Single Women Are Buying More Homes Now Than Ever

Sponsored

Single Women Are Buying More Homes Now Than Ever Read More »

Sponsored

Single Women Are Buying More Homes Now Than Ever Read More »

Bank of America Securities research analyst Mihir Bhatia joins ‘Power Lunch’ to discuss how much mortgage volumes will fall, if Bhatia’s coverage universe can survive a fall in mortgage volumes and which companies have advantages in this environment.

As I begin gathering my thoughts about what might happen next year, I like to look back at my predictions for the previous year to see how I did. It’s useful to look at what I got right and learn from what I got wrong to become a better investor.

I’m not a professional forecaster and don’t maintain my own economic models. But as an analyst and an investor, I do study tons of data to form a thesis about what is likely to happen in the coming months and years. The point is not to get it all right—that’s impossible. Data is backward-looking, and we can never say for certain what will come next. The point is to understand the most likely scenarios and to form a thesis about the economy that enables confident decision-making.

I create a lot of content and update my thesis regularly when new data emerges, so I don’t have one concrete “prediction” from last year, but let’s look at some of the themes that made up my 2022 thesis.

In January 2022, I wrote, “I don’t think the dynamics of the housing market will change too much in the coming months. Demand is still strong, supply is still incredibly low, and prices will likely keep going up…Ultimately, what happens in the second half of 2022 is more of a question mark for me. My estimate right now is that cooling will drop year-over-year appreciation to 2% to 7% appreciation rates by year-end.”

A major part of my thesis last year was my strong belief that 2022 would be “a tale of two halves” for the national housing market. We knew the Fed wasn’t going to start raising rates until March, and I felt that given the seasonality of the housing market, price appreciation would peak in Q2, and then the second half of 2022 would see cooling.

Overall, I think I nailed the timing of the market shift. It looked like home prices in many markets peaked in June (while others are still growing), and are now seeing month-over-month declines (which is different from year-over-year, which is how I made my prediction). The shift happened right at the halfway point! The most recent weekly data from Redfin shows year-over-year appreciation at around 6%, which is right in range, but we’ll just have to see if I was right about 2-7% by the end.

In November of 2021, I wrote, “If rates rise quickly, it could cause a shock to the system, and housing prices could slide backwards. But, the Fed is not likely to do that. They will likely try to raise rates as slowly as possible to allow economic expansion and wage growth to counteract the impacts of rising rates. This is what happened post-Great Recession, which was one of the strongest periods of property price growth in American history—despite rising rates. That said, if inflation stays high for too long, or even starts to accelerate, the Fed could be forced to raise interest rates faster than they want to, which could hurt housing prices.“

I think I got the logic here right, but with a caveat (more about that below). I believe the Fed’s intention around the end of 2021 was to follow their old playbook from post-Great Recession and raise rates slowly. I believed that because they said that’s what they would do!

This wasn’t exactly a hot take. But, I did recognize the very real chance the Fed could be wrong about inflation, and they could be forced to break from its post-Great Recession playbook and raise rates rapidly. And as we all now know, that’s exactly what happened.

Although I recognized the Fed might be forced to raise rates quickly, I’ll be honest, I did not think interest rates would rise as quickly as they did, as much as they did. I thought supply-side improvements would help moderate inflation sometime in Q1 or Q2 of 2022 (even though increased monetary supply and strong demand would keep inflation relatively high), and then the most likely course for the Fed was to follow their 2009 playbook and raise rates gradually.

But that’s not what happened. Instead, lockdowns across the globe persisted, and the Russian invasion of Ukraine caused even more supply-side issues. These events, coupled with the increased monetary supply and strong demand, sent the CPI higher than I believed it would go. It remains stubbornly high today, and mortgage rates are hovering around 6.25% as of this writing.

About those mortgage rates, that’s where things went off the rails for me. On November 21, 2021, I posted this on Instagram (I’m @thedatadeli if you don’t follow me):

Wow. It burns my eyes just looking at that. When I can’t fall asleep at night, it’s this post that haunts me.

To be fair to myself, this was posted before the Fed announced three rate hikes in 2022, and we were flying blind, but I figured I’d give you all a good laugh at my expense. And, at least I was very slightly less wrong than Realtor.com, CoreLogic, and Redfin.

But to be honest, even once the Fed announced three rate hikes in 2022, I still didn’t think we’d have rates as high as we do today. I figured we’d still end 2022 somewhere around 5%. Given that rates are around 6.25% as of this writing, I think it’s safe to say I missed badly on this one. I knew rates were going up to a more ‘normal’ level, but I just didn’t think the Fed would be as aggressive as they have been. I expected inflation to come down sooner, not because of Fed action, but because the supply chain would open up. That didn’t happen, and the Fed is going full throttle on rate hikes with limited success in containing inflation so far.

Given this, I see more downside risk in the national housing market than I did at the beginning of 2022. The decline in affordability accompanying this rapid rise in rates will weaken demand and put downward pressure on prices. It’s hard to say what will happen from here, but I still believe that a “crash” (20% decline or more) is not the most likely scenario on a national level, but some markets could see crash-level declines.

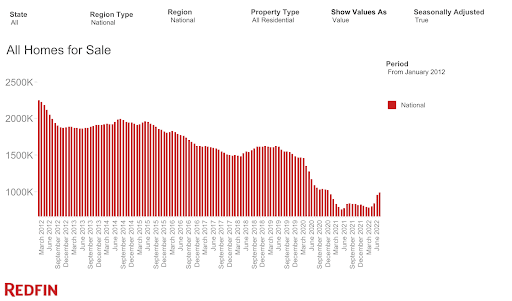

When we entered 2022, inventory (the number of homes on the market at any given time) was historically low. When inventory is super low, it signals a seller’s market that is likely to see price appreciation. And sure enough, that’s what we saw in the first half of 2022.

I knew that as rates rose, affordability and demand would fall, typically sending inventory upward. But inventory is not just about demand. It’s also about how many homes are listed for sale. There’s a lot of seller psychology to account for. Most people don’t want to sell their homes for a loss, so in a correcting market, many sellers opt to wait out the correction. I wrote about this idea in May if you want to understand more.

I honestly wasn’t sure what would happen in the second half of 2022, which is why I considered it the X factor that would ultimately determine if the national housing market remained slightly positive or skewed negative by the end of the year. I landed on the side of “slight modest YoY appreciation” because I was skeptical we would see inventory hit pre-pandemic levels, which turns out to be correct. Whether my price prediction is correct remains to be seen.

But the simplicity of this national-level chart betrays what’s really going on in the market—the housing market is splitting. Different metros are seeing very different inventory dynamics.

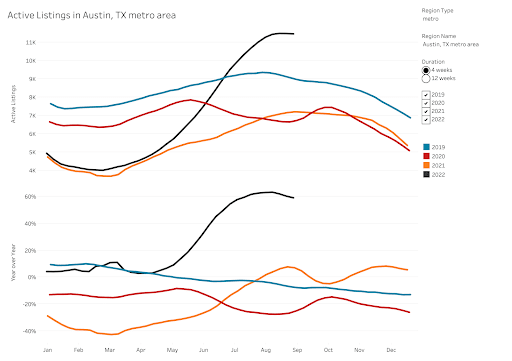

Just look at the difference in Active Listings between Austin and Boston.

In Austin, Active Listings are up 60% YoY, which indicates a rapid shift from a seller’s market to a buyer’s market. Pretty easy to see prices coming down in Austin.

On the other hand, we have Boston, where active listings have been declining! Still a seller’s market here. Prices could still moderate, but on a much smaller scale than in Austin.

So inventory really is becoming a major X factor! We’ll still have to see this all play out, but it’s definitely the number one thing I’m watching these days.

Given the complexity of the economic climate in 2022, I think my thesis has held up pretty well so far. Of course, I wish I wasn’t so far off on mortgage rates, but as I said above, the point of developing an investing thesis is not to be right about everything. It’s about formulating an educated understanding of the market that helps you make informed investing decisions. In that respect, I’m pleased with my 2022 thesis because my overall understanding of the market was good and allowed me to make solid investing decisions.

I locked in low-rate financing on long-term fixed-rate loans, dove more into large multifamily investments to take advantage of long-term supply constraints, and underwrote deals with little to no market appreciation in the next few years, just to be conservative.

As we approach another year of uncertain economic conditions, I encourage you all to start thinking about your investing thesis for 2023. Take the time now to take stock of the economic climate and the shifting market dynamics. Think about what might happen in your market in the coming year and how you can make strong investing choices given the realities on the ground. What will high rates do to inventory in your area? What asset classes will offer good returns? How do you protect yourself from a potential rise in unemployment rates?

You shouldn’t be scared of these conditions just so long as you’re prepared for them. There are always deals to be had. You just have to adjust your thesis to fit the market. To learn more about analyzing deals, be sure to check out my new book Real Estate by the Numbers here!

Run Your Numbers Like a Pro!

Deal analysis is one of the first and most critical steps of real estate investing. Maximize your confidence in each deal with this first-ever ultimate guide to deal analysis. Real Estate by the Numbers makes real estate math easy, and makes real estate success inevitable.

I’ll share my 2023 thesis with you all soon.

In the meantime, I’d love for you all to join me in this exercise in the comments. What did you get right about 2022? What did you get wrong? Let’s all share and learn together.

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.

Alexander Goldfarb, senior REIT analyst at Piper Sandler, joins ‘Power Lunch’ to discuss how to look at opportunities in the REIT space, why the single-family REITs are outperforming multi-family REITs and more.

The affordability of the Sun Belt cannot be overstated, says Piper Sandler’s Goldfarb Read More »

College isn’t the only option after high school. In fact, it’s not even the best option. Typically, twenty-two-year-olds fresh out of college are launched into the workforce with a lot of debt and little life experience. So how do you enter the workforce debt-free with life experience? Join the military.

Today’s guest, David Pere, is a financially free veteran with 100 rental units, all thanks to his time in the military. He enlisted fresh out of high school in 2008. While he did the usual “stupid young guy stuff” for a few years, once he read Rich Dad Poor Dad in 2015, he decided to get serious about financial freedom. After thirteen years of active duty, in 2021 he was honorably discharged with a net worth of a million dollars.

The military offers various benefits, from the ability to learn trades to getting life experience to its financial advantages. As a service member, you are in an ideal position to become financially free. Your housing and food get paid for, and you have access to government-backed savings plans and loans. You also get tuition assistance for yourself and your family. With all the support and benefits the military provides, you can start building the life you always dreamed of straight out of high school.

Mindy:

Welcome to the BiggerPockets Money Podcast show number 337, where we talk about why the military is the best job straight out of high school.

David:

Not to talk smack about the college world, but you take a kid fresh out of college, let’s put him in the Harvard MBA program, right? Like top-tier, fresh out of college, never had a job before, but this kid is brilliant. And you throw him against an infantry guy who’s never done a thing in business. And I’m not going to say that the Harvard guy won’t win, but I will just say that the decision-making power and the ability to make those decisions under pressure, you don’t know how you’re going to do until you get into some of those situations. And so there’s something to be said for being in those kinds of situations that transfers into life. People crack under pressure. It’s nice to have an opportunity to learn that before you’re playing CEO.

Mindy:

Hello, hello, hello. My name is Mindy Jensen and joining me today is my military expert co-host, David Pere.

David:

What’s up Mindy? How are you doing today?

Mindy:

David, I’m doing really good. I am so excited to talk to you about all the things. But before we do, David and I are here to make financial independence less scary, less just for somebody else. To introduce you to every money story, because we truly believe that financial freedom is attainable for everyone, no matter when or where you’re starting.

David:

Whether you want to retire early and travel the world, go on to make big time investments in assets like real estate, or start your own business, we’ll help you reach your financial goals and get money out of the way so that you can launch yourself towards your dreams.

Mindy:

Ooh. That was a good radio voice, David. Okay, David, when we were discussing this episode prior to hitting record, you came up with the title, “Why the Military is the Best Job Straight Out of High School. And you had a really great reason to back up your statement. What is that?

David:

Well, there’s a lot of reasons and I could argue this back and forth, but the overarching theme is, would you rather be 22 years old, a $100,000 into student loan debt, no life experience outside of school and looking for your first job? Or 22 years old, four years of life experience outside of school, also a degree, no student loan debt and a four year employment history with an honorable discharge to back you up to a new employer?

Mindy:

Okay. That sounds a little bit better than the $100,000 in student loan debt. Okay, David, I want to get a bit of background about you for anybody who is unfamiliar with your situation. What is your military background and what is the financial situation when you go into the military? What does that look like typically?

David:

Yeah. I joined the Marine Corps in 2008, right out of high school. Not because I had these grandiose streams of becoming rich, but because I wanted to get out of Arkansas, didn’t have money for school and didn’t like school. So I was like, “I want to travel the world. This sounds like an adventure.” And for the first seven, seven and a half years that I was active duty, I made all the normal Marine Corps, stupid decisions or military or just young guy. I blew all the money on tattoos, cars, Harley, rifles, women. I mean, you name it. The money that came in went back out. Alcohol. That was in there too. So it is what it is. And in 2015, somebody handed me the book, Rich Dad Poor Dad and I read it and was like, “Oh, this is cool.” And then as I was trying to research, I was reading more books and learning more about real estate.

Actually, that’s how I found BiggerPockets. Because every time I’d Google a question, BiggerPockets would come up with the answer. And so then I read book on managing rental properties, a book on investing in real estate or rental properties, all the things. Bought a duplex, house hacked, and was like, “Oh, this is cool.” So that was 2015. And in 2021, I left the military after 13 years active duty as an enlisted Marine with a million dollar net worth, financial freedom and over 100 rental units. And basically at this point, I’m kind of like, all right, cool. Well, I’m going to talk to other service members about how to build wealth, because I think they are uniquely positioned to do so. And a lot of them just don’t understand.

Mindy:

I think this is really important to highlight. You just said you left the military as a millionaire with over 100 rental units and a bunch of other stuff that I can’t remember, because I’m stuck on those two. That’s not your typical exiting the military financial position, right?

David:

No. Absolutely not.

Mindy:

But then you also said the military members are uniquely positioned to do exactly what you did and you messed it up.

David:

Oh yeah.

Mindy:

You didn’t even do it right until 2015, you messed up a whole bunch of stuff. Imagine what you would’ve done if you would’ve been listening to the BiggerPockets Money podcast when you first started and you learned of all these amazing things, you could be a batrillionaire right now, David.

David:

Well, a prime example is that currently I have … Well, it’s dropped. When I did the math, I had $120,000 in my thrift savings plan. I currently have like 96 or 97, but it’ll go back up. But that 120, when I did the math, would’ve been worth closer to 300 had I just known which fund to put the money in. I had it in the wrong fund. I had it in basically bonds. Government backed securities. And so from 2008 to 2015, when I realized that mistake, which was basically every year during that period was a 10 to 30% return on the stock market. I was invested in government backed securities and I was contributing and doing all the right things that if I had just known which account to put the money in, it would be almost triple the value that it is currently.

Mindy:

Wow. I think that’s something that isn’t unique to the military. I think that’s something that when somebody decides that they want to open up and account, an IRA, a 401(k) or Roth IRA, whatever they’re doing, they put money into the account. I’ve had people ask me, “Well, I put money in so I’m invested, right?” Did you direct where that money should go? You have to direct where it goes and then they go back in and they’re like, “Oh, for the last year it has been sitting in cash. I have no value other than what I put in there. I missed some gains.” You could say that you missed some losses. I am not going to even get into the timing the market versus time in the market.

For that, you are going to go back to episode 335 with Jesse Kramer and Carl Jensen where we talk about timing the market and how basically, long story short spoiler, it’s a bad idea. But time in the market is very important. Because you brought up the TSP, let’s talk about that. The TSP for somebody like me who is not in the military and doesn’t really know what I’m talking about with regards to the TSP, that’s like the 401(k).

David:

Yeah, absolutely.

Mindy:

Same contribution limits that I have. So why is the TSP so great if it’s just the same as my 401(k)?

David:

I mean, the main reason is that now when you join the military … For the record, now when you join the funds go into a life cycle fund instead of the government backed security. So you’re already in a better spot. But currently with the new retirement, as of 2020, the military will match 5%. So I think if you’re in the military, the reason it’s better is that you’re going to get a 5% matching contribution, which means if you contribute 5%, it’s an instant, guaranteed 100% ROI on day one, as well as a pay raise. So if you’re in the military, that’s why I say at least the 5% in the TSP before you consider anything else. But I think the more the merrier. I mean, there’s a few things here and there, but they’re so similar. The biggest one is just the fees.

I think most of the funds are between 0.4 and 0.5% fee annually, which is really low. So that adds up very quickly. And then there’s a couple of other things here and there that I’m sure are super nuanced. But the biggest one outside of that is that if you’re in the military and you go to a combat zone, your limit as of 2022 is not 20,500 for the year, it is 57,000 for the year. And so you could go to a combat zone and you are taking your tax exempt cash and you stuff it into your Thrift Savings Plan, you could put $57,000 away this year.

And by the way, if you do that in the Roth, because with the Roth, you pay the taxes up front and not on the back end, well, your pay is tax exempt so you do not pay the taxes on the front end because that pay is tax exempt, you’re in a combat zone. You do not pay the taxes on your earnings when you pull it out because it’s a Roth. And so it’s the life insurance argument for triple tax exemption, same thing except better returns and you’re not life insurance. So I love it.

Mindy:

Okay, hold the phone. I liked the 5% employer match because there’s a lot of people who are … I call it an employer match. I shouldn’t. I should say 5% government match, but the government is your employer, so we’re going to call it the employer match.

David:

Yeah.

Mindy:

You just said that if I am in a combat zone, which does happen from time to time if you’re in the military, unfortunately, you can put up to $57,000 into your TSP. Whereas my 401(k) is still 20,500. Actually mine is 27,000, because I’m over 50 this year. But 20,500, if you’re not over 50, an extra 6,500 if you are. But if you’re in the military at any age, that’s not over 50, that’s any age, 18 years old going into a combat zone, you can put in $57,000 into a TSP, which they have a Roth option. And if you listen to this show, you will hear Scott Trench talk about how much he loves the Roth option. I love the Roth option. Holy cow, that’s almost Peter Thiel Roth winnings.

David:

Yeah, it’s crazy, right? I see the wheels turn. Imagine if you deployed five times and each time you were able to put anywhere near that. Now that being said, a new enlisted service member is not going to be able to put $57,000 into the TSP, because that would be like 120% of their base pay. Because you can’t make the deposits off all of your benefits. It has to be out of your actual paycheck.

Mindy:

Okay. That’s fair.

David:

There are definitely people who can. And realistically, even if you only put 25,000 in, that’s still 4,500 more than you would be able to outside of the combat zone. And the only thing I would disagree with you on that you said, and I don’t know that I speak for all service members on this, but I speak for at least some, is the word unfortunately that you used around combat zones because there’s a large amount of us who join and that’s like the itch. It’s like, “Send me. Put me in coach, put me in.” Obviously there are not always desirable outcomes from that, but-

Mindy:

That’s the unfortunately that I’m discussing is the undesirable outcomes when you don’t come back. That’s pretty sad. Okay. I’ll give you that. Everything else, that is pretty flipping amazing and I will go ahead and say that you have proven your point that the military is the best job straight out of high school. Now, for those of us who haven’t been in a combat zone, when I go there, the military pays for everything, right? I’m not paying for my own food and housing. So I could conceivably put all of my money in there.

David:

Oh, there’s a lot of crazy options. There’s also an SDP, Saving Deployment Program, which I did. Or Saving Deployment Plan, something like that, which is a government backed, 100% guaranteed, 10% ROI savings account that you can direct your paycheck to, but you can also fund with the stroke of a check. And up to $10,000. So if you had 10 grand in a bank account and you deployed, on day one, you could transfer the $10,000 into the SDP. You would’ve a government guaranteed 10% ROI. So it’s basically a 10% bond. And then when you leave the combat zone, you pull it back out. And so there’s a lot of very interesting things. And to make it even more interesting, combat zone doesn’t necessarily mean I might drive over a bomb or a spicy road bump as I like to call them. It could mean Kuwait.

Kuwait is not an area that is currently under any attacks, but it is in a area that is close enough that you could get called in and so while at Kuwait, you rate combat zone tax exemptions. And so there are locations and periods of time where you rate that. In fact, and don’t quote me on this, but we mentioned Doug. I believe sub-mariners rate that pay depending on which sea or gulf they’re in. So there’s a lot of very interesting situations where you might earn that. And then even crazier, while you’re earning the zone tax exemptions, you’re also getting hazard duty pay. So you’re getting a pay raise. And there’s other things that go into that. But yeah, your chow hall’s covered or you’re on MREs. I mean, while I was deployed … This was not while I was making good decisions. I did the SDP and I did increase my TSP contributions. But then in seven months I had like $17,000 of pure pay or left over even after buying basically just protein powder and supplements and cigarettes and whatever else while I was deployed.

Mindy:

It feels like we could talk about combat zone benefits forever, but I’ve got other things that I want to talk about. I know you have a website where you talk about all things military and money. Do you have an article or something about the benefits of combat zone pay?

David:

I do.

Mindy:

Okay. We will include a link to that in our show notes, which can be found at biggerpockets.com/moneyshow337. David, what is the name of your website? What is your URL?

David:

Frommilitarytomillionaire.com.

Mindy:

Frommilitarytomillionaire.com. Okay, great. And I bet there’s a ton of really great articles. I do have to confess, I haven’t spent a lot of time there because most of them don’t apply to me. And I think that’s really important to note. This super awesome Roth TSP with the $57,000 limit, I’m not eligible for. Now that I’m 50 they’re never going to let me join the military. So you really do need to get in there a little bit sooner. Let’s talk about some of the other benefits. I think one of the most well known benefits of the military service is either the VA loan or the GI Bill. So pick one and we’ll talk about that next.

David:

Let’s go GI Bill first so that your listeners stay paying attention because the VA loan’s where the real goods are.

Mindy:

Okay. So the GI Bill, when we were discussing this before we hit record, I said, GI Bill and you said, yes and there’s tuition assistance. I thought that’s the same thing. Can you please clarify the difference between GI Bill and tuition assistance?

David:

Yeah. And just for sake of clarity, I’ve been out of the military for a year so some of the amounts have probably changed, so I’m not going to speak specific dollar amounts. So don’t cite me on that. But I want to say it’s like six grand. That’s what I think it was. But tuition assistance covers school while you’re in up to, I think it’s $6,000 a year. And there’re stipulations. You can take two classes at a time. You have to pass them. If you fail one, then you might have to do some remission to be able to be eligible or you have to pay it back if you fail. There’re some things. But if you pass your classes … And I say this, I have a couple of friends who’ve done this. So I have an associate’s degree that I did with tuition assistance at nights while in the military.

But I have friends who have their bachelor’s, their master’s. I have a friend who has a doctorate degree all paid for by tuition assistance without touching a dollar in their GI Bill. So my example, I have the associates and I stopped there because well, I hate school and was like, “This is just a waste of my time for what I’m actually doing in life.” There’s no degree that says real estate investing, although my associates is in real estate studies, which is nothing more than what I needed to be an agent so a total waste of time. I digress. I have the GI Bill still. Zero usage. And I have transferred a percentage to each of my kids, 1%. So that down the road, depending on which kid goes to school, I can give them the GI Bill or I could use it myself now that I’m out.

So if I wanted to go back to school, I could and it’d be covered. If I give it to my kids, it’ll cover one of their schooling or half of both of their schooling. I could give it to my wife. I mean, there’s a lot of cool options. So yeah, theoretically, if I stayed in for 20 years, I could’ve earned my master’s degree and still given my GI Bill to my kids.

Mindy:

You seemed to make a very distinct point that you had transferred 1% to each kid. Is that something you have to do before you separate from service?

David:

Yeah. You have to do it at a reenlistment after eight years, which is where I got hosed, because it’s not clearly articulated. So when you reenlist, basically they were like, “Do you want to transfer your GI Bill? Or do you want to keep it?” And I was like, “Eh, I’ll keep it.” I was like, “I can transfer it later, right?” “Yeah, you can transfer it later.” Wrong answer. You have to do it during a reenlistment. Unless if you’re a commissioned officer, you have to do it with four years left on your obligation. But if you’re enlisted, you have to do it at a reenlistment because you have to have four years left. It’s a retention bonus or retention incentive. Which I actually disagree with the way that it’s handled because I did 13 years and wasn’t going to be able to transfer it without going into the reserves.

But what really happens is you hit that eight year mark, you reenlist, what you should do is you should transfer 1% to anybody you would ever want to allow to use your GI Bill. Your wife, your kids, your dog, whatever. And once you transfer a percent, then you can go in the system and you can tweak that percentage at any time. So if one of your kids goes to school, you can say, “Yep, they get a hundred because the other one didn’t.” Or, “50/50 because they’re both going to school.” Or, “Neither of them went to school so my wife gets it all.” Or whatever. But if you don’t make that change, then you’re going to have to wait until the next time you reenlist to transfer. And if you don’t reenlist again, then you will not be eligible to transfer it because it is a retention bonus. So play the game right. Transfer 1% and then you can adjust allocations down the road because you earned it.

Mindy:

Okay. And that also sounds like you could go into a great bit more detail on your website. Have you made a video about that? Is it in your book?

David:

Yeah. There’s some information in the book on it. I might have an article or two on the GI Bill. It’s not exactly my expertise because I haven’t used it so I don’t know that I have anything super detailed on it. Although I’m thinking about using it because you can get a pilot’s license with it and that sounds fun. So depending on if my kids actually seem like they’re going to go to school, I might just use it.

Mindy:

Okay. Wow. You don’t even know what I’m going to ask you next. But that’s another financial advantage of serving in the military is the free skills you get. And the one that I can think of off the top of my head, the big one is the airline pilot skill. Because yes, you can go to airline pilot school. I have no idea about it. I’m not eligible to be a pilot because my eyesight is horrible. I’m not correctable to 20/20. I cannot see. They won’t let me fly and it’s been my whole life. So I found this out very early. I never looked into it. But I know it’s super expensive to go and learn how to be an airline pilot. It’s like hundreds of thousands of dollars or four years of your life in the Air Force. I mean they all have planes, right? Does the Army have planes?

David:

Yeah. They all have at least some equivalent. Well, I don’t need to be talking smack about different branches of the military, but let’s just say that there are branches of the military that are assumed to have more aircraft than others and that assumption’s not always correct, depending on how you think about things and what kind of aircraft you’re talking about. Like the Marine Corps has way more helicopters than you would ever know. The Navy has an exorbitant amount of planes. The Army is more helicopter and the A10 or whatever, but it varies. The Air Force is definitely the heavy mover logistics side more than the combat side for aircraft.

Mindy:

Okay. Oh, okay. Well that’s interesting. I didn’t know that either. So what are some other skills that you can get in the military besides the airline pilot, which you might use your GI Bill for, but could also have been a pilot if you-

David:

Yeah. I have plenty of friends who did that. In fact, I got a guy who I used to … When I was a Cub Scout leader for my oldest in Hawaii, I was the assistant den leader or whatever. And the guy who was the den leader, he was a Lieutenant Colonel. He retired and he flew the private jet for the general and he’d been a pilot his whole career and now he’s working airlines. So yeah, totally doable. I will say that being a pilot in the military is not necessarily the easiest gig to get into, but I do have a lot of friends who have done it and had successful careers in and out of the military. I think the intangibles honestly are better, but there’s so many … I mean, medical field. There’s doctors and nurses and whatever. That’s a good one. They’ve got Jags, like legal officers. The military goes and tries to poach law students and say, “Hey, we need Jags.” And so, you can get those for the doctor’s side. You’re learning all these skills in an area where you can’t be sued for malpractice. So there are benefits to that, even though the pay may not be as good.

I was a transportation logistics guy. I drove big trucks and did big picture logistics. I could do a lot with that right now. But I mean even infantry. You think infantry, oh, this sky learned how to shoot a gun so that’s not transferable. Maybe. I mean, yeah, you could do security, whatever, but the real benefits are the intangibles. You learn how to lead. You learn how to make decisions under pressure. You learn how to make decisions quickly under pressure. You learn how to be a critical thinker. You learn how to work as a team. You learn discipline and whatever. Those intangibles I think are actually what’s more important.

Not to talk smack about the college world, but you take a kid fresh out of college, let’s put him in the Harvard MBA program, right? Like top-tier, fresh out of college, never had a job before, but this kid is brilliant. And you throw him against an infantry guy who’s never done a thing in business. And I’m not going to say that the Harvard guy won’t win, but I will just say that the decision-making power and the ability to make those decisions under pressure, you don’t know how you’re going to do until you get into some of those situations. And so there’s something to be said for being in those kinds of situations that transfers into life. People crack under pressure. It’s nice to have an opportunity to learn that before you’re playing CEO.

Mindy:

That’s a really good point. That is. And I didn’t even think about that because I wasn’t in the military. I didn’t learn how to make decisions. Boy oh boy. You’re like, oh, take your four years out of the military and you’re right out of college degree. I’m like, oh yeah, I was trash when I was making decisions as a college kid.

David:

I went to Afghanistan when I was 20. I turned 21 in … Oh no. I take that back. I turned 21 four months after I got back from Afghanistan. And so the seven months that I did there and the things that I learned there, you put me against my friends from high school that were in college at that point in our lives, I don’t know that there’s anything they could have beat me on outside of math.

Mindy:

And that’s fair. And you know what? They’ll beat me at math too and I went to college. I have three college degrees and math is not in any of them.

David:

And not to say … Many of them are successful now. I’m not here to critique that. But some of them are still paying off their student loan debt too.

Mindy:

And I’m going to agree with you on this. At age 22, the fresh out of college kid is not … Fresh out of Afghanistan, I think you’re going to have a bit more backbone and forcefulness.

David:

And my intent behind us talking about this is not to be talking smack about college and saying if you go to school you’re terrible and you have to join the military. It’s just that I spent time as a recruiter in the military. So I hate the stigma that if you don’t go to college, you’re a failure. That idea that you have to go to school and that is the route. It’s not necessarily always the best route. And so I like to encourage other options. And I think that an option that allows you to travel the world, gain real world experience and go to school for free once you figure out what you actually want to learn … Because how many people change their major? Oh yeah, there we go. There’s a statistic that’s over 50%. I think it’s like 67% of people change their major and of that, 50 or 60% change it again. You don’t know what you want to do when you’re 18, 19 20. So why not spend a few years trying to figure that out in an environment where it doesn’t cost you a fortune?

Mindy:

Absolutely. I really like that. I’m going to throw you over to the episode number 44 with Tinian Crawford, Captain DIY. He got his associate’s degree in just six short years. For those of you who are unfamiliar, that is a two year college degree. And he uses 0% of it. He was not in the military. He was in college going and he’s like, “College just isn’t my thing.” And now he’s an electrician. He was working for college and then decided to go out on his own. And he’s like, “I have to block out time to have time for myself. Otherwise, I’m just busy all the time. I could work 24/7/365 and still be busy all the time.” And college isn’t for everybody. So what do you do if college isn’t for you? Well, maybe the military is for you. Here’s some more options. Here’s some really great options.

David:

Learn a trade.

Mindy:

Learn a trade. But here’s some really great life experiences that you’ll get while in the military.

David:

And while I made the joke about trade and we were talking about careers, and then we can pivot to the good stuff, the VA loan, all of those trades are available. You can do cybersecurity. You can do counterintel, you can do intelligence, you can do communications. But you can do plumbing. You can do electrical, you-

Mindy:

In the military?

David:

Yeah. We need plumbers when we set up a base. We need electricians when we run pretty much anything. They’re wire dogs. There’s water dogs, whatever. And in those occupations you can earn journeymen certificates while serving. So I have three or four journeymen certificates for various things while in the military through … I can’t remember the name of the program so I apologize. I think the certificates are actually in the closet back there. I’ve never used them because I don’t have a job, but you can earn those journeyman. So you could leave the military as a journeyman electrician with four years experience, no debt. And there are ways to really set yourself up for success. Yeah.

Mindy:

Wow. I didn’t even think of that.

David:

Yep.

Mindy:

Well that’s why it’s not the Mindy show today, it’s the David show. Okay. One last really quick question. When you go to Afghanistan, does your passport get stamped?

David:

Unfortunately, no. In fact, when I was stationed in Japan, I could not convince them to stamp my passport until the one time I flew back on my own for leave rather than on military orders. So the only two stamps that I have in my passport that is now expired and I have a new one, but the original passport, the only two stamps are Mexico when I was in high school and Japan the one time I flew home on leave. And I went to 13 countries in that first three years in the military. None of them are in my … So I’m like …

Mindy:

Because that would be a cool stamp. I’m not going to Afghanistan anytime soon. I’m not going to Kuwait. I’m not going to Iran. I’m not going to North Korea. I’m not going to any of those places because-

David:

I’ll never go back to Kyrgyzstan. Yeah.

Mindy:

That’s a bummer. Okay. Now to the VA loan. The [foreign language 00:28:26]. The big, big, big, big, big dog. The VA loan is amazing. And I’m a real estate agent. I was under misconceptions about the VA loan for the longest time until I met John Lallande. I believe he was episode 303 of the BiggerPockets Money podcast. He was my go-to lender forever. I met him through David because I was helping a veteran client, active duty military, active duty Marine client buy a house and he was using his VA loan. And as I was talking to John, I’m like, “Wow. Really? They can do that? They can do that?” I was writing up this contract and they paid $0 out of pocket. They got a check when they sat down at the closing table. After buying a house, they walked away with a check because of the VA loan. Let’s talk about the VA loan. Who is eligible for a VA loan?

David:

Service members and vets, federal employees.

Mindy:

Federal employees too?

David:

Sorry. No. That’s my bad. Service members and vets.

Mindy:

Okay. Well, but it’s more than that, right? If I sign up today and I’m in the military today, I can’t go and get it, right? There’s a-

David:

Yeah. There’s time requirements on that. And there’s a couple different stipulations, but the biggest one is 90 days on active duty orders before you’re eligible for the VA loan. So even a reservist, if you deploy for more than 90 days, you can then use it. If not, you got to wait the six years for the reserves. But if you’re active duty, within your first three or six months you could use it.

Mindy:

It and you have to be honorably discharged, right? You can’t use this if you’re dishonorably discharged.

David:

Yeah. If you’re big chicken dinner, as we call it, bad conduct discharge, or other than honorable … Or sorry, dishonorable. If you’re either of those, then you can’t use it. But if you’re other than honorable, general, or honorable, you could use the VA loan.

Mindy:

Okay. Why would somebody want to use the VA loan?

David:

Oh, I mean, why would you not? It’s the best primary residence mortgage in the market. I could go on and on and on about that.

Mindy:

Go on and on and on about that. Why is it the best primary loan residence? Okay. That’s a very interesting stipulation. Primary loan residence. So you, David, can use your VA loan?

David:

Yeah.

Mindy:

Okay. But you can’t use it on all of these rental properties that you’re buying?

David:

No.

Mindy:

Okay. So this is only for owner occupant.

David:

Yeah. It has to be owner occupant loan. And the word is intend to occupy and people like to misuse that and say, “Well, what if I just say I …” No. What it means is you intended to move into it. And then they understand if you have orders to Maryland and you buy a house 60 days prior to moving there because you can close on a house up to 60 days prior to occupancy, and then three weeks later, the military is like, “Ooh, Maryland. California.” And you’re like, “Crap.” Well, you already bought the house so you’re not going to be hosed because you got a change of station.

Mindy:

You did intend to occupy it. You didn’t buy it knowing that you weren’t going to move from your house down the street. That is not intending to occupy it. And I want to highlight, and John said on his episode, he’s like, “Look, mortgage fraud is mortgage fraud. And I will tell you that it’s mortgage fraud. And if you want to go out and try to explain to …” Did he say the FBI? It’s a serious deal. If you want to go and try to explain to the FBI why it’s not mortgage fraud, good luck. But you are not going to get any backup and you are not going to win.

David:

Yeah. It’s a felony charge. I think it’s a $10,000 fine and up to five years in prison or something like that. So what I always tell people is, look, there’s a million loopholes. There’s a million ways to skin this cat. There’s a million ways to get out of it or get around it or whatever. And you might not get caught. But people do get caught. And the reward of owning a house is not worth the risk of becoming a felon and spending time in jail when you could just do it the right way and still own a house. So it is what it is. In fact, I just made a post that’s getting all kinds of fire on my Facebook group because somebody basically messaged and said … Well, first they used the incorrect version of your and there so he’s getting ripped up for that. But he messaged me. It was on TikTok I think. And he commented and just said, “Can you teach me?” Or, “How do I ‘intend’ to live there?” Or something like that. The question do was basically how can I pretend-

Mindy:

How do I show intent?

David:

Yeah. And I responded with three words. You live there. That’s the way to do it. You actually move into the freaking house. Problem solved.

Mindy:

And that is for all primary residence loans. That’s the conventional loan. That’s the FHA loan. And that’s the VA loan. If you’re trying to get a primary residence loan, you are saying that you are going to live there for 12 months. If you are not going to live there for 12 months, if you have no plans to live there, you are committing mortgage fraud. Will you get caught? I don’t have a crystal ball. I don’t know. But like David said, it is not worth it. There are so many ways to make money in real estate. You should not be committing mortgage fraud.

David:

Yeah. And on the big picture, selfish thing, if enough people do that, there’s always the chance that the VA revamps their program and it’s not as good as it is now. So it’s not worth ruining the benefit. So to answer your question, I think the reason the VA loan is so incredible is that the guidelines are incredibly loose. The actual VA guidelines are very, very, very minimal for them to guarantee the 25% of the loan. And so it’s up to lenders. Most lenders have their own overlays and their own whatever. For a prime example, there is no minimum credit score requirement per the VA. So if you found a bank that would lend it to you with no credit score, like a zero, okay, the VA will guarantee it. You’re not going to find a lender who will give you a loan with zero credit score, but I’ve seen as low as 500.

Mindy:

That’s pretty garbage.

David:

Pretty significant.

Mindy:

Yeah. Okay.

David:

There’s not a 50% DTI cap. So I’ve seen somebody buy a house, a duplex in Venice Beach, a $1.93 million duplex that John actually did the loan on and he bought a … He house hacked it. His debt to income was like 76% and he got approved. Whereas you know with an FHA or conventional, once you hit 50, you’re done. That’s it. 49 is the limit. What’s another one? Oh, there’s no loan level pricing adjustments. So with an FHA loan or a conventional loan, your interest rate will adjust at 740 credit score, 680 credit score and 640 credit score. So somebody with a 739 credit score will have a lower interest rate than somebody with an 800 credit score. The VA loan does not adjust the first time until 640. So somebody with a 641 credit score using the VA loan will have the exact same interest rate as somebody with an 820 credit score, which is why the rates on the VA loans are often better because if you fall in that 640 to 740 window, every other mortgage product out there will have the adjustment for interest rate and the VA does not.

Mindy:

That’s interesting. I didn’t know about all of these. I knew about the 0% down, which you haven’t even mentioned yet, which is kind of like whatever. And I do want to circle back to the house hacking, but you have a no down payment loan. The only loan that I know of that is available to non-service members is the USDA loan, which is intended for rural properties. It’s an interesting kind of loophole to get a 0% down loan, but only rural properties qualify. But the USDA map doesn’t keep up with progress. So it’s entirely possible if you’re buying a new build in a place that had no houses three years ago, that could qualify for a USDA loan.

David:

It’s weird. And to my knowledge, the USDA still has MIP and PMI. I’m not 100% on that. But the VA loan does not have mortgage insurance premiums or private mortgage insurance at all, which is something that separates it from a 5% conventional or a three and a half FHA. Now, the one thing is the VA loan does a funding fee, which is rolled into the loan. So it doesn’t come out of pocket. It is 2.3% of the loan amount on the first use, and 3.6% on consecutive uses of the VA loan. So if you buy a $100,000 house, it’s 2300 added to the loan. I have a full breakdown on this, so I won’t go into super details, but it boils down to about $11 a month for every $100,000 you borrow. So if you buy a million dollar house, zero down, it’s about $110 a month that you’re paying for just that funding fee, which is peanuts compared to mortgage insurance premium and PMI. To put it in perspective, my $80,000 duplex, my first purchase with an FHA loan, my PMI was $81 on a $80,000 property.

So the math’s not even remotely close. And I will tell you, and I will argue all day about risk and opportunity cost and all of the other things. Putting 20% down to save that 2.3% funding fee will never win over putting zero down and reinvesting the 20% or putting zero down and having the 20% sitting in a bank account so that if something goes wrong, you have reserves. So I could go on and on and on and on and about all of those things but I like to say that, because everybody’s always like, “Oh, but the funding fee.” Yeah, it exists because it exists, but it’s still better than any other mortgage product with less than 20% down. And it’s better than putting 20% down.

Mindy:

So if I do use my VA loan and I put 20% down, there’s no funding fee?

David:

Yeah.

Mindy:

Okay. But on anything less than 20% down, there is a funding fee, which makes it sound like I should never put any money down and just pay the funding fee.

David:

Absolutely. Yeah. There’s very few times where I think it makes sense to put any money down with the VA loan, just because of opportunity cost.

Mindy:

I do know that there are some misconceptions on VA loan caps.

David:

They have the zip code caps. In January 1st, 2020, it went away on your first use. And then you can do a one time restoration if you sell your property. So that’s why that guy was able to buy an almost $2 million duplex, zero down while active duty. Because there’s no limit on your first time purchase, as long as you qualify for the mortgage. So if you’re buying a fourplex in San Diego County, you could buy $1.2, $1.3 million fourplex because the rent from the other units will balance out your debt to income and blase blah. After the first time use, then the limits come into play. And really it’s probably better if we don’t get down that rabbit hole so I’ll just throw this out there. The entitlement things for uses of the VA loan after the fact, I’ve seen someone buy four houses with the VA loan so it’s very doable. But what happens is that after your first use, the answer to all of your subsequent questions is it depends on your situation. And so it’s going to be 100% different for every single person. So go talk to a lender and give them your actual situation. Don’t come to me and be like, “Can I use the VA loan again?” Maybe. It really depends.

Mindy:

Okay. I am going to say yes to all of that, except I disagree with you on go talk to a lender. There are a lot of lenders who do great work. There are a lot of lenders who do great work and do terrible jobs with the VA loans because that’s not what they do all the time. If you want to get a VA loan, you need to speak with somebody who knows what they’re doing. I’m going to throw out a plug for Cross Country Mortgage. If you have a VA loan need, reach out to David, reach out to me, [email protected] I will connect you with them. I have somebody who can do a 17 or 21 day VA loan close. If you are familiar with the VA loan and you’re like, “Never going to happen.” Yes, it will. They’ve done three or four. I can’t remember how many military clients-

David:

I’ve seen them do 14.

Mindy:

Yeah, David’s done 14 with them. And when I say I, I mean my clients who were in the military. I’ve done zero. I don’t have VA loan entitlement. But I have worked with them and they have closed lightning fast. There are ways to do it. There are ways to take what, 45, 60 days to close on a VA loan? And that is never going to get you a property. That is just going to get you headaches.

David:

Yeah. Happy to make introductions to lenders or agents or whoever. I mean, we’ve got a pretty large network of people. And to just bring your point home, if you have an agent or a lender who’s telling you, the VA loan is not competitive in your market, then you need to just find a new agent and lender because they’re wrong. And I have data within my community to prove based on the amount of loans that I have seen done. I mean, John did $20 million worth of loans on his own for people in my Facebook group in just the state of California in 2021. In San Diego and Orange County. The hottest market in the country and the hottest market we’ve seen in decades. And you’re going to tell me, “Oh, you can’t use the VA loan in competitive markets.” Wrong. Your agent and lender doesn’t know what they are doing and you should change.

And just to the two biggest things that I hear outside of the funding fee are the inspection and the appraisal. And everybody’s always, “Ooh, they’re so terrible. It’s not going to get approved.” And blah, blah, blah, blah, blah. The inspection’s not that crazy. And the appraisal process for the VA loan, if you look at the national averages, on average VA loan appraisals come in higher than non-VA loan appraisals. But the appeal process is where it gets really crazy because you’re an agent. If you have an appraisal come in $40,000 low and you call that appraiser and you’re like, “Hey, here’s a whole bunch of reasons that we think you’re wrong.” Their ego gets involved. How often do you think they actually change their … I mean, it’s not very common for them to say, “Oh, you’re right. Yeah. We’ll give you the extra $40,000.” When you appeal with the VA, it doesn’t go to the appraiser.

It goes to the VA. And so there’s no ego involved and they will actually look at your data and go, “Oh yeah. You know what?” And then on top of that, if they say no, you can then go a third time and I’m drawing a blank on the organization, but there’s a third person that you can go to a third time and … And I’m going to mess up the specifics on this one, because I’ve not actually seen it done but I know it’s a thing. If all of that fails, there is a … And I’m going to call Chris and confirm exactly where this is so I can link to it in your show notes. But there is a way to essentially say, “Yo, this guy’s moving here in 30 days and if you don’t do this, he’s not going to have a place to live.” And they can rush order and you might even … I’m like that’s level four. So there are ways to get your VA loan bumped up, the appraisal, that there are not in other loans. So your appraisal process is actually way better with the VA loan. The inspection, okay, yeah, sure. It’s whatever, but it’s not any worse than the FHA loan.

Mindy:

It’s better than the FHA loan. I have two horrible experiences. One with the appraiser whose ego got involved. He’s like, “I’m not taking your additional data.” “What do you mean you’re not taking my additional data? I have all of these that prove that my property is worth way more than you’re saying.” And he’s like, “No.” Just refused. And it was a conventional loan. There was no appeals process whatsoever. And with the FHA loan, oh my goodness. The FHA appraiser is like, “Well, it’s fine at value as long as you do all of these things.” And I’m like, “All of those things? This is crazy. Okay, fine. We’ll do this. We’ll do this.” Some of them were legit. You have to have a smoke detector and a carbon monoxide detector on every level. Great. Three levels. Here’s three. I don’t care. There was an electrical outlet that was tripped outside. So we hit the reset button and now it works. And we had to find an electrician to come out to certify that the outlet worked, even though we made a video with a lamp plugged in and we’re like, “See, it’s on, it’s off. It’s it works.” And it was a nightmare.

David:

I hate that.

Mindy:

I really hate the FHA loan.

David:

I that so much because okay, you’re remodeling a house. If you had an extra smoke detector, does your value go up? No. So why are you hitting me on something that’s so stupid? It’s a safety thing and it should get pinged on the inspection as something to fix. Sure. But does a smoke detector affect the value of the home? Let’s be real.

Mindy:

She did take pictures as proof that the smoke detector was in there. I didn’t have to have some, I don’t know, smoke detector inspector come out. But it was so hard to find an electrician. All the electricians are like, “No, I’m not coming out there for that.”

David:

Yeah. Not wasting my time for that. Yeah.

Mindy:

Yeah. Finally, the buyer’s brother. She’s like, “Oh, my brother’s an electrician.” I’m like, “Get his butt out here to certify that this stupid outlet works.” It was a nightmare.

David:

Or just certify it and we don’t even care if he showed up.

Mindy:

Ooh. I would never put that in writing David.

David:

Not saying that’s the right thing to do. I’m just saying, hey, an electrical outlet that was a GFCI trip should not be a hit on your appraisal.

Mindy:

Shouldn’t. And with the VA loan, it wouldn’t be. My inspection process with the VA loans have always been very smooth. And when I was talking to John about what do I do if it doesn’t pass, he’s like, “Does it have an oven?” I said, “Yeah.” He’s like, “It’s going to pass.” He’s like, “It’s a nice house. If it was falling down, if it was a dump …” It doesn’t just have to have an oven, but there are parameters. They don’t want the service member to be buying a house that is a rat trap, infested hole. They want them to buy a nice house or a decent house. So there are minimum thresholds that they have to meet, but all of the houses I was selling were nice.

David:

Well, let me make the caveats and I’m going to go very, very brief, just overview of other things that are out there and not going to go into detail. And I’m going to tell you that the reason I’m not going into detail is because, again, these are very niche things where every single lending company is going to have a different way they do it, different things that they allow and don’t allow. And these aren’t necessarily the easiest programs to find. So I’m going to just keep it very broad. However, these are things that I have seen done personally. So it might not be the easiest to find a lender, but Mindy and I are happy to help you out with finding someone who does these things. The VA has a renovation loan. It is better than the FHA 203K. It is also zero down. It will do more than the FHA 203K.

And I’m going to just leave it at that because, again, every lender’s different, but I promise you it’s better. And I have a breakdown of that on the website. I can link that to you if you want. It literally compares. And it’s like VA wins. The VA has a one time use construction. You can buy a piece of land and new build with zero down with the VA loan. You can build a barndominium with the VA loan in doing that.

Mindy:

A what?

David:

Oh, you haven’t seen these things? It’s like the new trend. Barndominium. Basically, you build your house into a barn. So you build a 70 by 50 or 50 by 50 pole barn. And then you build your house into the back part. And the front part is … It could be a hangar for an airplane or your cars or your trucks or your tractor.

So it’s a big thing in Texas and states where people live on a farm and they’re like, “Well, I need a barn and I need a house. Why don’t I just put the house in the back half of the barn and build a really baller barn?” And the VA can build that. I mean, there’s stipulations on the construction type. And again, every lender’s different. But I know a lender who I have personally talked to who has done that for a client. So a lot of weird things that you can do with the VA loan, because again, the guidelines are pretty loose as long as you got lenders who are willing to … And they’re more willing to work with you because who’s guaranteeing the loan? Oh, that’s right. The government. All right. Pretty secure.

Mindy:

Wow. Okay. So yeah, there’s some pretty strict parameters. You have to be a vet or active duty, honorably discharged or not dishonorably discharged. And you have to live in it. It’s your primary residence. There you go.

David:

And you got to qualify for the loan.

Mindy:

Oh. And qualify for the loan. Yeah. I guess that’s a point an important fact too. But that seems really easy. So here’s some parameters that you have to follow. We didn’t even talk about house hacking, David. How do you house hack with a VA loan?

David:

I mean, the same way you house hack with anything else. You can buy a fourplex with the VA loan, you can buy single families with ADUs. One of my favorite ways, my buddy Rio did this and we should totally have him on the podcast to talk about this sometime because he’s just a cool dude. Him and his wife, they’re both awesome. Great people. John and I used to go to this house. We always joked that it was like the Playboy hangout. We would go to the house to … That was where we went to watch the Super Bowl. We’d have to set a curfew, be like, “Okay, John, we both agree that we will leave at this time no matter what.” Because otherwise you get sucked into partying all night. Great dudes. They’re entertainers. But he has a five bed, four bath amazing house, ironically on Players Lane.

I don’t remember the numbers, but that was the address in California. And it is right outside the main gate in a really nice subdivision. Like the kind of place that you have no business buying as a young service member. Single family, $600,000, $700,000 house that’s worth million, million two now. Three car garage. Just awesome. And he rented four of the bedroom. He was a single at the time captain. Now he’s married, but he rented four bedrooms to other lieutenants and captains who were single. He was making $1,000 a month to live in this house. Now that he’s moved out because he got stationed in Japan, he’s making $2,000 or $3,000 a month to live in this house. And by the way, all of his roommates are commissioned officers in the Marine Corps who are single, make good money, respect where they live, love to have a good time. There’s a reason that we always went over there. They had a garage that he turned into a gym. He had a room that he knocked a wall out of and turned into a pool hall. I mean, it was the coolest house you could possibly own as a young … At the time when he bought it, he was a Lieutenant. So pretty young in the military.

So there’s that. And then there’s fourplexes and everything else. I mean, anything you can do with an FHA or whatever. And just as long as you buy smart, house hacking is the best … I mean, I can go on and on. It’s the best way to start in real estate.

Mindy:

It really is. You cannot use the VA loan for an investment property, except you can use the VA loan for an investment property when you live in one portion of that investment property. So why not start your real estate empire with your VA loan, your 0% down VA loan and live on Players Lane?

David:

Yeah.

Mindy:

David, this was huge. This was so much fun. I learned so much about the military. I do believe you backed up your initial statement, which we said at the beginning of the show, the military is the best job straight out of high school. Please remind people where they can find out more about you.

David:

Pretty much any social media platform as either Military Millionaire or From Military to Millionaire.

Mindy:

Okay. And your website. Your website, your book, your podcast.

David:

frommilitarytomillionaire.com and we wrote a book. The No BS Guide To Military Life: How to Build Wealth, Get Promoted and Achieve Greatness.

Mindy:

Who’s we?

David:

Oh, me. I just try to not sound like an egotistical jerk. So I say we as if my team did stuff.

Mindy:

You wrote a book. You are a published author.

David:

Yeah. And it’s one of those books, I wrote it as everything that I wish I’d known the day I joined the military. So it’s kind of like a chronological order for if you were joining the military, here’s a book to hand someone and say, “Hey, if you do this, I can’t guarantee you’ll be financially free millionaire by the time you leave in four years, but I can guarantee you’ll be a lot better off than you would if you hadn’t read it.”

Mindy:

Why didn’t you call it everything I wish I had known the day I entered the military?

David:

Because The No BS Guide To Military Life is what the people voted for. I do almost everything via a poll and I have a very large Facebook group of service members and when I polled them on 20 different things, this was the clear winner so we went with it.

Mindy:

Okay. And what is that Facebook group called?

David:

Military Millionaire.

Mindy:

Military Millionaire. Is it? I thought it was From Military to Millionaire.

David:

I mean it probably shows up that way. The URL though is Facebook.com/groups/militarymillionaire.

Mindy:

Military Millionaire. Okay. Awesome. David, thank you. Oh, did you mention your podcast?

David:

I have one of those too. Military Millionaire podcast. Pretty much everything. You just Google … I tried to keep in … And for the record, the reason it’s From Military to Millionaire is because when that whole platform started, I was not by any means a millionaire and it was just documenting my journey. So it’s not an ego trip. It’s just, I was prophesying my future.

Mindy:

There you go.

David:

And I got lucky.

Mindy:

Well, you said it and it came true. Okay, David, this was so much fun. I really appreciate your time today. I appreciate you sharing all of this information. If you are thinking about joining the military, if you have kids in the military, if you have kids who just aren’t on the path to college, this episode is for them. Please share this with them. Please share David’s website, his book, his podcast. He is a wealth of information, clearly, as you just heard. He is a wealth of information on all things military.

David:

Why, thank you Mindy.

Mindy:

Okay, David, should we get out of here?

Speaker 3:

I suppose so.

Mindy:

From episode 337 of the BiggerPockets Money podcast, he is David Pere and I am Mindy Jensen saying Uncle Sam wants you.

Help us reach new listeners on iTunes by leaving us a rating and review! It takes just 30 seconds. Thanks! We really appreciate it!

Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Check out our sponsor page!

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.

Fabio Formaggio / 500Px | 500Px Plus | Getty Images

Last year, I moved into a one-bedroom apartment in Manhattan. At 28, I was living alone for the first time. It was tremendously exciting, but I also had a problem: I had no furniture. For weeks I slept on an air mattress that would be mostly deflated by the time I woke up.

After almost a decade living with roommates, when everything felt shared and temporary, I longed to make the new space feel like my own. I wanted each item, even my wine glasses, to say something about me.

But I was soon intimidated by the high costs of couches and tables and considered going into debt. Instead, I spent a lot of time wistfully scrolling online through all the beautiful things I couldn’t afford.

More from Personal Finance:

Inflation forces older Americans to make tough financial choices

Record inflation threatens retirees the most, say advisors

Tips for staying on track with retirement, near-term goals

With inflation hitting furniture prices of late, many other people are also likely finding it harder to decorate at a reasonable cost. Household furnishings and supplies were up 10.6% this summer compared with last, according to the consumer price index.

Yet there are ways to creatively use your budget, said Athena Calderone, author of the design book “Live Beautiful.”

“While it can feel really stressful to decorate on a small budget, the good news is that constraints are far from confining,” Calderone told me. “In fact, they’re often the source of true creativity.”

Here are some tips for saving money on furniture, home goods and decor.

Elizabeth Herrera, a designer at Decorist, an online interior design company, tells people to tune out the trend cycles and follow their hearts while they’re buying furniture.

“This way they won’t be wanting to redecorate every few years,” Herrera said.

People should also know which items are worth splurging on, she added: “It’s fine to purchase lower-cost, trendy accessories to refresh your space, but keep the larger pieces classic.”

It’s easier to tell when core items, like your couch and dining room table, were cheaply bought, experts say.

This is also the furniture you want to last.

“Think long-term,” said Becki Owens, an interior designer in California. “If you are patient with the process and invest in quality pieces when you can, you will have items that you can build on.”

“I have pieces that are 20 years old in my home.”

If the goal is longevity, Owens also recommends buying your core furniture pieces in durable materials and neutral colors.

“You can always change decorative layers like textiles as the trends change,” Owens said.

The trick to finding bargains on these sites, Calderone said, is to type in the right keywords. (She recently wrote an entire article on the phrases to plug in when looking for vintage vases online, including “old urn” and “large antique clay vase.”)

“Play around, type in lots of different variations and have fun,” she said.

“And don’t be afraid to negotiate on price, either,” she added. “Take a risk and submit lower offers on auction sites and see what happens.”

“I’ve been known to offer as much as 50% less on items, and they’ve been accepted.”

The handmade nature of artwork often means it’s on the pricier side, Calderone said.

Still, she says she’s found some incredible art from emerging artists, particularly on Instagram. Two of her favorites are Art by Lana and Aliyah Sadaf. Other works by newer artists, who tend to charge less because they’re just starting out, are available at websites such as Tappan and Saatchi, Calderone said.

You can also search for original art in your price range on websites such as Art Finder.

Boris Sv | Moment | Getty Images

John Sillings, a former equity researcher, helped found Art in Res in 2017, after realizing how much people struggled to make a big one-time purchase on artwork.

The art on the company’s website can be paid off over time without interest. The typical painting on the website costs around $900, which comes out to $150 a month on a 6-month payment plan.

“The mission is to make fine art more accessible,” Sillings said.

Now that I’ve been in my apartment more than a year, the place is filled with furniture, and I can hardly remember when it was empty. Unsurprisingly for a Manhattan tenant, I’m actually already running out of room.

But it reminds me of some advice I got from my mother when I first moved in. I was complaining that it would take me time to decorate the place, and she said that that was a good thing, that much of the fun is in the process.

When it was over, she said, I’d wish I could go back and do it again. She was right, although I still have a little more space to fill.

How to decorate your home on a budget, according to interior designers Read More »

Oren Klaff is best known for his groundbreaking book, Pitch Anything. In it, he gives a systematized way to take control of every meeting, negotiation, and deal on your terms without taking a submissive position. Oren has the expertise to back up his claims. As a world-renowned leader in sales, capital raising, and negotiation, he’s been in the meetings, flipped the script, and gotten deals done that most couldn’t even dream of. Now, he’s sharing his wisdom with you.

Much of what Oren describes gets a bad rap in today’s world. The terms “alpha” or “in control” are subliminally thought of as violent or harsh, but in Oren’s context, they are completely accurate. In part one of this two-part episode, Oren gives you everything you need to take control of your deal, get negotiations done on the terms you want, and put opponents in the position for you both to succeed, instead of merely butting heads.

But this advice isn’t just for the board room. These key principles work in every conversation you’ll ever have, whether you’re raising millions to close on an apartment complex investment or merely trying to get your kid to eat their vegetables. The way you pitch, frame, and control a conversation directly correlates to its outcome. And in real estate investing, this isn’t a skill you’ll want to be without.

David:

This is the BiggerPockets Podcast show 663.

Oren:

Write this down, raise the stakes. If somebody believes there is low stakes at this pitch, at this meeting, at this interaction, it is going to end like this, “Hey, this looks great. Love this. Love what you guys presented, something we’re really interested in looking at. Send me the deck. I’ll talk to my committee, my partner, my wife. We’ll take a look at it. If we have any additional questions, we’ll get back to you in the next week.” That requires no training. All buyers, all investors say that unless there are stakes. So raise the stakes.

David:

What’s going on, everyone? It’s David Greene, your host of the BiggerPockets Real Estate Podcast, here today with my co-host, Rob Abasolo with a fantastic show, and I really mean that. Today, Rob and I interview or Oren Klaff, the author of one of my favorite books you’ve heard me speak about often, Pitch Anything. Oren is probably, I would consider him to be the world renowned expert in teaching the concept of frame control and how to hold people’s attention so you can get them to see things from your perspective and invest in your deals.

He’s hired by the big guns to come in and raise money for very big projects and he was gracious enough to share his time with us today sharing very high level concepts that you usually won’t hear anywhere unless you pay tens of thousands of dollars to take courses to teach you stuff. This is the stuff high-powered business people will go sign up for and you’re getting it today for free.

Our show with Oren, I’m just going to give you disclaimer, we hit the ground running and he’s like a Tasmanian devil of value. So in these two episodes, Rob and I are actually going to stop it a few different times throughout the show to explain how the concept that Oren is describing would relate specifically to our industry of real estate investing, as well as give you some color commentary on how this might apply in your own business. Rob, what were some of your favorite parts of the show?

Rob:

Well, Dave, there were a lot. There were a lot of favorite moments in this because he was speaking to my soul, I think. I’ve been really going down the investor journey and working with investors. I mean, I think probably in the last year alone we’ve had at least a hundred Zoom calls with different people and we’ve really figured out who we are, who we want to be as real estate entrepreneurs and investors. So I really reflected a lot just in this episode because he really put a little knife in all my wounds and was like, “Yup. You were doing it wrong the whole time,” and I’m like, “Yeah, yeah, I was, I was,” but it’s really nice in retrospect to be like, “Okay. Well, here’s the silver lining. I learned it the hard way so that everybody at home can learn it the easy way.”

David:

That’s the role that you and I are in. We’re the vanguards that go ahead and make a whole bunch of mistakes, everything gets messy and ugly, you lose money, you lose employees, you go through pain and frustration, and then after you finally go through all that and you figure out the answer, our battered and torn bodies come back and say, “Okay, guys. I went out there and I figured out that’s where the tigers are. Don’t go there.” We’re all scraped up and clot. Our clothes are falling off, and we’re like, “This is the way that you can go and you can avoid all that pain,” and that’s a privilege we have of sharing that with everybody who listens.

Rob:

That is today’s retroactive quick, quick, quick, quick tip. Well, this is particularly topical for me because I threw out my back this week. So I’m just in shambles. I hit 32 and the old body’s just breaking down limb by limb, but it’s okay, I’m going to push through. I’m a survivor.

David:

Rob, you’re back in the gym, so everybody should know that Rob has taken his role as the co-host of the podcast seriously, and he’s now training for the BiggerPockets Olympics.