David:

This is the BiggerPockets Podcast show 741.

The reason you’re feeling bad is might be ego. You’re looking at other investors that are making money. You’re looking at your balance sheet every month and you’re saying, “Well, I’m losing money. I’m doing it wrong.” Maybe not. Maybe this is how real estate has always worked over time. It was the people willing to lose the short term to make money in the long term that worked. Now, I hope it doesn’t stay that way, but I am preparing for a reality where the golden age where you’re just bobbing for apples, you just put your mouth in there and you came out and you hope your apple’s bigger than the other apples, but you always got an apple, that could be over.

What’s going on everyone? This is David Greene here today with a Seeing Greene episode if you didn’t notice it in the title. If you haven’t heard one of these before, you’re in for a treat. On these shows, we take questions directly from our audience base. That’s right, you. I deal with the struggles you got going on, questions you have about real estate, clarity that you might need. Or when you have several options, which one would be the best? I love doing these shows and I love you guys even more for making it possible because you ask great questions, which lead to great shows.

Today’s show is fantastic. We get into what the person might be doing wrong if their property is not cash flowing right now. This is a great topic that we get into about ways that you can approach real estate investing as well as a small tweak that would make that property cash flow and how they can execute it. Should I take on an out-of-state rehab on my first deal? Things to be aware of if you’re going to invest out of state. I do a lot of that myself as well as renovation stuff, which I also do a lot of. And what you do when you can’t find cash flow in your market. Is it too late to invest in real estate? Should we stop listening to BiggerPockets and instead start buying NFTs again, cryptos, investing in tulips, buying Beanie Babies, maybe Pogs, if you guys remember that. Is that the future? Should we buy a bunch of that and wait to see if it comes back or is real estate still a good option? All that and more in today’s Seeing Greene.

Also, I just want to remind you guys, I forgot to turn the light on again. I’m really good at doing that, so as soon as this little segment ends, you’re going to see the light turn blue. Don’t get confused. It’s still Seeing Greene. It’s just going to be greenish blue. What are the colors when you mix green and blue? Is that like turquoise maybe? Seeing turquoise for the first 15 minutes and then it goes back to being green. This is just me being forgetful, guys. It ain’t easy being Greene.

All right, today’s Quick Dip brought to you by Batman is, we have a new show coming on the BiggerPockets YouTube channel where I’m going to be a frequent contributor. I’m going to be showing people how to make more money in their current job. This is something that I’m passionate about, I’m very, very into. Don’t quit something that you’re not good at and just try to find a new thing that you think you’re going to be better at without putting effort into the first thing. You got to pursue excellence in whatever you do. So if you want to be featured on that show or this one, go to biggerpockets.com/david. Write out your question and check the jobs box if you’d like to be on the YouTube channel. All right guys, that’s enough of me. Let’s get into our first question.

Nick:

Hey, David. My name is Nick Gutzman. I’m 19 years old and a sophomore at Colorado Mesa University in Grand Junction. I’m looking to purchase a single family property near my school to ideally lease the students. I’ve been consistent using Zillow and BP’s tools, but I can’t seem to find a deal with what current rates as well as supplies in my town. I’m struggling to take the next actionable step. My primary question is what are some tools or strategies you could recommend for finding a deal and what are some creative ways I could finance a deal? The lender I would likely go through told me I could expect a 7.5% rate from him. With that number, I’m struggling to find anything that pencils out and works for my situation. Thank you so much for all you and BP does. Have a great day.

David:

All right, Nick, thank you very much for the video. This is a common problem a lot of people are having, so don’t be discouraged. This is just the state of the market that we’re in right now.

Now the good news is the reason it’s so hard to find deals is because real estate is still competitive and valuable and people want to own these assets. Couple things that we can get into, 7.5% is probably a… That’s a standard rate, it’s where most people are. If you’re working with the lender and that’s what he’s telling, it’s probably what you’re going to get. If you’re trying to find a creative way to finance your deal, that just means you have to find the money from somewhere else.

There’s not a lot of people that have hundreds of thousands of dollars laying around that are going to be comfortable lending it to you for less than 7.5%, which means you’re probably only going to get that from the owner, which means you probably need some kind of owner financing, which means you’re either going to have to overpay for the property to make it worth it for them to give you the better rate you want, or you’re going to have to find a distressed motivated seller, which is going to be a lot of work, and frankly, going to be very difficult for you to do while you’re going to school. None of those sound super appealing for the situation that you’re in.

The advice I’m going to give you is that instead of looking to find a deal, I want you to look to make a deal. If you’re having a hard time getting the numbers to work on a property that you’re going to rent the rooms out to other students, you might be analyzing the wrong deal. So here’s what I’d like you to do. We’re going to work backwards from this. Let’s say that at the interest rate you’re being given at the price range you’re looking at, let’s say that you’re coming up with a $4,000 a month mortgage, which means you need to make more than $4,000 a month from the rentals. If you can get say $800 a room and you can get a five bedroom house, that now becomes $4,500. That could be enough to be more than the $4,000 mortgage. We’re assuming taxes and insurance are included in that $4,000 number. Which means your goal is to find a property that has five or more rooms.

Can you find a property that has five bedrooms but has a living room and a family room and you can convert the living room into two more rooms? Can you find a property that has four bathrooms and that has enough square footage that you can add stuff to? I’d set my search parameters to only show me stuff that has high square footage. In addition to that, I’d be looking at properties that have more square footage than is being advertised. So one of the things I do when I’m looking at houses is instead of clicking on the arrow to the right and looking at all the pictures that the agent has uploaded, I go backwards. I click the arrow to the left and I look at the back of the house first.

Now, the reason I do that is if there’s unpermitted square footage that’s ugly that the realtor doesn’t want to show in pictures, I want to see that. I want to see framing in the basement. I want to see the partially finished ADU. I want to see the extra garage on the property that has electrical and plumbing in it. A lot of people put bathrooms into their garages because when they’re out there working on their car, working on their projects, they want to be able to stop and go to the bathroom without walking in the main house. Well, once it has plumbing like that, you can finish out that bathroom and make it nicer and add a kitchenette into those properties for much less money than when you have to run plumbing and drainage all the way into that asset. So you need to look for properties like this that other people are missing.

Now, all of that being said, that might not still be enough because it looks like you’re looking in a town that doesn’t have a lot of inventory. That’s a problem. If you’re in a college town and there isn’t a lot of listings that are hitting the market right now, this is going to be tough. Part of that is because sellers are not putting their homes on the market because they’re waiting for prices to come back up. Sellers have seen, “Well, prices are down, people were selling for more before. I don’t want to sell my house for less money.” It takes a long time before they get to the point where they just willingly accept this is what a property is worth, and that frustrates buyers. So you could look in a different town and look to accomplish the same thing. Different college town that has more inventory, that’s one method you could take. Or you could use some of the creative methods like driving for dollars, skip tracing. You could look at neighborhoods and find the properties that are listed as more square footage. A lot of that’s public data.

So if you could figure out a system of finding the houses that are at least 3,000 square feet, you know they’re likely to have more bedrooms and bathrooms, you could go knock on their doors, you could call those people, you could send them letters. You could try to find an owner that is willing to sell, but again, this is not a great return on your time. The odds of finding the house that you want and then they also have a seller that’s willing to sell and they’re also going to do it at the price you want is very difficult. I know a lot of people pay money to take those courses, and this is very popular right now because deals are hard to find, so we’re out there trying to use creative methods.

What no one tells you is it’s basically like working a full-time job. Oftentimes after all the time you got to put in to make this happen, you’d have made more money if you’d just got a job and worked. So it’s not always the best method. What I do want to say is don’t be discouraged. You’re trying to do this at a very difficult time in the market. We are in a stalemate. Sellers don’t want to drop their prices because they’re not desperate yet. Buyers don’t want to or cannot pay the higher prices that sellers want, and there is not enough inventory to balance this out, so just stay in the fight. You never know when the next listing’s going to pop up.

What you want to make sure is that you see it first. So set your filter to show you only houses with at least 2,500, ideally 3,000 square feet, have more bathrooms, and then look at all the houses that come out and see if there’s more square footage in that house than what the listing actually says or that can be converted so that you can make maybe a five bedroom house into six bedrooms, plus it has a garage that can be converted into two to three bedrooms with a kitchenette and a bathroom. If you could do something like that, you can find a way to make the property work for what you’re looking to do.

All right. Our next question comes from Josh Lewis in San Diego. Josh says, “I love all your contributions to bp. You are a solid stalwart for the mission.” Well, thank you for that, Josh. “Some context, I own a property in San Diego. I have access to a large chunk of equity, approximately 350,000 to 450,000 depending on the appraisal, and I want to utilize a HELOC in conjunction with the BRRRR method to acquire my first rental property and kickstart my journey. Question, looking back on your career, if you were given the same circumstance, would you find it more advantageous to go after one larger expensive property like a $300,000 fixer upper to BRRRR in the lucrative California market? Or would you go after multiple properties, say, in the SEC football market, like $250,000 properties? For my circumstance, I’m giving more value to cash flow, but I do understand there are more factors at play here with potential long distance management, which I’ve already purchased both your BRRRR book and your Long-Distance Real Estate Investing. Thank you for your time and your propensity to educate.”

Well, Josh, thank you for your mastery of the English language. You said both propensity and stalwart as well as circumstance all in your questions here. Very impressive, my friend. All right, let’s get back to the first thing you said. Looking back in your career, “If you were given the same circumstance, would you find it more advantageous,” another big word, “to go after one larger expensive property or several smaller properties?” I don’t look at the number of properties as the way to approach this question. Now, I will say in general, less is better, because the more properties you have, the harder it’s to manage them. The more expensive they become and the more things you miss.

So I am in general inclined to buy a million dollar property over two $500,000 properties, but it’s not always that simple. I would more look at the total amount of capital that I’ve deployed, okay? So if I’m going to buy a million dollars worth of real estate, whether it’s over two $500,000 houses or $1 million house or three $300,000 houses, the number of houses isn’t where I start. What I would look at is the value of the properties I’m buying. What is the game plan here? What’s the play? I think people do better over the long term, investing in areas that both appreciate in price and cash flow, okay? It’s often framed like cash flow or appreciation, and it is isn’t true. When you’ve done this for as long as I have, you start to recognize patterns. And what you see is the areas that appreciate and value also appreciate in rents. The two almost always go hand in hand. And so cash flow grows over time just like the value of the asset grows over time.

When you buy in these cheaper markets, the $150,000 houses, it’s not that they don’t appreciate, it’s that the rent also doesn’t go up. And everybody here who bought into turnkey properties owns in the Midwest, I’m getting a hallelujah amen out of them, and they’re all saying now, “Wish somebody would’ve told me this,” because the assumption with real estate is that rents are going to go up every year, but your mortgage is going to stay the same. That’s what makes buy and hold so powerful.

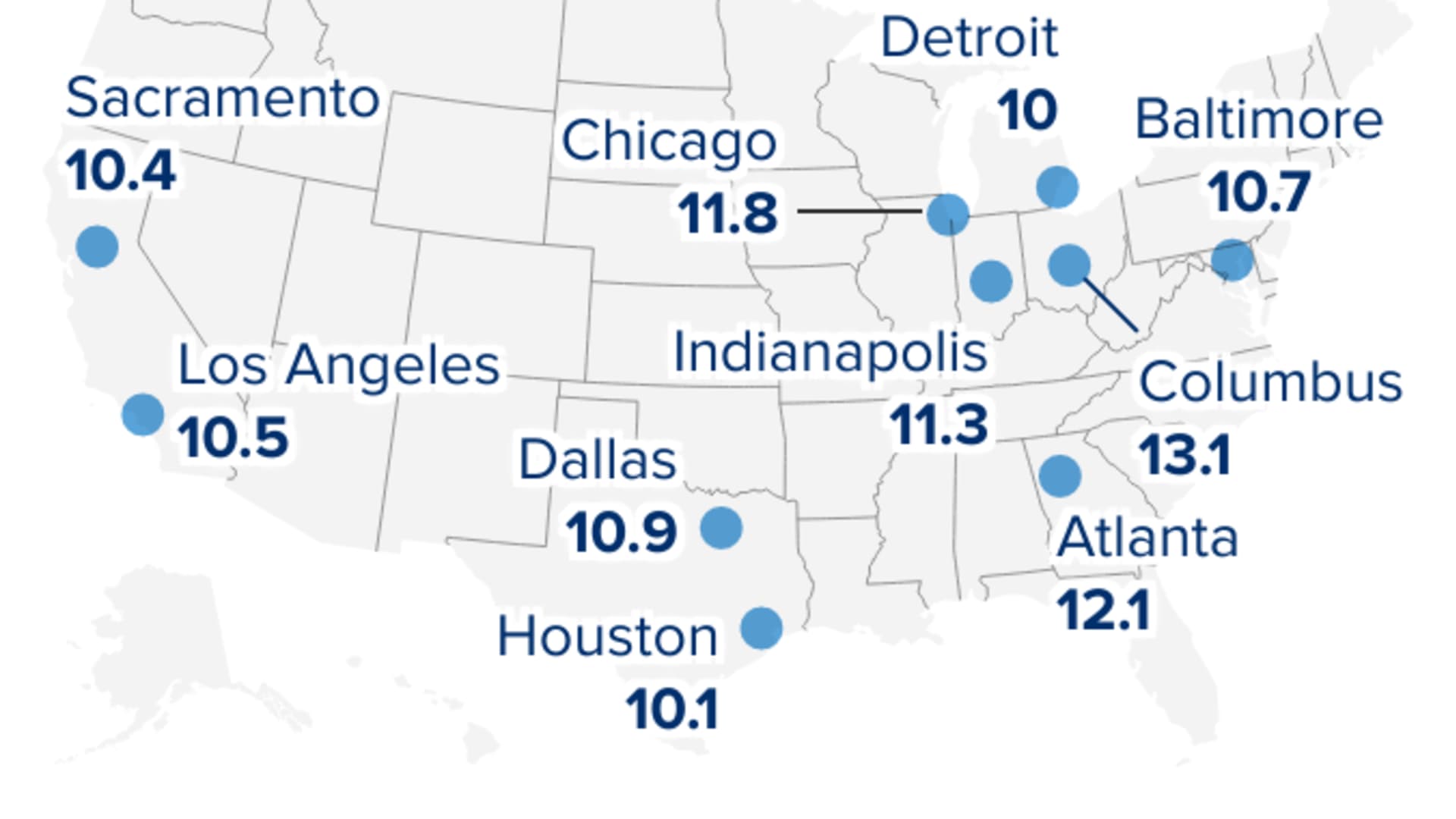

But that doesn’t happen in every market. Some of the areas like Detroit, Indiana, the Midwest in general, the rents may go up, but it’s very small. It could be like 10, 15, 20 bucks a year sometimes. This is the issue that I have with my cheaper properties. Versus the stuff I bought in higher growing areas that was more expensive, you get big rent jumps sometimes. My California properties were jumping $200, $300 a year in rent. So it could go from 1,500 to 1,800 to 2,100 to 2,500 over a four-year period. And when you bought it and it made sense when you first got it at 1,500, it’s really nice at 2,500. That’s the strategy that I want to take.

Now, this doesn’t work if you have to go into it and you need the cash flow right away, which is why I tell people all the time, real estate is a bad thing to invest in if you need money now. This is a thing where you’re constantly delaying gratification. This is putting 20 bucks in the pocket of your coat and then finding it later like, “Oh, cool, I forgot that I put this in here.” It’s like a supercharged saving account that’s going to grow over time. Real estate works much better when you give it a longer timeline to grow, like planting a tree. You can’t expect fruit the first year you planted the tree. If that’s the situation that you’re in, you need to do something else. You need to plant a bush or you need to grow a garden of flowers that can be harvested and sold and it’s going to be more work. It’s not like planting a tree that just puts off passive income all the time. Passive income takes time to develop.

So the first thing I would tell you when you’re looking at what you should do here is invest in an area that is likely to grow, okay? When I talk about ways to make money in real estate, there’s basically 10 ways to make money in real estate that I’ve concluded and five of them have to do with equity, okay? The first one that I just described is what I call market appreciation equity. This is choosing a market that is more likely to appreciate than other markets. It is not speculation, it is not guessing. It’s using education and facts to make an educated decision.

The next is what I call natural equity. This is just inflation combined with paying down your loan. That’s going to happen no matter what it is you buy, but timing the market can help. When you buy into markets where you’re more likely to see inflationary pressures, you’re more likely to make money in real estate. So when I see inflation ramping up, I put more time and more money into real estate versus my businesses. If I see inflation slowing down, I’d be less inclined to go crazy buying real estate and I’d be more inclined to put money into businesses or other endeavors. When I say put money, I mean put time and energy into them.

Another way that you can build equity in real estate is buy what I call buying equity, and this is just getting a good deal. This is buying less than market value. So if you’re going after a million dollar asset and you can get it for $825,000, you just bought $175,000 worth of equity. So the actual deal itself plays a role in this. And then the fourth way that I talk about creating equity is forcing equity. This would be something like a value add. You’re going in there and you’re going to cosmetically improve it or you’re going to add square footage to it. You’re going to do something to make the property worth more.

Now, I don’t look for deals that have one of these elements, although I may buy a deal that has one of these elements if it’s got a lot of it, if I can add a ton of value, if it’s a super hot market. Maybe I buy into a really hot market, I buy a turnkey property because I believe that the market appreciation equity is going to make up for the lack of value add because there’s nothing to add, right? Or maybe opposite. I’ll go into a market that I don’t think is going to grow very much and I don’t even get a great deal on it, but I see there’s so much value I can add to the property that makes worth it. But in general, I look for a little bit of all four. I can’t remember what the fifth one is off the top of my head. I might have to think about that.

But that’s how I want you to be thinking. “How can I add value to these properties that’s going to build me equity if I don’t need the cash flow right away?” Now, this is not saying cash flow doesn’t matter. What this is saying is focus on your equity and then convert that into cash flow. Much easier to build half a million dollars of equity and then go invest that for cash flow than it is to try to save $500,000 and invest that for cash flow. That might take you 40 years to save $500,000. That’s a lot of money. You can build that over three to five years if you’re using the methods that I just described when it comes to creating equity and then improving that equity yourself. So the first thing I would do is I would’ve gone into the markets like California. And I bought it at a great time. That was just dumb luck. I got a lot of natural equity because I started buying in 2009 through 2013, and then we made quantitative easing, and boom, the market shot off.

And then I bought it in a great market. California went up more than other markets. I also bought well. I bought them under market value, and so I came in with some equity. What I didn’t do in California was I didn’t force equity. I didn’t buy properties and then fix them up because I didn’t understand real estate that well. I didn’t understand construction, I didn’t know how to look at a property and see a vision for it like what I can do right now. So that’s one thing I would change, is if I was going into it where you are with my eyes now, I’d be looking at those four things and seeing how do each four of these apply. This is what we call the Greene goggles. When you’re looking at real estate from my eyes, you’re looking for those four things.

I don’t like the multiple houses in one market because it gives an illusion of safety, like, “Well, I’ve spread it out over three houses.” It’s just oftentimes you’re buying three problems instead of one good deal, right? You don’t hear about any investors, at least in my whole career, that made a lot of money buying cheap real estate and getting a lot of it. It doesn’t work. It’s like going to the flea market, yeah, you can buy a lot of the, not Nike, but Bike. You can buy a lot of Bikey shoes because they’re cheap, but they fall apart really quick and they give you blisters and you wish you never bought them and then you never want to wear them and then you’re trying to get rid of them as soon as you can and the next sucker comes in and they buy these.

What you hear about when it comes to buying real estate are the three rules, is location, location, location. There’s a reason that all the salty whiteheads are all saying the same thing. They bought the right location. You see Warren Buffet give the same advice when it comes to stocks. He’s not looking to get the deal of the century. He’s looking to buy the best companies, which would be the equivalent of location in real estate, and he’s looking to buy more when the market is down, which would be the equivalent of natural appreciation or inflation and loan pay down in our world. He’s using the same principles I’m talking about now, but he’s applying it in the stock market.

Well, in the real estate market, this is how that works. You’re talking about cash flow, of course you want it, of course you should want it. We all should want that. What I want to advise you is that you don’t need it until retirement. You don’t need cash flow until you just cannot work anymore or you don’t want to work anymore. So if you can delay that, if you can let the property build equity for you, and let’s say you buy a million dollar property for 825,000, it goes up to 1.2 or maybe two properties that’s worth a million that you pay a total of 825,000 and they go up to 1.2 and then the market kind of stalls and you sell those in 1031 into a new fixer upper project, you go by $2 million worth of property and get them both for 1.67 and then they go up to 2.4, you’re actually creating equity at every single rotation of this snowball that’s going down a hill.

And then when you’ve got that equity, then go invest it into the cash flow and then reive your scenario and decide, “Do I want to keep investing? Do I want to chill? Do I want to quit my job? What’s my next step?” We got a lot more options if you take the road that I’m giving you now, which most people don’t see. I look at it a little bit differently, which is why you guys are here for Seeing Greene episode.

And I just reminded myself that I’m doing a Seeing Greene episode, so now the light is green behind me. I swear people like me do the dumbest things over the dumbest things, like I can give a brilliant response to some question and people are like, “Mind blown,” but I can’t remember to turn my light green before I record. This is very common for me. I have to put my keys and my wallet in my phone in the same place because if I don’t, I’ll leave the house without one of them. I’m terrible for that. So if you ever make mistakes, if you ever do absent-minded things, if you ever beat yourself up for doing something that you think you shouldn’t, leave me a comment. Tell me what are the things that you do that no one knows or make you feel so dumb that you can share with the rest of us? And let’s see if other people make the same mistakes.

I know that I will get a comment from someone that says, “How am I supposed to know this is a Seeing Greene episode if the light is blue behind David’s head?” We get those every so often when I forget to do this, even though the title will say Seeing Greene, and I’ll start the show-off by saying it Seeing Greene. There’s always someone who’s like, “I’m confused. Is it Seeing Greene or Seeing Blue?” What I do about this light?

All right, our next question is a video from Justin Pack in New York.

Justin:

Hey David, thanks so much for making this podcast. Really enjoy the fact that you all take the time out to answer our questions and help out us newbies. So you all always talk about how house hacking is a great strategy to get started. Well, I’ve achieved step one and got a house hack. I was able to live very cheaply, renting my house out by the rooms. It’s a single family in Dallas that I bought in 2019. I’ve now rented out all the rooms and moved out of the house. The problem is the property’s not profitable, losing just over $200 a month in expenses after everything’s accounted for, but I have still haven’t transitioned into not paying for utilities, internet and those other things there. So I now have almost $100,000 in equity in the property after the pandemic popped, and I’m looking to figure out ways to either make the property more profitable or figure out if I should sell it. Let me know your thoughts. Thank you.

David:

Justin. Good stuff, man. This is a great question and you’re giving me a platform to just rant about real estate in a way that I rarely get to. So I appreciate you thanking me for making the show, but I want to thank you and every other listener we have for asking great questions because we wouldn’t have this show without it. And trust me, lots of people are in your same position and are struggling with your same situation, so they’re going to love hearing this.

All right, let’s break this down a little bit. When I first started investing, I had this thought. It was like 2007 and I was trying to figure out what could I buy, and I was talking to agents and I was like, “Yeah, I want a property that’s going to make more money than it cost to own it.” And they were laughing at me like, “Real estate doesn’t work that way. You don’t buy a property that makes more money every month than what it costs, at least not when you first buy it.” This was in the height of the market exploding, and so of course nothing was going to cash flow at that time. And I didn’t pull the trigger. I’m glad, because waiting, I got a better opportunity.

But I did realize something in that moment. In a sense, they were right. Real estate only cash flows if you get an incredible deal or you buy in at an incredible time or there’s not enough competition for the assets that you have an incredible opportunity, or you wait. Okay? Now I know this is going to sound like blaspheming real estate for the cash flow investors out there, so just hear me out. When you look at other countries, Australia, Europe, South America, their real estate does not cash flow when you buy it.

This is crazy. This is kind of an American phenomena. Nobody buying in Toronto is getting cash flow. Very few people that are investing in most Canadian areas are getting cash flow. In fact, the only areas that typically do cash flow historically at all times are the areas where management is a burden. You actually have to make it like a job to manage the property and manage the tenants. It is not passive income. We’ve become accustomed to this because we came out of such a huge crash in our economy and real estate that no one wanted to own these assets and no one wanted to buy. So we ended up with way more tenants. And then we also paired that with an economic boom after the crash where everyone is making more money, wages were going up. The value of these assets was going up. Inflation ran rampant. We had this perfect mix of you could buy real estate at incredibly low prices and then the economy soared after that. You got the best of both worlds. The result was cashflow became the norm.

And so as investors, we would just peruse through Zillow looking at every house and saying, “What has the best cash flow?” And it was awesome. I jumped in with both feet, right? I was working a hundred hours a week as a cop, saving as much money as I could because I felt like Super Mario when he touches the flower and he’s invincible and everything that I touched dies, that’s what I was doing. I’m like, “Dude, I’m going at a dead sprint and I’m buying as much of this real estate as I can.” Rates were low, property values were low, everything cash flowed. I could buy in the best markets and I could cash flow, and I was getting appreciation. I was like, “Everything was great,” and it all came to a screeching halt once we started to raise rates, and now we’re all frustrated. “I can’t make it cash flow. I’m doing something wrong. I’m messing up. I’m bad at this. Maybe I should go do something else.” No, this is actually normal.

Nothing in Australia’s going to cash flow. Nothing in Canada’s going to cash flow. Nothing in Europe cash flows. In fact, if you go to other parts of the world, you don’t get FHA loans. You don’t put 3.5% down on an asset. In fact, nobody gives loans for 30 years at a fixed rate of 3% or 4%. No one gives loans at a 30-year fixed rate anywhere. You wouldn’t do that. You wouldn’t lend your own money for 4% for 30 years fixed. That only happens because our government sponsors these loans. We’ve got a whole system created to keep interest rates low, and I won’t go into that right now, but this is why I started The One Brokerage is because I was fascinated with how lending worked, and I wanted to learn more about it and be able to help people buy real estate from lenders that they could trust. But I realized, “Oh my God, this is crazy.”

If you go to Egypt, they’re going to ask you to put 50% down and there’s going to be a balloon payment in two to three years, okay? It’s almost like a construction loan. A lot of people in other countries are paying cash for their houses, which is why houses are passed down from generation to generation. You can’t buy it. Okay? So it’s a little bit of a background in how hard real estate investing is in other places.

Here’s what I learned in 2007. Even if I paid ridiculously high prices for that real estate and I lost money every month, when you look at rent going up over time, your mortgage staying the same over time, the principle being paid down on the debt over time, I put it into a graph basically and I saw there was a break even point at about seven years in where I would lose money every year and at seven years years in I would start to make money. And then I said, “Okay, well, how much money will I have lost over seven years? And now that I’m making money, how long will I have to wait before I get paid back for the money I lost?” And at about nine years, I noticed like, “Okay, I’ve now broken even from cash flow.” This is before you get the loan paid down. This is before you get any kind of appreciation. This is just purely from rents going up.

And I realized, “Well, if I’m going to own this asset for 30 years, 40 years, 50 years, and I just got to wait nine years before I break even, that’s not the end of the world, especially if the tenant’s paying the mortgage off for me. So when I looked at it at a 30-year perspective and I ran the numbers, I saw, “There’s nothing that comes even close to this. I just got to be able to make it nine years of losing money, and then I’m golden.” Now, please stop screaming. Don’t yell at your phone. Don’t yell at your computer. I know what you’re thinking, like, “Don’t ever do that.” I’m not telling you guys to go do it. I’m saying it makes sense to do that if you take a long-term approach. When we take a short-term approach, when we say, “I want to quit my job right now, I need to find a duplex so that I can do it. I need money right now. I want to buy a Tesla right now. I need immediate gratification,” real estate becomes very frustrating.

I don’t have hardly any deals that made me a ton of money right out the gate, but I have zero deals that don’t make me money after I’ve owned them for a while. And I learned that delayed gratification is really the secret to wealth building as well as real estate investing. The deals that I bought, I have one in the top of my head right now, okay? It’s this 8,000 square foot cabin that I bought in the Smokey Mountains. It was owned by an executive at either Coca-Cola or Pepsi, I get them mixed up, but he was responsible for developing the extra value meal at fast food restaurants. So he got them to sell more sodas because a soda came with every single meal when they did the extra value meals.

He built this amazingly huge awesome place, okay? I bought it and it is making me money. It’s doing well because it can sleep like 30 to 40 people. It’s very unique. I tend to buy real estate that doesn’t just fall into a cookie cutter pattern, and this is why. But when you look at how much I can charge per night on that property, some of my other cabins maybe go for 200, $300 a night. That’s like the cheap stuff, okay? So if I get a 10% increase on that in a year, which would be really good, I go up 20 to 30 bucks a night. But on these expensive places that maybe I can charge 1,500 a night, a 10% increase is $150 a night.

Now multiply $20 a night times however many, 200 days in a year, or 150 times 200 days in a year, and the next year I’m getting a 10% increase hypothetically on the 1,500, that now became at 150 to that, so I’m getting a 10% increase on the 1,650. Okay, now my rents are going up $165 a night. It exponentially starts to increase because I bought more expensive real estate in markets that didn’t immediately take… It didn’t make me a ton of cash flow right off the bat, but it will grow to make much more cash flow.

This principle is what I wanted to highlight. Now, I want to bring this back to your specific scenario, my man. You are losing money right now, but you’ve gained a hundred thousand dollars of equity so you haven’t lost money, okay? You got to go through a lot of months of losing $200 a month before you actually break even at the $100,000 of equity that you have. So the question isn’t, “Do I need to sell this thing immediately and not lose the 200 a month?” unless your finances are in a position that you can’t take that blow. If you live paycheck to paycheck, $200 a month is devastating.

If you can’t find a one day of overtime or a side job… I mean, I know waiters that make 200 bucks a night work in a shift at a restaurant, okay? And if you said to me, “David, you got to work once a week.” No, once a month at a restaurant in order to not lose money on this real estate deal. You’re going to lose 200 bucks a month on the deal, but you’re going to make 200 bucks a month at the restaurant. Would you be willing to work once a month for the next 30 years to have a property completely paid off and appreciated? In fact, it wouldn’t even have to be for 30 years because at some point the rents are going to catch up. That is a no-brainer yes, do that. Okay?

The reason you’re feeling bad is might be ego. You’re looking at other investors that are making money. You’re looking at your balance sheet every month and you’re saying, “Well, I’m losing money. I’m doing it wrong.” Maybe not. Maybe this is how real estate has always worked over time. It was the people willing to lose in the short term to make money in the long term that worked.

Now, I hope it doesn’t stay that way, but I am preparing for a reality where the golden age where you’re just bobbing for apples, you just put your mouth in there and you came out and you hope your apple’s bigger than the other apples, but you always got an apple, that could be over. I don’t know. I don’t know, but I know that we kept interest rates really low for a really long time. And if you wanted a house at all, you had to overpay. You couldn’t get inspections. You got in a bidding war, you were very uncomfortable, you didn’t know what you were going to end up with, and it was risky. And I know that wasn’t healthy either even if you got cashflow right off the bat.

Now that we’re letting interest rates come up to kind of more traditionally normal levels, we’re all freaking out saying, “This isn’t how real estate works.” It might be that we have to accept that this is the new normal. And location, location, location is becoming important. Why? Because that’s where the rents go up. When you buy in the best location or you buy the best property, the rents go up everywhere and you get out of that hole faster. You get out of the hole of losing money faster.

Now, I’m not telling anyone here, go buy properties that lose money, okay? If you could avoid it, avoid it. I am saying, Justin, that you might not be in the worst situation ever. It might be your ego or you’re comparing yourself to other people’s deals that’s making you feel bad about this. Okay? This is Dallas, Texas. This is one of the hottest markets in the country. If I had to pick a market to put my money in over the next 15, 20 years, Dallas, Texas would be in my top three. That is a awesome market. You are going to continue to crush it in both rent growth and equity growth buying in Dallas. That’s a great place to park your money. It’s going to grow faster than if you found a place that cash flowed positively 200 bucks, but just was stagnant from that point forward. I don’t think this is a bad investment.

Now, it is a three bed, three and a half bath, okay? What if you just had a five bed, three and a half bath? Could you sell this property, move that money to another property in Dallas, Texas that was five bedrooms? That might solve your cash flow problem right away and you’re going to get more appreciation, okay? You did everything right. You just bought a house a little bit too small. If you just had two more bedrooms, maybe even one more bedroom, you wouldn’t have the negative cash flow. So this is an easy problem for you to solve. Sell it, move your equity into another deal that has more bedrooms. Boom, your cash flow positive. Keep it in that market for the long term, right? You want to plant a tree in Dallas, just uproot it, plant another tree also in Dallas.

But even if you can’t, for some reason if you don’t, it doesn’t mean you made a bad deal. You’re going to make a lot of money on this deal. Drop the expectation that real estate is supposed to be the magic pill that solves all of your problems in day one. You’re doing great, man. And you learned a lot from the deal, okay? You should be doubling down on real estate investing. You’re the person that should be investing more, buying more properties, doing better on everyone. Just make the small adjustment. When you’re running by the room, you need more rooms. It’s that simple, right? If you’re to sell cars, sell more expensive cars.

Sometimes there’s a tiny little thing that we can tweak that makes a huge difference in the returns that we get. For you, the minute that I see you bought a three bedroom, three and a half bathroom, I just think I wish the David Greene team had represented him because we wouldn’t have let you buy a three bedroom house. We would’ve looked for a five bedroom house that also had the ability to frame another bedroom out of a den and make it six bedrooms, and then you’d be making a bunch of money.

But I will tell you, the cashflow on this property will pale in comparison to the money that you make paying off your loan and letting the value increase over time. Thank you very much for your question. This was really, really good. Hang in there Dallas. Rents are going to continue going up while the rest of the countries don’t keep pace because that’s a great place to invest where a lot of people are moving to. Send me another question if you want to get deeper into what you could do to sell that property, what you need to talk to the agent about, where you should list it and where you could put the money into a new property.

All right, everybody, thank you for submitting these questions. I love it. In fact, I’ve talked a lot longer than I normally do on some of these because I’m so fired up about these questions. And I know so many of you love real estate just like I do, and you’re freaking frustrated. It’s very hard to find a place to put your money for a long time. You succeeded just by getting over the fear of investing and we were like, “Just do it. Just do it. Just do it,” and everybody did good. It’s not so much just getting over the fear. Now you got to get over the fear and you got to be willing to take a couple lumps and you got to look for a deal very hard. This is a harder time to invest than any that I’ve seen. At the same time, the potential’s probably bigger than it’s ever been. Okay?

I bought a lot of real estate recently, and I know that when rates do come back down, these deals that were like meh, are going to immediately look amazing. And over time with inflation, I want a portfolio worth $50 million going up as opposed to a portfolio worth $15 million increasing with time. All right. At this segment of the show, we are going to share some of the comments on YouTube, and I want to share your comments. So if you’d be so kind, go to the comments section on the BiggerPockets YouTube page and tell me what you think about the show. Is it funny? Do you like it? Are you annoyed that I keep forgetting to turn the light green, or is the humor actually breaking up the show? Let me know.

Our first comment comes from Susan Owen. “David Greene, thank you for this episode is my favorite in two years of listening.” This comes from episode 723 that we did. “I really appreciate the advice you gave the veteran in this episode.” Well, thank you Susan and thank you to all the veterans who served our country and served your fellow Americans with what you did. Respect to you.

Next comes from Lexi York. “I love how real he keeps it!” With an exclamation point. That’s pretty real. “Too many social media influencers out there preaching fake news and misleading people.” Thank you, Lexi. That’s not something that you’re ever going to get from me. When the market was exploding and inflation was taken off, I was telling people, “You got to buy. You got to put your money somewhere.” And now that it’s slowed down, I’m telling people, “Take your time and pick a deal, but wait. Give yourself a long runway of this real estate you’re buying. Don’t expect it to perform immediately right away.” Hey, if we could take nine months to grow a baby in a womb and we can wait that long for the joy of having a kid, you could wait a couple years before your properties are going to be cash flowing really high.

All right. And from OmarKansas1, “Yes! So glad you listened to Nate Bargatze’s podcast. I liked you before, but you just jumped up lots of levels in my book, seeing him in Vegas on Saturday.” Thank you for that, OmarKansas. I love Nate Bargatze. He’s a hilarious comedian. Check out his Netflix shows. This is where we got the idea to read comments because I would listen to his podcast and listeners would say the funniest stuff and he would try to read it on the show. It was very funny. That’s why we do this here. So thanks for that.

Also, if you see Nate at the show, tell him to come on ours. We want to get Nate on the BiggerPockets podcast and learn about his story. If he invests in real estate, what he invests in, or if he just makes jokes for a living and has no idea to do what to do with money, go tell him about BiggerPockets and see if he would come on our show. We’d love to have him.

All right, if you didn’t know before we move on, there is a new YouTube show that I’ll be a part of, okay? This is on the BiggerPockets YouTube channel. We are going to be talking about people that want to make a career in real estate as opposed to just become a full-time investor. Do you have a question about how to grow in your current job? You want to work in real estate or you want to maximize your earnings? We’re creating a brand new YouTube show all about using your W2 to start investing and grow your wealth. Use biggerpockets.com/david and choose the job question on the form, okay? So if you want to be on this show, you go to biggerpockets.com/david. You submit your question, we try to get you on. If you want to go on that show, you go to the same place, biggerpockets.com/david and just click the box that says Job Question, and we can have your question answered on the other podcast.

So this is for people that love real estate, but they’re not ready to just jump in with both feet, quit their job and try to make it as a wholesaler. Okay? Sometimes making more money at your W2 is a good thing. Sometimes starting a business is a good thing. And I suppose if you think about it, becoming a wholesaler is the form of starting a business. It’s not a form of just becoming a full-time real estate investor and living off the rental income. It’s what I did. So if you love real estate and you love working and you love making money and you love excellence, go to BiggerPockets.com/david and leave me a question there.

All right. Our next video clip comes from Brian Lucy in Colorado.

Brian:

My question is, I have a couple deals that are on our contract right now, and I would like funding for one of them specifically, but I have been trying to find private lenders that I can use that will fund the property. I’m trying to find out how I would go about vetting people that I find on Facebook. I’m a part of quite a few groups on Facebook and I want to make sure that these people are legit and won’t scam me out of my money because I’ve already had that situation happen once and it was a lot of money. So I’m wondering how do you go about vetting private lenders in order to find out if they are legitimate lenders. I’ve had one guy that told me to send him money prior to closing in order to do some administrative thing. I appreciate any help that you could help me out with this. Thank you so much, David. Love the show. Thank you.

David:

All right, Brian, thank you for that question. First off, very sorry to hear you got scanned by somebody. There’s a lot of scamming going on. There’s people with fake Instagram accounts that are saying that they’re me that are not. I’m actually nervous about this because I think people will be sending links that look like they’re coming from me to get people to sign up for stuff that I’m doing and it’s not going to be me. So you got to be super, super careful about vetting places before you send money.

One way that I’ve recommended that people look out for that is to ask for a voice memo from me if you think it’s me that’s asking you for something, like, “Hey, can you send me a video? Can you send me a voice memo?” You know what my voice sounds like, that’d be harder to replicate. Now, as far as how this happened with a private lender, it should be done through a title company. Okay, the money should be going to the title company and they shouldn’t be releasing any of it until it’s an escrow. That’s the way that I would avoid this, is if you’re just sending money back and forth between people you don’t know, there’s no immune system there. There’s no protection for you. So I try to avoid that.

But frankly, I’ve never had a problem of having someone rip me off off because I’ve only borrowed money from people that either I knew or that knew me. I don’t ask them for anything. There’s no, “Send me this money for an administration fee before I give you a bunch of my money.” That just shouldn’t be happening, okay? If there is going to be closing costs from this private lender, they should be done through a title company and they should fund their portion of money that they’re lending you into the escrow account, and then you can fund your administration fee or whatever they’re charging you into that escrow account, and the title company can release your funds to them only after they have their funds for you.

You want to have a neutral third party that’s going to protect you if you don’t know the person. Very sorry that happened, but thank you for sharing that with our audience so that more people don’t get ripped off because I can see in the future, it’s so easy to make social media profiles. It’s so easy to pretend to be someone else. That wire fraud is going to become more and more prevalent.

All right. Our last question comes from Heather Cha in the Bay Area. Heather says, “I’m finally at a stage where I’m committed to investing but have to look out of state. I’m currently looking at Dallas, Indianapolis, Atlanta, and Jacksonville. I’m specifically looking for long-term rentals and I have close to 800 credit score with money saved up and no debt. As a first time amateur real estate investor, do you recommend finding something that doesn’t need renovation? I have rented my whole life, so I really have no experience working with contractors since I’m really looking for somewhere out of state. I have the added layer of stress of not being close to the market I’m looking in. Thank you for your time.”

All right, well, first off, Heather, if you’re in the Bay Area, reach out to me. You never know when you need real estate help in California, and I got you when that comes. But if it comes to long distance investing, check out the book that I wrote about that topic. And yes, quite frankly, if you don’t have experience investing in real estate or knowing construction or working with contractors, don’t take on an out-of-state project. This is one of the fastest ways that people can make big mistakes and lose big money. In fact, the people who do out-of-state deals that have renovations on their first time, if they don’t lose money, they just got lucky. This happens all the time. All right?

So I don’t want you to buy a project that needs renovation other than small things that a handyman can handle, and your agent has referrals and they can oversee the project for you if you’re not there. Instead, I would be focusing on trying to buy a vacation rental and have it managed by a company that actually has experience doing that. I can put you in touch with a property management company I use if you’re in the Jacksonville area. They do some short-term rentals. I’m trying to remember the name of the city where a lot of people are doing really well. It’s not coming to mind right now, but if you reach out to me, especially with you being a Bay Area native, I will do my best to connect you with people. I’ll be happy to support you and look for ways you can support me.

All right, everybody. That is our show. I want to know in the comments, did I talk to long? Do you like it when I talk longer? Are you okay with shows that go a little bit longer? Do you want to keep these super, super tight because you’re on a schedule? Let me know when the timeline, if you would like longer shows or shorter shows, as well as what you think about some of the rants that I went on. Did that benefit you? Did you learn about the principles of real estate? Or do you just want to get to the nitty gritty? We read these comments and we adjust our approach based off of what you’re saying. Thank you again for your time listening. I know attention is expensive and you guys could be learning from anyone, so I really appreciate that you’re here learning from me and us at BiggerPockets.

If you want to follow me and learn more about what I’m doing, you can go to davidgreene24.com, or you could follow me on social media @DavidGreene24 on Twitter, Instagram, YouTube, whatever it is that’s you fancy, you can find me everywhere. I’m going to be putting a retreat together in Scottsdale at the property that Rob and I bought. So if you’re into goal setting, check that out at davidgreene24.com/retreats. And also, guys, if you skip through the BiggerPockets ads, stop doing that. Listen to them because I run ads on the BiggerPockets Podcast, and I want you to hear about some of the products that you can get from me where I can help you. So if you’re like me and sometimes you skip through ads, don’t, because there’s Easter eggs in there. You might hear my sultry deep base filled, smooth voice telling you about some of the things that I have going on, how we can meet in person, and how I can help you with your goals. Thanks again. If you have a minute, listen to another BiggerPockets video. And if you don’t, I’ll see you on the next one.

Help us reach new listeners on iTunes by leaving us a rating and review! It takes just 30 seconds and instructions can be found here. Thanks! We really appreciate it!