Hong Kong property market probably expecting downward pressure: JLL

Hong Kong property market probably expecting downward pressure: JLL Read More »

After incredible appreciation over the past few years, the residential real estate market has finally started to decline. Many chicken littles are saying this is the beginning of an all-out collapse. While the market will almost certainly go through a correction, a collapse is almost certainly not in the cards. There is a segment of real estate, however, that will go through something close to a collapse.

Broadly speaking, the outlook for commercial real estate, specifically office buildings, is not great. And large office buildings, in particular, are doing poorly and will have difficulty in the coming years. It will be even worse in large, coastal cities, particularly acute in downtown areas, with San Francisco being the poster child for this coming collapse.

Indeed, if such a thing as credit default swaps or some sort of short position on downtown San Francisco real estate, I would strongly recommend thinking about buying such (I believe non-existent) investments.

As The San Francisco Standard points out, “Citing data from real estate firm JLL, chief economist Ted Egan tagged future vacancies, in a worst-case scenario, as high as 53% in the Jackson Square area and 43% in the mid-Market area in 2024 as the clock runs out on office leases.

“The current vacancy epidemic cuts across buildings of all sizes and price ranges in San Francisco’s downtown core, from the struggling mid-Market area to the sparkling office towers of the East Cut.”

For some buildings, the collapse has already happened, “For example, 415 Natoma, a 653,900 square foot office tower owned by Brookfield Properties that was the sole ground-up office project to deliver in San Francisco in 2021, currently has just one announced lease: 20,000 square feet taken by ‘remote-first’ startup Thumbtack.”

The reason we can know for certain that this problem is going to get worse is the way commercial leases are structured. Unlike the typical lease on a home or apartment unit, commercial leases are usually 3-5 years long and sometimes more.

Downtown commercial real estate was already declining before 2020, but the pandemic turbocharged that decline. Many of the firms that signed leases in 2017, 2018, and 2019 are stuck in those leases for a few more years. But all signs point toward a large number of them leaving after the end of their lease.

So, if you think vacancy is high now, I’d recommend you buckle up.

As I noted, San Francisco is only the poster child for this phenomenon. San Francisco came in dead last in the Urban Displacement Project’s ranking of 62 cities’ downtown recoveries from Covid and lockdowns. But the rest didn’t do well either. Only four of 62 cities had fully recovered, with the average being somewhere in the 60% range (San Francisco was at 31%).

This has, quite understandably, led analysts at the Institute of Taxation and Economic Policy to project huge losses in downtown commercial real estate, with San Francisco coming in first (or, more accurately, last).

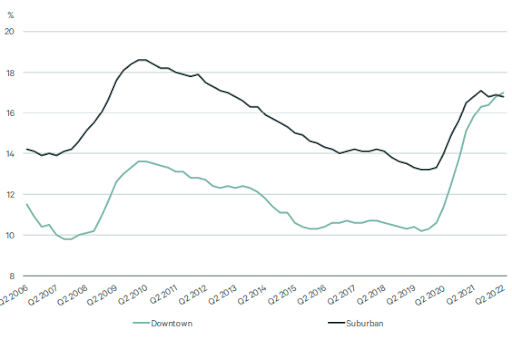

As The Business Journal notes, “Office vacancy is on the rise everywhere, but the rate of increase in downtown office vacancy is outpacing that of suburban office.”

They quote Ian Anderson, senior director of research and head of Americas office research at CBRE, who points out that,

“Downtowns across the U.S. have gotten clobbered much more through the crisis…People have been much more comfortable driving to work in suburban locations with less density, so that’s favored them more.”

Indeed, downtown Los Angeles office space has hit 25% vacancy. In Manhattan, it’s over 17%, downtown Portland, Oregon, is at 26% vacancy, and in Washington D.C., it stands at 20%.

And all of them have the same problem with pending move-outs once pre-Covid leases expire.

Typically, suburban vacancy rates are substantially higher than downtown rates. But the latest report from CBRE has shown the two rates have not just compressed but actually flipped.

The increase in vacancy rates has tapered off this year (for now) as Covid receded and various restrictions have been lifted. Even still, vacancy rates have leveled off over 50% higher than where they were before the pandemic.

Obviously, the immediate cause of this commercial real estate calamity was Covid-19 and the subsequent lockdowns.

A report from The Visual Capitalist noted in September 2020, during the first year of the pandemic (but after the most severe lockdowns had been lifted), that small business revenues in 52 American metro areas were down between 13%-49%. (And, of course, San Francisco was the city where they were down 49%). Furthermore, “Small businesses in the leisure and hospitality sector [had] been particularly hard hit, with 37% reporting no transaction data.”

The New York Times also pointed out that as many as 400,000 small businesses closed, and many went under, never to return.

Downtowns were hammered during the height of Covid, with places like Manhattan looking like a ghost town. And while things have gotten better since then, the damage done cannot easily nor quickly be fixed, especially since many downtowns have notably declined in quality since then.

A lack of proper maintenance and upkeep causes deterioration, making fewer people want to visit or work there, reducing the area’s revenues and funds available for maintenance and upkeep even more so, and the vicious cycle perpetuates itself.

Other policies have also caused significant issues as well. Unlike some memes you may have seen, California did not actually legalize stealing $950 or less, but it did downgrade and deprioritize such crimes leading to a noteworthy uptick in shoplifting which has led multiple retailers to relocate. Walgreens, for example, has closed 10 stores in the city, including several downtown and cited “organized retail crime” as a leading cause.

In general, crime is on the rise throughout the country, and that tends to be worse in densely populated areas, which makes downtowns less desirable.

The Martin v. Boise decision also made it difficult to remove homeless encampments from downtown areas unless the city has sufficient homeless shelter beds for its homeless population. Unfortunately, very few cities have enough beds to do so, and California’s “housing first” instead of a “shelter first” policy has resulted in a much larger homeless population sleeping on the streets at night. Thus, tent cities accumulate in high-density areas and often dissuade foot traffic and lower demand.

Unfortunately, as things get worse, they tend to spiral out of control as you reach a point where people don’t see the point in putting in any effort to improve a situation because their effort would make almost no difference.

Why pick up litter in a garbage dump? In fact, why not litter yourself?

This has gotten so bad in San Francisco that someone even made an interactive “poop map,” and the number of “human feces incidents” on the streets, showing that it had increased by over 500%, even before Covid struck.

And again, while I’m clearly picking on San Francisco, this is a problem in many large coastal cities and really throughout the country as well.

A while back, flex work was all the rage, and futurists dreamt of a time where everyone would work from home and live happily ever after. Then Covid hit, and those dreams were, more or less, realized.

And it turns out that working only from home drives a lot of people crazy.

That being said, many (probably most) people love the option of working from home and want to be able to do so 1-2 days per week. And there are some who prefer it and would like to work from home all the time.

The Census reported that the number of people working from home tripled between 2019 and 2021. Companies like Twitter (but certainly not Tesla) now allow employees to work from home as much as they want.

A survey by McKinsey & Company found that 87% of employees who are given the chance to work from home take it at least sometimes. They further found that 35% of job holders can work from home full-time and 23% part-time.

That seems a bit high to me, but such arrangements are certainly on the rise. Further, some research shows that people who work from home some of the time can be even more effective than those who only work at the office.

What this means for commercial real estate is that we don’t need as much office space as we did before. Sure, companies still need offices (working only from home makes a lot of people feel really “cooped up,” and zoom meetings can’t completely replicate the real thing). But those spaces don’t need to be as big. And we don’t need as many of them.

Furthermore, the ones that will be hit the hardest are the ones that require the longest commutes to get to. I know I would be much more apt to work at home if my commute was two hours of traffic!

And in the spirit of continuing to bash San Francisco, the average commute for San Francisco residents is the third worst in the U.S. at 34.4 minutes each way. The worst is New York at 37 minutes, and the national average is 27.6 minutes.

Lastly, as BiggerPockets’ Ben Leybovich pointed out, “Another major issue is vintage and the functional obsolescence that comes with it. Huge swaths of commercial real estate in old primary markets are aging. Before the pandemic, people were in those units by inertia. Now, nobody wants to go back there.”

It will cost huge sums of money to upgrade these outdated and sometimes obsolescent units.

Needless to say, right now is not the time to be buying downtown office real estate. Offices, in general, are something investors should be cautious of. But if you are going to buy office space, smaller units and buildings are safer. As far as commercial real estate goes, restaurants, industrial and retail are a better bet (although with retail, large outlets are still at risk of being bled out by Amazon).

That being said, every bear market has a trough. There will continue to be demand for office space in the future, and there will continue to be demand in downtown areas. We have, after all, seen this story play out once before. Downtowns throughout the country deteriorated drastically in the 1970s before making a major comeback in the 1990s and 2000s.

Right now, there is still an enormous housing shortage in the United States. In 2020, Freddie Mac released a report arguing there was a 3.8-million-unit shortfall in available housing units. And the pandemic and lockdowns slowed new construction to exacerbate that gap.

The National Association of Realtors even has an interactive housing shortage tracker with a map of where the problem is the most acute.

As you can see, the biggest housing shortages are in many of the same areas that are having and will continue to have severe vacancy issues in commercial real estate.

Despite crime and livability issues, many people love living downtown and being “close to the action.” Once the bottom falls out (probably around 2024), there should be major opportunities to convert old office buildings into swanky condos and apartments.

Sure, it will be very capital intensive, but for those looking for big projects in the relatively near future, this is definitely something to keep an eye on.

Run Your Numbers Like a Pro!

Deal analysis is one of the first and most critical steps of real estate investing. Maximize your confidence in each deal with this first-ever ultimate guide to deal analysis. Real Estate by the Numbers makes real estate math easy, and makes real estate success inevitable.

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.

The Coming Collapse of Downtown Office Real Estate Read More »

CNBC’s Diana Olick joins ‘Squawk on the Street’ to report homebuilder sentiment dropped eight points in October to 38, according to the National Association of Homebuilders Index.

Homebuilder sentiment drops eight points in October Read More »

The short-term rental game is not one to enter lightly. Regular rental property investors shudder at the constant turnover, consistent guest complaints, and far more intensive upkeep that vacation rental property owners pride themselves on. But is a week in the life of a self-managing short-term rental empire owner that bad? Well, maybe we’ll just have Rob Abasolo AKA Robuilt, YouTube’s go-to authority on vacation rental investing, answer this.

Rob has had a troubling week to put it lightly. From guests somehow deadbolting themselves out of their homes to ACs being frozen solid, sending vacationers to the wrong address, and almost obliterating a $20,000 pool, many things can go wrong in the realm of short-term rentals. But, is the profit worth the pain?

Dave Meyer from On The Market joins along this episode to act as Rob’s therapist/cheerleader as we go through a week’s worth of almost unbelievable events in the life of a vacation rental property owner. This episode highlights lessons learned from each mistake that you can use to build a better rental property portfolio, have a more seamless customer experience, and maybe get a little more “me and my burrito” time.

Rob:

This is the BiggerPockets Podcast show 676. This particular house didn’t have a fridge, so we bought a fridge, and that the wrong fridge was delivered to our house. Not one time, Dave. Not two times, Dave. Not three times, Dave.

Dave:

No. No.

Rob:

Not four times, Dave. Not five times, Dave.

Dave:

Wait.

Rob:

Six times. Six times in a week. What’s up, everybody? You got Rob here. We’re shaking it up today. I’m joined here by my co-host, Dave Meyer, as we go through the triumphs and tribulations and victories and downfalls of my short-term rental portfolio, completely transparent and out there for the world to learn from. How’s it going, Dave?

Dave:

Great. Thanks for having me. I am very excited to be here, because even though I come on and I do bigger news, you and I have never hosted a show together. This is the inaugural journey of Dave and Rob.

Rob:

I know, the beginning of a budding bromance as they say.

Dave:

I can’t wait. Well, it was fun doing this interview.

Rob:

So do you feel like… I know that you have some property management. I know you’re involved with some of your stuff, but after this episode, how do you feel? Do you have the appetite to get into self management on the short-term rental side?

Dave:

I don’t just because it’s not logistically really feasible for me because I live in Europe, but no, honestly, I self-managed my long-term rentals for the first eight years. You just learn so much. I think it would be very difficult for me to have hired a property manager without having self-managed at least for a little bit. You can, but I just feel like you learn what to expect. That way, when a property manager comes to you and they’re like, “This thing’s broken,” you don’t blame the property manager. You know these things just happen.

Rob:

Sure.

Dave:

You get used to it. That’s what I loved about the show is that you really just bear it all, and explain to people how things go wrong, mistakes that you’ve made. Honestly, a lot of them aren’t even mistakes, just things that go wrong that you can’t really control, but it’s super helpful to learn and see that even experienced, successful short-term rental investors like yourself still have these challenges, and normalizes some of the challenges. I think everyone listening to this will learn a lot from what you’ve been through.

Just in the last week, all these things that Rob’s going to talk about are just things that happen in a single week.

Rob:

It’s not always fun, but it’s always awesome. I mean, all the things we’re going to talk about today, 10 things. I actually had to cut out five out of the 10 just for keeping this podcast very nice and concise, but I cut out 10. We’re going to be talking about basically my learning journey in systems and everything that I’ve put in place to fix it. But before we get too far into today’s episode, we’re going to get to today’s quick tip. I think, I’m doing a good David impression on that. I hope he approves.

Dave:

I like that you’re doing an impression of David doing an impression of Christian Bale.

Rob:

Batman. That’s right. That’s right. It’s an impression of an impression. I don’t even know what that is at this point.

Dave:

Oh, you’re nailing it.

Rob:

Impression squared. Today’s quick tip is when you make a mistake, or you have a failure in your business, regardless if it’s short-term rentals, flipping, multi-family, anything like that, take that mistake and figure out how you can avoid ever making it again by creating a system or a process. Today, we talk about 10 different things that happened and all the different systems and processes that that has created for me, my workflow, and all the workflows of my different employees as well.

Also, if you just want to connect with others, and learn from their mistakes and learn how you can create processes through those, be sure to hit up the bigger pockets forums. There are people connecting there every day, networking, learning from each other, and sharing real-life experiences. All right, with that, let’s get into today’s episode. What’s up, man? How’s it going? I’m excited to talk short-term rental tragedies with you today.

Dave:

I am too, man. I mean, I have a little bit of experience with short-term rentals, but I’m sure the depth and drama of your tragedies are like nothing I’ve ever seen.

Rob:

It’s very funny, because I obviously talk a lot on YouTube about my short-term rental journey. If you’ve followed along since the beginning, most people effectively saw my Airbnb journey go from one unit to 15. Then as of last month, I went from 15 to 35. Then if things continue to go the way they are, then I’ll go from 35 to 58 here in the next couple of months, so scaling very quickly on my end of things.

Dave:

You’re going to have 58 times more problems over the next couple of months. I guess it’s good that you’ve had some training to give you the experience to deal with them better.

Rob:

For sure. That’s actually what I wanted to talk about specifically today, because obviously, I really do believe that all real estate is very accessible to the everyday person. For me, I believe that wholeheartedly about short-term rentals. I think they’re very scary to a lot of people, and it’s the vice versa, right? I get a little scared thinking of long-term rentals and thinking of all the things that can go wrong with that. Then most long-term investors that I talk to are like, “Dude, are you kidding me? It’s so easy. I’m scared to go into short-term rental, because I’m scared of all the things that can go wrong there.”

I’m like, “Are you kidding me? It’s so easy.” I think I wanted to give a little bit of context to my journey today, and really just talk about how things do go wrong. This is just true. Things go wrong when you’re self managing. This is going to be a self-management masterclass for anyone that just wants to understand the ebbs and flows, the highs and lows of short-term rentals. I’m just going to talk about today 10 things, 10 things that went wrong in my short-term rental portfolio last week. This is the crazy part.

I actually just recorded a YouTube video on this, and it was actually 15 items. But for the sake of the pod, I decided to cut it down to 10, and just give you my 10 juiciest stories and hopefully some learning experiences that came from each one. Does that work?

Dave:

Yeah, man. I’m excited to hear about them.

Rob:

Well, don’t be too excited. I mean, I’ll have a little bit of a sweat and PTSD throughout this episode, but it’s okay. We’re going to take it item by item here. So let’s start with number one. Number one was a story of guests that locked themselves out of my property. Now typically, when you’re in the short-term rental game, you try to do your best to automate the idea of check-ins. You don’t want to be there checking people in. I mean, obviously, that’s a very nice amenity if that’s what you want to do. But when you have 15, I just can’t hire 15 people to be there at the door.

We have a lot of different processes for this. One process is we take photos of all the different steps that you have, the literal steps that you have to take to get to the home, picture of the door, a picture of the keypad, and then you basically give them the keypad combination. So for me, when I was getting started in short-term rentals, I actually did use to check people in on my very first apartment. Then I figured out the idea of a keypad or a lockbox, and then I figured out that you can do an electric keypad.

I was like, “Man, this is awesome.” Then now, it even goes one step further, Dave, where you can actually do a keypad that syncs up with your property management system, and every single time a guest checks in, it changes the code for every single reservation to the last four digits of that guest’s phone number, so it makes it very, very easy. What kind of self-checking stuff are you doing on your property?

Dave:

That’s actually what I have, but I have a professional management company. I live in Europe, and I have automated as much as physically possible. I pay for it. It definitely costs a lot, but one of the benefits is having that kind of technology. I mean, given that you know about all this stuff, how did they lock themselves out?

Rob:

Right. Right. Right. This is where it gets very interesting. I’ve done this for five years. I’ve never really been in this specific situation. So basically, even though I have an electronic keypad, there is a deadbolt on the handle under it. The guests left, and then they came back, and they said, “Hey, the code isn’t working.” I was like, “Well, that’s probably not true because the code was working the whole stay. It’s been a week.” They’re like, “I don’t know.” Then they’re like, “I hear it, but it’s not actually doing it. We still can’t get in.”

Then they’re like, “It’s possible that we locked the deadbolt.” I was like, “Oh, well, I mean, if you’ve mentioned it, then you probably know that that’s the case, right?” I’m like, “Oh, okay. It’s no big deal. Let’s just make sure it doesn’t move.” They’re like, “No, it doesn’t move.” I was like, “All right, well, good news. I actually have another lock downstairs. There’s a back door entrance where you can get into the home.” She’s like, “Great. Fantastic. Shoot me the codes over to that.” I said, “Great.” All good. I’m… This is a Sunday.

Let me just say, Dave, I really pride myself on managing my places one to two, sometimes three hours a week. It’s very minimal. That was not true for this last week. That’ll probably be obvious as I move through every single one. But basically, it’s a Sunday. I’m trying to have dinner and make lunch and all that type of stuff. Then basically, she calls me, and she says, “Hey, that code is not working either.” Then I was like, “Well…” I mean, I’m looking at my app, and it actually says it’s unlocked. She’s like, “No, we hear it unlocking, but the door isn’t unlocking.”

They’re like, “Come to think of it.” She’s like, “I actually think I left at a different time than the other people in my group.” This was a 13-person group, and I think that they might have locked the deadbolt. I was like, “Well, you’re there with 13 people right now. Do you think… Maybe just confirm.” She’s like, “Yep, that’s what happened. Do you have a key?” I was like, “Well, I don’t, because typically, the other door is the fail safe.” I was like, “How did you leave? How did you lock yourself out?”

She basically was like, “Oh yeah, we left through the garage. We locked both the deadbolts, and we left through the garage. We weren’t really thinking.” She’s like, “I’m so sorry for the inconvenience. This is totally on us.” I was like, “Oh, okay. Well hey, let me get my handyman over. He’s pretty good at getting into my house. He always finds a way.” He comes out there, and he basically says, “Hey, man, confirmed. They did lock both of the deadbolts.” He’s like, “I can try to get into the garage, but it’s probably going to break if I do.”

Then I was like, “All right, well, give it a shot, and let me know.” He calls me back five minutes later. He’s like, “There is no way I can get in without breaking your garage.” I was like, “Oh shoot.” So at this point, it’s been an hour, and these are 13 guests sitting outside of my home. They’re getting a little antsy. I’m like, “I’m so sorry.” Obviously, even though it’s their fault, I’m like, “Let me help you. I’m going to get this taken care of.” I’m just going above and beyond to help them out as much as I can. Basically, I call a locksmith, Dave, and the locksmith, I call four of them, and they’re all going to be 250 to 300 bucks.

Dave:

Oh my God.

Rob:

I was like, Well, that’s the tax, the dummy tax for me.” I was like, “Okay.”

Dave:

Better than breaking your garage.

Rob:

It is better than breaking my garage.

Dave:

It’s cheaper.

Rob:

Here’s where it gets really spicy, the plot that is. Basically, I call one guy, and then he’s like, “Hey, actually, it’s going to be $100. I can be out there in 45 minutes. Everyone else was going to be two hours.” I was like, “Oh, you are the greatest man known to all real estate investors in the world.” He’s like, “No problem, man. I got you.” Well, he says he’s going to be there in 45 minutes. He never shows up. He never shows up. The guests call me, and they say, “Hey, we saw someone come about 25 minutes ago, and then he turned around and left.”

Dave:

What?

Rob:

Then I was like, “Well, that’s not good.” I know. I was so… I was just like, “I can’t believe.” I just want to eat my Chipotle burrito, Dave. That’s all I want in life is just to eat my Chipotle burrito, and so-

Dave:

You and me both, man.

Rob:

Do they have those in Europe?

Dave:

No. Man, the Mexican food is terrible in Amsterdam.

Rob:

I know.

Dave:

But no, I sympathize even if it’s not a burrito. I just want to eat a-

Rob:

Well, they do have a Vapianos over there, which is one of my favorite.

Dave:

What’s that?

Rob:

It’s like European pandera. Sorry, no, sorry, it’s like European Panera. Pandera is… Is that even a thing? I don’t even know.

Dave:

No, I think you made that word up, but I like it.

Rob:

Hey, that’s what we do here at BiggerPockets. Anyways, I call… Listen. I call and I say, “Hey, what the heck? I heard that someone showed up,” and then the lady on the phone was like, “Oh yeah, he drove up to the property, and he didn’t see anybody, so he turned around and left.” I was like, “That was an-hour-and-a-half ago. You didn’t think to call me and tell me that.” She’s like, “Oh yeah, sorry.” I was like, “He didn’t even drive to the house. He just drove to the beginning of the driveway, made the executive decision that 13 people weren’t standing in front of the house, and he left.”

So needless to say, that did not result in a happy guest. They actually ended up breaking into my house. They did the thing that the handyman didn’t want to do, and they broke into the garage. Dude, it was a big headache. That one, to me, that was a big L on my part for several reasons, because it was the guest’s fault, but it was also my fault. I just got to take the L on that one, I think.

Dave:

That’s a tough one. I mean, it’s hard to control for every situation with your tenants, especially people who are in a short-term rental game. You have people who are new to your house by definition. Is there anything you learned from it that you think to help you try and avoid something like this in the future?

Rob:

Yes, I did. It’s also a very obvious one. Let me just be clear with that, but I usually have a backup to a system, right? So the backup to the front door being locked is the back door being locked, and it’s like, “There’s no way that this will ever fail on me,” and it did. The learning is just to have an extra keypad with keys to the specific deadbolt. Now, we’ve done that. My handyman went out. He bought a little keypad, keeps it under the deck. Like I said, I mean, this has never really happened where the guests locked both of the doors, but just because it hasn’t happened before doesn’t mean I shouldn’t have been prepared for it.

I’ve learned to basically just keep just the original, the time tested, physical key on the property. This was not just the only occurrence that happened this week, Dave. I actually had another guest at a different property lock the screen door in front of the front door, and so they were locked out. Luckily on that one, we basically had other doors that they could get into. Took a lot longer to figure out than they realized. It’s the same code. A lot of messages back and forth, but this one really sank me for a solid five or six hours probably.

So on that one, we learned on screen doors, it’s a force of habit for people. They just will lock it if they do that at their own house. So, we’ve just now replaced that lock, or we’re about to replace that lock with a non-locking door doorknob, which, is again, very dead simple. It makes a lot of sense. If guests can lock themselves out, they will. That was the hard lesson for me. Let’s move into the second thing here that happened this week that really… Again, lots of gray hairs that happened this week as a result.

David and I just bought this really awesome 6,000 square foot apartment, sorry, 6,000 square foot Spanish mansion in Scottsdale. The water heater broke in it, and it’s a luxury place. So theoretically, obviously, you need hot water with any luxury place, right?

Dave:

I think you need hot water with any place.

Rob:

Arguably. Arguably, that’s true.

Dave:

I think it’s important.

Rob:

Oh man, so this was a $3,000 setback for me, and I’ll tell you why. So basically, this was a gladiator, or it’s like… I think the brand was Rheem Gladiator, which is the Home Depot brand. Apparently, it’s just a very niche brand that no plumbers would really touch. I don’t really know why. It didn’t make a lot of sense to me. But we called 10 different plumbers, and they were like, “Oh man, sorry, we don’t service that.” So, we were just trying to get someone to fix it, and we were hoping that maybe it was a user error. Sometimes you can just click the on-off button on the water heater, it’ll turn back on.

These guests were just like, “Hey, we get it. It’s not your fault. Water heaters go out. We even looked at the label at the front of it, and it says that it was manufactured in 2019, so it’s a relatively new water heater.” So I was like, “I’m sorry.” I really was just putting on my customer service hat, really trying to accommodate them because they did have kids, and they were talking about they were all having to share basically. We have a little casita at the back of it, so they were all having to share and do all that kind of stuff.

I basically was like, “Look, I will refund you the amount of days that you don’t have hot water, so it basically ends up being a free stay.” She was really… I mean, honestly, she was so nice, because she didn’t have to be. When I called her on the phone, basically, she was like, “What you’ve done for us, and how you’ve treated us, and how over and beyond you’ve gone just really goes to show how great of a host you are. We really appreciate it.” I was like, “Oh my God, that is so… That really moved me.” She’s like, “But as mentioned, do you think you could still refund us for the three nights?” I was like, “Of course. Of course.”

Dave:

I mean, that’s just one of those things. I’ve been there. Either both on short-term rentals and long-term rentals, there are certain things you just can’t make up for. Locking yourself out, there’s some mutual-

Rob:

There’s a system there.

Dave:

… mutual fault there. But man, you need hot water. You need heat.

Rob:

You do.

Dave:

When these things happen, there’s almost nothing you could do, I guess, except try and be a good person, refund their money if they’re not getting the experience that you intended. But man, is there anything else you think you could do to avoid something like that?

Rob:

No, but I think the lesson was really just… This is a tough one, because we have a home warranty, right? Typically, home warranties do cover system faults like this, but the one really big issue with home warranties is that they’re not super fast. Really, the premise of them is to not serve you super fast so that you are forced to go out and pay for this repairs or the replacement without involving the home warranties, especially in the short-term rental world. We have it for the really big systems, but in this instance, because I was trying to…

We thought it was going to be a very easy fix, but again, it was such a niche model that every plumber in town was like, “Even if we could get parts, we still can’t get them for 10, 15 days.” So I just knew relatively early on that we just couldn’t wait to get that fixed. I think the thing that I could have done faster is just knowing that water heaters are not necessarily super expensive, and so I could have just replaced that right from the get go. It’s just not necessarily something you want to do. You don’t want to always go straight to replacing an appliance. It’s not the most financially responsible thing to do.

But effectively, I ended up replacing it anyways. I replaced the $600 heater. It was $1,000 in repairs, so that’s $1,600. Then I had to refund $1,500 in nightly rates, so I ended up spending $3,000 for something that honestly probably would’ve cost $80 to fix if the parts were readily available. So for me, at this level and at this level of my portfolio, I am always just trying to address problems as quickly as possible, because refunds typically cost a lot more than the actual replacement cost of whatever you’re trying to fix.

Dave:

Totally, especially, man, with water heaters too. I don’t usually preemptively replace things. That’s not a great move. But with water heaters, that might be the one exception to the rule. If it’s been… I think, most of them last seven to 10 years. If you’re getting up there, that’s one of those things. You’re going to have to replace it anyway. Rather than trying to squeak out another six months or a year, just bite the bullet, and avoid what you had to do with refunds, but sometimes they flood. They break. That’s one of those things you just want to be a bit ahead of.

Rob:

Oh my gosh. Well, and it’s tough, right? Because I’ve got a business partner on it, right? I got to think of their best interest as well. So in my personal portfolio, I may have just swapped it out. I’m not really sure. I think I would’ve. But usually, it is. You try to fix it if it’s a simple thing, but because once you start having other partners in investors, you really have to start thinking of things a lot bigger than how you would personally handle it. So, that’s something that comes to mind really often in my 15-unit portfolio and now 35-unit portfolio is speed actually does save you a lot of money a lot of the times in this game, especially for something like this, especially on a luxury property where now, we’re charging about…

I mean, peak season coming up, $2,000, 2,500 a night, so one night of a refund could really be quite detrimental to you. Luckily, we were still in the slow season, so it was $500 to $700 a night reservation, but in a couple months from now, it would’ve been a multi-thousand dollars event. Actually, it still was now, but I guess more than $3,000. There’s that. That’s number two. Let’s keep these moving, because the sweat is already beginning to form.

Dave:

You’re just having flashbacks from that last week.

Rob:

Yes, hot flashes if you will. Number three, the AC went out at a different property. This was fun. Again, I’ve never had an AC problem ever up until this moment, but hey, that is why you have a CapEx account, right?

Dave:

Where is it?

Rob:

It’s in Gatlinburg.

Dave:

So it’s hot.

Rob:

It’s hot. It’s hot. Here’s what happened. There’s a misconception out there with most people that if you go to your thermostat, and it’s on 70, and it’s warm, and it’s cooling down, that if you go and you crank it down to 50, that it’s going to make it colder. That’s not how it works. Effectively, the way air conditioners work, from my understanding, not a tech, but basically it just shoots out the cool air until it reaches the temperature that you want it to reach. Just because you put it at 50 doesn’t mean that the actual air is coming out any colder. That’s not how it works.

It just will basically keep running continually until it reaches 50 degrees, which is effectively impossible for any old AC system in a house. I mean, maybe it is, but I doubt it. What do you think happened? The guest goes in. They’re like, “It’s a little warm.” I’m like, “All right, just turn it down.” Basically, they turned it down to 50, and because it was already basically cool, they never turned it back up. So, the AC basically ran for hours and hours and hours, and it froze up. The coil froze up. I was like, “Man,” and so they were basically out of AC for that day until the coil melted and could actually start to function again.

This, again, a very expensive repair for me, because I had to get the AC guy to come out, and both times, he’s like, “Yep, here’s the good news. There’s not much I can do. Here’s the bad news. It’s going to take about 68 hours for this to thaw.” I was like, “Beautiful.” I think that one put me back around total, that AC system that week, I want to say it was about $2,600, man. It was a fatty.

Dave:

Wow. I mean, have you tried Nest or Ecobee or any of these smart thermostats? That’s what I have, and I can control my tenants, what they’re doing with the thermostat. I pretty much let them do it. I mostly use it because I only have one short-term rental, but it’s in the mountains in Colorado. I don’t need it heated in the winter if no one’s at the place, so I can control it and turn it up. I wonder if that same thing would work for an AC.

Rob:

It would. Actually, that was my learning experience.

Dave:

There we go.

Rob:

This is really what it comes down to is that I don’t typically go out and replace things willy-nilly, unless I really have to. So if a house has a functioning thermostat, I’m not really going to go in and spend $200 and then whatever it might cost an AC tech to come out and swap it out, because it works, right? There’s no problem with that. When I actually moved into this house, and I was getting it ready for Airbnb and everything, one of the thermostats was faulty, and so I actually did upgrade that to the Nest. However, Dave, I have three air conditioning units on this property.

The other two thermostats were still the more primitive thermostats, just your typical one, not controlled by wifi. But now knowing the ramifications of that, and the fact, the Nest, like you say, you can set a bottom out of 70 degrees. That way, even if they try, they can’t get it any colder. It shouldn’t really matter, because you’ll never really need it to be colder than 70 degrees. I mean, if you wanted it to be 68, I guess you could still put that at your bottom, but it would at least block the people who try to do the whole hotel thing where they walk in, set it to 50, and leave so that it’s freezing when they come back.

Dave:

All right. I mean, they’re not cheap, but they can’t be worthwhile. Pain in the butt to install too, depending on your wiring, but they are very useful. That’s a good lesson. All right, what’s number four?

Rob:

Oh man, this one was a flub. I will say I’m dumb, but also, I have automations in place for this exact reason. All right, so a guest calls me, all right, and she says, “Hey, I’m coming to your house. I’m really excited. Can you shoot me the address?” I think she texted me that. Now, I have automations in place that the day before you check in, I send you all that information. I say, “Hey, all that information is in the trip details under your reservation. Also, here’s your guest book. It’s a digital guide, and if you use this, it’ll give you all the check-in instructions,” so I rarely have people that call me for this type of thing.

Actually, it’s pretty much, I would say in the last year, maybe two people, maybe. But there is one house, the house that I was just talking about. Sometimes I might get that type of question, because there’s not a lot of service there, and so I figured maybe they weren’t able to get the Airbnb app pulled up. So I was like, you know what, instead of being mini passive aggressive and saying, “As per the message I sent you literally two hours ago, here’s the information.” I was just like, “I’m going to help her out,” so I shoot her the address via text. She calls me, and she says, “Hey, this isn’t the house.”

I was like, “What? Can you clarify? What exactly do you mean by that?” She’s like, “This looks completely different from the photos.” So, sometimes you do have guests that are… They’re like, “Hey, these photos make the place look a lot more spacious than it is, or you used the filter on this, and this is actually…” You might have that every so often. I was really just trying to get to the heart of the frustration or the issue. She’s like, “Well, we booked a chalet, and the photo or, sorry, the house that we’re at is a house. It’s like a cottage.”

So when she texted me, and she said, “I’m on the way to your house.” I thought she meant the house, not my cabin/chalet, so I texted her the wrong address to the wrong house. I was just like, “Man, I should have just done the passive-aggressive thing, and said, “By the way, I sent this information to you yesterday, and this was…” I was like, “Man, I was just so annoyed with myself, because I just didn’t ask.” So luckily, the house was only… I mean, I don’t know. Now, I guess I’m not going to say luckily, but it was 45 minutes away. So luckily, it was within reach. Unluckily, it was pretty far away still.

They weren’t really happy about it. I was like, “Hey, I’m sorry.” I always call. If there’s a really big issue, I call. Text is not a really good place to work something out with a guest. So I call him like, “Hey, I’m so sorry. This has never happened before. I have two houses. Typically, people call me about this one. This is on me. I’m sorry.” She’s like, “No. No, it’s okay.” I mean, her husband, you could hear him in the background, and he was like, “Ask him if he’s sure. Is he sure that this new address is definitely it?” I’m like, “It is. It is. I’m so sorry. I’m the worst.”

The learning experience here is just to double check. She gave me her name. She was like, “My name is Megan.” I was like, “I casually remembered that,” and I didn’t think to check. I was like, “Oh yeah, here it is.” If I had just taken 10 more seconds, I could have saved them 45 minutes, right? Again, that one was a flub on my end. I have the automations in place, but you still can’t automate flubs like that, where you just don’t check, right? I should have double checked. That one’s on me.

Dave:

I mean, being on the receiving end of those passive aggressive host emails recently, I do think they do it for a reason. I’ve asked that question that they’ve definitely sent me the answer to. They’re like, “Just check your housing book.” I’m like, “Oh, yeah, I should do that.” Then when you read, that’s like, “Actually, the host put in a lot of time into this, and I should have probably read it like an adult, instead of just sending the host questions.” But yeah, man, I don’t know how you avoid that one. That’s just it. We’re all human thing. It just happens.

Rob:

Well, yeah. I’m busy too, so I’m living my life, and I automate this for the sole purpose of not having to deal with this kind of stuff. My assistant helps me with all this too. I think she was just busy. Whenever I can… You know what, my phone number’s on the account, so she reached out to me, and I was like, “All right, I’m just going to make this super easy, boom, boom, boom.” Then I get a call. Again, this is a 30-minute conversation, and me checking in and being overbearing with hospitality at that point, and being like, “I’m so sorry.”

Let’s move on to the next one, which is a bit juicier. This one, there was a learning experience that I… Let me just say, for everyone listening at home, I do hate this one the most probably out of all the ones that I’m going to talk about. But I think if you hear me out, you can understand how it would’ve happened. It’s August, and August on the east coast is not the coldest time really. It’s pretty warm, but we do have a cast iron stove in our cabins. We allow people to use that. That’s an amenity that people like.

We had a guest who wanted to light a fire in the cast iron stove in the middle of August when it was 95 degrees, maybe 98 degrees and completely human. So already, that’s just a weird scenario that isn’t going to happen. But effectively, when they opened the cast iron stove, there was a pair of blue jays in there, the birds.

Dave:

Living in there?

Rob:

No. No, they were dead.

Dave:

Dying in there. Oh no.

Rob:

I mean, they looked relatively fresh. They weren’t, I don’t know, rigor mortis or anything like-

Dave:

Wait, how did they get in there?

Rob:

Well, because there’s a flue that goes out to the roof, and so they made a nest.

Dave:

They were nesting in there.

Rob:

Yes, exactly. They made a nest. Basically, I guess the nest fell through, because you could see, and they couldn’t… Poor little things could not make their way out, which is that’s how it works. A little sad, honestly.

Dave:

It is sad.

Rob:

That one is just… We had to apologize. I’m like, “I’m so sorry. Please understand. Well, a, typically, people don’t use this, so we don’t open it.” My guests… Sorry, my cleaners, it is their job to check the cast iron stove literally between every stay whenever it’s being used. But when it’s not being used, it stays empty. I’ve had many cast iron stoves. I’ve had chimneys. This is not something that’s really ever happened, and so learning experience for all of us, and it’s, “Hey, just because the space isn’t being used does not mean that you shouldn’t check it.”

For the most part, it is actually on our cleaning list to check unused spaces like coffee makers, microwaves, cabinets, closets, garages. All that kind of stuff is checked, but a cast iron stove is really more of an aesthetic thing for that part of the year, and so my… Also, like I said, my cleaner, she’s effectively sweating when she’s in there because it’s hot outside, and she doesn’t blast the AC on or anything to be respectful and everything, so she didn’t check.

Now, our learning experience from this is, “Hey, literally, every nook and cranny of the house must be checked very diligently first thing before you ever leave the house.” Now, it is part of our cleaning routine to check for dead blue jays.

Dave:

Wow. I mean, everyone out there, make sure. Check for dead blue jays, very important part of your checklist. Honestly, I have a similar thing, a wood burning stove. I would never even think about that. Especially in the summer, I don’t think anyone’s checking in there. I mean, who’s starting a fire when it’s already so hot? But people want to do it. It’s tough. It’s a learning situation though.

Rob:

Right. Well, and here’s the deal, regardless of whether it was hot or not, there were blue jays in there. So if we had gotten to October, and no one would ever have opened it, there still would’ve been blue Jays in there, right?

Dave:

Sure.

Rob:

At some point, the other shoe was going to drop. But again, maybe at that point, once we start cleaning it out and getting it ready for use, then it would’ve been discovered, but it doesn’t really matter. I take the L on that one too, because I’m like, “Well, it’s such a rare thing that…” That’s what processes and systems are all about, right? Something happens that disrupts your day or your workflow significantly, and so you go back to your team and all of your employees or all of your vendors, and you say, “How can we prevent this from ever happening again?”

All of these things are a form of a system. I now have a manual lockbox outside of my house. I now have a nest thermostat in this house. I have the automations because people always would call me and ask me for directions to my house. I said, “I’m going to put this automation in place.” That one obviously failed on me that one time, but that has stopped this problem from happening. Then now, there were blue jays in my wood burning stove, and so it disrupted my Sunday or my Saturday. I’m like, “This will never happen again, and here’s what I’m going to do to make sure.”

So if you’re listening to this at home, please don’t judge. I mean, this really still happens at a large scale, especially with 35 units, this stuff, this is just another week for us. Stuff like this goes wrong all the time. Then we just say, “All right, this can never happen again. Let’s fix it.” Now, we’ll say typically this week was a little bit worse, probably the worst week I’ve had in a very long time. But all to say, I was never really freaking out because I was like, “Well…” I laugh about these things at this point. I’m like, “All right, that was dumb of me, or that’s a dumb situation. Let’s fix it. Move on. Who’s going to fix it?”

Obviously, it’s not going to be me, because I don’t live in the same place as any of my rentals. So all of this is a learning experience, and just understand this will happen to you at home, sorry, at your short-term rentals all the time. You just have to keep your head cool, and move on because you can’t shut down the business just because you failed one time or 10, like I did this week.

Dave:

Well, it’s not all failure, but I get your point. I mean, you can’t expect perfection. It’s not a personal failure. These things just happen, but your point is well taken.

Rob:

Thanks for the sympathy, man. I’ve been really down on myself.

Dave:

I’m just supporting you, man. I mean, if you counted everything that went wrong, and real estate investing is a personal loss, man, that would be a depressing lifestyle. It just goes wrong.

Rob:

But the good is really good, right? You read the reviews, and you’re like, “I turned this one around. I think I’m always more proud of this kind of stuff happening, and then the guest leaves me a five-star review because of how, out of my way, I went to make it a great experience for them.”

Dave:

Sure.

Rob:

For, I think, 90% of these, I think that worked out. Nine out of 10, I think everyone was relatively happy by the end.

Dave:

Good.

Rob:

Moving on to the second half of this list, number six, oh man, see, this one, not my fault, but we’ll let the audience be the judge of it. Number six, the guests that stayed at my cabin lied about how clean this cabin was.

Dave:

When they got there?

Rob:

Yeah. They reached out, and they’re like, “Hey, we’re super unhappy about the cleanliness of this place, and we’re not comfortable staying here, and so we want a refund. We’re going to leave.” My first assumption when this happens all the time is like, “Oh man, my cleaner’s going to have it. Let’s have…” I’m just like, “All right, no. No, let’s just think about it.” So obviously, I don’t ever come at my cleaners like that, but naturally, I’m like, “How could this… How could it be so dirty that they would feel this way?”

We reached out. We’re so confused because we had just hired these cleaners. We interviewed them. They were amazing. They’re like, “Here’s our process. Here’s our list. We take photos of everything beforehand. We’re going to send you timestamped photos of every clean, so you can see it.” They had actually done one clean for us, and it was really great. The guest was like, “An amazingly clean place,” and so we were like, “Okay, they’re great.” So when this guest reaches out and says that it was left dirty, our first thought is that they forgot to basically clean the place.

I mean, this has happened to me before in my career, in my short-term rental journey. We reached out, and we’re like, “Hey, I’m sorry to bring this up, but here’s what the guest just said.” We sent them photos. The photos, mind you, weren’t really… They weren’t… Let me tell you what the photos were. The photos were… There was a string of hair on the sink, and then there was a used towel in the bathtub, which is how we tell people… We always say, “Hey, can you leave the towel in the bathtub, so we know that it’s dirty?”

So, we bring this up to the attention of the cleaners, and the cleaners basically say, “Hey, listen, I don’t want to get into this with your guests, but they are lying. I can guarantee you they’re lying. You’ve talked to us. You know how seriously we take our job. You know that we’re very good.” So we were like, “Maybe they’re right.” Basically, what happens is this guest is like, “Hey, we’re going to leave. I’m sorry. We’re not comfortable.” We’re like, “All right, we’re checking with our cleaner. Let’s just get to the bottom of this, because we want to… Can we just send her back out so that she can clean this, and make this right?”

That’s always my first thing. If someone’s unhappy about something, I try to fix it as soon as possible. They’re like, “No, sorry, we’re not comfortable with that. We’re just going to leave.” I’m just like, “Okay, fine.” We send out the photos to the cleaner, and she says, “Hey, that white towel, you don’t even have white towels. They said that the dishes were all dirty. When you called me earlier today, I was literally unloading the dishwasher. You know that I washed the dishes, and you know that you don’t even have white towels.”

Then she’s like, “Wait a minute, hold on one second.” She sent me a photo of this one towel that they put in the bathtub at the very bottom of a stack of 10 towels in the laundry room that she took a photo of that was timestamped. She’s like, “There you go. This was a photo that I sent you today of the laundry room of that towel that we don’t even put out for guests. That’s our personal cleaning towel. They took that towel, because it’s our cleaning towel, and they put it in the bathtub to make it look like we left it there. We don’t use that towel.”

I was just like, “Oh yeah.” Again, this is a two or three-hour conversation between me, my business partner, my assistant, the cleaners, and the guests. I mean, it really set us back that Sunday night. This all happens on a Sunday, I feel like.

Dave:

I mean, what… That’s just mean. Do you think they just had another place or… What? That’s weird.

Rob:

There’s a couple things here, Dave. Basically, it’s not really that secluded, but it is in the country. It’s not really that creepy. It’s like there are houses in sight, but there’s a highway in front of it. So, there could be a multitude of reasons. They could have found out that it was just farther than they thought, which we advertise all that stuff very specifically. They could have been turned off by the somewhat seclusion of it. They could have been a little creeped out.

Dude, this happens all the time. People get to a property, and it really matches up to what we say it’s going to be from a seclusion standpoint. They get in their head, and they’re like, “Oh my god, I can’t stay here,” and then they try to find a reason to basically leave. That’s what happened to us this round.

Dave:

All right. I mean, this one is weird to me, because I don’t even know what you do about something like this. But is there anything you took away from this?

Rob:

Yes. It’s that you’re going to have the occasional guest that lies that is just trying to get out of things. This is just a part of doing business, right? So me and my partner were talking this out, so does my assistant, and then I’m just like, “Oh, heck no. We’re not… No, I won’t stand for this. I can’t believe that they would throw our cleaners under the bus, because we had verified…” I mean, the cleaners flat out basically proved that they were lying just to get a refund.

So I was like, “Here’s what we’re going to do. We’re going to call our Airbnb. We’re going to get to the bottom of this. We’re going to let them know what happened. We’re going to show them the proof. We’re going to cancel this reservation, and I’m not going to refund this guy, because this is something that… He’s trying to basically pull one over on us.” I was like, “I’m not going to have that in my business.” So my partner and my assistant, they’re like, “We agree. I think you’re handling this very well considering what the circumstance is.” I was like, “Give me some time. Let me put my daughter down, and I’ll let you know.”

You know the phrase cooler heads prevail, right? I think that’s the phrase, anyways. I put my daughter down, and I don’t know. Just my daughter is the joy of my life, so I was just like, “I left…” After I put her down, and I walked out of our room, and I was like, “It’s not that big of a deal. I mean, it’s $500. If this reservation was $2,009, maybe I would’ve been more adamant about it, but it’s $500.” I was like, “It doesn’t matter. It really doesn’t. On the scale of a 15-unit portfolio…” I flip flop from 15 to 35 a lot, because they’re two separate animals, and the cash flow are different, and there’s investors and all that stuff.

But on my personal 15-unit portfolio, $500 is such a tiny, tiny sliver of the monthly income, and so it just was not worth the several hours. When you value your time, and you have an hourly rate assigned to your time, you got to think about it, and you’re like, “Is it worth $500 for me to spend the next two hours dealing with Airbnb, And then the next 10 hours dealing with a disgruntled guest?” If they are disgruntled, and they went to these lengths to basically lie and get a refund, what links would they go to win this?” They have the check-in information. They can come back. They can break in. They can sabotage us in some capacity.

My name is attached to this in some capacity, the Robuilt name. I believe in that, right, from my brand perspective. I’m just like, “It’s not worth the $500,” and so I basically sent a long thing to my partner and my assistant. It was like, “Hey, here’s what I’m thinking. We just let it go. We just refund them, and we just pretend like this didn’t happen, and we rebook it. How do you feel about that?” Because I wanted to give my partner a chance to chime in, and he was like, “You know what? I think you’re right. Every so often, we’re going to have a guest like this, and it doesn’t happen really ever.”

“So because it’s the first time this has ever happened, let’s just take the L, and move on.” I was like, “Great.” You know what, I slept much better that night.

Dave:

Man, I mean, I think that’s such a good lesson, because this happens in so many different things in real estate just when you’re dealing with tenants or just… It’s not even necessarily with tenants. It’s like you get yourself worked up about short-term things, whether it’s how a long-term rental guest leaves your place, or a short-term rental place. Honestly, you got to just take a look at the long view, man. Of course, you don’t want to let people take advantage of you, and you don’t want to be sloppy with the way you handle your expenses.

But at the end of the day, man, you invest in real estate to make your life better. If it’s stressing you out, it’s just not worth it.

Rob:

Right.

Dave:

Luckily, like you said, cooler heads prevail, and you just have to think about long-term view. Think about how you can avoid these situations in the long term, but not get yourself too worked up about any individual problem.

Rob:

Well, I’d be curious on your side of things, because I know you have a lot of rentals, and I know you talked about how you have a property manager on your short-term rental. What’s that like? I mean, that’s got to be pretty relaxing, right? Does everyone manage your properties, or do you do any self-management?

Dave:

Well, for my rentals, I did self-management for eight years. I was doing that for quite a while. But when I moved to Europe, I’ve outsourced most of my management of my long-term rentals. I actually still do a lot of the leasing. I do a lot of the legal stuff like negotiating new leases, setting the prices, that kind of stuff. But, I have someone do maintenance essentially for me, and turning the properties. With the short-term rental, I am pretty hands off. They come to me. There’s certain dollar thresholds where it’s basically like, if the expense is going to be over $200, they need my verbal approval so they’ll call me or email me, and that’s super easy.

But for the most part, I’ve never talked to a short-term rental tenant ever. I’ve had the place for four years. That’s makes it a little bit easier, but you pay a lot for it. It’s definitely not-

Rob:

You do.

Dave:

… efficient from a financial standpoint. But for me just living abroad, I have chosen to-

Rob:

It has to be done.

Dave:

… to sacrifice a bit of cash flow in exchange for peace of mind, sort of like what you’re just saying. Peace of mind’s pretty valuable. I’m willing to pay for it.

Rob:

It is. It is, and let me just be clear with people. I mean, for me, I don’t want to… I don’t know. I don’t want to undermine how much $500 can be for someone at home. If this was your only rental, and that $500 is the difference between making your mortgage or breaking even or making a profit, fight for it. If it’s just your one, and you got the time, stick to your guns. Do it. There’s no problem with that at all.

Dave:

Totally.

Rob:

In this situation, it’s just not worth it for me at this level, right? $500 for the amount of time that… The thing is I already know what was going to happen. We’re going to say no. He’s going to message me for the next 10 days all mad. I’m going to respond, and then he’s going to get heated, and then I’ll probably be heated, and then we never talk to… It is just not worth it. So I think for anyone starting out, stick to your guns. Choose your battles. That’s effectively what this whole list is about. I’m very pro self-management, and sometimes I have to choose all my battles, and sometimes I have to walk away from all of them just because there’s 15 units.

The show must go on regardless of emotion, right? So if you can pull that out of the equation, and basically just focus on the objectivity of this, then you’ll hopefully just look at the final tally at the end of the month versus the profitability every single day. I think that’s the trap that a lot of people fall into. It’s like, “Oh, this is the reservation that makes me profitable or not.” There’s so much more at stake when you look at it that way versus the monthly bird’s eye view and the yearly bird’s eye view.

Dave:

No, that’s a great point. I’m glad you said that, because that’s definitely true. If it is your first property, and it’s $500, and you’re really relying on that, you’re going to treat it differently. But as you scale, you just encounter different problems, and need to prioritize your time a little bit differently.

Rob:

For sure. For sure. All right, well, this next one, I can’t make this up, Dave. I can’t make this up. I really can’t.

Dave:

I’m nervous now.

Rob:

We were setting up a place here in Texas, a new Airbnb, with an investor. Basically, we make this very easy for the investor. Investor comes in. They invest. They finance the property. We set it up. We’re the operations. We furnish it. We do all that kind of stuff, right? Good and bad there. The bad is we do everything, and we have to furnish everything. That in and of itself is an adventure. However, this particular house didn’t have a fridge, so we bought a fridge, and that the wrong fridge was delivered to our house. Not one time, Dave. Not two times, Dave. Not three times, Dave.

Dave:

No. No.

Rob:

Not four times, Dave. Not five times, Dave. Six times in a week.

Dave:

What? Wait. Is it the same fridge they keep trying to deliver, or did you have six different fridges delivered?

Rob:

Six different fridges, they were wrong. We had the right one at first. That one came in. It was broken. They sent it back. They sent another one. That one wasn’t counter depth, so it stuck out like a foot, because they were like, “Hey, this one should fit exactly the same specifications. We’re out of the other one.” Then they didn’t show up, and then they did show up. So six deliveries later, we finally have a fridge.

Dave:

Oh my God. Oh man.

Rob:

I felt so bad, dude. I felt so bad for my business partner. He’s the operations guy. He was there handling it. Man, I mean, we should have been done with this in a week, but it took two weeks. He was there for a whole week.

Dave:

God.

Rob:

Then they would say, “Hey, we’re going to deliver it tomorrow,” and so he would drive an hour and a half the night before to go wait. Then the morning of, they would say, “Hey, just kidding. We’re going to reschedule this to tomorrow.” He’d be like, “Okay, well, I’m just going to stay the night.” Then he would stay the night, and they still wouldn’t come and deliver the fridge. Then they did, and then it was the wrong fridge.

Dave:

Oh my…

Rob:

Dude, this is not an exaggeration. Every day, he would text me. He was like, “All right, we’re on fridge delivery number four now, number five.” Then, man, I felt so bad. No learning experiences here. This is just one of those things.

Dave:

Just a real annoying situation. I guess this is just part of the appliance supply chain issue, right?

Rob:

It is. It is.

Dave:

It’s tough to get anything right now. So if anything goes wrong, I feel like it just cascades and sets off this chain of events where it’s super hard. It’s not like you just drive to Home Depot anymore, and just snag a new fridge. It’s just you could be waiting another couple of weeks.

Rob:

That was… I mean, I can’t say this is a learning experience, because this isn’t logical. It’s just it was the perfect storm of stuff. The only thing that we could have done differently was rent our own truck, go to Home Depot or Lowe’s. Pick out the correct fridge. Hope that it was in stock. Put it in the truck. Hire someone to help us unload it and install it in the house. That’s the only thing that we could’ve possibly done a little bit different, but it doesn’t… Logically, you would’ve expected after the second mishap that the fridge would’ve come, so it’s bad luck. Just bad luck on this, especially since it happened on the same week as all this other stuff.

Dave:

I mean, honestly, I think that’s actually a really interesting point, because it’s like… We’re talking about how to prevent these things and lessons learned, but sometimes you just got to say, “I did the highest probability thing, and it didn’t work out.” That’s okay. You’re going to have to deal with these things, because if you… What you did, what you’re saying you could do as an alternative, it’s just not really practical to do that for everything, so it’s just you got to be like, “This stinks. It’s annoying, but I’m not going to drive my tie myself in knots to try and avoid this one, because it probably won’t happen again.”

Rob:

No. No. Well, hold on, sir.

Dave:

Knock on wood. Actively knock on wood. Oh no.

Rob:

Let’s move on to number eight.

Dave:

No.

Rob:

All right, so this one’s funny. This is a different property in California. My dishwasher went out, and it wasn’t working. Cleaner says, “Hey, it’s not draining the correct way.” I was like, “Oh, well, all right, let me get someone out.” I hire a plumber that… He’s actually… His name is Richard, all right? He works at Home Depot. Him and I have always had a… We’re spirit animals. I go to him. I talk to him about my problems. I’m like, “Hey, man, I need a faucet today.” He’s like, “Yeah, but what else is new with Rob?”

I’m like, “I’m so glad to ask Richard.” He’s my guy. He’s my go-to guy for plumbing stuff. I’m like, “Hey, it’s not draining. I think it’s because the way you install a hose from a dishwasher to a garbage disposal, it has to go up. I don’t really know the details, but basically, it wasn’t like that. So he goes in, and he installs it. He is like, “Hey, you’re good. It should work now.” I was like, “Great.” Basically, cleaner comes the next day to finish the job. She’s like, “Hey, it’s still not draining.” I was like, “Dang it.”

I called him, and he said, “Oh, that’s probably a motherboard thing then.” I was like, “All right, sounds good. Let me get a tech out there.” Tech’s like, “All right, we’ll come out. It’s going to be $150.” I was like, “Fantastic. Come and fix this thing.” He comes out, and he basically says, “Hey, it is the motherboard. We can fix this. It will cost you about $750.” I was like, “That’s more than a dishwasher.” He’s like, Yeah, that’s how it is on these appliances. Sometimes it costs more to fix them than to actually replace them.”

Dave:

Oh, I get that all the time, man.

Rob:

That happened to me one time with my… The very first experience I had with the home warranty, I hit the jackpot, I thought, because the drum inside my dryer broke, and so they were like, “It’s going to be $1,000 to replace. Here’s $800. Go buy a new one.” This was the first week of living in my house, and I was like, “Home warranties are the greatest.” That’s the only time it’s ever worked out for me. The other 15 claims did not work out for me.

Dave:

Dude, I wonder if they do that on purpose. They service your first claim really well, and they’re like, “We’re going to… Now, Rob’s going to buy a home warranty for every property, and we’re going to screw him over on each.”

Rob:

Let me tell you, it worked, because I am always like, “I need home warranty.” Now, I’m like, “I don’t even use it.” It’s annoying to use a home warranty.

Dave:

I know. They are really-

Rob:

I still pay for it. I’m the dummy here. But basically, so here’s several… There’s several stabs in the heart on this one, but basically, they come out. They say it’s going to cost $750. This is like the Boyz II Men like, “How do I say goodbye?” Because this dishwasher, I got for a-

Dave:

Oh, you have a good voice. Is this a known thing?

Rob:

No, I don’t know. We’re not going to get into my singing voice now. I’ve got nothing prepared. I’ve got nothing prepared.

Dave:

I’m impressed.

Rob:

Basically, I’m real sad to say goodbye to this dishwasher, because I got it for free off of Craigslist five years ago, six years ago. It was a stainless steel one. I was like, “Oh my God. Me and my wife were so broke,” and we’re like, “We got a brand new stainless steel dishwasher.” It really did live its life. It lived it full life. My final talk to this thing, I’m like, “You wash dishes really well, and I’ll always be thankful for the service you provided to this family.” This dishwasher is null and void. I was like, “Man, I should call my home warranty.” I was like, “Oh, I don’t have a home warranty on this. No big deal.”

So fast forward, I buy the dishwasher for this short-term rental, because the guest is like, “Hey, your dishwasher…” I was like, “Hey, it’s broken, but are you cool to handwash your dishes until I get the dishwasher? Is that cool?” He’s like, “Yeah, man. But definitely get it in here, because I’m going use it.” I was like, “All right, cool.” I order it. They deliver the dishwasher, Dave. The dishwasher is broken. It won’t open, so they call me, and they say, “Hey, I’m so sorry it’s broken. We have to send you a new one.” I was like, “Put it on my tab.”

They send it out, and then I’m like, “All right, they’re going to deliver it.” Several days go by, and I’m like, “They still don’t deliver it.” I call back. I’m like, “Hey, you didn’t redeliver it?” They’re like, “Oh yeah, sorry. Just a little life pro tip. We always tell you that we’re going to redeliver it, but you have to call to do that, to initiate it.” I was like, “All right, fantastic.” They send out the new dishwasher. The delivery guy… Basically, I don’t really know what happens, but he gets into a screaming match with his manager.

The guest was like, “I don’t know, man, It was so weird. He was on the phone with his manager, and his manager was like, “Do your job.” He’s like, “No, you do your job.” They were fighting back and forth.” So basically, the guy leaves. He’s like, “I’m not going to install this dishwasher.” I was like, “Great.” I actually don’t know if this dishwasher… I don’t think it’s been delivered yet. All to say, fast forward, I actually looked into it. I do have a home warranty on this that would’ve covered this because the mother board was broken. I would’ve just gotten this all handled.

The one time that the home warranty would’ve worked for me actually was this time, and I didn’t even know. I’ve been on the phone with Home Depot trying to coordinate the delivery with the delivery guy, and then this guy, and then they say that they’re going to schedule it, and then they’re going to reschedule it. Then they call me, and they’re like, “Just kidding. I don’t know why he told you that. He doesn’t even work for us. He’s some random guy that just plays pranks.” I’m just kidding. That didn’t happen, but that’s how it feels.

It really… I mean, I’m just like, “Ugh, appliances, supply chains, deliveries, leaving it in the hands of big box stores.” Dave, it just didn’t work out for me. No lesson to be learned here other than don’t buy new appliances. Get them for free on Craigslist. They last a lot longer.

Dave:

For sure. Wow. I was going to say not likely to happen again, but you proved me wrong in the course of one second. Oh man. All right.

Rob:

Two more, and then I’ll leave us with an encouraging word to inspire people back into self-management. I promise.

Dave:

All right. What do you got?

Rob:

Our pool at our motel was days from ruin.

Dave:

What do you mean?

Rob:

I don’t even know how to… Basically, we bought this motel, an inspector comes out. He’s like, “Hey, the chlorine you’re using is illegal.” We’re like, “Oh, that’s fun. Thank you. Thank you for letting us know.” We have to empty the pool. It wasn’t in use. It was already shut down. It needed maintenance anyways. But basically, we have to empty out the pool, which is a hard thing to do. The filter, the pumps, they’re broken. Like I said, it was already shut down. Basically, we empty out the pool. The previous, not the person who sold us the motel, but the person before that runs into the hotel and is like, “Hey, you can’t have the pool empty.”

We’re like, “Why?” They’re like, “We just installed a new liner. The last time that we did this, the liner tore, and the walls caved in, and it costs us $20,000 to fix. You have to fill it up with water as soon as possible.” We’re like, “Right. Hold on. We’re going to do our best,” and so basically, we tried to fill it up with water. The pumps are broken, so we have to go and get the water hauled in professionally from some random company an hour and a half away to fill up this pool. I think we were too late, and there was already a tear. The tear happened in the liner anyways. The walls didn’t collapse.

It’s all fixable, but it was all just one of those things where it’s like, we’re all trying to call pool companies. No one in the one and a half mile radius from Tupper Lake will do that. They’re like, “Sorry, it’s just we don’t have a company nearby.” That’s it. I mean, that was like, “Oh, okay.” Learning experience there, I don’t know. Pools I’m already finicky on. I don’t like pools. I don’t like hot tubs. Watch my YouTube channel, and you’ll understand why. There’s so much maintenance.

Dave:

Really?

Rob:

Yeah.

Dave:

It’s true. Actually, I have a hot tub, and it’s probably the number one thing I have to pay for, and it makes the electricity bill absolutely insane. But, they do say that you get more bookings because of it. I think-

Rob:

You do.

Dave:

Mine’s in a ski town. People love going in a hot tub after they go skiing.

Rob:

You need it. I mean, hot tubs are they add up to 39, maybe it’s $49 to your ADR, your average daily rate.

Dave:

Wow. Worth it. Worth it.

Rob:

It’s a net positive, but stuff goes wrong all the time, dude, all the time with my hot tubs. Actually, nothing went wrong last week, which is weird to say that, because that’s always the one thing that goes wrong in my whole portfolio.

Dave:

Don’t say that that out loud. Now, you’re going to be cursed.

Rob:

No. Well, this doesn’t come out for a while, so maybe I’ll be okay until it comes out, until it’s out in the ether. That one was… But we were already budgeting a $10,000 repair on that pool. We were over budgeting. We were really padding it. It looks like we’re going to use pretty much every dollar of that now. Not anything that we could have prevented because of the circumstances, but learning experience there is don’t keep a pool empty. Apparently, it’s really bad for a pool if it’s got a liner. New knowledge for everyone at home.

Dave:

All right. Round it out. What’s our last one? Is this going to be positive, or are we going to get some uplifting news here?

Rob: