In this episode, you’ll learn the pros (and very limited cons) of investing in medium-term rentals. You’ll also hear which markets this strategy works best in, what type of software you’ll need to run one, and how medium-term rentals are starting to rival vacation rentals! If you’re looking for an investment with a high ROI, that doesn’t need to be minutes from a beach, this strategy is for you!

Ashley:

This is Real Estate Rookie episode 232.

Zeona:

So actually we compare it mostly to a long term rental. And a lot of the people that are getting into medium term rentals do come from the long term rental side and go, “Ooh, I think I could turn these great rentals that I’ve had for a while into medium term and make them more cash flowing.” So what we say is look at the way that you’re analyzing your long-term rental, but then put in utilities and put in furnishing. So it’s really not that different. The short-term rental, there’s a lot more expenses, and so that complicates it a bit more. And in short term rentals, I don’t account for vacancy, but I do in the medium term rental. So I think long term rental is the easiest way to compare it.

Ashley:

My name is Ashley Kehr and I’m here with my cohost Tony Robinson.

Tony:

And welcome to the Real Estate Rookie Podcast where every week, twice a week, we’re bringing the inspiration, motivation, and stories you need to hear to kickstart your investing journey. And I love to start these real estate rookie podcast episodes by shouting out people from our audience. And today I’m shouting out someone who left a review for us on Apple Podcast. They go by the username, Teohe’s mom, and they said, “This is the go-to podcast for every new investor. This podcast has been so valuable over the last two years for me. Getting to learn from people who are “just like me” and going through similar emotions and situations I’ve been facing has been fascinating.” So Teohe’s mom, we appreciate you. Thanks for leaving us an honest rating and review. And if you haven’t yet, please do leave us a review on whatever platform it is you’re listening to. The more reviews we get, the more folks we can help. And obviously that’s our goal here at the Real Estate Rookie Podcast. So Ashley Kehr, what’s up? How you doing?

Ashley:

Well, I’m super excited about today’s podcast because we just had, on episode 231, we had Jessie on who talked about her house hack and how she is doing a medium term rental in one of the rooms. Well, today we have the co-authors of 30-Day Stay, a new BiggerPockets book where Sarah and Zeona are talking about how to actually analyze, furnish and manage a medium term rental. I almost said short term rental there.

Tony:

As you guys listen to this episode, you’ll hear my excitement building from the beginning towards the end. And by the end, I’m just pretty much convinced that medium term rentals are what we should all be doing. But I mean, Zeona and Sarah, they’re both super experienced. They have multiple properties, both long term, short term, medium term across the United States. And they really give, I think, a great breakdown on how to get started as a rookie in this space. They talk about how medium term rentals give you less risk than a traditional short-term rental, but more cash flow than a traditional long term. They talk about strategies for finding these tenants that stay 30, 60, sometimes 90 plus days at their properties and how they achieve almost 100% occupancy with the medium term rental. So just so many great ideas, tactics, and little tidbits to help you kickstart your medium term investing business as well.

Ashley:

And of course, we never allow anybody to come onto the show unless they have something for you guys. So if you go to biggerpockets.com/pod30 and you pre-order their book, you get all of the bonus content. So you have to pre-order before November 10th, but the bonus content includes a webinar with them, live with them. Then there’s also three interviews that they did talking about how to furnish your rental, how to transition from a short term to a medium term rental. Then they also do… Sorry, my kids just come running in. This is just me recording live if you heard that in the background. But also what they’re giving away too is they’re doing, you are entered to win a one on one with both of them with Sarah and Zeona.

So that is going to be really awesome because you could literally spend time with them learning how to do this strategy. So definitely worth pre-ordering the book before November 10th. Do you want to say hi?

Remington:

Hi.

Ashley:

You got to say it into the microphone.

Remington:

Hi.

Ashley:

That’s the littlest real estate rookie right there, Remington. Okay, so then we got my oldest yelling that he doesn’t have a shirt on. It’s just a chaos over here to finish up the recordings. But anyways, go to biggerpockets.com/pod30 and if you listen all the way through the episode, you will actually get a discount code. So make sure to listen to that so you can get 10% off. Now, Tony, back to you. Take it away.

Tony:

Sarah Weaver and Zeona McIntyre, we are so excited to have both of you join us here on the Real Estate Rookie Podcast. I’ve had the pleasure of meeting both of you in person, following you guys on social, and you guys are here to talk about something really cool that you’re launching for BiggerPockets. But before we get into that, Sarah, we can start with you. Just give us the quick 32nd background and who you are. Zeona will go to you afterwards and if you guys can, just let us know how you came together as partners on this project for BiggerPockets.

Sarah:

Yeah, absolutely. Well, thanks for having us. I’m Sarah Weaver. I’m a real estate investor, coach, speaker, and now author, thanks Zeona for co-authoring this amazing book with me. I met Zeona through a real estate event, which should come as no surprise. And we became fast friends because we realized we loved two things. We loved cash flow from our furnish rentals and traveling. And so you’ll hear a lot about both of those in the book.

Zeona:

And I am Zeona McIntyre. I’ve been doing short-term rentals since 2012. So some of you guys might remember me from the early days of the BiggerPockets Podcast on show 229 if you want to go check it out. But from COVID, I decided that I needed to come up with a new strategy. All of a sudden all of our bookings just fell off the calendar and it was a really scary time for short term rental operators. I imagine, Tony, you can relate. And that was a great pivot for me to realize that wow, this medium term space, there’s actually a lot of demand and it’s easier and I like it more. So it’s been a really great transition for us. And now with just so much expense in the industry, I think it’s nice to have something that still cash flows. So we can talk about that for the rookies.

Ashley:

Well first, can you define what medium term rental is? How is that different from any other investing strategy?

Zeona:

So a medium term rental is over 30 days is the easiest way to put it. So there are short term rentals under 30 days, which are average about three or four nights. And then there’s long term rentals that are unfurnished rentals that are about a year usually. And so the medium term rental is a furnished rental that is month to month and the average stay is about three months.

Ashley:

And then what is the name of your book? Because that’s why we have you guys on here. So tell us a little bit about the book and how it correlates with learning how to do medium term rentals. Is it how to buy the deal? Is it how to manage the deal? Give us a little insight into that.

Sarah:

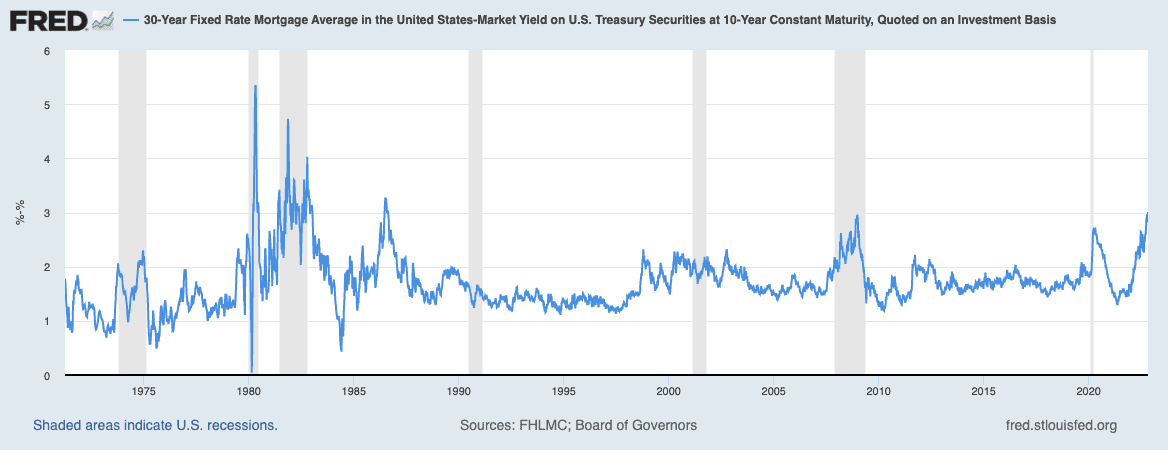

Yeah, the name of the book is 30-Day Stay: A Real Estate Investor’s Guide to Mastering the Medium-Term Rental. And we love this strategy because it’s applicable to any investor. If you own zero units or 50 units both Zeona and I highlight a lot of incredible investors in the book that own medium term rentals all over the country in rural Iowa to just outside of Seattle to Florida and Georgia. We really love this strategy because it’s possible in so many different markets and as Zeona touched on, it’s really nice right now in beating inflation and fighting higher interest rates.

Zeona:

And just to add to your question, Ashley, we are really thorough in the book, so we do highlight a lot of case studies and we wanted to make it a “how to” first and foremost. So I feel like somebody could pick up that book and go buy a rental because we go deep into analyzing deals. We go deep into finding markets, building your team, furnishing, which is usually the scary point for a lot of people. So there’s a lot of good stuff in it.

Tony:

I don’t have any medium term rentals in my portfolio, but-

Zeona:

Yet.

Tony:

… Yet, right. But leading up to this conversation, and I don’t know if you guys know, Zeona, Sarah, do you know Jessie Dillon? She’s a real estate investor in Massachusetts. So Sarah, I think she connected with you.

Sarah:

Yes, she does permanent makeups for anyone interested in that.

Tony:

Right. Well we just interviewed her earlier today and she’s doing a medium term rental, rents by the room. And after talking with her I was like, “Man, there, there’s so many cool ways to do this.” But after talking with her and leading up to this conversation, I realized that there is this really cool opportunity with the medium term stay because you get almost as much cash flow as a traditional short term rental. But there’s a little less risk associated with it because in most cities or counties or jurisdictions, because the stays are longer than 30 days. And correct me if I’m wrong here, you don’t even need a short term rental permit to do that. So if STR get banned as a medium term rental, you’re still able to make it work. So my mind is spinning. I got a lot of questions for you guys. So on the medium term rental side and Zeona will start with you, if I want to analyze a property as a medium term rental, what does that process look like and is it any different than a short term rental would be?

Zeona:

So actually we compare it mostly to a long term rental and a lot of the people that are getting into medium term rentals do come from the long term rental side and go, “Ooh, I think I could turn these great rentals that I’ve had for a while into medium term and make them more cash flowing.” So what we say is look at the way that you’re analyzing your long-term rental, but then put in utilities and put in furnishing. So it’s really not that different. The short-term rental, there’s a lot more expenses and so that complicates it a bit more. And in short-term rentals, I don’t account for vacancy, but I do in the medium to rental. So I think long term rental is the easiest way to compare it.

Ashley:

What are some of those expenses for a short term rental that are more that you wouldn’t have with a medium term rental? Is it just maybe supplies stocking of toilet paper or what are some examples of those?

Sarah:

Yes, so cleaning fees, which typically you’re going to pass on the tenant anyway, but those are decreased significantly. And then for us, both Zeona and I, we use virtual assistance to help us manage our properties. And there’s significantly less admin cost because you only have a turnover every 90 days rather than every three days. So that’s something to account for, especially if you’re a real estate investor running this like a business, which we highly recommend. And then you’re exactly right, Ashley, the supplies like the toilet paper, paper towels, shampoo, all of those kind of expenses that you have. Every single turnover, you’re only supplying what we call the welcome starter kit for a medium term tenant. And it significantly decreases the cost there.

Tony:

So again, I know when I’m looking at a short term rental, I usually use PriceLabs or AirDNA to do my analysis to understand what my average daily rates, what my occupancies might be for a specific unit. But Zeona, you mentioned earlier that you focus more so on the long term rental approach. So if you can Zeona, breakdown for us, how do I determine what that medium term rent should be for any given unit?

Zeona:

So with medium term rentals, you’re using a site called Furnished Finder. You can still use Airbnb and Vrbo and any other booking platform. But we also use Furnish Finder and on Furnished Finder you can look in their map for whatever town you’re in. And then you can see what all the places are charging around you. So in Airbnb it’s harder to do that because they fluctuate so much, but on Furnished Finder you can see it and so it’s really easy to look through their photos and go, “Oh, my place is so much cuter than that one.” And then it’s around this one and here’s the area. You can figure it out pretty easily from there.

Ashley:

What about as far as the management of it? Is there software for it too that you would use similar to short-term rentals or is that a whole completely different software?

Sarah:

We are using the same software that we use to manage short-term rentals. So we highly recommend using Hospitable, It will tie directly to Airbnb as most people will know. And then for tenants that you find via Furnished Finder, you just manually input them into Hospitable and then they take on the rest.

Ashley:

Awesome. Very cool.

Tony:

I just want to talk a little bit on the tenant screening side. So I know for us on our short term mental portfolio, we don’t do any tenant screening, we don’t do any guest screening. There are also some little boxes you can check, but it’s nothing super in depth. For the medium to rentals and Sarah, I’ll start with you on this one. Do you have a process in place? Are you doing background checks or credit checks or are you just letting the platform decide who can book your place?

Sarah:

Yeah, so one of the most common tenants that we have is a traveling nurse. And the great thing about a traveling nurse is that they are heavily screened both on the federal level and the state level. So when they get a placement in a hospital, they have background checks, fingerprints, criminal background checks, I don’t feel the need to do additional screening on those tenants. Which again, when we’re talking about admin time, if you’re paying $25 for an admin, that saves you a lot of time and money when you can say just send me proof of employment. So I’m asking for three things, I’m asking for their driver’s license, proof of employment and a reference. And I am calling, texting and emailing their landlord reference because you just want to make sure you’re protecting your property. When it’s not a traveling nurse, then I am screening the tenant through an entire background check, eviction check.

Ashley:

What software are you using for that to do the separate screening?

Sarah:

I’m doing it through Avail.

Ashley:

Okay, cool.

Tony:

So if someone wants to book your place Sarah and say it’s on Airbnb and not Furnished Finder, I have Instant Book turned on for all of my properties, which means someone can book without me having to approve them. But it sounds like based on your current process that people can’t instantly book, they can just submit an inquiry and then after that is when you engage and kind of given them the thumbs up or the thumbs down?

Sarah:

Yeah, that’s a great question. I’ve been playing around with it. So actually I got an instant booking yesterday and immediately I panic because I’m like, “Oh no, did they instant book too far out leaving a gap in between medium term tenants?” To my luck, I had already put in parameters, which is the great thing about Airbnb. So they didn’t have the ability to book too far in advance. So what’s great is that I had someone move in, she’s going to be there for 92 days, she moves out on a Thursday and this new tenant moves in on a Saturday and she just booked for 97 days.

Tony:

That’s fantastic. Go Zeona.

Zeona:

Yeah. So just based on the screening, because you were asking about that with Instant Book and there are parameters in Airbnb to say we don’t accept anyone with no reviews and we don’t accept anyone to book that’s not verified. So you have a couple of things that you can put in there for yourself to protect you in that regard. So that’s good. A lot of Sarah’s places you can do short term rental part of the year and then you do medium term if, correct me if I’m wrong, but I have some where you can’t legally short term.

And so that gap is a lot more important to not have, I don’t want to have somebody booked and then have three weeks there that can’t be booked at all. So what I do is I actually only open my calendar five weeks at a time and I don’t have instant book on. So I make people send requests and then I talk to them because a lot of times a traveling nurse is driving to the area and they’ll come out three days ahead or they’ll come a little bit later and so you can massage those dates so that you have less vacancy.

Tony:

Sorry, just one additional question on that piece. Are you guys keeping all of your communication through the platform? Are you picking up the phone and actually talking to them if they’re submitting inquiries through Airbnb? So Zeona, if you want to lead first and Sarah we can go to you after.

Zeona:

Yeah, so if it’s in a platform like Airbnb or Vrbo, I just keep it all in the platform. If it’s something like Furnished Finder, it’s actually not a booking platform in the same way. It’s more of a lead generation. So it actually just gives you a list of tenants and then from there you reach out to them. We do everything on email with them. And the only time I have my assistant call is just to get a feel when we’re doing the tenant screening portion because sometimes I think in short term and medium term, you really want to rely on your sense of somebody. And so if you get a creepy vibe from the way somebody asks you a question, you might just say, “Not worth it, I’m not going to do that.” So I imagine you’ve had that with your short term rentals and then the people you always let through, you’re like, “Dang, that’s the guy who’s going to rip up my carpet or whatever.”

Tony:

And Sarah, what about for you?

Sarah:

Yeah, we have a system where everything’s automated so when someone reaches out, they’re getting an automated email, we’re moving them from Furnished Finder to email and then we are hopping on the phone with them. We do everything through Google Voice. I had at the beginning where they had my phone number and I realized real quickly that that was a mistake.

Tony:

It’s a terrible idea.

Sarah:

It was a terrible idea. So we moved everything to Google Voice.

Tony:

And just one piece on that, I have one follow up question, but we also try and keep the majority of our conversations on platforms. I’m a little bit more like Zeona because we found that if there’s ever any issues with that guest, Airbnb and Vrbo won’t take your word for it if it isn’t in the platform. So we’ve had issues where we had a phone conversation with the guest and we knew that they had done something wrong. But because we didn’t have the proof of it in the platform, Airbnb didn’t have our back. So we try and keep the majority of our communication on platform as well.

Sarah:

That’s a really good point. Regardless of what investing strategy you’re going to use, all of us investors should get used to always sending a follow up email that says, “Per our conversation we have agreed to this and this.” And really ask them please respond and confirm that this is what we agreed to. And then just even having an email correspondence that says, “I agree,” I do that with every tenant I speak to.

Tony:

That’s a great idea, Sarah. So following along with the tenant screening portion. So once you guys have done your work on the front end, do you have these medium term tenants sign any kind of lease agreement as well for the 30, 60, 90 days that they’re staying there? Or is it just what they’ve done through the platform? So Sarah, we can start with you.

Sarah:

When they are going through Airbnb, everything stays in Airbnb. But when they’re coming off of Furnished Finder, I do treat them like a regular tenant and I’m putting them into an actual lease. Having them sign that inside of Avail, telling them the expectations, through Hospitable they’re getting automated messaging. So they’re getting the welcome email and all of these messages are inside of the book. Zeona’s done an incredible job after years of experience with short-term rentals. Really figuring out when’s the best time to send the message, what information to include in it so that you get less communication with the guest. It seems counterintuitive to say you never want to hear from your guest, but it’s incredible once I implemented the messages that Zeona has written, I barely hear from my tenants.

Zeona:

So I have seven emails, I went back and counted them because I have a whole series. So they’re all in the book and I find that to be really helpful. You almost have to think ahead about what they’re going to ask before they ask for it. So we prepare in that way.

Ashley:

Along with the lease agreement. Is there anything that you guys include that would be different from a long-term lease agreement?

Sarah:

The things you want to protect are the items inside of the house. So I’ve even heard of a long-term tenant leaving with the refrigerator because it didn’t have in the lease that the landlord owned the refrigerator. So all of the items that I own are specified in the lease. I think that’s really the biggest difference. Otherwise, I really want to reiterate that this is so similar to a long term rental. So for investors listening, taking the jump from doing long term to medium term aside from furnishing is not that stressful.

Ashley:

So I want to transition us here. We touched in it a little bit, but I want to make sure we walk through this because I think it’s a great starting point as to how do you even decide if you have a desirable market to do a medium term rental to find these nurses? And can you maybe touch on too, who are some other type of workers that you attract to your properties?

Zeona:

Yeah, so I think looking for hospitals is a great place to start and I know you’re saying who else do we rent to? But that is where I go first. And so I was looking around for some clients to see what other markets might be good and I just did a search, 10 largest hospitals in the US and then started looking around those. And so I think that’s a great way to go because you’re always going to have traveling nurses and they’re just really great tenants. But beyond that, we have a lot of digital nomads now, that has been a big thing since COVID that people can work from home anywhere.

And so urban markets in general I think are just going to be really popular because either people are flying in as business travelers to go to that local office or they’re working from home and they want to be able to walk around the city or go explore the sites on their off hours. So we see a lot of that. And then there’s a lot of people now that are actually living full time from Airbnbs. I know Sarah is one of them, even though she’s with a friend right now, she’s mostly in furnished rentals. And that’s actually been a big trend with a lot of retirees and other people that are living abroad, financially independent and such.

Ashley:

Do you see a big correlation with people whose jobs went remote during COVID that are still working remote with traveling around and staying at different places?

Sarah:

Absolutely. One of the things I’m seeing even with my traveling nurses is that they’re bringing their spouse with them because now their spouse has the ability to work remotely. So the spouse, I don’t know how the conversation went, but I always imagine it went, “Hey, you’re a nurse making $35 an hour, why don’t you become a traveling nurse, make $116 an hour and I’ll just follow you around?”

Tony:

It’s not a bad gig. But Zeona, I love what you said about just Googling top 10 biggest hospitals in whatever state you’re in. A lot of times when people ask me what market they should go into for short term rentals, I just say, “Hey, pick any state and Google top things to do in XYZ state. And usually you’ll find some kind of major attractions or things like that.” But to apply that to the medium term rental space, I haven’t thought of that. So I love that approach. Now one other piece along with the market selection, I guess more so property selection. When you guys do your medium term rentals, are you actually going out and purchasing these units or are these more like an arbitrage model that you guys are using?

Zeona:

So I prefer to purchase units. I’m kind of anti arbitrage even though I actually started that way because I didn’t have the money when I got started with Airbnb. But I think that it’s just flipping if you need the cash flow to start, sure arbitrage. But eventually you want to get into something where you’re building wealth and wealth in real estate is built with equity over time appreciation and you just don’t get that. I’m just not that into arbitrage.

Ashley:

And the tax benefits too, you don’t get the tax benefits of not owning the real estate either.

Sarah:

Yeah, I feel the same way. I think it’s a great way to get started, but it’s essentially another way to have a job. I view real estate investing as a way to build wealth. And so I think it’s risky to take on all of the cost of the furniture and a one year lease not knowing if that landlord’s going to renew your lease. I don’t think it’s a very secure business model. With that being said, all of the people out there doing arbitrage and making six figures, more power to you? I think it’s great. However, for a new investor that wouldn’t be the first direction I would point them.

Tony:

Yeah, I’ve always kind of been anti Airbnb or vacation rental in an urban setting because I am afraid of the regulation piece and maybe the predominance of hotels and all these other factors that go into it. But as you guys talk more and more about this, there’s so many hospitals within a 20 mile radius of where I live and I’m like, “Man, I could probably have an Airbnb down the street from my house and do a really good job with it if I rent it out to the right nurse.” So you guys got my gears spinning here a little bit.

Sarah:

And I think what’s so important about what you just said, Tony, is that you can make MTRs work in any market. And I think a lot of people have this preconceived notion that you’re making significantly less than you would as a short term rental. But for those of you that don’t know, I own medium term rentals in Omaha, Nebraska. I like to call it destination hotspot of America. And I make more money when it’s medium term because while the nightly rate is higher as a short term, the vacancies is so high that I actually net more as a medium term rental.

Tony:

Interesting.

Ashley:

Sarah, I just want to ask if maybe you could share the numbers on that just so people can get an idea of how they differ from if this property would’ve been a long term rental or a short term rental and then what it is now as the medium term rental.

Sarah:

Yeah, absolutely. I’ll give the example of a duplex that I own in Des Moines, Iowa. And I do that because one side is long term and one side is medium term. So I purchased the property in April of 2022 and I bought it for 180 500. My PITI, principal interest tax and insurance is 884. My long term tenant pays 850. Market rent is probably a little closer to 975, but she’s an inherited tenant. She’s a great tenant. So she pays 850. My medium term tenant upstairs pays 1900.

Ashley:

Oh My god.

Tony:

Wow.

Ashley:

That’s awesome. What do you expect for vacancy on that? What do you see on average with your units as to what your vacancy rate actually is for a medium term?

Sarah:

So for that particular building, I’m at 97%. And across all of my units I’m at 97% because four of mine are at a hundred percent. So someone moves out at 10:00 AM and someone moves in at 3:00 PM giving me a hundred percent occupancy for the year.

Zeona:

We do still estimate 8% when we’re doing our numbers, just trying to be safe. And then that gives you a month, a year. So you might have a couple days here or there if you end up having a week somewhere. But it’s really rare and we love that because as a long term rental owner, you might have two weeks or a month every turn. Because if they leave often with a long-term rental, they want to repaint the place and change out the carpets and do all these things if you’ve got a property manager and they’re just really slow. So as a short term rental operator, I’m like, “Oh my gosh, they’re the most frustrating properties I have are ones that are long term and operated by someone else.”

Sarah:

And that’s something I learned from Zeona is she is like the queen of asset management. So she treats her rentals like her business. So when she has a vacancy, she’s working her tail off to get someone in there as soon as possible. And sometimes that even means negotiating with them to pay a day early. But what I like is about Zeona’s model is that she doesn’t just sit back and say, “I hope people book.” She’s out there looking for tenants and I definitely learn that from her and I’m happy to say that my occupancy rates are fantastic because I treat it like a business.

Zeona:

I just want to add something to that because when we were at BP CON, I was talking to a lot of people that were starting medium term rentals and they’re like, “Oh I got on Furnished Finder, but actually we haven’t had any requests.” And I’m like, “Oh no, people don’t know how to use Furnished Finder.” Furnished Finder, you can get requests, but that’s not how people reach out to you. They’re just inundated with options and so often they put in their information and then you never hear from them.

So the way that Furnished Finder works is you get a list of tenants and if you are in your period of looking for someone new, you’re not doing this every week, you don’t need to do it more than every three months, but if you’re in that period, you are reaching out to them. And you can have an easy template that you copy paste and then you just blast it to all the people. And if you’ve got multiple units in one town like Sarah does, you can send them links to all the different units. So you don’t have to pay for additional listings on Furnished Finder because you pay for listing, if that’s helpful.

Ashley:

Well Jessie, who we were talking about in the beginning of the episode who was just recently on the podcast, episode 231. She mentioned how her virtual assistant or her assistant actually goes out and goes into Facebook groups and finds her people to place into her medium term rental too. And she’s the same, she doesn’t sit and wait for people to come to her. She has somebody out there actively looking for somebody to come into her unit.

Tony:

I want to touch really quickly on the time in between guests. So for us on the short term rental side, like you said, we have same day turns. Someone checks out at 10:00 AM someone else checks in at 4:00 PM. But what someone who’s been at the property for 30, 60, 90 days have either of you run into a situation where the property maybe was in disrepair and wasn’t ready for that person checking in? So Sarah, we’ll start with you and then Zeona, what will lead to you afterwards.

Sarah:

Oh yeah, my cleaners hate same day turnovers. So while I may brag about the hundred percent occupancy, my cleaner has wanted to quit about five times. And so I highly recommend having at least one day in between because you never know. Especially, I allow pets and I have pets in about 70% of my units that needs to be deep cleaned. The couch cushions need to be completely taken apart. All of the furniture needs to be moved and that takes time. And so I either offer to pay more and have her bring in extra help if it is the same day turnover or I try to have at least one day in between.

Zeona:

Yeah, I would say the same. I just have a day in between generally, you just don’t know what you’re walking into and I don’t allow pets anymore. I used to, but with the nurses, they’re gone all the time and that’s why we love them. But that also means that their pet is left alone a long time and so that leads to problems. And then I have found that the ones that have pets sometimes they won’t clean for an entire six months stay. It just seems like they never moved anything around. So that can be kind of intense with pet hair.

Tony:

But have you guys ever had to cancel on that new person that’s checking in because the last guests did such crazy damage?

Ashley:

That’s just you Tony, I guess. A bear coming up and ripping apart the garbage.

Sarah:

Tony, maybe you should try medium term rental.

Tony:

Yeah, maybe. I think that’s what that’s coming next. So I just want to get some clarity. We probably should ask this earlier in the show, but Zeona, if you can start, what markets are you currently invested in? What cities, what states?

Zeona:

Yeah, so I’m in four states. I am in Florida and I’m in central Florida and in Panama City Beach. So it just depends on what kind of rental it is. The Panama City Beach is a short term rental. The central Florida’s are long term rentals. I’m also in St. Louis, Missouri, and that’s a medium term rental. Then I’ve got Boulder Colorado, Denver Colorado, and Colorado Springs. And those are all medium term. And then I’m in Washington State, on the sound outside of Seattle and that’s a short term rental. So they’re all over the place.

Tony:

How about you Sarah?

Sarah:

I have 19 units in Kansas City, Des Moines and Omaha. And they’re all small multifamily except for one single family. And then all of my medium term rentals are in Omaha and Des Moines. And I would love to own a medium term rental in Kansas City. So if you’re an agent, send me some deals.

Ashley:

Well I want to wrap it up here with asking you guys what is the best piece of advice you can give a rookie listener who’s saying right now, “I want to do this.” Where can they start? So Sarah, let’s start with you.

Sarah:

I think what I see most success with the investors, especially the investors I coach, is you need to pick a market and then just love on that market. I love to use dating analogies like, “It’s okay to date multiple people, but if you’re looking to get married, you should probably pick one person and then wake up every day and love that person.” And it’s the same thing with real estate investing. I see investors all the time looking in nine different markets asking me should I do this? What about this? I read an article here and it’s like, “No, just pick a market and love on that market, growing on the ground team and write some offers and get under contract.”

Zeona:

Yeah, I do strategy sessions with investors all the time and I won’t give them more than two markets. They always ask me for more and I’m like, “No, you go and you do your research and if those really don’t work for you, come back. But I am not giving you more.” My advice is to house hack with this strategy. So that was how Sarah got incredible numbers. She bought a quad in Omaha and just because she was able to have just one vacancy and then slowly turn all of the rest of the units into medium and short term, it’s like her returns are insane on that property.

And so like you’re saying, Tony, where you live you know really well, and so if you can have a basement unit, if you can convert your master bedroom and make a little kitchenette out of it because it has a separate entrance. I mean there’s so many creative ways that where you live you can make another unit out of it. I think that’s the best way to go because you have the low down payment and the low interest rates. There’s just so much advantage to house hacking.

Tony:

Yeah, I love the house hacking idea. I love the idea of the medium term rental in a more urban setting. And I’ve wanted to purchase, I live in California, I’m in the suburbs of Los Angeles. And I’ve wanted to buy something here, but it just almost never makes sense from a cash flow perspective. But now I’m thinking, “Man, if I can go out and find a five or six unit something just above five units or more. Medium term rent every single one of those units, I can take the NOI on that five unit from something abysmally terrible in 510 x that by making it a medium term rental.” Now I’ve doubled the value of that property just by turning to a medium term rental. And if I rent it by the room, imagine if I got a six unit and each unit had two bedrooms, now I’m renting each unit by the room as a medium term rental. Like, “Oh my God,” my mind’s all over the place, before I-

Sarah:

And let me add one thing in there. You could also then buy a vintage trailer or an RV and park it in the driveway. And traveling nurses or medium term tenants will even rent that out. I have a friend and client in Sacramento and that’s exactly what he’s done. He’s house hacked his primary into a duplex and then he even has a cute tiny house parked in his driveway, made a nice little privacy fence. And that is rented as a medium term rental.

Tony:

One of the cool things about being a host for a podcast is that you get to hear so many cool stories and unique strategies. But it’s also like a drug because you hear all these cool things and you just want to go after all of them. So I’ve been telling my wife that we’re going to slow down, but after this episode I feel like that’s a lie now. So I don’t know if my wife’s upset, I’m going to blame Sarah and Zeona. But one last question before we wrap up. Are there any other software that you all use besides Hospitable or Furnished Finder to manage your medium term rentals that some of our rookies should look at? And Zeona we can start with you.

Zeona:

Yeah, so big three, you like to have something like Avail. And Avail is doing leases automatically, which is great. So based on your state, it gives you a template, you just enter in the blanks and then you can do electronic signing, so that’s so great. They also have background checks on there if you needed to go that route. So Avails get a great one stop shop and then they have all the auto payments so you can set people up for monthly payments and their deposit. So that’s really easy. But the thing we didn’t talk about outside of Hospitable, Hospitable is mostly auto messaging. They kind of aggregate stuff altogether. You have a joint calendar, but it’s mostly auto messaging. The last piece is pricing software, which you should be familiar with using short term rentals. And people think they don’t need it. But the thing is that it’s still a seasonal business and if you’re not using pricing software and you’re not changing your prices, you’re missing out on those high season rates. So you definitely want to be using a PriceLabs or Beyond Pricing or at least changing your pricing.

Ashley:

Sarah, did you have anything to add to that or it’s the same for you?

Sarah:

All of those, absolutely. And I’m a huge advocate of a task management software. I don’t know how anyone functions at a high level with a business without some type of fancy to-do list, which is what a task management software is. I personally like Asana. I’ve used Trello, I’ve used Monday, I use Asana and I use it for tenant turnover. I use it for property management repairs. I also use it for furnishing. That’s a big one. Every time you turn a unit there should be a checklist. Every time you furnish a unit, there should be a checklist and all of that lives inside of Asana.

Ashley:

Well thank you guys so much for sharing your wealth of knowledge. And everybody make sure you check out their book. You can get it at the BiggerPockets bookstore at biggerpockets.com/pod30. And if you use any of our names, you guys can actually get 10% off. So we’re doing a contest to see who you guys like the best. So everybody pick Tony’s name because we don’t want his feelings hurt that nobody used his promo code.

Tony:

I have a very soft ego.

Ashley:

Yeah. So Zeona, can you let everyone know where that they can reach out to you and find out some more information about you?

Zeona:

Yeah, so Instagram is the best way I check all my DMs. And so that’s @zeonamcintyre. You’ll have to just check my spelling in the notes.

Sarah:

And I’m @sarahdweaver on Instagram. You can also reach out at sarahdweaver.com.

Ashley:

And you guys, again, that’s biggerpockets.com/pod, P-O-D, 30 to get their new book. And you can use the discount code, use any of our first names to get 10% off. Well thank you guys so much for joining us. And once again, congratulations on your book. What an awesome accomplishment. I’m Ashley @wealthfromrentals. He’s Tony @tonyjrobinson on Instagram and we will see you guys back on Wednesday with a guest.