How would you describe the housing market right now? Is it up? Flat? Down? Crashing? Each option is a little bit correct and a little bit wrong. That’s because these days, there is almost no way to describe the housing situation in the United States on a national level. To understand what is happening and to make solid investing decisions in 2023, you need to be looking at regional trends and individual market metrics.

To shed some light on the differences in market behavior, I dug into the 295 largest housing markets in the country and wrote up the most interesting trends and findings from my research.

Sales Price

Of the 295 markets studied, 200 of them are up or flat year-over-year. This is true, even though on a national level, housing prices are down about 3%. Meaning although about two-thirds of markets are still up YoY, the depth of declines and size of the markets seeing negative price growth is dragging down the national average.

For the most part, the pandemic-era craziness is over, but there are actually still 37 markets with double-digit growth. Macon, Georgia, is up 28%, with many of the other red-hot markets coming in the Midwest. Springfield, Ohio; Saginaw, Michigan; and a few places in Wisconsin still have growth of over 20%.

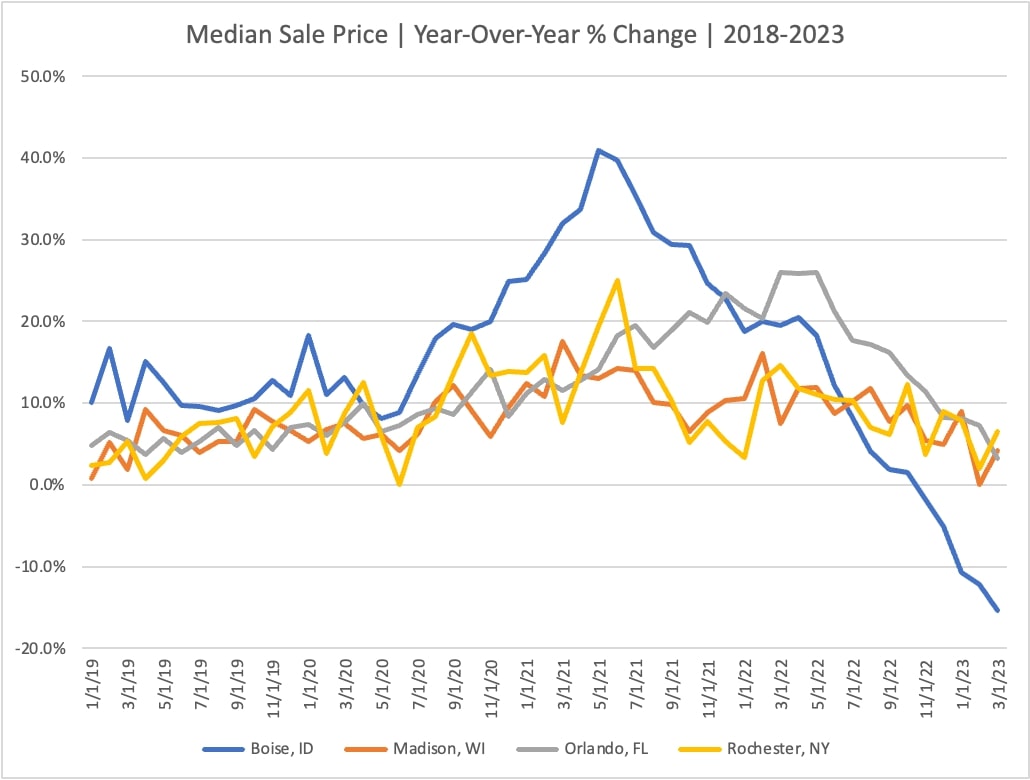

Of course, there are markets that are seeing big declines as well. Austin leads the way with -14% growth, followed by Sacramento and Boise at -12%, and other major markets like Seattle, Phoenix, Los Angeles, and Denver are all seeing some of the worst corrections.

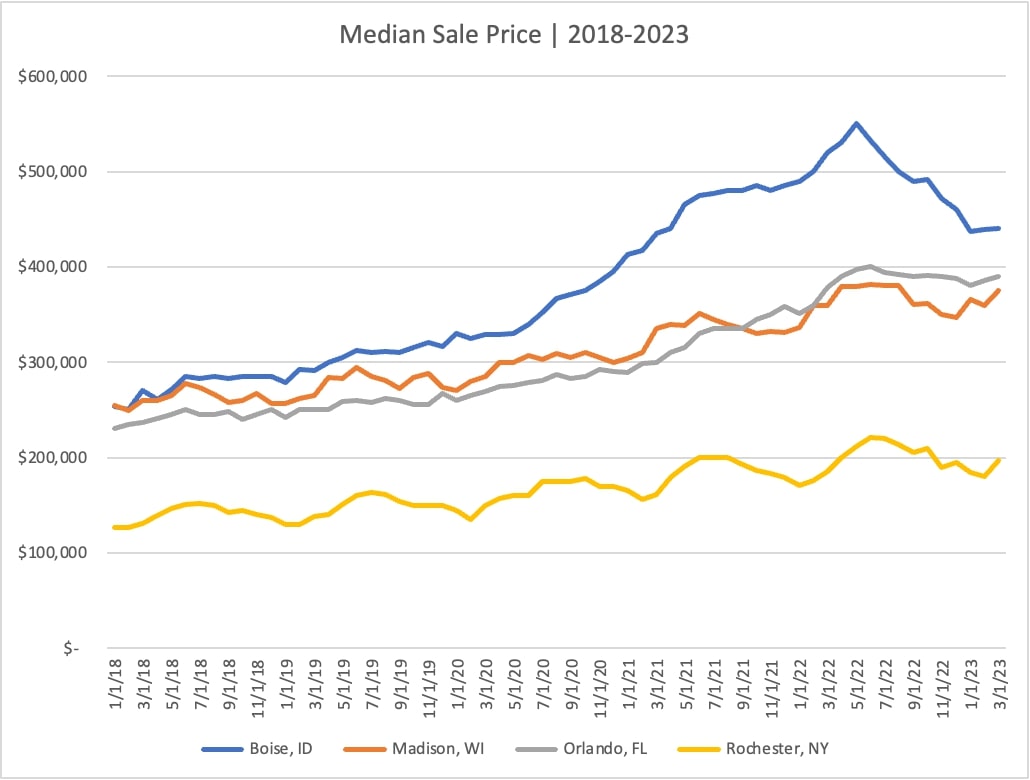

What stood out to me when looking at sales prices is how pronounced regional differences are. For the most part, western states are seeing big declines, while markets in the Midwest and Northeast are doing fine. The South is mostly growing still, but there are some markets in decline there too. To help visualize some of these regional differences, I selected markets (somewhat at random) from each region.

As you can clearly see, Boise has seen steep declines but has started to level off. Madison and Orlando are relatively flat, and Rochester is still on an upward trend (even though seasonality makes it look like it’s declined for a few months, it’s up YoY).

Inventory

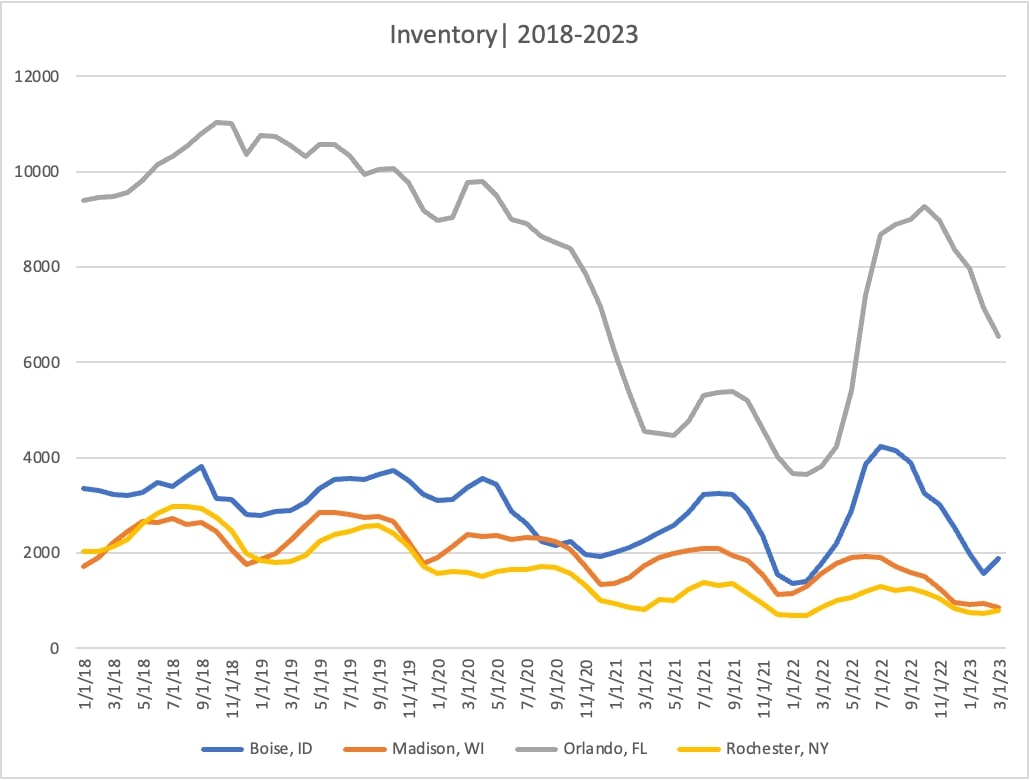

The prevailing logic over the last year is that inventory was going to rise considerably with higher interest rates, and in some ways, this is true. Of the 295 markets studied, 183 had inventory up YoY. Some markets have truly skyrocketed, with markets like The Villages, Florida; Austin, Texas; and Spokane, Washington, all seeing inventory more than double.

This seems like an alarming statistic because rising inventory can precede steep price declines, but year-over-year data might be misleading us. Inventory was extremely low during the pandemic, so I looked at current-day inventory and compared it to the same months in 2019. What I found was that only 20 markets have inventory higher than pre-pandemic levels. This is extremely low! Even with higher interest rates, there are only a handful of markets in the entire country with inventory levels that have fully rebounded.

What’s even more remarkable to me is how low inventory has stayed in other markets. In Muncie, Indiana, for example, inventory is only 21% of what it was in 2019. Meaning for every five houses for sale in 2019, there is now just one. When you look regionally, low inventory levels are primarily concentrated in New England. Massachusetts, New Hampshire, Vermont, and Connecticut all have several markets with desperately low inventory.

Even in Boise, which has seen a steep correction, inventory fell in line with seasonal patterns this Winter and is not accelerating out of control.

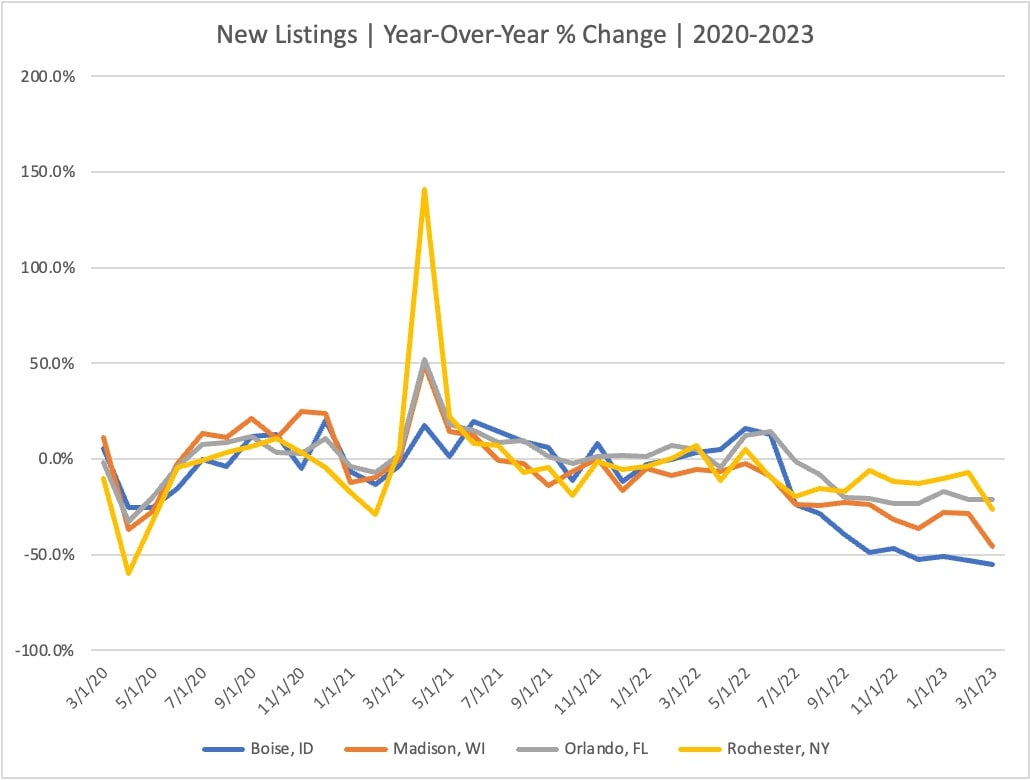

New Listings

One of the main reasons inventory remains so low is the lack of new listings. Of the 295 markets, only 16 have seen growth in the number of new listings in the last year. This is as close to a national trend as it gets in the housing market right now. Surprisingly, those 16 markets are primarily concentrated in Florida and Texas.

In certain markets, sellers are in revolt. Burlington, Vermont, has seen a 68% decline in new listings this year, as has Truckee, California. Other areas with ultra-low new listings are in New England. That makes sense—declining new listings and low inventory tend to be closely correlated.

If you want to know why the housing market isn’t crashing on a national level, this is one of the main reasons. There is very little to buy, which is offsetting the decline in demand that has come with rising interest rates.

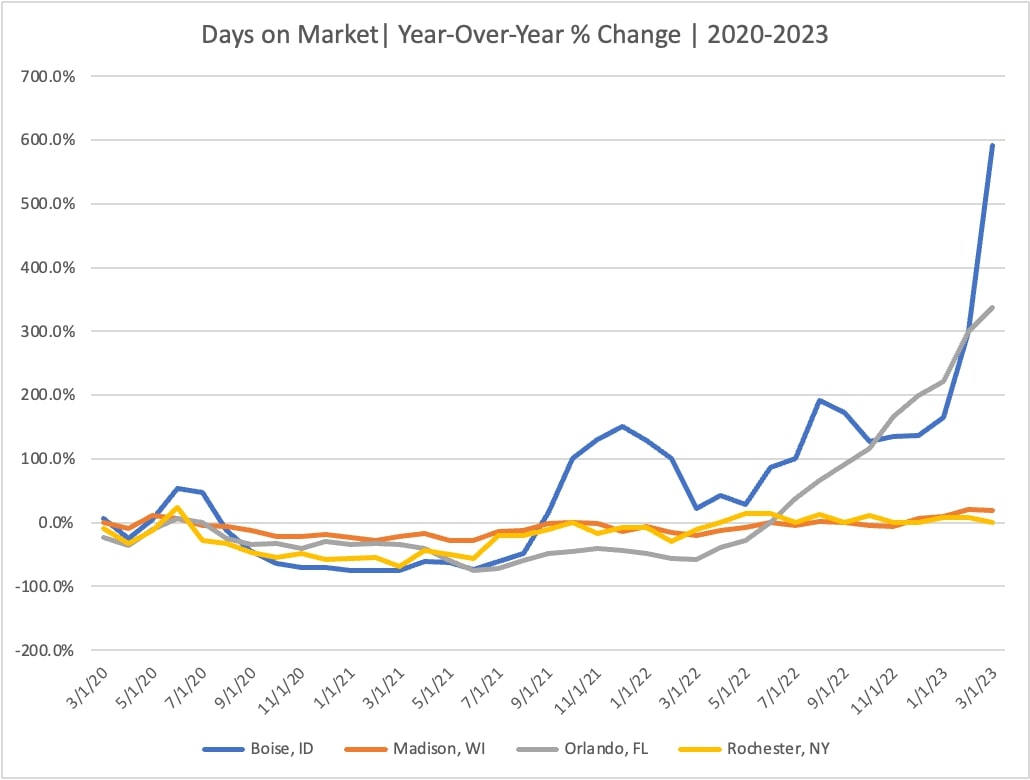

Days on Market

Days on market (DOM) is an excellent indicator because it helps us understand the balance of supply and demand in a market. In markets where there is excessive supply, DOM goes up. In markets where there is excessive demand, DOM goes down. Balanced markets stay flat.

What we see right now is that 246 markets have rising DOM. Even though inventory has remained low—properties are sitting on the market longer in most parts of the country. But how much longer varies dramatically.

In Boise, the average days on the market went from 13 one year ago to 88 today. That is an increase of nearly 600%! No wonder prices are falling in Boise. The chart above does a great job of showing what’s happening right now. Markets that boomed, like Boise and Orlando, are reverting. Meanwhile, the more “boring” markets like Rochester and Madison are holding almost perfectly steady, as they have for years. This is generally true for many major metros in the Midwest and Northeast.

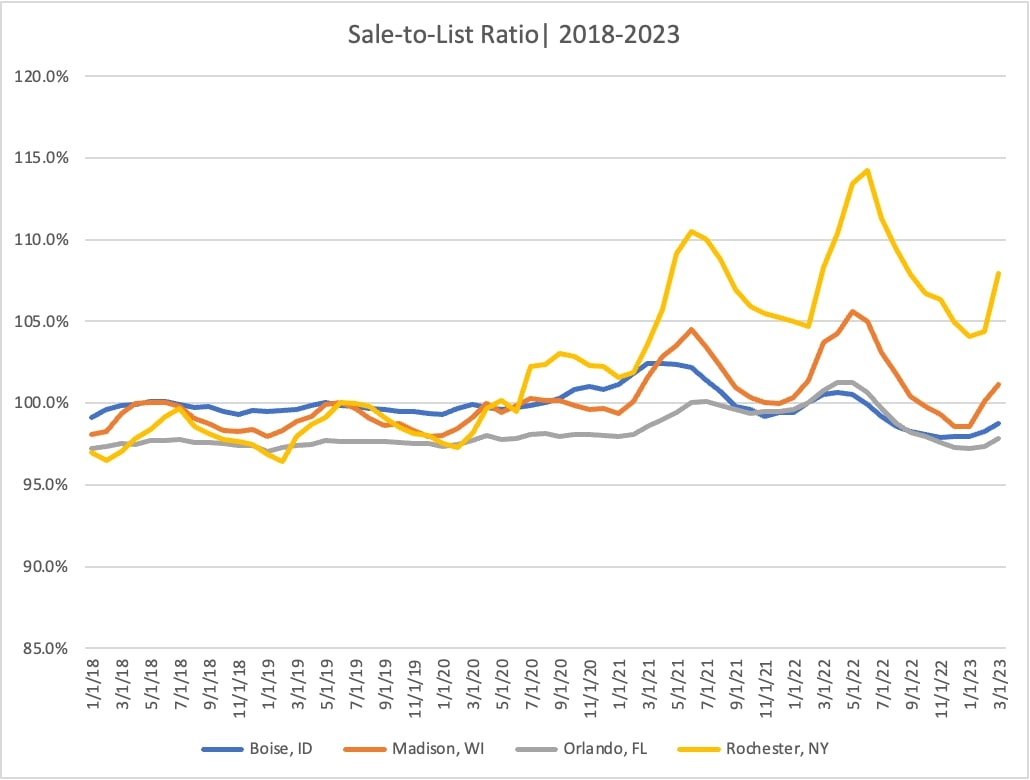

Sale-to-List Ratio

The last metric I looked at is the Sale-to-List ratio, which measures, on average, how much below or above the asking price properties are selling for. Despite dropping demand, there are still 49 markets in the U.S. that are averaging above-list sales. Of all markets, Rochester, New York, leads the way with the average home selling for about 107% of the list price. Madison is also above 100%, which again is no shock given the supply and demand dynamics.

For the other 246 markets, however, buyers are getting discounts on the sale price. I’ve been talking about the concept of “buying deep” for months (buying under the asking price), and it seems that in 84% of markets, this is happening. In Key West, Florida, buyers are buying at 95% of the list price, Austin is 96%, and in New Orleans, it’s about 97%.

To me, this is a perfect example of why it’s so important to understand local market dynamics. If you see that inventory is rising and you’re in a buyer’s market, you can offer less than the asking price—and as the data shows, you’ll probably get it! However, if you’re in a strong seller’s market, you may still have to write competitive offers and won’t have the luxury of being as patient as you might like.

Conclusion

Hopefully, this analysis has shown you that trying to describe “the housing market” is not possible right now. Every region and every individual market is behaving differently. There are markets still in the grips of the pandemic boom with massive growth and low inventory. And there are markets seeing steep corrections.

How you invest in 2023 should largely depend on the dynamics of your local market. Some markets will support flipping right now, while others are better for rentals, and some maybe shouldn’t be touched altogether. As an investor, I encourage you to stay on top of the metrics I outlined in the post above and use them to help you make investing decisions.

What are you seeing in your local market, and how are you adjusting your investing tactics accordingly? Let me know in the comments below!

Find an Agent in Minutes

Match with an investor-friendly agent who can help you find, analyze, and close your next deal.

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.