JPMorgan discusses the outlook for China’s housing market

JPMorgan discusses the outlook for China’s housing market Read More »

Shiny object syndrome is the phenomenon of being distracted by new and exciting opportunities. For entrepreneurs, this can mean new business ideas, or products or services that aren’t part of their current business plan. They have an urge to try this new thing that someone seems to be doing successfully. Realising you are experiencing shiny object syndrome means admitting that your focus is waning and you’re being pulled away by possibility and a fear of missing out.

Shiny object syndrome: the biggest problem for today’s entrepreneurs

Most seemingly overnight successes took years, rather than someone spending a few hours on the latest technology and becoming a billionaire. But as visionary people, entrepreneurs can see the potential of a shiny object very quickly, and they can become infatuated by the potential at the cost of their main business.

Getting a business off the ground and to any level of success requires focus, effort and persistence. While some businesses can succeed as side projects, those that go the furthest have the full attention of the founders. But founders can overlook the work required to make even the shiniest of objects perform, and barrel forward without realising the cost. Plus, shiny objects are particularly appealing when progress in your main venture is slow. Or even when progress is fast, if you have an underlying fear of success, shiny object syndrome can crop up as a form of self-sabotage.

Either way, succumbing for this common pitfall is a problem because it takes energy, focus and attention away from the core business. It also drills a less useful way of thinking. Rather than someone practising consistency, sustained effort in one direction, and focus, they are pursuing distraction, trends and short-term dopamine hits.

It’s never been harder to avoid shiny object syndrome because there have never been more shiny objects. When setting up a business, the founder needs to do three things: define their core product, know their ideal customer avatar, and find the one channel through which these people are reached. Once this product-market fit is achieved, the task becomes scaling the business based on these three metrics, deviating from the plan only when there’s a clear reason to. Spreading effort across multiple products, multiple customer avatars and multiple marketing channels because you’re trying out every idea that pops up is bad news for the early days and will only serve to confuse you and your audience. Confused customers don’t buy.

Shiny objects can include new business ideas or joint ventures that an entrepreneur might feel tempted to start, especially in the early days when things are less sure or in the later days when they might be stagnating. Shiny objects can include new technologies: AI, blockchain, automation and robotics. Shiny objects might arrive in the form of social media platforms, when someone hears the success stories of entrepreneurs on TikTok and jumps onboard.

New advancements and breakthroughs happen every day, and it’s human nature to wonder if you could be making use of them. Hopping onto the news or social media means you see everything other people are doing and wonder if you should be emulating their strategy. In such a fast-moving world, with so many possibilities, have we forgotten how to double down on one thing?

Attending just one conference can mean consuming hours of talks on why you absolutely should go down this particular route of making money. Attendees leave with notebooks packed with ideas that are full of potential. But scattered effort isn’t what made those speakers successful. They doubled down on one until they saw the fruits of their labour. Focus is a superpower and for entrepreneurs this is especially true. Those that crack the focus code will lap those that don’t. Which camp are you in?

The problem with succumbing to shiny object syndrome is that it’s never over. As soon as you drop the ball on your main venture for that new shiny object, another one appears. Entrepreneurs chasing the next shiny object will forever be chasing, never committing to one path and never seeing it through.

Shiny object syndrome: the biggest problem for today’s entrepreneurs

Experiencing shiny object syndrome doesn’t mean your existing business is duff. It means you’re human. But recognising when a shiny object is and isn’t useful will help you stay on track. When you become enamoured with the possibility of a new thing, train yourself to think about the potential of your current thing. It’s easy to think about the best-case scenario of something unknown, and harder when you’re facing challenges every day. But remember what you’re working so hard towards and how much progress you’re making.

When you’re hearing someone talk about all the crazy gains they’re getting from this new thing, consider their agenda. Why are they making it sound so easy? Perhaps they’re trying to sell you something. Maybe they have underestimated the time they spent making it move. Then there’s survivorship bias; what about all the people who jumped ship, went all in with the shiny object and didn’t win big? Be curious, ask questions, but tread carefully before changing your plans.

Avoid shiny object syndrome by knowing your strategy and sticking to it. Maybe it sounds obvious, but with a robust and agreed-upon plan of action you truly believe in, you’re going to be far less likely to deviate. If you’re being pulled away, you are forgetting the plan. In that case, make it front and centre. Write your number one goal on your bathroom mirror, make a desktop background of your roadmap to success. Don’t let yourself forget what you’re doing to deflect the shiny objects that won’t stop appearing.

Another way to avoid shiny object syndrome is to have a period of low-media consumption, where you intentionally avoid news and updates in favour of laser-focus on your business. This might mean unsubscribing from newsletters, logging out of social media, not booking meetings and letting a VA handle your email. During this phase you have a clear goal and you know exactly what to do on a daily basis to reach it. Hermit mode is a solid strategy that gives your venture the best chance of succeeding.

There’s often an urgency to shiny objects because they are new and exciting, and the winnings go to the people who jump on them quickly. After the early adopters comes the mass market and the latecomers, and by then it’s too late for meaningful results. This can instil a false sense of priority, that you have to do something immediately. Really, there are very few things that absolutely must be actioned right now. Even if your heart is racing and you can’t wait to get cracking, take a step back, sleep on it, and consider your options only after taking stock.

Finally, before starting a new business or exploring a new technology, think about the downside. If you spend time in this new arena, where does that time come from? It has to come from somewhere. If it’s not your current business it’s your sleep, leisure or family time. Do you really want to skip the gym to learn a new software? Do you want to miss dinner with your daughter for a webinar on AI? Think about what gives in order that a new interest is added. Maybe it’s not so enticing after all.

Strike that sweet balance between intense focus and unlimited distraction. This means defaulting to opting out, saying no and persevering with your main venture and the product, customers and channels it’s focused on right now. Keep an eye on advancements, make your move at the right time, but don’t be consumed by what every opportunity might mean for you. If you decide to pursue something, be absolutely clear on where that energy is repurposed from, and if that’s a trade-off you’re willing to make. Discern the true opportunities from the distractions in disguise to tame the shiny object syndrome monster that wants to keep you playing small.

Coliving has often been thought of as solely student housing. When you mention this strategy to investors, they think of house parties, dirty dishes, constant complaints, and a whole lot of maintenance. But ask Jay Chang from Tripalink, and he’s got a different story to tell. Jay works to develop the best coliving communities in the United States, securing a lower-rent option for his tenants and a high cash flow investment for his investors. He’s seen how coliving projects are built, managed, and maintained, and he may completely change your mind on this concept.

For expensive areas like Los Angeles, New York, and Seattle, finding an affordable place to live as a student or entry-level worker is near impossible. Your options? Spend the majority of your salary on a studio apartment, live with your friends who haven’t vacuumed in three years, or move into a coliving apartment. The latter offers upscale amenities, daily or weekly cleaning, private rooms, and a high cash flow solution for landlords in pricey markets.

Still have your doubts? Jay touches on the untrue myths associated with coliving, why vacancy is near-zero, property management and maintenance, and why this investing niche could be close to exploding as the economy takes a tumble. This strategy could take your real estate portfolio to the next level if you’re in an expensive market, college town, or densely-populated area.

Dave:

Hey, everyone. Welcome to On The Market. I’m your host Dave Meyer with Henry Washington today. How’s it going?

Henry:

What’s up buddy? Happy to be here, man. I love doing these types of shows with you.

Dave:

This one was fun, so we today are bringing on Jay Chang who is into co-living, which is a real estate investing strategy that I’m fascinated by. It seems kind of new and I knew nothing about it up until like two weeks ago and really wanted to have someone on tell us about it. So, what’d you think of the interview?

Henry:

I think it’s a really, really cool concept that as you’ll hear in the episode, I just think is going to take off at some point because the market’s calling for it, but it’s really, really early and there’s a lot of stigma I think tied to it right now because there’s only one thing really people know to compare it to, which is college dorm living. But when you look at these facilities and when you look at what they’re actually offering, it’s way cooler than that.

Dave:

It seems really nice. When you come to Denver for BiggerPockets, did you stay at that place, the CatBird by any chance?

Henry:

No, I didn’t.

Dave:

There’s this hotel there that kind of reminds me of, but it’s just a really cool model, really efficient use of space. You’ll hear from Jay, but you get way more rent per square foot than a normal rental, property management costs are a little bit higher, but there’s some really interesting economics behind this and I totally agree with you that whoever figures out how to do this well is going to do extremely well. So, I think this is a fascinating interview and we’re going to get into that in a minute, but first I wanted to talk to you and ask your opinion about something.

Henry:

Uh-oh.

Dave:

Yes, I know that’s what you’re here for.

Henry:

[inaudible 00:01:53].

Dave:

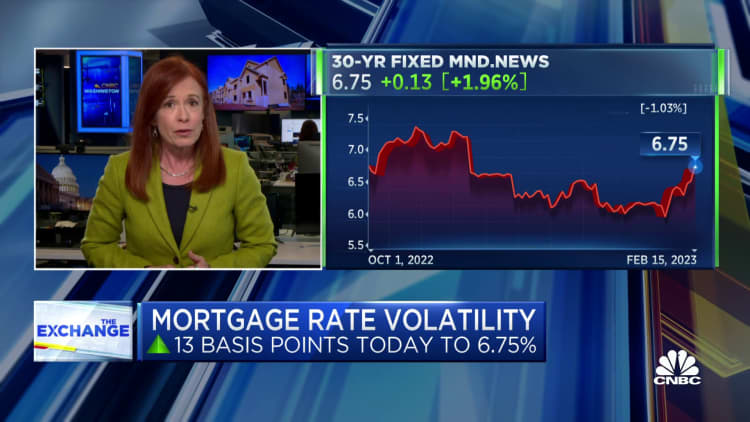

We just want your opinion. So I have been hearing, at least on Instagram, from some people that since the beginning of the year, there’s been an uptick in activity in the housing market and we’re recording this, what is it, January 19th, so just the couple first few weeks of the year that people have an uptick and now there is some data out that’s suggesting that there is more mortgage purchase applications. So, one of the things I love to look at as a proxy for demand in the housing market is the Mortgage Bankers Association releases this data set, how many people applied for a mortgage last week? And, it’s up like 25% over October and November, which is not normally what happens in January, so it’s considerable. So I was wondering, because I’m over here in Amsterdam and I’m just reading spreadsheets, what are you seeing? Is this real?

Henry:

Is it real nationwide? Probably, and here’s my theory, here’s what I think is happening. We talked about this, man, a while back On The Market. What I think you’re starting to see is call it normalization. Interest rates were low and people got used to them and then over the past six months they’ve been going up and going up and now recently flattening out… I wouldn’t say they’re flattening out, but they’re slowing down the speed at which they’re increasing. And typically your mortgage rates, even though the Fed is raising the rate, the mortgage rates are still sitting around anywhere, what, six and a half, 7%, somewhere in there?

Dave:

Yeah, some of them I saw today were like in the low sixes. They’re fluctuating a lot right now, so it really depends what day you’re listening, but the mid, low sixes.

Henry:

And, I think what’s happening is people are just starting to understand this is what mortgage rates are now. They’re starting to get it out of the mindset of expecting them to come down to two, three or four again and realizing that they’re probably going to do the opposite again and go up. And so if I want to buy or need to buy, because not everybody is buying just because they want to, sometimes they have to move for work, sometimes they’ve got to expand for a larger family, sometimes they’re shrinking because people are moving out. There’s all these life situations that are telling people that they need to move and they’re probably just looking and saying, “Well, this is what housing costs now, so I will buy what I can afford.”

Dave:

That makes total sense. I think that’s a very good theory. It’s so funny how your brain gets anchored to these ideas like, “Oh my God,” we were like, “4% a year. Oh my god, that’s crazy, 4%.” Now we’re like, “Yeah, six and a half, it’s so good.” It’s so funny, but I think it’s honestly better for the housing market in the long run to have rates in the fives probably, that’s a neutral rate and I don’t know if it’s going to happen, but right now it looks like that’s where we’re heading. There’s this perfect storm for a recessionary risk plus lower inflation, which both put downward pressure on mortgage rates, and if that is, I think the housing market is going to bottom earlier than people thought, and we are not going to see that big of a price decline, that’s if mortgage rates keep going down, which is a big if, but I think there is case for the housing market outperforming expectations from even just a couple months ago.

Henry:

Pre-COVID, rates were at 6% and people didn’t bat an eye.

Dave:

Still bought houses.

Henry:

Still bought houses.

Dave:

They were a lot cheaper then though, so it really is affordability. Affordability is really still an issue, but I don’t know, it’s going to be very interesting to watch. But anyway, it’s interesting to hear what you said. I saw someone in Seattle said they just got more views on their two open houses in the beginning of this year than they did in the whole fourth quarter combined, which is crazy. So, it’s just something to keep an eye on. I think this is defying my expectation so far this year, so something to keep an eye on, but I’m glad to get your opinion on this. With that, we’re going to take a quick break and then we’re going to come back with Jay Chang who’s going to teach us all about a new strategy called co-living. Jay Chang, welcome to On The Market. Thanks for being here.

Jay:

Good morning, Dave and Harry. Thank you for having me.

Dave:

Could you tell our audience a little bit about yourself and your involvement in real estate investing?

Jay:

Yeah, of course. Right now I’m currently working at Tripalink as a director of real estate, and I have been doing real estate since I graduated, so about eight years. After graduation, I did two years of construction management, working on high rises in Downtown LA. The building was called Metropolis, and then worked on some high-end hotels like the Edition Hotel in West Hollywood. And then after that, I really wanted to get into real estate development, so I joined CIM Group, I was there for three years, and then by 2017, 2018, I started hearing about co-living, and it’s not really a new concept, but it was getting more and more popular. And at the time, there were big co-living operators like Ollie, Starcity, and Common. That really captivated my attention, so a little more than a year ago, I joined Tripalink to do real estate development and they primarily focus on student housing and co-living. So, that’s where I am today.

Henry:

Man, that’s pretty cool. I was looking into some of the co-living communities in preparation for this and to be honest, it was a completely new concept to me. So, I’m sure it’s a new concept to a lot of the listeners. Can you define co-living for us and tell us a little bit about what that really means?

Jay:

Of course, to just put it simply, some people will just say you just have roommates, but it’s a lot more than that because it can be designed in a way that allows privacy, it has more consumers in mind. How do I define co-living? Shared space, shared common area. What we focus on though is having a private bathroom for each of our tenants because that’s where usually tenants get into issues with each other, so co-living, shared space.

Dave:

When someone described it to me, the first time I heard about it was a few weeks ago, someone explained it to me and I was like, “Oh, we’ve got to find an expert to bring on the show,” so thanks for joining us, Jay. But, they basically described it to me as a college dorm. It sounds a little like you do some different stuff like a college. None of my college dorms had a private bathroom, but it sounds like that’s this general idea. Everyone has their own room, has their own space, but there are shared amenities, and it sounds like there’s different models. Some of them maybe have their own kitchen and some of them shared kitchens, some have their own bathroom, maybe there’s a shared bathroom. Is that a reasonable way to describe it?

Jay:

Yeah, a lot of people compare it to a college dorm room, but it’s much, much better than that in many ways. When I was at UCLA, I lived with two other people in the same room. They’re actual roommates, just three adults living in a 200 square feet room. But, why is it better? Like you said, we have the private bathroom and also in our new projects under development, we put a lot of sound insulation and there’s a private electronic lock on at each bedroom. So there’s privacy, a lot of privacy. It’s almost like a private studio, an apartment, but the kitchen is shared. And, a lot of that also has to do with zoning. Sometimes zoning doesn’t allow you to build that many units in a building. So, by building less units and more bedroom per unit, that’s one way to get around it and allow you to build higher density.

Henry:

I agree. When I heard co-living, when started looking into this, the thing that stuck in my head was also college dorm, but then when I started to look at some of the properties that you guys are building or associated with, a college dorm is the last thing that came to my mind once I started seeing how beautiful these things are. So, what are some of the myths around co-living or the stigmas around co-living and then how are you dispelling those myths? What are the benefits or things that people get from co-living in the way that you guys do it versus what maybe people are thinking in their minds?

Jay:

The probably thing is the kitchen is dirty, the flooring is old, but they’re all new projects, new buildings. We have toured with a lot of… Sometimes banks come to look at our jobs and they say, “Wow, I can’t believe this is what college students get to live nowadays.” And it’s just brand new, brand new kitchen. We provide them a kitchen set, kitchenware when they first move in, and the common area is clean. We have a new project here that is a little denser, so we clean that every day.

We clean the main area. The kitchen is sparkling clean. Of course, that’s not for every property, it depends. Some properties are just cleaned twice or three times a week, and then in terms of amenities there, we provide amenities for our communities. So, we’re building areas that are close the school, close to metro station, so they’re very conveniently located to each other. And when we do that, we don’t think about each building as an independent building. We build communities… Sorry, communities, but also amenities, like a study room, a game lounge that have a pool table and ping pong table in there. Sometimes we host events, we have yoga room, just things like that for people to get together.

Henry:

When I look at this, I look at it from two lenses. It’s the lens of who is going to live in this space and what are their expectations, what do they get? And, then I also look at it from the lens of an investor, which is like, what am I going to provide them? And then, what does that mean for me in terms of expenses? So, when you look at a community like this and you provide this co-living, it typically means you are, you’re providing these amenities. So, it sounds like you provide cleaning frequently, it sounds like these places typically come furnished, is that true?

Jay:

That’s true. Not all operators do that, but we do.

Henry:

So from a tenant perspective, that’s a cool thing to be able to think about, but as an investor, it sounds like there’s probably a lot more expenses that come with this, and then you offset those expenses by density, building essentially more units because you’re just renting rooms that, am I on the right track there?

Jay:

Thank you for summarizing that for us. So as a renter, the main benefit that we haven’t touched based on is obviously the rent. In Los Angeles right now, if you were to live in the new studio in a decent place that’s built, at least 2,000 a month for a 450 square feet studio, so you’re paying basically $4 minimum a foot. Now, that’s ridiculous. What is a starting salary for a college grad? You can’t afford that, and right now in 2022, 40% of renters are spending more than 35% of their income on rent. And the way the economy is trending and how technology is getting better and better, a lot of the middle class is getting displaced and it’s going to become more and more unaffordable. No one’s going to buy a house unless your parents can help. So, that’s why co-living is such a popular choice.

And, also it’s very conveniently located in good locations. We’re not going to put it in the middle of a suburb. We put it next to grocery stores, a nice grocery store, like Erewhon or Whole Foods, or we put in next to a metro station or even a hospital for hospital workers. So, there are tons of opportunities, and in respect to investors, it really comes down to the bottom line. Of course, it’s higher expenses, but ultimately because of the density, even though each person is paying less on rent, the price per square footage per rent you can get on each property is much higher. So, if you’re getting $4 a foot on the studio, you can probably get up to $5 a foot, so that’s a 25% difference.

Dave:

That’s pretty impressive. And, what about on the renter side? Can you quantify the savings for the average renter? How much are they saving living in a co-living arrangement rather than in a studio, for example?

Jay:

At least 30%.

Dave:

Wow.

Henry:

Pretty substantial.

Dave:

That’s incredible. And, are the leases the same? Are you signing one-year leases or are they different in any way?

Jay:

It depends. Most of the time we sign a one-year lease, but I know some properties we do like a short term lease, like three months, six months. I know Common does three months, but when you do a three-month lease, they’re going to jack up the price by 20, 30% higher because there’s just higher turnover and vacancies.

Dave:

That was actually going to be my next question about turnover and vacancies. Do you find that people treat this as a short term option until they can find a more conventional living arrangement or how is your lease renewal rate with co-living?

Jay:

Most of our property is on student housing, so the renewal rate is less than 50%, but that’s because most people, they graduate from school and a lot of them are master’s. They teach here for a year. We also have a lot of international students coming here. We have a marketing team in China actually to market that, but to answer your question, for sure co-living is more attractive to young professionals and students were just here for a couple years. Let’s say you’re moving to a new city, you don’t know anybody. It is a really great way to get plugged in.

So, we obviously don’t want tenants to leave, and we also understand that not everyone wants to share a kitchen indefinitely. So, a lot of our properties we’re developing right now, it has a mixture of co-living and studios, one bedrooms. Personally, I wouldn’t live with five other people, even though I’m very big on co-living. If I were moving to a new city, I would, but I think we can all agree on first, everyone needs a place to live, and second, everyone wants a community. So even though you move out a co-living suite, you go into a studio or one bedroom, you can still enjoy the amenities and the community that you once was part of.

Dave:

You graduate from the co-living and you just move up a floor to a nicer apartment.

Jay:

True that.

Dave:

So for me, I can definitely see the appeal of it from the renter side. For saving 30% on your rent, honestly, sharing a kitchen doesn’t seem like that big of a concession. My big question is, how difficult is the property management for you on something like this?

Jay:

It is difficult, very difficult. However, we hire a resident manager, not really hire, we’ll give them some discounts and just help us… Most of the issues are related to maybe some cleaning or roommate conflicts. So, we give them some discount on rent and then just help us mitigate the issues, but to be honest, if you have higher sound insulation, we add resilient channels between the walls. Typically, you don’t do that on this unless it’s like a studio, in an apartment, so it’s better to soundproof. If an amenity area is clean, there’s really not that much issue. And plus, you have your private bathroom, you keep your bathroom as clean as you want.

Henry:

The private bathroom has to be the huge win to keeping… We used to call them… In the corporate world, we call them people issues. Private bathrooms have got to go a long way to keeping the people issues at a minimum, and then if you’re professionally cleaning the common areas and the kitchens because every roommate issue I had was typically around somebody leaving their dirty dishes in the sink.

Dave:

Do you have any thoughts on what the additional cost of property management is? I don’t know if you employ your team full time or do you play outsource it?

Jay:

We do it in-house. We’re not really charging more than an average property management. We’re actually cheaper than Greystar, and we try to automate a lot of the issues. AAA actually has a tech arm that works on a lot of automation, and we’re building a technology. So, AAA has three main functions. The first function is the tech arm that I discussed, and then the second arm is the property management. We manage all our properties that we built and we manage for others, for big developers like Jamison and Wiseman. So, I think 2,000 units in K-Town that we’re managing for other people. And, then the third arm is what I do. We do real estate development, so sometimes we co-GP with other developers, but most of the time we own it outright, and then we do the design entitlement, permitting, and then construction, and then we rent. Sometimes we exit.

Henry:

We talked a little bit about, obviously there’s going to be a higher turnover if you’re going to have a student base. So when you’re underwriting these, if you’re going to do a new property, do you underwrite them? What vacancy percentage are you underwriting? What are you expecting these to do consistently from a vacancy perspective?

Jay:

Our vacancy rate near USC is actually quite low. It’s about 2%.

Henry:

Oh, wow.

Dave:

Okay.

Henry:

That’s insane.

Jay:

There’s definitely turnover, but a lot of people are showing every year and we lease it out.

Dave:

Wow. What about maintenance costs? In my mind, I keep thinking this business model is a mashup between rental properties and short term rentals because you have the cleaning element of short-term rentals, you have the furnished, at least for you as an operator, not again, like Jay said, not every co-living operator does this, but you have furnished parts. And from my experience in short-term rentals, these places get used pretty hard. There’s a lot of need to replace equipment and furniture. Do you see that as well in co-living?

Jay:

Yeah, for sure. There’s definitely a higher maintenance cost. It comes at a cost. Our expenses also is about I would say 10% higher than a average traditional apartment because of the repair, maintenance, and also cleaning, and we also include utilities as part of our expense. So, you can really just come in with a luggage and moving into a newly built apartment for 30% below studio.

Dave:

Wow.

Jay:

And then in terms of replacement, we started to use higher grade materials, so they’re more durable. Some of them are commercial grade, better paint, more durable paint, all that stuff. One thing that’s difficult when you’re managing a co-living property is that it’s hard for you to do maintenance. When you do a studio, someone moves out, it’s easy for you to go in and repaint the whole thing or do all the cleaning, but in co-living, there are other residents in there. So, it’s better to use a better quality material, so you don’t need to do any extensive maintenance frequently.

Henry:

So, you’re budgeting that on the front end in your acquisition costs because you’re going to have to build it with the higher quality materials. How does that work? Or said differently, can you take something existing and convert it to co-living, or are you typically only doing new construction and designing it for co-living ground up?

Jay:

You can in some places, but the layout in an old apartment is really hard to do. If you were to convert office, I think there’s definitely room to do that. The office, that’s a big open space, but if you’re converting an old apartment, probably they have a bigger two bedroom, sometimes they have more than 1,000 square feet per bedroom. For a two bedroom, you can probably put that through a three bedroom, but you’re just adding one extra room. And, also it’s really hard for you to add plumbing. You cannot add a private bathroom without significant cost, so it’s not really worth it. And, also the way we look at it is we want it to be compact, but also not too compact. For a three bedroom, we try to keep it around 900 square feet, so it’s like 300 square feet per room. When we say 300 square feet, that includes the common area, the corridor, and the bedrooms, the entire unit.

Dave:

Jay, it sounds like you don’t do this, but have you seen any operators who do this with single family homes? I guess that’s more called-

Jay:

Yeah, bungalow.

Dave:

I guess that’s more called rent by the room. So, what’s their model?

Jay:

Their model is they find a single family house owner, and then they master lease it and rent it out. I know they also got some funding and started to buy a lot of single family houses. I have looked at it, kind of did. I was interested in seeing how much money they’re actually making per single family house, and I did some quick underwriting. I just don’t think that they can make much money from single family house because the maintenance is really high and you can’t really scale. Each location has five, six bedroom max, but for us, each location can be 40 to 100 plus bedrooms. So, it’s harder to do that effectively with a single family house.

Henry:

I can totally see this making sense in markets that are expensive and have high college density, like LAs, New Yorks, these major cities. What other areas do you think this model fits or make sense in?

Jay:

You hit it right on. Exactly what you said, to be honest, co-living will only make sense in the unaffordable market, in a key gate market like New York, LA, San Francisco. San Francisco is not really a great market right now, but pre-COVID it would have been an excellent market. I would say this though, as a traditional apartment developer, a lot of the metrics they look at is the income to rent ratio. So, they want the tenants to obviously be able to afford higher rent. So, they want the rent to not be too high, so they can afford it, but for us, it’s different. We actually look at it in reverse. We look at areas that are unaffordable. It’s a different target market.

Dave:

So, if people wanted to do that calculation for themselves and identify a market where they could consider co-living, how do you do that calculation? What metrics do you use? Do you have any advice for our listeners on how they can do it?

Jay:

Yeah, in an affordable market, usually the income to rent ratio is at least 3X. So if you make 100,000 a year, your rent a year is about 30,000. So if the income to rent ratio is less than 2.5, then it’s a signal that it’s not affordable, and they’re spending more than 30% of their income on rent. But in 2020… Actually I said earlier about affordability, the 23% of renters actually is now spending 50% or more of their income on rent now.

Dave:

That’s crazy, wow.

Jay:

23%. A quarter of us are spending all of it on rent.

Henry:

So if someone, let’s say from an investor perspective, they’re hearing this and they’re going, this might be something I’m interested investing in, getting into learning about, what options are there for people? Are there funds that they can invest in or are there companies that they can talk to who are doing these kinds of things? How does one go about getting into this space from an investor’s perspective?

Jay:

You cannot invest in a REIT. The couple challenges in co-living right now is it’s not considered investment grade because it’s a new type of property and it’s not investment grade because you cannot repackage a loan and sell it to Fannie Mae for agency loan. So, it’s harder to get financing. We had to work with local, smaller banks. So your question was, how can they invest? So, they cannot invest really on a public REIT, but if they’re a developer or they’re interested in investing, they can reach out to some co-living developers such as Tripalink. We actually have an investor portal. I really don’t know how else you could invest in co-living. Another way you can do that is some people, they buy their own house and it’s basically just house hacking and you rent it out in a small scale.

Dave:

They call it rent by the room or just house hacking a single family home. You can definitely do something like that because I’ve read some stuff about rent by the room where you get similar premium on rent per square foot or per bedroom, a 20%, 25% increase in rent by doing that with a corresponding headache in property management.

Jay:

Honestly, it makes sense financially, but is it really worth it to have five other roommates with you and then you have to clean the common area? I don’t know, it depends.

Henry:

It depends on how much rent is.

Dave:

I’m just remembering the houses I lived in with friends in college and it just seems like it was fun back then, but man, the property manager must have hated us. Jay, are there syndications available? If you’re an accredited investor, are there development projects that investors could invest in co-living passively?

Jay:

Yeah, I think there’s not that many co-living developers, but if you go to networking events, you might be able to meet some. We do some syndications. We know a few other small developers in the area also doing syndication.

Dave:

All right, great. Well, Jay, thank you so much for being here. We really appreciate you sharing this. I’ve learned a lot. I think this is super compelling. I do want to learn how to… If there’s syndications available, or maybe Henry and I are going to go in on our first one, but this has been super helpful. I think it’s a really cool idea that clearly there’s going to be demand for this. That part seems just so obvious to me that this seems like a cool place to live for way less than what you would pay elsewhere. So, good on you for being in this really cool industry. Is there anywhere people can connect with you if they want to learn more about this?

Jay:

Thank you for having me. You can contact me on BiggerPockets. It’s Jay Chang, and then you can also fly me on LinkedIn. BiggerPockets will have most of the links that you would need to contact me directly.

Dave:

I love that, you’re just sending people to BiggerPockets. That’s maybe the first time we’ve ever had that, but as an employee of BiggerPockets, we really appreciate that.

Jay:

No problem.

Dave:

Thanks, man. Big thanks to Jay for joining us. Henry, what’d you think?

Henry:

Man, it’s a pretty unique space, and I do think that demand for this kind of living in those expensive markets are just going to increase. It’s like the market conditions right now are saying that this is something people need. The interest rates are higher, the inflation is crazy. And so, not only is it costing people a lot to rent in these places, but gosh, groceries too, so if they can save 30% and have to share a kitchen, I think people would be willing to sacrifice that.

Dave:

Totally, I feel like there’s just going to be huge demand for this. First, saving 30% on your rent is enormous. We talk to people all the time, I’m sure about, if you want to get into real estate, low money down, what’s the best way to do it? Either house hack or reduce your living expenses. This is a great way to reduce your living expenses. So when I went into this show, I was like, “Man, this is going to be interesting for investors,” and it is, but also to invest it, but I think it’s also interesting for aspiring investors to consider living in one of these things because you’ll probably saved some money and then invest in real estate. But I also think the element of having… I think you’ve done this too, I moved to some new cities in my life where I don’t know a lot of people, I think the community element is kind of cool. It reminds me of a hostel environment, right?

Henry:

But, gorgeous.

Dave:

They’re really nice, but they’re more open. It’s just like going to a common area, hanging out, having a beer, doing like that, and it’s in a super nice place. So, I could imagine it being really popular.

Henry:

Let’s be real, I don’t want to clean my kitchen anyway.

Dave:

No.

Henry:

So, if I can use a kitchen that somebody else is going to go clean and I can go downstairs and have a beer with all my neighbors [inaudible 00:35:18]-

Dave:

That’s so [inaudible 00:35:18]. What’s the weirdest or worst place you lived?

Henry:

Oh gosh, man, the very first dorm I ever lived in was probably the weirdest place I ever lived because it was like if a sleazy Motel 6 was a dorm room, and we had this shared living space, and it was supposed to be furnished, but it was really just a futon as a couch and then a TV stand with no TV on it and shag carpet.

Dave:

Ooh, nice.

Henry:

And, then I had a bedroom with bunk beds that I had a roommate in. So that was-

Dave:

Oh God, that sounds not that-

Henry:

Not my favorite place to live.

Dave:

I bought my first house with three partners, but one of the partners and I were roommates at the time, and we were going to house hack it, that was our plan, we were going to move in. But, then Denver’s starting to do well and we’re like, “Man, we could get way more for rent than what we would pay in our own rents,” so we’re like, “Why would we house hack?” And, his grandmother had just passed away and she lived in a retirement community and the market was still falling like crazy and his mom was like, “You guys just pay the utilities, take care of the house. You can live there,” but it was like a 55 and over community, so we couldn’t tell anyone. So we moved in the middle of the night, just lived in this house. We were like, “It’s going to be six months,” but it was free, so we wound up living there for three years. And, I lived in the basement, so I lived in his dead grandma’s basement in a retirement community for three years.

Henry:

Did you just go to the community hall and destroy elderly citizens at ping pong, crushing them at ping pong full board?

Dave:

Yeah, exactly. There was no community area. I guess there was a little bit, but we never went, but we were just like… People loved it, actually. We would just carry their boxes then, just be the young guys who could pick up stuff. We just did it, and later and later we were just throwing ragers there. They had this nice outside space and we would just throw these huge parties there.

Henry:

Did your neighbors come?

Dave:

They’d wave, but unfortunately we never got them in, but that was a weird place to live. So long story short, I probably would’ve preferred to live in one of these co-living spaces.

Henry:

I don’t know, it sounds like it was pretty awesome.

Dave:

It was fun looking back on it. Sometimes I was like, “What the hell am I doing with my life?” But, it saved a lot of money. Anyway, now I’ve lost my whole train of thought, so let’s get out of here. Thanks for being here, man, and thank you all for listening. Hopefully this is interesting to you. I think it’s going to be a big trend. I guess that’s the last thing is I was a little disappointed that there’s not really an easy way to invest in it right now it sounds like if you’re just a regular investor and not a developer.

Henry:

But, typically this is when you should be looking for those opportunities because somebody’s going to get in early on figuring out a way to make this available to the public to invest in. So, I would try to be the early adopter because the demand is going to be there.

Dave:

Totally, it’s like every time we do one of these shows, like this one, and particularly the 3D printed houses one, it’s not easy, but whoever figures this out is going to make a killing off of it. So if you’re interested, follow Jay, follow some of the other operators. Maybe you can learn from them or get in on it, but we hope this was helpful to you. We always try and bring you these types of new investment strategies that are cutting edge because that’s what we’re about. So, we’d would love to hear if these types of episodes are helpful to you. So if you have any thoughts on this kind of episode, hit me up on Instagram where I’m at thedatadeli or Henry, you are at thehenrywashington, right?

Henry:

That’s correct.

Dave:

All right, so Let us know what you think. Thank you so much for listening. We’ll see you on Monday for another episode of On The Market.

On The Market is created by me, Dave Meyer and Caitlin Bennett, produced by Caitlin Bennett, editing by Joel Esparza and Onyx Media, researched by Pooja Jindal, and a big thanks to the entire BiggerPockets team. The content on the show On The Market are opinions only. All listeners should independently verify data points, opinions, and investment strategies.

Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Check out our sponsor page!

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.

Making More Cash Flow Charging Cheaper Rent w/ Coliving Read More »

A palatial estate in the Caribbean was listed for a whopping $200 million today, making it the most expensive home to ever hit the market in the region and one of the priciest homes for sale in the entire world.

A palatial estate in the Caribbean was listed for a whopping $200 million today, making it the most expensive home to ever hit the market in the region and one of the priciest homes for sale in the entire world. The Terraces, as the estate is called, spans over 17 acres and nine structures. It’s located on the small private island of Mustique which lies in the southern Caribbean nation of St. Vincent and the Grenadines north of Trinidad and Tobagos and about 45 minutes west of Barbados by private plane.

“The Terraces in Mustique is the most expensive single residential home to publicly come to the open market in the Caribbean region,” said Edward de Mallet Morgan, head of international super-prime sales at Knight Frank, who represents the mega-listing.

See even more pictures of the trophy property and an in-depth article on The Terraces, Mustique at CNBC.com.

Tour the Caribbean’s $200 million trophy estate: The Terraces, Mustique Read More »

Person arranging successful financial charts on desk

Recession. The word is enough to strike fear into business owners’ hearts. Naturally, they start looking for ways to trim any expenses they can. And those cuts could impact everyone from the CEO to front-line employees to the people companies serve.

While the ultimate goal is to keep the business afloat, slashing marketing budgets isn’t always wise. A lean strategy can still include ample marketing spend on activities designed to support growth. Even in a recession, businesses can grow. It may sound counterintuitive, but historical data backs this notion up.

Companies that kept spending on marketing and advertising during previous recessions outpaced the competition. In the financial crisis of 2008, businesses decreased advertising dollars by 13% across the board. Leaders who maintained their marketing spend, however, saw a 3.5 times increase in brand visibility. In tough economic times, growth marketing strategies are a way to keep reaching your audiences with maximum impact. Here’s how.

In a recession, shoppers aren’t going to respond to marketing messages with the same levels of enthusiasm. In an effort to be cost-conscious, most consumers will think twice about every purchase. If something sounds too good to be true, they’ll pass. The same goes for any in-your-face promos for solutions shoppers perceive as nonessential.

Businesses that are accustomed to healthy conversion rates from promotional email campaigns will doubtless find this unnerving. The solution is to embrace a growth marketing perspective and employ email as a relationship-building tool for the long term. Use email to engage leads in various sales funnel stages. Don’t simply push your product as a way to nudge consumers; showcase your company as a helpful resource even if prospects don’t buy right away. Your patience now will result in higher lifetime customer value later.

You can also use email to keep existing customers in the loop. Segmenting your client list by interests and past behaviors lets you target customers with relevant content. Highlight what your company is doing for local communities and educate people about how your solutions fill market needs. Email newsletters can build audiences for your online content, providing further opportunity to highlight your value and expertise.

Online content is a cost-effective way to increase brand awareness. Consumers may tighten their belts, but they still need to know your company exists. More importantly, shoppers need to be aware of what your brand stands for and why they should consider you.

Digital content, including a blog, helps consumers get to know your brand. But the information must be beneficial while appealing to shoppers’ motivations. Your business won’t get far with superficial, self-promoting blog posts and website pages. Whatever materials you produce shouldn’t leave your target audiences with more questions than answers.

You can help your digital content stand out by making it a go-to resource for consumers. When customers have a problem to solve, your online tutorials and how-to videos should help them do just that.

Of course, you aren’t limited to blog posts and videos. You might find your audience engages better with something more interactive. Livestreams, webinars and polls on social media sites represent a few ideas. Keep experimenting to find what works, regardless of which formats you initially choose.

Growth marketing strategies are all about cultivating your client base. When companies only offer incentives to new customers, it prompts loyal ones to look for greener pastures. Why should they pay more for the same product? More importantly, why should they remain customers of your company if you care more for new customers than those of long standing?

As with any relationship, consumers need a reason to stay invested. Providing exceptional service or a unique product may not be a big enough incentive. In a recession, it’s not unusual for consumers to start looking for lower-priced substitutes. While this behavioral shift is typical with commodities, hypercompetitive markets are turning once novel products into pedestrian offerings. Think specialty coffee and wireless phone service.

Reward programs can be effective, provided they don’t have several hoops for customers to jump through. So can referral programs that offer incentives to new and existing clients. With referral rewards, your company doesn’t have to spend as much money on attracting brand-new business. Current customers do the advertising for you. Plus, consumers are more likely to trust what someone they know says about your business versus what your company says about itself.

A well-known industry thought leader who advocates for your brand could quickly increase its visibility. Someone whom your target audience respects and listens to will help you make more inroads in the market. Consumers are skeptical of companies without positive endorsements from trusted sources. If you’re only tooting your own horn, the kudos will come across as inauthentic.

Partnerships with influencers give both sides a chance to say something more meaningful. A thought leader might enable your business to reach a coveted but elusive market segment. You can also feed off each other’s knowledge to create resources your competitors can’t duplicate.

Before joining forces with any thought leader, evaluate what the partnership can bring to the table. You want someone who will align with your company’s values and identity. While an influencer’s large following is nice, it’s not the most critical factor. Look for a voice with longevity — one you can envision representing your brand well for the foreseeable future.

Some industries seem to naturally withstand one economic downturn after another. But many businesses don’t have the luxury of being inherently immune to recessions. To help their companies survive, leaders must develop strategies to buffer the effects of reduced consumer spending. Growth marketing initiatives can keep revenues flowing by investing in long-term engaging relationships with customers instead of transactional ones.

How To Use Growth Marketing To Recession-Proof Your Business Read More »

The real estate markets that have the highest populations tend to have the highest housing prices. Think of cities like New York, Los Angeles, San Francisco, and Seattle. Just a few years ago, these bustling metros were packed to the brim with tech workers, all of which contributed to housing shortages and sky-high home prices. Now, with remote work the new norm, these big cities are seeing their populations slowly start to siphon out to more affordable housing markets in America.

As an investor, you may ask yourself, “where are the most people (and money) headed?” In this episode, Dave Meyer and David Greene will answer this exact question. But, it isn’t as easy as solely looking at population growth. Dave and David go deep into the data to see where businesses, tech jobs, and high salaries are moving so you can make the best bet for future equity plays. And even though it seems like Miami, Austin, and other booming markets have already priced out most investors, recent price drops could be a short-term loss that leads to your long-term gain.

But even if you know where Americans are migrating, you’ll still need to know the “why” so you can find future markets fitting these criteria. Dave and David touch on how work from home changed the housing market, why the pandemic split the nation into affordable and unaffordable housing markets, and how something as simple as a warm day could heavily impact where the best investing opportunity is. So stick around if you’re planning on buying, investing, selling, or moving in 2023!

David:

This is the BiggerPockets Podcast show 729. When we talk about why, I think it’s a combination of factors, but most of them are related to technology. So if you think about the ’50s, what made someone determine where they’re going to move? It’s probably where dad’s going to work. So, markets would explode stuff like New York or Boston. You had these areas, like you mentioned, San Francisco, where you had to be physically present because this is where things were done, Detroit, Michigan, right? You moved to where the jobs were. Well, internet has increased its capability rapidly in the last 10, 15 years, and we’ve gotten to the point where now people are specializing, and they work from home all the time.

What’s going on, everyone? This is David Greene, your host of the BiggerPockets Real Estate podcast here today with my partner in crime, Dave Meyer, to talk about real estate by the numbers. Funny enough, that’s the same book that he helped write with J Scott. We get into migratory patterns, absolutely. We get into data. We get into information. We get into objectiveness. If you like Excel spreadsheets, if you like to make your decisions on the firm bedrock of information, you are going to love today’s show about where you should be investing in 2023.

Before we move on with that, today’s quick tip is if you like this kind of information, if you listen to the show, you get all the way to the end. You say, “That’s what I want more of. I want people telling me the numbers, the data, the statistics, the facts, the cold hard facts about where I should invest.” Consider checking out the BiggerPockets’ YouTube channel. Now, this is a podcast, and there are other podcasts, and those do go on YouTube, but in addition to that, we make additional content that you might not know about that never makes it into the podcast realm. It only goes on YouTube.

You could catch me on there talking about the nitty-gritty details of what it takes to have a career in real estate, or loan products you might not know about, or negotiation techniques that you need to tell your agent to be using. You could catch Dave on there talking about more information like this, what studies have been done, how to interpret that data, and what the next trend in real estate investing is going to be. So if you’re like me, and you’re addicted to YouTube, and you listen to it all the time, go follow and subscribe to the BiggerPockets’ YouTube channel, and get more information in between the podcast that we try to release as frequent as we can.

All right, Dave, what were some of your favorite parts of today’s show?

Dave:

I think today’s shows is one of my favorite ones we’ve done in a while, because this is one of those areas where investors can really gain an edge over their competition. This is like… If you’re the kind of person who likes to research and understand what’s going on around you, this is a great practical episode where you can learn some of the specific things that you should be looking for and identifying to pick markets. We’re going to talk about where people are moving, why people are moving, where businesses are moving, and why they’re moving.

If you can follow these trends, and extrapolate them out to what might happen over the next couple of years, you’re going to be in a really good position to identify great locations and great markets to invest in real estate.

David:

Yes, and on today’s show, we name names. We’re not just talking principle. We get into the theories and the principles of why this works, and we actually give you specific cities that we think are going to do well and why. This is what nobody ever wants to do in our space, because if you’re wrong, you look like a fool, and nobody likes that, but that’s okay. Dave and I are willing to risk that in order to share where we invest and where we think that you can do well because we love you. All right, let’s get into today’s show.

What’s going on? Dave Meyer, I’m so happy you’re here today. We get to talk about a topic that I love. As the author of Long Distance Real Estate Investing, I like to track where people are going, what markets are heating up. As the BiggerPockets host of the podcast, I like to talk about where people could be buying real estate, what listeners from BiggerPockets happen to listen in the hot city that everything’s happening in, or a cold city that people are leaving. I think this stuff is really important. So glad you’re here with me today. Can you just briefly explain to people why you are the person that we brought in to talk about this with us?

Dave:

Well, sure. It’s a really fun topic to discuss, I think, as you just said, in normal times. But ever since the pandemic, basically, the trends of migration and businesses moving to new places has accelerated in a way we really haven’t seen. A lot of the trends that we were used to are now the opposite, and we’re seeing a lot of changes in where people are moving and where money is being invested. Obviously, this has implications for everyone and the whole country, but as real estate investors, we really want to know where population is growing, where money is being invested, because it has big implications for rent growth, for appreciation, for vacancy, for all these important things.

I’m pretty excited to talk about this, because there’s a lot of cool information that we’ve gathered for you.

David:

We have several headwinds that have all joined together to create this huge rush that’s made a lot of money in real estate in the last several years. We have the fed printing a whole lot of money, so you have this oversupply where this money needs to find a home. Then we have, obviously, COVID-19 and the way that that shook up the way that work is done, and so we have people moving into different areas based on all kinds of different reasons that we’re going to talk about. Then we have the fact interest rates were incredibly low, so you really couldn’t get any return on your money in most traditional cases, just like putting it in the bank.

So, you had to invest your money. You have a lot more money to invest, maybe not the individual, but the economy as a whole, and people are moving quicker. So if you got the right location, and all the money flooded to that place, you did really, really well. If you didn’t get the right location, you still did well because assets in general, the prices of them-

Dave:

You got lucky.

David:

That’s exactly right. But now that you see it starting to turn around, we’re starting to head into a bit of a recession. The people who bought in the areas that appreciated the most, they’ve got the most cushion, so they’re going to be hurt the least when things turn around. That’s why we’re talking about this, because we always want to try to be ahead of what’s going to be happening next. Let’s start off, and just have you get into the great reshuffling as we’ve called it. Tell me what’s going on in the way that real estate investing has changed.

Dave:

I think basically, you’ve hit on a couple of the major things that are happening. The first one, like you said, is the pandemic and just remote work. We saw that all sorts of people were working from home for the first time, and not that long into the pandemic, a lot of companies said, “We’re actually going to make this permanent,” and so people for the first time really in history were untethered from locations in a way that they never have. Historically, if you wanted to have a great job, you’d move to where you are, David, in San Francisco or New York or any of these big major metropolitan areas that have strong job growth, strong wage growth, economic growth.

Now, people were saying, “I can still make a San Francisco salary, or I can still make a New York salary and move somewhere else.” What we’ve seen just in terms of data, what’s going on here is that the number of people who are moving out of state who are moving to a different metro area has exploded. Just from data from Redfin came out, and showed that of all the people searching on Redfin for homes, 25% of U.S. home buyers were looking to move to a new metro in Q3. That’s up significantly from pre-pandemic levels, and it’s still…

We’re no longer in lockdown mode anymore, and we’re still seeing this elevated sense of migration. So, I think what I was hoping to talk about a little bit is what happened over the last couple of years, and are these trends likely to continue?

David:

I think that’s a great place for us to jump off here. Let’s get a bit of a foundation and understanding what led to the change, and then let’s talk about what we think is going to happen. Then before we do, I just want to highlight why we’re talking about this, why it’s important. In the past, it’s been enough with real estate to just teach someone how to analyze a property. What’s it going to cash flow? Is it going to make or lose money? Add a little bit of sauce on the top. Can you throw a little bit equity in there? Can you upgrade a little bit?

Boom, you’re good. You got a property, and that’s going to take you to financial freedom if you just repeat it a couple times. There has been so much changing in our industry that it gets a little bit more complicated with every single change, and you need a little bit more information to stay competitive in this market. That’s why we’re bringing this information. That’s why we’re not just only bringing in the story of the gym teacher that bought four duplexes, and now they’re done, and they don’t have to work. It’s getting harder and harder to do that, but at the same time, it’s getting more and more important that you are investing in real estate.

That’s why so many people are flooding into the space, because they’re recognizing the safety, the long-term benefits, and the fact that when you compare it to other investment options, they don’t stack up at all. The word is out. More people are hearing about this. We just want to bring more information so you can stay ahead of the others that are chasing after these same vehicles.

Dave:

That’s a very good point. I mean, there is also a good point about what you said earlier that even during the pandemic, it didn’t matter where you invested because everything was going up so much, but we’re not in that market anymore, and different housing markets are going to start to behave different from one another, which is normal for the record. Having some markets that are better for cash flow, and having some markets that are better for appreciation is the normal state of affairs. We were just in this crazy abnormal situation for the last couple years.

So, by studying and understanding different markets and some of the trends about population, migration, where money’s being invested, you’ll have a good sense of what markets are likely to withstand this downturn the best, and likely to start growing again in the future the soonest and the most dramatically. All right, so now you know why we’re talking about this, and why this is important. We know that people are moving a lot, and they’re continuing to move more than they used to. So before we jump into where they’re going and what this all means, maybe we should hit a little bit on why people are moving from where they currently live.

David:

That’s a great point, because if you can understand the why, you’re more likely to predict what will happen in the future. First thing I’ll say, I think this is going to continue in even more frequency as we go. People are moving more than they ever did before. It’s more important to know it than they ever did before. I don’t think this is a fad. I think this is going to continue. I think if we look at the next 5, 10, 15, 20 years, you’re going to see an increase in the velocity of human beings jumping around between markets and businesses probably doing the same thing.

When we talk about why, I think it’s a combination of factors, but most of them are related to technology. So if you think about the ’50s, what made someone determine where they’re going to move is probably where dad’s going to work, right? Back then, you got dad’s going to work. Mom’s staying at home, raising the kid. We have very traditional gender roles that people are operating through, and you can’t… There’s no Zoom calls. There’s no internet. You are driving into a physical location to attend meetings in person. I’m sure some stuff was done over the phone, but I don’t think it was very much.

So, markets would explode stuff like New York or Boston. You had these areas, like you mentioned, San Francisco, where you had to be physically present because this is where things were done, Detroit, Michigan. You moved to where the jobs were. This is the way that human beings have been for a very long time. If you go back before jobs, you have the Native Americans following the bison across the planes like, “I got to go to where I get my food, which now is our work.” Well, internet has increased its capability rapidly in the last 10, 15 years, and we’ve gotten to the point where now people are specialized, and they work from home all the time.

We had the capability to do that, but we just didn’t break out of the pattern. Then COVID-19 hit, and that was a pattern disruptor. You absolutely had to change the way you’re doing things, because you could not leave your house. So as they say, necessity is the mother of invention. People change the way that they operate in the workspace, and you started seeing more people working from home. Now, you also see that people can learn skills much faster, because we have technology-assisted abilities in the workplace. So if you’re someone who writes code on computers, you can learn how to write new code faster in different ways.

If you work for a company, and you’re in sales and marketing, you probably don’t have to be in that company. You’re probably locked into your computer studying algorithms of different social media websites. A lot of these tech-based jobs can be done anywhere. So, you got this niche where people can bounce around from different job to different job, and they can work from home. Then COVID-19 happens, and the place where certain people lived had its resources shut down. So where I’m at in San Francisco, it was terrible. I don’t live in the city of San Francisco, but I sell a lot of houses there, and they just shut down everything.

It was so hard to sell anyone on why they should live in San Francisco, because all the restaurants were closed. All the nightlife was closed. All the museums were closed. All the reasons that people want to be in San Francisco, they disappeared. Same thing happened in New York. Basically ,two of our biggest hubs for business in the country had the same thing happen. Some people moved into the suburbs, or they moved into new states. There were political differences, and I think we can agree that there’s becoming a bigger spread in the spectrum politics every year.

So certain people said, “I don’t want to live in a state that’s this way, or I don’t want to live in a state that’s that way,” and they moved to a different state. After a couple years of doing this, we figured it out. It became easier and easier to go from one area, and work one job to another area, and either work that same job or get a new job. Then technology increased with stuff like Airbnb and VRBO, and we had more people putting supply into the market, and so it became much easier to live in a new area. It used to be you stayed at a hotel that was super expensive, or you had to commit to a lease. Landlords like us don’t want to commit to a two-month lease for someone. It was a 12-month lease.

So if you didn’t know anyone in the area to move to, it was very hard to go get there, get established, set a foothold, figure out if you like it or not, and then make a long-term solution. Well, now Airbnb makes that so easy. You’ve got expensive options if you want to move your whole family into a big house. You’ve got cheap options if you just want to live in someone’s basement, and sleep on a pullout bed. It has become so easy to bounce around from location to location that people have figured this out, and what used to be a dream, “I want to make a bunch of money and quit and retire so I can travel,” is now something that you can do while you’re still working.

You don’t have to wait until you’re 50, 60, 70 years old to retire and travel. You can do it at the same time. You’re doing your work right now from Amsterdam. Are you in Amsterdam today?

Dave:

I am.

David:

So, you’re the perfect example of the person who is able to do a great job at their job, also work a side hustle hobby of sandwich connoisseurship if I can say so, and do it from different locations in the world. This is happening all over the place, and understanding these patterns and these trends will help investors buy in the areas where there’s going to be rising demand.

Dave:

Absolutely. I think one of the things you talked about, I just want to follow up on, which is that people used to have to move to these places to get good paying jobs like New York or San Francisco. We’re just picking on those two. You’re from around San Francisco. I grew up around New York, so we can pick on those cities, but basically, what happened though is because they offered in many cases the highest paying jobs or the highest concentration of high-paying jobs, there was so much demand that those places got insanely expensive. It’s not a coincidence that San Francisco and New York are two of the most expensive real estate markets in the world. It’s because people want to live there, because they want to have access to those very expensive jobs.

Now, you’re saying, “Oh, I can get that San Francisco or New York salary, but I don’t have to live there. I can go to Nashville, or I can go to Dallas, or I can go to somewhere in Florida, and live.” It’s basically getting a raise. You could be getting a 20% or 30% raise. People were doing this, and companies over the last couple years who have been struggling to find employees were allowing people to do this, because it was a way for them to basically give their employees a free raise as well. If you’re Facebook or Twitter or Google or whatever, if you say you can take your San Francisco salary, and move to wherever you want, you’re giving them a much higher quality of life, and I think for just cost of living wise.

I think people really wanted to take advantage of that. I don’t necessarily think they’re going back. I know you hear some of these high profile things where people are getting called back to the office, and some are. But if you actually look at the data about how much people work remote, it’s pretty stable. It peaked a couple years ago. It has come down a little bit, but now it’s pretty flat. So, I think we are going to continue to see people able to work remote. To your point, David, I think that’s going to just increase this transience among people going forward.

David:

Well, I think in some of the places that we’ve seen more people moving to than anywhere else, like the winners that are going to show up here, a lot of these were places that typically people only went to when they retired, which means they wanted to be there. It had a lower cost of living, a better client, more amenities, but they couldn’t. They had to wait till they were done. You think Florida’s exploded. That is our typical retirement community of America. Everybody waits to retire the move to Florida. You’ve got Arizona. Arizona has exploded in demand as Californians have realized it’s a little bit hotter, but it’s not a whole lot of different climate than what we’re used to, but it’s a third as expensive as the Bay Area.

Like you said, it’s a huge… it’s like getting a raise to move there. Texas has been a place that typically like you were just from Texas or that was it. Nobody was going into Texas, but the people that lived in Texas loved it. Now that the word is out, I’m sure the Texans don’t love this that are listening to this, but everyone else wants to go there. Tennessee was another place that a lot… It was like a niche market. You were a musician, and you went to Nashville to try to make it. It was like the Hollywood of the south a little bit, or you retired, and you moved up there. But if you lived in Tennessee, you knew about some of the gems, like the Smokey Mountains, Nashville, the areas that people wanted to go vacation to.

Now, you can just live in those areas. People are… They wanted to be there the whole time, but their job was restricting them. As we’ve cut the tethers of your workplace requiring you to be someone, we see people naturally going to where they wanted to go. That’s one of the reasons that I invest in those markets. I don’t see that changing in the future.

Dave:

100%, totally agree. Before we move on, I just want to say, David and I have been talking a lot about price-wise affordability. I do think that is probably the number one major driver people want to go where they want to go. But when we look at some of the data to why people are moving, I just also want to say that some of the things that we’ve noticed are, one, income tax. States with no or low income tax have been major winners like Nevada, Texas, Florida.

David:

Tennessee.

Dave:

Tennessee. Exactly. There you go. Then a lot of times… This is pandemic related too, but just a lot more space. People who were living in small spaces when you were confined to your home wanted bigger areas, so we saw suburbs really take off as well. Places that had affordable suburbs were other areas that really we’re seeing a lot of net migration, and are still seeing a lot of net migration. All those things combined have led to this trend, and now we have seen and have some winners and losers that we can actually share with you over the last couple of years, which markets have seen the most and most people lost and the most people gained.

David:

It’s funny. Three years ago, I was doing real estate meetups in the East Bay Area, and people would say, “You wrote long distance real estate investing. Where should I buy it?” I was like, “Everyone overthinks it. We overthink it so much.” You want to buy in places with warm climate and low state income tax, because the people who are making the most money are living in New York and California. They’re paying the highest in taxes, and people in New York don’t like the cold. They would rather live in the warm, and people in California can’t live in the cold. We can only live in the warm because we’ve been spoiled.

Dave:

You’re not adapted to the cold.

David:

Yes. It’s like 50 degrees over here, and everyone’s complaining like, “This is ridiculous. We’re going to die. My petunias can’t make it in this 50-degree weather.” We don’t adapt at all. I said, “You should invest in Texas, Tennessee, and Florida. That’s it.” Find the areas that someone would move to to start, and those places have exploded, and everybody has made money that’s invested there. It really can be simple when you understand the principles that we’re about to get into now.

Dave:

Hopefully those people listen to you.

David:

All right, so Dave, the numbers guy, the data guy I should say, tell me, what is Redfin statistics on this trend? What’s the data telling us?

Dave:

Well, we’ve been picking on New York and California, and I will say that those are the two cities, two states, excuse me, that had the largest out migration. New York, over the last couple of years, has lost 180,000 residents, and California has lost 300… No, excuse me. They’ve lost 343,000, but they gained another 150,000. Like we’ve been saying, you see, if you look at this and dig into it a little bit more, a lot of it is from the New York City area, San Francisco and LA areas. They’re very, very expensive, and we’re going to talk about that in just a moment.

A lot of this, I believe, is not just personal lifestyle, but you’ve seen a lot of companies move out of San Francisco and LA. You’ve seen a lot of finance companies, for example, leave New York, and head to Florida. Those aren’t super surprising. The other general area that has lost a lot of population is the Midwest. People are leaving Illinois and Ohio, and where they’re heading, no surprise, some of the states that we’ve already named, which are Florida, which gained a net of 400,000 residents. Texas has also gained 400,000 residents, and now is the second state after California with over 30 million residents.

The other ones are all in the south. Arizona, North Carolina, South Carolina, Tennessee, and Georgia lead the way in terms of cities with a ton of migration. I’m guessing you are not surprised by anything I just said.

David:

No, I think… Man, it’s not too hard to see the writing on the wall. Florida was the only state doing things the way they did, and because of that, what was the net addition to people that moved there? Was it 500,000 you said?

Dave:

400,000.

David: