4. Guerilla FSBO Tactics

4. Guerilla FSBO Tactics

Real estate agents are expensive for exit strategies, and aren’t always necessary. Sure, unique and upscale properties probably need a realtor to do some serious sales maneuvers, but an average middle-class house? The primary marketing is a simple MLS listing.

Today’s real estate investors can list their properties on the MLS using flat-fee listing services such as Clever and Houzeo that cater to For-Sale-By-Owner customers, at a fraction of the cost of a traditional realtor. But MLS listings are just the beginning.

There are entire Facebook groups dedicated to local real estate available for sale. If you’re targeting investors, there are also Facebook groups for local real estate investors, not to mention local real estate investing clubs. For that matter, you can take advantage of our nationwide Facebook group for real estate investors, with roughly 32,000 members!

It doesn’t take a realtor to put a “For Sale” sign in the window, or host an open house. Or, for that matter, to post flyers in the local grocery stores, fitness clubs, coffee shops, etc.

In some ways, this technique is the opposite of hiring an auction house. You’ll do all the work yourself instead of handing it off, but you’ll maintain much more control over the process, and you can wait for the right price. You’ll also be in an excellent position to offer seller-financing as part of the package, to help encourage buyers along (more on this later).

5. Auctions

Auctioning off properties works great when you need a quick sale.

Don’t expect top dollar – auctioning real estate prioritizes sale date over sale price. But when you absolutely, positively need to sell a property by a certain date, auctions are a reliable way to sell.

As anyone who has auctioned anything can tell you, who you choose as the auctioneer matters. A lot. Reputable auction companies attract serious, reputable bidders, who trust that the auctioneer is not deceiving them. It takes time for auctioneers to build trust – just ask Sotheby’s, who has been around since 1744.

Established auctioneers also have powerful marketing machinery in place, to reach the maximum possible audience. They cultivate extensive mailing lists, standing ad slots with local publishers, familiarity with the best ways to reach the right prospects in the local market.

But even when you use a reputable, experienced auctioneer, the outcome remains a gamble. Your final price will come down to who turns out that day, which can be affected by random variables like the weather, or seemingly unrelated events like a conference taking place across town. Maybe the traffic is just exceptionally bad that day, and prospective bidders decide not to make the drive.

Auctions aren’t quite an act of desperation, but they certainly won’t attract top dollar, either.

6. Dodge Taxes by Rolling Your Profits into a Larger Property

Taxes suck, even lower capital gains taxes on real estate. They siphon off money you could otherwise put toward building passive income and reaching financial independence.

Fortunately, you don’t have to pay taxes on your profits from selling real estate. Not if you use them to buy another property, using a 1031 exchange.

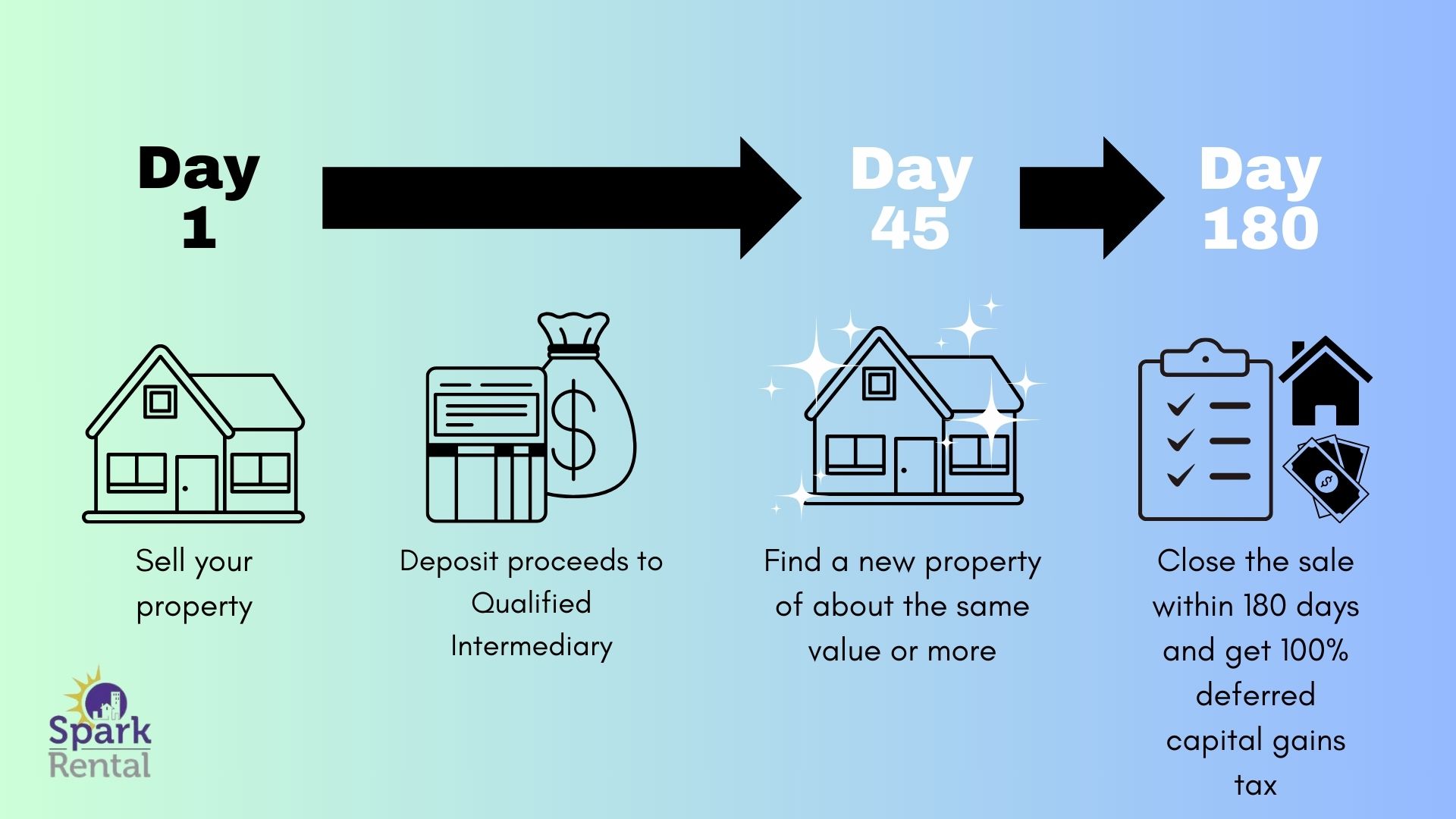

Within 45 days of selling your old rental property, you identify a replacement property you plan to purchase. You must then settle on the new property within 180 days of selling the old one.

The new property must cost at least as much as the property you sold — it’s a tool for scaling your real estate portfolio, after all.

Read up on how 1031 exchanges work before pulling the trigger, and keep rolling your real estate profits into ever larger rental properties with greater cash flow!

7. Pull Out Equity with Loans (Which Your Tenants Pay Back)

One of the most common real estate exit strategies is to sell the property to cash out the equity. But then you lose the asset, and no longer benefit from ongoing cash flow or appreciation. Where’s the fun in that?

Alternatively, you could keep the property and still pull out the equity through a rental property loan. It clips your cash flow, but you get to keep the property, which continues appreciating, and you can keep raising the rent each year. You get paid out for your equity, but you don’t have to pay taxes on it. Quite the opposite: you get to deduct the interest as a landlord tax deduction!

In other words, you can have your cake and eat it too. And your tenants can pay the mortgage back down again, just like they did the first time around.

Win, win, win.