David:

This is the BiggerPockets Podcast, show 728.

Jesse:

And the cool thing about the agencies is you can actually get these agencies, they can be the lessees on these properties. So in San Francisco or Central Valley, who you worry about, holy crap, there’s squatters. I don’t worry about that too much, but a lot of people do. These agencies are actually the lessees. And these are multimillion-dollar agencies, there’s no way they’re ever going to screw you over. And that’s one of the things that I love about this space too, is that they’re taking responsibility for the clients that are there. They’re taking ownership for that. And any damages, the agency’s actually paying for it.

David:

What’s going on everyone? This is David Greene, your host of the BiggerPockets Real Estate Podcast, the biggest, the best, the baddest real estate podcast in the world. Here today with my good friend and talented co-host, Rob Abasolo. Now, we have one of the best episodes we’ve ever done for you today. And I’m not exaggerating, it’s that good. You’re going to listen to it more than once. It’s going to inspire you. You’re going to go follow the listener, and you’re going to think, “Gosh, darn it, that’s why I listen to this podcast.” When you get that feeling, please do me a favor and leave us a review on Apple Podcast, Spotify, Stitcher, wherever you listen to this. Because we really need those, and you’re going to love it.

I’m going to make this a very short intro here, because we went long. We were supposed to record for a certain time, but it was such good content, that we just kept going and going and going. And I don’t think that you are going to be upset about it when you hear it. Today’s quick tip before we get to the guest is, look for creative ways to exercise your leads. Our guest today tells you about different ways of finding guests for different asset classes of properties that you probably never thought of. But he is making more than 10 times some of his competition, by looking for ways to do it. Make sure you listen to today’s episode all the way to the end, because you are not going to want to miss this. It is subtle, yet brilliant. Rob, anything you want to say before we get started?

Rob:

I have a feeling that if you listen to this all the way through, you will probably listen to it again. This is one of those episodes that I think people will reference for many years to come. I’m so excited. I’m so excited. This is one of my favorite, legitimately that we’ve ever done.

David:

Yeah, I end up asking our guest today, if he wants to coach me on the topic of today’s show. And so hopefully he does, and we come back, and you guys can follow along with the journey of me trying to implement Jesse’s methods. So without any further ado, we are going to jump right into our interview with Jesse Vasquez.

Rob:

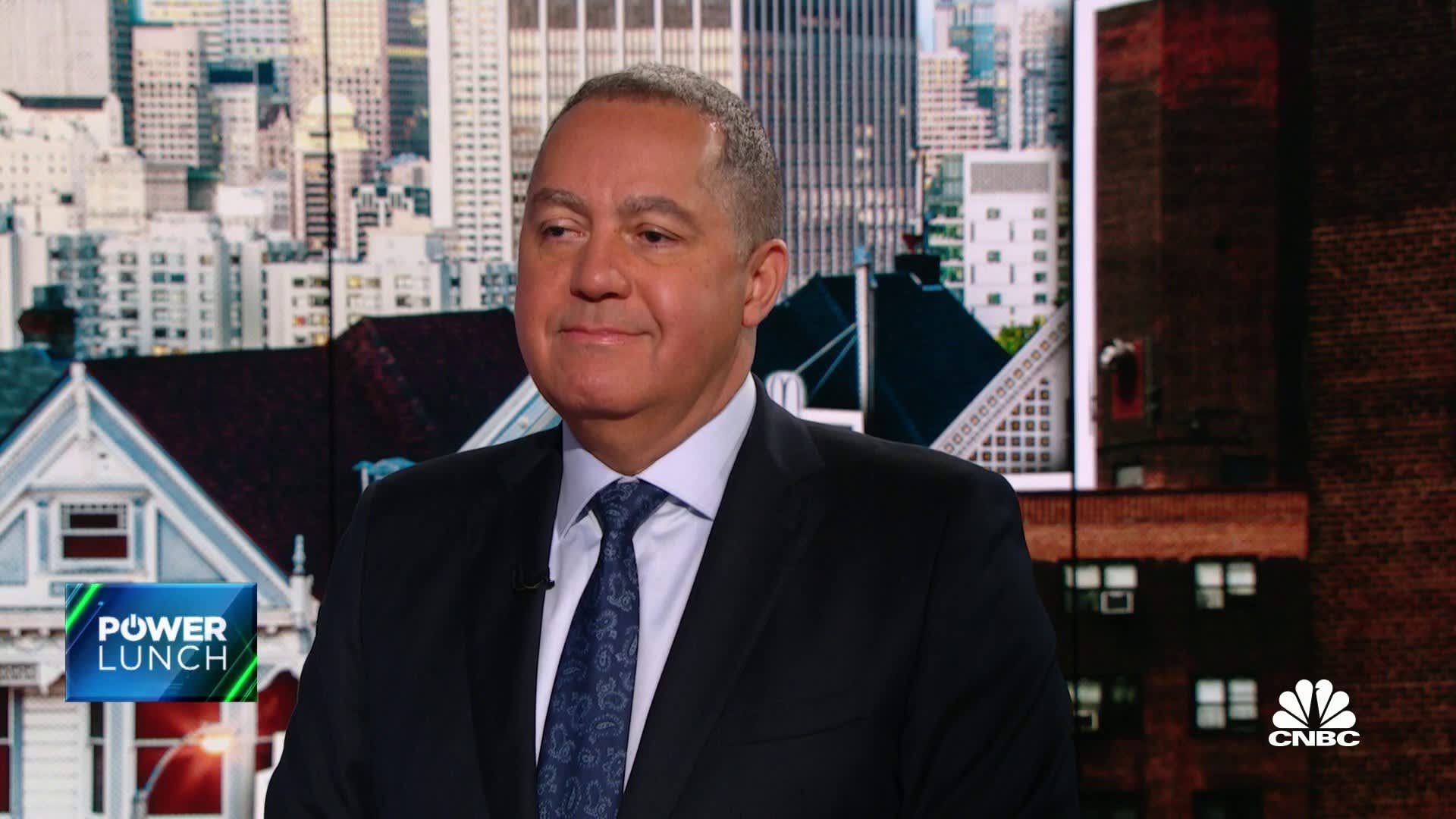

Jesse, welcome to the show. To give our listeners some background, you run a full-time mid-term rental or medium-term rental business rather, that caters to healthcare workers. You’ve hacked this market segment, and are here to give all of your secrets to our BiggerPockets audience. Your business includes 27 properties in Texas, Oakland, and in the Central Valley. And you’re a self-described go-giver. Did I miss anything?

Jesse:

No, man, that sounds pretty damn perfect.

Rob:

Oh, and also you’re a fellow YouTuber, right?

Jesse:

I am, man. Yeah, so I’ve been able to build a beautiful business, you guys, from both mid-term rentals and short-term rentals, and co-hosting other people’s mid-term rentals. And specifically in the Central Valley, in the Bay Area, David, wherever you’re at, San Francisco, Oakland, Berkeley, all those beautiful places in the bay. And even though the prices are high there, we still are able to get a pretty solid amount of income in a high market, which is difficult to do in a lot of places. That’s pretty much it, man. I worked in healthcare for 18 years.

Rob:

What’d you do in healthcare, specifically?

Jesse:

Yeah, I was actually a business development manager, so it’s a fancy way of saying sales. I was a sales rep for a hospital for companies. My job was to get permission for these doctors to have privileges at a hospital. And also for patients that were discharging, my job was to connect and schmooze with these case managers, to get them to use me to send folks home. If they needed… So David, imagine if you fell, God forbid that happens. You broke your hip. And Rob, you are the case manager. My job was to be buddies with you, so that you would send me David as a referral, and then I would get paid on that end. So yeah, it was a really cool business. It paid me really well. I was making over 200 grand a year. I had golden handcuffs at that time in my life, and I finally decided, “You know what? I’m not doing this anymore.” Plus, I was driving the Bay Area from the Central Valley. And for those of you who know, it’s like literally… Dave, you probably know Modesto.

David:

Oh yeah, I’m from Manteca, which is like 20 minutes away from Modesto.

Jesse:

Holy smokes. Yeah, we’re neighbors. So literally driving from Manteca, Modesto to the Bay Area, literally daily is, I’m not kidding you guys, is like a three and a half to sometimes even four-hour drive depending on what day you decide to go, what accidents and whatnot. So for me, it was just burning me out. That drive was killing me. And I just decided one day I went into work, I’m like, “I’m just done. I’m going to just go full in on investing in real estate and mid-term rentals.”

David:

This is fascinating. Also, so are you from Modesto? Is that where you grew up?

Jesse:

Yep. Yeah. And actually speaking of Modesto, there’s a couple of people that I know that know you, that actually started working with you back in the day, or working on deals. You probably knew who I’m talking about.

David:

That’s funny. We’ll have to catch up on that. But you can still catch me in Modesto at the Vintage Faire Mall, once every two years when I have to go shopping for new clothes. That’s the best deals around. So this is interesting because as people are going to see later on in the interview, these sales skills that you developed in this business development role, have come in incredibly crucial for you when it comes to running a medium-term rental business. And so this stuff is going to, it’s going to come full circle. That’s really good. Before we hear about your freaking empire that you’ve been building, tell me about your first real estate experience as a kid.

Jesse:

Yeah, this is a beautiful story. Well, it depends on what kind of beautiful you’re talking about here. All right, you guys have all seen National Lampoon’s Christmas Vacation, right? I’m assuming?

David:

Yes.

Jesse:

All right. So you know that Woody, that station wagon? So I need you guys to picture this. Me being a nine-year-old kid in the back seat of this wool, there’s literally wool upholstery in the car. My mom and dad were in the front seat. I grew up in a very Catholic household. Rob, you might know about this. Hispanics usually grow up Catholic, maybe in… I don’t know. So anyway, my parents were in the front seat. I was in the back bouncing around, because those cars do not have any shocks at all, by the way, and in this Woody. And my parents were arguing as we were on our way to the courthouse. They were arguing because they had tenants that were living in the property that didn’t want to move. They were literally not moving.

My parents, again, being super Catholic, were always very forgiving of people like, “Oh, they can’t pay this month. We’ll pay next month.” And literally as a kid, that was my first experience in the backseat, never hearing my parents argue of this 19… it was like a 1983 Woody, the same one in National Lampoon’s, for those of you who are picturing this. That’s my first introduction to real estate. And I remember thinking, “Holy crap, I don’t ever want to be in real estate.” Because here I am as a nine-year-old boy sitting in the back of a courthouse, my parents, and this lady that was renting from them.

And do you know the crazy thing, David and Rob? The judge looked at her and said, “This is not the first time this lady’s been in here.” And I remember her name specifically, I’m not going to use it on this show. But he said, “This is what she does.” So it’s literally she would go and stay at people’s places, take advantage of them, not pay the rent for months, and then eventually go into court. And then that’s what it was. So it was literally just repeating the cycle. So for me, that was my very first introduction to real estate in the backseat of a 1983 Woody, that’s what I’m going to call that. It probably doesn’t sound very good. Backseat Woody. Whoa, what’s going on here, guys?

Rob:

I’ve really restrained myself several times.

David:

So you got exposed to the very worst of the industry from tenants that are professionals at taking advantage of landlords. And you said, “When I grow up, I want to put myself in a position to let that happen to me?”

Jesse:

I grew up and I said, “I am not going to allow that to happen to me,” yeah, yep. Which is where the contracting stuff came in, and the Airbnb stuff came in. And my dad was always like, “Real estate’s great.” And this is not the first time my parents were going through that, you guys. Keep in mind, literally over probably the next… I was nine at that time. Over the next five, six years, we probably ended up in court again, probably three or four more times. Finally, my parents started selling off some real estate, and I just thought to myself, “Do I really want to end up like this?”

Yeah, obviously that’s not the route I wanted to go. And I was always told real estate’s such a good thing. Keep in mind, my parents were immigrants that came here in the ’70s, and built this pretty good real estate business. And then I watched it kind of deplete over that span of seven, eight, nine years, just because of them being generous in a lot of ways. And also not very business oriented. They were more on the emotional side of it than the actual business side of it. And I think a lot of people, especially immigrants sometimes can have that mindset. You know what I mean?

Rob:

For sure, man. So question, did your parents ever have any wins throughout the year? Were there ever any moments where you remember watching them actually have success in real estate, or was it always sort of a downward spiral, if you will?

Jesse:

No, it had peaks and valleys. So it was like, I’d watch them do really well, buy multi-unit properties, two doors, three doors. And then all of a sudden end up in court again. It was like the same thing. My mom was the business mind, and my dad was the emotional mind. So it was, those two things together were always kind of clashing with each other. And I think for me, real estate probably wasn’t the best avenue for them, because they were just way too forgiving. So I came in, and when I decided to do this, I’m like, “You know what? I need to get paid first. I’d watched this too many times.” I never heard my parents fight ever. My parents were not the fighting type. But the first time I was able to hear that was over real estate. Which David, you’re absolutely right, man. That was the ugliest thing that you could potentially see in real estate on the landlord/tenant side. That was it. That was my introduction.

David:

So that clearly had an impact on the way you decided to structure your real estate business. Before we hear about that, I just want to commend you. Props for not saying, “Oh, there’s a bad thing with real estate. I’m just going to throw the baby out with the bath water. Just screw it. There was a bad experience.” So many people take that approach. Instead, you were smart enough to say, “Well, how do I eliminate the problem and maintain all the benefits?” So you figured out a way to structure things to where the tenants had less ability to professionally screw you over. So let’s hear, how did you first come up with the idea to invest in real estate the way you do now?

Jesse:

Yep, yeah, so this is going to take me back to what I did at my W2 job. I was working on the floors of the hospital. And in California, you guys know how everybody says dude, and bro, and man, David? Rob, you’re in Texas, you don’t know. I guess you’re here from California.

David:

They say y’all in Texas.

Rob:

Y’all.

Jesse:

Y’all. So there was this really sweet lady, her name was Barbara. And I was working at the hospital, and there was a little… We were on the floor. And she was saying things like, “Oh, don’t you know? And such a doll.” And I’m just like, “Holy crap, where’s this accent? I love this. Where are you from?” And she’s like, “Fargo.” And I was like, “Cool. I watched the show. I get it now.” Or I watched the movie, this was a while back, and 2015 by the way. And I was like, “What are you doing here?” And Barb was like, “I’m a travel nurse.” And I was like, “Oh, that’s cool. Where are you staying?” And you guys are not going to believe where she was staying. And Dave, you might know this because you are from Modesto. She was staying at Motel 6 on 9th Street, Downtown Modesto.

David:

Why?

Jesse:

And for those of you who can’t see David’s face right now, he’s making a pretty cool face. And because literally, it’s not a place where a travel medical professional, especially a nurse is going to feel comfortable. And I asked her, this is my follow-up question, “How much are you paying for that place?” She was paying $3,000 a month for Motel 6. That’s what the rent was for her to pay. And at that time, this is 2015, I could buy a property for under 300 grand, my payment would be 15, 1,600 bucks. And they’re paying 3K, so my brain was like, boom, “I need to do this right now. How do I figure out how to do this?” She started to talk to me about contracts, which I already knew about. And everything in healthcare, you guys, whether you’re a doctor, nurse, clinician, physical therapist, everything goes around contracts.

Housing is not any different. Everything in healthcare is based around contracts. So I walked down to the HR department, knocked on the door and said, “Hey, I’ve noticed all these clinicians that are travelers here. How do I actually become a housing solutions provider for these folks?” Because they’re all staying at this crappy place.” And the hospital, Doctors Medical Center, by the way, David, was like, “Oh, we’re actually looking for housing. How do you want to accommodate housing? What property do you have?” And at that point, I was just like, “Tractor beams, real estate.” I didn’t even own my own house yet. And I went and bought an investment property. So that’s kind of how it started.

David:

My cousin is a nurse at Doctors Hospital in Modesto. We have a lot in common here, Jesse.

Jesse:

I know.

David:

That’s funny.

Jesse:

What’s going on here?

David:

I mean, we’re kind of glossing over it, but that’s brilliant. That you recognize the problem, that you saw a solution. And that you just said, “I can buy a house for 15 or $1,600 a month.” The nurse is going to be happy to pay three grand to have a house and not have to live in Downtown Modesto. That area’s gotten even worse, if you’ve been there lately. It’s kind of over overrun with transients at this point. So they’re not going to even feel safe leaving the hotel to get to their car, is what I’m getting at. And they’re probably doing this at nurses’ hours. So graveyard shifts, swing shift, they’re coming in and out in the dark. It’s terrible.

And they don’t have their own space. When you’re staying in hotels of ill repute, the type of noises you’re going to have to hear, and the screaming and the yelling, and just the overall chaos. And nurses need a place where they can find some peace and respite from the insanity that they’re dealing with. So you see all these things, and it just clicks like, “Oh, this is what I’m going to do.” Do you think that your parents’ background in real estate had something to do with your confidence level to say, “Okay, I can jump in and meet this need in a business way?”

Jesse:

Yeah, definitely, man. I think somehow subconsciously, that burned into my brain. I need to get paid. I need to make sure I get paid up front. And then also, my dad would always tell me, “Real estate is where most people make their millions. You want to build…” “It’s basically like a long-term bank account,” is what he told me. Verbatim, that’s exactly what he said. He’s like, “You buy a property, you rent it. It’s just like having a large bank account that’s going to eventually pay you in dividends over years.” It’s not like that you get to make money right away. In real estate, it’s not like that, right? It’s a long game. So he essentially burned that into me as a child. “Buy real estate, buy real estate, but don’t end up like me, in court every six months.” And he knew he consciously, he was in that specific space.

So yeah, 100%. My brain was like, “How do I do this? How do I grow, but how do I get paid?” So that was my introduction to… And that was just the nursing side. For nurses, the pay. At the other side is the contracting. I’m sure you guys are going to dive into that a little bit, but it’s so different. And by the way, David and Rob, you guys, I noticed this because my job was to go to all these hospitals. So like Manteca, David, you mentioned that. I was in Kaiser, I was in Memorial Medical Center, Emanuel in Turlock. Every single one of these hospital floors, guess what was there? A bunch of Fargo accents, “Don’t you know?” And stuff like that.

And so I realized, holy crap, the Central Valley has such a need for clinicians. And actually at that time, I had a friend that was going to Stan State University, another friend that was going to JC. And there’s only 30 graduates a year for these nurses in our specific market. And there’s over 400,000 people between Turlock and Lodi. Actually more than that. And what I noticed is, then I started calling around to these colleges, 30 graduates, and only a quarter of those students would actually stay in the Central Valley. So we’ve always been understaffed for the healthcare industry.

In fact, California, Illinois, Texas, North Carolina, and Florida are the most… they’re five underserved states for travel medical professionals. And they’re not going to be to pre-pandemic levels until 2030. So if you guys are in one of those states, you have a long roadway to build the legitimate business, that is housing clinicians. Because there’s not going to be enough clinicians until 2030, is what the National Registry of Travel Medical Professionals is predicting.

Rob:

And you’ve just ruined those tips for us by saying that on the podcast. No, I’m just kidding.

David:

Yeah. Thanks, Jesse.

Rob:

So Jesse, bring us back a little bit. Because you stated that you were making really good money at your previous job or at the job that you were working, the W2, multiple six figures. And it is golden handcuffs, right? You’re making money, very comfortable. You’re probably past that threshold where, yeah, it’s like you’re very comfortable, and you can probably buy whatever you want within reason, and travel, and do all that kind of stuff. And so the difficult thing with making that amount of money is that when you start going into real estate, you have to try to replace all that money that you’re making at your W2 with real estate, which at that level, takes a long time. So tell us about that shift and that transition from going to W2 all-in on real estate. What was that like? Why did you decide to even go all-in on real estate, when you were crushing it so much at your job?

Jesse:

Yeah, I had success and self-fulfillment. I was not happy with the job, but I was happy getting the paycheck. And at the end of the day, 200 grand for those of you in the Central Valley or people that realized, 200 grand is a lot of money in the Central Valley. It’s not very much in the Bay Area. But if you’re in the Central Valley, you’re like the top 5% in these areas. So for me, I was like, “Holy crap, I’m crushing it. I’m doing so well.” But at the end of the day, I was not happy. And I think my timeframe, and I think a lot of real estate investors always go like, “Oh, the time, freedom,” whatever, yada, yada, yada. But that’s not actually the case. When you dive into stuff, full force, it takes years to build that.

But for me, man, I just didn’t want to do that grind anymore. I was just done. And one day I literally went into work, and I’m just like, “I’m not doing this anymore.” I gave my resignation letter. They let me go that same day. And literally that was July 17th at 3:43 PM, I was in San Francisco. I know the exact time, date, everything. I know what I was wearing. I remember vividly, you guys, vividly. And from that point on, my family was like… Dave and Rob, they were like, “You are insane. Why would you ever do that?”

Remember my daughter, who was 17 at the time, 16. Called my mom, and she’s like, “My dad just quit his job. We’re going to be homeless.” Literally, my daughter called and told my mom this. Because in Hispanic families, you tell the moms, the grandmas everything, and then they’re going to get on me, and I’m going to be like, “Oh God, why did I do this?” So that’s what happened. Literally, everybody in my family was like, “You’re so dumb, why are you doing this?” And now, they’re just like, “You were right on. We were supporting you the whole time. We knew you could do it.” So it’s tough, man.

Rob:

Yeah. And so you go into this, you decide to transition into it. Obviously, the timing of going into real estate is always, you just never really know until you make that decision, and you march into the office. Tell us a little bit more about how your family took that. Was it something that… Because you said now they accept it, was it fast? Or did you really have to convince your parents? Because I’m sure they had some biases with their relationship with real estate. So how much did you have to pitch them on this idea? And how long did it take really before they were like, “Oh, okay, I think you got a good handle on this.”

Jesse:

So Hispanic families are very like, you go and do a job, you work your butt off, then you move up to manager. And then you move up to this, you climb that corporate ladder. So my parents were 100% like, “That’s what you need to do. What are you doing?” So it was not an easy transition. I think that the first few months, it was kind of, I had money saved by the way, you guys. I had six months of cash reserves, and probably even a little bit more than that. So that if it didn’t work, I can always go get a job somewhere else. I’ve been in this space for so many years, that I can literally go get a job. Even today, I can go get a job right now if I wanted to.

So for me, in my brain was like, “If I don’t do this right, if I don’t try this, then I’m not going to have any success. And I’m going to present this later on in life.” Granted, I did give up a 200K a year job. But I mean right after I did that, everything just took off. I started teaching people what I was doing, and that was successful. And then my portfolio was growing. Which by the way, for those of you who decide to leave your job, make sure that you start your actual corporation two years ahead of time. That’s where I screwed up, that I didn’t actually start my corporation until 2020, and I left in 2021. You have to have two years of experience through the IRS. They want to see those two years on paper. So that made things a little bit difficult to go buy property, but I did the SCR loans. But you know that you can’t conventionally get a loan that way.

So I did things kind of on a whim. I should have thought it out a little bit more, but I’m so glad I did it, you guys. My life is completely changed. I’m working way more than I ever have, but I’m also making way more than I ever even dreamed about making. And it’s just been such a beautiful ride. And not only that, but inspiring other people that are in these spaces like Modesto and the Central Valley, and places all over the US are not big. You don’t have to be in these big urban markets to do extremely well. You can be in the very underserved small market, and have a pretty good amount of doors. And build an actual legitimate business based off of relationships. And I think that’s where a lot of people can really drive home this specific model.

David:

So you mentioned that you’re making more money than you ever have before. Can you give us a quick rundown of what your business stands look like today, how many units you’re managing, and the revenue they’re providing?

Jesse:

Yes. Right now, I have nine properties that I own. I just did my books, and we did about $987,000, and that’s gross in just nine properties. And then I manage for other people, and we’re doing over a million, that’s short term and mid-term off of 11 other properties. So between the combination of these two, we’re doing 2.1 million. And then my coaching business is like, that thing’s going crazy right now. And so just the combination of all those things. And just keep in mind, you guys, when I talk about these numbers, those are gross numbers. The revenue, if you own properties, it’s usually 40, 50, 60% is what I get to keep, what I actually get to keep. But with mid-term rentals, there’s not as much turnover. For medium-term rentals, there’s not as much turnover, there’s not as much products that you need to use in these properties. So we have less kind of… And Rob, I’ve heard you mention this before. I feel there’s less wear and tear with having actual medium-term rentals in my specific place. So yeah, it’s been fantastic this last couple of years with just the growth.

Rob:

For sure. The wear and tear aspect of medium-term rentals. When I first started doing it, I was doing it incorrectly, because I was really only cleaning after that guest checked out. So if a guest was there for three months and we cleaned it, it was a disaster. But now what I’ve done is, I send cleaners in every month now to do a checkup, and to fix anything that I might like to… Basically, point anything out that might need to be fixed. For example, my cleaner just went over to one of my mid-term rentals last week. And there was a mailbox that’s attached to my house that was just on the ground. And she was like, “Hey, this is broken.” And I was like, “All right, I wish the tenants would’ve told me that.” So sent my handyman. So it’s a good way to help avoid some of that wear and tear. Do you have anything like that that you do for your mid-term rentals, or do you just let them play out their entire lease?

Jesse:

Yeah, man, there’s a lot of things we do for the mid-term rentals. So going back to the contract, connecting with agencies, and maybe we can drop in this in a second. But we have car rentals. So a nurse can literally hop on a plane, end up in San Francisco or Oakland, get an hour Uber into Modesto. As they check in, they have a car in the garage waiting for them. We had a grocery delivery service to clinicians or resident doctors that are there, we’ll actually go deliver groceries that they want. Kind of a shipped in Instacart before that, we were doing that. We’re still doing that now. So literally all they would do is work, and we were supplying literally everything they needed from point A to point B. And I think this is where you start building relationships with the recruiters of these agencies.

Their jobs are to place people in these specific jobs, and if I’m able to be a person that solves problems for them, then they’re going to use me every time. And that’s kind of what happened with me with a company called AMN Healthcare. I was able to see the needs, and then I solved the problems. And then I became that go-to guy for this specific market. So everything just kind of snowballed, like I was mentioning before, being able to grow so fast. And it’s doing things different. Most people are not intuitive in that way. They’re not going to go out of their way to build something that way. And for me, it’s like, how do I make these jobs easier for the recruiters?

Rob:

That’s really cool. So you’re a very turnkey solution basically. You’re not just housing, you are also transportation, and effectively food. And I think obviously there’s a lot of value there. It’s really, really smart. A lot of hosts and a lot of people in this space tend to really just stop at what they consider to be their “job.” But this really does seem to provide a solution. So if you wouldn’t mind, can you walk us through a little bit how you structure your business?

Jesse:

Yep, yeah. So I’ll kind of break things down for you. So again, going back to the needs. The needs of these clinicians are… So for you guys that don’t know, or anybody listening to this right now. If you just go on expedia.com, and you just type in the cheapest car you could potentially get, which is like a Geo Prizm. Do they still make Geo Prizms? I don’t know if they do or not.

Rob:

I don’t think so.

Jesse:

They don’t make Geo Prizms. But anyway, the smallest compact car is literally going to be like $1,800 a month. I had at that time, a 2012 Civic that I would rent for a $1,000 a month. So my payment was literally 180 bucks, you guys. So I was renting that car, renting that property. And then we’d also do the grocery delivery. So my cleaning crew, because I had short-term rental after that as well. So we already had these cleaning crews that were doing stuff. So we just applied them to pick up the cars, drop off cars, go in and do maintenance in the properties. Clean them weekly, monthly, pick up grocery services. If they wanted specific kind of oat milk. I know that we were talking about milk earlier, you guys. So they would literally go get all these things that these clinicians and doctors are very specific on what they eat, what they… so it’s very specific.

So we would go out and do all these things, so that these folks would literally go back to the recruiters and say, “Holy smokes, Jesse literally takes care of everything.” So once those recruiters find out about that stuff, that’s where I’m actually building market share with these actual companies. And I’m actually building a business that I don’t need to rely on Airbnb. I don’t need to rely on Furnished Finder. I don’t need to rely on all these people. I am creating my own business. And if I eventually want to sell my properties, guess what I get to sell? Not only my tangible real estate, but also my contracts, my actually legitimate business.

So I think that a lot of people think about real estate, and they’re just like, “Oh cool, this is just like a tangible house or a property.” But there’s other things that you can actually build that make it a business. And that’s being one of them. And again, David and Rob, if I didn’t have the 18 years of healthcare experience in that sales background, I would’ve never been that intuitive to think that way. I think a lot of people have jobs now, whether you work at AT&T, or you’re a drug rep for a pharmaceutical company, everything goes back around customer service, essentially everything. The easier you’re able to make somebody’s job, the better you’re going to be able to do in the outcome.

Rob:

So can I just ask a little bit more on the logistical side of this? Because I know a lot of people, they have to be wondering. So you talk about the Instacart thing, you talk about the transportation. The actual logistics of that. Is the client or the travel nurse, are they actually renting that vehicle from you? Is it a different business than the actual business of the home itself? Are you renting it via Turo? How does that look? And then I’ll get to the Instacart question here in a second too.

Jesse:

All right, cool. Yeah, we ended up actually getting an umbrella policy that covered both the property and the cars. We have two separate businesses. So I have my AirVenture, which is the hosting company, and then we have another company that actually handles all the vehicles, so we weren’t intertwining the two things. And then we had an umbrella policy that covered literally both businesses, and both businesses were under that policy. So that was the difficult thing is getting people from other states to get coverage in California. And for those who don’t know, if you drive a car in California… If I got in your car right now, Rob, and you’re in California, I’m literally covered to drive your vehicle. That’s how California state law is.

So we ended up getting an attorney, paying thousands of dollars to get this coverage so that I’m protected, and whoever rents the car is protected as well. And then we had them buy their own supplemental insurance, which was a short-term insurance for that specific car. So we were covered on three different angles. And for anybody thinking about doing that now, you can literally do that with Turo, which is Airbnb for cars. That’s literally what it is. So you can essentially do the exact same thing that I’m doing, and not to pay the thousands of dollars, but just pay Turo, what is it? 20 or 30% of the daily revenue or the revenue of that vehicle that it’s rented out.

Rob:

I think it’s anywhere from 10 to 30% depending on how much coverage you’re looking for. Okay, so on the Instacart side, this is just really interesting. I’ve really never heard of this angle. Is that something that, do you provide some kind of form or some kind of survey that’s like, what are the kind of foods you like, and then I’m the one that’s going to physically order it for you? Or do you just give them I don’t know, a promo code that gets the money off of their first delivery? How do you set that up?

Jesse:

Yeah, we use Typeform, I don’t know if you guys ever heard of a company called Typeform. So you could basically essentially put any type of questionnaire that you want, and we would formulate all the things that they like, what they don’t like, from Typeform. So whether it’s dairy, meats, a specific kind of meat, they would be able to put all that stuff. And I think it was 14 questions that were asked around food. So they would literally put what was in there. My cleaning crew would then go out, pick up that stuff, drop it off, and we would charge a $45 delivery fee specifically for that, which is including time.

So essentially, we weren’t necessarily making very much off of that, but what we were doing is creating that business mindshare with the recruiters, the agencies. Because these recruiters and these nurses, they’re very well-connected, especially the first time they’re coming in. So they’re going and just telling them like, “Hey, this company’s taking care of everything. We want to use this guy, we want to use this company. Or the next nurses that are coming behind me, you should refer them here too.” So even if there’s a company that doesn’t do contracts, where these actual agencies are paying me a specific amount, they’re at least giving the referral to these nurses. And that’s exactly what I was going for at that time.

Rob:

All right. So you’re talking about the contract aspect of this. Walk us through getting a contract. Because obviously you worked at a hospital, and you walked into the HR like we talked about. But the everyday person can’t just… I mean, not without being escorted out by a security. But they can’t just walk in the hospital, and go into the HR department. So how can the everyday person go about snagging a contract like this?

Jesse:

An everyday person can go into the hospital and knock on the HR department, first off, you can definitely do that.

Rob:

Okay.

Jesse:

But the smarter way would be to just call the hospital, ask for the HR department, and just say, “Hey, can you tell me what agencies you’re working with that are on the healthcare side? Is there any specific companies you’re connected to?” And secondary, “Is there a recruiter that’s attached to you guys, that you guys need for housing?” I’m just giving you an example. I own, I’m going to say five properties in the specific market. I want to be a solutions’ provider specifically for them.” Nine out of 10 times, we’ll have a HR department that will say, “Yeah, we use one company, AMN Healthcare or Trustaff, whatever those are. And our recruiter is Barbara.” I’m going to use Barbara again. Cool. That gives me some really good information. Now guess what I could do? I can literally call that company.

I can talk to Barbara and say, “Hey, I got referred to you from DMC. They’re telling me that you guys are connected. I actually have properties here. Is there a way that you and I can connect and actually create a contract for these clinicians to come?” And if they don’t answer you that way, guess what I can do secondary? We’re talking about business, right? I can now go on LinkedIn, and I can connect directly with that company, connect to Barbara with her last name on LinkedIn. And there’s my backdoor into getting this specific contract.

Again, everything’s about building relationships. And you got to think about it just like if you’re dating, everything’s very slow. It takes time, it takes energy, it takes consistency. But once you do that, and you’re able to build an actual contract with these agencies, you can get paid every time. You get paid up front, sometimes three months at a time. So first, last and deposit. And you can really actually build a legitimate business. And these agencies will go to you every single time, and you don’t have to rely on Airbnb. Again, we talk about Furnished Finder, we’ll dive in on a bit. But you can just actual build a legitimate business this way, by just literally building relationships, which is not an easy thing to do, but it’s possible.

Rob:

So I’ve heard you mention LinkedIn a few times on your channel, and I know that this is something that you do with connecting and everything like that. Do you ever advise anybody that’s wanting to go the LinkedIn route to get a LinkedIn premium subscription? Where they get the, I think it’s called an InMail, that allows you to just send a message to somebody without them accepting your connection invite? It’s been a while since I’ve been on LinkedIn obviously, but I think that’s about right.

Jesse:

Yeah, when I first started, I didn’t use that. You can send a message directly. So if I wanted to add David on here, I would be able to write, I think it’s like 500 characters. So I’d be able to say, “Hey David, my name’s Jesse. I own seven properties in Modesto. I just want to let you know that I talked to Barb over at DMC,” whatever, yada, yada. And that’s the other thing too. I’m creating instant credibility by that name, they already know that person, they work with them in the hospital. And they’re nine out of 10 times likely to actually read my email, because I’m name-dropping somebody that they connect with on a regular basis. That’s a warm lead, folks, you absolutely want to have those. If you have a cold email or a cold draft email, it’s harder to get across to those people.

So for me, that was how I built my business is just kind of talking to these clinicians. And we can all do it now on Furnished Finder, there’s something called the unmatched leads. And this is going to be a good tip for everybody listening right now. Take note of this. If you get on Furnished Finder, there is leads that come in, and there’s unmatched leads. All you have to literally do is pick up the phone and dial every single one of those nurses, and let them know what you’re doing. Ask for their recruiter and what agency they work with. And that’s literally how you could build your business for free. You don’t have to pay anything to do this. You can literally do it for free. So that’s another way that folks can get into this space by going after these agencies is by going on Furnished Finder.

Rob:

I need some clarity. When you say agency, like you said, “Call the HR department at the hospital, and you say, Hey, what agencies are you working with?” Can you just clarify what kind of agency are you talking about? Like a staffing agency?

Jesse:

Yeah, so every hospital does not have enough clinicians to meet the demand of patients. We talked about this a minute ago. Central Valley doesn’t have enough clinicians to meet the demand for patients. In the Central Valley, David, you might know this, there’s a lot of high acuity patients. Which means a lot of folks here are sick, compared to the Bay Area, it’s worse than the Valley. There’s just not enough nurses to meet the demand, so these hospitals have to outsource to be able to bring more clinicians in, and they have to outsource with agencies. And those hospitals typically have contracts with, say, AMN Healthcare, which is national or huge. Trustaff, which is another big giant company. Aya Healthcare is another big giant company. They’re national.

So they’ll have one recruiter or two recruiters that literally the hospitals will deal with. So if the hospital gives you that information, then you can now reach out as a third-party person and say, “Hey, I just got your information from the HR person at the hospital, here’s her name. How do I connect with you? How do I build an actual business? Or how do I actually build clientele with you guys? What is it that you need, or how can I assist?” And I think that’s where asking the right kind of questions, and making sure that you’re a go-to person for them. If you have multiple properties in the market, that’s better. I usually tell people, “Go deep, not wide,” which means you want to have a lot of properties in one little market, as opposed to being spread out so far. Agencies like to deal with people that have more properties in one specific space.

Rob:

Yes. So are you basically saying they want to know, “Hey Jesse, when I call you, I need you to have something available?” And so if you keep saying, “Oh, all my places are completely filled up,” they’re less likely to call you because it’s sort of a crapshoot with you, right?

Jesse:

Yep. Yeah. So most agencies will look at you, if you have five or more properties, you become on their preferred provider list. You’ll actually become like a preferred vendor. And that’s what you want to be. You want to be a preferred vendor. Not only on the healthcare side, we didn’t even dive into the insurance side of stuff. But that is what’s going to solidify you as being an actual true player in that market. If you have a one-off property here and there, you’re going to get bookings, I’m not going to say you’re not. But if you have that portfolio of five or more, there’s tremendous more upside of being that number one person that they go to on a regular basis.

And I’m seeing this more and more, where these agencies are now leaning towards, if you don’t have five or more properties, don’t contact us. That’s literally what they’re saying. So anybody’s looking to invest, you got to have multiple doors, and build an actual portfolio. Well, think big from the very beginning. Cool, I’m going to have my first door now, but in two or three years, or one year, I’m going to have five. And you build in that specific market.

David:

I want to ask you about how you choose the market, because I think you made a very good point, is in that, this is not a thing that you can casually step into, which at one point, it was. And so a lot of people hear the success stories from someone that says, “I bought a property in X city, and it does great.” And then they go, “Oh, if I buy a property in X city, mine will do great too.” And then you find out the competition is more fierce. They have a headstart on you. If you can’t get in with, like you’re saying, a minimum of five properties in some markets, it’s not everyone. But in some, it might not make sense. Probably the areas where there’s the most competition, where you’re making the most money.

That’s a very smart and helpful point, I suppose I would say, for the listeners who are like, “Oh, I was about to go buy one in Topeka, Kansas, maybe I shouldn’t. I need to look into it deeper.” What about the specific property? I don’t want to go too far down this, I just want to ask before I forget. Are you always renting to one nurse? Is it always a one-bedroom property that’s best? Or are there times where having two or three bedrooms in the same property is actually beneficial?

Jesse:

David, that’s an awesome question. So for me, I stick with two bedrooms and above. Any savvy investor, any intuitive investor is always going to have an exit strategy. And for me, that would be mid-term first, short-term secondary, long-term being last. That gives me more exit strategies. The more beds that I have, the more opportunities that I’m going to have. Most of my clinicians are coming in groups. They don’t come by themselves. There is a lot of clinicians that come by themselves. But I’ve been seeing over the last five years, millennials travel in groups. They’ll go to the Bay Area, work for three months, and then head to Ibiza for a month. And literally that’s the culture of this healthcare industry. It’s been changing over the last… I’ve been doing this since 2015, I’ve watched it change.

So for me, if I’m able to put more people in a property, that’s going to give me more opportunity to get paid more. And not only that, but I can house… I’m nicheing things down even more. Because most people will, exactly what you said, David, will get a one bedroom or a studio. But again, going back to what we were talking about a second ago, you got to diversify your portfolio, whether that’s a one bedroom, three bedroom to be able to serve multiple different people and clientele. But for me, it’s always been serving more people than just your typical one-off nurse.

David:

So getting a two bedroom or a three-bedroom property isn’t overkill, because sometimes they travel in groups. Which actually makes sense. If you got to move into a new area that you don’t know anything about, you don’t have any friends, you’re going to feel more comfortable doing that with other nurses you can relate to.

Jesse:

A 100%. And they’re already booking together. So when I talk to recruiters, I’ll say, “Hey, who do you have that’s coming in a group? Who do you have that’s coming with their wife or their children?” Especially during COVID, we saw this a lot. And you want to be able to house those people. And if you only have a one bedroom, you can’t, you’re not going to be able to get that extra income. And agencies want to group people together, that’s kind of why they connect. And a lot of times, doctors will actually travel with their families. So we got to contract with UCSF. And I’ll give you as an example. It’s a doctor that came from Europe, him and his family. He’s got two kids, a dog, a wife, and they’re staying in a property in San Francisco. And that’s what they do, they’ll pay. And they’re paying 14 grand a month for a property in San Francisco. They’re not paying, the agency is actually paying.

And the cool thing about the agencies is you can actually get these agencies, they can be the lessees on these properties. So in San Francisco or Central Valley, who you worry about, holy crap, there’s squatters. I don’t worry about that too much, but a lot of people do. These agencies are actually the lessees. And these are multimillion-dollar agencies, there’s no way they’re ever going to screw you over. And that’s one of the things that I love about this space, too, is that they’re taking responsibility for the clients that are there. They’re taking ownership for that. Any damages, the agency’s actually paying for it.

David:

That is so smart. So smart. Because you’re not going to have a hospital that wants to take you to court and potentially be sued, as much as you might have a individual that would be willing to roll the dice. It’s very similar to the advice I tell people who buy in college towns, and they rent out to the students. I say, “Don’t put the student’s name on the list, put their parents’ name on the list. You’re definitely reducing your risk by taking that approach.” So we’ve talked about the way you get the contracts, the type of properties to look for, the level of commitment that you recommend before someone gets into certain markets. Let’s talk about the actual market that you target, and why you target it? So what can you tell me about that?

Jesse:

Yeah, so this is perfect. This is the bread and butter of this conversation, you guys. So anybody looking to get into a market, here’s what I suggest you do. There’s hospital levels. Each hospital has a Level 1 and Level 2 hospital. These are like what you typically see on ER, Grey’s Anatomy. You guys have all seen that, I’m assuming, right? It’s this high acuity, lot of… Rob watches that all the time. So you’ll have these high acuity doctors that are there, brain surgeons, literally there’s on-call people. And I usually say, “Look for a hospital that has 300 or more beds. And that is not including labor and delivery beds.” These hospitals are going to have way more turnover. So if you look in the Bay Area alone, there’s probably, I’m not kidding you, probably like 15 Level 1 hospitals. These are massive. So they have a lot of people coming in and out.

So Level 1 and Level 2 hospitals are very similar. Level 3, Level 4, and Level 5 hospitals. Those types of hospitals are more rural, and they also have a lot of clinicians that sometimes come into these markets. So you’re going to want to look at what the level is. It’s going to give you a better insight on how many beds they have. It’s going to tell you a little bit more about how many clinicians are actually traveling there. Like UCSF, Dameron Hospital in Stockton, these big hospitals have a lot of people that come in and out on a regular basis. They need to have more clinicians to meet the demand of patients. In California, we have to have two nurses to one ICU patient. So you have these ratios that come into play, too, which means that bigger hospitals have more clinicians that are going there.

So look at that first. Call the hospital if you can’t get that information. It’s all public knowledge, you can look it up. But just call and say, “What level of hospital do you have?” One of the other things that I do, too, you guys, is I’ll actually go on indeed.com. And if you guys are all listening to this right now, you can do the same exact thing too. Go to indeed.com, type in Hayward, California, and whatever, travel RN, travel registered nurse. And you’ll literally see probably, I’m not kidding you, 30 or 40 different companies that are hiring for those specific people. That’s going to give you a mindset that, okay, cool, here’s a demand in my market. This is actually legit. This is today, right now, information.

Then I can go on Furnished Finder, and I can see what the demand is on that side. So furnishedfinder.com/stats will actually show you how many clinicians or how many people are actually looking for property in that market. So you have these two different angles. You have the factual data from Furnished Finder, right? And then you have the Indeed or Monster jobs, which is actually people hiring for travel nurses right now. And you can pick up the phone, and that’s another way to get contracts right there, is literally just by doing a simple, free Indeed search.

Rob:

I mean, it seems like you’ve got basically all these different I don’t know, places that you’ve kind of found on your own organically. Are there any other creative ways for getting some of these contracts or clients into your business?

Jesse:

There’s so many creative ways, man. Yeah, I can dive into a lot of them, the healthcare is one of them. So you guys know what Dave & Buster’s is, I’m assuming, right? You guys know what that is?

Rob:

Yes.

Jesse:

So they were building a Dave & Buster’s in Modesto a while back, about two years ago. I saw a construction truck. I literally went there and took a picture of it, called the company and said, “Hey, where are your guys staying that are working here?” And they were staying at Holiday Inn Express. There was five rooms that they were paying for. It was a $1,000 a day to have these five dudes working at this place. They were all engineers, by the way. So I just called that agency and said, “Hey, I can rent you guys a property for $7,500. They can house all your people there.” They’re literally going to be saving thousands of dollars. So there’s different ways of doing things. You guys have all heard of Extended Stay hotels?

David:

Mm-hmm. Of course.

Jesse:

Okay, cool. So if you literally just drive by there at 7:00 PM at night, and you take pictures of all the work trucks. Extended Stay hotels have literally massive contracts. They’re like the number one contracted agency with construction companies, stuff like that. All you got to do is literally pick up the phone, take pictures at 7:00 at night. That’s when the dudes are back, or people are back at the place. And you just call those companies in the morning and say, “Hey, I noticed your work truck out there. I have properties here. Can you tell me how many rooms you guys are renting? Did you guys contract with other people? We have a safe, comfortable house that can house all your people that are working right now. I can save you money. What are you spending right now?” You just start finding out information about these companies.

And again, this is the intuitive side of things. If you think outside the box, you’re going to be able to build a business. And I think a lot of times, people don’t necessarily think that way. And these are creative ideas and ways that people can literally start building a six-figure business relatively pretty quick, by literally just taking the time to call somebody and ask questions.

Rob:

That’s good, man. I love it. I love it. All right, so I don’t want to go down too much a rabbit hole on this, but you did say something that really sparked… I mean, we could do a whole nother episode on this, I’m sure. But you did mention, even outside of the medical industry, you talked about the insurance industry. Can you give us a little brief rundown of what you meant by that, what that means, and that entire side of the MTR business?

Jesse:

Yeah. So medium-term rentals in the insurance companies, so folks that are displaced from fires, floods, or any kind of catastrophic event. And just by the way, you guys, every 88 seconds in the US, somebody loses their property due to a fire, flood, or something like that. There’s a lot of these claims. So there’s companies like ALE Solutions, DAN Housing, these are two large scale agencies. And what they do is, if somebody loses a property, they have to relocate them right away. And a lot of times, just like we talked about with these construction workers a while ago, families are literally renting two or three rooms, and they’re paying thousands of dollars to… these companies are paying thousands of dollars. Families want to be comfortable, they want to be in a place that they know, that they feel like sharing. Two different rooms doesn’t work necessarily all the time.

So for me, this is something that’s been really growing for me too, you guys. I’m actually renting properties right now in the Central Valley and in the Bay Area from four to 5X what the long-term rental rate is, and I’m not kidding, this is legit. Because these agencies are actually paying, it could be 10% of the property value that they lost per month. So if somebody has a million-dollar house, they’re paying 10% of that per month on housing for them. That’s over 10 grand a month that they’re specifically paying for these properties. So that’s a huge play. It’s been something for me that’s been able to grow tremendously. With just two properties, I can cash flow 10K a month off just two insurance claims.

And all these things that we’re talking about a second ago, building relationships, connecting with these folks. There’s somebody called a relocation specialist, and you guys can all go on LinkedIn right now, and you guys can all look up these people. Relocation specialists are basically the bird-dogs for these families to find another property. So if you connect with them, you build rapport with them, they’re going to send you these clients relatively… not necessarily easy, but it’s about building rapport, building relationships with them. So for me, man, that’s been a game changer, going from the healthcare side and being able to serve multiple different clients.

You don’t want to put all your eggs in one basket, right? You want to have multiple different avenues or avatars to go after. And I think for me, the insurance side and the healthcare side, those two together, they work beautifully. And you can make a substantial amount of income from those.

Rob:

Can you clarify really fast? You said 10%. Does that mean if on a million-dollar house, roughly they’ll give you a $100,000 a year for a housing allowance?

Jesse:

Yeah, every housing allowance is going to be different. But yeah, so that’s how you can look at it, a year. If the family lost a million-dollar property, they’re going to be able to give you a $100,000 for that year. So that’s what we’re kind of looking at right now is… And when you talk to these folks, they’ll tell you. I had ALE Solutions tell me, “We pay 10% of the value of the property per month.” So again, if it’s a million dollar, they’ll split it up in 12 months, and give you that amount. So for me in the Central Valley, I have properties that are 1,500 to 2K a month, and we’re renting it for 8,000. I’m cash-flowing literally 5K a month from one property.

And people are doing this all over the US in a lot of different places. David, here in the Bay Area, same thing. Most properties are over one million, one, 2 million. So these companies are paying 14K, like I mentioned, in San Francisco. 9K in Oakland. Berkeley, we have 11K. So you can get substantial income, even in markets that are urban, that are more expensive. And that’s through building relationships.

Rob:

Jesse, on working with these insurance, I guess relocation specialists. Are there any tips that you might have for building rapport with them? Is that the same level of… I mean, do you do the same type of stuff for the insurance relocation specialist, as you would do with the medical HR department and agencies?

Jesse:

Yep. So what I typically do is, I’ll get on a call with them and I’ll say, “Hey, do you guys have five minutes, that I can have a conversation with you and your entire staff?” And they will say yes or no, or whatever. So I want to get on a Zoom call with them. So what I’ll do is I’ll… Actually, we have this beautiful thing in this world called DoorDash, you guys have heard of that? So I’ll actually find out what office they’re working in. I will find out every single person that’s working in that office, what their name is, what their favorite Starbucks drink is, how hot they like their Starbucks drink. And I’ll literally order Instacart or DoorDash food to them, get on a five-minute presentation, talk about my properties. I will literally have everybody’s email, favorite Starbucks drink, and that’s how I’ll build my business.

It’s almost like you’re meeting somebody in-person, but you’re talking to them over the phone. So for me, that’s, again, going in thinking intuitively, you guys, is not a lot of people think like that. Me coming from my background of being in healthcare and this is what I did for a living, it’s the same kind of concept. You want to build relationships. You want to be cute but not forgettable, right? You want to be somebody that they’re not going to forget about. And I promise you now, most people listening to this, those relocation specialists aren’t getting Starbucks drinks. People aren’t buying them Dunkin’ Donuts, we’re thinking different. We’re building a business and a brand. And I think that at the end of the day, you have to think about those things. And just get five minutes. That’s all you need is five minutes with somebody to talk about what you’re doing, and how you can help them.

David:

I want to highlight something I think you’re doing so much better than other people that have not had as much success. It comes down to the mindset and the approach you’re taking. Because you’re approaching this as a business, not a replacement for work. So many people get into real estate investing because they don’t like their job, and they’re like, “All right, I just want to get a couple of houses, and never have to work again. Once I’ve bought the properties, I’m done.” And that may have worked at one point in history when there was less competition, but there are so many people looking for yield, as rates have been kept very low. There’s not a lot of opportunity. Everyone’s hearing all the YouTube videos and Instagram Reels of, “I don’t want to work anymore. I do this thing.” It’s not a secret. It’s out there. Now you got to be better than other people.

And what you’re describing are fundamental techniques that worked in your sales role at the previous jobs you had. You are applying them to your real estate business, and you are having more success than other people that are doing the same. Rather than saying, “I don’t want to have to email someone, I don’t want to learn their Starbucks drink. I just want to buy a house so I don’t have to.” That subtle approach, taking a skill you had in one area, applying it to real estate, has probably made you 10 times more successful than the other people that could own the same properties you do, that could listen to a podcast like this.

You’re describing it so clearly, and it really is simple. It’s not a complicated strategy, but it isn’t easy. It doesn’t just fall into your lap, right? You got to do a little bit of work, learn their Starbucks drink, learn what Instacart is, learn what DoorDash is, learn how to use Zoom. Have a clear delivery when you go to this half-hour meeting that you explain what properties you have. You probably have a slideshow that’s prepared, or something that they can see pictures of what they look like, so they can feel comfortable here.

In my opinion, the future of real estate investing looks more like what you’re describing, than what it’s looked like looking back over the last 20 years, which was buy it, set it, forget it. Now is going to require an active role if you want to stay on top. And we should be very grateful for that by the way, because if this wasn’t the case, Blackstone would buy every single property and push us all out of it, and we wouldn’t be able to have a business anymore. It’s these detailed nuances that allow us to compete with the big dogs. And that is why podcasts like this are so important, because you can learn these sorts of techniques that worked in other parts of business, that will also work in real estate.

Okay, Jesse, you’ve mentioned Instacart, you’ve mentioned offering rental cars, everything you could do to make this convenient. I also, I keep highlighting everything you say. That’s good. It’s brilliant. You’re talking about customer service. You’re not saying, “I want to buy a property so I don’t have to cater to people.” You’re saying, “I’m going to buy a property, and cater to people through that property,” which gives you an edge. What other amenities can people be thinking about, that will improve their odds of being successful? Is design super important? Are there little details or things that can be left in a house that will improve the actual experience a person’s having, so that they go to their HR department and say, I loved it, I want to stay with them again? What are you doing?

Jesse:

Yep, yeah. So there’s two things I want to highlight here, David. As more regulations come into place from the short-term side, you’re going to see more investors looking at the mid-term rental space. Right now in the US, only 3% of the entire US is regulated by short-term mental regulations in municipalities, 3%. I was just reading a study, it’s expected to actually triple this year. So you’re going to see more people that have these beautiful, sexy, Rob, like you, Airbnbs that are going to get regulated, then what are you going to do next? Oh, I’m going to mid-term it. So you’re going to start seeing a lot of these properties come into this space that are beautiful, sexy, that have all these cool things in there. But at the end of the day, you want to be very thoughtful and insightful on design.

Most places on Furnished Finder, and everybody listening to this right now. If you go on Furnished Finder, it looks like most properties on there look like it was a hand-me-down, somebody lost their family member and they decided to put that property, grandma’s house on Furnished Finder. Literally, that’s what they look like. So right now it’s a competitive edge where you can have a pretty decent looking property. It’s not a crazy Airbnb, that extreme experience, but you still have a place that is done up well, and you’re probably going to do well. So you want to make sure you design it with intuition as far as what kind of clients you’re going to go after. If you’re going to have nurses, you want to have blackout curtains. David, you brought this up a minute ago. Nurses work from 7:00 PM to 7:00 AM, they work the graveyard shift. Guess what they’re doing during the day? They’re sleeping. So you want to have blackout curtains.

Box fans are really important. I’ve had so many requests for box fans, we have those in all of our properties now. Noise machines. Just stuff that’s simple that people… If you’re in an urban market, there’s a lot of car noise, things like that. A lot of these clinicians come from the Midwest or different parts where they’re used to sleeping in this absolute quiet stillness. And without box fans or those kinds of little simple things, it’s going to be important for them to have. And plus that’s another added little touch to those specific properties. So those are just small little things that I would say, really think about the design, and think about the little amenities that are going to help them sleep at night or during the day.

David:

As a former police officer, who also had to sleep during the day for much of my career. I can say with a resounding yes to everything you just mentioned, the box fans are huge. It’s hotter during the day, so it needs to be cooler. And they may not want to run the AC or may not be able to get the room cool enough to be able to sleep, and it drowns out all the noise. And I still have blackout curtains in my room because it was so hard to sleep when the sun was up. So these are things that set you apart from the competition, that can only happen at the micro level. That’s what’s so important if I think about the information you’re giving, and the strategy you have. Is it’s micromanaged, which puts the power in the hands of the investor, as opposed of the huge freaking corporation that can go buy 3,000 properties in every major city, and just try to push us out so that we can’t make a living like this.

Jesse:

Yeah. Well, David, there’s actually REITs like Greystar. All these big companies are actually in the medium-term rental space. I don’t know if you knew that or not. Over the last six months, they’re actually allocating a certain amount of properties. And all saw this with the Airbnb, right? They’re allowing mid-term, medium-term rentals in their property, so they’re actually doing the same exact thing as that I’m talking about here, just not on that super intuitive level. So we’re going to see more and more of this happening. And eventually, one day, my goal is to have such a big, big portfolio that smart institutional money comes in and buys my property, and they buy my book of business. That’s something to think about. That’s my exit strategy, for me thinking later on, is I have…

I was talking to a friend… I’ll talk about this real quick. This guy owns 200 doors in the Midwest. I’m literally making just as much as he is with 200 doors with literally 10 properties, literally 10 properties. So if you do things the right way and you’re really intuitive about it, you can make a pretty substantial amount of money. It does take more work though. Dave, you mentioned it perfectly. It takes more work, and most investors are not willing to put in that work.

Rob:

All right, Jesse, I have so many more questions, but we are getting towards the end here. But I’m sure that one of the more common things you hear are the squatters, the squatters, Jesse. I see those comments all the time, on mid-term rental and medium-term rental comments on YouTube videos and on threads. Do you make your tenants, whether they’re through Furnished Finders or through Airbnb, do they all still have to sign leases?

Jesse:

Yep. Yeah, they absolutely have to sign leases. And we have addendums that say that they’re there for a specific amount of time. That they’re not considered long-term tenants, even though they are there for over 30 days. But again, go back to what I talked about earlier, you guys, most of these contracts that I get, these agencies are the lessees. So I don’t have to necessarily worry too much about. And these folks are professional too, by the way. You’re not going to have a nurse that’s going to squat at your property. You’re not going to have guys that are working for Dave & Buster’s, these engineers. They’re not going to just be like, “Oh, we’re not going to pay.”

So I think you got to screen people just like you do with long-term, see, exact same kind of concept. I think people just take this to way an extreme in a what-if scenario. And most of the time, this doesn’t happen on a regular basis. And it can. Yes, it can, but you got to protect yourself in a way that if you can get these agencies to be the lessees, awesome. But you just got to do regular screening that you typically do with every other tenant that you have.

David:

I would bet it’s less likely to happen with a medium-term rental than even a traditional rental.

Jesse:

Right.

David:

Right. Because that’s someone who has something to lose. They don’t want to screw this thing up with the hospital. They don’t want to get the hospital in hot water by refusing to leave. They don’t want to lose their contract to go work there again. These traveling nurses, if that’s who you’re renting to, can make really good money. Especially in Northern California. I would guess that Northern California wages are probably higher than anywhere in the country, outside of maybe specific niche markets like Manhattan or something like that. So whenever you’re renting to someone who has something to lose, the odds of being taken advantage of like that, significantly decrease.

Jesse:

A 100%.

Rob:

It’s funny. It’s just, when people make content about long-term rentals, no one is ever commenting a thousand times, “But what about the squatters?” I mean, it’s a problem. It’s something that could happen in literally every real estate asset class that exists, not just mid-term rentals. But I just feel like that’s always the biggest fear.

David:

It’s the new, what do you do when the toilet overflows?

Jesse:

Yeah, I agree. Yes, I’ve heard more people with Airbnbs that have had these issues than mid-term rental operators. I mean, I’m not worried about it, I’m just not.

Rob:

Okay, so long-term rentals are, what do you do if the toilet overflows. Mid-term rentals are, but what about the squatters? And then Airbnb is, but what about an LLC? Do I need an LLC? Those are the three main questions I hear in all of real estate.

David:

Toilets, LLCs, and squatters have cost people more money than anything else that I know of, in my career. Those concerns about toilets, yeah. There always is going to be a challenge, but you have to learn to enjoy the challenge. Because if it wasn’t for the challenge, you wouldn’t have the opportunity. If it was super easy and nothing went wrong, people with more money than you, would’ve already stepped in and taken all the opportunity, and there’d be nothing left. It’s these little tiny paper cuts that are annoying that stop people from being able to do it at scale. And so as the mom and pop investors, the people that are listening to our podcast, that are all trying to find financial freedom through real estate, are looking for opportunities.

You actually should be attracted to and drawn to the obstacles to success that you may find, because that means you are going to have an opportunity. Where if it becomes too easy to do it, you will be pushed out. And we’ve seen this over and over and over through so many different industries. I actually feel better about something like this, Jesse, and the method you’re describing. Because it sounds safer, and it’s a more defensively sound option. Compare that to buying a 400-unit apartment complex that some massive corporation can buy, and hire one property management company to take care of it, and do nothing. That’s going to be much harder for the small person to be able to get into that space than this one.

Jesse:

Totally. A 100% agree. And you’re going to start seeing more of this stuff happen. Right now, I think about medium-term rentals as Airbnb in 2007. There’s no property management software out for it. There’s no PriceLabs. These companies aren’t necessarily making anything for it. So imagine being able to know where Airbnb is now. This is where we’re at in this space. I feel like Airbnb is in the fifth inning, right? It’s been around for a while. They’re pushing experiences now, unique properties. And going back to baseball terms, I feel like the medium-term rental space, the umpires are barely walking the field. They’re just chalking the field, grounds crew is out. That’s how early we are in the game. And the sooner that you get in, the better you build your foundations. The likelihood of you being able to succeed in the space is tremendous. And I think there’s just so much opportunity for people. And they might not necessarily see it like that, but I do. I’m all about skating to where the puck is going, and I see that, the bend is there. So that’s just my two cents.

David:

Fantastic, man. I’m glad that we had you here to share this information before anybody else heard it. This has been really good. We’re going to move on to the next segment of our show. It is the Famous Four. At this segment of the show, Rob and I will take turns asking you the same four questions we ask every guest, every episode. Question number one will come from me, and that is, what is your favorite real estate book?

Jesse:

My favorite real estate book is called Loopholes of Real Estate. That was the first book I ever read in real estate, and it was basically like tax stuff. It was how to find your first property. It was part of the Rich Dad Poor Dad series. You guys probably never heard of it. It’s not really that huge of a book. But that was, for me, my introduction to actually investing in real estate. And I kind of go back to it every now and then. So it’s called Loopholes of Real Estate.

Rob:

Awesome. And number two, what’s your favorite business book?

Jesse:

Favorite business book is The E Myth. So The E Myth, I’m sure you guys have heard of it. It is about removing yourself from your business. And that’s where I’m at in my life is, only doing the things that I’m uniquely qualified to do, and everything else is going to be delegated to people that can handle it. And that’s going to allow me more time for me to actually focus on the actual business. Because again, going back to what we talked about before, you guys. This type of business that I’m in, it’s very mindful that you have to be very intuitive with who you’re going after, what you’re going to do. So that book was extremely helpful for me to realize that I need to remove myself from a lot of the day-to-day operational stuff. And I think a lot of times, investors want to be involved in all this stuff all the time, and you can’t. In order to grow an actual legitimate business, you can’t be the guy that’s doing everything all the time, everywhere all at once. It’s impossible.

Rob:

Great book, would love to read it someday. Number three, hobbies. What do you do whenever you’re not out there crushing the mid-term rental game?

Jesse:

I play guitar. I love playing guitar, drums, bass guitar. Baseball. I’m a big baseball fan. I still play baseball even at 40 years young. I still skateboard, you guys. I can still kickflip. I have younger kids, I still go out and skateboard with them, so I stay young and hip, and still like a cool dad. So those are my hobbies.

David:

It’s always funny when we ask the hobby question of anyone that has kids. It’s like the biggest struggle ever to try to find anything to say, because I think when you have kids, they are your hobby. You’re like, “I do real estate. That’s my hobby. I freaking have kids, what do you expect out of me here?” All right. My last question for ya. What sets apart successful investors from those who give up, fail, or never get started?

Jesse:

Yep. I think grit, and having a mindset that is going to keep you going is extremely important. I think a lot of times, most of us will run into an obstacle. And you just talked about it earlier, David. Those finger cuts, those simple things that people are just like, “Oh, I’m not going to do this anymore.” It’s about being consistent. The more consistent you are, the more reps that you have, the more opportunities that you have. And I think that being able to build a business takes time. It takes energy, and it takes consistency. So if you have all those traits, that’s what’s going to make you successful. That’s what’s going to keep you going. That’s what’s going to keep you. From your first YouTube video to your thousandth video, it just takes reps. It takes consistency. And I think that, for me, is what is the most important. Because we’re all going to fail. No matter what we do, we’re all going to fail. And you have to learn from those mistakes. And you still stay consistent, and diligent, and build. I think that’s what needs to happen to be successful.

Rob:

Amazing. Well, Jesse, tell us where people can find out more about you on the interwebs, Instagram, YouTube, all that kind of stuff?

Jesse: