Scott Galloway on Why Smart Investors Stay Away from “Sexy”

Scott Galloway, NYU professor commonly known as “Prof G,” thinks that America is adrift. Communities are dying, young people are feeling helpless, and wealth is slowly being sucked out of the system to give the ultra-rich even more comforts than before. The average American merely wants to make it—having a house, a family, and maybe an ounce of peace. But with mainstream media violently pointing fingers at one another and the modern worker feeling desolate in the daily grind, what can we do to put this country on the correct course?

Scott knows that the game is rigged. He has strong feelings that real estate investors, like many of us, are playing with “cheat codes.” But, that doesn’t mean we’re doing anything wrong. Scott dives into his personal philosophy on who has taken advantage of this country, who needs the most help, and how a young, aspiring entrepreneur or investor can build wealth, without blindly buying into “sexy” assets.

Although Scott likes real estate (and wishes he bought more of it), he cautions young investors to take a step back and be intelligent with their investments. A few right moves when Scott was young allowed him to live the life he has today—but this was through hard work and taking the right action, not waiting for someone else to save him. No matter what age you are, what side of the political spectrum you fall on, or your feelings toward real estate—Scott has words you’ll want to hear.

David:

This is the BiggerPockets Podcast Show 688.

Scott:

What I would tell people, through no fault of your own, the lobbyists who have fomented this notion that buying a house is the American dream, and there’s been such amazing regulatory capture that if I had it to do again from day one, I would probably be putting a disproportionate amount of my capital in real estate.

David:

What’s going on, everyone? This is David Greene, your host of the BiggerPockets Podcast, the biggest, the best, the baddest real estate podcast in the world. Joined today by my co-host, Dave Meyer, as we interview Scott “Prof G” Galloway. Scott is a very intelligent and very successful man who teaches other people how to build wealth, has a lot of experience in the tech sector, has started and sold companies, writes a book a year, has a lot to say about a lot of different things and brings a very well thought out and nuanced perspective to the podcast. Dave, what were some of your favorite parts of our interview with Scott today?

Dave:

Man, he is, like you said, really knowledgeable about a lot of different topics. I think it was just interesting to hear from someone who’s an investor, a big investor, but not primarily a real estate investor, and just get their opinion and take on the economy, what’s going on in the American society, what’s going on in the American economy. He knew more about real estate than I thought he was going to, and I thought he had some really-

David:

Surprised us at the end there.

Dave:

Yeah, he was like, “I don’t invest in real estate,” but then he was dropping some bombs right at the end. So I thought it was really insightful to learn from a different type of guest than we have a lot of times on these shows.

David:

Well, I think it’s important to do that, right? You don’t want to end up in an echo chamber of your own, especially when you criticize other people for ending up in their echo chamber. So we typically talk about real estate and, more specifically, real estate success stories. This person house-hacked a million houses, this person bought 27 units working as a janitor, and we’re like, “Oh, this is so great.” But you don’t hear about the people that didn’t make it.

The same is true about people that built wealth in other ways that were not specifically real estate investing and the perspective that they have on how wealth creating works, what principles work, what people should focus on, the right path to take as you are looking to improve yourself and build your wealth in the process. It applies to real estate, absolutely. I think it’s healthy to get a perspective that’s not just the same thing we’ve had recycled by every single BiggerPockets guest that comes in. So, yeah, that’s exactly what we’re trying to do here-

Dave:

Totally.

David:

… is we’re trying to bring a more mature and nuanced perspective to what we know works with building wealth, which is real estate, and see if there’s ways we can accelerate the process, improve the process, or decrease our own risk in the process. That leads us to today’s quick dip, which would be follow some of the best advice that I ever heard Robert Kiyosaki say.

So I was listening to Robert speak at a GoBundance event and he said, “Look, most people are either a Republican or a Democrat. They see heads or they see tails, and they argue over if the coin is heads or if the coin’s tails and they do not want to acknowledge what the other side also sees. Well, there’s a third side of a coin that many people don’t realize, and that is the edge.”

Robert’s advice to us was don’t pick a side. Stand on the edge and you can look over each side and see what is happening on both sides, and then make your decision based on the information you’re presented, not the ideal that you identify with. I thought that that was brilliant advice.

So as you listen to today’s show, keep that in mind. It doesn’t really matter if you’re a heads person or a tails person. What matters is you see heads and tails. You know what’s going on around you and you make the right financial decision to put you in the best position possible. Dave, any last words before we bring in Scott?

Dave:

No, well said. I think I believe strongly in objectivity and trying to develop your own understanding of issues.

David:

That is right, because you love data, and data doesn’t lie.

Dave:

I sure do.

David:

Scott Galloway, welcome to the BiggerPockets Podcast. How are you today?

Scott:

I’m doing great. Thanks, David.

David:

I’m glad to hear that. I’ve got to say, your hair is looking fantastic.

Scott:

That’s right. Same barber.

David:

I’m actually considering copying you.

Scott:

Yeah, no. If we had Dave’s hair, we’d be the junior senator from Pennsylvania.

David:

Well, anyways, Scott, thanks for being here with us today. For those of our audience that are not familiar with you, can you give us a rundown of your background, what you’re known for, and then the contents of your new book?

Scott:

Sure. So good to be with you guys. I’m a professor of marketing at NYU Stern School of Business. I’m an entrepreneur turned academic. Born and raised in California. Brief stint in investment banking, then graduate school, and started several consulting eCommerce and business intelligence firms. Then started teaching at NYU about 20 years ago and now do a lot of media, write books, stuff like that.

David:

Awesome. If you had to say what you’re most passionate about right now, what’s on the front of your heart?

Scott:

I consider myself, at my core, a teacher, at least professionally. I think the only business card I think I’ll have, and I don’t have a business card, but metaphorically, will be that I think I’ll always teach. I have an online edtech company. I’m still on the faculty at NYU. But at the end of the day, I think of myself as a teacher.

Dave:

All right. Well, Scott, I’d love to get into the book Adrift, which I read over the weekend. Really, really fascinating topic. After reading it, I was just curious why you called it Adrift and not something like We’re (censored) or Everything is Terrible, because it paints a grim picture, right?

Scott:

Yeah. I force myself now in every presentation, and tried to do it in the book, to talk about solutions and silver linings. But Adrift was I don’t think we’re lost. I think all of these problems are of our own making, and that’s the bad news.

The good news is they can be unmade. I think we can see land. I think all of our issues are fixable. There’s nothing wrong with America that can’t be fixed with what’s right with America. I think we see land. I think we know what needs to be done. I think we have to row in unison, or whatever nautical metaphors I can come up with.

But I don’t think we’re lost. I don’t think we’re (censored). For lack of a better term, I just think we’re a bit adrift. Like I said, I’m actually quite hopeful because the incumbents and the what I’ll call the entrenched want to create this illusion of complexity and that these problems are intractable.

I don’t think there’s a single problem that ails us that can’t be fixed. We talk about teen depression at the hands of social media. They will claim it’s multidimensional and difficult. It is difficult, but they’re absolutely solvable.

There’s no reason we can’t age gate social media. There’s no reason we can’t hold these firms accountable when they are sending emails saying … Pinterest sends an email, saying to a 14-year-old girl, “Here’s a board with images on suicide you might be interested in.” There’s just no excuse for that. We can fix that. We can fix our tax structure. We can make investments in trade schools and junior colleges.

We’ve accomplished much bigger things. We’ve stared down much bigger problems before. So I don’t think we’re lost. I don’t think we’re (censored). I think we’re adrift.

Dave:

It’s a good way of saying it. Yeah, I’m mostly kidding. But I agree that acknowledging what the problems are is probably the first step towards coming up with some of those practical solutions. So for those of our audience who haven’t yet read your book, can you tell us just what are the big problems, some of the themes that you’re seeing that are impacting American society?

Scott:

Sure. So there’s several. I’ll start with some major ones, and then what I think is the profound one or the biggest one. We talk a lot about income inequality. That gets a lot of warranted attention. What we don’t talk about that I think needs more attention is what I’ll call age inequality. That is a 75-year-old is 72% wealthier than he or she was 40 years ago. Someone under the age of 40 is 22% less wealthy.

The percentage of wealth controlled by people under the age of 40 in the last 40 years has gone from 19% of GDP to 9%. In some, we have, from a legislative standpoint and a fiscal standpoint, decided to transfer money from young people to old people.

Again, the entrenched, the old wealthy generation will say, and I’m a part of that generation, is that these are big problems because of globalization and network effects, which is total (censored). These are concerted decisions.

Reagan taxed all income at the same rate and then we decided, “I know. Let’s have a lower tax rate for capital gains.” Then the second biggest tax deduction is mortgage interest rate. So who makes money off of stocks and bonds? Old people. Who makes money off of current income and salary? Young people. They pay a higher tax rate. Who owns homes? People my age. Who’s renting? People your age.

Social security is considered the third rail. I get attacked immediately when I say we should reconsider much harsher means testing for social security. The largest transfer of wealth that takes place every 12 months on the planet in history is young people transferring a trillion and a half dollars to the wealthiest cohort in the history of the planet, seniors, in the form of social security.

But because over a quarter of our elected representatives are over the age of 70, because the first two states that basically set the presidential primary are the oldest states in the Union, Iowa and Maine, we have massively overinvested in older people at the expense of younger people. Even if we get a chance with the bailouts from COVID to make rich people richer, we decide, okay, we’re not only going to (censored) younger people, we’re going to (censored) their kids and their grandkids with unsustainable levels of debt, so pop-pop and nana can upgrade from Carnival to Crystal Cruises.

So there’s been massive age inequality. There is also massive … I think a huge issue we’re going to talk more about is failing young men. The education system is highly biased against women, and people are afraid to talk about it. Richard Reeves from the Brookings Institute just wrote a wonderful book called Of Boys and Men. But the moment you start advocating for men, you’re labeled a misogynist. People see it as a zero-sum game.

When we decided to advance the interest of women when it was 40, 60 women to men in college, when you were in favor of affirmative action, people of color, which I am, I’m a huge advocate of affirmative action, you weren’t seen as being anti-white. So we don’t even want to have an open conversation around how young men are really struggling.

I think it’s changing. I think people, mainstream media is becoming much more open and accepting of saying that. You’re not immediately labeled a misogynist. But, look, three times more likely to commit suicide, four times more likely to be addicted, 12 times more likely to be incarcerated. Seven in 10 high school seniors are girls. In the next five years, for every one male graduate of college, we’re going to have two females. It’s going to be two to one. Two to one.

Then you have this war on what I’d call masculinity, or we’ve conflated toxicity with masculinity. We’ve decided that masculine attributes … Female attributes should be celebrated and protected and honored and male attributes should be starched out, that there’s something unhealthy or dangerous about them.

So I think failing young men is a huge one. Incredible age inequality. An emerging crisis, loneliness. People don’t speak to their neighbors. Church attendance is down. People aren’t joining the boy and the girl scouts. The number of kids that see their friends every day has been cut in half in the last 10 years.

We don’t go to work. We don’t go to the mall. We don’t go to the movie theaters. When we don’t touch and smell each other, we have less empathy from one another. We resent people. When there’s immigrants in your neighborhood you interact with, you’re pro-immigration. When there are no immigrants and you don’t see them, you become very anti-immigrant. Too many people, especially young men, are spending way too much time alone in their parents’ basement.

Then what I think is the biggest problem is if America’s problems were a horror movie, the call is coming from inside of the house. Now what do I mean by that? Geopolitically or relatively speaking America, I would argue, has never been stronger. We’re food independent. We’re energy independent. Smartest, brightest people in the world all have one thing in common. They all want to come here.

We’re the football team that gets every draft choice, the top hundred draft choices every year, but we don’t like each other. A third of each party views the other party as their mortal enemy. 54% of Democrats are worried their kid is going to marry a Republican. We have 20% of Americans would be fine with an autocrat as long as it’s his or her gal.

So it just strikes me there’s this falsehood, this dangerous falsehood, or a lack of recognition that Americans’ greatest allies will always be other Americans. We don’t like each other. People dislike our leaders on the other party more than they dislike Putin or Xi. That’s (censored) ridiculous.

Just to wrap up this word salad here, I’m a huge fan of World War II history, and there’s this wonderful photo generalist, I think her name’s Maria Amolo, and she’s been colorizing these World War II photos. I don’t know if you guys have seen this, but my favorite is a landing craft, in the invasion of Normandy, dumps its front doors and you see these men wading through the water, really boys. Average age was 26, average salary was $800, these GIs.

The most unskilled, expendable men were sent first because they knew that most of them were getting killed. They’re headed towards Omaha Beach, wading through this cold water. Two of three wouldn’t make it off the beach.

I can’t even imagine any of them at that idea, for the life of them, could have told you who was a Democrat and Republican wading towards that beach. Then I imagine them turning around and being able to suspend the time-space continuum, as we can looking at the past, and they could look and see us and go, okay, teen depression, election interference, polarization. They would go, “You can’t fix that? Jesus Christ, look what I’m facing. Look what I’m running into. But you can’t face that?”

So I’m motivated by history to believe that America can absolutely fix all of these issues. But I would say the biggest problem is Americans need more connective tissue and to start joining hands physically and metaphorically with other Americans and stop this nonsense and this polarization and just this vitriol towards each other.

David:

If I’m hearing you right, Scott, I’m picking up a pattern in what you’re proposing here, and I just want to get verification that this is the point you’re making. It’s that a lot of this is due to policies enacted that affect incentives. So we created policies that would incentivize women to attend college and now it’s out of whack. We’ve created policies that have allowed a certain generation to be able to hold onto and attract wealth at a faster rate than others, and it’s created something out of whack. Is that more or less your perspective?

Scott:

There’s some nuance there. So when it comes to education, what we found is when we leveled the field in education, girls blew by boys. Boys, biologically, are at a disadvantage. An 18-year-old girl and an 18-year-old boy, essentially when they’re competing for a college seat, the girl is competing against a 16-year-old. Boys’ prefrontal cortex doesn’t grow and mature as fast. The executive function that is gas, break, when to play FIFA, when to stop and study. Girls are one to two years ahead of boys, and school and college rewards that behavior, that discipline, that delaying of gratification.

I don’t know if you guys have kids or boys, but basically when you’re a dad, all you really are is the prefrontal cortex for your boy until he develops his own, right? You’re like, “Okay.”

David:

By proxy.

Scott:

Yeah. “Okay, stop playing video games. You have homework tomorrow.” “No, you can’t yell in a restaurant.” I mean you’re just sitting there going, okay, I’m the front part of your brain until it actually grows. Girls, theirs shows up sooner. It just shows up sooner.

Also just there are societal reasons. Two kids in the principal’s office, a boy and a girl, exact same behavior, cheating on a test, exact same test, exact same cheating. The boy is twice as likely to be suspended. Black boys five times as likely to be suspended. Once a kid is suspended two to three times, he’s not going to college.

80% of primary school teachers are women. Who are they going to champion? I don’t resent them for this. Who do they see themselves in? In that little girl who has the same colored hair that comes from the same background. Two-thirds of high school teachers are women. So there’s fewer male role models.

We also have 21% of US households are run by a single parent, which is Latin for mom. Girls actually have similar outcomes in single-parent homes. Boys come off the track. The moment there’s no longer a male role model living with a male, he becomes twice as likely to be incarcerated.

So the system, the educational system, is biased against boys. Now having said that, the labor market, there’s this moment of equality when men and women are young. They have about the same wage as girls, or women have closed the gap, which is a wonderful thing. Then the labor market turns against women about the time they have kids. Wages for women drops to $0.77 on the dollar once they start having kids. Anyway, so there’s biases everywhere.

In terms of school, I think it wasn’t policy as much. It was that we level the playing field and the behaviors that the educational systems value favors biologically women, both in terms of the norms of education and just straight biology.

Now on the age inequality stuff, or income inequality, this has been a concerted policy effort by a Congress and a Senate that increasingly looks like a mix between the Golden Girls and the Walking Dead. We’re just too goddamn old. It’s not surprising that one in five children are living in food-insecure households because none of these people have young kids at home. They just have trouble relating. And old people vote. So we effectively have a geriatric government that is supporting other old people.

That’s not to say people can’t represent people on like [inaudible 00:18:41]. We have the oldest leadership in the world. I mean think about the presidential race, the two leading candidates. If Biden or Trump win president in 2024, that means the last time Marine One leaves the West Lawn, we’re either going to have an 86-year-old or an obese 82-year-old. That is (censored) ridiculous.

We are so worried about being called an -ist, specifically an ageist, that we don’t want to acknowledge that you know who else is ageist? Biology. The majority of us have this uncomfortable conversation with one of our parents, taking their driver’s license away. It usually happens in the ’70s, but we’re going to have an 82 and an 86-year-old running the biggest economy and in charge of 11,000 nuclear weapons.

There’s a huge problem, I think, around a representative government that does not represent young people. And so, the policies you were talking about have been enacted that it just slant money, just the level the playing field that’s just taking more and more money from young people and sliding it down to the entrenched incumbents.

David:

So looking at this from the perspective you have, what are some of your recommendations for how younger people can navigate through this environment to put the odds in their favor to build wealth?

Scott:

Well, one, I think we should have one … Just from an economic standpoint, we need to reform the tax code and make it progressive again. Basically at about 99%, your taxes go down.

So I’m an entrepreneur. I sold my company, L2, for $160 million. The first $10 million is tax-free. That doesn’t make any sense. Why am I not paying any taxes? Why is FedEx and Nike not paying any taxes?

If you look, I would like to see taxes coming down. Government requires 23% of GDP. We’ve been deficit spending, so, arguably, tax rates should be, on average, 21%. If you had corporate taxes at 30% and you tax people making over a million dollars current income, just one income … There’s just income. I believe in what Reagan did. There’s just one income. And you tax people making over a million bucks 30%, that means everybody else would pay somewhere between 12% and 14% tax.

So you could cut taxes as long as you force everyone to pay taxes. As somebody who came into wealth later in life, you just see how the game is rigged. I have these incredibly intelligent people engaging in massive tax avoidance. It’s all legal, but it’s just striking. My tax rate is between 17% and 19%. When I was working my ass off making all my money in current income living in California, my tax rate was 46%.

So we’ve decided, we’ve made a concerted decision that if you get the gold medal, we’re going to give you the silver and the bronze. We’re not going to say, “Okay, you’re lucky you need to pay some tax and help get more people on the podium.” We need to redo our tax policy. We need to provide double the number of freshmen seats at colleges.

Me and my colleagues are so drunk on exclusivity that we’ve created artificial constriction of supply such that we can feel better and better about our degrees. We have a numbious rejectionist culture. Once I have a college degree, I want admission rates to go down. Once I have a house, I don’t want any new projects or development projects approved. Once I have a successful tech company, I’m going to weaponize government such that small companies can’t get merged because I engage in monopoly abuse.

The result is the gale forces of disruption never really get to blow, and there’s no churn. There’s fewer and fewer younger people who have access. We artificially suppress interest rates … Unless you have rich parents, how do you buy a house if you’re a young couple? How on earth do you buy a house?

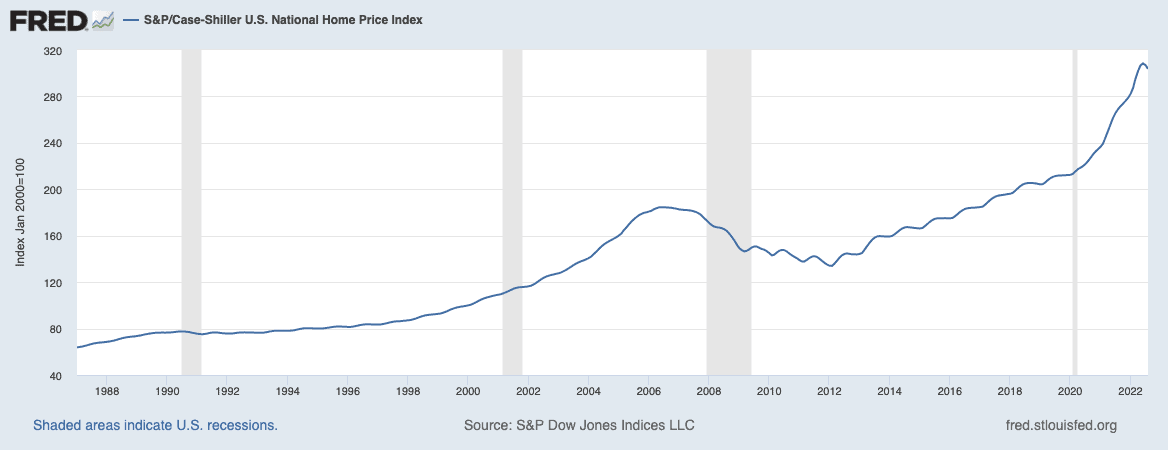

Now that’s changing, I think, for the better. I’d love to see mortgage rates go to 9% and see housing prices crash, because I got to buy a house when I was young and I didn’t have parents that could help me. How the hell does a young couple buy a house right now?

Anyway, I think simplification of tax code, massive increase in freshmen seats, big investment in our junior colleges and vocational programs and stop fetishizing the traditional four-year degree in elite colleges. There’s a lot of job demand for cybersecurity, specialty construction, installation of solar panels. There’s a variety of two-year certification degrees, vocational degrees that would give kids $60,000 to $120,000 day one. But instead we have this weirdness in the US where if my kid doesn’t end up at MIT or Google or KKR, I failed as a parent.

33 out of every thousand workers in the UK and Germany have the term apprentice. In the US, it’s three. 50% of Germans have some sort of vocational certification. In the US, it’s five. So I’d like to see national service. I’d like to see similar to what they do in Israel and Northern Europe, mandatory conscription of one to two years. So you meet people from different backgrounds, different ethnicities, different income levels, different sexual orientations.

I think we need to establish connective tissue and have a generation of Americans that see themselves as Americans first, not as Republicans or Democrats, or college attendees or non-college attendees. So I think there’s a variety of social and fiscal initiatives that we could do to start investing, again, in the middle class, and specifically investing in our younger Americans.

Dave:

Scott, a lot of this advice is this societal-wide, macro ideas, and it’s really interesting, your thoughts there. What about some of the individuals … Because a lot of the people listening to this show are in the Gen Z or millennial age group. By the fact that they’re listening to this show, I’m going to presume that they’re very interested in getting ahead financially. What are some of the ideas or paths that you recommend to people who, despite these headwinds that they’re facing on the societal level, that they can take as individuals to try and improve their own financial position?

Scott:

Well, I mean there’s a few best practices. So very basic peanut butter and chocolate is certification and geography, and that is we live in a LinkedIn economy. What is on your LinkedIn profile is very important in terms of access to middle-class economy. So if you can have the opportunity to get to college … We all like to say college sucks and people don’t need college any longer. But that’s mostly a gag reflex because it’s become so unattainable for most people.

But if you have the opportunity to go to school, you should take it. I’m not suggesting you go to a mediocre school and pay $100,000 or issued a ton of debt. You need to be smart about it and make sure it’s worthwhile. But if you have access to a good certification at a reasonable price where you can afford it, it’s a good plan B.

Get to a city. Two-thirds of economic growth is going to happen in 20 super cities. It’s like I’m a mediocre surfer, but occasionally I get somewhere with a perfect offshore breeze and perfectly shaped waves and I believe that I’m a good surfer. Then I go back and surf in real waves and realize I can’t surf. You want to get to where the waves are great. In cities, the waves are just better.

It’s like when you play tennis, you play against someone better than you, your game elevates. When you get to a big city, you’re playing against the Federers of the world. You just have to be better, and you are better. You have to work harder. You have to get better skills. So the peanut butter and chocolate of early ascent is certification and getting to a city.

The algebra of wealth, and I think about this a lot, is, loosely speaking, focus on your talent, not your passion. So first thing is focus. Find something you think you’re good at. This is what you need to do in your 20s. Don’t try and figure out what your passion is. That’s dangerous. I’m super into sports and I like alcohol, so I should open a sports bar, or I love media. I would love to start a magazine. I would love to start a magazine.

You want to open a restaurant, go to work for Vogue, open a nightclub, or go to work in sports, you better get a ton of psychic income because it’s going to be (censored) return on investment, because those fields are overinvested. Just as Miami real estate, no one wanted in 2010 and the returns were huge. Now everybody wants Florida real estate and the returns have been starched out. The same is true of your own human capital.

So your job isn’t … Be a DJ on the weekends. Find something you’re really good at. Like I’m good at math, or I think I’d be really good selling soft … What can you do that you think you could be amazing at, like you have some natural inclination? You can’t hate it, but you don’t have to … When people say passion, people immediately go to, well, I’m really into art. Oh, okay, great. That’s a tough way to make a living.

Anyway, find your talent, investor requisite 10,000 hours, and becoming great at it. Then get to a certain level of stoicism. It sounds basic. Try and figure out a way to make more than you spend. When you’re young, before you have kids and dogs, live in a (censored) small apartment. Spend as little money as you can on your living situation because you don’t need to. If you’re young, you should be in your apartment max eight hours a day, and seven of that should be sleep, or six of that.

Try and start saving right away. Try and show a level of stoicism around being really disciplined. Try and work out five or six times a week. You should, before the age of 30, be able to walk into any room and know that if (censored) you got real, you could kill and eat everybody or outrun them.

I think being in great physical shape before the age of 30 makes you more confident, makes you more kind, gives you the stamina to work really hard. You bring very little to the workplace when you have no skills when you’re young.

I joined Morgan Stanley out of UCLA. I wasn’t as well-educated. I don’t think I was as smart as the majority of my classmates or peer group, my analyst class. So I decided, every Tuesday morning, I was going to go to work and I was going to stay till Wednesday at 5:00.

I would work the night through Tuesday night. I would work for 36 hours straight. And I could do it. I was an athlete in college. I didn’t have kids. I didn’t have dogs. I could go sleep-deprived. No problem. It sent a signal that I came to play. They were like, “Oh, yeah, that’s that kid that went to UCLA, who works through the night every Tuesday.” I got opportunities. People like that. I could not do that now. I’m not physically capable of it and I want to see my kids at night.

So go really hard. Be stoic. Try not to let emotions get in the way. Try to show real discipline around saving money. I’d say focus very much on work. I think there’s a lot of talk about balance. I get that a lot of people work to live. Good for you. You’re going to need to move to a lower cost neighborhood and you’re never going to get that economic security that most people want. I’m not saying my way’s the right way, but most of the people I talk to are very economically ambitious.

Then in terms of once you have a little bit of money, diversify. I think diversification is your Kevlar. It’s easy to think, oh, Solana’s going to the moon or Michael Saylor is a genius, and I think he is. He thinks Bitcoin’s going to $400,000, so I’m going to invest everything in Bitcoin. By the way, he might be right.

But diversification is your Kevlar and that is … I’ve lost everything twice, 2000 and 2008, because I was convinced and I was a genius. eCommerce was everything, and then tech was everything. The market is bigger than any individual, and you are putting yourself in a position where if you take a bullet, it can kill you financially.

So now I diversify, put money in all sorts of different unrelated things. That way if I take a bullet in my stock, a stock goes to zero, it hurts, but I survive.

Then time. Find things you want to invest in, where you don’t have to pay attention to them and ignore them. The best performing cohort of investors are dead people, and there’s research here, because they don’t trade their accounts.

So, anyways, find your talent, focus, a certain amount of stoicism, save more, spend less than you make, diversification, and then let time take over. You’re going to wake up … You guys are younger than me. I was 22 yesterday. I’m going to see my college buddies in LA. It’s like we’re seniors at UCLA. I literally can almost feel and smell the same things.

Now I’m 57, and just a little bit of money back then, just a little bit of money every month would be millions of dollars right now. Most young people don’t believe it because they can’t evaluate time. They can’t assess time correctly.

David:

Or inflation, the way that the actual value of the currency changes so dramatically over time.

Scott:

100%. Yeah. I’m always invested. I’m always in the market, because I don’t think you can time the market. I just try to diversify. I think the market’s going to absolutely throw up in the next 12 months. I’m still fully invested, because I don’t know. I mean I don’t know. I have a gut, but I don’t know.

David:

I heard a conversation on the Lex Fridman Podcast, where he was speaking with someone … I couldn’t pronounce the guy’s name, it was like Amadeus or something, that was talking about … He was a proponent of Bitcoin as well. He’s talking about the fiat standard versus the gold, or he was calling it the Bitcoin standard, and just discussing how in a fiat economy like we have, which basically means the government can manipulate the money supply, they can print the crap out of it … And print isn’t actually accurate, but it serves the same purpose … to fund wars that we’re fighting or interests that we have overseas or programs that we have here. Whatever it is that the government wants to do, instead of raising taxes on people, which is unpopular, they just print more money.

For some reason, none of us talk about it. To me, it’s amazing that we’ve done what we’ve done to our money supply. Maybe 80% of the entire money supply has been created in the last little over two years, probably. It hardly ever gets talked about at all. But we’ll talk about other things in the news nonstop.

Well, anyways, his point was savers are punished. If you’re just simply making money and saving money and setting it aside, you can never catch up to the rising tide. You are forced to become an investor if you’re in a fiat economy, almost just to stay even. Like you were just saying there, Scott, if you look back 30 years, there’s not a human alive who would say, “I wish I wouldn’t have bought that house,” “I wish I wouldn’t have invested in that stock,” “I wish I wouldn’t have invested my money in something prudent.”

But when we think forward, I don’t know, there’s a disconnect that the same will be true 30 years from now, and probably much more dramatic with the way that we’re printing money now. Are you of the same opinion that we should be telling people you have to be investing your money and you have to be holding onto it because you’re not going to get ahead if you’re just making some money, spending some money, and saving a meager amount?

Scott:

So in terms of … So let’s go here, fiat currencies. Every fiat currency throughout history has eventually failed because, to your point, the political temptation to spend more money such that you can provide a short-term sugar hit to the economy and not be fiscally responsible, which requires short-term pain and oftentimes means you’re going to be booted out of office, requires adults thinking about their kids and grandkids, and the political system doesn’t occur. So that’s long-term thinking. So, ultimately, over time, the temptation to print money becomes too great and the currency becomes inflated and goes to zero.

So by that standard, you probably always want to be in an asset. You don’t want to hold onto cash. Now having said that, treasury bills and bonds, for the first time, are giving a decent amount of reward relative to the risk. So I think there’s a decent argument. Older people would say it’s not a bad time to own treasuries because you can get 4% instead of 1%.

But I’m a big believer in always have your money in the market, diversify. But I would tell young people … Adidas, I’m fascinated with what’s going on with Kanye right now. Adidas is at $60. It’s off, I don’t know, $50 or $60. It’s been cut in half. Alibaba’s been cut by two-thirds. PayPal’s off. There’s just so many great companies.

I don’t want to say they’re on sale because their valuations got so high. But I think a decent strategy is looking at places where there’s dislocation and then buying stock, trying to be really disciplined. I’m going to try and save a thousand bucks a month, which is a lot for a young person, and I’m going to put it in names I like or I’m going to, better yet, put it in an index fund or an ETF, the natural trajectory the market is up, and then ignore it.

You know what is a low ROI? Buying crypto. The reason I don’t like kids buying crypto, it’s not that I don’t like the asset class. What I don’t like is that crypto usually means you’re staring at your (censored) phone all day. That’s an investment.

Dave:

Yeah.

David:

Well, that does remind me of the older folks that are like … They’re retired, they’re bored, they have nothing to do, and they sit at their computer and they watch the tickers. They tinker with their portfolio doing absolutely nothing to benefit. But it’s such like their brain needs something to do.

It does turn that into the 23-year-old that bought an NFT or some crypto, and now they’re doing the same thing. It gives you this dopamine release as if you accomplished something. But, like you said, Scott, it’s not building skills. It’s not putting your 10,000 hours into something. It’s not putting you on a path that’s going to improve your position. It’s like a substitute for it that many of us have just been hypnotized into.

Dave:

Yeah, there’s an inverse correlation between how often you check your portfolio and your returns. I think you mentioned that with dead people, Scott, like the less you look at your returns and the more you just allow your investments to compound over time, the better your returns actually become.

Scott:

Robinhood’s tagline, if it was honest, would be the more you trade, the more you lose. 80% to 95% of day traders lose money. If you owned any five stocks in the S&P and you own them for longer than a decade, no one has ever lost money.

So now I want to be clear, occasionally I trade. Occasionally I buy options or I usually write options, and I enjoy it. It’s like gambling for me. I take a little bit of money and I do it.

I love Vegas. I was in Vegas last week. I go with a group of guys. I put on a kilt, I get (censored) up. I go down, I take a thousand bucks. I assume I’m going to lose it all. So if you’re trading stocks or you’re trading options or doing weird stuff, realize, okay, it’s fun, it’s consumption, but you’re probably going to lose most or all of your money.

But don’t con yourself into thinking that you’re learning or investing. I’m not against it. I love to gamble. I love to drink. But neither of those things are going to create economic security for me and my family, their consumption. What makes wealth is the boring (censored) buy a REIT. You think the future is in eCommerce, buy Prologis and then don’t look at it for 10 years.

Dave:

Scott, what do you think about regular real estate, though, in addition to REITs? Buying rental properties. How do you view that in the spectrum of potential investments?

Scott:

So I’m now at the age where I think about what if I could do it all over again. If I could do it all over again, I’d be a Broadway dancer, a Navy Seal. So there’s still time. But I would also get into real estate.

Essentially, if you look at the most valuable companies in the world, they’re a thick layer of innovation based on enormous government investment. Google and Apple are built off of GPS and DARPA technologies. Tesla’s built off of massive subsidies for carbon credits. Moderna is built off of NIH investments and vaccine research at universities.

So the way to make a lot of money is to be a remora fish on massive investments by other people. The regulatory capture of the real estate industry is extraordinary. I don’t have any other investment. I wish I’d come into this later.

I bought some apartments. During 2010 or ’11 in Florida, the Palm Beach County Clerk’s Office was auctioning off repossessed condos. I was buying these things for $80,000 or $100,000, and I could get $12,000 a year in rent. I’m like I don’t know real estate, but I can do math. If I can get 12% cash-on-cash, this is just going to work out. If I can hold onto these things long enough, this is going to work out.

Then I find out, your industry, I can depreciate these things. I’m like, okay, they’re going up in value, but I can depreciate them? I can’t depreciate my Amazon or Apple stock.

Then if I get a call from an investor who says, “Oh, you own 30 apartments. I’d like to buy them,” I can then, within six months, not incur that gain and roll it into another asset? I mean you can’t do that anywhere else. You guys have figured it out. So here’s the thing. You can be good in real estate, and it’s as good as being great in any other asset class.

Dave:

That’s true.

Scott:

So what I would tell people, through no fault of your own, the lobbyists who have fomented this notion that buying a house is the American dream, there’s been such amazing regulatory capture that if I had it to do again from day one, I would probably be putting a disproportionate amount of my capital in real estate.

Now, having said that right now, I wouldn’t buy a house right now. I think there’s a standoff between buyers and sellers because the top is sticky. I love real estate. I’m one of those SNL skit where I look at real estate like a lot of people look at porn. I’m just fascinated what’s selling where and for how much. I don’t think sellers … Sellers anchor off the high. They go, “Okay, my house was worth $500,000.”

David:

That’s now their baseline.

Scott:

Yeah, that’s it. “Oh, that’s the normal market.” No, it wasn’t. That was the peak. Now your house is worth $380 and it’s probably going to be worth $340 in another six months. Eventually there’s capitulation, but capitulation usually takes 12 to 24 months. I wouldn’t want to buy a house right now, I think, with interest rates going up.

David:

What about an investment property that would cash flow positively?

Scott:

It’s all about cap rates and specifics and nuance. When I saw the hurricanes coming to Florida, I started looking at Fort Myers. I love these apartments that I bought and I’m like, “Oh, maybe there’s opportunity.” I also, and I’m in a position of privilege, I try to pay all equities so I’m not forced to buy insurance, which is a total (censored) scam.

David:

Oh, I’ve heard you talk about you’ve saved, what, $200,000 over four years or so of not paying for …

Scott:

Again, everything we do in our society is a transfer of wealth from the poor and the young to the old and the rich. Okay, let me give you a shocking statement. Me and my family do not have health insurance. Really? Bad dad, bad husband. Irresponsible citizen.

Here’s the thing, I’m a narcissist. So I think if I have health insurance, I have to have the best plan. So I got the best plan costing me $48,000 a year for me and my family. $48,000 a year. I am very privileged. I could absorb any health shock, any rare disease, million, two million bucks. I can absorb it. I don’t need to worry.

Then I did the analysis. Half of our medical expenditures, we weren’t getting reimbursed for, because the insurance industry is very good at creating complexity and nuisance. You have to call somebody and they’re only there from 11:00 to 3:00, central standard time. You give up and you don’t get reimbursed for going to have that mole removed. Oh, and the dermatologist I want to go to is not covered under their plan. There’s purposeful breakage.

So I said (censored) it, I’m not having health insurance. I did that six years ago. I’ve saved $300,000. That will buy a lot of healthcare. 45% of insurance premiums go to administration and profit. When I bought these apartments, because I paid cash, I’m like I’m not getting flood insurance. These things could fly away. They could Wizard of Oz on me. As long as they don’t fly away more than every 11 years, I can afford to rebuild them with the money I’m going to save in insurance.

It’s this industry that plays on fear and ignorance, and also regulatory. If you get a mortgage from the majority of bulge bracket banks-

David:

They’re going to require it.

Scott:

… you have to have insurance. Otherwise, you can’t qualify for a mortgage. So what does that do? It means a guy with some money who’s older like me doesn’t have to have health insurance, doesn’t have to have flood and fire. So, again, another transfer of money.

But I think real estate … Again, if I had to do it again, the wealthiest families in Manhattan, they don’t really talk about them. Everyone’s obsessed with tech billionaires. There’s like a handful of families in New York that own all the office buildings. They never sell them, they just borrow against them. I mean if you have the capital and the staying power to survive cycles in real estate, which can be very vicious, those are the people …

If you look at the Fortune 400 or the Forbes 400, the two people that populated outside of people who inherited wealth are entrepreneurs, number one, and number two is real estate people. It’s just a great way to get rich slowly.

Dave:

So why’d you get out of it? You bought in at a great time in 2010 and you like a lot about it. What stopped you from continuing?

Scott:

Well, in my core, I’m an entrepreneur and I’m fascinated towards eCommerce and growth. I think I’m seduced by what I’ll call the sugar hit of investing in Airbnb and seeing a double. Tech is my bag. It’s what I get. I’ve worked with Ned Spieker at Spieker Properties, and Hamid Moghadam is someone I would call a friend. I know people in real estate and it strikes me that their business is better than my business, but it’s just not my business. I’ve never really done it, understood it.

So I did a crash course in it in 2010 because I saw an opportunity. Now, looking back, I wish I bought 300 of these things, not 30 of them. But I think it’s a fascinating business. Again, if I’d do it again, I would probably try and be in and around real estate. I think it’s a great business.

Dave:

Well, it gives you some of those advantages you were talking about that might be geared towards older people. But if you’re able to buy real estate as a young person, it does allow you to capture those things, like you talked about, mortgage interest, depreciation, some of these things that you said at the top of the show are more designed to help older folks. But if you are young and able to get into this industry, it can help you get some of those cheat codes that the older generations are enjoying, right?

Scott:

Well, again, going back to what other asset class can you get five to one leverage on? I mean-

David:

Or better sometimes, yeah.

Scott:

Some young people do some … I think government programs can get 10 or 30 to one leverage. Again, I think prices have gotten a little too high, so I’d be careful. But I work with Goldman Sachs. They’ll give me two to one on my stocks. By the way, if my stocks go down, they start issuing margin calls. But I can lever up 10 to five to one in real estate. Usually, if you get a five or a 10-year mortgage, they can’t do margin calls on you. They can’t go, “Oh, your house has gone down 30% of value. We need you to put more money up.”

David:

No, that’s-

Scott:

They can’t do that. So it’s the most tax advantaged, it’s the most levered. Now the bad news is all of those things have probably led to an asset class that I would say … And, again, it’s so specific, it’s so regional in asset class type, but I would argue the majority of residential real estate … You didn’t want to be buying six months ago, right? I’m not even sure you still want to be buying.

You guys are going to forget more about this and I’m never going to know. But I went back to the Fort Myers thing. When I saw the hurricane hit and they were saying insurance costs are going to triple, I’m like, okay, there’s opportunity here. I love running into the fire.

I called some brokers down there and said I’d be willing to buy some apartments, or even a small apartment complex, and I thought I was going to get a great deal. They were like, “Oh, yeah, all the guys with the black hats have already shown up. All the biggest capital in the world is already down here trying to be … ” It’s like, “Oh, this wasn’t an original idea?” They’re like, “No, the blip, if you will, or the decline in prices in these areas that were hit by the hurricane lasted about 48 hours.”

But I love the asset. I think it’s a very interesting way to make a living. The majority of my friends out of business school who went into real estate didn’t get as wealthy as I did in the first 10 years, but they didn’t get as broke as I did during the downturn. Yeah, they’ve just slowly but surely … I think real estate’s a great way to get rich slowly.

David:

That’s a wonderful line. When you were describing why you didn’t get more into it, and I really appreciate your transparency there, which what I heard you say is compared to what I’m used to, it’s slow and it’s boring and it doesn’t hold my attention. There isn’t as much upside, there’s not as much creativity I can exercise.

People like you that have the capacity of intelligence that you have, Scott, they know what they can do when they’re put in the highest of stakes environment, which in our modern day environment, I would consider to be tech. You’ve got the biggest upside.

It does make real estate, by comparison, just seem, I don’t know a good comparison, elementary. It’s just this is hard for me to follow. I’ve heard several other people in tech that were pitched real estate opportunities. They’re like, “So you’re telling me I’m going to get a 12% return over five years? It doesn’t really move the needle for me. It’s not a bad idea, but I don’t get excited.”

That is absolutely true. I look at it like people in your space and a lot of your audience, they’re used to throwing haymakers and they’re getting big knockouts. It’s very exciting. They know they’re very talented fighters. This is just a steady stream of body shots that don’t appear to be very powerful until you look over a 20 or 30-year period of time.

Like you said, it’s very difficult to lose and your returns start to amplify, largely because, this is David Greene’s opinion here, inflation. Inflation makes your casual real estate tinkerer look like a brilliant mad scientist because it’s so leveraged. So you’re putting 20% of your capital into an asset that triples in value, but your 20% down payment then would have a 600% increase. It’s different when you’re looking at how quickly you can build equity over real estate, but it’s boring.

So when I come across the people that are very successful in the tech space, a lot of our audience is, they’re into podcasts, they’re into media, they’re also … I live in Northern California. So I’m right near Silicon Valley. They’re fascinated by innovation and creativity and what’s next, what’s a better way to do it, how do you do it more efficient. I look at it like you’ve got to work these vegetables into the sexy, fancy diet that you’re used to. You have to bring this in as a safety net or a baseline on top of what you’re already doing.

When we’re giving advice to young people about building wealth, are you of an opinion that real estate could be a part of a bigger picture or are you pick your thing, completely doubled down on that, and excel as far as you can in whatever asset you’re investing in?

Scott:

So there’s your human capital and there’s your financial capital. I think with your human capital, you should be 110% focused, and that is I don’t believe in side hustles. I think if you have a side hustle, it means you need to find a different main hustle, and that if you find a good job that’s your main job, that incremental investment and time and effort and mental bandwidth that you would give to a side hustle, you’ll get a greater ROI.

In other words, try and figure out a way to be great at your main hustle. The difference between being good and great at your main hustle will produce more than if you’re just good at your main hustle because you’re on weekends and evenings selling rare tennis shoes or something.

David:

DoorDashing.

Scott:

I think side hustles are actually dangerous, unless you see it as a short-term pivot to something else that’ll be your main hustle.

David:

So if you don’t like your girlfriend, get a better girlfriend. Don’t start dating other girls on the side as a hedge.

Scott:

That’s a whole other talk show. But in terms of your investments and your capital, you don’t have to be fully diversified when you’re a young person. You can take more concentration risk. But a third of my net worth, maybe 40%, is in real estate.

A lot of it’s around consumption. It’s hard to time, “Should I buy a house right now?” I get a lot of that question. Then I’m like, “What’s the situation?” They’re like, “Well, we’re in an apartment and we’re having a kid.” I’m like, “Well, do you make a good living?” “Yeah.” “Does your wife make … ” “Yeah.” I’m like, “Buy a house. You need a house. I mean your family’s growing.”

Real estate has a different component of it. Some of it is about consumption where you are in your life. But I wouldn’t … I go all in and have huge concentration risk around your human capital when you’re young to get great at something. I think focus is a key component of being great at something.

But in terms of when you start investing, if you love real estate and you’re young, maybe half your money goes into real estate. But as you get older, and especially when you get to my age, you really don’t want to have more than, in my opinion, 20%, maybe 30% in any type of asset type, because real estate just might get the (censored) kicked out of it the next 24 months.

Now I don’t care what kind of genius you are, market dynamics will always trump individual performance and genius. And so, as smart as you are, as good as the opportunities, your Kevlar is diversification. I invested in oil companies, I’m investing in aircraft maintenance companies.

Another thing you said, David, that I think is really important. I have a chart that I present at the end of my class at Stern. On the Y axis, I have sex appeal and on the X-axis, I have ROI. I’m sorry, I flipped that. Y-axis, ROI. X-axis, sex appeal, how sexy an industry is. The line just goes straight down.

A friend of mine is starting a members-only club here in New York just for artists and entertainment people. It just sounds like it’s going to be awesome. No way will I invest. That is way too cool.

Another friend of mine is starting a healthcare maintenance company that uses scheduling to manage workers who maintain health tech equipment. I hear this business, I want to put a gun on my mouth. That sounds so boring and so awful. I am absolutely stroking a check to that guy. The less sexy the business, the higher the ROI, because not every kid’s dreaming of going into that business. It’ll have an underinvestment in human capital. It’ll have an underinvestment in financial capital.

So there is an inverse correlation between sex appeal and return. Real estate is somewhere in the middle. It’s kind of cool. It’s kind of cool, but I would imagine investing in sea malls or warehouses. It’s not that sexy. Everybody wants to buy, probably.

David:

Self-storage, mobile home parks, [inaudible 00:53:13].

Scott:

Whatever it might be. Yeah, that’s where the money is. When something sounds awful, you should smell money, and when it sounds boring. My dad, later in life, four marriages, total train wreck financially. He and his fourth wife bought a trailer park and it saved his ass. Just saved his ass. A weird business banging on doors for rent, collecting quarters from the washing machine. Great business. Like 17%, 18% a year. Great business.

Dave:

All right. Well, we do have to get out of here soon ,Scott. So I want to bring it back to your book, Adrift, and some of those high-level realities that we’re all facing as Americans. Is there anything you think real estate investors or the people who listen to this podcast can do to create some of the change that you suggest?

Scott:

It’s a thoughtful question. I would just say that … And this is more around, I guess, philanthropy or trying to. I think this notion of third spaces, I think we need more spaces where people who are strangers, or maybe don’t know each other through the course of their day, have a chance to be in physical proximity with each other. Open layouts.

I tell my kids … When I say my kids, the kids who work for me. I have about a dozen people. The median age is like 24. It’s like a bunch of kids straight out of college and then a few of us old people. I say to them, I give them my credit card, and I’m like, “Anytime you want to get together, if you all want to go to Tulum, if you all want to go have dinner, if you all want to go to a concert, I will pay for anything you guys do together.”

I think young people need to be in physical proximity. I worry we’re losing our third spaces, our movie theaters, our malls, the workspace. So any opportunity … I think an investment in your culture and an investment in society is to try and figure out really compelling places for people to meet each other, to establish friendships, to establish romantic relationships. But I worry that young people aren’t meeting, that they aren’t meeting people from different backgrounds. So they don’t have the opportunity to develop empathy, to realize that, okay, that guy who just immigrated here from El Salvador loves his kids, kind of like me, and you have a little bit more empathy for someone.

You run into someone who had a marriage that didn’t work out and she’s trying to raise a kid on her own, and you realize, (censored), this is hard. This is hard. Also, have the opportunity to meet people, fall in love, have sex, and get married.

I think that’s the basis of our society, and we’ve decided that somehow it’s bad, that somehow people getting together and wanting to have romantic relationships, that that’s fraught with all sorts of HR risk. Now that’s the whole (censored) point of all this. That’s the whole point.

So what I tell young men is there’s nothing wrong with approaching a stranger and exhibiting interest. If you don’t know the difference between expressing interest and harassing someone, you’ve got bigger problems.

But I’ve had three weddings from my last company, L2, and each of them is a mitzvah. It’s wonderful. They met and they expressed interest to each other. They started a relationship and now they’re getting married and they’re going to have kids.

Anyways, you asked me what real estate people need. Create third spaces. You might already have your mate, you might already have your house, you might already have great places to hang out with people you love. The majority of young people, and they’ve been taken away. Those opportunities and those spaces have been taken away from them. We need to create more of them

Dave:

Is what you’re talking about here, Scott, really boiling down to community, like a lack of community?

Scott:

I think that’s right, but you can have communities online. You can have … What I’m talking about is physical proximity. Online dating, I think, is a disaster for men-

Dave:

Oh.

Scott:

… because we don’t like to talk about it on the left, but women have different criteria for mating than men. Women primarily want kindness, number three, intelligence, number two, and, number one, resources. Online dating creates this mating inequality where 50 women on Tinder, 50 men, 46 of the women throw all of their attention to just four to six men, leaving 44 to 46 men fighting over four to six women.

The beautiful thing about relationships, friendships, romantic relationships is there’s an X factor, smell, body language, movement, your humor, all this stuff, the way you laugh. You just never know the people you’re going to be drawn to for friendships, mentorships, or romantic relationships, and you’ve got to give the bottom 90% of us an opportunity to exhibit some of those behaviors. You can’t do it online.

So I think to your point, Dave, we need to create more opportunities to develop community in person, boy scout troops, sports leagues, church groups, if that’s your thing, riding clubs, whatever it might be, talking to strangers. I think we’re desperate for touch. I think we’re desperate for community. I think we’re desperate for affection.

David:

Yeah, get out of the YouTube comments.

Scott:

100%.

David:

If you don’t mind, I’d like to move us on to the last segment of our show before we get you out of here. It is called Would You Rather in 2023. So Dave and I are going to take turns asking you questions, and you can give your answer and a supporting statement of which you would choose. So I will go first. In 2023, would you rather buy real estate or stocks?

Scott:

Yes, whichever declines more in the next four months. Whichever takes the biggest beating in the next four months. Probably real estate because … Probably real estate.

David:

Because you see what interest rates are doing and it’s just creating it.

Scott:

There’s opportunity and dislocation. I think the next six months, we’re going to see capitulation and a lot of buying opportunities in real estate.

Dave:

All right. Well, along those lines, which would you rather invest in: tech stocks in the next year or a REIT?

Scott:

Probably a REIT because, at my age, I’m more focused on diversification. I’m just always overinvested in tech.

David:

That’s wise. Got to eat a little more vegetables. That’s my problem. I always want to eat that steak.

Scott:

There you go. 100%.

David:

All right. In 2023, would you rather invest in a series C round of startups or in a real estate syndication deal, which is basically somebody else is buying a property and you are having an opportunity as a limited partner to come in and get access to the equity?

Scott:

Probably the latter, because I get a lot of opportunities around series C investments. I’ve been investing a lot in opportunity zones. Again, another tax avoidance scheme you guys have figured out. But, yeah, probably … I’m at a point in my life … It’s all so true. I’m at a point in my life where I’m not looking to get rich. I’m looking to not get poor. So probably real estate.

David:

Yeah, defense.

Scott:

Yeah, that’s right.

Dave:

All right. Well, then we might know this answer already and, Scott, we’re going to have to have you back on to talk about your opportunity zone investing. But a short-term rental like an Airbnb or Bitcoin?

Scott:

Investing?

Dave:

Yeah. Which would you invest in? I know you like gambling. Want to throw some Bitcoin in there?

Scott:

Oh no, no. Short-term rental. I’m a no-coiner. I’ve never owned a coin. I don’t get it. I just don’t get it. I can’t think of a use case-

David:

It’s too sexy.

Dave:

What is there to get? What’s there to get?

Scott:

I don’t.

David:

That’s the first thing I thought of when you described your inverse relationship between successful and sexy was all these cryptocurrencies that were just popping up out of thin air along with the NFT space. Then we found a way to marry them. So you’re like, well, if you buy this crypto, it works in this theoretical metaverse that we’re trying to create, that has an NFT that is the door to get into it. They took all of these things that were inherently useless on their own and tried to make them valuable by turning them into … It’s like combining a bunch of alcohol together that shouldn’t be good and trying to make it taste good. This Voltron of nonsense is how it looked like to me. It was very sexy, and we saw what happened. It corrected very quickly.

Scott:

Yeah, some of it’ll be enduring. You can’t have this much human in any asset class and not have enduring innovation. But at this point, every time I try and understand crypto, I feel like I could slip and break a hip. I just feel old. I don’t get it. I don’t.

Dave:

[inaudible 01:01:28].

Scott:

More power to them. I know some really smart people making big investments in it. I’m on the board of a company called Ledger, which is a cold hardware storage for mostly crypto, but also for identity. I did it just so I could learn. But I’ve never owned a crypto asset and I doubt I ever will.

David:

So short-term rental it is.

Scott:

Oh, by the way, I should have disclosed, Airbnb is hands down my biggest holding from an investment standpoint.

David:

All right. Dave, any last questions for you?

Dave:

No. Scott, it’s been a lot of fun. Really fascinating. Wish we had more time. But appreciate you coming on the show and sharing some of your thoughts with us.

Scott:

Well, thank you guys and congratulations on your success.

David:

Thanks, Scott. If anybody wants to look you up and learn more about you or opportunities that you present, where’s a good place they can go?

Scott:

God, to resist his futile. I’m everywhere. It’s Prof … Again, my Twitter handle is-

Dave:

He’ll find you first.

Scott:

Yeah. Twitter’s @profgalloway. I have a newsletter called No Mercy/No Malice that comes out every Friday. I’m about to do a show on BBC. If you want to take a course, I’m involved in an edtech company called Section4. So I’m everywhere.

David:

Well, we appreciate you, brother. Thanks for coming on. We’re going to have you back to talk opportunity zones and Tinder strategy in the future. Seems like you have a lot to offer on every element there.

Scott:

They’re related. All right, gentlemen.

David:

Thank you.

Dave:

All right. Take care, Scott.

Scott:

Take care.

Dave:

All right. Man, well, that was a fascinating conversation, David. What were your initial takeaways from the conversation with Scott?

David:

Well, first off, we went all over the place, which was pretty cool. Scott gave us some pretty insightful commentary on a lot of different things, a lot to chew on there.

I like his perspective. He’s coming from someone that has made a lot of money that has been successful in a lot of different areas of finance and has a nuanced position when it comes to both the individual, specific micro ways that we can earn more money for ourselves, as well as the generalized macroeconomic perspective that has to do with government policies and the unseen pressures that allow wealth to be created in different ways.

So I mean I would love to have talked to Scott for longer. We only had a short period of time, and I’m glad that he did talk to us. So what were some of your favorite things that he brought up?

Dave:

Man, yeah, there was a lot there. I do agree, I wish we could have a longer conversation. But I think one of the things that really stuck out to me, which I have conflicting opinions about it, I should say, is the idea that he hates side hustles. I think that’s pretty contrarian to what we talk about here on BiggerPockets a lot.

I get what he’s saying and I think for a certain type of individual, it makes sense to do what he’s saying. But I’m not sure that’s advice I would give blanket to everyone. What do you think?

David:

Yeah, you’re making a good point. See, I think when he said side hustle, we never defined what he meant by that. So I don’t know. I’m now speculating for Scott. But when he said side hustle, what I interpreted was don’t allow your energy to be diverted in several different ways. This is when Brandon Turner would say don’t try to build five bridges to Hawaii at the same time.

So if you’re in a location, in an opportunity where you can be building your skills, which I am passionate about, and I heard Scott talk about as well, like especially when you’re young, skill-building needs to be at the forefront of what you do. I did my TED talk on this.

Dave:

Totally agree.

David:

In the next book I’m writing, I’m big into it. When we interviewed Cal Newport, So Good They Can’t Ignore You, some my favorite books, and that’s exactly the point he makes is you’ve got to build your skills like Napoleon Dynamite, because girls like guys with skills.

I think what he’s getting at is don’t try to avoid the work. It’ll be like, ugh, that’s a hard path to take. I’d rather look for the next NFT that’s going to blow up, or I’d rather make my own blog and make money that way because it’s easy. He was like, no, stay the course. Walk the path.

But what we talk about with BiggerPockets when we talk about a side hustle is probably more geared towards you don’t have a lot of opportunity in your job. You’re listening to this podcast and you’re picking up shopping carts at Home Depot or Lowe’s. What you really want to do is be in construction. So you like working at Lowe’s, but you’re not making enough money to get anywhere.

To you, your side hustle’s actually a step up. Your side hustle might be a contractor you met coming into Home Depot, that hires you to help do some work on the job site, and now you could start to learn a trade. Your side hustle becomes the path, right?

So I think that’s how I’m looking at what he’s saying is it depends on which path you’re on and if the side hustle is a step up, which is a good motivation, or if it’s a distraction, which would be a bad motivation. What were your thoughts on that?

Dave:

Yeah. No, I actually think that’s a really good way of phrasing it is that it’s really about where your focus is. If you’re in a career where you can make a lot of money and do what he’s talking about, or if you really focus, your income can go from $50,000 a year to $500,000 a year, maybe that is a great option for you. I don’t know. I don’t think there are a lot of those careers out there, though.

And so, I think for everyone else who might not have that potential, maybe you’re not working in finance or on Wall Street or whatever, you try and find the place … Put your attention towards the thing that can offer you that ability to 10x your income. If it’s not your regular W2 job or whatever job it is, maybe real estate, or what we were calling a side hustle, can be your main hustle. It’s just something you’re doing concurrently or at the same time as your real job. So I think that was really interesting.

But I completely agree with the sentiment that it’s just get really good at something. I completely agree with it. I think that’s excellent advice for pretty much anyone.

I guess the other thing I was interested in was when he was talking about taxes a little bit and about how advantaged taxes. He was really going off about how amazed he is that you can depreciate things, you can lever it. This is for someone who is primarily a stock investor. So I thought that was pretty cool that he was recognizing some of the advantages that real estate investing have.

David:

Yeah. He also made it clear he doesn’t operate in this space very often. He’s not a real estate person. He’s a stock person. He’s a tech person. He’s fascinated by innovation and startups. If you listen to Scott, Prof. G, he talks a lot about his opinion on Elon Musk per se. That space is much more in creativity.

He mentioned real estate is just comparatively boring. It’s a great way to build wealth slow, which was funny he said that because that’s literally what I say all the time. I’d say this is a get rich slowly scheme. It’s not a microwave, this is a crock-pot, and at the very end is where it starts to get really fun. When you’re really hungry and you’re like, “Oh, I want to get out of this situation in life. I want to eat. I’m so hungry,” no one thinks of a crock-pot.

You’re looking for that hot pocket. You can hit it really big in tech. You can make a lot of money really quickly. When I say a lot of money, we’re like, wow, an 18% ROI is fantastic. They’re more like it’s an 800% ROI. That’s just the world that they’re used to playing.

I liked that he admitted real estate’s amazing, it’s just slow. It’s not my speed, because not everybody is in that same boat. For some of us, slow is the best speed. What about you? What do you think?

Dave:

Well, it’s funny what he says about diversification, because in the venture capital world, which it sounds like what he operates in mostly, the calculus is very different than real estate. They’re acknowledging that they’re going to hit on one out of 10 investments, and they’re hoping that that investment is a huge home run. I think he was an early investor in Airbnb, and that’s awesome. He’d probably readily admit that it took him failing on 20 investments to hit that home run with Airbnb.

That’s just a totally different game than real estate. Real estate investing is about making incremental progress with every single investment and hopefully losing on none of them. You might never hit a grand slam, but that’s okay. You’re like the utility guy in the baseball team who’s just hitting singles every time. That’s totally fine because, for me, especially if you’re starting young, that’s all you need. If you’re starting in your 20s or 30s, if you do that for five to 10 years, you’re going to end up in a good position, almost guaranteed.

David:

You want an analogy I just thought of?

Dave:

Yes, I definitely do.

David:

All right. So tech in the world that Scott operates is like animal husbandry. You are trying to breed-

Dave:

Where is this going?

David:

… a race horse. You’re trying to breed a race horse that’s going to win the Kentucky Derby. You’re going to go through a lot of duds, but if you get that one that hits, you’re incredibly wealthy. You’ve made a ton of money. You can now stud out that horse and do really well.

Our world is much more like farmers. We’re just planting trees. We want an almond orchard. No one ever said it’s really sexy to own a lot of almond trees. It is a little bit more work to have to harvest those almonds and then store them somewhere and sell them. It’s a little more work when you’re running a short-term rental or you’re managing a property. It’s a little bit more like running a business.

When you hit a big on a property, it’s not like you’ve got this race horse that you can make a bazillion dollars off of. You’re probably going to take some equity out of it by three to four more trees and wait, wait for them to start growing almonds.

Dave:

[inaudible 01:10:59].

David:

Right?

Dave:

Yeah.

David:

But it is so easy to repeat it. It’s simple. I mean it’s the same freaking thing you’re doing with a tree over and over and over. Maybe you have some almond trees and some orange trees and some apple trees. You diversify a little bit between a duplex and a short-term rental and a regular house somewhere, but it’s all the same type of stuff. You’re watering trees, the land works the same, the irrigation works the same.

And so, to me, the weaknesses of real estate is it doesn’t scale incredibly fast. The strengths are it’s harder to mess up, for sure. You can have a curb where you never lose money on a house ever and it’s much more scalable versus the high-risk, but high-reward element of the world that Scott lives in.

Dave:

Well, it’s interesting. First of all, if we were playing the game of bingo where you try and work weird words into the podcast, animal husbandry is one I never thought I would hear on this show, but here we are.

David:

Here we are, Dave.

Dave:

No, it makes me wonder about his personality. He said several times he really likes gambling. And so, it’s interesting if that kind of high stakes VC, venture capital world is attracted to him. It’s part of his personality trait. People always think like investing, it’s so dangerous. It’s risky. It’s like, personally, I’m a very financially conservative person.

David:

Me, too.

Dave:

I’ve got a lot of financial anxiety. I just want to keep what I got and just build it slowly. I just wonder if it’s comes down to different personalities and what you’re looking for.

David: