Airbnb Is Partnering With Apartment Complexes—Here’s What That Means

Sponsored

Airbnb Is Partnering With Apartment Complexes—Here’s What That Means Read More »

Sponsored

Airbnb Is Partnering With Apartment Complexes—Here’s What That Means Read More »

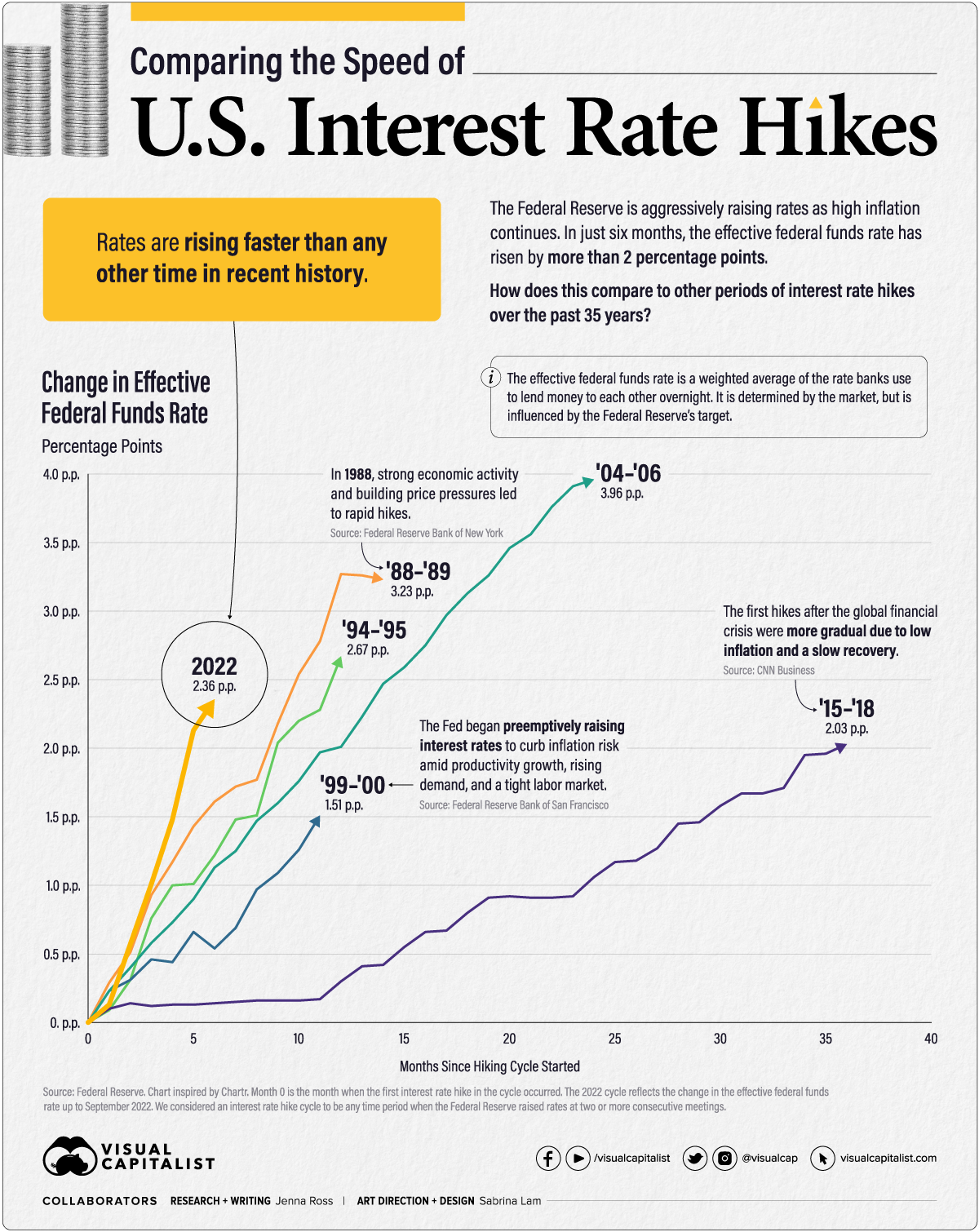

Last week, the Fed raised its benchmark interest rate by half a percentage point, a slowdown from previous sprints. Still, the federal funds rate is at its highest since 2007. While traders are betting the Fed will begin reducing the federal funds rate in the second half of 2023, historical trends suggest a different timeline. And while economists from major firms are split on where and when rates will peak, Fed policymakers have signaled that rates will likely remain elevated until 2024.

Why the varying estimates? No one is certain how long it will take for high-interest rates to impact the job market or whether we will enter a recession. Inflation has been stubborn (albeit declining) largely due to low unemployment and supply chain issues, experts say.

Interest rates have peaked for an average of 11 months over the last five cycles. In past rate hike cycles, however, the Fed acted earlier to tame inflation and gradually raised rates.

Since high inflation in 2022 was initially thought to be a temporary, “transitory” result of the global pandemic, inflation was allowed to exceed target for 12 months before the Fed took action. This led to the fastest rate hike cycle, a rise of more than two percentage points in only six months. With inflation stickier than in the past, a longer-than-average holding period may also be required.

Fed policymakers forecast additional increases in 2023 to a range of 5%-5.25%. Rate cuts are not expected to happen before 2024. But that’s not set in stone. The Fed’s own forecast clashes with trader expectations, while history seems to support the Fed’s timeline. Still, a sooner decrease is possible if a deep recession takes hold, analysts say.

Financial firm Morningstar expects inflation to turn around faster than the Fed currently forecasts, predicting rate cuts in the second half of 2023 that continue into 2024. The firm contends that the Fed is attempting to “talk” the market in the direction of maintaining tight financial conditions while dropping bond yields over the last two months and slowing economic growth, suggesting the fight to control inflation will end in 2023.

Barclays initially expected rates to come down in the third quarter of 2023 as well but has pushed back the forecast to November of 2023 due to the resilience of inflation. But the firm’s estimates remain ahead of the Fed’s schedule due to a high likelihood of an upcoming recession. And Morgan Stanley continues to predict the first cut happening in December of 2023. Researchers at JPMorgan Chase say the Fed could cut rates next year as well—but only if factors like increasing unemployment, lower inflation, and weakening economic activity converge in time.

Meanwhile, most of the investors the bank surveyed don’t expect rates to fall until 2024. Economists at Goldman Sachs agree. Chief Economist Jan Hatzius says inflation has been more persistent than expected and doesn’t expect rate cuts until 2024.

Still, Bloomberg Economics is nearly certain a recession will take hold within a year, and most economists agree. Some say if unemployment rises enough, the Fed may rest its attempts to hit the target inflation rate of 2% since there are signs the inflation rate will remain above that target for the foreseeable future. In any case, future rate increases into 2023 are probable, which will impact mortgage rates as well. Even in a best-case scenario, most experts don’t expect mortgage rates to come down until the end of 2023, and they could stay elevated into 2024 if a resilient economy requires the Fed to be more aggressive.

Fundrise is revolutionizing how you invest in real estate.

With direct-access to high-quality real estate investments, Fundrise allows you to build, manage, and grow a portfolio at the touch of a button. Combining innovation with expertise, Fundrise maximizes your long-term return potential and has quickly become America’s largest direct-to-investor real estate investing platform.

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.

When Will The Fed Lower Rates Again? Sooner Than You Think Read More »

The housing crash is always looming. If it wasn’t, how would media outlets push you to constantly stay informed, glued to the television, watching every new mortgage and inflation update? For years now, a housing market crash has been the talk of the town, with everyone from well-known news anchors to your “very informed” family members telling you that it’s only a matter of time until this house of cards comes crumbling down. But these “forecasts” aren’t as rock-solid as they may seem.

This is just one of the stories we’ll touch on in this episode of On the Market, where we’re joined by our entire panel of expert guests! With the housing market in a standoff between buyers and sellers, our expert real estate investors are here to save the day, giving you the top stories that could impact your income. To start, Jamil talks about the “cancer” that’s affecting the Arizona housing market, Kathy touches on new landlord legislation, Henry hits on the US recession, and James debates the housing market doubters.

But we’re not just talking about how investors are faring, we’re diving deep into a rarely-talked-about subject among investors—homelessness, housing affordability, and our impact on society. You’ll hear why investors are open to building affordable housing, but there’s one BIG hurdle standing in their way, stopping them from moving forward. We’ll also discuss whether or not landlords are the villain retail homebuyers portray them to be, and how we, as investors, can help more homebuyers reach their dreams of finally becoming owners themselves.

Dave:

Hey everyone. Welcome to On the Market. I’m your host, Dave Meyer. Joined today by the full panel. We have Kathy Fettke, James Dainard, Henry Washington and Jamil Damji joining us. And all four of you just got back from what looked like a very fun party that I’m very sad to miss to celebrate Jamil. Jamil, congratulations. Can you tell everyone what you were celebrating?

Jamil:

Absolutely. Thank you for the shout-out. We had the premiere of season two of Triple Digit Flip and my brothers and sisters were all in attendance. Other than you, Dave, we missed you. But we had you there in spirit. It was a phenomenal premiere, super fun show and the network executives came out.

We had The Outlaws from Tupac and The Outlaws performance, like are childhood heroes of mine and just got to live up a night that I’ll never forget. It was super fun.

Dave:

That’s awesome, man. Well, congratulations. It’s a great show and you definitely deserve to celebrate all of your success there.

Jamil:

Thank you, bro.

Dave:

Henry, what was the most compromising thing you saw or learned about Jamil during the party?

Jamil:

Great question.

Henry:

Well, it’s funny is when I showed up, he made me sign an NDA. So I can’t really disclose what I did or didn’t see. All I can say is that it was a night definitely to remember.

In all seriousness, what I love about hanging out with Jamil is that his warm, inviting and comforting nature is reflected in everybody that’s around him. We’re in a room full of hundreds of people and everybody is just having a good time, sharing information with each other, loving on each other, and to be able to create a community like that is not only a testament to his success but a testament to him as a person.

Thank you for letting me be there.

Jamil:

Thank you, man.

Dave:

Wow, awesome. Kathy, why, do you have something mean to say?

Kathy:

I was going to say no, no. I agree so much. Jamil and Pace are changing so many lives that the room was just full of hope and happiness and optimism of people who were learning how to invest and how to change their lives and their future that way. And it was just so much love in the room. And I got to see Jamil do some attempt at break dancing maybe.

Jamil:

You mean break necking?

Kathy:

Break necking.

Henry:

That was a really cool full circle moment for me. I had posted a video about it I think yesterday, but a guy came up to me who recognized me and said that he saw one of my videos about a challenge I was having a long time ago, and when I just started investing and me talking about that challenging experience changed his life, his perspective and he knew at that point he was going to be successful.

He then ended up connecting with Pace’s group. And while his mom was battling stage four cancer, he was able to go from where he was to make $90,000 in a year. And it was just cool to know that something that I said sparked this guy to get started.

He then works with Pace. I didn’t know Pace at the time. He probably started to connect with me. And then now we’re all in the same room together at the same time seeing his success. That’s the impact that sharing this information about real estate can have on people. And the world is smaller than we think it is.

Jamil:

Man.

Dave:

That’s awesome. That’s awesome. Wow, that’s super cool. And congrats on the community that you’ve created there, Jamil.

Jamil:

Thank you, man. It’s been a phenomenal experience and it’s just getting started. I see this as our life pursuit and I’m excited to do this until they tell me to stop.

Henry:

Amen.

James:

I hope you do. The parties are fun.

Dave:

James is like yeah, community. Whatever. I don’t know. Let’s have more parties.

Jamil:

James had one of the best outfits on ever. It was like we did a ’90s hip hop theme because it was so good.

James:

I will say the community is awesome. I lost my credit card in the bathroom somehow and someone had tracked me down somehow and handed me the card. I literally had just canceled it. He’s like, “James. I’ve got your credit card.” And I was like, “Oh, wow!” It was-

Jamil:

Wow.

James:

Talk about a good community.

Dave:

I just bought a boat on it.

James:

Yeah, I know. I need it for the boat repairs.

Jamil:

That’s so cool.

Dave:

All right, well I’m glad you guys had such a good time. Hopefully I could be there for next year. Let’s get into today’s show. We’re going to be doing one of our, I guess, repeat formats now, which is a correspondence show where we can… Each one of our panelists will bring a story that they are finding interesting that they think are important for our listeners to pay attention to.

We’ll get to that in just a minute. But first, we’re going to take a quick break. All right, Jamil. You’re the man of the hour. So let’s start with you. What story did you bring for us today?

Jamil:

Well, I wanted to look at this from a slightly different angle and perspective because as we have seen the real estate market shift and as investors, we all have a specific point of view and our point of views differ for sure. But we’re really looking at it from the bottom line of our perspective. Are we going to be paying more money for our houses? Are we going to be able to cash flow? Is the BRRRR still working so many different things? Is real estate going to correct? Overcorrect? There’s just a lot of tension and things that we as investors care about and think about and talk about.

Yesterday, however, I’m doing a popup meetup at my office and a lady who follows me on YouTube comes in and gives me a big hug and says, “I just want you to know that I’ve been watching you on YouTube and I was able to do my first deal. It was a small deal. I made $2,000 and it allowed me to sustain life for a little while longer and living in my car.” And I was like, “Hold on a second. What? You came to a meetup and you’ve done your first deal, you made 2,000 bucks, but you live in your car?”

And she said, “Yeah, I live in my car. Housing is just way too expensive and I can’t figure it out. I can’t figure this out.” Right there, I just had this moment where I thought, this perspective is so important to understand and at least talk about. And so lo and behold, I’m looking at articles and I see an article by AZ Big Media and it’s titled Why Experts in Arizona Say The Growing Housing Crisis is a Growing Cancer.

And I needed to understand what this is talking about. And so again, we’re looking at this from the different angle, a different perspective. Homelessness here in Phoenix, Arizona has become a massive, massive problem. We’ve got tent cities popping up all over the spots. In every neighborhood you go, there’s homelessness. It’s just regular people. It’s not just people with mental illness or addictions that you’re seeing where you’re like, “I understand there’s a lot of greater social problem or a greater mental or health problem here that’s causing some of this difficulty.” But this is like moms, dads just families and just regular folks having hardship, not being able to pay rent.

And as I see this and I think okay, we’re walking into or we’re in the middle of a correction and housing pricing, is there any way that this gets better for the little guy? As I read the article, I see it’s not getting any better for the little guy because what happens is right now, especially as we see rates increasing and demand slowing, days on market in Arizona or Phoenix especially, is still 33 days.

33 days on market, which means that there’s still demand. There’s still demand. People are still buying. Yes, prices are depressing. We’re already at over 10% correction and price, but that has not stopped trading. That has not stopped investors from buying, buy and hold investors from buying, large hedge funds and private equity groups from buying. That has not stopped, Ma and Pa Landlords from buying. We’re just getting everything cheaper right now. That’s it.

Because we’re getting everything cheaper, when you have people looking at opportunities now, because now you’ve got the little guy who can come in and actually purchase a home, albeit they can purchase a lot less home than they could have purchased say six months ago. But now they’re at the table and they’re trying. Their offer, even though it’s probably significantly higher than my offer, my offer’s cash, my offer is safe, my offer closes and it’s guaranteed and I’m still winning.

I’m still winning at the negotiation table even though I’m coming in significantly lower. That is creating more of a situation. It’s creating more of a homeless situation. It’s still sucking inventory away and rents are not following the housing situation. Pricing right now is correcting 10% or greater in Phoenix, Arizona. Rents have not changed. They’re still going up. It’s that whole… Is there a trickle down here? Is there a reprieve for the little guy? I need to take the perspective because again, we all, as a community of people, investors, we are all in this together. And there is a greater conversation that we need to have because what they’re proposing in this article is legislation.

They’re proposing that there is no fair market situation here. The market is not going to correct itself. The market is not going to allow opportunity for smaller people or the retail buyer to come in and participate. It won’t because we don’t play by the same rules because what that buyer has to qualify for, show for income, show for credit, I never have to do that.

I don’t have to play by those rules because I come in with cash and I’m going to best them every single time. They’re proposing legislation. They’re proposing legislation on rent control, they’re proposing on legislation on how many houses a specific LLC or a corporation can buy. They’re really wanting to create, in my opinion, some regulations that are going to take the fair market or the natural capitalistic market conditions that we all or many people believe need to be there off the table.

When you see Arizona has flipped from a red state to a blue state. We’ve all seen it happen. I believe that legislation like this is going to become the conversation. I want to talk about it. I want to hear perspectives. I want to understand, well, what do we think as investors about this? What about the perspective of the lady who came to my meetup who is living in her car right now, who is participating in real estate and doing deals and is a part of maybe the problem. That’s the article. That’s the thought.

Kathy:

I would love to comment on that, Jamil, I remember in the ’70s, I know many of you were not born, but I was young, very young. And we were sitting at the dinner table, and it was in 1971 when Nixon took us off the gold standard. And my father said, “This is going to be really bad. This is going to create separation between the haves and the have-nots because this will allow more creation of money without anything to tie it to.” Which at the time had been gold.

We know that politicians like to spend money. So inflation and the printing of money is a silent tax. It’s a tax that people don’t understand and don’t know about. And that tax is most felt by those who have less money because they have a finite budget. When things cost more, there’s no room for that.

Printing money and inflation hurts the lower class and creates more of a lower income class because more money is going to pay for goods because more money is being printed instead of taxing people. It always falls, the culprit always falls on the investor or often on the investor. In my opinion, what needs to be regulated, which may never be regulated, is the Federal Reserve that creates that money and politicians who want that money to stay in office because they keep offering things.

I have a very strong opinion on this. It always falls on the landlords. But if you look at it this way, if you’re throwing trillions of dollars out of a helicopter, let’s say, and the people who pick up those dollars because they’re fast at getting them or they’re doing something with them, those are the ones that get blamed when what they’ve really done is just picked up the dollars that were thrown out.

The regulation is going to come and that’s what my story is about. And we’ll talk about that when we get there. But I do hope that people really look at the systemic issues versus the bad naughty investors. Because at the end of the day, rentals are very important too. If we look back to the ’70s, again when we’re talking about this, home ownership rate was much lower. It was 63%. In the ’60s, it was 66% home ownership in the ’70s. Today it’s higher. It’s about 65%.

Dave:

Right there, 66%. Yeah, it’s gone up the last two quarters. Just for everyone says that it’s returning to a renter nation.

Kathy:

Yeah. More people are owning homes. It’s not that different. It’s better than the ’70s, ’80s and ’90s. And of course when regulation came in to stimulate housing and get more people buying, that’s when things went crazy with more regulation because of course we know that that’s when loans got too easy and it became too easy to buy a home. Home ownership for everybody. But people, all people do need a home unless they like to live in their car, which some people do.

I’ve got nephews who love living in their vans. That’s their choice. But otherwise, if you want a home, you’re either going to rent it or you’re going to own it. There has been typically 30-40% of people who choose to rent for whatever reason or who are renting. So again, I know that regulation is coming, but I do hope that we’re able to get the message out there of what the real problem is.

Jamil:

You’re talking about treating the disease instead of blaming the symptoms?

Kathy:

The disease is money printing and where does that money go? And when people really dive in and look where that money goes, I think they will probably be more upset than with a bunch of institutional investors providing rental homes.

James:

To piggyback on Kathy, I’m in the Seattle market where there is a lot of regulation that has been passed over the last three to four years. One thing about the news articles is I will say they start hyping up the regulation a little bit more than what it actually is. But the issue is if it becomes this fight, investors versus politicians and it doesn’t need to be a fight, it should be a common solution. There’s so many different things that could happen that could make homes more affordable.

You could subsidize the builders, the investors on their construction costs. You could get them their permits quicker. If the city came to me and said, “Hey look, we want you to cap on rent, but we’re going to forgive you all, maybe some tax relief, some utility relief and we’re going to give you your permits in two weeks.”

That would be a negotiation that’s a fair trade at that point. But the issues there is a lot of times is the cities, they kind of put up roadblocks all the way through with these investors. The permitting, the construction costs, the fees. We got a new tax that was put on us two years ago. We call it the developer tax in Seattle, where they charge us roughly to $2-3 per square foot on any permit that we’re pulling for new construction. Then that’s supposed to be going back into the community to help out. The problem is it never makes it to that community.

And then all that did wasn’t affect us as developers. That just meant we have to pay less now. It just affected this seller that’s trying to sell their property and then move into another… Whether it’s on their next phase of their life. And so I wish there was more community and brainstorming because there’s so many different solutions out there that could keep actually homes more affordable. We saw a construction cost went up by 20-35% over the last 24 months. The replacement costs are really high. If you can get those costs down, you can charge less for rent. Hopefully, at some point in the future, people will come up with solutions that help everybody because that’s how you fix the issue. You don’t overcorrect here and overcorrect here.

Henry:

Yeah, I want to piggyback on that because James is making a phenomenal point. I think we’ve gotten too comfortable in this country of playing this us versus them mentality. There’s the right and the left, the Democrats, the Republicans, the conservatives, the liberals, the landlords and the investors versus the regular guy. James is 100% right. Us versus them doesn’t solve the problems. I think when you look at this legislation, you have to understand what is the motive behind it.

Not what they’re saying the motive is because they’re saying the motive is let’s help the little guy. But that’s not the motive. The motive is I want to do the things that my party thinks is good so that I get more votes reelected, can continue to live the life and do the things that I want to do. If the true reason is to solve the problem, then it has to be together.

Nothing gets solved with us versus them. Things truly get fixed. The wound truly starts to heal when we work together. I had the exact same conversation that James is talking about. I spoke at an event about affordable housing and they invited me because I’m the dirty landlord and they wanted to talk about affordable housing. That’s exactly what I said to them is, “I do have property that I can and will take less rent on, but I still have to pay for that.”

And so if we can work with the city and come up with a way for the city to say, “Hey, if you can charge less rent for these types of properties, we can do this for you.” If we can go and then we work with the builders and do the same thing and say, “Hey, if you will build this type of property in this neighborhoods, we can give you these types of breaks or credits or…”

So that everybody is doing something that helps each other out. And then we heal the wound. That way, we’re not just treating the symptoms just like it. And it’s got to be that way with everything that we’re facing as a country right now, we’ve got to stop fighting each other. We’ve got to stop talking about, “Well, this person or this group of people is bad and my group of people is right.”

It’s not about that. We’re all on this planet together sharing these resources that we have and we all want to live the best lives that we possibly can. And so the only way that happens is if we start to have some empathy to other situations. That’s why I love that Jamil brought this story up. He brought the story up. He’s on the opposite side, he’s on the investor side, but he has empathy and understanding for what the regular person is going through and he’s able to listen to what their struggles are.

And so now maybe on a small scale, you and [inaudible 00:20:39] come to some sort of way to improve each other’s lives. But without each of you being willing to understand where the other person is coming from, what the other person has to deal with and then being able to talk about that in a way that it’s constructive and not combative, you get to real solutions. We’ve got to understand that for any of this to change landlords, cities and municipalities and local governments and national governments all need to sit down and try to figure out what can we all do collectively to fix the problem. Not what can I do on my side that my people like.

Kathy:

Amen.

Henry:

Yeah man.

Dave:

Well said. Well all of you, very good points. Jamil, I agree. Thank you for bringing up this important topic. It’s a really pressing issue right now. It sounds like we all agree that this is a problem. Affordability, I think in terms of housing is at a 40-year low hardest.

It’s the hardest time since the ’80s for people to buy a home. Even though as Kathy said, home ownership is up and is going up, that is sort of under threat if we remain at these levels of affordability. Rent is going up. This is just both a moral and societal economic imperative to fix, in my opinion, at least.

Jamil, to your point, something is wrong if people are hustling and working hard and they’re living out of their car. That’s a problem. But to your point, we also need to consider what solutions actually work. I actually just listened to a really good podcast on Freakonomics. I don’t know if you guys listened to this.

Jamil:

Yeah, great. I love that podcast.

Dave:

It’s great. Yeah, about rent control. I really recommend anyone listen to it. It’s a really good, well-balanced, unbiased perspective on what happens with rent control. And a lot of the times it doesn’t work. It actually leads to higher rent. And I won’t get into the details with that there, but I think it’s really important in solving this issue to not just be reactionary and look into say like okay, let’s cap rent. It makes sense on a logical level, but evidence-based, evidence-wise, it doesn’t actually do what anyone really wants it to.

I’m curious, Kathy, you mentioned that your story was about some regulation that is potentially coming, I don’t know if it’s on a national level in California, but can you tell us a little bit more about what some of the proposed regulations are to try to address this issue?

Kathy:

Yeah, it’s three Democrats from California who just came out with a new house bill in October. It’s called Stop Wall Street Landlords Act. This is an article from Vox, it is called, if you want to look it up, Democrats Eye New Legislation to Reign in Wall Street Landlords. I remember in 2012 right before Warren Buffet said, “Oh, if I could buy a few hundred thousand homes, I would.” That’s when Wall Street did jump in because they listened to what he says and they did find a way to manage the properties and jump in.

It was right around that time that of course prices were so low and interest rates were pretty low. I told all of my friends, you have got to buy something right now. Anybody in California who didn’t own real estate at that time, I was like, “Do it now because this is going to be your chance.”

Well, they tried and because they had FHA loans and any kind of loans that they were bid out, it changed like this. It was in a matter of weeks. Warren Buffett said his thing, funds jumped in and it was crazy. My friends and family who were making offers with loans were losing out every time because what seller is going to want to sell to a first time buyer with an FHA loan that may or may not close when they could get a cash offer from a Wall Street firm for much more.

There’s always two sides or three sides or four sides to any story when you talk about regulation. Personally back then, I would’ve loved to see some regulation back then because it was an incredible time for homeowners to be able to lock in low home prices, but they couldn’t compete.

That would’ve been a great time to maybe do something where you get 30 days to see for a first time buyer to see if your loan closes for what the institutional investor would pay. So the seller is still going to get the deal. The investor can be on the sidelines if the first time home buyer doesn’t close, then the investor can come in. I mean, some kind of regulation I really think would’ve been nice because I now see my friends 10 years later who never were able to get into the market and they can barely survive.

And some of them are in their 60s and they’re still renting and are getting priced out. So it is a very serious issue, has been for a long time. Regulation has not come in. Probably, it’s kind of late basically. We’ve got to remember that the Fed was subsidizing housing until this year, until March.

Keeping interest rates low, which drove prices up. This article is again, it’s basically saying we’ve got to stop Wall Street landlords, even though they only represented 3% of home sales and that would be funds that own a hundred homes or more. Between 2021 and 2022, it was only 3%. They’re not as bad as people think. They own about a little over 1% of rental properties that are out there. But in certain markets they’re really active and it’s in those markets and I’ll mention some of them, Atlanta, Jacksonville, Charlotte, Phoenix, Miami, and those markets, they have made it really hard for homeowners to get in.

With this act, I kind of like… I like the proposal in the sense that they’re basically saying maybe we don’t give the investors the same tax deductions that a home-owner would get. Maybe there’s a transfer tax or there’s a different kind of tax if you’re an institutional investor, they also recognize that really the real issue is supply and that maybe the better regulation or incentive would be tax credits.

This to me is super obvious, of course. Tax credits to people who will bring in affordable housing. Because anytime you give any kind of tax incentive, that’s where the money goes. So I do think it’s a somewhat balanced proposal. I didn’t read the whole thing and the article just talks about it or may not or may not go through. But I do know that other countries charge more to an investor than a homeowner in taxes. The property taxes going to be higher, there’s going to be potentially a transfer tax. So this isn’t something new or unusual and I don’t see that as a bad thing at all to… I’m a fund manager. This would not be good for me.

We have a fund. We’re buying aggressively. I just got back from Dallas and we just tied up homes for about 120,000 that don’t need… Well, they probably need 20 to 30,000 in rehab and the ARV is going to be about 220 for our fund at Grow Developments.

I can tell you from a fund manager perspective, a first time buyer wouldn’t want that home. You guys know that. We fix homes. To put a first time home buyer who’s barely able to afford the home to begin with maybe doing a 3% down FHA loan, now they got a house that it is barely livable? Investors are needed. I think that voice has to be out there too, that investors like me come in, take these old houses up and pick them up. We have the capital because we’re raising that capital to buy it, fix it and make it a really nice clean, safe place for a rental. There are people who need that rental.

Jamil:

And you need to be incentivized.

Kathy:

You need to be incentivized. So if we were taxed too much and if there were too high a transfer taxes, we probably wouldn’t do it because quite honestly, a single family rental fund, there’s not a huge spread there anyway. It’s not 20, 30, 40% returns that you’re seeing. I don’t know if you’re seeing that anywhere, but flippers are going to make more money.

The buy and hold investor funds, the margins are pretty thin. If you want companies like mine, mine’s definitely smaller than these big ones. There does have to be incentive to be able to create this clean, safe housing. Housing gets old. Somebody was saying the earth likes to eat housing. If you leave a house for very long, it will fall into the ground and Mother Nature will eat it. It will. After 20, 30, 40 years, those homes don’t do so well. They need constant investment.

Dave:

27.5, right?

Kathy:

Yeah. Appreciation. It’s an interesting article. I would definitely read it and check it out. One other thing I do agree with is that you shouldn’t be subsidizing the investor if it’s not needed. Like I said okay, subsidize the investor for trying to bring on affordable housing. I think I told you guys in our Park City project, we had to bring in 30% affordable and we’re super happy to do it.

But when costs went up and it costs twice the price to build that house, they’re not letting us sell it for more because it has to stay in the affordable. We’re losing about $400,000 per property of what it’s costing us to build this affordable housing. Why should I have to do that? That seems like it should be a… They’re a government incentive for that because it’s hurting our investors too. If prices go up, we have to eat that.

Dave:

I think that’s a really good point and agree with a lot of what you’re saying. But just to extrapolate that and how this has an impact on, in the long term, if the requirement that developers have affordable housing makes sense to a lot of people, myself included at the surface level.

But then you have to think about you’re in this conundrum now and unfortunately you’re losing money, your investors are going to be hurt by this. It means that you are probably less likely to do something like this in the future. And so it has this way of, even though the government is trying to create more affordable housing, if it’s not done in a tactful way where there’s some flexibility and into James’s point where you’re actually working together as partners to make something actually work long term, it could actually have some of the adverse effects and sort of the opposite of what is intended.

Kathy:

I could not agree more. We will never do this again because who could have predicted, who could have… The government’s telling us we can’t send our workers to work yet we’re still paying the overhead and then costs go up double and we go to the county and say, “You told us we could only sell these homes for $350,000. They’re costing us 800,000 to build. Is there any flexibility?” And the answer is no. They won’t do it.

James:

The only answer is don’t build it.

Dave:

Yeah.

James:

It’s just like, all right. This turns into a parking lot at this point.

Kathy:

And that’s not going to help the firefighters and teachers that need that.

Henry:

And then we’re charging rent for parking.

James:

One thing I want to mention is when I read these articles I hear this, how about these hedge funds that have bought a lot of homes and I’ve sold a lot of hedge funds’ properties and hedge funds did not take inventory from the first time home buyer. They did not take inventory from any home buyer and especially with a low down home buyer because they needed so much work.

They’re creating inventory. They’re carcasses. They’re homes that are not livable. They require capital to fix them. And no homeowner is going to go… The government needs to, if that’s what they want to do, then they need to come in with some construction teams and some zero down programs and some construction financing and then you government fix the properties.

Because it’s not inventory. The inventory’s not leaving because it was never inventory.

Jamil:

Good point.

James:

It’s being created by these investment companies and everyone’s complaining about them eating up all of the product right now or over the last two years. We needed those buyers in 2008, ’09, ’10, ’11. The inventory was massive and it was unconsumable at the time. And the only reason it got consumed up is because these big funds came into the markets and they bought the dirtiest of the dirt and they restored these properties.

We don’t know what would’ve happened to that market and how long we would’ve been bottomed out if it wasn’t for these companies. There’s always give and takes at both times, but I think it’s shortsighted because they’re creating inventory and housing. It’s a matter of how do we control the cost and that’s just policy at that point.

Kathy:

Yeah. I’m curious what you guys think because one of the comments made in this article was at a minimum, investors shouldn’t be subsidized for rental housing. What I mean by that is a lot of these big funds got Fanny and Freddy backed low interest rate loans.

These are government loans. Fanny and Freddy were created to help people, individuals, low income individuals buy homes. That’s why we have government backed loans. Why were these hedge funds getting those? So I can agree. Again, I love what Henry said, let’s work together towards a common goal. I think nobody wants families living in their cars unless… Again, unless they want to. Like I said, my nephews make good money and they love living in their van. Again, unless they want to.

Dave:

All right. Well this is a great conversation everyone. Thank you. It’s an important topic and probably one that’s going to come up more in the near future. I’ll definitely be reading up more on this. Thank you Jamil and Kathy for sharing these stories with us. All right, let’s move on to a different conversation about the housing market. Henry, it sounds like you brought a different type of story for us. What have you got?

Henry:

Yeah, I like this article because the article itself kind of mirrors what’s happening in real life. So the headline is, economists say a US housing recession has already arrived, it’s already here. And what they’re saying is that the housing market index is basically telling us that it’s declined to 33 and anything under 50 spells trouble because it’s on a hundred point scale. And so what they’re saying is based on this housing market index, that the housing market is already in recession. It’s been in a recession since mid-summer.

But this and the index has declined for 11 straight months. So the article itself is a scary headline, but at the end of the day, this index was based on what home builders are saying. And the market for a home builder has been different than the market for a traditional investor or the market for a first time home buyer, somebody who’s not looking to buy to invest but to buy to live.

It then goes on to talk about, well the interest rates are high and the same home now is going to cost you a $1,000 more a month than it was three months ago, which is very true. But then it also goes to say, well interest rates pass 7%, but they’ve come back down a little bit to around 6.3% this month. And so this article in itself feels like a rollercoaster ride. When I read the article, I’m not quite sure how to feel, I just feel like I’m going up and down. So this is good and this is bad and this is good and this is bad. It’s such a reflection of what the first time investor, the new investor, the first time home buyer is all feeling right now. Because they’re like, “Do I get in?” “No, I don’t get in.”

This is high. What I want people to understand is that we can really only make decisions right now based on what we currently know. But what I know as an investor is that the real estate market is a cycle. There’s going to be a time to get in when prices are really low like right now. You’re able to negotiate a lower price. That goes for the first time home buyer and the investor because there are less buyers than there were a few months ago. That gives you an opportunity to buy at a lower cost, but there’s also going to be a time in the market where the prices are high, but maybe the cost to borrow the money is lower, meaning A, that you can afford more and B… So it’s easier for you to get in there and to buy something and be able to afford a home maybe at a higher price.

What’s important is understanding what the market is giving you right now, I think I’ve used this analogy before, but in sports they say you take what the defense gives you. There’s always going to be an opportunity no matter what type of market cycle that we are in. If you look at what’s currently happening right now, I want people to be able to focus on okay, what is this market giving me as an opportunity?

Is that opportunity something that fits my financial goals? If your financial goal is to buy property and hold it for the long term so that you’re creating cash flow and building wealth through equity, it’s a phenomenal time to buy a property at a discount. Yes, the money costs more, but you’re getting a deeper discount. So it somewhat offsets itself depending on the discount. If that’s your strategy, it’s great.

If your strategy is to trade, to buy a property, fix it up and then sell it in a short period of time, the market isn’t really giving you that if you’re inexperienced. If you’re experienced and you have processes and systems in place to help you find those discounted properties, to help you get them renovated very quickly and back on the market and sold very quickly, then you can probably do that strategy.

But if you’re just the normal investor doing this first, second, third, fourth, fifth deal, trading isn’t as easy right now. It’s better for a more experienced investor. So you just have to understand what is the market telling me right now that is an opportunity and does that opportunity fit my financial goals?

Kathy:

I could not agree more, Henry. That was such good points. As you know, I just got back from Phoenix and there was the IMN single family rental conference. It’s their 10th year and you had all kinds of buy and hold investors there. In the opening session, they gave these really good stats from John Burns that I just want to share that supports what you said. They said that right now, there’s a 57% decline in iBuyers. So if iBuyers were bugging you, there’s 57% less.

That’s huge in itself. There’s a 27% decline in purchases from the funds that are the big ones, a hundred homes or more. And what was super interesting and they said they didn’t really know why, but they think they know why. But in the kind of 9-100 units that they have not declined, they’re buying and then the newbies, there’s a 22% decline because maybe they don’t have the experience like you said and aren’t sure how to get the deals.

The interpretation was these big funds, these big investors, they’re kind of struggling right now because a lot of them pivoted into building new home build to rent. Huge developments of new homes and the terms have changed. Their construction costs have gone up as I know and as you guys know. Their cost to borrow has gone up and then the end financing has gone up. So their plans are not working out as expected. So there’s expected to be quite a bit of fallout in that regard. And then those who would buy scattered lots like we’re doing or scattered homes, just buying homes and basically a BRRR fund model, buying, fixing, getting our money back and doing it again in the fund, you have to be nimble. You have to really know your market. You have to be a really expert investor.

You can’t be a white-gloved Wall Street investor and do that. This is the time. I can’t emphasize enough what Henry just said, that this is the time for us, for the people that can be nimble and can go in there and buy what nobody else wants and fix it up and still keep it affordable for somebody and provide safe, affordable housing. This is our turn, it’s our game. The big players are out because they don’t know how to manage a game like that.

James:

The big guys have… They can’t adjust and that’s…

Jamil:

They move too slow.

James:

They move too slow, their staff is too heavy. Even us, and we’re not big by any means compared to funds, but as you grow your businesses out, as the market has transitioned, we’ve had to shrink this back and get nimble. We can’t have… The more bodies you have and the more people you have doesn’t mean it’s more efficient. It just means it kind of gets more process orientated. But that doesn’t mean that your processes are, like you said, nimble, where you’ve got to cut cost.

Flipping homes is not an easy thing. It is not something… You can build a home a lot easier than you can flip a house. With building a home, you get plans, you’re working with professional subcontractors, they bid the plans and then you can schedule it accordingly. These old homes you rip, rip into and all of a sudden you got rotted walls, things fall, you got dead bodies in the… Who knows what happens inside these walls. And you have to be able to pivot.

Henry:

Dead bodies everywhere.

Jamil:

Only in the Pacific Northwest by the way, guys.

James:

Things happen and that’s what happens is they can’t adjust. And then that’s where I do think we might see a graveyard of investment property coming up. I keep coming back to that because if you can’t adjust and you can’t control your cost, if you’re 10% off on your construction, your values and your whole times, that turns into a big number if it’s a large property. And you have to be able to adjust and adapt. I know I’ve switched all my businesses to where we are way more nimble, way smaller, way more ninja get in, get out. On whatever business it is, we’re getting in and out. You have to do that by being nimble.

Jamil:

What’s interesting is from my company, Keyglee, we’re a national wholesaler, so I get to see what this looks like from the investor standpoint and what the volume of trades are happening and how much demand is there. Now, what’s funny is that a lot of my competitors, when the big funds were buying a lot of homes, the iBuyers, the institutions that have a hundred or more homes were buying most of my competition focused right on them.

They said, “Oh, these little mom-and-pop investors that are buying hold guys fixing flippers, they’re not paying us enough. They’re not closing fast enough, they’re not overpaying. So let’s just focus on these institutions.” And they failed to create relationships or maintain relationships with the small ma-and-pa guy. Our business model never shifted.

We stayed with the small ma-and-pa guy all the way through right now, when you look at our volume of trading, I’m looking at wholesalers and there’s a graveyard of wholesalers out there because they all screwed up shifting their business to the funds where we stayed with the man-and-pa guy and our volume, although we did take a dip, we had a couple of months where things were a little bit… We had to pivot and understand. But again, being nimble and being able to adjust, our volumes have picked right up and we’re crushing it.

You can see that this demand that you know guys are talking about when Kathy says it’s our time, it is our time and the people who are in the know who understand it, they’re getting in and they’re making it happen.

Dave:

All right. Well great conversation. This has been really fascinating. Thank you for bringing that Henry. James, what did you bring for us?

James:

I pulled an article because I think it’s important to kind of look at these types of click baby articles, but it says from Fortune, 20% price decline, seven forecast models are leaning towards crash. Here’s what the other 13 models, the 2023 market are going. The reason I do like the article is it gives you a good perspective from all different kind of sectors. It’s talking about Wells Fargo, J.P. Morgan, they’re giving their predictions. There’s Moody Analytics in there with John Burns.

They have their predictions and then you have the Zillows and the Redfins are all in there too. And in this article you can click through each one and read their perspective on how they came up with the analytics. The one thing I don’t like about it is this click bait, right? People are trying to get people to download stuff, 20% drop. That’s fear. If you really read through the whole article, there’s only two people that even referenced that number. Most of them are substantially lower in the 5-10% range on the decline.

Dave:

Can I guess who the 20% are?

James:

Yeah. Who do you think?

Dave:

Ivy Zelman?

James:

No, that wasn’t one of them.

Dave:

Ivy Zelman and Moody Analytics

James:

Actually no, no. Moody was not. John Burns was the most negative. 22% actually.

Dave:

Yeah, they’re pretty bearish.

James:

Yes. Moody was around 10%.

Dave:

John Burns is a smart guy.

Kathy:

And he’s usually right.

James:

I know.

Dave:

You might want to take that one seriously.

James:

And I might agree with him because there’s this one stat that just… Sometimes I’ve got to remember common sense. There’s all this data out there, there’s all these opinions, like Henry was saying too, this roller coaster of a ride, but sometimes just comes down the straight common sense. It says 20% peak through drop.

Home prices will be back to October 21 levels with a 10% drop. They’ll be at a 20% drop will still be at 2021 levels in the late February. It’s all about that massive run. And so it’s like most of the gains were done in 2021 are a big chunk of them. And so what the article’s really referencing is we’re not going into 2008 because they don’t think that there’s going to be this mortgage crisis and all these things going on with the economy. They just think everything’s deflating backwards.

Right now, I firmly believe that. I don’t think we’re going into a tailspin of 2008. 2008 was the lights went out and we were all sitting in the dark for a year going, how do we get this back on? This is just going to be deflating things down and it is going to hurt a little bit on the way on the door from stuff that you bought in 2021 or in ’22. But it will get better and you just have to kind of adjust.

The reason I like digging into all these stats and all these predictions is we’re building this into our underwriting. We can still buy very safely if we’re not… There’s nothing wrong with predicting the market might go down a little bit, but you have to do it in an intelligent way because I’m an active investor, I can’t get spooked. That’s unrealistic.

A lot of the 20% drop, I think a bit, we’ve already seen a lot of that drop and I think that we’re probably another 5% skid from where we are because we’ve already seen this 10. I know in Seattle I’ve seen 20% and that’s just what it’s been. But it allows me to continue to purchase. I can build that into my analytics as I’m underwriting, I’m looking at things. I’m going, “Okay, if I think the market’s still a little bit risky, I’m just not pushing the values.” There’s nothing wrong with that. And you can still get those buys and close the deals.

I think it’s really important that investors establish what they think personally. What I think is going to be different than Henry, Kathy and Jamil, we’re going to buy differently. We’re going to do our businesses differently but we are doing the right research off all our experience and we’re building that into what we’re doing in our specific market.

Because Jamil’s in Phoenix, I’m in Seattle, these are different markets. We’re also doing different things. And so you have to really narrow down to what do you want to do in this transitionary market? Then research that information and you can protect yourself. There’s a lot of really good buys right now. I don’t really mind these articles because it does spook people. We are buying a lot of… We’ve bought more property and it’s been way different type of property, but we bought more volume of property in the last 90 days than we did in the first six months of the year.

It’s completely different product. But the opportunities are out there just really you have to, as an investor, listen to everyone but then, and you got to kind of interpret it and really figure out what you want to go with. One of them is Redfin was, or I think it was Zillow, was predicting a 0.1 drop. And so based on what I know about the iBuyers, I go the opposite direction or whatever they’re recommending. If they’re saying 1%, I’m thinking it’s five to 6%. But I think it’s really important that people kind of interpret this information and then build it into your own day-to-day practice into your market. Cause every market’s different thing you’re doing is changing. And so just because housing could drop 20%, that might not be affect you at all. So just really pay attention to these news headlines and dig in. Don’t just pay attention to the scary click

Dave:

Bait. Yeah, I mean when it comes down to forecasting, I feel like there’s basically two things you should be considering when you read this stuff. First is what’s the business model of the people forecasting? Are you Zillow or Redfin or the Mortgage Bankers Association? Because you probably have a vested interest in predicting things one way. But I think there’s a lot of really good reputable forecasts out there. To me, it all just hinges on mortgage rates. If you think mortgage rates are going to stay above 7%, prices could fall 20%. I don’t personally believe mortgage rates are going to stay that high.

I think it, there’s a different group of people who are saying mortgage rates are going to be in the high fives, low sixes next year, and then you’re probably seeing single digit declines. I’m personally in that camp, we’ve all probably talked about this at length, but I think that’s a lot of why you see these differentiating things.

Because if mortgage rates stay high or go like seven to 8%, there is going to be a crash, in my opinion, like 20%. But we’ve already seen mortgage rates come down to 6.3%. Bond yields continue to fall. If they stay where they are right now, mortgage rates will be in the fives next year. So I think those are just things that you should keep an eye on. If you want to understand who’s correct here, just look at mortgage rates and the higher they go, the higher chance of a crash. Any last thoughts? Jamil, Henry, Kathy?

Kathy:

Just last thoughts from IMN were that renting is 30% more affordable in most places than owning the same home. So the fundamentals are really strong for being a landlord right now.

Dave:

Yep. Awesome. I like that tidbit. Put that on Instagram. All right. Well, thank you all so much for being here. We appreciate it. I had a lot of fun. And we’ll see you guys next time.

If you are listening to this, we always appreciate a great review or sharing this content. If you also think this was one of the best shows of the year, tell everyone you know on Instagram or just in the street. Tell everyone that this was the best episode and that they should go listen to it. Thank you all so much for listening. We’ll see you next time for On The Market.

On The Market is created by me, Dave Meyer and Kailyn Bennett, produced by Kailyn Bennett, editing by Joel Esparza and Onyx Media, researched by Pooja Jindal and a big thanks to the entire Bigger Pockets team. Well, content on the show on the market are opinions only. All listeners should independently verify data points, opinions and investment strategies.

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.

Homebuyers Are Getting Crushed: Are Landlords the Cause? Read More »

Renting vs. buying a home, forty-year mortgages, HELOCs, and relationships vs. real estate. There’s something for everyone on this episode of Seeing Greene, as David tackles questions that go far beyond just basic investing. And as the housing market continues to get even more confusing, homebuyers, landlords, and sellers are stuck with some serious debates that only an expert agent, mortgage broker, and investor like David can answer!

When choosing to rent vs. buy a home, David uses some geographic-specific data to decide which markets make more sense to own. Then, we have a question on how an interest-only mortgage works, and whether not paying into principal is a waste of time or a better option for cash-flow-strapped landlords. If you’re thinking of buying a property in all cash, David has some advice as to why now may not be the time to use loan-free dollars to get a better deal. Finally, David takes a more personal question from a listener, asking when to put real estate over relationships and why dating feels like a “waste of time” when trying to build wealth.

Want to ask David a question? If so, submit your question here so David can answer it on the next episode of Seeing Greene. Hop on the BiggerPockets forums and ask other investors their take, or follow David on Instagram to see when he’s going live so you can hop on a live Q&A and get your question answered on the spot!

David:

This is the BiggerPockets Podcast Show 702.

I’m not against using 40-year loans and I’m not against interest-only periods. There is a danger to 40-year loans, and the last time we saw them was 2005, ‘6 when the market was red hot.

The reason that they introduced 40-year loans into the market was because you couldn’t afford the house at the price the seller wanted on a 30-year loan, which meant you couldn’t afford the house. So by making it a 40-year loan, they could reduce your payments to the point that you could now get pre-approved. That is dangerous because it allows you to pay more for a house than you really should be paying.

What’s going on everyone? This is David Greene, your host of the BiggerPockets Real Estate podcast, here today with a special edition Seeing Greene episode. What makes it special you ask? Well, because it’s a Seeing Greene episode.

In these shows, if you haven’t listened to one before, we take questions from you, our audience, asking specific things about situations they’re in or general questions about the market and what’s going on. And I do my best to give them the most sound advice possible based off of my experience with the portfolio of properties that I own myself. These are some of our most popular episodes, so I really hope that you like this one.

You’ll notice that the light is green right now, letting you know it’s a Seeing Greene episode, but I forgot and it was blue when I was actually recording the content. So don’t be surprised if you’re watching this on YouTube when the light turns to green to blue. That’s just me making a mistake, but instead of doing the whole thing again, I left it in there so you could see that me just like you is not perfect and I make mistakes also.

Today’s episode is awesome and we get into some very cool stuff, including if somebody should buy a house when renting actually is cheaper in the short term. This was a really fun one that we got into. If a 30-year loan or a 40-year loan with 10 years of interest-only payments is the better option. And how to make a decision between focusing on relationships or real estate when you feel that you got to make a choice and make a decision there.

This was a fantastic episode with some of the best questions we’ve ever received. I want to thank you all, give you a big shout-out for asking great questions and continuing to support the show by asking them.

Before we get into the show today’s quick tip brought to you in the Batman voice is consider that investing in today’s market is different than investing in a market even as short as six months to a year ago. Things are changing very, very quickly and that’s why you need to be listening to podcasts to get new information.

My personal strategy, the way that I’ve adjusted is I’m focused more on building a financial fortress than I am on just expanding as quick as I can. When I’m making investing decisions, I’m thinking about defense and how I can protect my wealth, not just offense and how I can grow it.

Most wealth will grow on its own over time if you make wise decisions. So you don’t have to focus on that, but you do need to focus on protecting what you have, especially as things change. So always ask yourself the question, what will I do if things go poorly?

All right, I hope you enjoy today’s show. Let’s get to our first question.

Collin:

Hey David, hope all is well. I am reaching out with a question for you on the house hacking strategy. So I’m currently looking to relocate to Boston, which is a fairly expensive market, and as I’ve started to crunch the numbers on the properties that I’m looking at, which are mainly three units, I’ve found that in many cases my out-of-pocket cost on a monthly basis would be more than if I rented.

And so what I’m trying to figure out now is if it makes sense to pay a little bit more every month than what I would pay if I rented so that I can get into a property earlier and start building up equity, building up my wealth, which is my ultimate goal, or whether I should focus in the short term on renting, paying as little as I can every month, saving as much money as I can and then getting into properties down the road.

Would love to hear your thoughts on this. Thanks so much as always for your time.

David:

All right, Collin, thank you for that. This is a good question. What do we do when we can actually rent for less than what it costs to own?

Well, there’s a few factors that I think you should take into this decision. You kind of hit on it at the very end there, so I know you’re thinking the right way. You’re asking, should I be trying to build equity or should I not and try to save a little bit of money? Because when you own a home, you pay for more than just the mortgage, the tax, the insurance. There are capital expenditures, there is maintenance. There are other things that are going to go into owning a home.

So the question here is really what do you want your future to look like? 30 years down the road, 20 years down the road, 10 years down the road, what kind of a position do you want to be in? Because while rent may be cheaper right now, it tends to not stay that way. Rent tends to not go down or even stay the same, it tends to go up.

And when you have inflation, rent goes up quickly, especially when you have a shortage of housing, which we have in most cities. Not everywhere of course, there’s some places where more people are leaving than are moving in, but man, if you’re in one of those areas that people are moving to and you’re not having increasing supply, rents can get out of hand very, very quickly.

The other thing is you’re talking about Boston. That is a high appreciating market and appreciation doesn’t just affect the value of the property, it affects what the rents are as well. So if you were asking this question and you were somewhere where you’re talking about a $65,000 house and rents are $400 a month, I don’t think there’s as much at stake there. That would be okay to continue renting.

But for you talking about being in a major metro area where prices are going to be going up, especially when rates come back down, where rents are going to continue to increase as wages increase and inflation increases, it becomes exponentially more expensive to continue renting in a market like that long term.

So one of the mistakes I see people make is they look at the rent right now versus the cost of home ownership right now, and it’s almost always cheaper to rent. In fact, I bet if you went back and studied the housing market over the last 50 years at almost every single point in that 50 years at the time you bought the house, it would’ve been cheaper to rent than to own. But if you go back to any of those points 20 years ago, 30 years ago, 40 years ago, and you compare it to now, owning is much cheaper than renting.

So do your best to face your fears and get away from this idea of what’s cheaper right now and think about the future. 10 years of paying that place down, of rents going up, but your mortgage being locked in place, pretty significant.

And with house hacking, I say this all the time, it’s not just that you’re saving in the rent you would’ve been paying going up, you’re also charging more rent to the people that are renting from you. So it’s a double whammy, so to speak.

In that case, it sounds like it would be better for you to buy right now, even though it might be a little bit more expensive than renting and own a home instead of paying somebody else. In 10 years, you’re not going to regret it.

Now, if you can repeat this process with a new home every year for 10 years, you’re probably going to be a millionaire. And this question of, well, should I have saved money on rent instead of buying isn’t even going to be in your mind.

All right, our next question comes from Adam Quinonez in SoCal. Is doing a HELOC on my primary residence wise for my first investment deal? Also, if yes, would it be a better strategy to use the BRRRR method to recoup the initial cost? Thank you.

Well, Adam, I can’t say for sure if you should use a HELOC on your primary residence to buy your first investment property because I don’t know what your financial situation is like, but I know that if it’s a good deal that usually ends up working well. If it’s not a good deal though, it can hurt you twice because now you’re saddled with extra debt and you have a property where you’re losing money on. This is where I don’t have enough information about your specific situation to get into this and this is where having more specific information about your situation would allow me to give you better advice.

The concern here is that because you haven’t bought a property before, you’re probably not going to make a great decision on your very first home. So now you’re increasing your risk factors and you’re increasing the likelihood that the deal you buy goes bad. Throwing a HELOC on top of it, you actually needed to do extra good to be able to pay for the extra money that comes out of the HELOC. So in some cases this could work out, in other cases it might not.

I would say I would not recommend that you go forward with this strategy unless you have enough money and reserves and you make a decent enough income that if you do lose money on the investment property, it’s not going to bankrupt you. It’s okay, everybody, to lose some money the first year, the first two years of owning an investment property. It’s okay to lose money in real estate, believe it or not, in the short term. It’s not okay to lose money in the long term and it’s not okay to lose money if you cannot afford to lose money in real estate.

That’s a really key point I want to make. This is why I’m always saying to save reserves, to continue working, to increase your income everywhere you can, to be a great employee, to work hard to push yourself because you want more money coming in to cover up for the inevitable risk of investing in real estate. It’s like everything else. There’s going to be times where you lose money.

Now to the question of should I use the BRRRR method? Yeah, that’s ideal because you’re giving a loan to yourself with this HELOC. You’d like to be able to pay that back after you refinance, but you just can’t assume that every BRRRR’s going to recoup a hundred percent of the money. In fact, oftentimes they don’t recoup a hundred percent of the money. That’s actually rare when that does happen. So you don’t want to depend on that.

And an alternative to BRRRR is house hacking. Look, if you go invest money in a BRRRR and you pull out 90% of it, you only left 10% of the deal. That’s a win, that’s better than 20 or 25% if you bought it traditionally. But you can house hack and put 5% down or three and a half percent down and when you do that, you don’t even have to BRRRR.

If this is your first deal, I’d much rather see you take the HELOC on the property and buy another primary residence to move into to house hack and get your housing expenses lower. Take the place you have now and make that a rental. Then I would want to see you go try to take on a rehab project, something big like a BRRRR that could go bad, if you’re having to borrow money from your HELOC to pay for it.

Again, you know your financial situation much more than I do. I didn’t have a ton of information to go off of here. But in general, if this is your first investment property, I don’t love you having to use a HELOC unless you have a great deal.

Drew:

Hey, what’s up BiggerPockets? First of all, really want to thank Dave and Rob. They’ve been extremely impactful to me in my journey for financial freedom. Thank you guys so much.

A little bit about me, my fiancée and I did a live and flip three years ago that just recently netted us 130K. We put all of that into a house hack, a one bedroom STR house hack that’s going to cash flow us 4K this month and should average over 2K cash flow per month.

I also just recently started a co-hosting company that’s allowed me to develop a lot of the systems I need to scale my portfolio while also helping other hosts be able to grow their business and increase their revenue and essentially pay for myself while managing their business for them.

I consume most of the content out there on Airbnb optimization, arbitrage, acquisition, how to scale my Airbnb business. And right now I’ve opened some HELOCs one on my house and one on my mom’s house, which should give us access to about 250K in capital. My goal is to become financially free via cash flow and then start building wealth.

So most of my cash is being saved right now and I want to start leveraging some of this debt. So how do I spend it? Should I primarily focus on, one, networking, content, social media and marketing? This would grow my co-hosting business and my fundraising credibility, capability. Two, acquiring my next STRs via arbitrage or purchase through the HELOCs to grow my cash flow and add to my visible co-hosting portfolio. Or three, investments in high level education on sales or content creation, which I consider to be my weak points right now.

I’ll be doing all three, so I guess you could say I’m in a bit of analysis paralysis in terms of how to take the next big step. Thanks again so much. You guys have truly changed my life. I appreciate it.

David:

All right, thank you Drew, and thank you for the kind words. Excited to answer your question here, and thanks for asking it. If any of you would like to have your questions submitted here, just go to biggerpockets.com/david. You can submit a question just like Drew did.

All right, Drew, if I remember correctly, it sounds like you got three options that you can put this money into. You can either invest into the business that you created to try to get more clients coming in to earn more revenue. You could invest into more short-term rentals or you could invest into education to try to improve yourself.

I don’t know enough of the numbers for how your business is doing, how much time you want to put into this to be able to tell where the best ROI is going to be. But I do remember you saying that you recently started this business and you only own one short-term rental right now.

I don’t think it’s super wise to try to scale a huge business teaching other people how to run short-term rentals when you only have one. You can’t know some of the problems that are going to pop up when you only have one property. Sometimes you hit it lucky and you get an easier one and as you get more and more, stuff pops up that you wouldn’t have known could go wrong.

You’re basically not going to be an incredibly well-rounded educator until you get several properties and you see things going wrong that you couldn’t have anticipated and you adapt to that. That’s why people pay a coach. That’s why people listen to a podcast like this. It’s not all the stuff I can tell someone that can go well. It’s all of the anticipation I have for things that can go wrong and how I prepare them to get ahead of those problems before they happen.

You also mentioned that you’ve been building out some systems. I don’t think you want to be coaching and training other people until you have well established systems that, like I said, help prevent mistakes from going wrong.

So right off the bat, I think it’s cool that you’re doing some coaching and you’re helping some people, but I wouldn’t want to see you dump a ton of gasoline on that fire because it’s still so small. You just got a little bit of kindling, you’ve been rubbing the sticks together, you got a little bit of smoke coming out. You don’t want to dump gas onto a fire until it’s a big healthy raging bonfire. Once you’ve got the solid base of wood that’s in there and the flames are hot, then yeah, dump your gasoline on it.

But if you try to dump too much marketing money onto a business that’s new, has barely got started, you don’t have systems, you don’t have support, you don’t have employees, you don’t understand how to do it, sometimes rather than the gasoline making the fire go bigger, it actually snuffs it out and you lose what you even have right now.

Now that brings us to option number two, should you buy more short term rentals? I’m leaning towards this. If you’ve got the one and it’s going to average 2K a month, I would lean towards you should get another one, because you’re going to have increasing returns on your time.

You’re not going to have to build a new system from the ground up getting a new short term rental, especially if it’s in the same market as the one that you have right now. You’ll actually be able to benefit from economies of scale, buying a second property in the same area, using the same systems, using the same software, and using the same knowledge. You’ll make a lot less mistakes. This is very synergistically sound.

Your third option was to invest in training, which you say is a weakness of yours or more courses. That could be good, but I think if you’re already managing a rental, it’s probably not necessary. I’d rather see you get a couple of them and hit a ceiling.

Let’s say you get three or four short-term rentals and you’re like, “Man, I don’t know how to keep up with customer complaints. I don’t know how to keep up with managing the cleaners.” At that point, you see what your own limitations and your flaws are. That’s when I would invest the money into the coaching.

Right now they’re going to be teaching you a bunch of stuff that isn’t even a problem in your business because you’re only running one and some of that money could be wasted. You won’t get as much value out of it.

So on one hand you’ve got your marketing company, on the other hand you’ve got investing in yourself, and then the other you’ve got the actual real estate. I’d buy the real estate and once I had enough of the real estate, I would invest in the coaching. And once I had some of the knowledge from the coaching and the real estate portfolio to back it up, then I would dump money onto the business you’re trying to create to show other people how to do the same as you. And at that point you should have a well-oiled machine and be well on your way to doing great financially.

Thank you for asking this question, Drew. I like that I got to dissect that and give you some advice. And make sure you keep in touch with us and let us know how it’s going.

All right, at this part of the show I like to read comments that y’all have left on YouTube from previous shows. This is one of my favorite segments of the show because sometimes you guys say some funny or some insightful stuff and I get to share it with the rest of the audience.

Our first YouTube comment comes from episode 687 and it’s from Laila Atallah. I love you’re Seeing Greene episodes, David. This episode was jam-packed with gems and it was intriguing to hear a bit of what’s going on your computer screen all day as you manage your businesses.

Yes, please do a lot more episodes where you and other investors share all the details start to finish and the dollar amounts and other relevant metrics of the deal, rehab, ongoing management costs, big repairs, cash flow, cash on cash return, et cetera. Also, please share a bunch of stories of people’s different real estate failures with all of the numbers of what exactly went wrong and the lessons we all can learn.

Well, I can see that Laila is definitely a stickler for details and she wants all the details. So we will keep that in mind and we’ll look for more people to come in and share specific numbers in the future.

Our next comment comes from Lorena Zaragoza. OMG, David, when do you sleep? Side note here, are you supposed to say OMG or oh my God? I’ve always read it as OMG when somebody texts that. I don’t ever actually read out loud oh my God. Same for WTF, which is why I think it’s funny that people send that because how much time are you really spending? But I don’t know. Let me know in the comments. Are you supposed to pronounce this OMG or oh my gosh?

OMG David, when do you sleep? I’m going through a divorce and I’m getting myself positioned to not only survive but thrive going from two incomes to just mine. Sold the marital home and used part of my portion as down payment on my home. Reserved money to build a 700 square foot ADU, fully stocked and furnished to rent out. I’m renting my master on Furnish Finder and will also list my ADU on Furnish Finder once it’s built.