Full-time real estate investors David and Rob are back to answer your investor questions! This time around, live-caller Ethan wants to know when enough is enough. He’s built a big real estate portfolio, but his spouse is asking, “What’s the end goal?” Next, David and Rob share what’s going on in their own lives and the “perfect storm” that hit David head-on that could be headed your way. A young house hacker wants to know the best plan for his property after he moves out: rent by the room, turn it into a long-term rental, or go the short-term rental route. Finally, a homeowner with some sizable equity but no extra money asks if she should sell her low-rate primary residence and exchange it for some investment properties.

David:

This is the BiggerPockets Podcast show 922. What’s going on everyone? This is David Greene, your host of the BiggerPockets Real Estate podcast here today with a Seen Green episode and I’m joined by Rob Abasolo. We’ve got an awesome episode for you. If you’ve never heard a Seen Green show, we take questions from you, our listener base, and we answer them for everybody to hear. Today’s show starts off with a live question where we go back and forth with the caller and then we have some recorded and written questions that we share with everybody. We’re going to talk about house hacking, we’re going to talk about options to scale when it comes to house hacking. We’re going to be talking about what happens when you hit lightning in a bottle and you grow a big portfolio and you’re not sure what to do next. And we’re going to be talking about if you should keep a property with a lot of equity and a great rate, or if you should sell it and start scaling a new portfolio. All that and more in today’s Seeing Green. Rob, how are you feeling today?

Rob:

I’m excited. I’m excited for the curve balls that are going to be thrown our way and I’m excited to hit some home runs, hopefully for everyone at home, help them get a little perspective on how to do this whole real estate thing.

David:

Yeah, so let’s see how Rob does when he takes his at bats. Let’s get into our first question today from Ethan. Oh,

Rob:

Before we jump into it, just a quick reminder, if you ever want to submit your own questions for a Seeing Green episode, head on over to biggerpockets.com/david and who knows, maybe we’ll pick a ruki, one of your cues.

David:

All right. Our first question comes from Ethan here. Ethan’s got quite the portfolio, 20 single family homes in Nebraska. Two flips a short-term rental in Scottsdale, a short-term rental in the Smokies, 11 single family houses in Chattanooga, Tennessee, and 50 doors in Illinois, as well as a farm ground in New England and Kansas, England. I dunno if I left anything out there. Maybe you also own a private jet, some oil rigs, perhaps a yacht you put on

Rob:

Turo. Maybe it’d be better to ask where Ethan doesn’t have real estate.

Ethan:

Being diversified is always a good thing. I don’t own anything in New England, that’s Nebraska, but I’ll have to take a look in New England.

David:

Good point there. That does make sense. There’s not a lot of farms I would imagine in New England, Nebraska does make a lot more sense there. It’s like

Rob:

I was like what? I was like, does that farmland go from Nebraska or New England to Kansas? It’s like a giant farm.

David:

I’m in Vegas at a Keller Williams event that I have not been sleeping enough and it is very visible here, but don’t worry, I am still awake enough to answer your question. So Ethan, let me know what is on your mind.

Ethan:

Simple question I get from my wife often I’ve been actively growing this portfolio the last decade. I probably have no end in sight as far as what is going to be the destination and my wife asks me every time we talk about a property or even our existing portfolio is when is enough going to be enough? We have a big family, six little kids. Oldest is 11, youngest is going to be three here in about a week. So I understand those. There’s a lot of expensive things coming down the roads with medical weddings, school, we go to a Catholic school here in Nebraska, so again, it’s a high operating cost family and I understand that and try and want to prepare, but she’s very humble and very simple and I know you guys are actively growing. It seems like those wheels never stop. Kind of relatable to that. So curious where the finish line is for you guys.

Rob:

Well lemme ask you this, are you still working at W2 or are you like a full-time real estate investor?

Ethan:

I do have a full-time job. I’m a independent contractor, but I do have a full nine to five job, yes.

Rob:

Wow, okay, cool. And then what is your income from your real estate portfolio?

Ethan:

I actually updated it today. My monthly cashflow is about 3,400 bucks. That’s just in Nebraska. The other stuff is with the partnership, so it’s him and I, so I didn’t figure anything that into our monthly income.

Rob:

No worries. Well, I think it really depends, man, honestly on what your goal is and you can kind of start to sniff it out pretty quickly. I talk to people, friends in this industry that their goal is I want to be a billionaire. And I’m like, okay, well then I don’t know when enough is enough because it’ll take a very long time to get there. But then there are people like me that I’ve realized there is sort of like this. There really is this moment where a certain amount of money doesn’t really change happiness or anything like that. And so for me, I always find that where I’m trying to go is to where I could make the income that I was making at my full-time job in real estate, I’m not going to say passively, but consistently with doing some work, I would never really count on this idea of retiring and being completely passive in real estate. I think you’ll still have to work for it, but I mean it depends on how much you love real estate and I understand your wife is wanting to keep it more simple, but if you feel like you want more out of this and you want to keep doubling or tripling up where your income is, then you may not really be close to enough yet. So I mean I don’t know enough about you to know this yet, but how much do you love real estate and let’s start there.

Ethan:

I enjoy it a lot. Honestly. I go back to the original BiggerPockets days a decade ago and I was reading through some of the forums last night and some of my inboxes with guys and it’s really kind of got me fired up again in the interaction that we can find amongst the real estate space. So it is something I really enjoy, whether that be the tenant relationships or even just the finding new deals. I really like to travel and I think that’s one thing my wife, I know that she likes to travel as well and I try and push her. These future opportunities are going to allow us to go wherever we want to. That’s one thing I try and push, try and plant that seed a little bit and water it as much as I can.

Rob:

Sure. The other thing I was going to ask that I probably should get some clarity on is do you want to work your job for the rest of your life? Because that’s important too. Some people are like, I hate working for the man I need to get out of this. And then there are other people that are like, yeah, I want to work my solid job for the rest of my life. And so I think that kind of factors into your decision a little bit too.

Ethan:

And I do have a great job, work for a great group of guys, so that is probably something, I mean I would say normal retirement age, that 50 mid fifties range, which is going to be 20 years, which as fast as the life goes right now, especially with young kids, it’s going to come quick. So I’d say 20 more years of that full-time job and I’ll be ready to be be done.

Rob:

So then honestly, this is my favorite scenario to be in, to be completely honest with you because there’s so many people that want to replace their salary with real estate, quit their job, and if you make 50 to a hundred thousand dollars, that’s really hard to replace with real estate, it’s really, really, really hard. You’re not super far off from that, but you would have to triple how much you’re making right now to make $10,000 a month where the power of real estate comes in. For many, many people, especially in your circumstances, if you’re okay with working for the rest of your career and working a nine to five and that’s where you’re going to make your money, then you’re in such an amazing spot because if you have an extra 3,500 bucks, let’s say you scale that up a little bit to $5,000 a month coming into your pocket, that’s life-changing money for a family that is vacation money.

That’s where the fun of real estate starts to really ramp up because you actually have cashflow to use for expendable income and vacations and everything like that. And then where it all comes to a head is when you’re 65 and you do retire from your job and not only did you make $5,000 a month doing real estate, you now have this portfolio of 20 single family homes and this and that and all that stuff. That’s all paid off worth multimillions is my guess. And then you can sell all that and retire a millionaire. That to me is the best place to be versus the person that’s trying to get to $10,000 a month in real estate and wants to quit their job tomorrow. So I actually think you’re probably going to find a lot more happiness being a small and mighty investor as our friend coach Chad Carson would talk about. And we did an episode with him back on episode 7 95 talking about his book, small and Mighty.

Ethan:

That’s awesome. Good perspective and definitely relatable. I’ve always said the real estate I don’t think provides my family any value even when it’s on our deathbed or down the road. So I’m sure the plan long-term would be to start selling if a house at a time will pay for a wedding hopefully at that point. But

Rob:

Absolutely, I mean you buy $150,000 house and 15 years from now I’d like to think that that house has been paid down considerably and has it appreciated a lot more as well. And at that point maybe you can sell it and use some of those to fund those things. So I think I find happiness with real estate funding the life that I want, trying to chase some big arbitrary goal of, I don’t know, like I said, a billion dollars. I have a lot of friends that want to be billionaires. I’m like, why if you make a million dollars a month or a hundred million dollars a month, your lifestyle probably isn’t going to change all that much if you’re actually a prudent investor and you are frugal if you got to a billion dollars. I don’t know. To me it all, it becomes this really weird competition with real estate investors and sometimes I’m just like, honestly, I’m pretty good where I’m at. I like to be happy in real estate. And I think for me, the whole enough question really comes down to at what point does real estate make you unhappy and that’s when real estate is enough.

Ethan:

That’s awesome. That is very solid insight. So it helped this year we were able to travel to Scottsdale and stay in our own Airbnb, my wife and I and our two friends. So I do think that provided a good insight for her to say, okay, maybe this is why we’re doing it, but I’d love to have an Airbnb or a Hellman every travel high travel or high vacation place in the country. That’d be a future goal of mine.

Rob:

Well, and I could have given you a much shorter answer and just said enough is when your wife says it’s enough and that’s the right answer to that question. But yeah, I think you have to kind of throw her a bone and make sure that she’s down for the ride to otherwise, yeah, there’s a turning point with real estate where it’s like, man, I’m making $3,400 a month to, I’m only making $3,400 a month, and you want to try to stop that second sentiment from ever coming in.

Ethan:

Right, understood.

David:

Alright, Ethan, do you mind if I offer you another perspective here?

Ethan:

Of course.

David:

Alright, before I do, let’s take a quick break and we’ll come back to hear my thoughts and we’ll come back. We’re here with Ethan who’s got a lot going on in the real estate world and he’s trying to figure out when enough is enough. When we say things like When is enough enough, the answer is typically I have as much as I need, how much more do I need? And it starts to feel like it’s greedy and then implied in that is life would be better if I wasn’t doing this. Which oftentimes very well maybe the case. It’s like I’m not spending as much time with my kids, I’m not doing as many things as I could be doing that I want. And that is a great question to ask, is accumulating more real estate the best move for my specific life? But for a lot of people, I think the assumption that what I have is good and it could only get better is erroneous.

I went through a two year period, I’m barely now climbing out of it. It looks like where business got decimated, my portfolio got decimated. I was the victim of a lot of property fraud where people stole titles to my properties. That forced me into a 10 31 where I had to buy a lot of real estate in a really short period of time. Right When I did that, I had a lot of bur properties, projects going on, interest rates doubled, everything went wrong at one time, and what had appeared at one point to be way more reserves and way more conservativeness than what I would’ve possibly needed actually became, thank God I have that because the plane would’ve crashed if I didn’t have a buffer that was that big. And everyone had asked me that same question, well David, when is enough enough? Why are you working so much?

Why are you doing this? And I think in my gut I knew the answer and this confirmed it. It’s because the more real estate that you accumulate, the more risk you’re taking on. We don’t talk about it like that a lot of the time and it doesn’t get presented that way because the market’s done nothing but go up. We’ve had a great 10 year run where everything just went up and so you don’t think about the risk you’re taking on because it rarely ever occurs, but when those rates shot up really quickly, it got exposed that, oh, this is actually a risky thing and things can go wrong. And to me it was like a perfect storm. I hope to God nobody else ever has the perfect storm of what I had, but I’m very glad that I had a lot of equity in my properties.

I’m very glad I had way more in reserves than I thought. I’m very glad I was still working and I had not retired and I didn’t have the ability to make money through stepping up efforts with whether that was flipping houses or selling properties or running businesses more. I just want to put that out there for you and for everybody else, if it’s just getting more to get more, it’s a good question to ask, why am I doing this? But if it’s getting more to offset the risk that we’ve taken off building big portfolios, well then I would say keep working, keep saving, but do it in a way that doesn’t take away from the goals you have in life, your family. Do the things that you like doing, do the things you enjoy doing, but don’t just be like, well, should I quit the whole thing?

Ethan:

I get that. Yeah, and that’s been a big part of why we started to go out of state and it was through a lot of the stuff again, through BiggerPockets that I realized I thought I had to be able to touch it, see it, feel it to invest in real estate and quickly realized that wasn’t the case. So we’ve been kind of backing off what we have here in Nebraska and moving out of state and my wife knows I can’t touch those, so that’s made her happy on that side of it.

David:

Yeah, that’s great. Rob, I mean you’re scaling probably one of the fastest real estate investors slash content creators out there on the interwebs. Is this something you’ve thought about as much as you’re taking on right now and as fast as things are growing, what you’re doing to kind of counter some of the risks that you’re taking on as your portfolio grows as fast as is?

Rob:

Yes, David, this is all I think about, especially as someone that’s looking at getting into developments and buying developments that are typically three to 10 million at a time. What I’ve learned is that we have this idea that we want to make cash so much on the front end and like cashflow, cashflow, cashflow that we never want to hire people because when we hire people we see that as making less money. But what I’m discovering is to really scale, you do have to hire people, make less money on the front end, but in the long term you’ll actually build so much more wealth because of what you can do with teams. And that’s the thing that I’ve never really unlocked building a 40 unit short-term rental portfolio is I was just doing it all by myself and I was too greedy and now as I’ve learned, if I can bring more people on, be a little less greedy right now, it’ll actually set me up for the rest of my life. So yes, existential question that you just asked me there, David, but it’s the only thing I think about whenever it comes to real estate.

David:

Well Rob, you need to read scale if that’s where you’re at, the book that you talked about all the time and haven’t actually read,

Rob:

I guess so I guess so

David:

Ethan, anything we can tie up for you there?

Ethan:

I do have one last question, especially Rob, you mentioned these bigger portfolios or bigger books or properties that you guys are buying. Do you get any sort of anxiety or like buyer’s remorse when you get the acceptance on an offer or if you sell a property? It’s like every time that offer’s accepted it’s like this rush of dopamine and I can’t decide if it’s fear or anxiety or joy, but it’s the same thing every single time. I’m just curious in your guys’ experience if that’s the same thing.

Rob:

No, I’m usually pretty relieved, but I’m a little scared, but I’m always happy that I did it. That little buyer’s remorse is really short-lived and will never compare to whatever the opposite of buyer’s remorse is. When you miss a good deal that was in front of you, that’s a lot more painful to see. This property that I just stalled on for like 12 hours or a day and it just went because I knew deep down it was a good one and it flew off the shelf and I’m really sad at myself and disappointed that I didn’t move faster. That’s a way worse pain than the short-lived buyer’s remorse that I’ll have on having an offer accepted. That’s common, everyone has that, but for the most part the excitement typically takes over pretty quickly.

Ethan:

Right on. Good.

David:

Alright, thanks Ethan. Keep us up to speed with what goes on there, man. Appreciate you. Thanks

Ethan:

Guys.

David:

Alright, thank you everyone for submitting your questions. We would not have a show without you, so give yourself a little pat on the back for making all this possible. And remember, I want more of them, so head over to bigger biggerpockets.com/david and submit your questions. And who knows, maybe we can feature you on a future episode of Seeing Green. Alright, if we’ve changed your life or if you’re just enjoying this show, let us know. Make sure that you like, comment and subscribe to the channel and let us know on YouTube what you think about today’s show. Alright, moving on. We have an Apple review to go over and then we will move on with the show. The review says the more the better you do. I’ve been listening and learning from the BiggerPockets podcast for the past three years. This free resource has led me to making some really solid real estate decisions. Did I say it’s free? I share the podcast often and I really hope that others see the value in this podcast from great B eight via the Apple podcast app. Well thank you for that. That’s awesome. I remember Rob, when you first stumbled upon our show and we had you on and you were an amazing guest and you thought that I hated you, but I didn’t. I thought you were really cool and you had similar things to say. So if you, did you ever leave us a review, Rob? Curious.

Rob:

I was too hurt. I was like, David doesn’t like me.

David:

We got over that now we’re besties, besties, trying to change the short-term rental landscape one property at a time. Time. But

Rob:

How funny would that be if I went and left us a review right now? Hey, I’ve been listening to the show for five years. This is a five star show. It’s my favorite. Rob is so handsome.

David:

That would be funny. You should do that. You should leave a review and say why you’re better than David. Alright everybody, we hope that you’re enjoying the show so far. We’re going to take a quick break and then we’re going to be back with a question from Zach about what to do after his house hack. Alright, and we’re back. Thanks for sticking around. Zach’s got a question about house hack strategy and Rob and I are going to get into it. Let’s hear Zach’s question.

Zack:

Hey David. Zach Chesky here, 27 years old. I’m a biomedical engineer by day and I try to be a house hacker by night. I just bought my first single family home in Dearborn, Michigan. Looks like a good market for medium term. There’s a hospital DTW airports right there and just general visitors of Michigan. My question is after this rent by room house hack strategy, do I shift towards Airbnb, which seems like the market could get me about two x, what a long-term could get with I understand recommended three to five x. Do I rent my room continuing once I leave rent out my area getting around the same with arguably less work or do I just go to a long-term rental, sacrificing some long-term cashflow that I would need to supplement my current job? Appreciate the help always. Awesome, thanks.

David:

So with his buffet of options, where should he start?

Rob:

So basically he could just hit the easy button right now, replace himself with someone else to rent his room in that home and cashflow like 800 bucks a month. A little bit more than that, but I think that’s a pretty good option.

David:

So you’re saying that he should continue to rent by the room?

Rob:

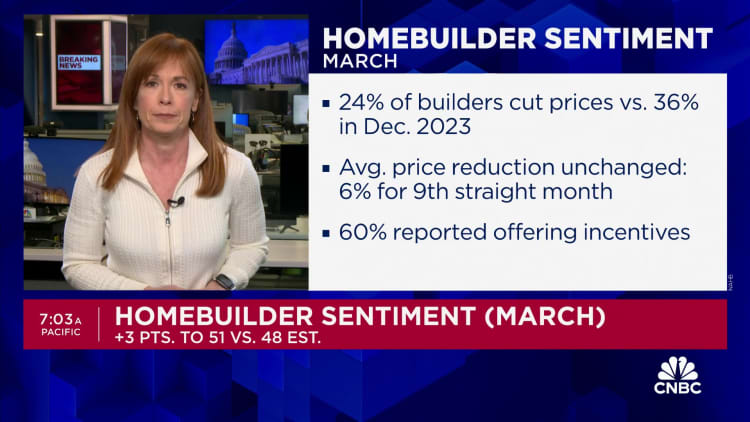

I think so. I mean if we examine his other options, he could do a long-term rental, long-term rentals in his area. He mentioned our 1500 to $1,800 to do that, so he wouldn’t make as much money doing that. And then short-term rentals in the area are looking at around a 31% occupancy. Again, this is information that we have on the backend, so for him to try to make money on Airbnb would be tough. What most people don’t consider with short-term rentals is that there’s a huge operational expense that goes into running a profitable short-term rental, whereas long-term rentals are just fixed expenses for the most part. Short-term rentals, you start adding cleaning and what you pay to Airbnb and vrbo and it really takes a lot more money to be profitable in an Airbnb than a long-term rental at first glance. So I don’t know if that’s going to be his best route.

And then of course he can always go the medium term rental route, a three bedroom and his area goes for about $2,600 a month. However, it’s not like you can just snap your finger and fill your place with the midterm rental tenant. It’s hard to do that and you really have to work to find those tenants. So because it seems like the safest option he has is to rent by the room, I would go that route. He’s making a little less than he would with the midterm rental, but he won’t have to work super hard to source that midterm rental tenant. So I think it’s pretty clear he just transitions from house hack to rent by the room.

David:

You know what I love about your analysis there, Rob? You went over all the options and you wait each of them on their own merit and it became pretty clear at the end of the day, Hey, there’s a lot of vacancy as a short-term rental. Hey, traditional rentals aren’t bringing enough money. The rent by the room strategy here is the perfect answer for this property. And then it’s not that much work, especially if he goes forward with economies of scale. If he gets another house hack, he does the same thing. He rents by the room, he’s got all the same systems he’s using with his first property, then he could just transfer over onto the second one and then he could do it again and then again and then again. Now he’s got five houses, he’s doing rent by the room. Now there’s enough income that you can hire a person to sort of manage that little mini portfolio and just handle whatever little disputes come up with all the tenants and it’s going to be the same disputes that happen all the time.

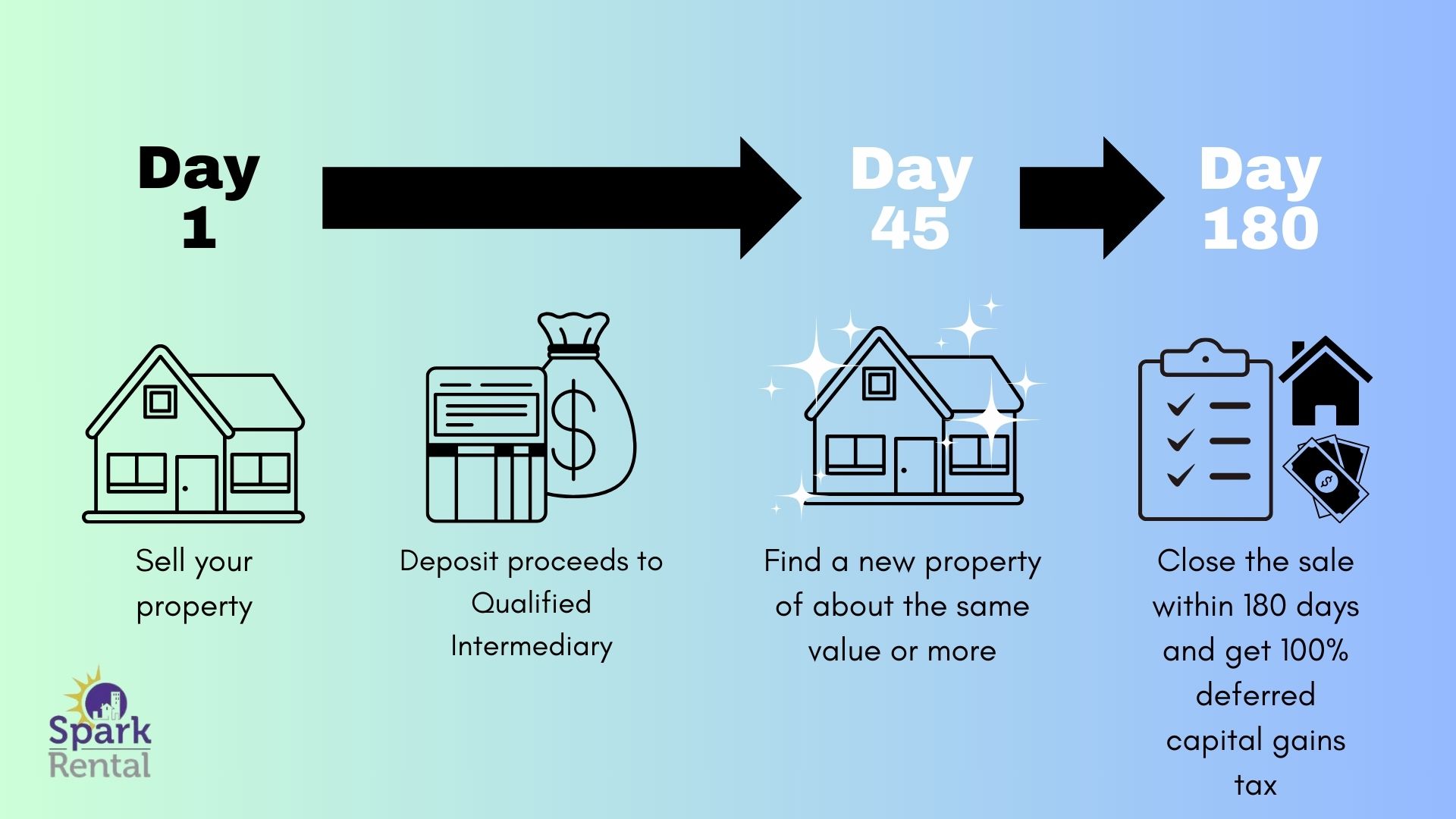

So that person isn’t going to take a ton of time and you have a pretty efficient system that allowed you to scale five properties. And if you hit the point where you’re like, you know what? It’s too much work with all these rooms that I’m renting, fine sell all 5, 10 31 into a small little apartment complex, buy a 10 unit place somewhere and start over scaling again with these smaller little houses doing the same thing that you’ll move into hotels. This is not a bad way to get started in a tough real estate market, building a portfolio and creating some equity

Rob:

And he’s pretty much already doing the rent, buy the room. All he has to do is put one tenant in there, easy peasy, go make your extra $880 a month. My man, that seems like a pretty solid plan to me. This next question comes to us from Robin in Idaho who posted this question in the BiggerPockets forums. Her question, should she sell her primary residence and use it as equity for her rentals? She says, we have a home worth about $650,000. We owed $350,000 in a place where we couldn’t afford to sell and buy another property. They got it back during Covid times interest rate was 2.8% and it was before a crazy boom out in northwest Idaho. She says, we’re stuck because my husband makes just enough to live. We’ve cut every possible expense and really want to acquire rentals but can’t find the capital. We have $250,000 in equity in the home after realtor cost. Is it crazy for us to sell, take the equity and move to a better cashflow market like Atlanta or Fayetteville, North Carolina and start our rental acquisition there. And then she asks, what are some great, even if they’re crazy strategies for building the real estate empire with $250,000 if we could go anywhere and we will do anything. All right. That’s an interesting question.

David:

Short answer here. I don’t think it’s crazy actually. When I started my whole bur run in north Florida, that’s where I buy most of them. I sold a property in Arizona that had appreciated more than the rents had kept up with it. It was basically a property that had a new housing development that was being built close to this house. And so the value of my house kept going up because the comps that were being built were brand new homes that were more and more expensive, but there were so many of these new homes that were built that were bought by investors that I really couldn’t keep getting tenants in my area or rents to keep going up because they had too many options. So what I found is the value of the home went up faster than the rents could keep up with.

Rob:

So scrolling around in the forums here, some of the answers were it sounds like they’re living on a single income. So one solution is get a job and work on that double income to save up money so that you can buy another rental. Some other people said you should house hack and then other people said it’s too risky right now to sell. I’ll give you my take First and foremost, I think that, I mean I hate to sound like a broken record, especially since we just did a whole question on this. I love house hacking and I think for you, getting a job might be pretty tough. Maybe you’re accustomed to a certain lifestyle. I would go the route of figuring out how I can make money the fastest. There’s two ways to do that. One, you can house hack rent out a room in your property.

Maybe that makes you an extra 300, 4, 500, 6, 7, 800. I’m not really sure in that market, but let’s just call it 500 bucks a month. That right there, that helps. It’s not going to be what turns into a real estate millionaire, but it definitely puts a dent in things over time. That’s one. Two is I probably would try to get some sort of extra job. You don’t have to go full time, you don’t have to go back to corporate life. You don’t have to work a nine to five maybe if it’s even 10, 15, 20 hours, that alone right there, the money that you make there can compound pretty quickly with the money that you’re making on a house hack. I’m not a big fan necessarily of selling. I mean, you always have this age old question of like, well, if I sell it, where am I going to go?

And you mentioned that, hey, we live in a place where we can’t afford to sell and buy another property. Well, if that’s the case, you kind of have this once in a lifetime opportunity to own this house that you can’t afford to live in because you bought it at the right time. That to me is always going to be the safest, more conservative route. I’m an aggressive investor by nature, but I always tell people, if you’ve got this magical primary residence with the 2.8% interest rate, that should be your backup plan, that should be your ripcord. In the case of like everything goes wrong, you can sell this property and cash in $250,000 if you really, really, really needed to. So for that reason, I’m always a big advocate of just hanging onto it. I know it’s not a super sexy answer to say, Hey, get a job house hack, make an extra 10, $20,000 a year, but it’s not a sprint, it’s a marathon.

And if you save up 10, $20,000 this year, house hacking and getting another job, and you do that next year as well, well great. Two years of hard work, saving and preparation can actually put you into a position where maybe you do invest in a different smaller market where 40,000 bucks or $50,000 depending on what you can save up, does allow you the luxury of buying another rental property. But my answer is, if you sell it, where are you going to go? So for that reason, stay there. 2.8% interest. That’s a beautiful thing in 2024. Don’t mess with it. What do you think, David? I mean that’s my approach. I think a 2.8% interest rate in this world in 2024. It’s the most beautiful thing ever. I think getting lucky and buying at the top of a boom is amazing and I think that they should build their net worth based on this amazing purchase that they made in 2021 and not sell it. I know it’s a bit of a conservative answer, especially considering I am a little bit more aggressive, but that’s how I feel. Sue me.

David:

All right, I’m going to play devil’s advocate here. I had a property in Arizona that I bought and then they built a housing development right next to it. They built more and more expensive houses making the value of my house go up. But a lot of those houses were bought by investors. So the rents never went up on my house because they couldn’t raise ’em too high because they would just go rent one of the new homes. So I had growing equity without growing cashflow. I sold that property, I took the equity, I took it into North Florida, and that’s what was my first bur. I pulled the money out, I bought my second bur and I bird up to about 40 properties, maybe 50 at one point in that area off of that seed money from the one thing. So even if they do something like that and they lose that 2.8% interest rate, if you can turn it into a whole portfolio of other properties, it can make sense.

The beauty of this dilemma is both options work. You keep a great rate, you keep a lot of equity, you win or you sell it and you take 300 grand, 250 grand into another market, and if you can execute growing that capital, you win. I think the key here is are there other opportunities and can you execute on them? Do you have the experience of an investor? Do you know what you’re going to be doing? Do you feel confident in what you’re going forward in? Or are you kind of just slow and steady wins the race and you still need to slowly acquire properties? That’s what I’d be looking at here. This is not the market where you can just go throw a quarter million dollars into something and trust that it’s going to work out well. There’s a learning curve to whatever strategy you get into because there’s a lot more competition.

So in today’s show, Rob and I talked about when enough is enough when you should keep scaling and how you should keep scaling, which is great to know in case you ever hit that great run where you buy a whole bunch of property, including a farmhouse in New England. We talked about how to evaluate your opportunities after you do a house hack. That’s something to think about once you get the first one down, where do you go from there? We talked about selling a primary resident to build a rental property portfolio, and we talked about Rob’s perspective as seeing solo. We also got into what’s going on in Rob’s life and in my life and in what you can do to support us. And we want to know what can we do to support you all. So let us know in this YouTube comment what we at BiggerPockets can do to help you with your goals. We will read those and we just may put those in a future episode of Seeing Green as well. Remember to submit your questions at biggerpockets.com/david so we can put you in a future episode of Seeing Green, and I’m going to let you get out of here. This is David Green for Rob. Seeing solo AB solo signing on.

Help us reach new listeners on iTunes by leaving us a rating and review! It takes just 30 seconds and instructions can be found here. Thanks! We really appreciate it!