a tremendous book called Set For Life, which is essentially a guide for, as he describes it, middle income earners that are looking to kind of kickstart their investing career. And they’re launching a new version of Set For Life, and it’s going to be coming out here soon. So, we figured it would be a good call to bring Scott onto the show, and kind of get his insights on how rookie investors today can get started.

Ashley:

Yeah. And even if you’ve already started investing, or you know you’re set to go, you’re good to go, and you don’t think that you need his book, this book, Set For Life, is a great graduation gift. Any graduation party I go to, I give Scott’s book to the person graduating, because they just… Even though they may not have started their full-time job yet, whether they’re graduating from high school or college, I think it just puts that little reminder in their mind. Okay, like here are some things you can start doing now to set yourself up so that when you do start getting that W2 income, or whatever your job is, you can go ahead and start getting into real estate investing. So, he went through… The book first released five years ago, and he since then has grown older and wiser, and has kind of revamped it and just tweaked some things that he thought he could explain better into the book.

Ashley:

So, it might even be worth going back and re-reading, if you’ve already checked it out. So, that is the book, Set For Life, by Scott Trench, and then it’s available on the BiggerPockets bookstore. Scott, welcome to the show. Thank you so much for joining us. Can you start off telling everyone who you are and a little bit about yourself please?

Scott:

Sure. So, my name’s Scott, I’m the CEO here at BiggerPockets. Been here at BiggerPockets… I’m coming up to my eighth year anniversary here at BiggerPockets, joined in 2014, was a big fan of BiggerPockets before I ever joined. I co-host the BiggerPockets Money Podcast, and I am an author of two books for BiggerPockets, the Set For Life, which I’m sure we’ll talk about in a little bit. And then First-time Home Buyer, but I forget what that second book is actually about at this point in time.

Tony:

So Scott, obviously you’re super-successful today, right? CEO of BiggerPockets, obviously we all know what BP is. You’re the guy pulling the strings behind all the curtains. Author of multiple books, you’ve got a real estate portfolio so you’re doing well today. But I want to go back to Scott, maybe when he first started at BP. Tell us what the kind of picture for Scott looked like, and how things have changed since then.

Scott:

Yeah. So, I would say when I joined… Zooming back to 2013 when I started my career, I joined a company called Dish Network, and I was a financial analyst, and I did not want to be a financial analyst. I saw the career track ahead of me and I was like, “I do not want that, I want to become financially free and live my own life.” And so I actually stumbled across a blog called Mr. Money Mustache at first, which tells you how to become financially free through stock investing and frugality. And I was like, “That sounds great, I’m going to definitely do that.” I dove headfirst, but I wanted to invest more aggressively. And so I also… The idea of real estate allured to me, and I eventually stumbled across the BiggerPockets Podcast, became a member of BiggerPockets, joined the community.

Scott:

Actually met my agent on BiggerPockets, her name was Mickey, and she sent me a couple of duplexes back in 2014. And around that same time, I also met the founder of BiggerPockets, Josh Dorkin. I met him because the podcast had told me, “Go network with local real estate investors, and get to know them in your community.” And one of those local real estate investors I happened to be networking with shared the same co-working space as Josh. And so I saw the BiggerPockets logo, I’m like, “Oh my gosh, I listen to your podcast, you’ve changed my life, look at all these things you’re doing. Can I come work for you for free on the weekends or in some way help you?” Because I just knew BiggerPockets was this special thing at that point in time.

Scott:

And he remembers it differently, but I remember him saying something to the effect of, “Go away kid, what are you doing? You’re bothering me in the middle of my work day.” So I followed up six more times, and then he eventually offered me a job as the Director of Operations. So at that point the full-time employees were like himself, Brandon Turner, we had a couple… A contractor in an engineering role, and we had Dave Osia, who still works with the team in a contracting capacity, editing our podcasts. So, that was the team when I joined back in 2014.

Ashley:

Scott, do you think that joining BiggerPockets helped you build your real estate portfolio? For somebody who’s maybe looking to get into real estate, do you recommend that they apply for jobs at BiggerPockets, or other kind of… Even property management companies, or other places that are already involved in real estate to really help them get their foot in the door?

Scott:

So actually, I was looking for a different job in a general sense, because I knew that hey, becoming a financial analyst and getting a promotion to Financial Analyst too, and then Senior Financial Manager and so on and so forth, would be too slow from a career standpoint to get me to where I wanted to go. So I actually had two job offers at the time when I joined BiggerPockets, one was at BiggerPockets and the other was at a brokerage. I would have gotten my real estate license and been selling real estate. And so, I like to think that that… Because I have a peer who actually did that, took that job and did really well, and would have had a good career. And so I like to think that that would have been a good option as well.

Scott:

So I think yes, I would recommend that folks get into that career. But ironically, I think I would actually own a lot more real estate and be much more active as an investor if I hadn’t joined BiggerPockets as an employee. Because I’ve poured my heart and soul into building this business, like I obsess over the business. Obviously during the 40 hour regular week, and then again when I go home, and in the shower, and all that kind of stuff. So, I really haven’t taken on fix and flip projects, or BERs the way that I think I would have if I had gone into becoming an agent, paradoxically. So I do own 13 doors today, and have built a small portfolio. But not the size that I probably would have if I didn’t work here.

Ashley:

I think that you are in an interesting position, because you get to see kind of the whole picture of who the BiggerPockets members are. And that gives you the opportunity to see, “Okay, what do the members need?” So for us, everybody listening here is most likely a rookie, maybe doesn’t even have their first deal yet. What are some things that someone as a rookie investor that you have seen coming to the BiggerPockets community, what can BiggerPockets provide for them? What can we do for them to help them get started?

Scott:

Yeah, so I actually think that’s the best thing that BiggerPockets… We have so much more work to do to help rookies. But I think that we do pretty close to a world-class job at this point of helping people get started in this business, with a realistic assessment about the risks and rewards of real estate. I don’t think we sugarcoat it, you know, “Ra, ra, this is always the right thing.” I think we’re really clear about the trade offs, and the time commitment, and the leverage risk that you take here from that. We always need to do I think a better job of serving those things, but I think we have a really… What is the investor journey, is probably a good question, right? What does an investor look like when they come into this world? Well, I have this idea of real estate investing.

Scott:

I want to begin learning about it, I know it’s risky. I’m going to spend 500 hours learning about real estate prior to making my first investment, and I’m going to do that by immersing myself in this world of podcasts, or videos, or books, or forums, or Facebook groups, or whatever. And I think what BiggerPockets offers those folks is this ability to do that for free, right? And the way we’re able to do that is because we make money selling ads, or selling books, or very low-cost products. And then after 500 hours, maybe six months to a year and hundreds of hours of self-education, building up your financial position, getting good credit, those types of things, folks, decide, now’s the time to make that investment.

Scott:

I’m going to commit. And I haven’t actually bought my property, but I’ve decided to actually make that investment in the next 30, 60, 90 days, maybe 180 days. And that’s a big moment for us as well, because that’s when people start actually analyzing deals, meeting their agent, meeting their lender, meeting peers, maybe investing in tools that they can use to build that business, right? And then they get that first deal, and then guess what happens? They’re out of money. So, not everyone’s able to immediately scale up. So, a lot of folks will need a year or two or three to buy that next property, and save up to buy that next one. And so that’s kind of the investor journey, and what we’re trying to do here at BiggerPockets is serve people throughout that investor journey with a particular emphasis on helping people get started in the game.

Tony:

Scott, I think like so many investors my journey started the same way, where I was looking for a path of income, and I Googled how to get rich or something like that, and you land on real estate investing, and then you want to figure out all these different real estate investing strategies, you Google something. And then something from the BiggerPockets forum shows up in the Google search results, and then you spend the next, I don’t know how many hours of your life going down this rabbit hole that is the BiggerPockets forums. But I want to kind of go back to you at the beginning, Scott, right? So we know that right now you said you’ve got 13 doors, been investing for a while. But you know, obviously your book Set For Life is about I guess the framework, or like the operating system someone should implement into their own life to be able to set themselves up to eventually invest in real estate.

Tony:

So if we go back to Scott back in 2013, ’14, when you first started out, what did your kind of, I guess like financial discipline look like? What are some of the habits you had that you feel have kind of set you up for the life that you have today?

Scott:

Yeah, so when I graduated college and started my job in 2013 I didn’t have any financial habits, I didn’t have… I was naturally not going to spend a lot of money, but I was maybe… You know, I was making $48,000 a year, I was maybe spending $3,000, $3,300 a month, I paid 500 bucks for rent, had a brand-new 2014 Toyota Corolla, bought at the end of 2013 because you can do that. And then maybe spent… Bought most of my own groceries, ate whatever. But when I discovered Mr. Money Mustache, that’s when I became really frugal and was able to cut my expenses steadily down from that like $3,500 to probably $2,000 a month, even with my rent payments included in there. Because I was investing in basic things like cooking, literally that’s a big investment for somebody who’s getting started in their career, is not eating out every day.

Scott:

I’m going to actually learn how to cook, and buy reasonable food from reasonable grocery stores, and those types of things. And steadily I was able to cut those expenses bit by bit. And so, over the course of that first year on that $48,000 a year salary, I’d started with maybe $3,000 in cash left over. Actually I went on a little backpacking trip around Europe, where I was actually talking about this with Tony right before the recording here, with both you guys on this. So I had $3,000 after that backpacking trip, and that’s what I started with. And by the time I closed my property I had about $20,000 in total cash, and I used $12,000 of that to buy a $240,000 duplex here in northeast Denver. And that was kind of the game-changer, right?

Scott:

Because that duplex generated 1150 in rent from the other side, which is $1,100 plus two cats at $25 a month each. And then 550 in rent from my roommate, and the mortgage is 1550. So after utilities and those types of things I’m close to break even, and that’s really the kind of catalyst that really kind of began turbocharging things. I also switched from that job at Dish Network to BiggerPockets, and I went from making $48,000 to $50,000 a year, which was a big raise for me and helped me save another 800 to $1,200 a year on that front. So, that was my situation, kind of entering into the game.

Tony:

Yeah. And you touched on something that I want to draw down into a little bit, right? So, there are kind of two schools of thought when it comes to achieving financial success. You’ve got like, I’m going to choose two guys on the opposite ends of the spectrum. It’s the Dave [inaudible 00:16:28] approach, where he’s all about cutting expenses, and couponing, and beans and rice, and very strict budgeting. And then you’ve got like Grant Cardone on the other side that says, “You don’t need to budget, just make more money,” right? Where do you kind of fall on that spectrum? I guess, let me pose the question this way. Can someone build massive wealth quickly by only focusing on saving? How do you kind of strike that balance between the two?

Scott:

I think that having low expenses and having readily accessible cash in your life is directly correlated with the ability to earn more income. And so, here’s what I mean by that, right? I saved $20,000, $17,000 in that first 10 months after starting my career, right? And that meant that I was spending $2,000 a year, and had $17,000 saved up. So I had the option at that point in time to leave my high-paying, my moderately-paying job after college and take a job as an agent, for example, or at a startup called BiggerPockets, right? And that option does not exist for somebody who’s spending $45,000 and making $48,000 a year, right? It just does not compute. So, I think that they’re directly related. And I think that for the median income earner with no assets, the wealth creation journey begins by spending less.

Scott:

Because that enables you to have a lower floor for the expenses you need your business or endeavor to generate, and it allows you to amass some cash with which to begin playing a game. It’s just that much easier to get these partnership deals or these other types of things if you have a little cash to throw at the situation, strong credit and those types of things, and don’t need much, don’t need a lot of income right away, right? It’s very hard to convince people from a partnership perspective, I think, if you want to get paid a salary, and have these other expenses right away from that. It’s hard to think long-term without that fundamental in place. So, I think it’s directly related. There are four things you have to do to build wealth.

Scott:

You have to earn more, spend less, invest, or create assets. And so I was determined to do all of those things in as rapid succession as I could to get started on my journey. And I think that the beginning of that starts with frugality or spending less, because you can control that immediately. And it has such a powerful, freeing impact on the options you have to pursue with your career or business. It gives you cash to begin investing, and then absolutely it’s about using that strong financial foundation to pursue the highest, the best… A good income opportunity for you downstream. Which for me, I thought was BiggerPockets. I couldn’t explain why I thought BiggerPockets was a good bet at that point in time, I was just like, “This is a cool company, it’s going places,” right?

Scott:

I didn’t know I would become CEO at a future point, I just saw there’s something special about this company and what it’s doing, and I want to be a part of it. And I know income opportunities will follow that. In fact, I have never asked for a raise in my eight years here at BiggerPockets. But, I’m sure you can guess that I probably have gotten a few raises over my eight years here at BiggerPockets.

Ashley:

I would hope so.

Tony:

Yeah. So Scott, something you mentioned man, and I’ve heard this saying, I can’t remember who shared it with me initially but it’s always stuck with me. And it was a story about Jeff Bezos, and he was talking about the success of Amazon. And people said, “Was it your ability to hire the right people, was it your ability to create cool products, was it your ability to,” whatever it was. And he said that he boiled Amazon’s success down to one thing, and it was the fact that they had patient capital. And that stuck out to me so much, because it’s like yeah, if I can have the flexibility to get my return over 10 years then I’m going to be able to beat everybody that gets a return, or that needs a return in two years, or in five years.

Tony:

And what you said is like the exact epitome of that playing out in real life, where you have the financial flexibility, the financial cushion to take this risk that other people wouldn’t have been able to if they didn’t have the same kind of financial footing that you had. So, just a really, really great example, Scott, of playing that out in real life.

Scott:

I think that’s great, and let’s [inaudible 00:20:38] to the next level where you see all these folks becoming financially free. But they start their journey, and it takes them three years, or seven years to buy their first two properties, and then they’re off to the races. Why is that? Well now I’m financially free, or very close to it, lots of flexibility and I can afford to play longer, bigger, riskier games with this next pool of capital, and it just transports me to a whole another level because I’ve met this baseline of flexibility in my life. And I think that we see a lot of people achieving that, maybe that’s been true to some extent in your stories for you guys, I don’t know.

Ashley:

Scott, I want to talk a little bit about your book, Set For Life. So it’s been five years since you have written the book, and you have gone through and kind of updated it and revamped it now that you’re five years older. Still the same good-looking guy from five years ago, no physical appearance has age. But also you’re wiser, and you probably have learned some things over these five years, and also the economy has changed, the markets have changed, there’s been a lot of changes in the last five years. So, what are some of the things that you have put into your book that may be different than the first one? And actually before you answer that, who is the book Set For Life for? Who is the ideal reader of this book?

Scott:

Yeah, so Set For Life is for the median income learner who is starting with zero, essentially. So it assumes you have no debt and no assets, and you’re in a median income. How do you go from that position to financial freedom in as rapid a time period as possible, right? Or financial flexibility in as rapid a time period as possible. And I wrote the book in 2016, launched in 2017, because I thought that there was not a good answer to that question. I thought a lot of books had been written by folks who had already been there and done that, and were way past that point, and thought really big from, “Hey, I’ve got to invest,” or you know, “Raise…” All these different things that are inaccessible in a practical sense to many middle-class wage earners with no assets.

Scott:

And the reason I wrote it at that point in time was because I was in it, had just done it, and felt like… And I was dogmatic and obsessed about this world of financial freedom. And I thought that only somebody who was actively going through that can understand the intensity of this grind period of building wealth and getting to the other side of the rat race at that point in time. And so, what you get with Set For Life is this very clear, “Hey, I’m going to save my first $25,000 through frugality. Then I’m going to use that $25,000 in low based on expenses to build my next $100,000 in wealth, and I’m going to do that by changing jobs, combining that with a house hack, and now I have this opportunity to begin turning my housing into an asset and earn a lot more income at this new career field that has the potential to scale.

Scott:

“But, may come at the cost of a cushy base salary to some degree.” And then after that, once we have $100,000 liquid, now we can begin at making serious investments. All right, $100,000 liquid, and the ability to accumulate 40, 50, $60,000 liquid on an annual basis. Now I can begin a system of investing that will inevitably lead me to the wealth that I want and the passive cash flow. So that’s what I wrote, and that’s what I believed at the time. I still believe that, and I look back, and I read it, and I was like, “Oof, I am pretty critical of the middle class here.” I think I used… You know, I think the word moron was in the book, I think ridiculous was used 10 times to describe choices that folks… And there was a lot of tactical and nuance missing, right?

Scott:

I’m all, never use a retirement account from this in the early stages, right? And why shouldn’t you use a retirement account? Well, because you can accumulate this cash to use on that first house hack for example, and the house hack is such a better ROI than a retirement account could ever be, right? Or the ability to leave my job at Dish Network and join a startup like BiggerPockets, the ROI on that decision is incredible, and I don’t have that freedom if my cash is tied up in a 401(K). But I left out that after a few years, you should probably begin investing in that 401(K) when your cashflow picks back up, right? And you should use these tax-advantaged tools, and there’s a nuance to that, right? There’s this concept as well in the book where I’m like, all these rich people say hire out jobs instead of doing it yourself.

Scott:

And that’s good advice, right? If you’re a high income earner, you’re silly to fix your own toilet. But what I was trying to communicate, not so effective in the first version was this concept of, if you’re earning $50,000 a year your time is worth $25 an hour before tax, right? So if you’re hiring somebody out at $50 an hour, you’re negatively arbitraging the value of your time, right? Because you should be spending your time to fix that toilet in that situation, right? But what happens for real estate investors and investors in general over the course of your career is, your time is getting more valuable, right? You own a couple of properties, you’re reducing cashflow, you have a job. Now your time might be worth $50 an hour, now you have a hard choice.

Scott:

Do I hire somebody out at 50, or do I do it myself, right? Some jobs you may have to do yourself, some jobs you may hire out. And now as CEO my time is worth much more than that, so I hire everything out, right? And that concept was not something that I could fully have internalized, or been able to communicate at the point when I wrote Set For Life. So I went back and made a lot of changes to that effect that show the nuance of this, right? Another thing is, the goal in life is not to live to achieve financial freedom at $25,000 per year and then spend $25,000 for the rest of your life retired. That’s not what we want, right? But you have to get there, keep that frugality, be happy with it paradoxically, and then stockpile the wealth on top of that.

Scott:

And then that allows you to continue to enjoy the benefits of lifestyle inflation, which is what we want really. Is that we want the ability to inflate our lifestyles over time, by piling assets on over time. Not by spending earned income dollars, right? And so again, lots of these points I think were missing from the book because they missed the zoomed out perspective of what’s the journey like long after it’s been completed? But the dogma and intensity of, it is an all-out grind I think if you want to really get on the other side of the rat race in a short period of time, like a few years. And it’s going to be a mental grind, and it’s going to be something that involves your attention for on the expense side, on the income generation front, thinking deeply about investing, starting a business.

Scott:

That’s an all-out approach for a couple of years, and that intensity I think is what I wanted to preserve while bringing the perspective that I have of being five years removed from that inflection point in my journey. Long rant there, hopefully that was helpful though.

Tony:

No, that was awesome Scott. And I’ve got a couple comments that I want to pass over to Ashley after this. But the last point you mentioned about the grind, that is so incredibly true. And I think it’s a part that so many people underestimate when it comes to building your own real estate business. In my W2 job, I was a senior-level manager, I had a big team, spread across the nation. Very busy guy in my W2 life. I am exceptionally more busy now working for myself than I was working that W2 job, and it felt like… I was literally telling my wife the other day, I was like, “I think we might need to take like a sabbatical or something, because we’ve been going like 100 miles an hour every day since I left my job in December of 2020, and it’s exhausting.”

Tony:

But to your point Scott it’s like, if you can grind it out for that short period of time it can really… You can truly change your life in two years. So, I just wanted to comment on that piece. And then you also mentioned about the hiring it out, and I remember Scott being in college, I was a broke college kid and I had these little side businesses that I was running. And trying to hire someone out when you’re making like 15 bucks an hour, it’s like, “Who can I afford to hire this thing out to,” right? So yeah, I think at the beginning of your journey you are going to find yourself doing a lot of things on your own simply because you can’t afford to do it any other way. Then as your business starts to scale, and you do have some more cashflow coming in it does become a little bit easier to do that. But what I really wanted to-

Scott:

Oh, I was just going to chime in, it’s actually bad business in my opinion to hire things out, if you’re negatively arbitraging the value of your time, right? That’s the point that I think a lot of folks like, “I’ve got to hire, I’ve got to be like these guys, and hire a bunch of people out.” No, if your time is worth $15 an hour you should be doing it yourself, that’s good business. You’re arbitraging time that you have to pay somebody else $50 an hour for to do that job, and then you should be tracking it over time, just back of the napkin. “I’m going to make 100 grand this year. Okay, my time’s worth 50 bucks an hour, right? I’m going to make 160 this year. Time’s worth 80 bucks an hour, right?” And knowing that information will help you make good business decisions.

Ashley:

Scott, with our rookie listeners, I understand that you came prepared today with a rookie checklist to provide a lot of value to the listeners today. And this checklist is for somebody who does not have their first property yet, and a very common question to ask yourself is, should I even start investing in real estate right now? The position I am in in my life, my situation, is it a good time to start? So, not only with the market, with the economy, but also on your own financials, what you look like too financially. Are you ready to invest in real estate? And I know a very common one that I’m always asked is, “I have student loans. Should I pay off my student loans first, or should I invest in real estate?” So Scott, what do you have for us?

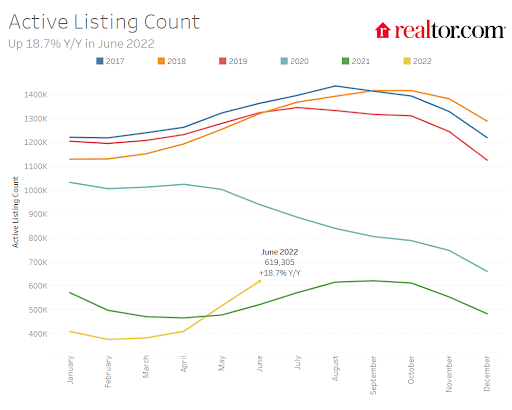

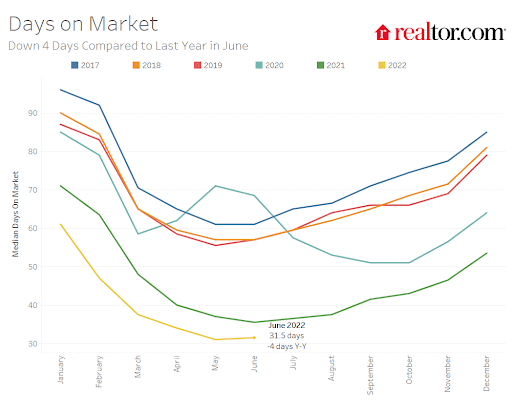

Scott:

Yeah. So, I think this is the question, right? And the reason it’s the question, it’s always a major question for investors. But the difference between 2022 and the last five years is that for the first time, most investors think that property prices are going to stay flat or go down with a slight leaning, rather than go up over the next year. That doesn’t mean that investors think that real estate’s a bad investment, they think it’s a great long-term alternative to stocks, cryptocurrency and other alternatives. But there’s a real skepticism about whether prices will stay flat or go down. And so that makes this question harder for folks, I think in an intuitive sense. So yeah, I wanted to prepare what I thought was a tough checklist.

Scott:

And if you can say yes to all the items on this, I thought that would be a helpful starting point. “Yes, I should invest in real estate.” So I’ll skip around a little. Actually, I’ll go through it literally and then I’ll get to your question about student loans as part of that, if that works. So you know, there’s 10 parts to it. The first one is, do I understand my endgame, and is real estate going to be a part of that portfolio I want in that future sense, right? So in three to five years, I want to have a million dollar portfolio. What does that portfolio look like? Do I want a completely passive stock portfolio, do I want bonds in there, do I want real estate, right? But don’t get started in real estate investing if you don’t have a clear picture of what a portfolio looks like in the financial freedom sense.

Scott:

And if you don’t think real estate will be an effective part of that portfolio. A very basic question, but something that I think people need to wrap their heads around, because very few people that I’ve talked to, even on The Money Show Podcast when we have people coming on and asking for advice with goals, they’re not clear on what they want from their life in a financial context, and they don’t know if real estate would be a good tool in that. There are trade offs, and work, and leverage that come with real estate investing, and risks that are not the same with stock or bond portfolios, or small businesses with them. So, that’s what the first question is, I understand my endgame and real estate’s going to be an effective part of that journey, right?

Scott:

Second one, I believe that real estate is a good long-term investment for me, compared to my alternatives like stocks, bonds, cryptocurrencies and private businesses. That’s the question, what are you going to put your dollars into in 2022 to make money over the next three, five, 10, 20 years, right? And this has been the problem all year. It was this way before the market started sliding in the last six months from January, we were asking it. It was like, “Do I put my money in stocks with valuations at all-time highs? Do I put my money in bonds with yields at all-time lows? Do I put my money in Bitcoin? That seems pretty scary and risky, that seems like a great way to make a million bucks right now is to start with two and put it in Bitcoin.

Scott:

“Do I invest in private businesses, do I invest in cash, right? With losing value to inflation. There’s no good answer to that question in this year, and so I like to reframe it as for me, the least bad option is real estate, right? Because I can take out long-term debt that is going to be worth less over time with inflation, and my rents should be indexed to inflation. And we know that the Federal Reserve is going to push for it, that 2% inflation over the long-term, so it’s a good long-term bet in my opinion relative to other asset classes. But you have to answer that question for yourself, if you think that’s the case, and you have to internalize it. And that may take you a few dozen hours of listening to stuff like this to feel confident and go explore those alternatives.

Scott:

Like what the Bitcoin people have to say, and what the Seeking Alpha or stock investing sites have to say, and make that decision for yourself as part of this journey, right? Okay, so the third point, and this answers your question here, would be the context of going all-in on your investment property. So, do I think you should invest in real estate if you have student loans? I don’t know, right? It’s a question of, am I going all in to buy this property, can this property bankrupt me if things go poorly? If that’s the case, you probably shouldn’t be investing in real estate. You should have a strong income and a strong savings rate, several thousand dollars per month ideally, and a cushion that allows you to put down a healthy amount of money and cashflow, any problems that come up in your business in the early years, right?

Scott:

If something goes wrong and that can derail your investment plan, you’re doing it wrong in real estate in my opinion. You’re not investing from a position of financial strength. And you don’t need to have that built out to get into this game, you can skip that step by finding a financial partner who has that strong position, right? You can bring in somebody who will guarantee that mortgage, bring the cash, and help you get started if you’re willing to do the work on that deal. But you should not be investing and putting all of your chips in on the table in something that can make or break you, because that’s not a formula for long-term success.

Ashley:

Yeah. The one thing I wanted to comment on is how you said that if you are going to be risking everything to invest in real estate, there’s definitely ways to get into real estate without putting your family’s finances at risk, or bankrupting yourself. When I first started I took on a partner, and he actually put in all the cash and held the mortgage on a property. So worst case scenario, we could not pay the mortgage on that property, it was him, my partner, that was not going to be paid. And he still had lots of cash reserves, and he would be okay not getting his mortgage payment for a couple months while we figured out, “Okay, what’s our next strategy, what’s our next plan, how are we going to exit this property?”

Ashley:

So I think looking at different scenarios like that can help you get into real estate too, and not just like, “Oh, here I go. I’m risking everything, I’m putting all my eggs into one basket.” It’s definitely something to be cautious of.

Scott:

How did you structure things with that partner to make sure that they got a fair return, and you were compensated for the work you were going to put in?

Ashley:

They definitely got a way better deal, but it’s how I got started in real estate. But we were 50-50 partners, we started an LLC together. So we got 50% of the cash flow, and then he was also the mortgage holder on the property. So he had a note payable to himself, where he earned a five and a half percent interest, and was amortized over 15 years, and he received monthly payments. So he was making five and a half percent on his money he put into the property, and then he was also getting 50% of the cashflow. And then I was doing the property management on the property, and I had found the deal, and did all the work. And he was completely passive, pretty much.

Tony:

Awesome.

Ashley:

So we did that for about three properties, and then we kind of restructured a little bit how our partnership worked.

Scott:

And there have to be so many people out there who would be absolutely thrilled with that type of situation. And more importantly now, you don’t have to go all-in in a way that if the market had slid 15% and you lost the property, that might have been it for your real estate investing journey at that point in time, I don’t know. But that, you can’t risk that, we want to be in this business for 30 years. You can’t go all in at any point in time, where a downturn can wipe you out. You have to play for consistency, we’re going to average, three, 4% appreciation long-term, with ups and downs in this business, at least that’s what I believe. And that’s going to be leveraged three, four to one, and that’s where our returns are going to come from over a long period of time as real estate investors.

Scott:

And that works really well, as long as you don’t go bankrupt.

Tony:

I want to add one other comment, Scott, to what you mentioned about stocks and crypto and all these other investment strategies, how they relate to real estate. The reason I love real estate investing is because I am almost 100% in control of how that asset is going to perform, right? I’d say like 95% in control. There are always some bigger macroeconomic things that are happening that are going to impact the economy, but for the most part you as the owner are in control of how that asset is going to perform. In my day job I worked at Tesla, and a big part of our compensation was company stock. And I literally remember, Elon could tweet something crazy and the stock would swing like 10% that day. Nothing else changed in the company, we didn’t produce more cars, we didn’t have a good day, we didn’t have a bad day.

Tony:

Simply because Elon tweeted something crazy, the stock would swing. And I would see this happening, and it would just play with my emotions, and it just made me fall even more in love with real estate. Because if I go out and I buy a property that’s old, beat up, needs some love, I put some money in it to rehab it, I furnish it up really nicely, I put it on Airbnb, I put it on Vrbo, I can say with a certain level of confidence that I know I’m going to get this kind of return on my money. So, I know a lot of people kind of go back and forth, and obviously there are benefits to both. But for me personally, what I love about real estate is the control aspect.

Scott:

Tony, how many hours of self-education did you put in prior to coming to that conclusion?

Tony:

Oh, I don’t know. It’s almost like unquantifiable, hard to even… No, I mean hundreds, probably, easily.

Tony:

250, 500, somewhere in that ball park? Maybe plus?

Tony:

Yeah, probably, yeah. Probably more than that, honestly.

Scott:

So, I think that’s another checklist item here, right? Like, you have to be willing to put it… That is absolutely true, I completely agree with what you said there, for the most part. I think there are market things that we have to be cognizant of. The long-term appreciation rate of our local market, three, 4% will be interrupted or accelerated based on things like Federal Reserve policy, market dynamics that we think we can anticipate, sometimes can’t. But the value of the property in terms of forced appreciation and the way that you operate your business and produce cash flow, most of that, the 80-20 of this is under our control as investors. But you’re only going to feel that way, or you should only feel that way if you’ve put in those several hundred hours of learning about this thing.

Scott:

Not just by consuming content like this, passively, but also by actively engaging with local people in your market, networking, meeting those professionals, that type of stuff. And then you can have the total swagger, well-deserved, that Tony has in terms of feeling like he’s completely in control of his investment, because that should be true at that point in time. I think that’s another item here you have to have, is that willingness to put in that time to figure this business out.

Tony:

Yeah. They say repetition is the mother of skill, right? And it’s like, the more you consume, the more you read, the more you do, I think the more confident you become in your own abilities. And what holds so many rookies back is that lack of confidence.

Scott:

Absolutely. And again, the only way to build that confidence, I think, is putting in the time. Well, a couple more things here on strong financial position, right? So we talked about the strong… I don’t have to go all in, but I think there’s two other parts to your financial position that are important as a rookie investor. And one is a foundational point which is a strong credit score, if you have a bad credit score I think that’s a really good thing to fix before getting into this business, right? Or to at least find a partner that can solve that problem for you while you’re getting into this business, because you’re going to miss out on the key advantage of small mom and pop residential real estate investors, which is probably most rookies that are listening to this.

Scott:

Which is the ability to get a 30-year, fixed rate, low-interest mortgage insured by Fanny Mae, like an FHA loan or a conventional loan to buy a property. That’s a massive advantage that you are missing out on if you have a bad credit score, because you’re paying so much penalty in the form of higher interest rates on that. So fix that problem first, again, very basic situation… Very basic financial thing, but something I think you should reflect on and think hard about before getting into real estate on your own.

Ashley:

Real quick, do you just have some quick tips as to how to even start fixing your credit score? If somebody is in that position, they’re like, “I’ve been paying on time, I had mistakes in the past.” But how do they… Are there any little tricks to build it up faster than-

Scott:

Yeah, well I think for the most part what I find with the really bad credit scores, it’s usually about a six month to a year-long process to get to above 700 in most cases, even if you’re starting from a really bad position. We just had my buddy Andrew come on the BiggerPockets Money Show Podcast, actually released on Monday, July 4th, the day before we’re recording this show. And he started out… He was a rugby buddy of mine, he started out with a 400 credit score. And we were at a social or something, and he just heard that I had bought my second property. He was like, “Okay, I’m going to figure this out.” So, we started working on his credit situation, and within like a year he was able to move that to 700 plus, or the high 600s.

Scott:

And it’s as simple as getting your credit card statements, tracking, understanding the problems. A lot of folks, if you have a really bad credit score, often that’s reflective of you not even knowing what accounts you owe on, having mistakes on there and not tracking that. Once you get the basics applied and you’re beginning to make the minimum payments on a regular basis on those core payments, you should be able to get north of 700. Then it’s a years-long journey to march up from 700 to the 800s, and get into that truly excellent range. But you should get into that good range I think within a year to 18 months in most cases, with a couple of exceptions with that. But it’s as simple as, pay attention, have a strong cash reserve, increase your credit card limits so that you’re using less of those credit card amounts on a general basis, and make sure that you’re on time with all your payments going forward.

Scott:

And it should begin to correct itself quicker than you think, within a year, and slower than you think in terms to go to good, and slower than you think to go from good to excellent, I think.

Tony:

Scott, what are your thoughts on like the credit repair services? You know, there’s the guys and girls on social media saying, “Hey, I’m the credit repair guru.” Like, is there some legitimacy to those types of services, or is it maybe a waste of people’s money?

Scott:

I think if you really want to move quickly, maybe some of those could be good. I would bias against it though, I think that you’re likely to get… I think a lot of this is just hard homework that you’re going to have to do bit by bit. If you’re totally financially illiterate, you first of all have no business getting into real estate investing and investing someone else’s money, like a partner’s money on that front. But maybe that would be helpful for you, to actually have a coach walking you through that. But if you’re going to try to get into the game of real estate investing, which involves learning about understanding cash flow analysis, what CapX is, how to manage contractors who are not going to show up on time, you need to be able to figure out what is affecting your credit score and begin fixing that.

Scott:

That’s time you need to invest, in my opinion frankly. I think that’s a DIY job, for the most part. Exceptions would be if you earn huge amounts of income and you had some catastrophic event like a divorce or something like that happen that wiped out your credit score, right? But if you’re a median income earner or a little bit higher, and you have that credit, that’s a… I think it’s a DIY fix, in my opinion.

Scott:

I don’t know. I’m not sure if I see any value for the most part in what those credit gurus are offering folks. Like, I’ve seen some of what they offer, and a lot of it seems to be that they’re just like, “Hey, I’m going to try and call and dispute this delinquency for you, I’m going to try and get this thing removed from your credit score.” And I don’t know, I’ve just seen a lot of bad actors in that space, so I just want to caution people against choosing the right person if you do go down that route.

Tony:

Yep, I think that…

Tony:

Yeah. So Scott, I know you had some more outside of credit scores as well. So, what else have you got for us?

Scott:

Let’s talk about cash. What do you need, what kind of cash do you need to buy real estate? And I think that there are four components to the way I would think about cash. One is the downpayment, you need to have the downpayment. The downpayment doesn’t have to be 25%, it could be 3%, it could be 0% if you’re using the VA loan. But you need to be able to bring that downpayment, I think in cash, either yours or somebody else’s to that deal. You need to have cash for anticipated closing costs that are not going to get wrapped into your mortgage, right? So you need to plan for that. So if I’m going to buy a house hack, and I’m going to bring 15,000 in cash for the downpayment, I need another five for the closing costs on top of that.

Scott:

I also need cash for my anticipated repair costs that I don’t have baked into my financing model, right? So if I’m going to bring $10,000 in known repairs, I need that in addition. So now I’m up to $25,000 in cash for this fictional duplex I’m inventing, right? And then I need a cushion on top of what I know I’m going to spend, right? And I think that should probably be in the ballpark of 10 to $15,000 minimum for the investor buying that first property. Again, this can be stuff that you get access via a partner, but Mindy Jensen, co-host of BP Money, likes to say, likes to joke that the amount of the expense… The unanticipated expenses you’re going to have, or the amount that you’re going to go over-budget by in your rehab project, is inversely correlated with the amount of reserves you have set after the known expense, right?

Scott:

So if you have your $15,000 in cash on top of the downpayment closing costs and rehab costs, you’re not going to have anything unexpected happen, and you’re going to be just fine, right? That’s obviously a joke, that will definitely have its problems. But if you don’t have that cash, that’s when you’re going to run into unknown problems and be scrambling for a long period of time, and this business is going to suck cash out of your life in a way that’s going to be really unhealthy and make you resent it, rather than put cash back into your life, which is the reason we get into this business in the first place. And so I think that’s really important, to think through the cash position here from a financial perspective.

Ashley:

That’s why it’s so important to go and get that pre-approval before you even start putting offers on properties, because I think it can be kind of sticker shock when you see what those closing costs actually add up to. You look at the 0% down VA loan, that doesn’t mean you’re going and buying a property with 0% down. You still have to pay those closing costs. There are some programs where you can get those paid for you, but you should expect to pay them, the fees to the bank, the appraisal fee, and then also paying your insurance and your property taxes a year in full. That’s a pretty good chunk of change there, especially if you’re in New York State where property taxes are through the roof.

Scott:

Yeah. I think you’re going to be in trouble if you don’t have five figures in liquidity in cash that you can access. Not in your HELOC, not in a line of credit, in cash. Because you’re going to need that cash when it’s going to be hardest to access the financing at a future point for you, right? That’s just how it’s going to go. I think that’s a really good thing. Buying your first property, I think that’s really important. And again, if you don’t have it, find a partner who can bring it to the table. All right, let’s move on from the finance side of things and think about… We talked about time, but let’s also talk about ability, right? I think that there’s a… For most real estate investors, you’re probably starting out in this business with a median income, 50 to $70,000 per year, right?

Scott:

Value your time, your time is valued at $25 an hour. I don’t mean value your time as in hire everything out, I mean value it accurately and make a decision based on that that is a good use of that time, right? So that means that for most people who are buying that first property, it’s going to be a good idea to DIY that property, especially if it’s at all practical in your local market for example, right? And you’re going to have the time and inclination to learn those skills, to do basic rehab, basic property management, those types of things, and get that property set up in the early days for that property, right? So, that’s an additional time investment on top of the time that you’re putting in to learning this business from an educational standpoint.

Scott:

And I think that having those skills is incredibly valuable. You better believe that I DIY repaired my first duplex, right? There’s certain projects that I hired out, I didn’t do a major plumbing overhaul, I paid three grand for that. But I’m staining my cabinets, I’m installing the blinds, I’m doing the painting, I’m fixing lots of different various problems around the place, poorly doing the landscaping, all that kind of stuff to get things started, because that’s a good use of my time. I’m self-managing that property at that point in time. And not until I had I think 10 units did I begin hiring out those jobs instead of doing it myself, because it would have been negative arbitrage for my time. I probably waited a little too long, actually, but…

Tony:

I probably could have hired it out a little bit sooner, but that concept I think is really important, so… What do you guys think about DIY as part of… A willingness to be able to do DIY, more specifically, in the early part of the hold period?

Ashley:

Well, I think that if you want to be a DIY landlord, you should check out the BiggerPockets Real Estate Rookie Boot Camp, new landlord one is coming out. So you can go to BiggerPockets.com/bootcamps, and we’re going to go through learning how to self-manage your very first investment property.

Scott:

Yeah, that’ll be awesome. And who’s that going to be led by?

Ashley:

Me.

Scott:

Awesome, great plug.

Tony:

That was a shameless plug there.

Ashley:

Yeah. And now we’re back from our commercial, Tony.

Tony:

Yeah. I’m going to, I think for me I started my investing journey, like I said, with a very busy W2 career. My initial investments were over 2,000 miles away from my home, so it wasn’t realistic for me to try and do any sort of DIY work myself. And I just, I don’t have the skillset. So based on my financial position and my time commitments outside of real estate investing, I had to find a way to make sure that I had a good handyman on-staff that was able to manage most of those maintenance concerns as they popped up.

Ashley:

And what would you say the value of your time was when you started investing in real estate?

Scott:

I don’t know. When I got that first job I was making like 100 grand a year, so I don’t know what that breaks down to like per hour. But whatever that was, you know?

Scott:

Yeah, that’d be about… You can just do some… You can usually divide those numbers by two, and then drop a couple of zeros. So that’d be $50 an hour, right? 2,000 hours in a work year, divided by 100,000… Or 100,000 divided by 2,000 hours, so that’d be $50. So, I would argue that you’re kind of in that upper range for a lot of folks. Like, compared to where I was at the start of my journey, right? I’m earning $25 an hour at that point in time, right? So it’s different math, depending on that situation. You also owned a lot of Tesla stock, which probably influenced the value of your time in spite of the volatility of it that you mentioned earlier.

Tony:

Yeah, most definitely. I mean, and it helps, you know? But that was the decision that we had to make, was like, “Hey, we’re only going to be able to do this if we can also afford to hire out the work when it needs to be done.”

Tony:

And Ashley, did you do a lot of the work yourself when you guys started?

Ashley:

Yeah, I mean I was only making $20 per an hour in my job as a property manager. So, I think it definitely helped and was a benefit that my day job was property management, and I was building a property management company for somebody else. So I just kind of rolled my properties into that, and that was beneficial. But even still today, I fired a contractor a couple of weeks ago, and I just couldn’t get anybody in there. So me and my kids went up one day, we did some painting, we got the ready for new flooring, and then the new contractors came in. But just us doing that one day of a little bit of work that we couldn’t really find anyone to fit into that space of tedious things, was just us going in and doing that to get…

Ashley:

These other contractors came in, just kept our project moving. So, even today I’m still super-DIY if I have to, if it keeps a project moving, and you know, stay on track, so…

Scott:

You know, I love that. I have a similar example, a few years ago there were some squirrels running around the attic of one of my rental properties, and the contractor quoted me like $2,000 to patch the hole and get the squirrel out of there. And I’m like, “This is going to cost me 60 bucks and take me an hour and a half.” So, even though I don’t like to do those types of things anymore, obviously my time is not worth $1,000 an hour at this point. So you know, I’m going to do that job myself. And so I think that’s another good use case for this, especially for folks who are starting out in that lower income range, below the $100,000 probably that Tony was making there. This is a really good thing to do, because it will…

Scott:

Throughout your career as an investor, you’ll have the ability to call BS on some of these situations when somebody’s not doing a good job and just say, “I’m going to roll up my sleeves and do this one myself,” because that… Those individual cases will be good arbitrage for your time, from a time perspective. Okay, we have two more points in the checklist here. One is, I have a strong economics foundation, so I have a basic ability… And this is where we can get into like a checklist of terms, right? I understand what IRR means, and how to calculate that. I understand what net present value, or NPV is, cash and cash return, ROI in a general sense, compound annual growth rate. And you understand those and have a preferred way to compare investment opportunities, right?

Scott:

You’re not just comparing, “I like this duplex better than that one.” No, I am going after IRR in my investment, and I’m going to choose the property that’s going to produce the best IRR for me. Or, I like cashflow and I’m going to go after cash and cash return, in a hold perspective and I’m going to use that to compare investment opportunities. If you’re not sophisticated enough to understand those terms and have a preferred mechanism for comparing investment opportunities, you’re going to be shooting randomly at the deals that can come into your… And you’re not going to get a quality target to go after in terms of your investment portfolio. And then last thing is understanding… Last in economics is understanding this concept of how macro factors like supply, demand and interest rates at a high level will impact your business, right?

Scott:

We’ve had 10 years of low or lowering interest rates, with a couple of blips over that time period. And for the first time in 10 years, 10, 12 years, we’re seeing interest rates steadily rise. That impacts real estate investing, and if you are not able to internalize that and understand how that will impact real estate investing, even with the puts and takes that supply and demand will have happen, you’re putting yourself at a major risk. And that’s why I think a lot of people are questioning real estate at a high level, it’s because they don’t understand that and don’t feel comfortable with explaining that to their friends and family. If you can explain that to your friends and family I think you’re going to be in a good position to talk about whether real estate’s a good bet for you.

Scott:

And then last, I promise this is the last one, is understanding your local market like an expert, right? You understand the rules and regulations, you understand that in Denver they just changed the rule where you can have three unrelated… Up to three unrelated parties living in a property together. They increased that to five, so now you can do rent by the room on five-bedroom single-family houses, where you could only do that on three-bedroom single-family houses economically a few years ago. You understand that in Wheatridge, which is a neighboring town for Denver, Airbnb is perfectly fine. But in Denver, you can only Airbnb if you’re an owner occupant, and you can only do it for a certain percentage of the year, right? And those rules impact the strategies that you’re going to employ.

Scott:

You understand where the investment is going, right? In Denver, Colorado, they’re trying to open up this area called Rhino as the gateway to Denver, they’re investing billions of dollars into parks and new infrastructure here to make this part of town look good. And why are they doing that, what’s their intent and how is that going to impact zoning, and what types of properties do I want to buy? If I buy here in five years, I’m going to be the edge of this park. What’s that going to do to values there and desirability? Understanding that path of progress is key, and you can do that by spending some time on your local city’s website, you can go to local meetups, you can ask investors in the forums about these types of things.

Scott:

But you should be able to speak like an expert to what’s going on in your local community and where the ins and outs are. And again, the hard way to do that is to do all that research yourself, the easy way to do it is to meet local mentors and get that cheat code from folks who know the market and know where to look all that stuff up.

Ashley:

We have in Buffalo Buffalo’s Business First Newspaper that comes out, and it’s actually pretty expensive to get it sent to your house. But it is a wealth of information about what is going on in real estate, new development, or what’s happening with city zoning, or things like that. Different projects that are happening, what people are trying to do in the city. So if your city or your market has anything like that, I highly recommend checking it out. Scott, also you kept mentioning your local market. But would the same apply to whatever market you’re trying to invest in, even if that was, for me, down in Florida or something like that.

Scott:

Yeah, I should rephrase. It’s a strong understanding of the market, the local market to where you’re investing, right? And so I imagine Tony for example, you know the markets that you’re investing in very well. But you may not know the place where you live quite as well as those areas, I could imagine.

Tony:

Actually not at all, yeah. I don’t know anything about investing in my own city.

Scott:

Yeah. But that’s the key, is you don’t have to… Who cares about your own city if you’re not investing there, right? It’s where you’re investing, yeah. But that’s great, local newspapers are great. Again, local investors, city council can be great. Those are all good resources for that. Now, I’ll caveat something here, I did not check all 10 of these boxes when I started investing. And I bet you most investors will not come back and say, “I checked all 10 of those boxes,” right? What I’m trying to provide here is a very strict list, where like, “Hey, are you ready to invest in real…” Well, you’re definitely past that hump, in my opinion, if you can say yes to all the 10 things I just listed there. Because you’re going to be ahead of the game for most…

Scott:

Every real estate investor I’ve talked to in terms of getting their first property, including myself, right? I was not an expert on my local market, I didn’t have… I was well-versed in some of those economics things, right? I had my strong financial position with that, but I couldn’t have articulated my long-term thesis about what I want my portfolio to look like in three to five years. But, if you want something to feel like you’ve totally checked the boxes as a rookie in terms of getting that mindset ready to invest, I think this is a really good starting point for that.

Tony:

Scott, I want to take us to our rookie example. Before I do, first just thank you so much for walking through those 10 steps. I think analysis paralysis is honestly one of the biggest obstacles for folks in our rookie audience in terms of what’s stopping them from getting started. And like you said, if you can check even the majority of these 10 boxes it means you’re in a pretty good position to start. But one thing I want to comment on before we move on is, you talked about interest rates. And I just want to share with everyone that’s listening, if you guys haven’t heard check out the website, or I don’t know what it is. But it’s FRED, Federal Reserve Economic Database, and I just found out about this website like, I don’t know, like a couple months ago.

Tony:

And the amount of information they have on that website about the housing market is insane. And just to your point, Scott, about interest rates, if you go onto the FRED website, look up interest rates in the ’80s. They were in the high teens, I think it peaked like 18.7% for an interest rate for an entire year, which is crazy. So yeah, even though rates have crept up we’re still in a really good place historically speaking. So, I wouldn’t freak out too much.

Scott:

Absolutely. And what does that mean, right? It means real estate prices are going to slow down relative to… If you hold the other supply and demand factors constant and interest rates rise, real estate prices are going to rise slower or go down relative to where they would have in a constant real estate interest rate environment. It doesn’t mean that they’ll go down, and there’s a question you have to ask from a long-term perspective, right? Even if real estate were to go down, I’m going to have a lower interest rate today, and a lower payment on that property, and more cashflow a year or two from now, even if the property value doesn’t go up by much because I’ve locked in my interest rate at a lower valuation at this point in time. So, lots of things to consider, this is not uncharted territory. It’s just the first time we’ve seen rising interest rates to this degree in a few decades.

Ashley:

Yeah, that website Tony was talking about is FRED.stlouisfed.org. And then also, all of the information that Scott talked about today, the checklist for rookie investors, whether they should get into real estate right now or not, Scott is actually giving that away as bonus content when you purchase his book, Set For Life, at Biggerpockets.com/setforlife. But, he is also being super-generous to his favorite rookie listeners, and you are going to get this book if you go to the Rookie Show page, Biggerpockets.com/rookieshow. And you don’t have to be a pro member to get this, free or paid you can get access to it just for listening, because we love you guys all so much. So Scott, are you ready for the rookie exam?

Scott:

Let’s do it.

Ashley:

So, for our first question, what is one actionable thing rookies should do after listening to this episode?

Scott:

I think you should download the free checklist, and I also have another 6,000 words that I’ve written that go into detail about what each of those mean as part of that as well, so there’s both the checklist… But you should download that on the Rookie show notes page.

Ashley:

Yeah you guys, it’s not just the bullet points Scott highlighted, it’s… I read it this morning, it’s about 12 pages long and it’s definitely going to be a great read and a wonderful resource. So, make sure you guys check that out.

Tony:

All right Scott, question number two. What is one tool, software, app or system that you use in your business today?

Scott:

Well, I use a lot of the BiggerPockets tools. I use the calculators to analyze deals, I use the forums to network with folks, and ask questions, and get some thoughts, especially on the broader economy and local market. And then one non-BiggerPockets tool I use is Buildium, my property manager uses Buildium to manage our properties.

Ashley:

Scott, what about something maybe that BiggerPockets uses just for maybe project management or communication through… Do you have a favorite kind of software, maybe for somebody who’s building out a team right now that would be valuable to them?

Scott:

For building out a team? Oh, I think the best thing, I think-

Ashley:

Or just somebody who’s building out a team right now and looking for different software that they can use for their business, I guess. What’s something that you enjoy using within BiggerPockets, that’s [inaudible 01:04:15]-

Scott:

Yeah. I think that the tool section of the website, you can just hover over the navigation bar and you can find things like our rent estimator software, property management software tools, our leases, our tenant screening tool. Those types of tools are all available at BiggerPockets.com, and you just hover over the tools part of the navigation section of the site.

Ashley:

And lastly, where do you plan on being in five years?

Scott:

Well if I’m lucky I’ll be right here at BiggerPockets, and BiggerPockets will… What we’re trying to do here is build this kind of one-stop shop that helps you get started as a real estate investor, buy that first property, manage it, buy three, five, 10 more, begin scaling up like Ashley and Tony here, or sell off those properties and become a passive investor in syndication funds with your millions that you’ve built. We want to help you build that entire journey, and have this kind of mission control center at BiggerPockets that allows you to tie into your property management, your accounting software, and those CRMs to build your team and manage your projects. So, that that’s all available to you in one place to help you across that journey. So, that’s where I hope to be in five years, is doing the same thing. But with much of what I just described there is that one-stop shop achieved.

Ashley:

Well, that’s exciting. I think we’re all really looking forward to that, because that will make all of our lives easier too.

Scott:

Well, thank you guys for all you do.

Ashley:

Though, I want to highlight today’s rookie rockstar. It is Scott Reynolds, and he just finished the remodel on his second investment property. This is his first BER, and it will be closing on the refinance in the next week. He is set to get 100% of his original investment back, and is going to go live with the property as an Airbnb. So, congratulations Scott, he said that he spent about $125,000 total on the remodel. It’s a four bed, two bath, 1,900 square feet, and he actually made it into a five-bed, three-bath with 2,500 square feet. So that’s awesome, added on a little square footage for another additional bedroom and bathroom.

Scott:

Wow, that’s awesome.

Ashley:

So if you want to be featured as this week’s rookie rockstar, make sure you guys check out the Real Estate Rookie Facebook group, join and post your in in there. Or, you can send Tony or I an message on Instagram @wealthfromrentals, or @tonyjrobinson. If you guys are loving the podcast, please leave us a review on your favorite podcast platform and tell us how the podcast has helped you. Well Scott, thank you so much for joining us. Can you tell everyone where they can learn some more information about you and reach out to you?

Scott:

Yeah. The best place is on BiggerPockets, you can find me by searching my name in the search bar, and I’m always posting to the forums and making new connections. So, love to meet people for coffee, whether that’s you flying through Denver for the weekend, or you live here or nearby, would love to meet you up and buy you a coffee or a beer, and hear about your story with BiggerPockets.

Ashley:

Well, me and Tony will be there August 15th, so I’m sure you can take us down [inaudible 01:07:25]-

Tony:

Yeah, we’re going to hold you to that.

Scott:

Sounds great, I’m sure. Yeah, we’ll definitely have some food and beverages for you guys, so it’ll be great to see you.

Ashley:

Oh, every time we come visit we hit the great snack bar at BiggerPockets headquarters there, so… Well, thank you so much for joining us. We appreciate you taking the time to come on and talk to the rookie listeners. Everyone, have a great week. I’m Ashley @wealthfromrentals, and he’s Tony @tonyjrobinson. We hope you enjoyed this special Rookie Reply episode 200, and we will be back on Wednesday with another episode.