Living for “Free” with 63 Self-Storage Units

The older you get, the more you realize how much life costs. As a kid, it’s easy to take for granted the free rent and free meals, but what if you could get back to that? What if you could live mortgage or rent-free as an adult? What if you could have your meals paid for on someone else’s dime? In today’s episode, our guest, Nate Weintraub, shares how he lives for “free” with his three properties that total sixty-five units.

With a real estate investor as a father, Nate has always been around rental property investing. He never saw himself getting into real estate until he worked his first W-2. After seeing the realities of a nine-to-five, Nate decided to buy a property after college and pursue real estate. In March of 2020, he put a house under contract in Rochester, New York. Since then, he has purchased a sixty-three-unit storage facility in Alabama and is currently house hacking in Florida.

As Nate works toward financial freedom, he has made steps toward reducing his cost of living while still living a life he loves. In addition to being an investor, he does what he loves as a self-employed copywriter—BiggerPockets’ copywriter in fact. At only twenty-four, Nate lives rent-free in his house hack, his rental property covers most of his food, and his real estate investment trusts pay for his car.

Ashley:

This is Real Estate Rookie, episode 213.

Nate:

I don’t count on any of the income that comes from the rental or the storage facility as true income. I don’t touch it. It’s just for reinvesting for right now, but in my mind I can allocate that stuff. So basically, I’m living for free right now in the house hack. The rental property covers most of my food every month. And I invested in a bunch of real estate trusts, which you can invest in the stock market and that pays for my car. So we’re slowly ticking the things off, with each property that comes up it becomes how can I live my life for free? And if you keep your expenses down to a pretty low amount, it’s very easy to do that with a small amount of properties.

Ashley:

My name is Ashley Kehr, and I’m here with my co-host Tony Robinson.

Tony:

And welcome to the Real Estate Rookie Podcast, where every week twice a week, we bring you the stories, inspiration, and information you need to kickstart your real estate investing journey. And if you guys have not yet done this, we would really, really appreciate an honest reading and review for the podcast on Apple, Spotify, or wherever it is you consume this content. And before we get started I just want to highlight a recent review that came in, this one’s from Iscriminator. And Iscriminator said, “Every episode is unique. I’m glad you guys do what you do. I’m addicted. I discovered you guys three weeks ago and I’ve been binge listening and catching up. Hopefully, soon I can share my success story with you.” So guys we appreciate all the honest ratings and reviews, it helps us reach more like-minded investors just like yourselves. So Ashley Kehr, let’s get into some boring banter. Tell me what’s going on. What’s new in your world today?

Ashley:

While we were actually recording this podcast, I was having an inspection done by a home inspector on a lake house that I have under contract. And this is the first time that I’ve actually hired a home inspector in probably five years I think. So really exciting to have a bit more peace of mind of what’s going on in property than just buying such a dilapidated property, where I already know there’s so many big issues that it would be a thousand page report from the home inspector, so why even bother hiring them. So excited to see how it turns out. My business partner went there and met the home inspector and there was no big red flag, so we’ll just get the final report and hopefully be moving forward.

Tony:

That’s awesome. The reason you haven’t gone much is because you knew you were going to have to gut the whole place anyway.

Ashley:

On other properties. Where this property it’s turnkey, we really shouldn’t have to do anything to it. But we just wanted to get just an inspection report on it, just because we’re buying it at a turnkey price.

Tony:

And want to make sure it’s solid. For all the inspection reports that we’ve done, I don’t think I’ve ever been there in person when the inspection was actually taking place. Usually, I’ll just get it afterwards and I’ll call if I have any questions. You said Darrell was there at the property today walking with the inspector?

Ashley:

Yeah. And actually the seller was there too, because he let them in. But when I first started out and I had inspections done on every property, I would go and I would just follow the inspector on just because I wanted to learn.

Tony:

Learn. Right.

Ashley:

Darrell brought back this binder of stuff that I’m like, “Wait, where’s the inspection report?” He’s like, “Oh no, they send it later.” Where five years ago when I was having it done he would hand write it as he was going along, and he got it at the end of the inspection and would go over it with you. And so when I stopped using an inspector, I would go through the property using his inspection checklist and-

Tony:

Template.

Ashley:

… his sheets. Yes, template and go through the properties myself and look at everything. And obviously I couldn’t do everything like check the electrical outlets, things like that, but it really helped me get familiar with what actually a home inspector does.

Tony:

There you go. What a great tip to start today’s episode.

Ashley:

So Tony, what about you? What’s going on?

Tony:

Yeah. So much is going on. We’re still working on our big BRRRR deal, so we got until the end of August to get that one closed, so making steady progress there. We’ve got a few flips that we’re working on. We’ve got a new short term rental that just went live two days ago, another one we literally just published today. So just lots of things happening, so we’re excited for the next couple of months here.

Ashley:

Yeah. Well, that’s awesome. And I think we are both very excited about the guest that we have on today.

Tony:

Yes.

Ashley:

So we have Nate on who is actually the copywriter for our podcast. We’ve never really gotten to put a face to his name that we see all over the podcast stuff, so this is awesome to really be able to meet him too along with hearing how he got started in real estate.

Tony:

There’s this misconception maybe about all the folks at BiggerPockets that everyone’s just this massive successful real estate investor, but it’s not the case a lot of people are just getting started. And Nate’s at three properties right now, two of those are single family type residences, but one is a self-storage unit. So we spent a pretty good amount of the episode talking about how he graduated up to self-storage, how he educated himself on analyzing and the process that he’s gone through to manage that property as well. So overall, just a lot of really good nuggets from Nate about breaking into the world of real estate investing.

Ashley:

So if you read the description of this podcast and you did not think it was great, blame Nate.

Tony:

Nate, welcome to the Real Estate Rookie Podcast, we’re super excited to have you. And before we get into your story, I just want to let everyone know that Nate you are actually a very, very, very important part of this Real Estate Rookie Podcast. Literally, every piece of copy that anyone has ever read about the Real Estate Rookie show came from Nate’s fantastic artistic marketing. I don’t know I’m running out of adjectives. I’m trying to be like you man, but you’re the copywriter for everything Real Estate Rookie. So super excited to have you on the show, man, but tell folks a little bit about yourself.

Nate:

Thank you so much, it’s been fun working with BP. And I’ve gotten to see every single time Tony’s worn a black shirt, it’s every episode, it’s just black shirts. There’s never a gray, there’s nothing, so he keeps that vibe going the whole time. So I’m the copywriter for the BiggerPockets Podcast. I started about a year and a half ago, we were probably in the high 300s on the regular show. You guys were much, much earlier than that, but I basically look at and watch every podcast that comes out from the BiggerPockets Podcast network. We write all the titles, the descriptions, so if you don’t like any of them, you can email what’s your email Tony?

[email protected], that’s the email you can email. But it was slightly before I started working with BiggePockets, I had just started getting into real estate investing. So obviously, digesting this on a daily basis, a multiple daily basis has helped out a lot. And it’s just been great to listen to Ashley and Tony give insight to other investors that are new like me.

Tony:

Yeah. I think there’s this idea that everyone that works at BiggerPockets is already a real estate investor, but it’s not the case. There’s quite a few people who haven’t started yet, or at the very beginning phase of their journey. And obviously, Ashley and I get to chat with a lot of folks at BiggerPockets, and it’s always so cool to see people start from zero and build themselves up. And Nate, you’ve got an interesting story as a real estate investor as well. Just give us the background. You were already thinking about real estate investing before you came on at BP, but take us through where that journey has led you so far.

Nate:

Sure. So from the very, very start, I grew up with a real estate investor as a father. My dad had been investing in rental properties before I was born, so that has been ingrained in me for a long time. The problem was growing up with someone who is heavily into single family and small multi-family rentals, you can see the headaches that come with it. So every single day it was not unusual for my dad and I to be talking and then he’s like, “Hold on.” And then he’d pick up the phone and it’s his handyman and a strong Southern accent, and I still have no idea what that guy was saying. Talking about a plumbing issue, a lighting issue, painting, something like that because he was running this small portfolio with his partner. And there was just a lot of things to take care of all the time.

So the 5:00 AM phone calls, the toilet calls, all that stuff that everybody dreads that’s scared of. It wasn’t a thing that I had to really like, “Oh, is that a possibility when I buy a rental?” I saw that growing up the entire time. The downside of that was because I saw that so much, it didn’t really seem like an option for me because I saw my dad stressing so much over it. And obviously, it had huge benefits for the lifestyle we were able to live. I never had to worry about any mortgage being paid or food or anything like that, because he was investing from a pretty young age. But I didn’t know that was exactly what I wanted to do because I seemed to only see the downsides of it. I didn’t see the nice life I lived around me.

I just saw, “He’s always on the phone. He’s always talking to these guys. He seems stressed a lot, there’s eviction, stuff like that happening.” So I remember when I was 16, he tells me he’s like, “Nate, when I don’t want to do this anymore, I’m going to give you all these rentals.” And I was like, “Please don’t do that. I don’t want that.” Which I know for everybody listening is like, “Are you kidding, that’s the opportunity of a lifetime.” But I think when you’re growing up, you just see the hassle a lot.

So it wasn’t until I started working at an internship close to the time I was leaving college when I was like, “Oh, this is how people actually work W-2s in the real world. I understand why he was doing this the whole time.” Because I had always had small businesses that I relied on for money from age 16, up to early 20s. So when I saw what the other reality was, which I know you both know very well, it clicked to me that, “Okay, there is a reason for all this stress.” It’s a worthwhile pursuit to do that.

Ashley:

That stress is better than working a 9:00 to 5:00 job.

Nate:

Yes. And that’s the thing is you always have to think about that, you’re going to suffer either way in life. And so are you going to suffer doing what you like and having control of your life, or are you going to suffer at the helm of somebody else and that’s your choice. So he chose the right thing in my opinion, but as I’ll tell later in the story I went a different way because I didn’t want to have the full throttle amount that he was handling.

Ashley:

We had this guest on once that was talking about how when he got his first rental, he got his first call from the tenant and they had a maintenance request, and he was just panicking and full blown anxiety and just like, “Oh my God, this is the worst thing ever,” and blah, blah, blah. And then he hung up with the tenant, he called somebody to go take care of the plumbing issue. And then he was like took a breath and was like, “Wait, that was just five minutes of my life and this lady is paying me a $1000 a month,” or whatever it was.

“I just made a $1000 for five minute phone call. That’s the only issue I had that whole month, it was that five minute and I panicked for no reason.” And I think that’s a great example, there’s going to be headaches, there’s going to be things you don’t want to do, but it’s so minimal and minuscule compared to other opportunities such as 9:00 to 5:00 jobs to make money in life.

Nate:

Exactly.

Ashley:

So tell us a little bit more about what you did before you started in real estate, and what made you decide to actually buy that first property.

Nate:

So during that internship, when I was looking around at everybody and I was like, “What are you guys doing?” And everyone’s just the same thing it’s like, “Oh, on the weekend I go out, I come home, I sleep and that’s it.” And I would talk to people about their finances because I’m generally interested. Now you can do that when you’re a younger person at an internship because people will just be like, “Oh, he’s young, he’s stupid. He doesn’t know that’s pushing the boundary.” Use that, do that when you’re young because people won’t mind. But I was talking to people like, oh, financial stuff, “How are you investing? Are you doing your Roth? Do you have any rental properties, stuff like that?” And the amount of people I talked to who were doing nothing really scared me, and I was just watching it week in and week out.

So I kind of clicked where I was like, “I think I should try and buy a rental property after college.” So at the internship I started going on Zillow and it was just looking at markets, looking at how much the prices of every house was in different places that weren’t crazy unaffordable, like my home state of California. So after I got a W-2 after I left college and then a year after that this was during about a year and a half after, so this was March of 2020. So the best time to buy real estate ever, nobody said it was a stupid decision at that time, everybody said, “Great. Buy during the pandemic.” I put a house under contract in Rochester, New York, Ashley, which I know that you’re probably well aware of.

Ashley:

Yeah. It’s like an hour from me.

Nate:

Yeah. This is a very heavy cash flow market, and I think when you’re young you care about that a lot more and you’re just like, “Oh, I got to get cash flow so I can retire early,” stuff like that. So I put a full cash offer in on a $40,000 house in Rochester, New York. And I had it under contract March of 2020, we didn’t close until June of 2020, it took that long, and that was the first investment I made.

Tony:

But before we keep moving Nate, can you just give us a brief overview of what your portfolio looks like today?

Nate:

Yeah. So I have the house hack I’m currently living in Florida. I still have that Rochester property and we also bought a self-storage facility, a 63 unit self-storage facility, me and two partners last month. So it’s just three properties, but I guess I can say 65 doors, which makes me sound really impressive. Can I say that at a meetup?

Ashley:

I would say don’t say just three properties because that’s still impressive. I think there’s people already drooling right now, “He has a self-storage facility. I want one of those.”

Nate:

That was me for a year, I was like, “How are you people doing this?” But with that first property it was really entirely cash flow. It was not a good market, I’m sure I can talk to Ashley about this later. It’s not a very good market. It was a C neighborhood. It was a C house. It wasn’t super taken care of. The saving grace, which was the reason I probably still invest in real estate now is that I had really good inherited tenants, really good people who the entire time during COVID, when they couldn’t have paid me, tried their hardest they could to pay me the whole time. And it was the same thing Ashley that you were saying before where as soon as I closed on the property, I remember I was going to sleep that night after everything was done.

And I was like, “Oh my God, they’re going to call me and something’s going to happen. I’m going to have to call someone else.” And that happened and you just get over it. But that was the first property and I think buying in a C neighborhood, a C property with still very good tenants, but not the best house, not the best area, the cash flow was fine. But buying that residential real estate and realizing that I was like even if I’m picking up the phone three or four times a month, and it’s maybe taking me one to two hours of work to do this rental property stuff. The scale of doing that isn’t that fast with just buying a single property at a time, and that led me into maybe we should try something a bit bigger.

Tony:

And I definitely want to get into the self-storage piece Nate because I think people are always intrigued by the idea of going bigger. But before we do, so you’ve got a property in Rochester, where’s the self source facility at, what state?

Nate:

The self source facility is in Alabama and I’m in Florida.

Tony:

Alabama. Okay. So you got one in Rochester, one in Alabama, this other one in Florida. So walk us through your process for choosing a new market to go into. What is your analysis and due diligence looks like? And at what point do you say, “Okay, this is a good market let me sink my teeth in. Let me start submitting offers.”

Ashley:

When you bought the Rochester one, was that when you were living in California, that’s literally the farthest point across the country to choose.

Nate:

I don’t know what it was, but I’ve never been to New York. I tried to go to upstate New York one time to look at the house during COVID and they were like, “Get out. You’re from California.” I was like, “Okay.” So I couldn’t do that. I don’t know why I chose the farthest part-

Tony:

Wait. So Nate, you still haven’t seen the property in person-

Nate:

I still haven’t seen the property in person, and I’m probably going to sell it soon so I can move it into more self-storage. But no, I never saw it, I don’t know why I picked that far away. But when I was doing it, I wasn’t very educated on choosing a market in the first place. It was literally just does it cash flow? Is my house going to get damaged by some really bad thing? And if it basically was there’s two to 300 plus dollars of cash flow and I feel like my tenants can safely live there, that was kind of it. That’s not the way you should do rental property analysis at all, but it’s worked out until now, it was very basic. I was a complete beginner.

Tony:

But Nate there’s several thousand miles in between California and Rochester and there’s thousands of other potential cities in between those two location, so what was it about Rochester that made you even begin to look there?

Nate:

They don’t have an increasing population, but they have a pretty large population, it’s 200,000 plus, their houses are relatively cheap. I bought the first house 40k in cash and I’m a very financially anxious person probably as it is. So for me buying something in cash took away that fear of a mortgage collector’s going to come after me. I just wanted to do the first one in cash just as a complete learning experience. Because I didn’t want to mess with any leverage when I really didn’t have any idea of what I was doing. So that was a market that hit, the population was relatively big, I knew there was a lot of renters. The cash flow was giving me two to 300 plus bucks a month, that’s true cash flow after everything. Their Section 8 laws are also really good. So that was another thing because I was buying in a C class neighborhood, I knew that I could probably get Section 8 renters there.

The thing is the house I bought it for $40,000, it could be rented on Section 8 for 1480 right now. So what is that like a three point something percent, it’s insane. But I just knew that there were options that I could take if something really went bad, because there is a pretty strong Section 8 market in Rochester and they seem to be able to give out the money quite freely. I had a few points where I felt like I had some defense going into the deal that I felt comfortable with that. Why I didn’t do anywhere in the Midwest it was just I looked at so many markets and nothing was matching that I can buy this in cash, making cash flow metrics. As soon as I got there I was like, “Let’s just do something,” because I was tired of waiting.

Tony:

So Nate something else you mentioned that I want to dive into is the fact that you still haven’t seen this property. So for a lot of new investors there’s a high level of fear and anxiety around buying property sight unseen, but you were able to do this nonetheless during a pandemic. So walk us through what your process was for completing your due diligence on this property that you were never able to see in person.

Nate:

So the first thing I would tell people is if you’re going to buy a residential property, probably see it in person, unless you have a really good team. I had obviously we did a full inspection and everything and we had about three months of closing, so there was time to do it multiple times. I had an investor friendly agent who I found probably through BiggerPockets that I got to go into the house and do the full Zoom videos with me, so I could see everything. Also when you’re buying a rental property in Rochester they make you go through a certain I forgot what it’s called, but you have to get a certain rental qualification.

Someone has to go into it from the city and make sure that it’s livable, so that passed. I looked at it with my real estate agent and I got an inspector to look at it. I also had a few months after I bought it, now this was after the fact. I had a handyman that my father knew in a neighboring state drive up there and do a full deep dive into everything that had to be done there. But it was basically inspector, the city and my agent who were all able to lay eyes on it before I wanted to dip out of the deal if I wanted to.

Tony:

Nate, I’m so glad you mentioned that because that is exactly the same advice that I give to new investors as well. It’s like Nate, you had never purchased a rental property before, so how much value do you believe you would’ve added on top of the city inspector, your agent and a professional property inspector?

Nate:

Oh zero. I’m a first time homeowner right now house hacking. I was impressed that I installed a sink in the bathroom. I don’t know anything about construction. If you show me an electrical box and you’re like, “How many volts?” I’ll be like, “I can’t even read this. I don’t know.” So if you’re someone who’s new that’s getting it and you know that there’s people, who have experience that you can trust that can do the things that you can’t do. I could say you could feel pretty confident buying an out-of-state property that you’ve never seen, because it’s like what you said what are you going to provide that they can’t?

If you’re coming from a background like mine where it’s like, “I know the numbers, but mechanically I know zero,” there’s not much I can add to that besides do I feel safe in this neighborhood physically, and for some people that might be worth it to go see it. But I asked my agent, “What do you think about this? How do you feel? Is it okay as a rental?” And he got back to me on all those questions, and we were talking every day about this stuff. So I had someone I could trust that I could ask.

Tony:

Nate I do think there’s a ton of value in obviously being able to see the property in person, but not so much for anything other than emotional. I think for a lot of new investors there’s just a sense of emotional, I don’t know, you just feel better as a new investors if you can see the property in person. But usually if you’re a new investor, that’s never purchased a property before, you’re just going to walk around, take a look, “Oh, this looks good.” You’re not going to have a really technical or critical analysis of what needs to be done to that property.

But you can get an inspection report and see that, “Hey, this panel is an old panel that might need to be upgraded,” and you can take that and get a quote. Or you can see that, “Hey, there was some leaking in the roof here in this bathroom that looks like maybe it was a bad patch.” You can take that and say, “Okay. What’s the quote to get that corrected?” You can take all the information that’s in an inspection report, shop that around to other qualified professionals, and then you’ll get an idea of whether or not that property’s still a good deal. So that’s always my advice for new investors is to have a property inspector agent, if you can get a contractor to walk through it, let the professionals be the ones to give you their opinion on the value of that property.

Nate:

Yeah. For the house hack I’m living in right now I came here. I came from California for me to look at all the properties because I’m living in this property. I’m also going to be living with other people in this property, that’s emotional value to me that I need to feel safe in my own neighborhood. If it’s your own house you’re living in, you’re like, “Oh, there’s a fountain out there. I love that fountain. I don’t know why, I just like it.” But that’s something that it’s not the same with a rental property as it would be when you’re living in there, so I completely agree.

Ashley:

There are those differences. And especially even with doing the due diligence, there may be things that you’d be able to live with if it’s your own house or versus if it’s a rental, it can go either way. But Nate, I want to know are you managing this from afar or did you hire a property management company?

Nate:

I learned from my father that 90% of property management companies are not great. And most people told me they’re in the Rochester area, I talked to so many agents and every single one said, “None of the property managers are good.” I tried to reach out to someone they didn’t even get back to me, that was like, “Oh, that’s the sign.” So I’ve been self managing it for two years now. I have a very good relationship with my tenants. They’ve done right by me so many times and as soon as they need anything fixed, they call me and I call whoever needs to come out and take care of the house.

It’s worked out fine for me, I haven’t gotten a call from them in a month and a half. If it’s a busy month I’ll get maybe three calls and it’s just stuff you have to deal with. But not even the money saving part of it, I felt like it was important for me as a first time investor to manage the property myself, even if it was out of state. Because I feel like I know so much more about not only my tenants, but the house through just talking to them through any issue that comes up.

Ashley:

Are you using any software or anything to make them pay their rent online, or they submit their maintenance request online or anything like that?

Nate:

I wish because I work for BiggerPockets I hear this enough. No, but I don’t though. It’s just because I had that one rental, I think if it was beyond that I would. But it’s so easy for me to manage everything internally, that I don’t have anything. I tried Stessa for a bit, that was fine, but I don’t know why I’m such a spreadsheet freak that I like my own stuff much better.

Ashley:

So you’re a lady in the streets, but a freak in the spreadsheets.

Nate:

Yes, I am a lady. I think if it’s just one property and you’re really trying to get nitty gritty, it’s fine. But I think anything past that where you have multiple tenants, it makes no sense to not use all the free property management software that’s out there.

Tony:

So Nate, I want to talk a little bit about your move as well. Now you were in California, you’re SoCal like me and you packed up a move to Florida, and I just want to know what prompted that move, was it a cost saving thing? Was it because you wanted to invest there? What was the motivation and what have been some of the benefits of making that move?

Nate:

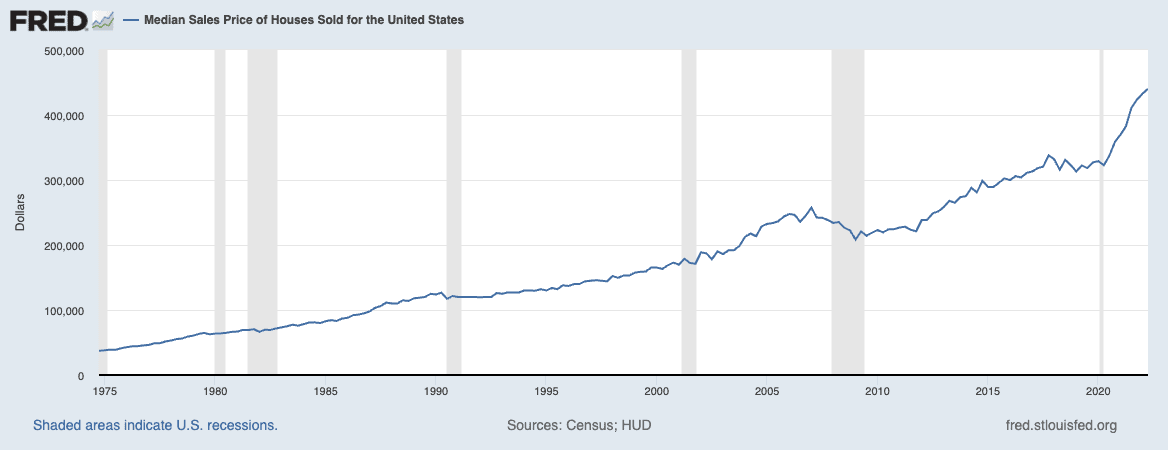

I lived in San Diego, so for me being by the ocean is very, very important. Now there’s no waves here because I’m on the Gulf side, but there still is the ocean in a relatively short distance, so that was nice for me, but the biggest thing was probably affordability. Tony and I lived in California or he lives in California, I lived in California. I think the average home price in San Diego is about $800,000 right now. And even if you can afford that it’s hard to make that sense. I have friends who are house hacking in San Diego and even with the subsidies from renting out another room as a medium term rental, something like that, they still have to pay three to $4,000 a month just towards PI, CI stuff like that. So for me it was a lot of cost savings.

It’s not only that, you can buy a house here for 400,000, my house is 428,000 and I should be able to subsidize the rent by about 75%. And on top of that, I also now don’t pay any state income tax. So even though I’m not living for free on paper, I am living for free because I’m saving enough from state taxes that covers the rest of what I would be paying on my mortgage. So for me it was like, “I can be close to the beach, this area’s growing a lot.” I’m in Sarasota, so it’s close to Tampa, so it’s growing a ton. It’s a very nice place to live. The school systems are great. You’re close by the beach and I get to essentially live for free. I don’t really know why I wouldn’t do that, especially when I don’t have so much physical attachment over to San Diego that I couldn’t.

Ashley:

Do you have any other tips or tricks? It seems like you’ve gotten a great plan in place to live for free, but do you have any advice for our rookie listeners of some creative strategies that they can do to reduce their living expenses?

Nate:

I mean you can rent hack if you’re renting a place and it allows you to sublet it to other people, you can rent out another room that you’re not using. I know people that have rented out their garages as storage. You can get a couple hundred dollars a month for that. If you’re thinking about making a move for house hacking, definitely visit the area first, but look for the places that seem like there’s a lot of businesses going into them. Tampa’s a big part of that and that equals job growth, which usually equals more pay, so then everything is probably just going to increase in price.

Also Sarasota’s a place with very, very low inventory and you have to basically whack down jungles to build here, so there is some barrier to entry for new homes. So if you’re looking for some place that is going to appreciate that you are going to be able to subsidize your costs, just look at where the population is moving towards. Look at your total cost with state tax savings, if you’re going from one state to another state and go on roomies.com or roommates.com and look at what a room could rent for. And then just use the BiggerPockets calculators to go calculate out how much money you would save.

Tony:

So Nate, I know you’ve got the house hack going on, which is fantastic, and we recently had Craig Curelop on an episode where he gave all the ins and out outs of house hacking. So if you guys haven’t listened to that episode, go back and listen to that one. But Nate I know something else that a lot of folks use, as they’re building their portfolio they’ll say, “Hey, this rental is to cover whatever my credit card debt or this rental is to cover my student loan payments.” Are you using any of those strategies as you build your portfolio?

Nate:

Yes. 100%. I don’t count on any of the income that comes from the rental or the storage facility as true income. I don’t touch I. It’s just for reinvesting for right now, but in my mind I can allocate that stuff. So basically, I’m living for free right now in the house hack. The rental property covers most of my food every month. And I invested in a bunch of real estate trusts, which you can invest in the stock market and that pays for my car. So we’re slowly ticking the things off, health insurance is going to be a tough one because I’m self employed. With each property that comes up it becomes how can I live my life for free? And if you keep your expenses down to a pretty low amount, it’s very easy to do that with a small amount of properties.

Ashley:

So Nate earlier you said that you’re getting about $200 per month cash flow was it on that Rochester house?

Nate:

It’s probably 300.

Ashley:

300. So you said that covers most of your monthly food costs.

Nate:

Yes.

Ashley:

How much are you spending on a meal?

Nate:

I bet the producer Eric told you guys about this. I watched The Money Show because I’m also the copywriter for that. And I’ve always been a pretty frugal person and it’s made sense to me my whole life that the less I spend, the closer I am to financial freedom. So my girlfriend and I consistently will eat out for probably $25 or less. And if it’s over that we look at each other and we’re like, “What are we doing? This is insane.” We just buy a bunch of vegetables and beans and stuff like that and eat that stuff all the time.

Ashley:

The Dave Ramsey, beans and rice.

Nate:

Exactly. Oh my God, I get those Taco Bell, just bean and rice, no cheese. Just bean and rice burritos those are a $1.50 and I’ll just eat four of those at a time. There’s ways to do this people.

Tony:

So Nate, I want to talk a little bit about the self-storage piece because I know that’s an asset class that I’m super excited about. And I think honestly after we do short term rentals, self-storage would be the next asset class we move into. So I’m just curious, so you have this new one that you just got on your contract, 63. What do you call them in self-storage? They measure by the square footage, however many square feet typically. But anyway, so you have these two residential properties and you leveled up pretty quickly into this massive self-storage portfolio. Talk us through, A, why you made that decision to kind of level up, and then, B, how did you even start educating yourself on what is a good purchase in the self-storage asset class?

Nate:

Learning about this whole different asset class it’s just weird if you’re a residential investor. Because for a long time you don’t think you can buy these things, you think that’s for really rich people. Only they can buy self-storage facilities, only they can buy hotels and motels and camp sites and all this stuff that you guys are doing now. It takes a big mindset shift for you to realize that there’s not really a barrier in entry to any of this. There’s just, can you do it? And if you think you can do it, you probably can. So what was happening was I have someone who I used to work for, she was my manager at my old job and we were always talking about real estate at work. So she ended up buying a duplex in Cleveland around the same time I was buying the single family house from Rochester.

About a year later, she texts me and she’s like, “Can I pay you money to help real estate coach me?” I’m like, “I don’t think I can accept money. I have one unit, that doesn’t really seem like an acceptable amount to do coaching.” But I was like, “Do you really want to buy more real estate?” She said, “Yeah.” I said, “Why don’t we just go at it together and then just pull our money and do it together?” Because I trusted her, I worked with her for so long. So originally, we were thinking apartment complexes, but then we got on the whole topic of the toilets and the trash and everything else like that. And that over time it blended into, “Okay. So what should we do?” And we were thinking, “What can we do that’s not residential?” And then we had two options, mobile home parks and self-storage.

They both kind of operate the same, because both of them you’re literally just paying for a spot somewhere, that’s how it works. For mobile home parks, most of the time the mobile home owners will pay for all their own maintenance. Is self-storage, I have a concrete box. And it’s like in those movies where the angel scene because someone realizes something, that’s how I felt when I realized that somebody would pay money to put their stuff in a box. I didn’t realize this before, but it was so amazing when I realized it, so we shifted gears towards that. And then we hunted around for a deal for about a year before we finally got one. But the way that you would get educated on that is you read books, you read books by AJ Osborne. You read books like what is it Crushing It in Commercial Real Estate, is that by? Why am I forgetting his name?

Ashley:

Brian Murray.

Nate:

Brian Murray. And there’s sites. There’s tons of people talking about it on BiggerPockets, there’s sites like Storagerebel, stuff like that. It’s very easy to get self-storage information. And anytime I had a question, “Does it need to be climate controlled. What unit breakup do you guys have on your facilities?” I could just ask it in a forum and someone would answer it, and that was pretty much how we got educated on it. I don’t know if I answered the full question, maybe I went on a tangent.

Ashley:

Well, Nate, can we use this as your deal dive here?

Nate:

Yes, we can do the rookie deal review. Let’s go.

Ashley:

See, he even knows the name of it better than I do.

Nate:

Yeah. I’m ready for this.

Ashley:

Okay. So I’m going to rapid fire you some questions and then you can go into the story of it.

Nate:

I’m completely unprepared.

Ashley:

Okay. So you had mentioned this deal was in Alabama?

Nate:

Yes.

Ashley:

And how did you find the deal?

Nate:

So when I was looking for off market self-storage deals, I would be calling everybody throughout Florida, Alabama, Sun Belt area. And I found a deal that didn’t work for me, so I called a wholesaler whose list I was on and I said, “Just take this information. I don’t even want anything for it. Can you just keep sending me more deals?” And he was like, “Sure.” So luckily enough four months later, he’s like, “I’m on the email list and there’s a deal that’s coming up in Alabama.” I saw him start to drop the price over time and nobody was bidding at it, so I thought it was overpriced. We ran the numbers. We realized it would work at some level or some price, it wasn’t the price that he was asking for. So I got it through a wholesaler. Can I explain what a wholesaler is for people who don’t know what wholesalers are?

Ashley:

Yes, that’d be great.

Nate:

Okay. So a wholesaler is basically someone they’ll either send letters to or call properties that aren’t for sale on the market. And they’ll ask owners who might want to sell the property, “Would you sell the property to me?” If the owner of the property says, “Yes.” They’ll lock it up in a contract and then the wholesaler legally because there’s a stipulation in that contract that says, “Even if I don’t buy this, I can hand it off to another person who can buy it at the same price, same everything in the contract.” And they usually charge a fee for this, so our wholesaler did charge a fee. But that’s how a wholesaler works, they’re basically just the matchmaker between an off market property and you a person who doesn’t want to do all that work and they collect a fee at the end, so we got it through a wholesaler

Tony:

Nate really quick, before you move off the wholesaler piece, how did you find this wholesaler in this new market you’ve never been in? What advice would you have for someone looking to find a wholesaler?

Nate:

If you want to find wholesalers, if you’re looking at residential houses or anything, the easiest thing to do is look up on Google cash for houses, insert the city you’re looking for and there will be tons of websites that come up. You can email any of the people on those websites, and they’ll put you on a buyer’s list where they’ll send you deals. They like to blast a lot, Facebook groups, I’m part of a bunch of self-storage Facebook groups. People always say, “If you need deals sign up for my email list,” I know there’s people who will probably say it on BiggerPockets. You might even be able to look up wholesaler, my city and you can find a website and you can sign up for people’s buyers list on that website.

Tony:

That’s so funny, I’ve never thought of doing it that way.

Nate:

Oh yeah.

Tony:

I just Googled cash buyer or cash for houses Pigeon Forge and there was six, seven websites that popped up saying, “We’ll buy your house in Pigeon Forge.” That’s a great tip, man.

Nate:

Quick tip. There you go.

Ashley:

Wrong podcast. Back to the rapid fire. What was the purchase price on this property?

Nate:

So he wanted 400,000 for it, it didn’t make any sense at 400,000, it made sense around 360, but not 400. So I went to the wholesaler and I was like, “Dude, you’ve been emailing this out maybe four or five times, nobody wants it at this price. What if you just let the contract go, void it with the seller, give me the seller’s contact information, and then I’ll just pay you the same wholesaler price if I lock down a deal with him.” And for him that’s a zero risk way of doing it. We signed kind of a JV agreement with each other that if I got the deal, he would get paid his wholesaler fee. So there wasn’t any way of me going around him, so he says, “Let me wait for one other buyer to see if he wants it.” The other buyer didn’t want it.

He comes back to me and he goes, “Okay, I’ve just voided the contract with the seller. Here’s his information.” So remember the wholesaler was asking 400. I called the buyer and within about five minutes the buyer says to me on the phone, “I’ll take three 50 for it.” And I go, “Okay.” So that’s how we got to that price and that was a price that worked well with me, it was also a very, very nice owner. He’s helped us the entire time moving over to our management, sending us everything we need, going to the facility cleaning out units that he had stuff in.

He’s like, “I’ll mow the lawn for you the whole summer.” That’s fine. I’m like, “Okay.” I think people get hung up a lot of times where this is the price and it’s never that this is the price, there’s ways to get around that. But we ended up at 350 and the wholesale fee was 14,500 and that’s on a 2% interest only loan for two years. So hopefully, by the time we refi we can just give him that… Yes Tony, pretty crazy, right?

Tony:

2%.

Nate:

Oh no, sorry 5%. Two year at 5%. That’s still pretty good though.

Tony:

Oh, gotcha. Gotcha.

Ashley:

Yeah. Still.

Tony:

Okay. But still really impressive. Still really impressive. Wait, so if I can keep going, how did you guys finance this thing? Was is it a cash offer? Did you guys bring some debt? What did this look like?

Nate:

It was just a 20% down commercial loan from the local credit union who the seller was actually a commercial underwriter there. So he was like, “Hey, if you buy this and use our bank, I will give you a 4% interest rate for 15 years, 25 years amortized.” And I was like, “Yeah. Let’s do that.” So that was the thing, that closed on the first of this month. Interest rates were not 4% at the first of this month. I don’t know how they’re doing this, I don’t want to ask, I’m just getting the loan.

Let me explain that again for the rookies who don’t know what I was saying. It is a 4% interest rate, the loan will last 15 years, but the length of the loan is over 25 years. So at the end of that 15 year period we will in theory owe the next 10 years worth of loan payments at once. But we’re probably going to refinance out sooner than that or sell it before that even happens. So for us, it’s more a long term, low mortgage, low interest rate loan.

Ashley:

And instead of having it amortized over 15 years, the length of the actual loan spreading it out to the 25 years makes your payment a lot smaller, and hence gives you more cash flow the longer you can amortize-

Nate:

Exactly.

Ashley:

… out to, which is awesome. Your strategy with this is obviously self-storage, but how are you managing it? You had mentioned that the owner helped you switch over to your own type of management. What are the differences there compared to what he was doing?

Nate:

So before he was like everything’s on a piece of paper, that’s how he sent me everything. Every customer info phone number, address, contract is a written down piece of paper. I love the gentleman, he’s so kind. I would not do what he was doing, because it seems like such a headache. And my partners had to take the time to transfer 45, 50 tenants worth of all information contracts and everything onto spreadsheets and then into an online system that’s called ESS, it’s Easy Storage Solutions.

And that’s kind of a property management software for storage that allows people to put in their credit cards and have recurring billing, purchase insurance, stuff like that. But it was basically a Nate is on the weekend, Nate turns on a Netflix show, Nate tries to understand what this man scribbled on a piece of paper and put it into a spreadsheet, but we got it. We got all the customer info in after a month, it’s amazing, I’m so happy about that.

Ashley:

That is really cool, so what is your exit strategy on this? You said maybe you’ll sell it or refinance before 15 years, but what are some of your immediate goals that you have for it?

Nate:

Part of the reason we liked the storage facility, it was so heavily under rented or not under rented, the rents were way below market. It was about at 75% occupancy when we bought it, so pretty close to full, but for something that might have been $85 a month unit, the old owner was charging $40. And every single self-storage facility in the area was charging 85, $90. And this one had no online presence, nobody knew it existed unless you drove by it.

So our long term thing is basically we’re going to try and increase the rents over time, by either, A, getting new customers at the full price it should be, and slowly through a multiple tiered way that we’re doing it increase the rents of the current occupants. That should take us probably about a year or two, because I don’t want to do things too quickly and get people to just dip all at once. But when that’s done, when we get everything to market rent, start selling self-storage insurance, which if you don’t know this, if you offer self-storage insurance you get a kickback from the company, a pretty significant amount that increases your profit.

Once we get it all rented out like 90% plus, we’ve calculated the facility should be worth at a minimum with a pretty high cap rate $500,000. So then there would be 150k profit made over about a year or two. And then we could either choose to should we refinance and buy a same size facility or should we sell the whole thing and 1031 into a bigger facility, and just repeat until we’re bajillion, trillion, fafillionaires.

Tony:

So Nate, gosh, so many questions rolling through my head right now. So first I know you said that you’re using the Easy Storage Solutions software, but are you personally managing this thing or is Bubba still playing some kind of role in the day to day management for you guys?

Nate:

So we’re managing all that, we’re managing that ourself. I have two other partners, so one of them handles the customer service. I kind of manage getting everything into ESS, my other partner then just takes it from there. So we have everything in there, it’s super streamlined, you can text people, email everyone through that system. We’re handling all the management, the old owner isn’t handling anything besides just helping us continually get it rolling, because he lives in the area, but we’re self managing that whole thing.

Ashley:

Have you been there to that property?

Nate:

Oh no. She asked me this question. No I have not. I will be going in… I think we’re going to try and go in September. But the thing is which is cool is because it’s about an hour outside Huntsville, and I have a good friend who invested in Huntsville and had a great property inspector, so I got that guy too. And he looked around the facility, sent us a lot of pictures, we asked him his opinion of stuff and it’s been pretty good so far. And every single time we’ve had a new customer come in and say, “You guys have any open units?” And we say, “Yeah.” And they go, “Okay.” And they accept the full price that we ask them for. So we know we’re not completely off base for the area, but no, I haven’t visited. Why did you ask me that Ashley? Now I seem like a rookie.

Ashley:

No, I think that’s so cool that you’re able to get all this stuff done and you don’t even have to go to the property or look at it.

Nate:

Have partners.

Ashley:

I think that’s awesome.

Nate:

Have partners that do things that you don’t want to do. Doing this alone, I guess it’s cool because you get all of the clout if you’re like, “Oh, I own a 63 unit self-storage, I get all the profit.” But dude, it sucks if you’re doing all this on your own, it’s less fun, it’s so much pain. Everybody’s asking you for something all the time. When you spread the risk it’s just way better.

Ashley:

I have to 100% agree with you today while I’m recording podcasts, which I love to do. My business partner Darrell was out at the lake house where we’re buying and getting with the inspector getting this section done. And for me that is not something I enjoy standing there waiting for the inspector to be done, small talking a little bit with the seller, that’s things he loves to do. So you’re exactly right, it makes it way more fun doing it with somebody else. And especially when they enjoy the things that you don’t want to do.

Nate:

I hate calling people. I think it’s the worst thing ever. I just don’t like talking to people, even though I’m a very social person. So I have a partner who has no problem with it, I’m like, “What do you mean?” He’s like, “I’ll just pick up the phone from people.” And that’s the weirdest thing to me, but I’m so blessed. Thank you Alex, I love you, that he’s taking care of this for the business because there are things you’re good at. I think I’m good at the learning about real estate side and there’s some things my partners are good at, like calling customers who won’t pick up the phone and calling them five days straight, stuff like that, so I’m very thankful for them.

Tony:

So Nate, I want to talk a little bit more about the analyzing piece. So you talked about how you guys stumbled into this one and a little bit of the educational piece. You’ve talked about maybe 1031-ing wanting this property into something larger. So it makes me wonder, what is your buy box for these self-storage facilities? What kind of boxes do you need to check to say, “Okay. This is a good investment for us our team.”

Nate:

So off of the first one, we didn’t really want to borrow anybody else’s money. We wanted to make sure that we could do it all on our own. So we had a half a million dollar was the max price. We wanted it in an area that had at least a population of around 6,000 people, and there’s ways you can figure this out. How many storage facilities per a certain area does the area need to fulfill the demand? So that was another thing we checked out. I think this town is 9,000 people that we invested in and there’s four storage facilities. And if you can count up all the units under demand of what people need.

Tony:

Can you dive into that a little bit more Nate? What is an adequate number of supply given 9,000 residents in a city?

Nate:

So I’m not AJ Osborne, so please don’t quote me on this. But the way that it works is about… I think the recent numbers show that 10.5% of US households use self-storage, and there’s about two to three people per household. You can look that up in the county website, how many people per household on average is there in the city? So if you think there’s about a 10.5% need for how many households, you can divide it and say, “Okay, how many storage units are there available?” And if it’s under what the demand shows you can start up a storage facility in there. If it’s way over and there are some cities like small towns that have… I’ve seen towns with, “It’s a 300 person town, I have a 400 unit storage facility.” I’m like, “I don’t know if that’s going to work.”

So that’s some way to look at it is because it’s like this is a business. It’s more of a business than rental properties I think, even though obviously rental properties is a business. But it’s a real business, you’re on Yelp, people are looking you up on Google reviews. You need to make sure there’s actual demand there. And another great way to look at this is because ours wasn’t online, nobody knew it existed. We looked at all the other facilities within a 10 mile radius, every single one was booked minus a parking spot here, a one unit there. That shows you already that if everything’s filled to the brim in the area, there’s probably a good chance that other people want to get in. Especially, if you can call other places and they say, “Oh, we already have a 10 person waiting list, so you have to get on it.” 10 people, those are my 10 customers. Let’s go. There’s a few ways to figure that out.

Ashley:

And Nate real quick, he mentioned AJ Osborne, who is the self-storage king. If you guys haven’t heard of him and you are really loving this episode with Nate talking about self-storage. So you can listen to AJ Osborne on the BiggerPockets Real Estate Podcast, episode 286. If you really, really want to dig into the mind of a self-storage genius and check that out.

Nate:

Aren’t you friends with him?

Ashley:

Yeah. Yeah. He is an awesome guy too. I plug him every single day. Not only as a great real estate investor, but just a really awesome person in general.

Nate:

All right. Don’t show him this episode in case I’m wrong.

Ashley:

You know what’s funny I was thinking as you were saying that, I was like you could probably give him the exact town and he’d like, “Yeah, that’s about-” He’d be able to throw off some statistics, just a random town in Alabama.

Tony:

Cool. Well, can we talk a little bit more about the marketing aspect. So I know you said that this place had no online presence whatsoever. So what has been the plan for you all to beef up the online marketing for the self-storage facility?

Nate:

So the good thing about this is I come from an SEO background, and now a kind of SEO combo copy writing background. My partner also comes from an SEO background where she worked at multi-billion dollar companies and knows everything about organic search. So basically, the way that we’re doing this now is obviously you get your Google page set up. You have to submit all the information about your self-storage facility to the billions of listing sites out there, so you’re on every single one of them. And we’ve just been doing that, we’ve been hitting all those listing services.

We’re going to start trying to get in reviews because you’re in short term rentals, you know this, it’s the biggest thing if you’re trying to make your business just grow out of nowhere. So we’re getting set up with Google Business, all the listing services, Yelp, SquareFoot, everything else like that. And then we’re going to start a referral program with the current customers, we’ll look at X percent off of rent in two months if they refer someone over and that person also gets X percent off. I think in these small towns referrals is way bigger than for us in big cities, so we’re going to push on all those angles. My SEO partner could go more into this than I can because she’s doing all of it.

Ashley:

How are you going to track those referrals? Is that something you’re manually going to have to track or is that built into the software?

Nate:

We can set that up with different UTM URLs and stuff like that, where we can set up different URLs that people come in from. So on Google Analytics or other analytics softwares like that, you can see which site someone came from or which code they used or which ad campaign they came from as well. Again, it’s a business, less of a rental property, so if you know your stuff it’s kind of helpful, which thank God she does.

Ashley:

So to wrap up the deal here what is your cash flow going to end up being here?

Nate:

I think if we do it right, we should be cash flowing somewhere between two and a half to $4,000 a month off of it, and that’s after the mortgage payment. So it’s pretty good for three partners as a split, especially if it’s 3k, it’s like a $1000 each, but it’s more important that we get the cash flow up so we can refi. Because this is a commercial loan they’re looking at income, we need to just show as much income as we can to get the value of the property up.

Ashley:

And what do you think that value is going to be after you increase the rent to where you want them for everyone? What do you think that value will be on them?

Nate:

Hopefully, low estimate around 500k, it could be anywhere from five to 600, if things go really well. But we always set up these parameters in our calculations where we have a worst case, okay and best case scenario. And I always look the worst case scenario, I’m like, “That’s the one.” So if I can at least hit that I’m doing all right.

Ashley:

Increasing a property value by 150k in a short period of time, that’s awesome, that’s great. That’s 50k in net worth for you and each of your partners.

Nate:

And it’s cool because the partners I’m working with no one’s really concerned about taking profits or spending any of this right now. All of us are just thinking, “Okay, we’re going to use this for the next one and then do that for the next one.” And then in about five to 10 years when we’re all like, I’m tired of working with you, “I’m done with this,” then we can be good.

Ashley:

Just sell it all cash out, take your money and run.

Nate:

Put it in REITs and then just go to sleep for a while.

Ashley:

Yeah.

Tony:

Well Nate, congratulations, man. It sounds like you got a pretty killer deal there and we’re excited to see how it turns out. And again, just before we move off of this, I think that’s obviously the big power of commercial real estate is that you do have the ability to manipulate the value of that property in a way that you can’t really with single family residential properties. Because your commercial properties are based off of your NOI, your net operating income, and then the prevailing cap rates, where other big properties are selling for and you divide those things, whereas your single friendly residences are all based off of appraisals. So if you can buy this property, increase the NOI by increasing the income, decreasing the expenses or some combination of both, you’ve just immediately increased the value of that property as well. So really, really love the approach there, man, and we’re excited to see where you take that one.

Nate:

I’m going to try guys. I’ll do it just for you two.

Tony:

All right. So I want to take us now to our rookie request line. So for those of you that are listening, if you want to get your question featured on the show. You can give us a call at 885-ROOKIE and if the question is a good one, maybe we’ll use it for the show. So today’s question Nate it’s actually about partnerships, which you just talked about. So are you ready for today’s question?

Nate:

I think so.

Tony:

All right. So today’s question is from Davidson D. And Davidson says, “Having multiple properties with the same partner, should it be one big LLC or multiple single member LLCs owned by a parent LLC that is then split 50/50? Thanks so much for your time.” So what are your thoughts on that Nate?

Nate:

It’s multiple rental properties.

Tony:

That’s what it sounds like having multiple properties with the same partner, how have you guys structured your legal setup with you and your partners?

Nate:

The way that we want to do it long term thinking is each property has its own LLC. We want to limit the way that people can go after us. I’ve listened to a lot of the what is it asset protection on this show and the other shows. I can’t say because I’m not a lawyer, but we’re going to set up each property in its own LLC. And then eventually when it’s probably worth over a million dollars worth of things, we’re going to try and put it in a trust as an umbrella for all those LLCs, and then one day do the, “That’s in Bermuda, you can’t touch me,” type trust.

So I think that pretty much is our plan going forward. It’s so cheap to file LLCs that if you feel like there’s even a smidge of protection extra that you’re getting, it probably makes sense to pay the 100 to $200 to just set up for each property. And then I think you may know this better than I do, is it easier on an accounting end because then you each have each entity instead of just this whole scrambled seven properties and one LLC, and all these expenses for different houses type thing.

Tony:

For me in California, it’s actually, I think it’s 800 bucks to open up a new LLC, and then the tax returns is only 1200 bucks a year. So it can get pricey, especially on smaller family residences if you’re trying to spring up an LLC for each one. But to your point I think everyone’s going to have a different risk profile. And if you’re you’re really concerned about potential litigation or protecting your assets, then obviously it might be worth that extra expense. But I think our approach moving forward is that we’ll have a collection of properties that fall under one LLC. So maybe five in this one, five in the next one and so on and so forth, and then eventually we’d like to put a trust in place as well.

Nate:

And then it probably also matters on how expensive the properties are, you’d probably not want three $3 million properties in the same LLC. But if you have five 50k properties, that’s probably fine, don’t quote me on that. I’m not the lawyer.

Ashley:

I want something that Tony said to be a reminder to everyone, how he said it costs $1,200 for an LLC tax return in California and to do his return. So I think a lot of people forget to actually add that into their numbers when they are doing a rental property. If you don’t do your own tax return and you are hiring an accountant out, if you get an LLC that’s a separate tax return you have to pay for, I think mine runs 250 to $300 per year, per tax return. But if I were to go and put an LLC on every single property, that’s $500 plus that $300 for the tax return. And if you are just buying a small single family rental cash flowing, maybe a 100 bucks a month, you have a mortgage on it everything, there goes your cash flow it’s gone, if you don’t remember to add in that accounting cost.

But for my partnerships, each partner I have an LLC with them and we put our properties and I think Nate’s point is very valid. I’m buying $50,000 properties, we’re throwing a bunch of them into an LLC and then it just depends on the equity split. So with one partner we actually have two LLCs, one, we are 50/50 each and the other one we are 60/40 each. And it just depended on the money that each we’re putting in and the workload that we were each taking on, that determine that we are changing some of the properties to that 60/40 split too. So I think there can be a lot of costs associated with having multiple LLCs. I actually like having more properties under an LLC, because if you are using bookkeeping software like QuickBooks, they charge you per an entity.

So if you have an entity for each property, you’re going to have to pay 50 bucks per month per each property that you have, where if you have the LLC with five properties in it, you’re just paying for that one QuickBooks file. So I think there’s definitely an advantage. And as far as asset protection liability, if you have mortgages on these properties and there’s not a ton of equity, there’s not $3 million of equity in the property, you don’t have a ton to protect anyways, if you only have $50,000 in equity in your portfolio.

I think that kind of plays into factor too, because no big time attorney hotshot is going to go after your LLC, if it only has $10,000 in equity. Nate, we’re going to go to our rookie exam and this one is special for you, we actually have four questions for you today. So the first one is the most important, which podcast is your favorite to copyright for of the BiggerPockets platform?

Nate:

It’s not a hard decision. It’s the new podcast On the Market, which you guys should check out. More people over there because it’s a really good podcast and Dave Meyer does a very good job talking about up to date information. No, Rookie’s a really good podcast. Every single time it’s good because you see people who are in the same situation as you. And it’s just good because sometimes you’re learning the same lessons over and over again, but with just a different flavor, so you’re like, “Cool. I won’t do that thing that that person did.” So I love the Rookie Podcast, but go check out On the Market, it’s a great podcast.

Ashley:

On the Market is such a good answer because I love it too, my friend James Daynard who’s one of the hosts on it and I’ve been listening to every episode, it’s really great. Especially, now with a lot going on in the market to stay informed.

Tony:

And in the economy.

Ashley:

Yeah. Okay. So the next question, what is one actual thing rookies should do after listening to this episode?

Nate:

Just talk about real estate more. I met my partner through work because I just talked about it a lot. I’ve had people offer me money because I’ve talked about it a lot. She’s had multiple people offer her, they’re like, “Oh, you did a self-storage deal. You don’t want money for the next one?” It’s weird just post on Instagram, even if you’re not that comfortable with it, post once in a while, talk to people at work, talk to family members, just talk to everybody. Because most likely someone might not even be thinking of it, but it might be able to change their life in a way that they can do something that they love, so just talk to people.

Tony:

Yeah. That’s fantastic advice Nate, love that, man. Ashley and I have preached the same exact thing many, many times in this podcast, so love that. All right. Question number two what’s one tool, software, app or system that you use in your business?

Nate:

Easy Storage Solutions, it’s pretty intuitive. I like it. I know there’s two big ones for storage, storEDGE, it’s something called storEDGE. And it’s called Easy Storage Solutions, those are I think the main two that people use. But if you’re trying to get into self-storage, watch some videos on that because when you get a self-storage facility, it’ll be way easier, but it just makes running everything really easy.

Ashley:

And Nate, the last question, where do you plan on being in five years?

Nate:

Probably with more storage units, hopefully doing less. My goal is to do nothing, not in a lay around all day thing, but really just taking your brain away from things that, I don’t know, just putting your brain to the best use possible. And I feel like if you invest in real estate and you like investing in real estate and solving these fun financial problems that are fun for you. Buying more real estate probably will give you more energy than taking away from it even though it’s work. So hopefully with more units, hopefully doing less, maybe with a gator farm in Florida, who knows. We’ll see.

Ashley:

I can’t wait to come visit that.

Nate:

Yeah. Please.

Tony:

Yeah. I’m excited too, man. All right. Before we close this out, I just want to highlight this week’s rookie rockstars. So again, if you would like your story featured on the show, get active in the Real Estate Rookie Facebook group, which honestly one of the most active, the most engaged Facebook groups out there. Get active in the Real Estate Rookie forum on BiggerPockets, there’s a wealth of knowledge.

Almost any question you can think of asking has probably been answered somewhere at some point on the BiggerPockets forums, but today’s rookie rockstar is Andrew White. And Andrew says, “Started last week on our most ambitious project yet. This will be our fifth property in our fourth Airbnb, it’s a 1930s historic build in San Antonio, Texas. The plan is to Air-BRRR-nb this property and it’s a doozy.” Almost 4,000 square foot main house with five beds and four baths, as well as a two bed, one bath casita, so seven bedrooms in total, but they purchased it for 265,000.

They’re planning a whopping $210,000 for the rehab, and the ARV is projected at 70 or I’m sorry, $700,000. And then they did a cash out refi leaving about 10 grand into the property. Right now the monthly revenue is about 11 grand a month and they’re cash flowing about 5,100 bucks a month, which gives him a crazy cash on cash return of 660%, which is-

Ashley:

Wow. That’s awesome.

Tony:

Pretty solid.

Nate:

Get Andrew on the show. Why am I here? Drew’s killing it.

Ashley:

Well, Nate, thank you so much for joining us, really enjoyed hearing about your Rochester property and the self-storage. Can you tell everyone where they can reach out to you and find out some more information about you?

Nate:

Sure. If you have any organic content SEO copywriting needs, you can go to calicocontent.com, that’s calico like the pirate or the cat, calicocontent.com. Or you can email me at [email protected] You can also find me on Instagram at natelikesmoney, that’s actually my handle.

Ashley:

That’s a good one. I like that.

Nate:

Yeah. So that’s basically it.

Ashley:

Well, thank you everyone for joining us this week. If you love the podcast, please leave us a five star review on your favorite podcast platform and check out our YouTube channel and make sure you are subscribed at the Real Estate Rookie. My name is Ashley Kehr at WealthFromRentals and he’s Tony Robinson @TonyJRobinson on Instagram. And we’ll be back on Saturday with a rookie reply.

Band:

(singing).

Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Check out our sponsor page!

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.