Dave:

Hello everyone. Welcome to On the Market. My name’s Dave Meyer, joined today by Kathy Fettke. Kathy, how are you?

Kathy:

I’m doing great. Happy to be here.

Dave:

Good. Well, we’re going to do a new show format today where Kathy and I are just going to talk about a very important topic which is rent growth. I don’t know if any of you listened to this have heard or seen some of the headlines recently that rent growth is starting to stall out, and in certain segments, rent growth is actually starting to come down, or rents are coming to get them down, and there’s a lot of noise out there. So, we’re going to try and make sense of what’s actually going on in the rental market. How’s that sound, Kathy?

Kathy:

Sounds like a very good and important topic.

Dave:

All right. Well, let’s just start and recap what has been going on with rent over the last couple of years. How would you describe in some historical context what we’ve seen in terms of rent growth since the beginning of the pandemic?

Kathy:

Completely manic is the best way I can describe it. A frenzy, a lot of it based on fear that people won’t get anything if they don’t get it now. I’ve seen enough cycles now to know that people think the cycle they’re in will continue forever and don’t see an end to it, or that cycles change pretty regularly, especially when they are caused by something rare like a pandemic. This is going to obviously throw a wrench into typical cycles, and people started to think that maybe it was normal, that low rates were normal for home buying, and that the frenzy and the lack of supply would last forever. So, people act out of fear a lot of times.

So, there was a mixture of people acting out of fear that they would never have a place to live, and also people thinking that the good time, let the good times role forever, that there would be government stimulus forever, low rates forever, and that they could just live remotely and wherever they want and be in control of their employment, tell their boss, “Hey, if you want me, I’m going to work wherever I want.” I mean, it’s just been a very manic couple of years. That’s the best way to I can describe it.

Dave:

How do you think that translates to rents going up in the way that we’ve seen them going up? Because the housing market, that’s one side of it. We’re seeing a lot of people behave in emotional ways, but there’s also this element where seemingly from a renter’s perspective, there’s no winning. Right? You have to either go to a super expensive home or you’re facing super expensive rent. So, have you ever seen anything, or how do you explain why rent has gone up so much?

Kathy:

I have never seen rents go up the way they have over the last couple of years, but I haven’t seen anything like the last couple of years before in my lifetime. With the last couple of years, I would say the kind of mania and the kind of loss of reality that people are experiencing was that they could live anywhere. So, when you have people coming from a high priced market moving into say a vacation area, I mean, maybe not a typical vacation area, but something that they thought, “Maybe I want to retire there someday, but I can do it now. I could do it now. I can move to this area, and it’s cheap.” Right? So, when you have enough people from high priced markets going into more affordable markets, they can pay anything, and rents can go up, especially if that area hasn’t expected that kind of wave, that movement of people. I mean, there were certainly markets that didn’t experience double-digit rent growth, but the sexy markets really did.

Dave:

Oh yeah.

Kathy:

And that’s because a lot of people were migrating to those areas, and it looked cheap to them, and they’d gladly paid 20% over what the market rate was because it’s still cheap. Right? It’s still cheap to them.

Dave:

Totally.

Kathy:

Yeah.

Dave:

Yeah, it’s a great point. People just got in this frenzy where it’s like the desperation to get a place to live which is terrible, I mean, that’s just not a great place to be, but people were overbidding on rent. Just for some numbers here, on average, the rent in the US went up somewhere between 25 and 35% over the last couple of years which is much faster. I don’t know about you, but in Denver where I have some rental properties, it took 10 years to get about 50% rent growth and Denver was one of the fastest growing rent markets in the country. Now we’re seeing that nationwide, we got 30% rent growth in two years. It’s just something that doesn’t seem sustainable, and I’m just, I have some theories about what drove that other than the mania. But I’m curious, do you think there’s any macroeconomic demographic, any other issues that sort of drove this behavior?

Kathy:

Oh, absolutely. I mean, absolutely. After the last great recession when builders were wiped, literally just wiped out from that, they were a no hurry to go build more supply at a time when the demographics were really shifting, and this very large group of millennials, I know we’ve talked about this so many times, who are now 29 to 34 and forming households, that’s the largest segment of the millennials were just coming to household formation age starting in 2020 right when kind of everything shut down. They were given a whole bunch of stimulus checks and didn’t have to go to work. You know what I mean? So, it was a blast. I mean, not for everybody, but for a lot of people, they got to go live in Colorado and ski, or they got to go to Florida and live by the beach and things that they normally wouldn’t get to do. Right?

Dave:

Sounds pretty nice.

Kathy:

I know, right?

Dave:

Yeah, I think it’s a good point. I feel like household formation is one of the most underutilized metrics in economics or at least specifically housing economics, and we’ve talked a lot about that to your point about how millennials, not only are they a big demographic, that matters, but how many of them are going out and trying to start their own home or their own family is equally if not more important because I know for example, for me, I’m a millennial, and for the first many years I was out of college, I live with a roommate or several roommates. And then at a certain point when you reach the level of financial stability or capability or need because you start a family or something, you form a new household, and we’ve talked a lot about that in terms of how that’s driving home prices.

But that’s a great point that it’s also probably driving rent because not only are people more households, they were flush with cash, and so they’re like, “I’m going to form a household, and I’m going to do it with style, and I’m going to go and pay for something,” that maybe they previously couldn’t afford.

Kathy:

Yeah, most people aren’t really thinking long term. And so, if they’re suddenly given a big stimulus check and have some freedom, they’re going to go live their lives and try new things and that’s great. I think there was a record number of new businesses that were created over the last two years. There’s a lot of good that came out of it and a lot of bad, and personally, the bad is something that none of us can really fight against because we have zero control over it. And that is the manipulation of the markets that we’ve talked about with the Federal Reserve who is now, I think it’s pretty common now, I think a lot of people didn’t even know what the Federal Reserve was until now. I’ve been studying for years kind of the control that they have over the economy and over us, and I’ve based a lot of my investing decisions on what they might or might not do.

So, basically, when they’re going to stimulate the economy, you can pretty much count on the economy being stimulated and growing. When they decide to pull that back, you can pretty much count on things reversing and that’s all it is. That’s all it is. When you boil it down, you go up to a bird’s eye view and look down, all it really comes down to is the manipulation of the market from the Federal Reserve. And when we could follow that and follow whether they’re pouring money into the economy or pulling it back out, you can either make a lot of money or you can prepare and get out before they pull the money back out.

It’s really like a gamble, and I hate to say that, but in February when we’re all scratching our heads going, or at least I was, like, “Why are they still stimulating the economy? Why are they still buying mortgage backed securities to keep mortgages low at a time when the housing market did not need stimulation?” There was already lots of reports on the massive price growth and rent growth. Why would they keep stimulating? Why would they keep printing money? You only do that in a downturn. And we were up and we were up high. The economy was booming.

So, in March when they made it real clear, oh, well, we got to stop this train that we put the gas on, we got to slow this train, and they made it real clear early on this year that there would be seven rate hikes to slow it down. That means they’re going to take that money off the table. I’ve said this before and people don’t like to hear it, but the way that that happens is usually through stock market crashes which is what we’ve seen. That’s if that you pull it, there’s a lot of money that’s been pulled out there, a lot less money that people can spend.

I’ll tell you what, we didn’t bring this up yet, but with young people being kind of super savvy now, and I don’t know about savvy is the right word, but able to invest in the stock market just on their phone and play it like it’s a casino, and you’re watching your money grow, and you take some of that out, and you spend it, and you live big. Right?

Dave:

Mm-hmm.

Kathy:

I had a friend that I surf with who was like, “I want to invest in real estate, but I only have 40 grand,” and I was like, “Well, you can do that.” But then I was kind of telling them the returns you can usually get from a $40,000 cash investment, and he’s like, “Nah.” He put it into Tesla stocks. I saw him a year later and he’s like, “I made 400,000.”

Dave:

Oh my god. Yeah, but now, yeah, now where is he?

Kathy:

He’s still-

Dave:

He’s probably still up a lot. I mean, it’s still up way before where it was.

Kathy:

Yeah.

Dave:

I sold Tesla stock in 2020, not all of it, but way too much of it. That is a very big regret of mine.

Kathy:

Yeah, I mean, that’s the kind of mania we were experiencing over the last two years, and it was exciting, and there was money to go do these things and to get these air Airbnbs up and running. That’s part of the reason why rent growth went up is when you have that much money circulating, and it was 7 trillion extra dollars. Right? The amount of money circulating in the last two years, the extra money, was 50% of what had been there, and it was the amount of money that was circulating completely, entirely in 2007. So, $7 trillion added and people were having a good time who could get their hands on that money, and like I said, just invest in something and have it go up 10 x. I mean, that’s amazing. Why would you not gamble it?

Dave:

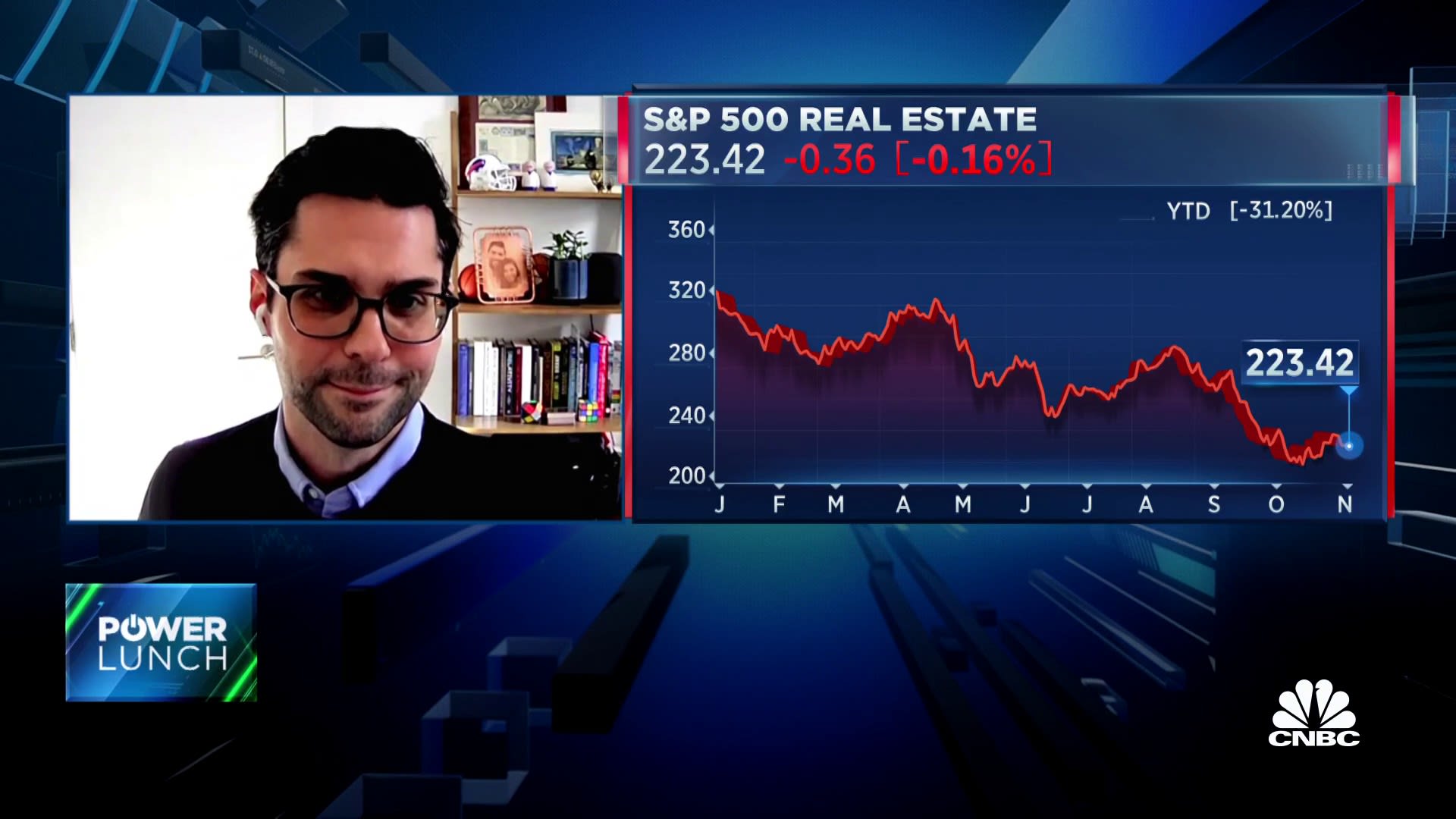

Yeah, I think it’s interesting because we associate Fed action with housing prices but not necessarily always with rent, but if you look at the pace of rent growth over the last couple of years, it follows the stimulus pretty carefully. At first, even though rents went down, rent actually dropped for the first few years of COVID, but then it just kept going up linearly like a true hockey stick. If you’re watching this on YouTube, it just went straight up the charts. But then when they started to pull off the gas, you see that rent growth started to peak around February/March when people started to realize that the party was coming to an end and we were no longer going to be in this crazy accelerated economy where money was flowing around, and people could pay for everything because their crypto or their stocks or their stimulus checks or enabling them to pay more for rent, and I think that’s what we’re starting to see.

So, as of now, we are starting to see rents, the pace of growth for rent really start to come down. Back in February, it was up 17% year over year which is just insane, but now we’re still up 11% year over year which is still really, really high. But what’s sort of the impetus for this show and why we wanted to talk about this now is because some data has come out that rent is starting to go down. I got a lot of questions about this, like oh, is rent crashing, and let me just first explain that rent going down in September is normal. That is what’s supposed to happen. Just like in the housing market, this type of pricing is seasonal. It always peaks over the summer. That’s when most people are moving. That’s when there’s the most demand for apartments. And then starting in September, October, things trail off. If you’ve ever tried to lease an apartment over the winter, it’s pretty tough. There’s not a lot of tenants looking to move at that point. So, you know you might have to drop your prices.

So, seeing rent come down in September of 2022 is actually, in my mind, it’s kind of a good thing. This is a sign that we are actually returning to normal seasonality and it’s still up 11% year over year. So, Kathy, what do you make of it? Does this worry you or are you sort of on my side of things here thinking that this is actually maybe a great thing?

Kathy:

It’s a great thing. It’s a great thing. Homelessness has increased, and people have been complaining about rents going up 20% in certain areas, 30% in some areas. Absolutely unsustainable, not healthy. Again, a lot of that, like let’s take Phoenix or Austin, a lot of that was California money that, hey, you could double the rent. It could have gone up a hundred percent, it’s super cheap for people coming from California. So, I will blame a lot of it on Californians taking their money and going to a cheaper market.

Dave:

It’s always you guys. It’s always the Californians is just screwing things up for everyone else.

Kathy:

New Jersey and New York helped a little too, but it’s, again, these areas where someone your age is like, “I could live in San Francisco where they have apps showing the poop on the street.” Right? Has it become kind of a dirty city? Or you could move to Phoenix or Austin, I mean, where a lot of millennials are moving. These are the places they’re moving, they’re cool, they’re fun, there’s things to do, there’s young people. You’re not going to probably move to, I don’t know, I’m trying to think of a place, Jackson, I always pick on Jackson, Mississippi, but that’s not on the map. Right? That’s not the city that you’re hearing about. Not a lot of young people are moving there.

Dave:

Never makes one of the lists. It’s never on the top migration lists, yeah.

Kathy:

Never going to make the list.

Dave:

Never been to Mississippi.

Kathy:

People invest there because it’s stable. It’s stable. Right? Doesn’t really change at all no matter what’s going on.

Dave:

Yeah, I don’t know. But yeah, so I think I’m with you. I mean, obviously it makes sense that things are starting to cool down now. Do you worry though that rents are going to start going down in some nonseasonal way where we actually are going to see cash flow for existing properties start to decline?

Kathy:

I’m not worried. I welcome it. I have to look at this data as a human versus an investor because what matters most is the health of our country and of the families that live in this country, and rent needs to stabilize. It can’t keep going up like that, just like home prices can’t either, and it was definitely stimulus based. So, we’re just coming back to where we should be.

Now, at the same time, wages have gone up, wages have gone up in I wouldn’t say an equal rate, but based on the data that we’re seeing, the wages went up enough that some of these higher rents are still affordable, even in the C Class. I kind of was shocked to see that in the data. C Class apartments tend to get hit hard during recessions because that tends to be a group of people that are more transient. Yeah, well, look at what happened during COVID. It was those jobs that got hit the hardest, for sure, anything in hospitality. Of course, they were helped out through the stimulus. But now that those jobs are coming back and wages are up for a lot of people, surprisingly, they’re able to afford rents in a lot of markets because of the higher wages.

But seeing the rent growth slow down is a wonderful thing. It’s a good thing, and we should be rejoicing over that for our country. We should be rejoicing that home price growth has slowed down because a year ago we had a different conversation about that. We didn’t know when it would slow down, and people were scared they wouldn’t have a place to live. There was nothing on the market in some areas. When my daughter bought, she’s a typical millennial, aged 30 with a baby and a husband and two dogs, and there were two properties available in the area that she wanted to live. Two, two, and maybe two for sale and two for rent in the price range she could afford. So, that’s a scary time. Right? It’s like are you going to live with Mom and Dad with your two dogs and your kids? I mean, what are people going to do?

So, that was the story last year. The Fed came in, turned on the lights, took the stimulus away, and here we are going, “Oh, okay, things are going back to normal.” The headline is different. It’s a better headline. It just depends on how you want to interpret that. As an investor, you better be playing defensively. You better not be writing up your pro formas thinking that it’s going to be anything like the last two years. It’s not. Same with home prices. There are going to be areas where there’s still just not enough supply for demand and where it’s still affordable enough because people moving there or living there still have high salaries. Like North Texas, that’s one of the areas we’re looking at, $100,000 jobs moving there. We’re still buying homes for 200,000. So, the numbers work. The numbers work. But as an investors when you see these headlines, you need to be careful, you need to be cautious, you need to make sure that your pro formas makes sense and that the average person in the area can afford your rent.

Dave:

Yeah, that’s a great point. I think that when investors who are looking for existing properties see this, they think that their rents can decline, and that might happen, to be honest. I think there’s a chance that that happens. But just to ease people’s mind, if this is one of you, it is unlikely that rents will fall that far. Unlike housing prices, rent prices are pretty sticky. If you looked at what happened in the Great Recession, housing from peak to trough, so the highest it was during the mid-2000s to the lowest it went where it bottomed out in about 2011, housing prices dropped 27%. Very significant. That is a genuine crash. Rent prices during that time, the worst they went down was 6%. So, we’re talking about a whole different scale here.

I think most people don’t believe that even the price correction for homes will be 27%, but even if it were that bad, rent might only go down a couple percentage points. It’s probably very unlikely that we see double-digit rent drops because like we were saying, people formed new households, and although there was actually an article in the Wall Street Journal yesterday talking about how some people are moving back in with their parents or moving back in with a roommate, they didn’t really provide any data about that, so it’s hard to know, but just knowing from personal experience, I think people are very reluctant to go back and live with their parents. That’s sort of like a thing of last resort right now, and right now people are still employed. We haven’t seen an uptick in job losses. So, I think inflation is hurting people’s spending power, but I think it’s unlikely that we’re going to see just a very significant drop-off in demand for rentals at any time soon.

Kathy:

Yeah, at the end of the day, it always comes down to supply and demand, even when the government is stimulating the economy, and even if mortgages were still at 2%, but we had a glut of inventory. Let’s just say that we had the amount of inventory we had in 2007 which is three times, nearly three times what we have today, it was over 3 million, and mortgages were still at 2%. There might not be the kind of price gains that we’ve seen there. There still would be, right, because people decide, “Well, if mortgages are 2%, I’ll take three, I’ll take four houses, I’ll have one in each city.” So, people get greedy and want more than one.

So, it comes down that we still have a supply issue. We still had a decade of slow building because like I said earlier, builders got wiped out. That is how I got started syndicating. Back in 2009, I had a 40-year veteran developer come to me and say, “Do you know how to raise money?” I’m like, “No, I’ve never done it.” He’s like, “Well, figure it out,” because he would walk into B of A, he would literally walk into the commercial division of B of A, I don’t know if I can, I guess it’s public news now, that he would walk down the aisles and it was boxes to the ceiling of foreclosed subdivisions and foreclosed land, and it was an unbelievable time. So, we were able to buy up all the stuff that builders had lost during that downturn, and it made sense for us because we were paying 10 cents on the dollar.

But you could see why those builders weren’t in a hurry to come back. So, building was so slow over the last decade while our population grew, and this group of millennials that have been given such a hard rap over the last 10 years, basically saying, “Oh they’re just sitting home on Mom’s couch smoking pot.”

Dave:

They’re [inaudible 00:24:21].

Kathy:

Yeah, maybe. But now they’re older. I think anyone who was judging them should ask what they were doing when they were in their early twenties. Now this millennial group is older, and it’s a huge demographic, and there just simply wasn’t supply created for them. Add to it, the baby boomers living longer, feeling healthier.

Dave:

Totally. It’s a really, yeah.

Kathy:

There was all this media headline about boomers dying and of course there’s a segment that are, and that they were going to leave their homes, there’s going to be this glut of inventory from all these old people that die, and that just hasn’t happened. They’re living longer.

Dave:

There’s a very famous real estate person I won’t call out but who has been predicting a crash for years based on this theory that boomers were going to all die off and leave just a huge glut of supply, and clearly that’s not happening.

Kathy:

Just hasn’t happened. So, with those kinds of headlines and that kind of lousy data that was being shared and that I guess builders were listening to, they’re not going to take risks again. They were going to build spec. And so, it’s just we’re behind on supply. I see comments a lot of times on the On the Market podcast of people saying, “What do you mean? Now there is more supply. Thank goodness there’s more supply.” But kind of not really. It just moved down again. Right? At least in home sales, the inventory just went down again. So, it’s not better. There’s a little bit more inventory in rentals, and I don’t know what you saw in that data, but actually absorptions and occupancy is… Wait, let’s see. Vacancy is rising in apartments so it’s something to pay attention to, but home sales and homes on the market, that’s declining again. It’s just, it’s incredible. So, this is still an issue. Inventory is still an issue, not in every market and maybe not in your market, but overall, nationwide, it’s a problem.

Dave:

Oh absolutely. Yeah, just to speak, I do want to get back to the multifamily thing in a minute, but just if you didn’t see the show a couple months ago with Caitlin Walter who’s from the National Multifamily Housing Council, their organization showed that by 2035 we need 4.3 million new apartment units just to keep up with demand. So, yes, I think there might be some short-term things which I do want to talk about in terms of more supply coming on at a time where we might be entering recession, that could create some short-term stuff. But long term, demand for rent is going to be huge. I mean, to your point, we just don’t have enough supply.

The other thing you mentioned quickly that I want to talk about first that bodes well for rents being sticky is that lack of vacancy. Right? We’ve seen in the US that we are now at the point, vacancy’s the lowest it’s been since 1982. So, we’re talking about 40 years since we’ve had vacancy as low as it is now. That’s not just multifamily. That’s across the whole economy. And so, when you’d have rent that, I mean, vacancy that low, it’s kind of hard for rents to fall that much, and yeah, we could see vacancy start to tick up, but at this point there’s not really a sign that we’re going to start seeing this just lack of demand for rentals.

Kathy:

Yeah, my hope is that it just stabilizes and balances out what it did over the last two years so that the next couple of years it’s just flat, and that’s just kind of what we’ve been seeing in the last month that it’s flattening. I don’t think there’s any chance that rents will just collapse or that we’ll have a ton of evictions. That is again, unlikely, although it is very sad that homelessness has increased, and I will 100% blame that on the Fed, I will, for all the stimulus because that really separate the haves and the have-nots. Those who do not own hard assets, like real estate are just, it’s going to be hard to keep up. It’s going to be hard to keep up with inflation. Inflation, they will never tame it. It’s never been tamed. Just look at prices of anything.

Dave:

Yeah, They target 2 to 3%. They want some inflation.

Kathy:

They want inflation.

Dave:

Yeah.

Kathy:

Yeah.

Dave:

So, I totally agree, yeah. A low interest rate environment like this, it inflates asset prices. It’s just a fact. And so, to your point, we’ve been in, what, a 12-year low interest rate environment, 15-year low interest rate environment. That’s going to really create a lot of wealth inequality for the people who do own assets like real estate and the people who don’t.

Kathy:

Yeah, and I imagine those people will start to move to more affordable areas which is again why one of our strategies right now is to focus on those markets, just steady Eddie markets, the markets that don’t do too much. That’s kind of my safe place during times like this.

Dave:

Jackson, Mississippi.

Kathy:

Well, maybe not Jackson. I still want to see growth. I want to know something cool is happening in that area. There’s got to be a big university or big hospital. Like again, Cleveland is a market that we talk about sometimes, huge medical industry. That’s important. We know we do have aging baby boomers. They won’t die, but they’re going to stay alive forever and want hospitals.

Dave:

Exactly. Well, no, I totally agree. We don’t just want to go anywhere. But I think part of the challenge here is that the demographic shifts are creating, everyone wanting to move to Austin, to Portland, to Boise, rents going up crazy there, and a lot of these markets, it’s been above the normal level, but it’s not been double-digits every year for the last two years. I don’t know what Cleveland was off the top of my head, but it wasn’t 30% a year. I can tell you that much.

Kathy:

Exactly. It did go up, definitely, and it was already cheap. Right? So, going up 10% in a market like that is still pretty darn affordable.

Dave:

Yeah, that’s probably not so different from wage growth over the last few years.

Kathy:

True.

Dave:

So, before we move on to the multifamily stuff because I want to pepper you with some questions there because I’m curious, but just so people know, I did do some analysis and we have a data drop for you guys. So, if you’re curious about what rent is doing in your market, we have a data drop that shows for the top hundred markets, largest markets in the US. It’s going to show you how rent has performed over the last five years. We’re going to talk about… It shows you month over month and year over year changes. You can get that by going biggerpockets.com/rentaldata. Again, that’s top hundred markets, all this amazing data for you. Definitely go check it out. It’s free, there’s no reason not to do it, biggerpockets.com/rentaldata.

But I wanted to see if there are any markets that are actually declining, not just month over month because remember, seasonality, not surprised things are going down month over month, but year over year, and there were actually four markets that were. I think I made you guys guess on a recent one, but the number one was Spokane, Washington, went down 6% which I don’t know much about Spokane, but I know it was one of those crazy boom markets over the last couple of years. Reno, Nevada is the second one which I have a friend who bought there at the peak and is very much regretting it right now. And then we have St. Paul and Minneapolis which are kind of interesting because they implemented a couple of rent and price control things and we’re seeing rent start to fall down. So, it’s just those four cities. So, four out of a hundred. Personally, I wouldn’t be too concerned about big drops.

Kathy:

Yeah. I went to school in Spokane.

Dave:

You did?

Kathy:

Whitworth College. Yeah, I know the area.

Dave:

What school?

Kathy:

Whitworth College for two years, yeah.

Dave:

Oh, cool.

Kathy:

It was a small Christian college because I’d partied enough in high school that I just wanted to go to a college that didn’t have it.

Dave:

Wow. Wow. I want to know high school Kathy.

Kathy:

But I know Spokane. It’s just not high income growth area, but I think that nearby in Coeur d’Alene and-

Dave:

Which has gone nuts too.

Kathy:

… went crazy, so Spokane is really just not that far from there, and there were definitely some new businesses moving into Spokane, but I think it was more of a investor frenzy would just be my guess there.

Dave:

Totally. And one of the things I think people get wrong sometimes is when we see, oh, people are leaving big cities like Seattle, the vast majority of them stay within the state, we assume, and you do see people moving to Austin or to Las Vegas or whatever, but most migration is intrastate migration. And so, I’m just guessing, but I would think people are tired of Seattle prices, making a great income. I’ve heard that area of Washington’s really beautiful. So, maybe people are just moving there with their Amazon salaries and moving to Spokane like you’re talking about.

Kathy:

Yeah, yeah. I mean, it’s a quick drive over to Coeur d’Alene. You can still enjoy that, not have to pay those prices. But I think it’s really the millennial cities that pops the most because again, it’s such a big demographic and so high paid. So many of those young people have really high salaries and could go live quite a nice life in some cool, hip areas.

Dave:

Totally. So, those were the only, the four markets that went down, but 96 are still going up at least on a year over year basis. And if you’re curious, do you have a guess about… I wrote out the top three, one of them is kind of obvious, two of them are sort of obscure. Do you have any guesses? Still growing very quickly.

Kathy:

I’m looking at my notes and I’m not sure. Miami?

Dave:

Ah, that’s number three. Very good.

Kathy:

All right.

Dave:

27% still, 27% year over year, Miami. That’s crazy. But that was actually three. So, Lubbock, Texas. You know a lot about Texas. Where’s Lubbock?

Kathy:

I actually have a good friend who owns a ton of rentals in Lubbock. I’ll have to ask him. It’s kind of I think oil related which is not surprising.

Dave:

Oh, okay. West Texas, I don’t know. I’m not good at geography, but your friend is probably enjoying 31% year for year rent growth which is absolutely wild.

Kathy:

Oh yeah. Yeah, I should have listened to him.

Dave:

The second is Jersey City, New Jersey which I’m familiar with, not so far from where I grew up. But I think that’s one of the big stories too is you see cities like Jersey City, which is right across from Manhattan, going up a lot because it was one of the places where rent actually fell in the beginning of the pandemic. So, it’s recovering and then some, but it sort of distorts the data a little bit. But you do see at least the New York metropolitan area rent has recovered and then some at this point,

Kathy:

Yeah, I think in these areas where we did see so much rent growth, what’s important to focus on is which businesses moved there versus which people moved there because that’s what’s going to keep it sticky. And that’s the thing about Miami, that’s why I guessed Miami is I know that many New York financial firms moved to Miami. I’m surprised it took up so long because it’s like-

Dave:

Yeah, Wall Street South.

Kathy:

Exactly. Why would you not choose beaches over snow? I don’t know.

Dave:

And no state income tax.

Kathy:

And no state income tax. So, that to me is an area that I don’t see it dropping substantially because of that. You’ve got New York financial giants moving there and they still think it’s dirt cheap.

Dave:

Totally. I moved out of New York because I always thought it was a little bit of a scam. I love New York, I love visiting there, but people put up with a lot there because they’re like, “Everything’s happening here,” and you have this small apartment that’s super expensive because there is a lot of culture, there’s nightlife, there’s great food, there’s a lot. But I think some people moved during the pandemic, they’re like, “There’s also stuff elsewhere.”

Kathy:

There’s some good food here too.

Dave:

There’s a lot going on in Miami too, and you get a lot more for your money.

Kathy:

Oh, that’s so funny. I’ve been doing this for 20 years. I would bring kind of California snobs, no offense y’all, but you know what I’m talking about, and I would take them to Birmingham or something, and take them to an amazing restaurant where they couldn’t read, they didn’t know what was on the menu, they didn’t know what it was. I was like, “If I blindfolded you, would you think you were in California based on what we’re seeing and the buildings?” And they were like, “We wouldn’t know the difference.”

Dave:

Yeah, exactly. There’s great stuff everywhere.

Kathy:

But they just don’t know. They just don’t know because they hadn’t been. Yeah, and I think people got a chance to go travel a little bit.

Dave:

Yeah, it’s great. So, the last thing I want to talk about before we go is about multifamily rent. So, you have experience with this, but the data I’ve seen is a little bit contradictory. Right? So, we’re looking at some of the similar data. So, one thing that we’ve seen is that occupancy levels in multifamily have gone down. There’s still really high. They’re still like 95%. Just for context, they usually hover between 93, 95 and we’re still at 95%, but they had shot up to like 98% for a couple months now. So, that suggests that there could be an increase in vacancy. When vacancy goes up, rents tend to go down. But at the same time, we’re also seeing that the number of lease renewals, people who are choosing to stay in place has also gone up for multifamilies. So, these are sort of contradictory data points. So, we’d love to just get your read on the multifamily rent market.

Kathy:

You know, I just spoke at several conferences and got to hear and interview a lot of investors. In fact, I’m going to give those interviews to you guys and see if we put together a YouTube video on that-

Dave:

Oh, that’s great.

Kathy:

Yeah, just to hear what people are thinking and what they’re doing in the multifamily space. So, one of the big things I took away from the conference was that we’ve got to compare today’s number to pre-COVID. Every city’s different. Right? Every city has different dynamics, different employers moving into the area, different employers leaving the area, and different dynamics because people are moving in, and they have different political views, and so forth. So, there’s been lots of change.

But to try to guess what’s going to happen when you’re underwriting a deal, especially in multifamily where the difference if you get it wrong could be millions and millions of dollars. We know that. Jamil shared that with us. You do not want to make a mistake in your underwriting with multifamily. So, use numbers in that market. 2018, 2019, you’ll get a better idea of what a typical vacancy rate would be in that area, and even better, take the decade, take the average of the decade starting with 2012 up to 2020, and that will give you a good idea of where we might land in that market.

Now, if something really major changed, and that would be really in Florida and Texas, because the big thing, the major things that have changed in those states is so many businesses moving to those states for, what you just said, the tax benefits, but also they learned a lot during COVID. They learned that there are certain markets that are more job friendly than others. This is something I’ve been focused on for years, I’m sure you have too, because it matters if you’re a landlord. You want to be in a landlord friendly area. So, it’s easier that laws are in your favor, and that’s when a lot of businesses realized, “I want to be in a state where the laws are in my favor and where I can keep my doors open.”

Those two areas, I think you’ve got to taken into consideration the amount of new jobs that have come to the area that are permanent, that are not leaving, factories that have been built and so forth and headquarters where it’s probably not changing anytime soon. But other than that, I would look at the last 10 years and pre-COVVID and just take the average, the vacancy rate, occupancy absorption.

Dave:

Yeah. I mean, I think it’s a great point we don’t talk about that much, but if you miss rent estimation by let’s say 50 bucks on a single family home, you’re going to be fine. It’s not that big deal. Right? I was thinking about this the other day, if you miss rent by 50 bucks on a 300-unit syndication, that’s 600 bucks per year per unit, that’s $180,000 per year in revenue which is a lot, but not crazy. But when you consider that the way that multifamily units are valued is by cap rate, if you then sold that or if you’re selling at a 5% cap rate, that’s $3.6 million in value that you’re wrong by just estimating $50 off on your rent.

So, I think that’s very wise, very wise advice, Kathy, that to be extra conservative right now because there is sort of contradictory data, we don’t know exactly which direction it’s going to move nationally. If you study your market, hopefully you have a better idea of what’s happening locally in your market, but I think it’s true just of generally anything right now. I would personally underwrite anything single family with little to no rent growth for the next year or so.

Kathy:

Absolutely. And I would assume that cap rates are going to increase which generally means that the price is going down.

Dave:

Yeah, definitely. Yes.

Kathy:

Which is great if you’re buying. Right? If you’re buying, that’s great.

Dave:

Right. I mean, I think James said in a recent episode when we were all chatting, he thinks there’s going to be a lot of these opportunities coming on the market too because people are going to be defaulting. So, it does mean there could be opportunity there.

Kathy:

Or just even if they’re not defaulting, just the values are down. If your expenses go up, and again, it’s coming back to the nuances of multifamily and anything commercial, it all comes down to NOI, and so, what is your net operating income, what are your expenses, and that determines basically the value of the property. And so, if the goal is always decrease expenses, increase income, even by little tiny amounts like you said, and that can increase the value by millions. But the reverse is true too. It just goes down ever so slightly if your expenses go up, your rents, your insurance, cost of money.

Dave:

Yeah, cost of debt.

Kathy:

Exactly. That is going to affect the NOI. It’s going to affect the price. So, again, it could be a wonderful opportunity as a buyer and really tough if you’re a seller.

Dave:

Yeah, absolutely. Well, I think that’s really, really good advice. Just generally speaking, just to sum up sort what we’ve talked about today, rents are starting to come down on a month over month basis. That is normal. This is seasonality. This is what we would expect in a normal year. In 2021, that didn’t happen and that’s what’s not normal. That’s the concerning thing in my mind is that it didn’t follow the pattern that exists every other year. But on a year over year basis, rents are still up 11% year over year nationally, and out of the top hundred individual markets, only four of them have seen individual declines. Vacancy is still really low.

But I think anyone who’s following the market understands that there is downside risk right now, and that you should be careful. If you are underwriting any sorts of new deals, you should be very conservative in what rent estimations you’re making, and I think for a couple years honestly, people were buying a deal being like, “Oh, it’s not going to cash flow this year, but next year it’s going to cash flow.” And that probably actually was true for one or two years, but I would not do that anymore. That is not wise. I would personally recommend being conservative because you probably can be because home prices are probably going to come down in many markets and rents are a little bit stickier. So, cash flow prospects are going to be better, and I would recommend just being patient for that. Any other advice you have, Kathy, before we get out of here?

Kathy:

Yeah, I mean, this is really going to be a good opportunity to get into multifamily. I would just be very cautious if you’re investing in somebody else’s syndication or if you are embarking on it yourself that you have somebody on your team that’s been through a down market because most of the people that I meet at these conferences have only been doing it for a few years.

Dave:

Like me

Kathy:

Yeah, maybe the last eight years and haven’t experienced a real recession. We may or may not have a tough recession ahead of us. We don’t know. It could be awful. It could be barely a blip. We just don’t know. It depends a lot on what the Fed is going to do and we have zero control over that, like zero. It’s going to do what they’re going to do. So, just have someone on your team who’s been through a down market and who knows how to navigate that and knows how to underwrite with that stress test in mind.

Dave:

That’s great advice. And again, we don’t know what’s going to happen and no two recessions are alike, but history is your friend too. If you go and look at what happened in previous recessions, in previous job losses, the last time the Fed raised rates like this, you can learn a lot about what might happen and how you can protect yourself and be conservative but still be opportunistic. I think that’s sort of the name of the game. Right? It’s like don’t get ahead of your skis. You want to be careful right now, but there will be opportunities if you’re informed and know how to buy correctly in this market.

Kathy:

It would be really cool, here’s just a little idea for BiggerPockets, but it would be really cool to have some kind of mentorship program where you take these people who have been investing in multifamily for 30, 40 years and are maybe all set. They don’t need to do anything else. They’re raking in the dough from their acquisitions from years ago. But to come and just give some mentorship and advice to people getting into it, it would really help to bring in that wise counsel.

Dave:

Definitely. Well, we do have the bootcamps if you haven’t, I don’t know if you’ve seen any of those, but we have bootcamps where people who are more experienced. I know we have a multifamily bootcamp. Do you know Matt Faircloth?

Kathy:

Yes, of course.

Dave:

Yeah. So, Matt and Liz who host the BiggerPockets InvestHER podcast are both doing those bootcamps and they’re super experienced. But yeah, I think that’s great advice. We’ll have to send those to the higher ups.

Kathy:

Well, it’s just one of the benefits of BiggerPockets is there’s just so much wisdom on the website of people willing to help you and kind of mentor you, sometimes just for free. But yeah, we love Matt, we love the Faircloths. They’re the best.

Dave:

They’re the nicest people. But yeah, honestly, so many people, I don’t do any mentorship or coaching, but people reach out to me on Instagram and they’re like, “Hey, can you answer this question for me, or will you mentor me?” And I’m like, “Did you just ask this on the BiggerPockets forums?” You can for free get dozens of super experienced investors can answer these questions for you and will, and honestly it’s better than having an individual mentor. You’ll get a lot of opinions which is really helpful. So, if anyone’s listening to this, I think a lot of people who listen to BiggerPockets podcasts don’t know we have a website which we need to work on, but if you don’t know, go on the forums and ask questions. It’s an incredible resource for investors, and to Kathy’s point, you can ask people who have been through these types of situations before how they would handle your circumstances or just approach this type of market. Very good advice.

Kathy:

You can even just put the deal that you’re thinking about getting, maybe not the address because someone might snatch it from you, but just you’ll get so much input it. It’s a really an incredible resource.

Dave:

Absolutely. And also, if you’re on the website, download the free data drop that we’re given out this week. It is biggerpockets.com/rentaldata. It’s free and you should absolutely do it. Kathy, thank you for being here. If people want to reach out to you for your sage advice, where should they do that?

Kathy:

Oh, thank you. You can always reach me at, well, @kathyfettke is my Insta, but also realwealth.com is our company where we help people acquire investment property nationwide, and my syndication company is growdevelopments.com.

Dave:

All right, great. And I am Dave Meyer, and @thedatadeli is where you can find me on Instagram. Thank you all so much for listening. This has been On the Market, and we’ll see you next time.

On The Market is Created by me, Dave Meyer, and Kailyn Bennett, produced by Kailyn Bennett, editing by Joel Esparza and Onyx Media, research by Pooja Jindal, and a big thanks to the entire BiggerPockets team. The content on the show On the Market are opinions only. All listeners should independently verify data points, opinions, and investment strategies.