How Long to Hold On to a BAD Rental Property

DON’T sell your low-cash flow rental property just yet—you could make it a cash cow with one quick strategy switch. At least that’s Rob Abasolo’s advice as he joins David this Sunday for a Seeing Greene episode, where they take questions directly from BiggerPockets listeners, commenters, and reviewers! And even if you don’t have your first rental in the bag, this episode will be worth tuning into.

David and Rob discuss whether buying your first property with a fixed vs. adjustable-rate mortgage (ARM) makes more sense with today’s high interest rates. Then, we hear from an investor looking to sell their rentals and move that money into a bigger city with more appreciation potential. The problem? Their rentals are making some serious cash flow. Speaking of cash flow, we hear from an investor who’s got a townhouse that COULD become a rental but would have some meager returns. Is it worth keeping? Tune in to hear answers to all those questions and more!

Want to ask David a question? If so, submit your question here so David can answer it on the next episode of Seeing Greene. Hop on the BiggerPockets forums and ask other investors their take, or follow David on Instagram to see when he’s going live so you can hop on a live Q&A and get your question answered on the spot!

David:

This is the BiggerPockets Podcast show 828. BiggerPockets has a Rental Property Calculator that you can use to look into this and decide would that town home support that rent? You can also call local property managers, meet local real estate investors. You’re living in LA, one of the benefits other than the rattlesnake sausage, is all the other people that are out there that are investing in real estate themselves. So, take advantage of that. Talk to people that own town homes and ask what they’re getting for rent. If it doesn’t bring in what you need for it to make money and you can’t afford to bleed money every month, the answer becomes pretty clear that you need to sell it.

What’s going on, everyone? It’s David Greene, your host of the BiggerPockets Real Estate Podcast. The biggest, the best, the baddest real estate podcast in the world here today with a Seeing Greene episode. In today’s shows, we take questions from you, the listener base, the future millionaires, the future financially free. And I do my best to answer them with the knowledge that I’ve gained with over a decade of investing in real estate, serving people as real estate agents and a loan officer and more.

In today’s show, we cover how to structure a short-term rental with a partner, when to go with an adjustable rate versus a fixed rate mortgage. If you should keep what you got or invest where it’s hot. And more. And as a surprise, I’m joined by my partner today, like Captain America with the Falcon, Rob Abasolo. Rob, welcome to Seeing Greene.

Rob:

Hello. Hello. Listen, I was really offended there because you talked about the future of real estate investors, the future millionaires, but you didn’t hit on the most important group of people, the future farmers of America.

David:

You heard the word future and your mind went there right away, didn’t it?

Rob:

Hey man, the FFA, it was a very popping group in my high school. I wasn’t part of it, but I knew lots of good people that raised cows and stuff.

David:

That tells you a lot about where Rob grew up, we’re the cool kids, we’re the future farmers of America. If that is you, if you’re in FFA, keep an eye out on future shows. We may have something about a USDA loan. I know we’ve interviewed people before that do hog hacking, pig flipping.

But in today’s show we are going to talk primarily about real estate, partnerships, structure, moving money around to make more sense, and more. Rob, it’s nice to have you on today’s show, especially with those growing muscles that you’ve been working on.

Rob:

Well, David, I had a really great time today and I appreciate the offer to come on to the show. Listen, if you ever need a day off, I’ve been thinking maybe we rebrand the show. We call it coiftions and answers with Rob Abasolo and David Greene, or maybe Q&A-basolo, just a couple of working titles. I’ll let you sleep on it, but just wanted to tell you where my head’s at. Feel free to take a breather here and there.

David:

Thank you for that, Rob. I appreciate your coifidence in the matter. You’ll be the first call if I ever need a day off. All right, let’s get into our first question with Rob and I.

Ben:

Hey David, love the show. I would like to know your advice on how to structure a deal with family members that want to invest in a short-term rental with me. I’d like to purchase the property as a second home to put 10% down and use their investment for that deal. I’m looking for something in the Hudson Valley in New York for the property.

I currently have a two unit and a three unit property in New York with a W-2 job that I don’t plan on leaving anytime soon. So, I want to purchase the short-term rental for my next property to help offset tax liability from my W-2, which my CPA has recommended as the best way to accomplish that. Mainly, I want it to offset taxes for my W-2 and they want a place to park their money that will appreciate over time and have a nice rate of return that a short-term rental could offer. So, outside of investing money in the deal, they don’t want to necessarily be involved in any of the day-to-day management and would like to really just invest their money. So, how would you structure a deal to be able to accomplish that and still use that process? Look forward to hearing from you. Thanks.

David:

Thank you, Ben. This is a very good question. You are thinking the right things and you’re asking the right questions. This falls right into your wheelhouse, Rob, probably not the tax planning part, but definitely the short-term rental part. So, what advice do you have for Ben? Let’s start off with your perspective here.

Rob:

Well, it sounds like he’s looking for the tax benefits and the family members aren’t looking for the tax benefits, so there are a lot of different ways you could structure this. You could almost structure it to where they get all the appreciation, so all the upside, you get all the tax benefits and then you split the cashflow down the middle. That would be the first way to do it. You could also just split everything across the board.

And I think you get really interesting territory here when you’re working with family because so many things can go wrong. So, I think you should almost work harder to make sure that the family member is getting paid back. So, I would probably suggest a waterfall here. They get paid back 75% of the profits and you get paid 25% of it, and then once they get paid back their initial contribution, then you waterfall the cashflow to be 50/50, all while giving you as much of the tax benefits as you can negotiate.

So again, not enough context to know if that’s important to the family member. I’m going to say it’s probably not because they’re not going to be actively managing that short-term rental themselves, so they won’t get to take advantage of the cost segregation or the bonus depreciation. So, I almost feel like if he’s going to be sacrificing 75% of the profits out the gate to pay back that family member, maybe he could negotiate or maybe you, Ben, can negotiate keeping 100% of the bonus depreciation. Did you keep up with all that, Dave, or was that a bunch of mumbo jumbo?

David:

No, that was really good and I always love sitting in the position where I get to talk after you do. Like Alex said when we interviewed Alex Hormozi and Leila, he likes to let Leila talk first because then he can sum up what she said and add something that maybe she missed. You always sounds smarter. But the real work is done by the person who speaks first.

There’s basically several benefits to real estate. We typically only talk about cashflow, but there is some tax benefits in this case, there is appreciation and there’s cashflow. These are the main three that we see in this deal.

So, if the person that you’re partnering with doesn’t care about the tax benefits, then take all of them. They probably care about the cash on cash return. I think that you could probably structure this where you split the equity 50/50, you split the cashflow 50/50, you keep 100% of the tax benefits for yourself because they don’t want it anyways. They’re happy to be getting a good return on their money.

The only question you didn’t ask is how are you going to split up the management of this asset? Are you going to be doing that work? Are you hiring a third-party company to do it? If you’re thinking about hiring a third-party company so that neither of you is doing the work because your partner has already said they don’t want to, I would caution you to look very closely at the service that you’re getting. Sometimes you find a great property manager. Most of the time the deals don’t make sense when you have a third-party person managing it unless you’re doing it in-house.

Rob:

I think he has to self-manage because he’s doing the bonus depreciation, so he has to materially participate in the management. So, I think Ben will be self-managing. And it has to be that way just for the sake of his … Why would they need him?

David:

Good point there. Thank you, Rob, for catching that. I’m a real estate professional because of all the work that I do in the real estate brokerage and the mortgages, so I sometimes forget other people are not in that position, but thank you for bringing that up. He’s going to have to manage it if he wants to get the hours in that he needs to, to qualify for the short-term rental loophole.

So, there you go, Ben. You got a really good plan there. I don’t think you have to give anything up. I think you can go back to your partner and just say, “Hey, there’s some tax benefits that I’m going to get out of this, but that’s because I’m running the show. Doesn’t hurt you, because you can’t use them anyways.” You’re going to get half the equity, you’re going to get half the cashflow and then they’re going to contribute the down payment. So, fingers crossed for you.

Rob:

I think that’s a good resolution. I think he should have 25% of the cashflow, so he gets a little bit. Investor gets the cashflow since Ben is getting the majority or all of the tax benefits. That’s a very tangible benefit to him. I think that’d be a better way to strike that deal personally.

David:

Yeah, Rob, that’s a good point. That’s an option too. I’d probably go there myself if the partner didn’t like the 50/50 split, I’d maybe say, “Okay, then fine, I’ll take 25. You take 75.” Definitely a good backup plan. That tends to be how you negotiate though. You start with what you want and then if they agree to it, great, and if they don’t, then you, “Okay, here’s plan B. Here’s plan C.” And you keep working down until you find something that works for both of you.

The last piece to consider is how you’re going to structure this agreement. You could buy a property and put both of you on title. You could form an entity that you each own 50% of and then buy the property in that entity, and then that entity has an operating agreement that dictates who’s going to be doing what and what the splits are going to be. That might be the cleanest way. So, I’d recommend reaching out to a lawyer and having them draw up the documents for you. I have someone that I use for that. If you’d like to DM me, I’d be happy to put you in touch with them. But in general, this doesn’t have to be super complicated. I think you’re asking all the right questions and best wishes to you. Thanks for reaching out to Seeing Greene.

Before we move on to our next question, Rob, in your answer, you mentioned waterfalls. As a child, I was cautioned not to go chasing them. Can you share for everyone listening what a waterfall is in this context?

Rob:

Sure. Simple terms here. If you have a waterfall agreement, I talked about the 75/25 thing, it basically means that the terms change. So, it goes from 75/25 to 50/50. It waterfalls into a different tier once you’ve returned the capital of that investor.

David:

There you go. And that’s a principle that works in most syndications or partnerships. So, you’ll often see the silent investors or the limited partners, also known as LPs, will tend to get a preferred return or a higher return that they get out of the cashflow before the sponsors or the general partners get any money. And then once their investment is paid back, the splits switch to something that’s more equitable for both parties. It’s just a way of making sure the investors get their capital back out of the deal they put in and then the returns are adjusted. So, thanks, Rob, for helping provide a free education to our BiggerPockets listeners.

Our next question comes from Melissa N in SoCal. Rob, this is your hood. You spent quite a bit of time in Southern California. You know it well. You took us to a sausage restaurant when we were all there recently and I believe you ordered the rattlesnake sausage. Longest I’ve seen you go without talking. You are definitely into that thing. So, I’m going to let you read this question since you might know Melissa, since you guys grew up in the same area.

Rob:

It’s true. Los Angeles is a very small city, so I’ve probably run into her. “So, a little bit of background here. Husband is interested in getting me on board with real estate for the last five years, but he’s not very convincing. Fun fact,” she’s saying nice things about us, “you made it very easy for me to understand, follow along and stay motivated in this industry. I hope he isn’t listening to this episode. Anyways, thank you so much for all the motivation. I’m a big fan of your analogies. We listen to you on our LA commute to work every day. You make the drive something to look forward to.” That’s very nice.

David:

Yeah, before you continue here, every husband loves for his wife to compliment other men and tell them how they did a much better job than he did. So, Melissa N, thank you for that and to Melissa N’s husband who probably is listening to this, I feel you man.

Rob:

“Okay. So, the issue. We purchased a town home house hack in Lakewood, California. We’re in a dilemma because we realized after using BiggerPockets’ Rental Property Calculator, our purchase wasn’t as great as we thought it was when we initially bought it for a future rental. So, the pros for keeping the property are we want to keep this property as an investment because the area is great for families, it’s safe, has great schools and is within walking distance to so many shops and restaurants, grocery stores, and even a mall.

The cons. The problem is we looked at rent in our area and it doesn’t make up for even a small amount of cashflow unless we hike the rent price up. We think part of the problem is that it’s a town home, which means we can’t expand and there’s an HOA.” Ew.

“So, the needs. We want to purchase another property, but we’re just not sure if we want to keep this house or house as a long-term investment. If we hike our rent prices up $500 or more, we could make about $100 in cashflow. We’re just not so sure if anyone would pay 3,500 bucks to live in a town home. We’re considering Section 8, but we would have to do more research. My question to you David and Rob, what would you do in our situation? Would you keep this property and try to rent it out to a family who can afford it for 3,500 bucks? Or, would you sell it and purchase a single-family where we can build an ADU?”

David:

So, first off, Ms. Melissa, you’ve already noticed that the time to use tools to analyze properties, like the BiggerPockets Calculator, which is great, is before you buy the property, not after. No need to beat that dead horse. You learned that one the hard way. That’s okay. It’s all about learning.

I think what happened is you looked at a town home and you assume that the comps would be the same as the single-family homes. They’re not comps. Learn that lesson the hard way too. That’s okay. That’s a part of real estate investing. That’s one of the reasons that we say everybody should house hack first because you get some of these little errors or misunderstandings of how the whole thing works out of the way at a relatively low-risk experience. Rob got into house hacking when he lived in Los Angeles. I started house hacking. It’s how a lot of us learned how to ride a bike. We put the training wheels on before we took them off. So, no shame in your game there.

I don’t think you should look at it like, “Should we raise the rent to 3,500?” I think you should look at it as the question being, “Can we raise the rent to 3,500?” BiggerPockets has a Rental Property Calculator that you can use to look into this and decide would that town home support that rent? You can also call local property managers, meet local real estate investors. You’re living in LA, one of the benefits other than the rattlesnake sausage is all the other people that are out there that are investing in real estate themselves. So, take advantage of that. Talk to people that own town homes and ask what they’re getting for rent.

If it doesn’t bring in what you need for it to make money and you can’t afford to bleed money every month, the answer becomes pretty clear that you need to sell it. You sell the property, you reinvest into something else. That’s something that we at the David Greene Team help people with all the time, how to make good financial decisions with their real estate, reinvest the money into somewhere better. So, we’d be happy to help you with that.

And then moving forward, I would, my last piece of advice, say, you need to get other people involved in these decisions before you make them. That’s one of the things that when we’re helping clients with, we’re looking into this stuff for you. Your real estate agent really should have known what you were attempting to do with this, and they should have told you, “A town home isn’t going to cashflow as much.” You don’t have the right team. This shouldn’t be a mistake that you’re having to learn the hard way. There should have been other people involved, and if it’s not your agent, if it’s not your loan officer, although it should be them, you should have other investors involved in the process.

This is something that if you had bounced off of Rob or I, we would’ve known in two seconds, “Hey, hey, hey, hang on here. Town homes have HOAs and they also get less rent. Let’s slow your roll. Let’s look into something that’s better.” But when you’re flying solo, you could easily make these mistakes. Rob, what are your thoughts?

Rob:

A couple things here. I don’t know what the bed/bath count of the property is, so take what I’m about to say as a grain of salt. Los Angeles County, you cannot really Airbnb there and even if you could, she’s in an HOA. The HOA may not allow it. Typically, town home HOAs aren’t going to be quite as strict as neighborhood ones, but you never really know.

I actually think it’s a perfect play for a midterm rental. I mean, 3,500 bucks, if that’s what she’s trying to lock down, assuming it’s at least a 2/2, I think she’d be able to get the 3,500 bucks. But if it’s a 3/2 or a 4/3 or anything like that, I think all day she’s going to get at a minimum 3,500 bucks in Lakewood, California, which is, I think it’s north of Long Beach, east of Los Angeles, I want to say. Never eat slimy worms. Yeah, east of Los Angeles. And so, I really do think as a midterm rental, I mean, she could possibly be making four to $5,000 a month in rent.

It’s not like you just list it as a midterm rental and you rock it, right? She has to go and she has to list it on Airbnb for 30 days at a time. She has to build relationships with health agencies and relocation agencies. I mean, she has to hustle a little bit, but if she wants to not be in this predicament where she’s losing money, she’s going to have to work for it. So, 3,500 bucks doesn’t really scare me. Think it’s totally primed for a midterm rental. Or, she was already house hacking before, just rent out all the rooms. If it’s a three-bedroom, I think she could probably get 1,200 bucks or something like that for each room. I don’t know enough about the bed/bath count for that to be an informed decision though.

David:

Yeah. But if they bought it recently in Los Angeles, even 3,600 is probably not going to be enough to cover the mortgage with where today’s rates are. It’d probably need to be five to six bedrooms before they could expect to make a decent amount there. Again, we don’t know the details of the purchase price, but from what I’ve seen, most of those properties are going to have a higher mortgage.

Rob:

I agree, but isn’t $3,500 the number that she cited? I assume that that’s her mortgage.

David:

Great point there, Rob. And that’s some creative thinking. If you got to get to the 3,500 a month, if you can get 1,200 a room, you’re there. It’s a little more work. Just like if it’s a medium-term rental, it’s a little more work, but like you mentioned, Rob, you’re going to have to work for it. So, go to Craigslist, look up what rooms rent for in that neighborhood, and if it’s $800 a room, this isn’t going to work, but if it’s close to 1,200 you can get there.

Last piece, I’ll say, you mentioned, “Should we do Section 8?” I forgot to address this earlier. You don’t control the rents on Section 8. There’s actually government regulations and guidelines that tell you for the size of the property, the bedroom and the bathroom count, what you will be paid by Section 8. And then how much the tenant is responsible for is something that the HUD program themselves will determine, not you. So, I wouldn’t look at Section 8 like that’s going to be your saving grace necessarily, because you can’t determine the rent there. I would look up what the guidelines are and see how much a property like that could bring in on Section 8 or even call the HUD program, that stands for Housing and Urban Development, and ask them what your property would rent for. And if it’s not 3,500, throw that out as an option.

If you decide you’re going to sell it, remember that there is a capital gain exception for those that have lived in a property for two years out of a five-year period. For most people, that means they lived in it for two years in a row, but that doesn’t have to be the case. If you’ve rented it out and you’ve lived there as long as over a five-year period, you’ve been in it for two years as your primary residence, you can sell it and have up to $250,000 of your capital gains wiped out or $500,000 if you are married.

So, selling that property and reinvesting into something that you analyze a little better and you get some more supporters on your side going into it is probably where this one’s going to end up. Send me a DM if you’d like to talk about that more, and thank you for sending this question to Seeing Greene.

Rob:

I will say, that sounds a lot harder than just trying to make it work though, like selling and then buying. I think you should try to make it work if you can. I don’t know if it’s worth the rigmarole of getting into a new property, because she’s so close. 3,500 bucks, I think that’s super achievable in the midterm rental pad split space, co-living area. So, I would really leave no stone unturned on this before selling it, I think.

David:

Thank you for that, Rob. All right, let’s get into our next question. This comes from Joel Yunek in Des Moines, Iowa.

Joel:

Hey, David, I’m Joel Yunek. I’ve been listening to the show for about five years now. Huge fan. So, thank you for all the years of knowledge that you’ve been able to give to this audience.

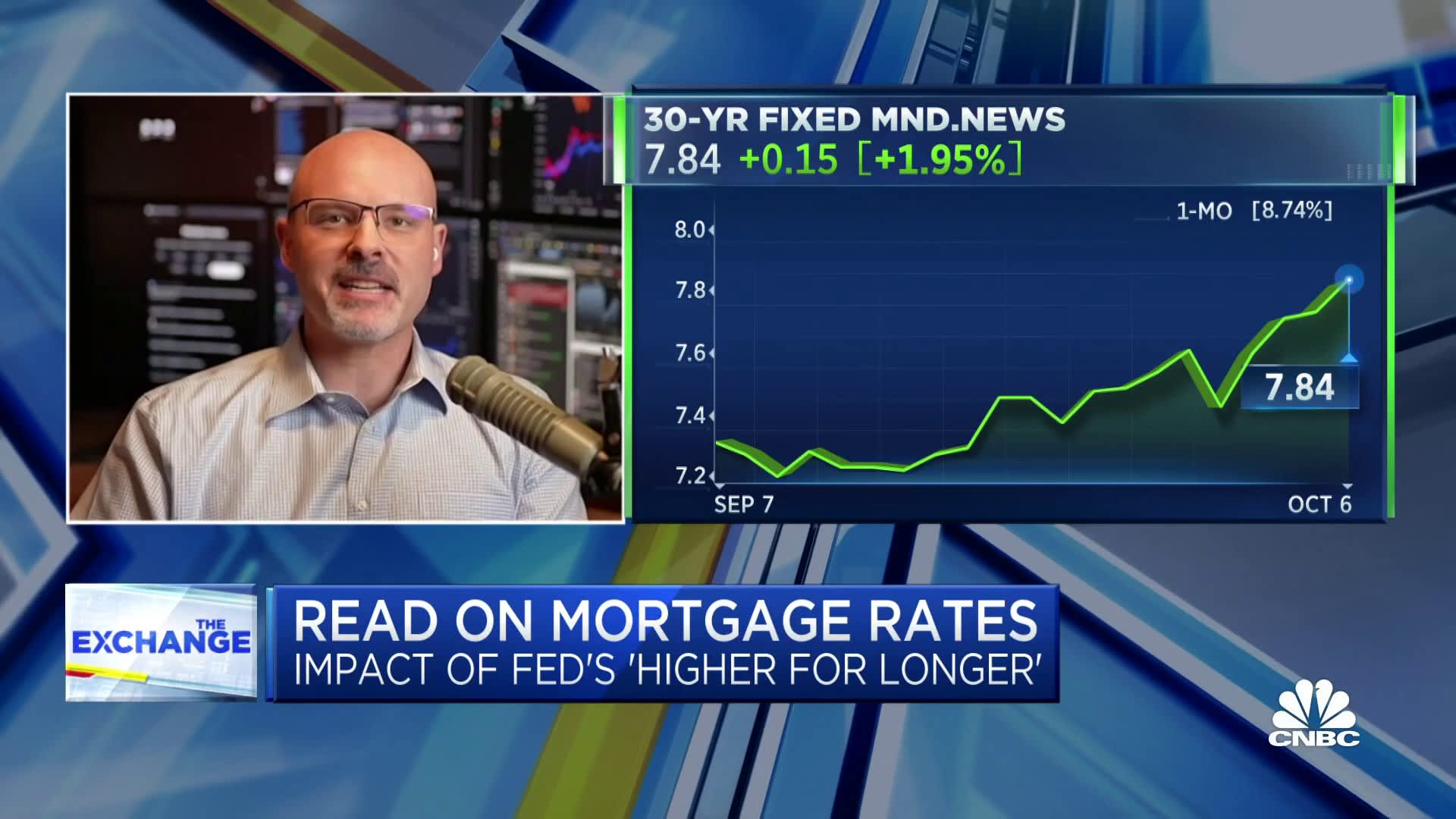

So, I just graduated college and had my first house hack under contract. So, my question is when it comes to financing, with the increasing rates, I’m sure it’s on everybody’s minds right now. I’m looking at a 30-year fixed versus a adjustable rate mortgage, probably a 7 or 10 year fixed rate before it’s able to adjust. So, I know there’s some risk there with the adjustable rate, it seems like a 10-year period is a long period of time to figure out what is the next stage, whether it’s selling, refinancing or just assessing where the interest rate environment is in a decade.

So, with the fixed rate, you get the security of locking that in for 30 years, but while I’m investing with a long-term horizon, what are the odds I hold onto the same property for 30 years? So, my question is when it comes to balancing the options of an adjustable rate and the fixed rate. So, what would you recommend to get the security with a locked in 30 year versus the money saved and the compounding effect of that over the course of a decade with the adjustable rate? Yeah, thanks, David. Appreciate all of the knowledge over the years.

Rob:

Okay. I think I get this one. So, he is basically wanting to know should he get a 30 year or should he risk it for the biscuit and get a 7 or 10 year arm? Which personally, I mean that’s a big difference between 7 and 10 years. I don’t really think either one is particularly risky. I would say 7 years is so far from now. I think he’d certainly be able to refi out pretty close to the 5 to 7 year mark. Chances of him keeping that mortgage for 10 years, that exact mortgage at the current interest rate, I feel is low. But what do you think?

David:

It’s hard to know where interest rates are going to be in 10 years. My gut says whoever the next president is, is probably going to lower rates. Much like when someone’s elected class president, they immediately want throw a party to reward everyone for electing them and establish goodwill. We’re probably going to see rates come down with a new president put in place, but we don’t know that. And you can’t bet on that happening. Although, every decision that you make is some form of a bet. And what we’re talking about here is hedging your bets to put yourself in the best position.

So, Joel, if you’re really good at managing money, if you live beneath your means, if you save a lot of money, if you don’t mind working overtime, working side hustles, working two jobs, it’s okay to err on the side of taking a little bit more of a risk with that 7 to 10 year arm, much better than a three-year arm or something like that.

If you know you’re not that person, you’re not a Rob Abasolo who’s going to work 18-hour days, or a David Greene who’s going to just sleep in his office chair and get right back to it. You’re probably better off taking the safe bet, going with the fixed rate mortgage. And neither decision is going to create a huge difference in the portfolio you have. We’re splitting hairs here. What you really want to do is accumulate more assets in great locations where rents are going to be increasing and values are going to be increasing, and over time you’re going to build some big wealth.

So, don’t get too caught up in these decisions, but as a general rule, I am a fan of being more aggressive with your strategy if you’re more conservative with your finances, and more conservative with your strategy if you’re more aggressive with your personal spending. Rob, what do you think?

Rob:

Yeah, I think that makes sense. And for everybody at home, do you think you could just clarify what a arm mortgage is, for those of us at home that don’t know what it is? I mean, for those that … I know what it is, but…

David:

Yeah. So, a fixed rate mortgage is one where for the life of the loan, the rate stays the same. And an adjustable rate mortgage is for a period of time you get a certain interest rate and then it could adjust. Now, I will also say most of us look at adjustable rate mortgages like they are evil and bad and risky, it’s like gambling, but that’s how most loans are made across the world. Most people do not lock in on a 30-year rate, especially when it’s really low like 3 or 4%.

Rob, you and I would never lend our money at 3% for 30 years. The only reason those exist is because the government sponsors these loans through Fannie Mae and Freddie Mac. It’s a cool little option that we get in America, but it doesn’t exist everywhere.

Rob:

Well, you’d be surprised, man, I just got a seller financed deal locked down about five minute walk from my house here at 3%. They wanted 5, knocked them down to 3%. So, you’d be surprised. I mean, they’re still out there. They’re few and far in between, but…

David:

That’s not you loaning out your money. That’s you buying an asset from somebody who they’re giving you a loan, but they’re not doing it because it’s a pure loan. It’s attached to a real estate transaction where they probably got something in return. They got a better price for the house, right?

Rob:

No, not really. I really knocked them down. No, it was a very equitable transaction. But I agree. And to go to your point about the president changing the rates and all that stuff, I mean, 10 years from now … That’s why I say the difference between a 7 and a 10, pretty drastic because 10 years from now is technically like two and a half presidents from now, possibly three different presidents. No, probably not three, but definitely two different ones. Right?

David:

So, you’re tripling your odds of seeing rates come down, right?

Rob:

I think so. 7, take it or leave it, but 10 I’m like, yeah … I mean, I did a five-year arm, didn’t really know. I took the risk when I was first getting into real estate. It was a really good deal at that time and I refied out of it before it mattered, but I was pretty aggressive with how I did things. So, I think you’re right. It all comes down to investing preference.

David:

There it is. And just keep that in mind. If you’re a more aggressive investor, you got to be more conservative with your finances, with your reserves and with your work ethic. And if you’re someone who doesn’t love work and you’re not out there trying to set the world on fire, just invest a little bit more conservatively to balance it out. Thank you, Joel, for giving us the opportunity to highlight this. Good luck with your investing endeavors. And my final piece of advice will be, don’t get too caught up in the financing of real estate. It’s really not the foundational wealth building piece. It’s just fun to talk about.

Rob:

And definitely don’t get too caught up in the spelling of rigamarole.

David:

And our production team has had Rob’s back. He spelled it incorrectly, however it would apply in the situation that he used it. The definition is a mid-18th century word, apparently an alteration of ragmanrole, originally denoting a legal document recording a list of offenses. You are welcome for this completely useless but still entertaining piece of knowledge on today’s Seeing Greene episode. It’s also considered a long and complicated process that is annoying and seems unnecessary, which is exactly how Rob meant for its to sound.

Rob:

Yeah. And then I looked it up on Urban Dictionary and it’s just a picture of my coif.

David:

Moving on to the next section. At this part, we like to get into the comments that y’all have left for us on YouTube as well as wherever you listen to your podcast. So, today’s comments come from episode 816. The first comes from henneyhomes1852. Rob, I’d also like you to note that I’m not the only person that puts a number at the end of my name. As much as you make fun of me for that, apparently it’s a trendy thing. Maybe I made it trendy.

Henneyhomes1852 says, “‘Luxury’ house hacking,” in quotes, “we’ve been there, done that a couple of times, made tons of equity, over $600,000 on each, allowing us to stay in upscale neighborhoods, paying less than half the mortgage every month, saving lots of cash and being easy to rent out. And yes, rent went up every year.” This comes from a question that I answered on the Seeing Greene episode 816 where someone was asking, “Is it okay, is it allowed financially to splurge a little bit? Instead of house hacking and having 100% of my mortgage paid, what if I want to house hack in a really nice neighborhood where my family would love to live, but I’m going to be covering part of my mortgage?”

And my answer was, if you’re financially in a good position, hell yeah, that’s absolutely okay. And as we’re seeing from henneyhomes, you actually can make more money when you’re paying part of your own mortgage because the rents go up every year. It’s very easy to find tenants. The equity grows faster in the best areas. Look, the three rules of real estate are and always have been, location, location, location. I recommend starting off with the best locations and then figuring out the strategy, whether it’s short-term rental, house hacking, BRRRR, whatever, in that area to make it work. So, I thought this was a great testimony, Rob, you had a similar experience, right? Didn’t you do a house hacking where you rented out an ADU at your luxury property, and maybe it wasn’t luxury, but it was expensive real estate in Los Angeles, right?

Rob:

Yeah. House was 624,000 bucks and the mortgage was $4,400, which was, I mean, a lot of money, a lot of money. But we had a little studio apartment underneath and that was going to make about 2 to $3,000 on Airbnb. So, really, it did end up being that. We were paying $1,400 out pocket on our best months, which was most of them on that particular property, and that was still less than the rent that we would’ve paid at the apartment that we lived in right before that house. And then we built a tiny house ADU in the backyard, and that completely covered all the mortgage.

So, I think it’s better to do what he’s saying where you can splurge a little bit and pay a little bit out of pocket because ultimately that’s still probably going to be cheaper than just living on your own without house hacking. And B, if you could have a plan for expansion or a plan to eventually get that all subsidized, I think that’d be great too. That’s what I did in LA. I knew one day maybe I could build a tiny house. I didn’t do it initially. It took about a year, year and a half, but once I did, mortgage was completely subsidized and that house is now worth twice as much.

David:

Great point. If you wait long enough, especially in the best areas, the rents will go up and it will eventually subsidize your mortgage and then you get even more upside.

Moving on. The ongoing Cali, California, Californi-A and hella usage debate continues. This was a big part of episode 816, and if you haven’t heard of this before, go check it out. We have lots of great comments from fellow Californians that we’re about to read here. Geography and age may be the reasons for the hella differences. We can call on the great USA and First Amendment and put this one to rest, freedom of speech. Remember that we have a First Amendment and we can all use the language that we want.

But in reference to that show, cowvet2018 says, “I love the show. Listen to it on Spotify, and it got me into real estate. I live in the Central Valley of California. I’ve been here my whole life. I’ve never heard anyone in this state call it Cali, unironically, I say hella. Boom.” This was in reference to my perspective that no one in California actually calls it Cali. It’s only people outside of California that say that, there was a few people that disagreed, and cowvet is taking my side.

They also use the phrase hella, which funny story, I grew up in Northern California, I didn’t know other people didn’t say that word until I had a conversation with my aunt in Washington who did not know why I was saying hecka. And as a kid I was like, “Well, I’m not allowed to say hella.” And she still did not understand what that meant. And it was not until the No Doubt song Hella Good came out that I realized, oh, other people don’t say that word. Funny story there. Rob, did you have an experience like that? It’s not really a Southern California thing, right?

Rob:

No, no. I’ve always heard it was a Northern California thing. So, we in the southern part of California, the cool peeps, we didn’t say that stuff.

David:

Rob, why don’t you go ahead and take the next comment here from JevonMusicGroup?

Rob:

All right. JevonMusicGroup says, “Biggie had to say, Cali. You try rapping with California in its place.” That’s funny. Yeah, it is a very long word, I suppose. “Great episode, by the way, answered some questions I had with my current situation.” They even got four likes and a reply. What that reply was, I’ll never know, but I’m sure it was a great one.

David:

Go give JevonMusicGroup’s comment on episode 816 on YouTube a couple more likes. Let’s reward him for that great insight.

And jeanpaulg1037 says, “Hi, David. Thank you for all your knowledge sharing. Question, my lender said that I would not be able to buy a cheaper house than my current one and make it a primary residence. Is there any merit to what he’s saying? That means I would need to buy a more expensive home every year if I was going to continue buying new ones. Thanks in advance for your great support. You’re great.”

Great question there, Jean Paul. First off, you should have came to us because we’re better than that and we would’ve got it to get accepted. Here’s what’s going on. When you try to buy a primary residence in the same area where you have one, you’re trying to put a smaller down payment down, lenders look at that and go, “Uh, uh, uh, you’re trying to get an investment property using a primary residence loan, because nobody would downgrade their house unless they were trying to be sneaky and they deny it.”

You can overcome this. Our company, The One Brokerage does this all the time. We go back and fight and say, “No, this person’s actually financially smart. They’re making good decisions. They’re a BiggerPockets listener and they are going to be moving into it as a primary residence.” And we get these exceptions covered. Your lender’s not fighting hard enough for you. I don’t like this. I don’t like it when anyone in my world comes back and goes, “Sorry, we can’t do it.” What they should be coming back and saying is, “We can’t do it. Here’s what we need to change so that we can do it.”

Rob has had some experiences like that with properties that we’ve bought where insurance goes up and they say, “We can’t insure it.” And we just say, “Great, tell me what you have to do so that you could.” Or different issues like that. That’s what you’re looking for when you’re building your core four and you’re picking your lender, not a person who comes back and says no. But now all of you know how the lending world works and when you get this, “Nope, you can’t buy that house.” It’s because it’s in the same area as the one you have and they believe you’re trying to buy an investment property with 3.5 or 5% down. You want to read the Apple Review, Rob?

Rob:

Yeah. So, let’s get into this five-star Apple review from HGDTNVK. See now that right there, that’s a complicated username. “The best place to learn. Been listening for over a year now and every episode has something to teach. There are so many strategies discussed and so many stories that prove every person can become an investor. Listen, absorb, apply the knowledge. I have unlocked deals I never thought I would. I have unlocked deals I never would’ve known to look for if I hadn’t listened to the show religiously. Five stars, baby.” Wow, thank you very much, HGDTNVK. I’m going to tattoo that on my arm.

David:

That’s awesome. We would love it if you’d leave us a five-star review wherever you listen to your podcasts, whether that’s Apple Podcasts, Spotify, Stitcher, whatever your fancy, please consider doing that. It helps the show quite a bit.

And they’re making a good point. With The One Brokerage, we were having a meeting and I realized people tend to learn from watching other people do it. So, when I had agents that were joining the David Greene Team, they would sit in the office and listen to me talk to clients, listen to me talk to agents, then we would debrief and I’d say, “Here’s what they said that let me think. This is the strategy I use. I’ve put it into a book. This is the approach you should take.” And they got good.

Well, as we grew and I stopped selling houses myself, the new agents that joined didn’t get that same ability to watch me do it, and it was much harder for them to build confidence having these conversations. Podcasts like this are a really cool substitute where you don’t have to be in Rob’s attic where he’s recording right now, or in my studio. You can listen to us from the comfort of your own home, car, or gym and learn from what we’re doing. This is a great perspective that if you just listen to the show, you absorb the perspective that people that have experience investing have, and will slowly start to develop your own confidence and like they said, “Seeing opportunities and deals they never would’ve known to look for.”

So, thank you for listening to us. Thank you for your attention and we are going to be getting right back into the show. We love and we appreciate the engagement. Please continue to like, comment, and subscribe on YouTube, and like we said, if you’re listening to this on your podcast app, take some time to give us a rating and an honest review. Helps the show a lot.

Rob:

And I’ll possibly get your username tattooed on my arm, that’s bigger than Dave’s.

David:

Our next question comes from Christopher Dye who says, “I am in the Air Force active duty and moving from Little Rock to San Antonio. I have three long-term rentals in Little Rock that cashflow $1,500 combined every month, with two properties having sub-3% interest rates and one property with the 5.375 rate. There’s roughly $200,000 worth of equity trapped in these properties and they are all in neighborhoods that will continue to appreciate.

I’m considering a 1031 exchange for a small multifamily property in Texas. I’m seeking advice on the best way to move forward. Should I hold on and sell in 5 to 7 years or capitalize on this opportunity to take the 70K that I have invested that’s been turned into 200K in two years and use it to propel into the San Antonio multifamily market?” Rob, what say you?

Rob:

Okay, so this is a very tough one because, I mean, it sounds like he hit the jackpot. Right? He invested 70,000 and it’s turned into $200,000 in two years. It feels like maybe he feels like he’s on top of the world a little bit, right? He’s like, “Wow, if I can just do that again, then I can turn 200,000 into 600,000.” But he purchased at a time where that was possible.

So, I don’t want to necessarily steer him away from using that money and reinvesting it, but we are in a tougher time right now and I think he’s got something that a lot of people want, 1,500 bucks of cashflow and sub-3% interest rates. Going into a multifamily, as long as he can at a minimum get that $1,500 cashflow, I think I’d be okay with it. But I think he’s just got such a good situation. I don’t think there’s anything wrong with holding onto it. He’s got 3, he’s really at the beginning of this. I think patience would really serve him well in this particular situation, but I don’t know, what do you think?

David:

I would try to make this as logical of a decision as possible. So, first thing, people talk about interest rates a lot. It’s not that they don’t matter, it’s that they themselves don’t matter. They matter in the sense of they influence cashflow. So, your cashflow is what it is. Getting rid of a good rate isn’t a bad thing if you’re getting more cashflow. I’d rather have higher cashflow at a higher rate than lower cashflow at a lower rate. The rate just has an impact on how the cashflow works.

So, I wouldn’t worry too much about giving up those rates. I’d worry more about, well, how much money are the other ones going to make? So, to simplify this, there’s two ways that we typically look at making money in real estate, equity and cashflow. Can you sell these properties and buy another one that will earn you more than the 1,500 a month you’re getting now? If the answer is yes, we’re heading in a good direction.

And the other equation would be if you sell them, over the next 5 to 7 years will San Antonio appreciate more or will Arkansas appreciate more? Odds are San Antonio is probably going to be the better bet. The next thing I’d look at would be, well, how much more? Because there’s an inefficiency every time you sell and buy. There’s closing costs when you buy and there’s closing costs when you sell, so you’re going to lose some water out of that bucket. What you want to be asking is, in 5 to 7 years will I replace more water than I lost during that transaction?

And the last piece I would say is you also can walk into a transaction with water in your equity bucket if you buy it below market value. Do you have an opportunity to go get a really good deal on San Antonio real estate where the rents are going to appreciate faster than Arkansas and the values are going to appreciate faster than Arkansas? My gut would say, probably so. San Antonio is likely to grow faster than Arkansas would. So, I’m leaning towards you should sell and reinvest that money somewhere else. Rob, what do you think about that?

Rob:

I think it’s fine. I don’t think there’s a wrong or right on that. I think makes sense, looking at the appreciating market, which I totally agree, San Antonio is a very, very fast-growing city right now. I think you can confidently buy in San Antonio and know historically that it’ll probably outperform Little Rock.

I just think he’s got a good situation. Sometimes, if it ain’t broke, don’t fix it. I think $1,500 off of three long-term rentals is a lot of money. I don’t know. I personally wouldn’t mess with it, but sometimes I understand there’s a little bit of impatience of like, “I got to make more.” Right? If his dream is to become a full-on real estate investor and he wants to make a ton of money and he’s like, “This is going to be my thing.” Then he has to make some big moves to make that happen. But if he’s just trying to play the slow and steady route, I think he should hang onto it. But that’s a bit more conservative than I would typically advise probably.

David:

Great point. Christopher, how aggressive do you want to build a portfolio? If you want to go big, selling and buying in San Antonio makes more sense. But what if you don’t, what if just want slow and steady wins the race because your job at the Air Force keeps you super busy and you’re not going to have time to manage this somewhat complicated process full of as Rob loves to say, rigmarole? When Rob deals with it, we call it Robamarole. Is that something that you could take on right now or is that going to be too much?

If you’ve got tons of time on your hand and you want to jump into this, I’d move to towards selling and reinvesting. If your plate’s already a little full, there’s nothing wrong with keeping what you got, saving up money and just buying a new property in San Antonio with a 3.5 or 5% down, low down payment option and house hack. Either way, you’ve got some good options. Both of them look good, so don’t overthink this one.

All right, we covered a lot today. And Rob, thank you so much for joining me. We got into structuring a partnership when the partner wants no part of the day-to-day operations, hanging onto a potential bad rental deal that may not reach market rents, and what options do you have when you’re not cash flowing, using a 7/10 arm or a fixed rate mortgage, as well as other things. Thanks for joining me again on this, Rob, anything you want to say before we let you get out of here?

Rob:

No, thanks for letting me infiltrate Seeing Greene. I hope to be invited back if you think I did okay, I’ll happily do it because I’ll do anything for you, bud.

David:

What do you guys think? Let me know in the comments if you want to see more Rob on Seeing Greene. Do you feel you’ve been robbed of his presence when he’s not here? Let us know. We read those and we incorporate them into our shows.

All right, that was our show for today. Thank you everyone for joining us for Seeing Greene. And Rob, thank you for joining us. It was so nice to have a little bit of backup here, bringing a different perspective and even pushing back a little bit on some of the perspectives I had. If you enjoyed hearing these dual opinions and different perspectives, please go to YouTube where this is hosted and leave us something in the comments. Rob just might get your username tattooed onto his ever-growing arms, and remember to leave us a review wherever you listen to these shows.

If you would like to submit your own question to Seeing Greene, just head to biggerpockets.com/david where you can upload your question and have it answered on the show. If you’ve got a little bit of time, check out another one of our videos. If you don’t, we’ll see you next week on another episode of Seeing Greene. This is David Greene for Robamarole Abasolo, signing off.

Help us reach new listeners on iTunes by leaving us a rating and review! It takes just 30 seconds and instructions can be found here. Thanks! We really appreciate it!

Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Email [email protected].

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.