Creative Financing 101 with No Cash, Credit, or Credentials

Pace Morby’s name is synonymous with creative financing. In fact, you could say that he’s brought back a revival of strategies like subject to and seller financing. He’s been so successful with these strategies that Pace has been able to buy over six hundred rental units this year without using a single bank loan! He believes that now, even with rising interest rates and high inflation, rookie investors have a chance to get better deals than ever before!

Welcome to this week’s episode, where we’re live from BPCon2022! We’ve brought in Pace Morby, friend of BiggerPockets, to talk about everything related to creative finance. If you’re brand new to this topic, don’t be alarmed. While some of Pace’s methods may sound complicated, they aren’t actually so difficult in practice. And in just one episode with Pace, you could be convinced to try them out on your next deal!

Pace shares how he’s finding deals, where he’s buying, the negotiation tactics he uses, and why now may be one of the best times to buy. He also discusses why sellers are so open to trying alternative financing options, how you can pick up real estate deals for zero dollars down, and why creative finance options offer far better returns than bank financing in 2022, 2023, and beyond!

Ashley:

This is Real Estate Rookie episode 236.

Pace:

People confuse debt and ownership, meaning I can take over payments on a house and people go, “How? Don’t you have to pay off the debt in order for you to become the new owner?” No, I don’t. Think about it this way, if I go into a grocery store and I use a credit card and I buy a bunch of groceries, who’s the owner of those groceries if I use a credit card to buy them? How do you know that? If I use somebody else’s money, how am I the owner of those groceries?

Ashley:

My name is Ashley Kehr and I’m here with my co-host, Tony Robinson.

Tony:

And welcome to The Real Estate Rookie Podcast, where every week, twice a week, we bring you the inspiration, motivation and stories you need to hear to kickstart your investing journey. And I usually read a review at this point, but I didn’t pull one up. So I’m just going to ask you guys, leave us an honest rating and review on whatever platform it is you’re listening to and we’ll give you a shout out on the show. So Ash, we have an amazing guest, one of my favorite episodes we’ve done recently, we have Pace Morby on the podcast, and this was an encyclopedia of everything subject two.

Ashley:

And we are going to have him back on and do a live workshop. So we’re super excited about that, too. But Pace talks about creative financing, so doing subject two deals, and seller financing, breaks down what the difference is between them, who is the motivated seller to actually want to do these deals with you, how to negotiate, what the steps you take to actually get these deals done.

Tony:

He also talks about how a truck with over 300,000 miles is what prompted his whole journey into creative finance. It was a really great story, so make sure you listen for that as well.

Ashley:

So once again, we are live from BP Con. We are taking every advantage and opportunity of getting to meet people in person and get them into our interview room here that we have set up that is actually sponsored by Pace. So thank you very much for that, Pace. Welcome to the show. Thank you so much for joining us on our morning talk show, or evening talk show.

Pace:

This is amazing. Look at this backdrop you guys have. They made this just for you guys.

Ashley:

No, it’s just for you. All the other guests have come in here, it was nothing. Then they brought this all on when you came in. But for anybody that doesn’t know you, just tell us a little bit about yourself and actually how you got started into real estate.

Pace:

Oh, great question. So I came from a family of 12 kids, so 12 kids in my family, I’m number three, nine kids underneath me, same mom, same dad. And when I was growing up, my parents were in the construction trades. I learned how to work really hard, blue collar background, and my dad could never afford the house, the size of the house, that he needed to house all the kids he had. So he had a job as an accountant and then moonlit as a contractor. And so my whole life growing up, my parents lived in sub two houses, seller finance houses, lease option houses in order to afford those houses. So that was like my background in real estate and creative finance. But when I got older, I became a contractor and I was Opendoor’s main contractor for seven years.

So I opened up their markets and that’s how I got into construction and got into the real estate world. And one day somebody comes up to me and they go, “Pace, why aren’t you in real estate?” I’m like, “What are you talking about? I am in real estate.” And they go, “No, no, no. Opendoor’s in real estate, you’re a service provider.” And I was like, “Oh my gosh,” and it hit me right in the chest. And I knew that I had to make a deviation into doing projects and construction and stuff for myself. And so luckily I met some people at some meetups, a lady named Brittany, and she says, “Here’s how you do it, here’s how you send out postcards, here’s how you do this.” And I got my first deal 10 years ago, roughly, and it was through a postcard, it was a wholesale deal, and that’s how I got into real estate.

Tony:

So we talk all the time, Pace, about the power of networking and building relationships, and we were just talking about this before we started recording as well, and something we tell all of our audience members is that if you want to get started in real estate investing, oftentimes it’s such a scary and lonely path, and the best way to get past that is by networking. And it’s so funny that the person that you met at a meetup was the person that kind of changed your life trajectory because the same thing happened to me. I met a guy at a meetup, we invest mostly in vacation rentals, and I met a guy at a meetup and it was that guy that introduced me to Airbnbs. Now we’ve got a portfolio across multiple states. So it’s like you never know where that one connection might take you.

Pace:

Yeah, it’s empowering. So when you’re looking at this path of real estate, if you look at it like everybody only has one flashlight, I can only light the path in front of me so far and so I’ve got to find other people with other flashlights on the same path. And so I’ve got to just put people on that path in front of me that have a flashlight too, that light it just far enough, and you’ll get far enough down your path, you’ll get your first deal, your second deal, and you turn around, you look back and you go, “I have never made a dollar in real estate by myself.” Have you guys ever made money in real estate by yourself?

Ashley:

Actually, no.

Pace:

So think about that. If you guys are at home, you’re a rookie, you’re a newbie, you’re just starting in here, if you’re consuming content, no matter how much content you take in or any education you take in, you have to apply that with other human beings. So you have to network, it is an absolute requirement. It’s not a suggestion, it’s not a great idea, it is an absolute requirement. Every single deal we’ve all done has had other people involved that you’ve had to network with in order to get those deals done. Unless you guys… have you ever done a deal where you’re like, “I didn’t need anybody else?”

Tony:

No.

Ashley:

No.

Pace:

Isn’t that weird to think about?

Ashley:

It is.

Pace:

Nobody talks about it. But two weeks ago I was like, “Oh my gosh, I’ve never made a dollar in real estate by myself.”

Ashley:

So in the beginning, when you mentioned your parents talking about how they were able to purchase properties, you mentioned a couple terms, subject two, can you talk about those different creative financing deals and explain what those are?

Pace:

So most people look at buying a home, you got to go through a bank. You go down to Chase, Bank of America, Quicken Loans, and you apply, you get a loan and you acquire a house, right? It’s based on your credit, how much cash you have and your credentials, like how long you’ve been at your job, what kind of job do you have, your degree, those types of things are important, credit score, blah, blah, blah. My parents, no matter how good their credit score was, my dad’s income during the day was a… he was a CPA, so he made $60,000 a year, but he had 14 people in his household. So how is my dad going to afford living in a eight bed, five bath house, making $60,000 a year? He’s not.

Ashley:

And paying for all the food, clothes, everything else.

Pace:

Right. And so what my dad did, bless his heart, he would come home from his CPA job and then he would run a painting company, but his painting company was all under the table, so it was non-documented cash. So a bank’s not going to look at that and go, “Okay, you’re approved for a bigger house.” So what my dad did is he went directly to the owners of properties, he goes, “Oh, there’s an eight bed, five bath house, or a seven bed, four bath house, my kids and my wife and I could live in there.” And my dad would go to them and say, “Why don’t we just work out a deal, instead of me going to the bank and applying, you become my bank?”

And I didn’t really truly understand this until later in life, but I realized that creative finance, like the ability to buy anything without your own cash, without any credit and without credentials, applies to everything, even things outside of houses. And it wasn’t until I was a contractor, like I mentioned earlier, that it really hit home with me. My dad didn’t teach me this stuff. I just knew we lived in bigger houses than my dad could qualify for and my dad would stay, say stuff like, “Own or carry, sell or finance,” and because I was a teenager and a knucklehead, I didn’t take the time to learn it. And my dad also didn’t utilize those strategies as an investment strategy, he only used them to get his family into a bigger house.

Ashley:

It was more survival more, really.

Pace:

Survival. So when I became a contractor, I have this story that really hits home of what seller finance is. It’s my F-150 story. Have you guys ever heard this story? It’s cool.

Ashley:

No, I don’t think so.

Pace:

All right, great. So I have this F-150. I’m a contractor. My guys are driving the truck. The truck hits 320,000 miles. Okay, well now I’ve got some problems. This truck’s starting to have issues. So I go, “Okay, well I’ll take it out of my fleet and I’ll throw it out on Craigslist and I’ll sell this thing and I’ll take that money, go buy a better truck, something with less problems.” So where do we go when we want to find the value of a car?

Ashley:

A Kelley Blue Book.

Pace:

Boom, Kelley Blue book. So it’s like Zillow for cars, right? So I go on Kelley Blue book and the truck says it’s only worth five grand. And I’m like, “Okay, well if I sell my truck for $5,000 on Craigslist, Facebook marketplace, Offer Up whatever, am I going to get $5,000?”

Tony:

Probably not.

Pace:

No. Because somebody’s going to come along and be like $3,500 all cash today, as if like… what else were you going to pay with besides cash? You know what I’m saying? So I decided not to put it up for sale for five grand, I put it up for sale for $10,000 because I’m a belligerent seller. And I go for 10 grand and I’m thinking, “I don’t need all the buyers. I just need one buyer that would pay 10 grand.” Well, three months goes by, I don’t sell the truck. So my wife comes in to me, she goes, “Why don’t… you know how your dad used to buy houses where he would just get the sellers to let him make payments? Why don’t you sell your truck on payments?” And I’m like, “Oh my gosh, that’s so freaking genius.”

So I go back to Craigslist where I had the truck for sale and I changed one thing and it was, “F-150, will take payments.” So did I sell that truck for 10 grand? I sold it for $12,500 and I let the buyer just make monthly payments to me. And I was like, “Oh my gosh, I did this with a truck, why can’t I do this with a house?” Now you might ask yourself the question of, “Well, why did Jose,” the guy who bought the truck from me, “why did he pay $12,500?” I also learned that the value in anything is not based on the purchase price. The value, this is important for people that want to learn creative finance, the value of anything is based on what you can do with the thing you bought.

So he looked at that truck, he made me $350 payment, but he turned around and earned $7,000 a month in a painting business he used for that truck. So did he overpay for that truck? No, he didn’t have to use his credit, he used a thousand dollars down payment to get into a truck he couldn’t otherwise qualify for and I was like, “I need to be doing this in real estate all the time. I can go acquire anything I want this exact way.” So I call my dad and I go, “Is this what you’ve been doing?” He goes, “Yes, every single house I bought.” And so I go, “Well, what about people that have payments on their cars or on their house?” He goes, “Oh, you can just take over the payments.” I’m like, “You’re joking me. I can just take over somebody’s payments on their car?”

And he goes, “Yeah, go to lease trader.com. You can take over somebody’s lease right now. In two minutes, you want a BMW X5, you want a G wagon, you go to lease trader.com right now and you can take over somebody’s G wagon, just take over their payments.” And I was like, “You can do this with houses?” And that’s what subject two is. Subject two is a seller sells their house to you by you just taking over their existing payments. You don’t have to qualify, you don’t have to do anything, just take over their payments. And seller finance means that the seller had the house paid all the way off, and they create an agreement with you that says, “Hey, just make the payments to me.” And I was off to the races and we’ve now, just this year, we bought 600 multifamily deals with seller finance… or with creative finance, and we bought about 70 single family homes all through creative finance, just this year alone.

Ashley:

That’s awesome. Congratulations.

Pace:

It’s pretty cool, pretty cool.

Ashley:

When you had that conversation with your dad, were you already purchasing property, you were investing in that?

Pace:

I was doing some wholesale.

Ashley:

And how did that pivot and change for you?

Pace:

Everything. Because there’s a KPI, if you guys don’t know what the word KPI means, it’s key performance indicator, the number one KPI I looked at in my business at the time as a acquisition person buying deals was cost per contract. So how much money in marketing did I have to spend in billboards, TV, radio, postcards, letters, SEO, PPC, whatever it was, what was my cost per contract? And if you’re a wholesaler or you are somebody out there trying to fix and flip, the average cost per contract when you’re spending money on advertising is about seven to $10,000 depending on what part of the country you’re in.

So you go, “Okay, I want to go out and find my own deals direct to seller.” Well, you’re going to have to spend seven grand in marketing. That’s daunting and scary for somebody that’s brand new. But with creative finance, my cost is zero. And so for me, when I was wholesaling, I go, “Oh my gosh, I can go to other people’s sellers,” like a real estate agent or another wholesaler and go, “When you have a seller that wants too much money, I’ll buy it on seller finance, and when you have a seller that has no equity, I’ll buy it on subject two.” And it changed everything for me. And my cost per contract went to $0.

Tony:

So Pace, you talked about your motivation for selling the truck, seller finance. If I’m a new investor, can I make the assumption that the motivation for homeowners is the same as your truck? What would prompt someone to want to sell their home subject two or a seller finance?

Pace:

Okay, so let’s talk about the difference between subject two and seller finance. So subject to typically, like I’d say 80 to 90%, I haven’t done the math on this, but just my gut experience, 80 to 90% of the time on a sub two deal, the seller’s in some sort of pain, they’re in foreclosure, they’re going through a divorce, they don’t have equity, a lot of times they refinanced their house last year, they pulled all their equity out, now they want to go sell, they don’t have any equity, so they can’t sell without cutting a check. So that’s subject two, that’s typically that pain. So if you guys are looking for a sub two deal, a really great place to go is expired listings, agents. What market you’re in…

Ashley:

Buffalo.

Pace:

Buffalo. You’re doing deals in Buffalo? I don’t know why I thought you were doing deals in Florida.

Ashley:

No, no.

Pace:

Maybe I saw you guys on vacation in Florida.

Ashley:

Probably.

Pace:

That’s what it was.

Ashley:

We’re down there like every month.

Pace:

Okay, there you go. That’s why. See, I follow you and I thought you were doing deals in Florida. So expired listings are a really great way to find sub two deals. Seller finance is not pain, it’s gain. The seller of a seller finance deal wants one thing and one thing alone… now, there’s other benefits than this one thing, but the one thing that they care about anything else is they want to win the negotiation, which means they want the top line price to be as high as possible. So I’ve got a deal in San Angelo, Texas, I just closed 30 days ago, it’s a 43 unit deal, seller’s name is Mario, seller finance, seller gave me $0 down, 4% interest and he gave me 50 year note. Crazy, right?

Tony:

50 years?

Pace:

50 years. I took Eric, my video guy, over there, and it was just like jaw dropping to watch me negotiate this deal. Why would Mario do that? Well, number one, the property, 43 units, is only worth 2.7 million. I paid three million. Did I overpay for the property? I think most people go, “Yeah, you overpaid for the property.” But I go, I didn’t put any money down, it cash flows on day one. I have zero cost of capital. Why would Mario do that? Well, he got $3 million on paper, he’s charging me interest 4%, he avoided going through an agent, so he didn’t have to pay 6% to agents, he didn’t have to pay the closing costs, no appraisal. When you guys are in the commercial world, like multi-family, appraisals are expensive, surveys are expensive, we avoided all of that stuff.

So if you compare him getting three million at 4%, he’ll end up getting about $6 million over the term of the loan. But where do those payments go? They go to his children. So when he passes away, he doesn’t need the three million, he’s like, “I’m worth a hundred million dollars, I don’t need the $3 million right now.” So the biggest reason is sales price. The second biggest reason is that it mitigates their tax liability. So imagine if Mario, who bought that property for a million 20 years ago sells it to me for three million 20 years later, how much in taxes he is going to have to pay?

Tony:

That’s a big tax bill.

Pace:

Massive. He has a $2 million gain. So he’s got a big influx of cash that comes into his bank account, now he’s got hundreds of thousands of dollars of tax. But if we spread that out over 30, 40 years, what he can now do is every year he can offset the money he receives with other tax right offs. So essentially being zero tax liability on that deal.

Ashley:

Okay, so now that everybody listening knows that, they know the advantages, they know what they are for the seller, What happens when you’re actually negotiating with the seller? You’re face to face with them, do you do it on phone, what’s your typical setting? And then how do you actually convince them or pitch this or give them some key points, I guess, or tips?

Pace:

I love that. So here’s the great thing about creative finance, it’s easier than cash by far. People think, “Oh, I’m going to start with wholesale or I’m going to start with fixing and flipping and I’m going to start with BRRRR.” Guys, no offense to any of those, I do all of them, they’re all great, they all work incredibly well, but in order for me to do a wholesale deal, I’ve got to offer 60 cents on the dollar, 50 cents on the dollar. In creative finance, I can pay 80, 90 cents on the dollar and make actually more money than the person who paid 50 cents on the dollar.

The greatest part about it is that creative finance is the only thing that is… it’s not a zero sum game, which means the seller makes more money, it doesn’t take money out of my pocket. In a cash transaction, I have to low ball a seller in order for me to make money on my flip or in order for me to have a good refinance on a BRRRR. In create finance, no banks needed, no credit needed, so I can pay the seller more on paper and when I’m talking to a seller and they go, “Well, why would I do that?” And I go, “Honestly, why would you let somebody pay 60 cents on the dollar? Why wouldn’t you let me pay 90 cents on the dollar of what it’s worth?” What would you rather do, go into appointment and pay 90 cents on the dollar or 50 cents on the dollar?

Ashley:

50 cents.

Pace:

Really?

Ashley:

No.

Pace:

No, I mean in terms of as a salesperson.

Ashley:

Yeah, as a salesperson because-

Pace:

As a sales person.

Ashley:

… you’re going to get the commission.

Pace:

No, no. Let’s say that you’re a wholesaler.

Ashley:

Okay.

Pace:

And your job is to go in and get a contract with a seller directly. There’s no agent, you’re not the agent, you’re just acquiring the deal. You have to convince that homeowner to sell their property to you for 50 cents on the dollar to be a wholesaler. But in creative finance, I can tell them to sell it to me at 90 cents.

Ashley:

So, okay. So yeah, so they’re going to be more willing to make more.

Pace:

They’re making way, way more. The second they see how much more money they’re making, it’s like why would they ever sell on cash?

Ashley:

So, okay to clear it up is you’re saying that you’re able to make the numbers work at 90 cents on the dollar and that’s the advantage?

Pace:

Yeah, all day long.

Ashley:

Okay.

Pace:

So for example, if I go out and if I did that same deal with Mario and I had to buy it cash, I would’ve had to given him $2.4, $2.5 million to make it work and guess what I would’ve had to do? Qualify for a loan and then go raise $700,000 from partners or investors and give that $700,000 worth of ownership to those investors. So now I’m into that deal with a higher interest rate, I had to pull my credit, I had to raise money, give up ownership and the seller actually got less money.

Ashley:

Okay, so let’s break that down even more. How are you figuring out what that purchase price is? So are you working backwards then?

Pace:

We’re always working backwards. So the number one thing I always ask… So when a seller’s… I go, “What are you looking for?” Mario says, “I want $3 million.” I go, “Great. If I was able to come up to $3 million, could you give me terms?” Mario says, “Sure, I’ll give you terms. What are you thinking?” And I go, “Well, here’s the problem, Mario. Most of my deals I buy are $0 down, 0% interest. So I doubt you’ll want to do a deal with me.” He goes, “I’ll do $0 down, but I will not do 0% interest.” I go, “Okay, well what are you thinking?” This is all recorded by the way, I record most of my appointments. “I’ll do 4%.” I go, “Okay, great. Do you want a balloon?” He goes, No. If I do a balloon, I still have the same tax problem. I’d rather just let you make payments to my kids even after I’m passed away. My kids keep bearing the interest, it’s a great investment.” So that’s how… literally was like a four minute conversation.

Tony:

So Pace, are you specifically looking for… you talked about failed listings as one way, you talked about talking with wholesalers or agents that the sellers are maybe asking for too much, but say I don’t have a relationship with an agent, say I don’t have a relationship with the wholesaler, I’m brand new, am I just going on the MLS looking for listings that say seller financing or creative financing? What other ways can I…

Pace:

You could do that. So you could go on the MLS. If you are an agent, you could go on the MLS. If you go on landwatch.com, have you guys ever heard of Land Watch?

Tony:

No.

Ashley:

No.

Pace:

It’s so gangster. It’s a great website. If you go to Land Watch, Land Watch has 11,400 seller finance listings right now on their website. 11,000. That’s nationwide. If you go on your MLS, you’ll average, depending on the market, you’ll average about a hundred seller finance listings per one million population. So there’s a lot of seller finance stuff out there. But let’s say that I’m brand new, I don’t know any of that, what list do I go pull? I would go to listsource.com or wherever you guys… if you guys are using PropStream, they’re a big sponsor of this event, Foreclosures, huge.

Right now, this is what I love doing too and you guys should have me back, I’ll call Foreclosures with you guys. We’ll do it. Tell them in the comments, tell them whatever I will call Foreclosures live. So Foreclosure list is the easiest. We can get a deal in 15 minutes. Hands down, easy done. Foreclosure is really good. Expired Listings is really good. People are going through divorce, people are going through bankruptcy, typically that’s sub two deal. Seller finance is a high equity list, so you can literally pull a list on ListSource that says people have their house paid off. Or you can see people that have owned a property for over 10 years, that typically is a really great seller finance opportunity too.

Tony:

So once I find someone Pace, and I’m like, “Okay, this person’s a good candidate for seller finance or sub two,” how do I structure that in a legal sense that they don’t just run away with the property or try and kick me out after I moved in?

Pace:

Well, he who has the deed is the one that controls the property. So it’s set up the same paperwork that you go to… if you go to Bank of America and you get a loan from them, it’s literally the same paperwork. So it’s no different than anything else. Same paperwork, same documents, same ownership goes to you. It’s not some under the table, weird thing. The deed comes in your name. Nobody can change anything about that. So think about this too, this is something that confuses a lot of people, people confuse debt and ownership. Meaning I can take over payments on a house and people go, “How don’t you have to pay off the debt in order for you to become the new owner?” No, I don’t. Think about it this way, if I go into a grocery store and I use a credit card and I buy a bunch of groceries, who’s the owner of those groceries if I use a credit card to buy them?

How do you know that? If I use somebody else’s money, how am I the owner of those groceries?

Tony:

Cause you bought them.

Ashley:

You take them home.

Pace:

Okay, so great, I love that. So two reasons why. One, I have the ownership physically, but couldn’t somebody just come up and steal those from me? They could, but the second thing I have is I have a receipt and proof of purchase. So in real estate, the receipt of real estate is called the deed. Whoever holds the receipt is the owner of those groceries, so whoever holds the deed is the person who holds that property. So think about this, I go to grocery store, I buy groceries with an American Express and I’m walking out into the parking lot and I walk up to you and I go, “Hey, I see you got those groceries. What’d you pay for them?” You go, “200 bucks.”

I go, “I’ll pay you $225 for those.” And you go, “Okay, I’ll make 25 bucks like that.” And I go, “But one caveat, I’ll just pay your credit card payment for you.” I just subject twoed your grocery bill. So the credit card payment and the ownership are not the same. And so people don’t understand that I can just go and transfer a deed 25,000 times in two days, but the debt just stays in one place. The American Express bill stays in the same place, nothing alters, nothing changes, nobody does anything to it. It’s just whoever is currently holding the deed makes the payment to the mortgage. So a subject two deal is the seller’s name stays on the mortgage, your name stays on the deed, you’re the owner. Nobody can take the deed from you without a legal transfer.

Ashley:

I actually did one subject two deal, and it was actually before I even learned who you were, and we had had a guest on the podcast who had kind of taught us a little bit about it, but I wish I would’ve found you because it would’ve made the process a lot smoother. It took I think over a year to actually close on the property just because my attorney wasn’t familiar with it and get everything… all the ducks in a row. But as I did it, I… it was a farm. So there was lots of pieces moving with it and dealing with this farmer, he didn’t really know a lot and it was answering his question. Cause some of the common questions that he had, and I had, so the first one is how do we know that the mortgage isn’t going to be called because of the change… for the due-on-sale clause?

Pace:

Okay, she’s talking about the due-on-sale clause. So the due-on-sale clause happens about one out of every 5,000 sub two transfer. So it’s going to happen. And if you do a lot of sub two deals, you will run into a due-on-sale clause. There’s very typical reasons why the due-on-sale clause gets called. Number one, improper paperwork. Upfront, you use the wrong paperwork. Number two, you didn’t transfer the insurance properly. And number three, you’re a knucklehead and you stopped making the payment. Those are the only three reasons you’ll ever get the due-on-sale clause called. Then when a due-on-sale clause gets called, which it does happen, it’s happened to me five times. You need to know how to handle it.

So why did the due-on-sale clause get called? It’s because you transferred the… or the farmer, me, I transferred the ownership, the receipt of my farm, over to you, I gave it to you. And the bank sees that we transferred ownership and they go, “Hold on, you just took ownership of this farm, but there’s a loan in that farmer’s name still, you need to pay that off.” Legally you don’t have to pay it off. The bank has the right to call it due, not the obligation, but they have the right to say, “Hey, we want Ashley to pay that now.” So how do you handle it when you run into it? How do you handle the due-on-sale clause? How do you get rid of it so easy?

Ashley:

I don’t know the answer, do you?

Pace:

I don’t know either, yeah, no.

Okay, so the way you get rid of the due-on-sale clause is one, make sure you did your paperwork up front, two, make sure you did your insurance properly and three, make sure you make your payment. But if it does still get called, which is very incredibly rare, what do you do? The deed is what triggered the due-on-sale clause, so what do we have to do?

Tony:

Transfer it back.

Ashley:

[inaudible 00:26:14] deed back.

Pace:

Transfer the deed back to the farmer and repurchase it on a lease option where your option price is the mortgage balance the day of your execution. Does that make sense?

Ashley:

Yeah, it does.

Pace:

So it’s technically a… it’s still a sub two deal, but you haven’t transferred the lease… or you haven’t transferred the deed.

Ashley:

So my second question-

Pace:

I got that from a bank by the way. So I’ll tell you how this happened. So I had a property on Lost Dutchman trail. The seller was in foreclosure and we reinstate the foreclosure, he was behind like $20,000, but we reinstate the foreclosure the day before we transferred the deed. And why is that a problem? Well, because the bank that had the loan, they’re a small bank, Johnston Bank, shout out Johnston Bank. They only had five branches. So the president of all the branches was the person actually handling the foreclosures. So we reinstate the loan, we closed the deal the next day and the following Monday he goes to his stack of manila folders and he goes, “Oh, Lost Dutchman is now no longer in foreclosures.” So he goes to reinstate it. It’s just a slow process for them, they did a couple days after we had already closed on it, and he goes to reinstate the loan and he sees that we transferred the ownership.

So he physically manually saw… nobody’s calling due-on-sale clause unless it’s like a situation like that. So they send out a letter, we get the letter two, three weeks later, I call the guy myself, the branch owner, and I go, “Dude, we caught up the mortgage payments. Why are you calling the due-on-sale clause? We’re making the payments.” He goes, “Oh, it’s just bank policy.” I go, “Okay, well,” and he sounded nonchalant, like he ran into this a hundred times, I go, “Okay, well what do you suggest I do? Because I bought this subject two and I caught up the payments.” And he goes, “Oh yeah, easy. All you do is just deed it back to them and then rebuy it on a lease option and the option price is the mortgage balance the day you execute the option.” I was like, “Done, thanks, have a good day.” Pretty simple.

Ashley:

Yeah, that is.

Pace:

So that’s one of five ways to overcome the due-on-sale clause, we can talk about another day, but that one’s really simple.

Ashley:

So follow Pace if you want to learn more about that.

Pace:

Yeah. If you want to get nitty gritty, this is not rookie stuff, but the reason why don’t I just originally buy on a lease option with the option price being the mortgage balance?

Tony:

Because you want the deed.

Pace:

I want the deed because when I have the deed, I get the tax benefits and the tax benefits allow me to not pay any taxes every year.

Ashley:

So my second question for that would be on the seller side is, okay, the mortgage is still in their name. How do they go and get another mortgage? And this is-

Pace:

So DTI coverage.

Ashley:

This is actually how I found you because this was the last piece of the puzzle, the last question I needed and that’s how I found you.

Pace:

Love this. Okay, how does any investor go and get another loan when we go get multiple loans on… and you guys are going and getting Airbnbs and you’re investing, How do you get more loans?

Tony:

You have to show that there’s income on the other properties.

Pace:

There you go. So it’s the same thing. So when I get a seller, so I had one of my favorite deals I ever did, Dave Biarsky. Okay, so here’s what happens. Dave ski driving home one day, he gets a wild hair and he is driving home one day from work and he sees a new home development across the street from his development where he’s lived for 19 years and he turns in there, he goes in, gets suckered into a $20,000 non-refundable deposit on a brand new build, drives back over to his house and his wife’s like, “Hey sweetheart, where you been? I haven’t seen you. You usually home on time.”

He goes, “Babe, I just bought as a brand new house.” And she goes, “Oh my gosh, this is amazing. Can we turn this one into a rental or something?” And he goes, “No. The lender over at the new home build said we have to sell this house in order to qualify for the new house. We can’t have two houses.” She goes, “Okay, no problem. Let me call my friend who’s a real estate agent and let’s have them list the property. It’ll sell in two months and that house will be done in six months. It’ll be perfect. We’ll rent for a couple months, it’ll be perfect timing.” You following me? Okay, so five and a half months later they still haven’t sold the house.

Ashley:

And it’s coming time to close on that new house.

Tony:

Yeah, they got two weeks.

Pace:

It’s coming time to close. They’re going to lose their $20,000 non-refundable and they’re going to sell that house to another person. The agent on that listing calls me up and goes, “Pace, I saw that you do this creative finance stuff, what do we do?”

Tony:

Wait, and had you ever met this agent before? Did you have a relationship with them?

Pace:

I saw her at a meetup and I was like, “Hey, if you ever have-

Ashley:

The power of networking.

Pace:

The power of networking. So I go up to people, I go, “Hey, if you ever have a seller that has a hard time selling their listing because they have lack of equity, come to me.” The seller had lived in the property 19 years, why doesn’t he have equity? Cause he refinanced, pulled out all his equity out of the deal. So he has no equity. Now you’re telling a homeowner that just put $20,000 on a new home build that he’s going to have to write a check to sell this house. Is that the only money he’s going to have to pay to close out on that house?

No, he’s got the rest of his down payment, he’s got furniture, because everybody, when you get a new house, you’re pumped about your furniture. He’s like, “I got a barbecue thing, I got all the stuff I want to do and now she’s telling me I got to cut a check to sell my other one.” I go, “Well what if you didn’t have to write a check? What if you just walked from the property, let me take over the deed?” He goes, “No, I can’t do that.” I go, “Why not, Dave, it solves every problem in the book.” And he goes, “Because my lender on the new house says that I have to sell this house in order to qualify.” I go, “No, she doesn’t know what she’s talking about. I was a loan officer for years. Let me call her and talk to her underwriter.”

So I got on the phone with the underwriter, I’ve done this 400 times by the way, get on the phone with the underwriter, not the loan officer, if you’re talking to loan officer, they don’t know, they’re salespeople. I was a loan officer, we’re salespeople. Talk to the underwriter. So you talk to the underwriter and you say, “Hey underwriter, I’m buying this house subject two, I’m going to be making the payments. What do you need to see from me in order to wipe this off their debt to income ratio to qualify for the other one?” She goes, “Oh, he never told me he was going to do that. No problem.” So we write up our agreement. By the way, you should always use a servicing company when you do sub two and seller finance stuff. West Star is the company-

Tony:

Can you define servicing company?

Pace:

So a servicing company is, let’s say that you and I create a financial arrangement and we want to make sure there’s a non-interested third party watching what we’re doing, making sure you’re receiving it, I’m paying it on time, we would hire her as a servicing company to make sure. So there’s companies like West Star Loan servicing that you pay them $17 a month per house and they are the sheriff of every creative finance deal you’ll ever do. So I worked this out with Dave and Dave goes, “Holy crap, you solved every single problem in the book for me. I thought I was going to be in a world of hurt.” So debt to income ratio needs to be wiped out by the underwriter on the deal.

Tony:

So Pace, I mean first dude, thank you so much man. This has been a crash course on everything subject two.

Pace:

Oh yeah, I could talk about this for 20 hours.

Tony:

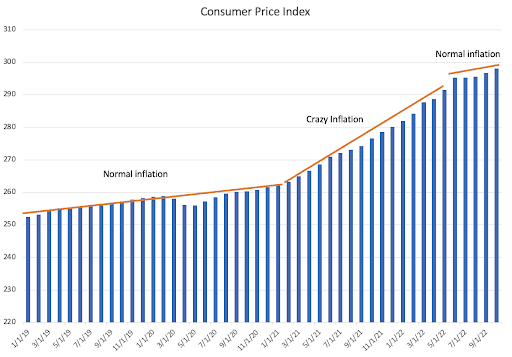

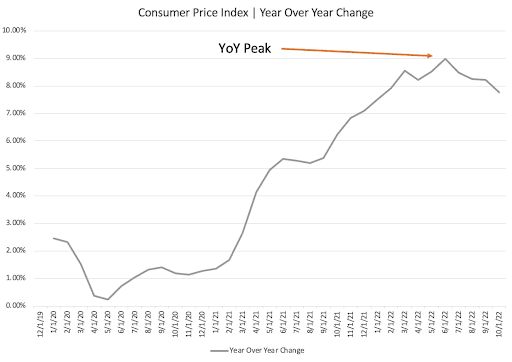

So I mean, last question for you, brother. So I just want to know, so given where we’re at with the economy, with inflation, there’s a lot of people feeling the sky’s falling, now is a terrible time to invest in real estate. Does subject two still make sense in this environment?

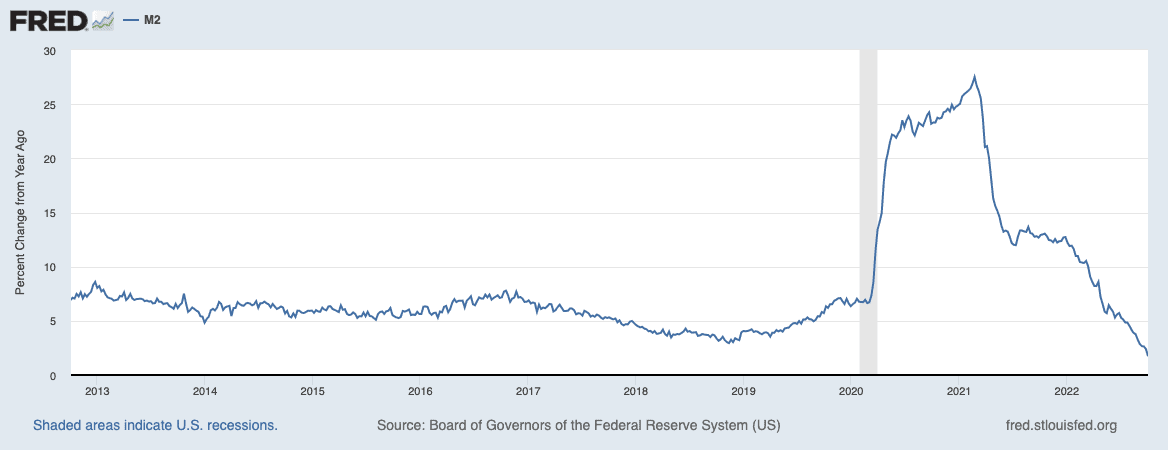

Pace:

My average deal I’m acquiring is 3.25%. My average BRRRR deal that I do is about seven and a half to eight and a half percent. So I honestly don’t know a market where subject two hasn’t made sense, will not make sense. Subject two is and will always be a strategy that will dominate. Right now it is winning big time. I’m being overwhelmed where people are like, “Oh my gosh, our listings went from 10 days on market to now 70 days on market, please whatever you got to do.”

So here’s a really good example for brand new people. I will randomly do this once a month or I’ll go in my local market in Arizona and go, “Anybody in Arizona come to my office today, We’re going to go… we’re going to do a group activity for seven hours today where I’m going to teach you guys what creative finance is and then we’re going to do a contest at the end of the day for 45 minutes and we’re going to get everybody on the phone and we’re going to see how fast we can get a deal.” So we just did this two weeks ago. First, where you go is you go, listings have been on the market for longer than 90 days, call the agent, say, “Hey agent, if you’re having a hard time with that listing, I’m okay just taking over the payments. Would you pitch that to your seller?” So in 45 minutes a group of a hundred people got six written contracts signed back from the agents done in 45 minutes. This market is incredibly easy. You’ll be pouring in with properties.

Ashley:

So when they’re doing that, are you guys looking up on PropStream or any other software?

Pace:

That’s where we got the list.

Ashley:

What the estimated payment is and mortgage payments?

Pace:

Yeah, so you’ll have the estimated mortgage. Here’s how you know, when you said structure, last thing guys, so sorry. Have them have me come back because I will come back and I’ll talk forever. Here’s how we know if it’s a good deal. I don’t care about purchase price. People send me stuff like, “Pace. I got a four bed, three bath or three car,” I’m like, I don’t care about any of that. What can I bring in on the property? What’s the highest and best value of that amount?

Same thing. I go to AirDNA, if it’s going to be an Airbnb, if it’s a sober living facility, I call a sober living company and I find out what I could bring in on that property and then I reverse engineer with the seller and I go, “Okay, if I can bring in three grand a month, the most I can pay the seller is $2,000 a month because I’ve got blah blah blah blah blah, expenses and whatever else.” So you reverse engineer and a lot of that information before we get to the negotiating part of the conversation, a lot of it we find on PropStream.

Ashley:

Yeah.

Pace:

Yeah.

Ashley:

Cause I think that’s such a… Are you finding that too with the seller, finding their motivation to… or what they want out of the deal? So if purchase price is important to them or interest rate, like they just know they want a high interest rate, but maybe you amortize it over 50 years or things like that. Are you thinking at all variables?

Pace:

Sellers typically don’t want a high interest rate unless they’re already a creative finance guy like me. When somebody goes, “Yeah, I’ll seller finance it to you, I want 20% down and 8% interest. I know he’s already… he’s probably already taken my course, or whatever, or he is been in the game for 20 years. Yeah. But if they go, “Oh yeah, what does that mean?” I go, “Great, you care about purchase price,” it’s kind of like a teeter-totter, “I’ll give you a high purchase price but you got to give me low down payment, low interest.” And they go, “Okay, no problem.” They care about the purchase price more than anything else.

Ashley:

Interesting.

Pace:

We have literally barely touched the surface of this. We could go on for hours.

Ashley:

I know, I feel like I’m going to be laying in bed tonight just like there’s so many more questions.

Pace:

Oh my gosh. The thing is I can’t go out and get a cash deal… I could get a cash deal pretty quickly, but I could guarantee you if you guys had me back, I could show you how we could get a deal under contract within an hour on the Rookie show start to finish, agent sending us a contract signed. It’s that simple.

Ashley:

Yeah, we should definitely do that.

Pace:

Guys, less information, more implementation, I would love to implement some of the stuff and do it live if you guys would have me back.

Ashley:

I think that’s part of the problem with the show is we get a lot of stories and what people are doing and stuff-

Pace:

Let’s freaking do it.

Ashley:

… but like the step by step, like doing a workshop, that would be so fun.

Pace:

I would love to. That’s what I… You get, and I know you guys are the same way, you start talking about these strategies, you’re like, “Okay great, let’s go. Let’s go buy something.” So if you guys have me back, I’d love to do that. It doesn’t have to be in person, but we even do it virtual, it’d be great. We could do the same thing.

Ashley:

Yeah. Cool. Well, one question I do have, because I think this would be for everyone that’s listening, where are you getting the proper steps and the proper documentation? So when I bought the farm, it was… my attorney had no idea where to even start with documentation.

Pace:

So I went and paid an attorney in my local state named Sean St. Clair. I have an attorney, actually brought him here to BP Con, had him on my panel. My attorney who I learned from for years and years actually was on my panel today. So I just go to an attorney that’s been doing creative finance and I had them draft documents and then the documents were great, but really you need somebody when you run into a specific situation, especially with a farm, there’s all sorts of weird things going on with farms, you need to have somebody that knows what they’re doing and the way I found these people was networking at meetups.

Ashley:

And that’s cool, the answer is basically just asking what their experience, if they have experience, in doing subject two.

Pace:

Yeah. Have you ever closed a sub two deal? We have a list actually because my job, or my goal, years ago with creative finance is, I said my overall goal is I want to normalize the conversation around creative finance. That’s my goal. If I accomplish that, I could die, I’d be happy. I want to normalize the conversation. One thing that we’ve done is we’ve found five title companies or title attorneys in every single state across the country and we’ve put them on a Google sheet. So if you guys want, I’ll give that to you guys, you can give it to your audience.

Ashley:

Yeah, we would love that. So we’ll put that into the show notes for you guys.

Pace:

There’s not a single state in the country you can’t do sub two, seller finance, novation agreements, wraps, [inaudible 00:38:51], you can do anything in all 50 states. Not just legal, it’s been getting done for hundreds of years.

Ashley:

Well, thank you so much Pace. This has been awesome.

Pace:

Have me back.

Ashley:

And also thank you for sponsoring this media room. We’ve been really taking advantage of it. This is our third podcast we’ve done today in here, so thank you. Yeah. But where can everyone find out more information about you?

Pace:

Go to BiggerPockts episode whatever I was on. It was the first one I was on in November of 2021.

Ashley:

We will also link that number in the show notes.

Pace:

There you go. Go watch that.

Ashley:

Well, thank you so much for joining us today. I’m Ashley at Wealth Rentals and he’s Tony at Tony J. Robinson on Instagram. Thank you guys so much for listening and we’ll be back on Wednesday with another episode.

(Singing)

Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Check out our sponsor page!

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.

Creative Financing 101 with No Cash, Credit, or Credentials Read More »