David Greene:

This is the BiggerPockets Podcast show, 754. What the experts know when it comes to investing in real estate is it’s not about timing the market. People make this mistake so much. They’re waiting for the entire market to turn around to where they think investing will be easier. It’s time in the market. The longer you own property, the better those deals get because of the nature of real estate. They also know that focusing on what your portfolio will look like 10 years from now is more important than just thinking about, “I want to buy a house and be done.” Okay? Let’s try this in real life, let’s analyze that deal that I told you about. What’s going on, everyone? This is David Greene, your host of the BiggerPockets Real Estate podcast Here today with a special episode for you. We have got a webinar and I am going to teach you how to get your first, second, or third rental property. Every investor will tell you the importance of their first few deals, they are crucial. Whether it’s learning valuable lessons or building the foundation of their portfolio.

The first few are key. That’s why we created this webinar to cover how to buy your first, second, or third rental property. We’re going to cover how to find and finance investment properties plus a massive deep dive into analyzing rental properties to see their potential that you don’t want to miss. If you’ve ever wondered, “How do I analyze a property to make sure I’m making a good choice?” This is a show you don’t want to miss. You’ll also learn all about how BiggerPockets can support your investing journey, and we’re even offering 20% off your first year, a Pro membership with the Code Rental 20. So if you’ve been trying to figure out if BiggerPockets Pro is right for you or not, you will probably really enjoy today’s podcast. Before we get into it, today’s quick tip is check out biggerpockets.com, not just the podcast, there’s a bunch of stuff in there.

There are forums where you can ask questions or be like me and read questions other people have asked to figure out what’s on everybody’s mind. There’s an agent finder so you can get locked up with agents, hard-money lenders, private lenders, whatever you’re looking for to finance your next deal through there. There’s a killer blog. You go to biggerpockets.com/store and see all the books that BiggerPockets has. I believe there’s 25 to 30 different books to pick from. I got a couple in there, all that and more. So don’t forget, we are not just a podcast, we are also a website. Check us out. All right, buckle your seat belts. We are going to get into how to buy your first, second, or third investment property, so a few rules that we should get into before we get started.

First off, you are allowed to have your phone on. I’m not one of those people who says, “Put your phone away. You have to take notes.” If you like taking notes, take notes. If your phone is a distraction, yes, put it away, but that doesn’t mean you have to. It’s okay to have it out. I actually like when you have it out because there will be times that I ask you to take a picture of the screen for a particularly powerful slide that I want you to remember, so go ahead and have your phone out. Then if you don’t have an account made on BiggerPockets, I would encourage you to do that as well. It’s not just a podcast, it’s not just video content. We have an entire website, so go make an account on BiggerPockets when we get done with today’s webinar and with that, let’s get into it. All right. So why do so many people think about getting into real estate investing but they never pull the trigger?

Does that sound like you? Are you someone who likes to peer in the window of the store but you never actually go in? There was a time in my life where I was very skinny and very insecure about that, and I would look at other people lifting weights and I just didn’t have the confidence to go do it too. I know that sounds dumb, but different people struggle with different things. Some people are like, if they want to do something, they just go do it. I know those people, but I’m not one of them. I often have just demons in my head that stop me from going and trying new things, or I’m afraid I’m going to fail or not be good at it. Really, just fear shows up in different ways and I used to be afraid to go to the gym and try to lift weights. It wasn’t until I had a friend that brought me with him, showed me how to do the exercises, how to use the machines, what form to use, how far to go down and up again.

It got me started the first couple workouts that I actually had the confidence to go back. It was very similar with jujitsu. I used to go and watch the classes before I just jumped in there to do it. I had voices that were like, “You’ll never be able to do this.” I know that sounds crazy to people that listen to me all the time, but I’m just like you, there are things that I’m very confident about. Those happen to be the things that you listen to me talk about. There are other things that I am not confident about, and if I’m not confident about it, I struggle with doing it just like you do, and real estate may be that thing for you. For me, it’s not. I’m confident because I have momentum, but before I had momentum, I had all the same fears that you do. So if you’re one of those people that never pulls the trigger, but you like to look in the window and see the other people doing it, today’s webinar is for you.

We are going to talk about what you can do to get over that fear and actually get in the game and get started. Why do so many people buy one deal but they never scale up? Well, like mentioned, it’s about momentum. Think about a train. When a train first gets started, it uses a lot of energy, but it doesn’t make very much progress. Okay? Like the amount of calories that train is burning, remember, in the old cartoons or they’re taking the coal and they’re throwing in on the fire and Bugs Bunny would do that even faster to try to make the train go quicker? That is a powerful, powerful understanding of how hard it is to build momentum. It’s a lot of effort and not a lot of progress, but over a course of time, a train goes faster and faster and faster, and then it has a lot of momentum. Now just like it was hard to get started, it is also incredibly difficult to stop. Once a train’s going, you could put almost anything in front of it on the tracks. It’s going to smash right through it.

That’s what momentum is and that’s what momentum does. It is normal that something is very difficult to get started in, but once you’re started and once you’re competent, it’s nothing, right? When a train’s going quickly for it to go 60 miles an hour is half-a-second. Boom, it’s gone that way, but when it’s first getting started, man, it might be going less than one mile an hour. Cha-choo, cha-choo, cha-choo. I want you to think about real estate investing in a similar fashion. The goal of the first few deals is to build momentum. It’s not to get financial freedom in the first couple of deals. It’s not to make yourself a millionaire in the first couple of deals. It’s not to have this home run deal that you could show up at a meetup and tell everybody, “I did this great thing. Here’s my numbers.” We all know those people. The point of the first couple of deals is not to do that. It’s just to build momentum.

Today’s webinar is going to show you how to get those first few deals, the hardest ones to get into, and how to scale to financial freedom from that point. Before we get into that, let’s talk about us at BiggerPockets. We’re an educational content community with tools and more all designed to help you use real estate investing to achieve your goals. So put shortly, we want you to have financial freedom. We believe real estate’s the best way to do it. We’re the best resource on the planet if you are interested in financial freedom through real estate. My name is David Greene. I’m a real estate investor in the Bay Area. I’m a rental property owner. I flip homes. I’ve also invested in commercial properties. I’m a short-term rental investor. I hold notes on properties, which is basically people pay me their mortgage as if I’m the bank. I co-host the BiggerPockets podcast. I’ve written some books for BiggerPockets including The BRRRR book, that’s Buy, Rehab, Rent, Refinance, Repeat; Long-Distance Real Estate Investing Distance, and SOLD, SKILL and SCALE.

We call that the top producer series for real estate agents who want to sell more homes. I’ve been featured in Forbes, HGTV, CNN and more, and like you, I was once a newbie to real estate, which is why you should be listening to me. You could follow me online @DavidGreen24. You want to go and take a picture of that screen so you don’t forget it. I know my last name is spelled kind of silly. It’s got this extra E at the end. I should have the blue check mark now so you can make sure you’re following the right person, but if you hear this and you go sign up on BiggerPockets, you make yourself a profile, but you want to know a little bit more about me or see a little more detail about what I’m doing, whether that be selling houses, helping people get mortgages, talking about philosophy or life or exercise, whatever it may be, go follow me @DavidGreene24. So why do the first few deals matter and why do they not?

This is a good way to understand what the reason is of trying to go. Just like when I first started going to the gym to work out, I was not going to get buff or even strong in the first several workouts. You’re not making progress as far as size or strength or any metric. The only thing you’re doing is conditioning your body to get used to what you’re asking it to do. You’re just getting your muscles sore and then the next time they won’t be as sore. You’re just getting to the point that I used to remember my stamina was so bad, I would just run out of energy after 30 minutes of trying to do exercise. It was so frustrating. Just boom, I’m done. I got nothing left. Now I can work out for over two hours, sometimes three hours. I’ll space it out on the weekends and do these really long workouts. My body can keep going. The first couple of workouts were not meant to get me strong, they were just meant to get me conditioned. Okay? This is a method that we call the stack.

You start off buying a property, one-unit property. The next year or the next deal, you buy either a duplex, which has two units or two single-family homes. Then you do four, you get a 4-plex. Then you move into an 8-plex, then a 16-plex. Here’s what we’re getting after. Continually doubling the size of the properties that you are buying will force you to challenge yourself, okay? There’s this strategy in this book called The One Thing written by Gary Keller and Jay Papasan. It’s a really good business book. Lots of people have read it, highly recommend you guys checked that out, I did a TED talk and I took a concept from the one thing for my TED Talk. You can actually look that up on YouTube too. If you just put David Greene TED Talk, you’ll see BiggerPockets. We’re getting all over the place and in that TED Talk I talked about how a one-inch domino can knock down another domino that’s 50% bigger, so that’ll be one-and-a-half inches. Then the one-and-a- half inch domino can knock down one that’s 50% bigger.

That would be what, 2.75, I believe, and then so on and so forth. The dominoes get bigger and bigger and bigger, and by the 17th domino, you can knock down something that’s the size of the Leaning Tower of Pisa. That exponential growth is really important. The point of the first, second, third, or fourth domino is not to knock down something really big that’s going to turn into a lot of money. It’s just to get to the fifth domino, and the point of the fifth domino is just to get to the sixth domino. You never get to the sixth domino if you don’t knock down the second or the third. You see where I’m going here? But when you get to the 17th, that’s some really, really big returns you get. Then the 18th are 15% bigger and then you hit this exponential growth where your financial success really takes off. Buying that 16-unit and then that 32-unit is going to get you some significant money. The first one, two or three are not going to be life-changing, but that’s okay.

Just like the first five minutes of a train trying to get started at, I’m assuming it’s five minutes, I really don’t know how long it takes a train to get going, but the point I’m getting at. They’re not making great progress on the tracks. The train’s not getting far. It’s not a Tesla that just takes off. The point of the first slow movement is just to get to when the train’s been going for 30 minutes and it’s at full capacity, it can run through anything. There are three roadblocks that new investors face. We call them the three Ds: dollars, deals and direction brought to you by David. Number one is dollars. How are you going to fund that deal? Well, there’s traditional loans. That’s the way that I finance most of my deals. I go to a mortgage broker. I have a mortgage company, the one brokerage, and I say to the people that work for me, “Find me a deal.”

Their job is to go find me the loan, so they come back and say, Well, here’s our options. We could use this loan, this one or this one. These are the interest rates. These are the down payments. This is what they’re going to require of you. This is the documentation they’re going to need to approve your loan, and this is what we need to do.” I typically look for the one that’s going to give me the least headache, the least hassle required, the least amount of documentation. Now, that’s a DSCR loan debt service coverage ratio in most cases where I will get a loan where my property is approved based on the cash flow that the property is going to generate, not based off of purely my income or my own debt’s income ratio. There’s also a partnership. You can have somebody else that brings the money and you go find the deal and manage the asset. You can BRRRR. I mentioned that I wrote a book called BRRRR that stands for buy, rehab, rent, refinance, repeat.

It is a strategy that we use to buy a property, make it worth more usually through a rehab, rent it out to somebody, then go to a bank and say, “Hey, I have this asset that’s worth this much money, but I only owe this much money on it ’cause I bought it at a good price and then I made it worth more. I want to refinance it.” You often get all of or most of your money that you left in the deal back out, then you repeat it. You recycle that money putting it into the next thing. I might have to find some way to work recycle into BRRRR because it’s an R as many of the words start with. So sometimes you save up a bunch of capital or you get a loan and then you don’t need to keep getting new money because you recycle the money that you put it from one deal into the next one. If you want to learn more about how to do this, you can check out a full workshop on how to invest with no or low money down.

That’s only available to Pro members, but I’ll teach you guys how you can be a Pro member later in the webinar if you want, where Brandon and I cover nine strategies for investing when you have no money. Now, I will say this is probably some of the best content that Brandon and I ever made. When we were making it, when we were sitting in his shed, as you can see in the picture there, making this content, we were talking to each other saying, “This is some of the best stuff we’ve ever done.” The energy was great, the ideas were great. We were just floating because of all the different ways that we are realizing people can get into real estate without any money, so if that’s something you’re interested in, you should consider going Pro or if you’re already Pro, you can see it at biggerpockets.com/pro/videos to learn creative ways to get around the dollar problem of the three Ds. The secret to financing real estate is no matter how much money you have, when you find great deals, you’ll find the money.

All right? If you’re a person who says, “Hey, I’ve got a house that’s worth $400,000. The person’s willing to sell it to me for 230,000, would you like to partner in this deal and get a big stake of the equity?” It’s not hard to find somebody who has money that’s like, “I’ve been looking for a place to put my money. Yeah, I’ll do that.” The way that inflation’s going, we have to put our money into appreciating assets. If you get a deal that’s significantly worth more than what you’re paying for it and is likely to appreciate, there’s a lot of money that’s out there on the sidelines that’s looking for a home. Number two, deals. Well, this is my favorite way. I like to use real estate agents and I like to look on the MLS. Now, that doesn’t mean that I always pay the MLS price, okay? Oftentimes, I will write offers for less than what the person’s asking for. I target homes with ugly pictures that have been sitting on the market for a really long time. I’m looking for that ugly duckling.

If you put a little bit of makeup on it, if you do a little bit of work, you get past that frumpy sweater, ooh, you got … remember that movie, She’s All That? I might be dating myself a little bit, but the idea with She’s All That was there was this guy, Freddie Prinze, Jr. played the character that saw this nerdy girl and everybody else ignored her ’cause she dressed funny and she wasn’t popular. But he saw underneath it the beautiful swan underneath the ugly duckling. He ends up falling in love with her and he gets himself a hot girl that everybody else passed up on. Well, I’m not looking for that, but I am looking for that hot house. I am looking for that hot deal. I am looking for that property that other investors are missing because guys, I can promise you, this isn’t 10 years ago. 10 years ago, no one even understood real estate investing was all that easy to do, easy comparative to other things. People were just skipping out on it ’cause they didn’t know how, they didn’t have information.

There wasn’t webinars like this that they could watch. There wasn’t software to manage it. It was a pain in the butt. Nobody’s skipping it now, everybody’s looking for deals. Everybody wants financial freedom. They’re all looking for a place to put their money ’cause what we’re seeing with inflation now, if you want to find these deals, you got to see something that other people are missing, especially if you’re looking on the MLS. Some people go around looking on the MLS, they get into driving for deals. This is where you drive around. Maybe you’re an Uber driver, maybe you’re going to work, maybe you’re driving around doing errands. A lot of us drive in different neighborhoods and you just see one house that looks uglier than the other ones. Okay? This would be like being in high school and Freddie Prinze, Jr. is walking around and he’s checking out all the girls and he’s like, “Well, that one over there has weird glasses and her hair’s kind of funny. She’s wearing a sweater that it looks like grandma made for her that she got for Christmas, but she could be kind of cool.”

You see her speaking kindly to somebody or reading a book that you think is interesting and you go put attention on that person, not the cheerleader that every other person’s already pursuing. That concept works with real estate too. You go look for the house that has the overgrown weeds, the really bad siding. Every other house is updated, this one’s not. It’s clearly not having anyone pay attention to it. You’ve got a much better chance of finding a seller that would sell you that ugly, messed up house that would be hard to sell on the MLS than you would going after the pristine one. You’ve also got direct mail letters and direct mail cold calls. This is where you send letters to entire neighborhoods telling them, “Hey, I buy houses. If you want to sell your house, you want an easy, quick fast sale, I’d like to be that phone call.”

You continue to do that over a period of time until people remember you and when they hit that point where that tenant won’t leave or property taxes are due and they don’t want pay them, whatever it is, you’re the person that they call and then you negotiate yourself a deal, and then also relationships. This is another one. Do you know real estate agents that might bring you their deal before they put it on the MLS? Do you know tax attorneys or divorce attorneys who are going to come across clients who need to sell a house and probably don’t want to put it on the MLS list? They don’t want to take the time to paint it, clean it up, get rid of all the scratches on the floor that their pets might have made. They’re in a bad place emotionally and mentally that they don’t want to put the effort into getting their house ready for sale, and you can come along and swoop it up before anybody else does.

You can also check out a masterclass hosted by Brandon Turner on how to find great deals if you’re a Pro member where he gets into driving for deals, relationships and direct mail marketing as well as relationships, interviewing experts in every single one of those fields and sharing their nuggets of wisdom with all of us. The last D is direction. You need education. That’s why you’re here today, I’m assuming. Maybe it’s because you think I’m handsome. Maybe it’s because you like the blue light that’s behind my head. Maybe it’s just you miss my voice and there isn’t a podcast to listen to, but that’s probably not it. You probably recognize that you want financial freedom and you’re coming here to get education for how to do it. You also require focus. This is very important. The book I’m writing for BiggerPockets right now, it’s going to be called Pillars of Wealth. I use this analogy that light bulbs versus lasers, okay? A light bulb shines and sends its energy everywhere. You turn on a light bulb, the whole room lights up. It’s got this energy, but it’s dispersed over a big area.

Now everyone sees a light bulb. Light bulbs will make you happy. You don’t stub your toe when you’re walking around on the furniture if there’s a light bulb. They serve a purpose, but what they’re bad at is sending light through obstacles. If you want to get through an obstacle, if you want to get through a barrier, you need to focus your energy and turn a light bulb into a laser. A laser is just focused light energy, and when there’s enough of it focused in the right place, a laser can burn through whatever obstacle is in front of it. Now, financial freedom, financial success, wealth through real estate is not going to find you like light from a light bulb. I’m not just going to hit a button and do a webinar and boom, the light’s going to hit you and you’re going to have what you want. You are going to have to burn through the things that are stopping you from having what you want. There are obstacles in your life that are probably not something you’re aware of right now.

Maybe you are aware of them if you’ve been listening to BiggerPockets content for a while that are literally preventing you from having that bad spending habits, fear of failure. When I gave the example earlier of me being afraid to go work out at the gym. There is a part of me that was afraid to overcome obstacles and get in there and work out. Now, it was low self-esteem. It was like the negative thoughts I told you had in my head. It was the shame that I felt like I would have. There was a lot of stuff that was in my mind from a very rough childhood that I had that was affecting me as an adult, and I’m only sharing this with you guys, I know you’re not Dr. Phil, okay? I’m only sharing this with you because I don’t think I’m the only human being that has those issues. I don’t think I’m the only person who has a hard time focusing on my goal or becoming a laser to push through the obstacles that are inside of me. Maybe you’ve been working the same job for 12 years.

You drive a truck for Coca-Cola, and it pays the bills, but you’re listening to this podcast while you’re driving that truck doing your deliveries, and you’re like, “I know I was made for more than this. I know God has more for me than this. I am not content with my life. I am afraid to lose what I have trying to go after something better, or I don’t want to face the shame and the rejection of failing.” That’s an obstacle you have, and you’re going to need to focus your energy to burn through that. There’s also a process. You have to understand once you get through your obstacles that are in between your ears, do you know what your process is to get those deals, manage them and make money with them? This is what we call the LAPS funnel. This is a very powerful and simple way of understanding how you get deals, okay? So whenever you listen to someone talking about how they make their money in real estate, how they acquire deals, really the acquisition part, all they’re doing is describing a stage in the LAPS funnel.

So for real estate agents, if you read any of my books, I talk about the sales funnel. It’s the same idea. I’ve broken down the steps that you take with a person that’s out in the world or in your database and what has to happen to turn them into a closed deal or a paycheck, meaning a commission check to you, and it really helps simplify the job of agents. Well, the deal funnel does the same thing for investors. You start with leads. I classify a lead in the real estate space, like as an agent, is a person who knows who I am and wants to buy or sell a house. It’s very similar in real estate investing. A lead is a person who knows who I am or who I know who they are ’cause I can go pursue them who wants to sell their house. Now, if you’re looking at houses on the MLS, they all want to sell their house. That’s why they’re there and you know who they are ’cause you’re looking at the house and you can go content. That’s the easiest place for me to find leads.

But let’s say you’re driving for deals and you see that ugly property, that’s a person who may want to sell their house and you can find out who they are. You use skip tracing technology. You find the owner, you call them or you send them a letter and you say, “I want to buy your house.” If they reply back to you, that’s a lead. They’re interested, okay? You’re constantly looking for leads to start your funnel, as many leads as you can get. If you send out direct mail, what you’re trying to do is get responses from those letters, those are now leads. As leads come in, the next step is very simple. You analyze it. “Would this deal make money? Would this deal be something I could get for below market value? Would this thing cash flow? Is this an area that I want to own in? Is it a good neighborhood? Does it have good schools? Is there a plan for this property that I can see?” BiggerPockets has tools that I will tell you guys about in a couple of minutes that make it very easy to analyze properties.

In fact, we are going to do that together as a group so that if you’re intimidated by math, like I used to be intimidated by weights, you realize there’s someone else or something else that can do that for you, and you don’t have to be intimidated. I’m going to walk you through it just like my friend walked me through the first couple of workouts at the gym ’cause I have a heart to help you guys just like that person help me. His name was Paul, by the way, then you pursue the deal. For the deals that make it through your analysis and you’re like, that’s a good one. You got to go pursue it, right? Freddie Prinze, Jr. Walking through high school sees that girl reading the book and being ignored by everyone else. She’s not just going to come talk to him. You got to go after what you want. You have to go make an effort. You have to pursue it. For us, that often means telling the seller, “I want to buy your house. Here’s an offer.”

It’s simple stuff, I’m just helping you understand how to classify it. We’re only three steps in. Of the deals that you pursue, a certain number of them will close, and we call that success. That’s where we get the acronym LAPS from. Now, here’s what’s amazing. This is only four steps, but the last step is success. That’s not a thing you have to do, that’s just what happens. It’s really only three steps. Three steps that you have to understand in the process to building wealth through real estate is find leads, analyze those leads, pursue the ones that make sense, and eventually you’ll hit success. Can you find leads, analyze them and pursue them? If you can do those three things, you can be a real estate investor, and you can build momentum with your first, second, or third rental property. Now, many properties are not good deals, but you can find the right ones, you just have to know how to analyze them.

You have to analyze for the best opportunity. Brandon Turner, one of my good friends used to host the podcast is notorious for taking every conversation we have and saying, “Everything’s a funnel. Everything’s a funnel,” it’s his favorite thing to say. In fact, I often make fun of him because if you’ve ever seen the Lego movie where they sing Everything is Awesome, I’ll say that about Brandon. He thinks everything’s a funnel. He can’t stop looking at it that way. He thinks dating’s a funnel. He thinks applying for different jobs is a funnel, all of it is. It’s true in a sense. We’re always looking at different opportunities we have in life. I’m going to call those leads. We’re then analyzing them to see if they would work for us. “Oh, there’s a nice restaurant. Well, there’s another one. Well, there’s another one. Which one do I want to eat at?” That’s the analysis. You look it up on Yelp, you see what the reviews are. You look at the pictures of the food, then you decide, “I think that would be the best one,” then you pursue.

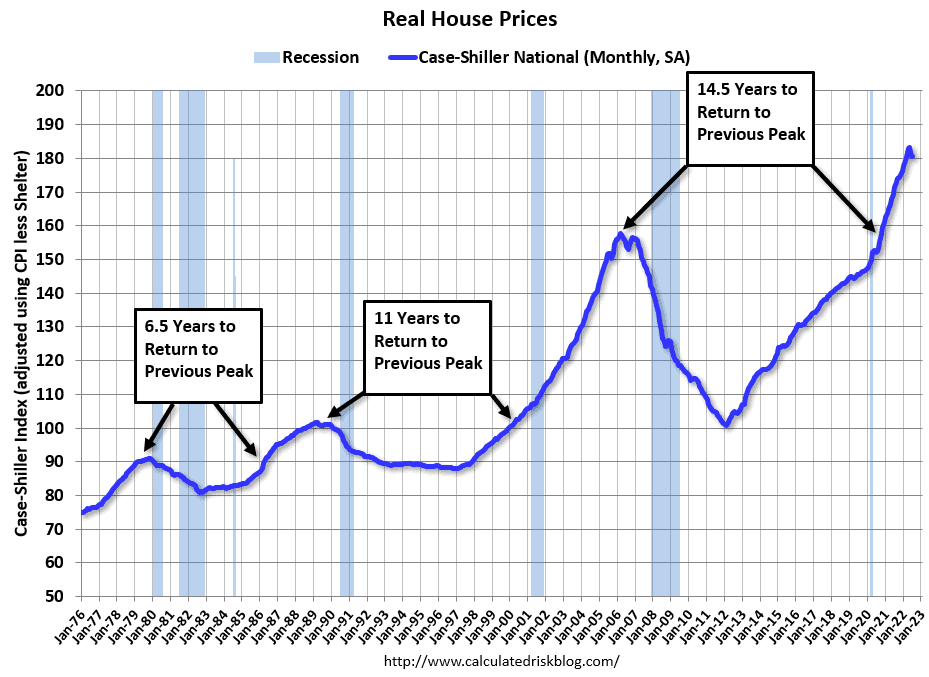

You call it and say, “Can I get a reservation?” You just use the LAPS funnel to get yourself food. You’re already doing this every day, we’re just talking about how to apply it to real estate. What the experts know when it comes to investing in real estate is it’s not about timing the market. People make this mistake so much. They’re waiting for the entire market to turn around to where they think investing will be easier. It’s time in the market. The longer you own property, the better those deals get because of the nature of real estate. They also know that focusing on what your portfolio will look like 10 years from now is more important than just thinking about, “I want to buy a house and be done.” Okay? Let’s try this in real life. Let’s analyze that deal that I told you about. This is the property we’re going to look into. It’s in Tulsa, Oklahoma. It’s for sale for 165,000. It’s a four-bed, two bathroom. They don’t have the square feet listed.

Now, I can tell from looking at this property, it’s got these two doors. This is a duplex, so it’s not a one home with four bedrooms and two bathrooms. It is one property that has two different units that each have two bedrooms and one bathroom, okay? So we are going to look up 1050 North Irvington Avenue in Tulsa, Oklahoma. Let’s hope that I can remember that when I move us over to the BiggerPockets calculators and I show you guys how easy it can be to analyze properties once you’ve found yourself a lead, which is what this is. All right, so here we are at biggerpockets.com. All you need to do is take your little cursor, hover over Tools, and then we’re going to go to the BiggerPockets rent estimator. This is how we figure out how much we think that this property is going to generate in rent. All right, so once we get to the rent estimator here, we’re going to type in the address of the property, which was 1050 North Irvington in Tulsa, Oklahoma. Hit Search Address.

Now, here’s what’s cool. The software’s going to look up all the other properties that are around this one and tell me what those ones are renting for, so I can’t get an idea what this one would rent for. Now, it was a two bedroom, one bathroom I remember from the description, so we put that in, so now it knows what to look for. It’s telling me that it thinks it’ll rent for 795 a month, so right around 800, but it has low confidence. Why does it have low confidence? Well, we just have to hover over the question mark. It basically says there’s not a ton of comparables in this area for me to know for sure that this is what it would rent. So all we do is we use the number that it gives us and then we verify that with a property manager before we buy the property. Maybe you do this during the due diligence phase. Maybe you do it before you write an offer, but there are ways that you can get a much better idea of what the rent’s going to be.

You’re not just flying blind based on software, but this will help us understand after an analyzing it if it is even worth pursuing. So we see $800 a month, and then here’s a list of the other properties that are two bedrooms, one bathrooms. You can literally see their addresses and how much they’re renting for, or you can go on the map. See this little blue one? This is where our property is. Here’s all the other properties that are around it. There’s a ton of rentals here, and they’re all right around that. You know that one’s 1100, this one’s 650, there’s different numbers. Sometimes people rent out properties for less than what they could be getting because of they’ve had the tenant for a long time, they’re not paying attention to it. That happens a lot. Rarely ever do people rent out properties and you can’t get as much as they did. That hardly ever happens. It’s not very likely that this guy got 1100 and you’re only going to get 800. It’s almost always the other way. The numbers that are existing are lower than what you could get with today’s market.

But we still just use the number that the software provides to be extra conservative. So we can see looking at, there’s a lot of rentals in this area. This one’s at 925. This one’s at 1095. This one’s at 1125. This one’s at 500. This one down here is at 750. This one right next to it’s at 1100. So looks like the ones that are close to this unit are in that same 800 to 1100 range, which is pretty good. So we’re going to take that $800, and we’re going to remember that’s much it’s going to rent for in a month. We’re going to hover over Tools, and then we’re going to go to Calculators Rental Property. We’re going to put the same information in here. So we’re going to type in 1050 North Irvington just like we did on the rent estimator tool. Click on it, and it’s going to import all the property data for us once it finds it. Isn’t that cool? You don’t even have to go manually put all this stuff in. It knows the address.

I’m going to click next. It’s going to take me to the purchase price, okay? In this case, they were advertising it for $165,000. We’re going to start off assuming that’s what we’re going to pay. The closing costs would be around $5,000 for a property like this, but what if you don’t know that? What if you’re not me that works in the real estate field that has a good idea for this? Well, BiggerPockets has you covered. You just head over here to Calculating Closing Costs. You click on it, and it will tell you what closing costs are. They say typically they’re around one to 2% of the purchase price of the property. If unsure, 1 1/2% of the purchase price is a good number to begin with. We’ve gone much higher than 1 1/2, okay? I like to be conservative when I’m underwriting stuff or I’m analyzing things. I assume everything’s going to be more expensive than it actually is, so I put in 5,000 instead of maybe the 2,500 that it would probably be. In this case, we’re not going to be rehabbing the property, so we won’t be putting in any rehab costs.

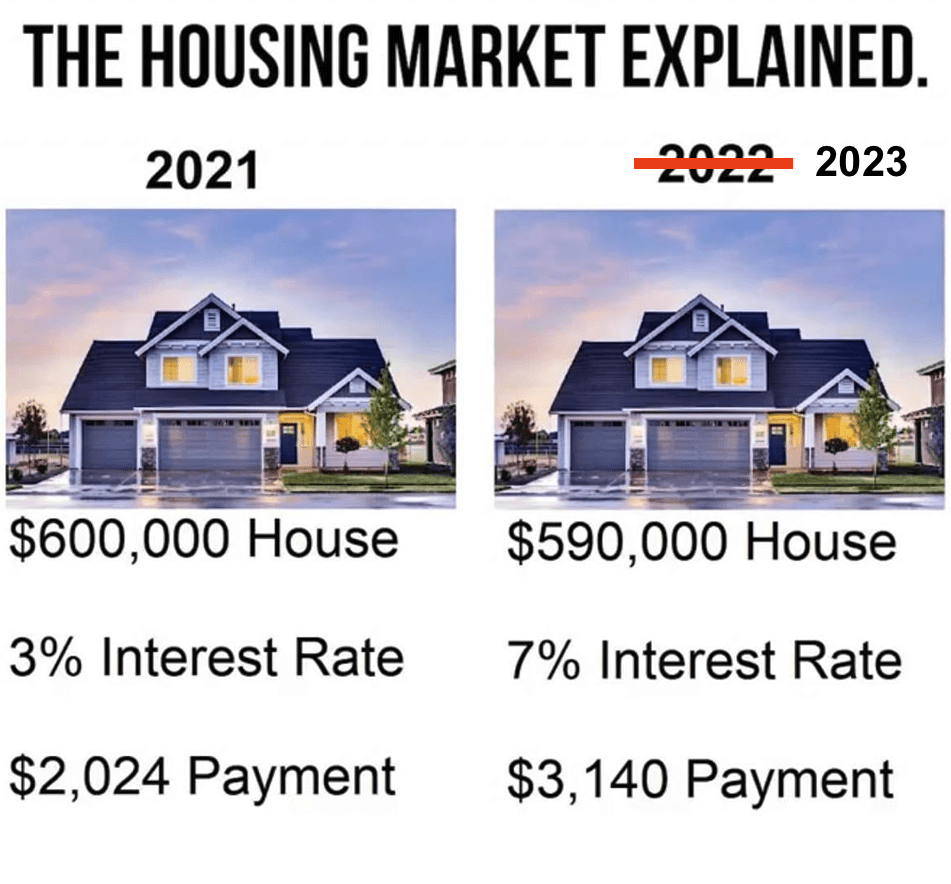

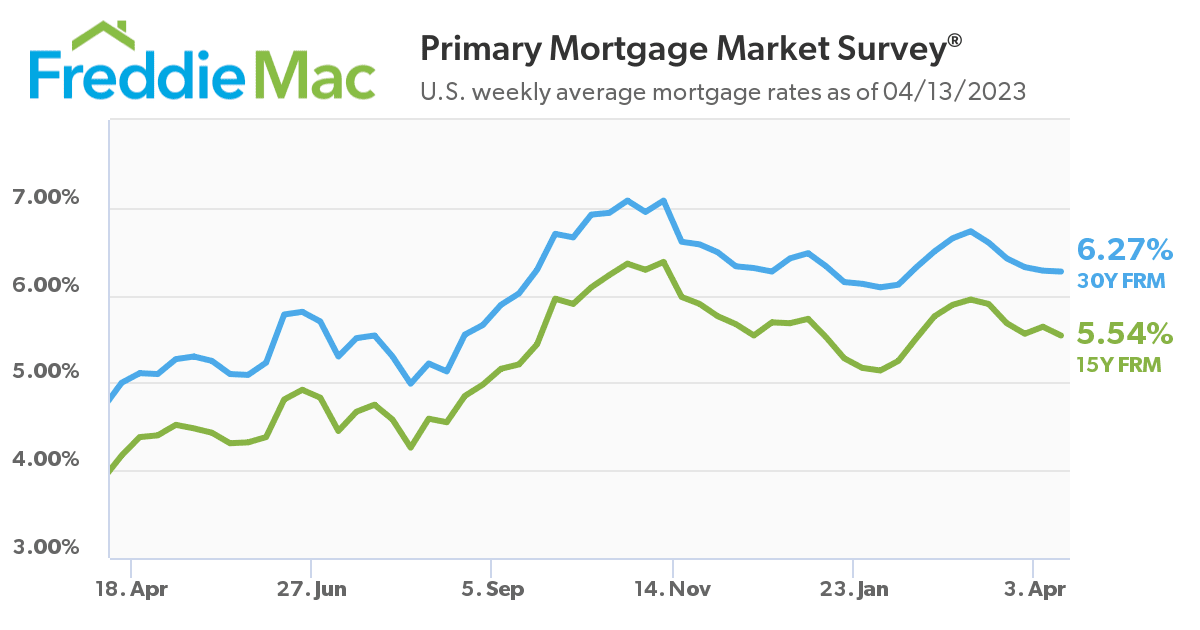

We’re going to put 20% down because we’re assuming this is an investment property. Now, if you lived in Tulsa, Oklahoma and you wanted to buy this as your primary residence and live in one of those units and then rent the other one out to keep your housing low, you could absolutely do that. You’d only have to put 5% down on the property. Maybe duplexes might be a little more. It could be in the 10 to 15% range, but single-family homes you could absolutely put 3 1/2 to 5% down on those. We’re going to analyze it as if we’re buying this at 20% down because we’re assuming that we’re a long-distance real estate investor, we’ve read David Greene’s book on long distance real estate investing, and we like this market. Interest rate, let’s go with 7% since this is an investment property. No points, and you almost always want to put in 30-year loans, the term as 30 years to calculate what your mortgage is going to be. Gross monthly rent, check this out.

The BiggerPockets calculators already know what the rent is because they went to the rent estimator tool, looked up the property that we put in there and are telling us. Now, I showed you guys how to do it in case the calculator can’t find it, or in case you want to look something up on your own without going through this whole process, but how cool is that, right? It’s showing us that it’s likely 795 a month. Now, we know there’s two units, so don’t mix this up. They’re telling you that’s how much a two bedroom, one bathroom will rent for in the area, but this property has two of those. Okay, so we’re actually going to bump that up to, it would be 1600 minus 10, so that’d be 1590 would be the gross monthly income on this property. Now, there’s more expenses, though. BiggerPockets has you covered there. It’s estimating the property taxes will be $2052 a year. What if you don’t know if you can trust that or what if you want to understand it?

Just come over here and click on the help button, how to determine property taxes. They will tell you how you can go find what property taxes likely will be for a property. The insurance on a property like this, I’m going to assume is going to be around, let’s say, $60 a month. Don’t know what that is? All you got to do is click on how to determine your insurance costs. The repairs and maintenance, we typically budget 5% for all of these, okay, so 5% of the money that comes in from the rent we’re going to set aside to fix things that break. We’re going to set aside 5% for vacancy. If you can’t find a tenant that’s going to stay in it. 5% for capital expenditures, well, you can click on what are capital expenditures or you can just listen to me right now. Capital expenditures are when you spend money to fix a big thing that breaks like an air conditioner, a water boiler, the roof, things that at some point are going to need to be fixed that are not normal repairs and vacancy.

Then management fees, usually those are anywhere between six to 12% depending on the cost of the property. For this one, I’d probably say 10% is what most people would charge. As the landlord, you rarely ever will pay the electricity, the gas or the water and the sewer, and this property is not in HOA, so we don’t have to worry about any of those. The tenant is going to be responsible for all of those costs. I’ve explained slowly how this works. I’ve shown you all the pieces of the calculator. It’s still taken less than five minutes. All we have to do at this point after putting that information is click this blue button that says Finish Analysis. Check it out, the calculator is doing all the work for us, okay? This property would likely produce based on the numbers that we gave the calculator, $83 a month. The income was 1590, the expenses were 1506 with a cash-on-cash return of 2.63. Now, the calculator will show us where most of that money’s going. You see this big blue line here?

That’s showing us that the majority of our expenses are associated with the mortgage. That’s the blue. The next biggest expense is the orange, which are the variable expenses, that’s going to be your maintenance, your repairs, your CapEx, your property management. I’m going to show you guys why that’s important in a minute here. It also gives us numbers if you like that, that you get a net operating income of about $11,538 with a cash-on-cash return of 2.63. Then this graph shows you how the equity is going to develop over time. So this green line shows the property appreciating at around 3% a year, so the first year you buy it, you bought it for 165. By year 30, it should be worth more like 299. Now, I got to say, I can’t tell you what market is only appreciating at 3% a year right now. Inflation is running rampant. Real estate is way outpacing the conservative numbers that we’re using. This purple line shows the loan pay down, so at the same time, the property’s going up in value, what you owe on it is going down in value.

The difference between those two numbers is what we call equity. Okay? So as you see over time, remember I said th?at real estate is about owning time in the market, that’s how you make money the spread of equity is very small right here in the very beginning, but right around year five, it starts to get interesting. By year 30, it’s very, very appealing, and this blue line shows you how your equity grows over time. Right around year five, it starts to kick up and then it significantly increases at year 15, and by year 30 it’s doing very, very well. The calculator makes this very easy. Now, for those of you that are savvy investors, you probably see that 2.63% cash-on- cash return, and you think, “Yeah, that doesn’t get me super excited, David. That’s not really sexy. Once I’ve done my analysis, I don’t know if this property is worth pursuing it. 2.63.” Well, you got two options. One, throw it away, not worth it. You spent five minutes of your life. In fact, you probably would’ve spent more like one minute if I wasn’t stopping to explain how to use the calculator.

You find your next lead, you plug it in here, and you analyze that one. You got another option too. What you can do is you can click on this Edit button, takes you back to the screen where we input all the information. Remember how I said the mortgage was the biggest part of your expenses there? That was quite a bit of expenses related to the mortgage, if you bought it at 165 at a 7% interest rate. You can maybe change that interest rate to 6.25 and assume that maybe you pay a couple of points to get that to see if it makes a big difference with the price, or you could say, “Yeah, I wouldn’t pay 165 for that property. You know what? I would offer 125 because it’s been sitting there for a little while and the economy’s not doing super great. I think that seller’s going to need to sell. Maybe they’re a little bit more desperate than what we thought.” Now, once you just change the two keystrokes, you erase the six you put in the two. You go back to the Analysis button, update analysis.

Let’s see how the numbers look now. Whoa, cash flow jump from 83 to 296 and the cash-on-cash return went from less than 3% to almost 12%. Now, this deal’s looking a little bit better. During your analysis, you determined that this deal is worth pursuing at $125,000, not at 165,000. So when you go to then pursue that deal, you tell your agent, “I will offer 125,” or you contact the seller directly and you say, “I will pay you 125 for that property.” If they say no, that’s okay. You move on to the next one. If they say yes, you’re getting an almost 12% return on that deal. Now, once it’s in contract, you’re going to verify that that $800 a unit number is good. You’re going to look at the crime. You’re going to look at the type of tenant you’re going to be getting. You’re going to get an inspection on the property and look at its condition to make sure that it’s not going to cost more money than you thought to get it ready to go.

There’s more work that goes into it, but those all happened during the pursuit phase or actually after you pursued it and it’s in contract. Okay? You see how easy I’m talking about it? You can build momentum really, really simple by just following the three steps of the LAPS funnel, and BiggerPockets had you covered with the analysis portion. You don’t have to do hardly any of the work, the calculators do it for you. All right. Moving back into our presentation, now that you’ve seen how easy it is to analyze the property, let’s begin to wrap things up with three simple questions. Number one, are you committed to buying your first, second, or third deal in the next 12 months? I really, really want you guys to think about that. Are you committed to doing this? Now maybe what has stopped you from getting into the gym and signing up is the fear of not knowing if the deal’s good or not. Maybe you’re just afraid of guessing and hoping that you’re wrong. The calculators take the guesswork out of the deal.

That’s one of the reasons I wanted to show you guys that. Numbers are very difficult to lie, I think we interviewed someone, I remember, I believe his name was Rick, and he said, “Liars can number, but numbers can’t lie.” As long as your inputs into the calculator are correct, the guess work’s taken out of the deal. You can know if you have a deal or not. So what is stopping you from committing? This is a screen I want you to take a picture of, and I want you to spend some time reflecting. What is stopping you from committing to the things that you want. You’re probably not giving it your all. You’re probably not going to the gym and lifting the weights as hard as you can. You’re probably not pursuing that girl that you really like. You’re probably not pushing yourself out of your comfort zone to go get another job or a better job.

You’re probably a little too addicted to the life you have, not the life you want, but that’s only going to come to the service if you spend some time thinking about it. So lack of commitment reveals fear somewhere. I want you guys to identify where you’re afraid. Next up, are you prepared to follow a process towards success? Okay. If you’re just blindly wandering around hoping that you fall into a better job, fall into a relationship, fall into being a millionaire, that doesn’t happen. Like I said, life is not like a light bulb that the light’s going to come find you. You got to become a laser and shoot through the obstacles that are in your way. Are you prepared to follow a process to get that success that you want? Will you execute your plan daily to reach your full potential? You have potential. I have potential. All of us have potential. Most of us are very far away from getting anywhere close to living by it, okay? Becoming wealthy through real estate is just like becoming fit through exercise. It’s just becoming happy through relationships.

It involves you pushing yourself out of your comfort zone. You’re not going to get there any other way, and if you’re not living to your potential, that should bug you a little bit. I want to push you guys to ask yourself where you are leaving things on the table. Are you not executing daily to reach that potential? Here’s a quote that I love by Jim Rohn. “Life doesn’t get better by chance, it gets better by change.” That’s really, really good like, the light is not going to find you. You got to go out there and look for what you want. If you’re ready to make a change this year, let’s talk about one of the best ways that you can do that, BiggerPockets Pro. I told you guys about this earlier. BiggerPockets Pro is your one-stop shop to start scale and manage your real estate portfolio. With BP Pro, you will analyze investment properties in minutes like I showed you, and determine which ones are worth pursuing with unlimited access to that analysis calculator that I showed you and more.

There’s also the rent estimator calculator, the rehab calculator. There’s a lot of them, a BRRRR calculator. You get unlimited access to all of those if you’re a Pro member. This is an example of what it looks like when you run your analysis that’s doing all the work for you. I love that. I don’t like having to guess and hope that a property’s going to work out. You can become a better investor with curated video content and webinar replays covering everything you need to make smart investments. Now, guys, many of you love the podcast. Many of you’re listening to YouTube all the time. If you’re like me, you’re constantly looking for information. You get access to information that other people don’t get. You can watch all of these replays of webinars like this one that have been done by many people, by me, by Brandon, by other BiggerPockets personalities all for free when you’re a Pro member. You get these exclusive videos that other people don’t get. Here we have the Investor Guides to Tax Benefits, Multi-family Private Lending, a lot of information that other people can’t see to increase your education.

You also get access to the Investing With No or Low Money Down Workshop that I did with Brandon that I told you is awesome. That’s a $200 value for you as a Pro member. You get access to the Finding Great Deals masterclass that we went over earlier. This is where Brandon Turner sits down with experts in door knocking, direct mail marketing relationships, and driving for deals. That’s a $990 value available to Pro members. You show the community that you mean business with your Pro badge. Everybody can see you’re legit. You’re not someone who’s just looking in the window, you actually have a membership to that gym and you’re there to work out. This is one of the ways that you set yourself apart in the BP community where I know, “Hey, that person means business. They’re serious.” You save time and money and minimize risk with lawyer-approved lease documents from all 50 states, so at BiggerPockets. We’ve contacted lawyers. We’ve had them draw up lease agreements for every single state in the entire country.

In case you want to manage properties yourself and save that 10% property management fee that we went over early, you get access to all of those with your Pro membership. You also save thousands of dollars on tools and services that you’ll use in your real estate business with BiggerPockets. Partners like RentRedi and Invelo. Rent Redi is free property management software that is available to you if you’re a Pro. You pay for it if you’re not a Pro. You’ll gain access to discounted 10-week educational boot camps. Okay? Now, these costs some money. They’re $225 a bootcamp, but you can only attend them, you can only go if you’re a Pro member. Non-Pro members are not allowed to go. It’s only serious people allowed. You can choose the course that fits your real estate investing goals, whether it’s the Rookie Bootcamp, the Multifamily Bootcamp, the Short-Term Rental Bootcamp, the Rookie Landlord Bootcamp, the House Hacking Bootcamp, whatever strategy you want to use, we got you, but what’s the number one reason to consider going Pro? It works.

“The BiggerPockets calcs are my go-to for analyzing rental properties. There’s no way I could analyze the volume of properties I do without being a Pro member. I locked up my first three-unit almost a year ago that I’m now selling for almost a $70,000 profit that will go towards something larger. The BiggerPockets calculators were a huge factor in making sure my numbers were right.” That’s from Aaron C., who is a BP Pro member. Patrick M. says, “Back in June, I attended one of your webinars. Right afterwards, I signed up for Pro. In the next couple of weeks, I analyzed a bunch of deals. Eventually, I found a 4-plex. I got it under contract. Three weeks after signing up for Pro and a week later, close on another property that was six units. A big thank you to you and the entire team. Final quick tip, sign up for Pro annual. I made my money back at the closing table.

So how much is BiggerPockets pro? This is the part that’s going to shock you the most. It’s only $390 a year. Everybody else that’s in our space charges 10, 15, 20, sometimes $50,000 to teach you how to invest in real estate. You’re going to get access to every single thing that I just told you guys for 390 bucks a year. That is less than the cost of a home inspection on one deal. You’re going to spend money once you’re pursuing properties, okay? That’s less than the money you’re going to spend sending out letters to people to cover an entire step of the LAPS funnel, the analysis part, and help you with the other things like your access to Invelo, which will help you send out letters, your access to rent ready, that will help you manage the properties, AirDNA, the tax course, all the content that I told you, everything there. We’re covering the majority of the work you’re going to have to do for less than the cost of a home inspection.

But if you guys sign up for a Pro annual today because you’ve sat through this webinar, because you’ve shown that you’re loyal, because you’ve shown that you want this year to be better than last year and you really want to build momentum, you can get another discount of 20% off, making it only $312 a year. That’s right, you could save 20% on a Pro annual membership using the code on the screen. So here’s what I want you guys to do. Get your phones and take a picture of that code. This is your benefit for hanging out with me this whole time. All right? Let’s recap what you’re going to get. If you use that code, 20% off your first year of Pro annual membership, a $78 value, the Pro exclusive video workshops, a $1,500 value. The lease agreement templates, a $99 value per state.

You’re getting 50 of them, the free rent ready property management subscription, a $239 value plus unlimited rehab and rental estimates, analysis calculator reports, and a Pro profile badge. Now, here’s what you need to do. If this is interesting to you. If you want to start building momentum with your own portfolio in your own wealth, go to biggerpockets.com/pro. Very easy. Do that right now. Open another tab, hit the little plus sign on your browser, type in biggerpockets.com/pro, and you will see a place that you can fill out some fields. I want to make sure you put that code that was on the screen in there so you can get your discount. It’s not expensive to be Pro, but hey, if they’re going to give you a free thing, if we’re giving you free access to this, you need to take advantage of that. Now, what if you’re already Pro?

Well, you can get all of the things that I talked about at biggerpockets.com/pro/videos. You can also find the bootcamp info at biggerpockets.com/bootcamp. Many people that are on these webinars are Pro members that are watching it. There’s a lot of value there. But for those of you that are not Pro, I do want you to go to biggerpockets.com/pro and put in that discount. What if you don’t like it? Well, what do you know? BP has a guarantee. Give us a try for up to 30 days, and if you don’t love it, you can email [email protected] and get a 100% refund. So there’s no reason not to do this if you’re serious about taking advantage and making momentum in your own portfolio. Remember guys, that quote from Jim Rohn, “If you really want to do something, you’ll find a way. If you don’t, you’ll find an excuse.”

I was very nervous about going to work out when I was a young man. I had a lot of reasons not to do it, but what happened is I just told a friend how I was feeling and that I was afraid. He said, “I’ll go with you.” That was my way. Since then, I’m not as skinny anymore. Now, I don’t worry about it. Now, working out is a part of my life that I really enjoy. I’m so glad I did that and I didn’t live in security forever. You guys can do the same thing. You might be insecure about your job. You might be insecure about your mind. You might think you’re not smart enough. You don’t know enough about real estate. You don’t want to lose all your money. You don’t want to push yourself out of your comfort zone. You don’t have what it takes to be a laser, that is normal. What’s not normal is making excuses for staying that way. If you actually want your life to get better, it happens on purpose. It happens by change. Okay?

It doesn’t just happen on its own. Just a reminder, these bonuses are worth over $2,000 that you can get for only $312 a month if you sign up for BP Pro Annual. You want to do that, head over to biggerpockets.com/pro. Fill out the forms there. Put in your discount code and save your money. All right, and that was our webinar. Thank you very much for listening. I hope you learned something there, and I hope that you were inspired to go get your next property. Remember, building momentum is what it’s about. This gets easier and easier the more momentum you build. So instead of just asking, “How can I get more passive income?” I’d like you to ask yourself, “How can I build more momentum?” And the passive income will follow. If you’ve been on the fence about going Pro, remember, you can get 20% off using the code Rental 20. So go to biggerpockets.com/pro and put in Rental 20. Upgrade to Pro. Get serious, get committed, and get wealthy. This is David Greene for BiggerPockets signing off.

Help us reach new listeners on iTunes by leaving us a rating and review! It takes just 30 seconds and instructions can be found here. Thanks! We really appreciate it!

Take your business to the next level with Left Main: the #1 CRM for Real Estate Professionals, built on Salesforce.