In today’s episode, David shares some of the characteristics of a top producer. He goes over the importance of generating leads and how to do so, building your marketing funnel, and the metrics you should be tracking to find and convert more leads. Instead of telling you how to get better through abstract concepts, David provides concrete step-by-step examples on how to differentiate yourself, so you can beat out the other agents in your area.

Ashley:

This is Real Estate Rookie episode 191.

David: I firmly believe if you’re looking for an agent, they are the one who should be driving the car because they understand this world. Now, if you’re an experienced investor, you know that market inside and out, you’re not looking for a person to drive, you are more looking for a chauffeur. You can tell them, “take me here, go do what I want, I’m gonna work at the back of my computer”, but most people listening to this podcast and most people working with agents are not in that position, they need to be driven. And so, you really want to look for the agent that is not afraid to tell you the hard truth, that isn’t afraid to say, “that’s a bad idea”, “that won’t work”, “I don’t think you should do it” and then hear them out on why.

Ashley:

My name is Ashley Kehr, and I’m here with my cohost, Tony Robinson.

Tony:

And welcome to the Real Estate Rookie podcast where every week, twice a week, we bring you the inspiration, information and amazing stories you need to hear to kickstart your real estate investing journey. I want to thank everyone, Ashley and I both want to thank everyone that’s left an honest rating or review for the podcast. Every review really does go a long way, it helps us reach more people that haven’t heard of the Real Estate Rookie brand yet.

Tony:

And if you think about how much it’s changed your life, think about how much might change someone else’s. So if you haven’t yet, do us a favor, leave an honest rating and review. But Ashley Kehr, my wonderful co-host, what’s new? What’s going on?

Ashley:

Well, I found out today that I am speaking at AJ Osborne’s event, the CRE Circle in Boise, Idaho. And actually I was looking at it and I’m going to be speaking there as this airs. That is when the avenda, is so everyone listening now, follow me along on Instagram @wealthfromrentals and check out the event. I’ll share everything that’s going on and you guys can get some information on all the great stuff that AJ Osborne puts out. It’s going to be a commercial real estate investing conference. So that’s something you’re interested in, definitely check out the CRE Circle that he puts on.

Tony:

Yeah. AJ is literally one of the smartest investors that I’ve ever met. He’s obviously built a massive business in the self storage space, but just the way he talks about the economy and just the level of detail he goes into about self storage I’ve only been lucky enough to meet him a few times, and every time I do it’s just a wealth of information.

Ashley:

I know. I could listen to him talk economics forever. Anytime in the car with him I’m like, “So what do you think about this?” I go on to a tangent. I love it. We also have another great investor on the show today. Tony, you want to make the introduction?

Tony:

Yeah. Today we’ve got someone you may have heard of, but we’ve got David Greene back on the podcast. I’m sure most of our Rookie audience has heard of David. But if you haven’t, David is the co-host of the BiggerPockets Real Estate podcast. So not our show, but the other show. And he’s here today to talk about his new book called Skill. So this book just came out about a week ago from the time of this air. So you guys are able to go out and get it now. We’re going to talk a lot about the book, but if you want to learn more about it, go to biggerpockets.com/skill, and you can buy the book there.

Ashley:

I love this interview with him because we had him on when he did his first book, Sold and now that’s getting started as an agent, and now it’s how to become the top producer. And this isn’t great just for agents, but also as an investor, learn how you can help your agent succeed, set them up for success so that you’re not failing as a team. So even if you are not an agent, this is still a great episode to listen to.

Tony:

And just what you should expect from a top performing agent. If your agent isn’t doing the things that David’s talking about in this episode, it could be a sign that maybe they’re not the right agent for you. I think one of my favorite parts was when he goes over his listing presentation and all the detail that goes into that. So this is super beneficial, both as an agent that’s looking to find more clients, and as the investors so you can set some expectations for your agent in terms of what you need from them.

Ashley:

David, welcome to the show. Thank you so much for coming back on with us. Last time we had you here, we talked about your book, Sold and now you have a new book coming out. Do you want to start off with maybe just telling everyone a little bit of about yourself in case for some reason they haven’t checked out the awesome BiggerPockets Real Estate podcast?

David:

Oh my gosh. Yes. I’m so nervous right now. I’m such a big fan of you guys. I can’t believe this is actually happening. BiggerPockets changed my life.

Ashley:

We’re not sure if it’s going to air, so contain your excitement. We’ll let you know.

David:

That’s exactly right. Okay, I’ll calm my nerves. Well, thank you guys. I remember the last time we did this, it was actually really fun. And so to be honest, I prefer being interviewed than being the interviewer. It’s easier. You guys have all the stress of, “Is he answering the question right? Did I ask the right question? I get to just run my mouth.”

David:

Since we were last on, so Sold, came out. Sold was a book written for real estate agents. When I got my real estate license, I had to learn every lesson the hard way. It took me years to figure out some form of, I wouldn’t say a system, but just a level of confidence that I could go tell people I’m a real estate agent with boldness that made them think, “Okay, you should be my agent.”

David:

And I think that is the key to success in anything. If you’re an investor, if you want to get into fitness, if you’re trying to have better friendships, people are drawn to confident people and you don’t ever get confident until you understand the fundamentals of whatever you’re trying to achieve. So I know Tony, you’re really hitting your stride with fitness. You’re competing for shows. I’m sure there’s a level of your nutrition and what you do at the gym that you’re like, “I got this locked in. I know what I’m doing,” and so you move faster.

David:

So the book is written to help new agents figure out how to make money quicker. This is all the stuff you’re going to take five years to figure out. So here it is right off the bat. This book, the sequel is about how you become what we call a top producer. So this is about how you become really good real estate agent. It’s if you want to make good money, which everyone does, they all get in the business thinking it’s HGTV and they’re going to be rich. This is the actual path that will take you to being good.

David:

So I think if you have your license and you’ve sold a couple homes and you’re trying to figure out, “Is this for me,” this is a really good book to read, because it will tell you this is the path. I can use an analogy of the fitness world. You two are both obviously pretty deeply into that. If somebody went on one of your workouts or saw your diet, they could quickly know, “Is that the road I want to take? I want to look like one of them, but do I really want it? Because I’d have to live like them.” This book will open up that door.

David:

Or if you’re already committed, like you’re in a position where, “I have to make money, I need to build some wealth. I want to buy more homes,” this book will basically be the blueprint of how you become a top producer.

Tony:

So David, Sold laid the foundation and this next book Skill is about how to really, really refine that. I love that you’re making this a sequential journey for folks because obviously a lot of people in the Rookie audience, they’re new to real estate investing, but we have a lot of folks that are new agents as well. Ash and I just had the Rookie bootcamp weekend. We just got back a couple of days ago and I was surprised at how many investors there were also agents. So we’re definitely filling, I think a big void there in the marketplace of how to become a good agent.

Tony:

One thing, I want to touch on this a little bit before we go into it. I know we spoke on this last time we interviewed you, but I feel like it’s worth repeating. Do you feel that it’s necessary for a rookie investor to get their license to be a good real estate investor? Do those two things have to go hand in hand with one another?

David:

No. I almost think it’s detrimental in most cases. So everyone gives different advice. My perspective is the only time you should get your real estate license is if you are 100% committed to making money as a real estate agent and you’re going to do whatever it takes. It’s not worth dipping your toe in the water, just see what happens.

David:

I can tell you what’s going to happen. You’re going to spend a lot of money on licensing. You’re going to have to spend a lot of money on office fees. You are going to get a business card and be very hesitant to tell people you sell houses, then your confidence is going to get lost and you’re going to carry around a never ending bucket of shame that you’re like, “I should be doing more, but I’m not.” And it’s horrible.

David:

So if you’re not wanting to represent people, wanting to really learn how to be good at this, don’t do it. You can buy houses with a real estate agent for free to you. And I think a lot of what we talk about today is going to be geared towards what an investor should be telling their agent, “This is what I’d like for you to do for me,” because most agents won’t have read this book and just won’t know.

Tony:

Dave, one followup question to that, do you think there’s value in nicheing down as an agent? I have a friend who he started and all he did was foreclosures. I have other agents where all they do is short term rentals. Do you feel that there’s value in doing that or are you maybe hurting yourself by reducing the size of people that you can work with?

David:

That’s a really good question. In a perfect market where supply and demand are very even and the only realtors that are in the business belong there and they’re good, your advice would be very applicable. The answer would be, yes, you should niche down.

David:

How it actually works is you go look for people who want something, more or less beg them to let you be their agent, work your butt off to try and help them, and then pray to God that it’s actually going to close and you’re going to get paid.

David:

So in a market like we have now, I think if you’re really good at short term rentals, you should say that all the time, “I know how to do short term rentals.” You should look for short term rental people. But if a foreclosure comes your way or a listing comes your way or a house hack that comes your way, it’s not a huge difference to learn how that works. If this was going from being a real estate agent to being a chef in a restaurant, I would say, no, it’s too much, but it’s very, very small variation. So you should look for how to do it for everyone. But when you are marketing, it helps if you say, “I do this thing.”

David:

One of the things that I look for, if I’m going to find an agent is I want to find an agent who owns the properties that I’m trying to buy. So if I’m looking to buy a luxury short term rental, I want to find an agent in that market who also owns luxury short term rentals. And so that’s where I think it really helps you is if you own that type of property, if you house hacked yourself, you are naturally going to be more confident working with people that are house hacking. They’re going to be able to tell when you speak, when you talk, but I wouldn’t say no to other opportunities. I just would go into it with the understanding that my bread and butter is probably going to be this thing.

Ashley:

To follow up on that, I think that whether you’re deciding to go with an agent who niches down or not is to look at what you actually need from an agent. If you’re like me and you’re just going to use an agent just to do the showings for you and do the paperwork, then you don’t need an agent that’s going to niche down. So maybe that’s not valuable to you.

Ashley:

But if you need help on maybe analyzing the market or what is actually going to produce income for a short term rental, then it would be helpful to find those agents that have niched down into that category or have that experience because they own it themselves. So I think that’s something too that goes back and forth, not only should I become an agent or should I hire an agent, but also, why do I need an agent first of all and what that value is from them. And looking at that when deciding if you need to find an investor friendly agent or not.

Ashley:

David, so with your Skill book, what is the criteria that you have laid out into it? Because in your book Sold, we talk about getting started as an agent. But now it’s, who wants to become the top dog, the top producer? Because as you said, it’s only worth it to get your license if you are going to go gung ho with us and not just have it as a little side hustle.

David:

Something that makes a top producer a top producer is actually very similar to what makes any form of salesperson good, and this would include an investor, is how many leads you can generate for yourself. This is what HGTV doesn’t show. What people typically think an agent is, is you get a phone call, someone who is very motivated and really wants to buy a house is asking if you will help them. You will get to feel good, because you’re helping someone and you’re getting paid. You’ll show them the houses that are available to buy. You will go look at them, you will share all of their emotion, their excitement, their nervousness, you’ll form this bond. Then you will pick the house that they like. You’ll write an offer and you’ll make a $10,000 commission. That’s how people look at it.

David:

That happens maybe 2% of the time, and it’s the last 1% of everything you do. The other 99% of the job is just frantically looking for the lead. Putting your name out there, getting rejected, constantly seeking after the person who wants to buy a house or sell a house. Then analyzing that lead like, “Are you serious? Are you motivated? Can you actually buy a house? Is this your money we’re spending or are your parents involved in this and they don’t want you to do it?” You got to qualify the lead.

David:

Then you have to convince them to work with you. Then they become your client, and then 98% of those people you work with don’t ever actually buy a house, but you spend your time, your money, your gas. That’s the reality of what we’re getting into. And that’s a lot like an investor. Nobody calls you and says, “Hey, I have a house I really want to sell. I’m looking to get rid of it at a discount. Do you think you’d want to buy it? You’d really be helping me out if you could do so.”

David:

We all know as real estate investors, we’re hunting. We’re telling people that we know, we buy homes and houses. We’re looking on the MLS. We’re analyzing them constantly, would this be the right property for me? Then if you decide that it is, you’re putting it in contract, in a sense that is when it becomes your client. And you’re trying to figure out, “Can I close on this thing? Can everything work out the way I need it to?” And a small percentage of the houses we analyze, do we ever actually end up buying?

David:

That same mentality is required of a real estate agent. When it works out well, agents and investors are a really good synergy because they understand the skillset is similar between the two, the mindset you have to create. When it doesn’t go well is when someone thinks that being an agent is like a W2 job they had somewhere else. At every W2 job any of us had, we typically waited for a lead that the business generated to walk in the door and tell us what they want.

David:

So if you think about the person that works at McDonald’s, they’re not out there looking for someone who’s hungry and saying, “You should come eat at this McDonald’s. This is the best McDonald’s ever. You should let me be the person.” They just stand there, the person walks up, they say what they want. They punch it in a computer and they call that work. That’s how we’re brainwashed in America to look at what our job is. We’re just waiting for the very last piece of this huge structure that’s been developed to create interest in something and compete against other restaurants and drive in clients.

David:

That’s where most agents have a hard time making the switch, and especially top producers are the ones that embrace it. It’s just like the real estate investors that get it. It’s like Ashley, I know you buy tons of different kinds of real estate, you have all these opportunities that come your way. That’s because people in your community know, Ashley buys stuff. So when something comes up, you pop in their head and they go, “Boom. I want to go to her.” Tony, in your market I know, is it in Joshua Tree? Is that where a lot of your work is being done?

Tony:

Yeah.

David:

I guarantee you there’s realtors there and people there that when they see a listing come up in Joshua Tree, they associate Joshua Tree with Tony. So right off the bat, you’re going to get opportunities to look at before other people do. That’s how you guys are getting deals is you’ve learned to associate your name in people’s heads with what you want. I tell realtors that there’s there’s a game you have to play. I’ll play it with you guys right now, all right. I’m going to say the name-

Tony:

It sounds like Saw or something, right?

David:

It’s not that kind of game. This is cool. Because you have to have me back for my third book that comes out. So if this goes like Saw, I wouldn’t be able to come back up and talk about it. I’m going to say the name of a household item and you two as quickly as you can, are going to tell me the brand that pops in your head. It’s going to be a race to see who can come up with something first. All right?

Tony:

Okay.

David:

The item is going to be toothpaste.

Ashley:

Colgate.

Tony:

Colgate.

David:

All right. So Ashley won, but the point is I’ve only heard two brands the entire time I’ve ever played this game. People either say Colgate or Crest. So the idea is if one of you were going to pick up some toothpaste for me, you’re coming over to hang out and I’m you say, “Hey, can I bring anything to the party?” “Actually I need some toothpaste. Can you pick some up,” you would not go through the 40 different kinds of toothpaste and spend a lot of time trying to figure out what’s the one that David might want. You would look through it all. As soon as you saw Crest or Colgate, you’re like, “Boom, that’s it.” You’d grab it. And you’d check out and that’s what you would bring.

David:

That’s what every realtor has to do in their spheres world. Every human they know, when they hear real estate needs to think that realtor’s name, just like every investor has to do the same thing. That’s why we always say, “I buy houses.” And I even go a little bit further. I tell people, “If you hear the word divorce, if you hear of a death in a family, I need you to remember me right away, because those things often lead to the sale of a house and I want to hear about it before it goes to either another realtor or another investor.”

David:

And so if you want to be a top producer in real estate sales, mortgage loans, real estate investing, house flipping, really anything, what we’re all doing is we’re competing for the real estate in people’s heads, so they think of us first when that thing pops up.

Tony:

So David, I want to touch on this or pull this thread a little bit more. We talk a lot about the importance of having a platform and people knowing you, liking you and trusting you. And it sounds like that’s what you’re saying. There’s this big funnel that you need to build where there’s a lot of people at the top. And the better you can get at widening the top of that funnel, the bigger your business becomes. For someone that’s looking to become a more skillful agent, how important is it to build that platform? And what is the best way to do that as an agent?

David:

That’s a great question. Let’s go back to my McDonald’s example. The most valuable person at McDonald’s is not the person that stands at the computer and waits for you to walk up and say, “I want a cheeseburger and I want fries.” The most valuable person at McDonald’s is the one that sits in the marketing department and says, “What commercial should we run? What special should we run? Where should we put our restaurants to get eyeballs on it and make people want to go eat? When should we run these commercials? What are we looking for in this?” They’re looking to trigger your brain to get you to think of them when you’re hungry or when you’re driving by to think, “Oh, I should go to that place.” But in the W2 world, we are absolved of any responsibility of having to think about how to generate a lead.

David:

So one of the epiphanies I had to have was I had to realize every job I ever had was not a job, it was a tiny piece and a very big puzzle that was the least important part of the whole thing, which is why they leveraged it out first.

David:

Think about the job of a host or a hostess at a restaurant. That was one of the first jobs I had. I was a host and then I worked my web to bus boy, then server and I kept going. I literally would just wait for someone to walk in a door, say, “Hi, how many people are there in your group? Oh, there’s three of you.” Did a little bit of thinking like who’s the next server to get a table, and then grab menus and walk them 20 feet or something. It was ridiculously easy. But I called that work. And if I worked for six hours or eight hours, I was like, “I’ve been at work all day.” No, I’ve not been at work. I’ve been walking 20 feet back and forth in an air conditioned environment, wearing comfortable shoes without having to think very hard.

David:

When I embraced that really isn’t labor, that as long as the world’s been spinning this might be one of the easiest jobs a human being’s ever had, I stopped feeling bad when I had to do more. And that was when I started to really work hard and ask other people, “Hey, can I help you with what you’re doing?” And build a good reputation and show ambition that my boss started looking to promote me.

David:

If you want to be a top producing agent, what you have to understand is it’s your job to get people to come eat at the restaurant. That is the most important part of your business and that’s what you need to be doing. You have to be talking to human beings, hosting events, putting stuff on social media that people care about and want to watch. If McDonald’s made bad commercials, we wouldn’t go eat there. It doesn’t matter how good the food might be. This is a terrible example, because we started talking about fitness and I went to McDonald’s. But I think you guys know what I’m saying here.

David:

Realtors have to understand your job is marketing and then the paperwork and the legal aspect and how to use a lockbox. That’s all the job of the hostess, just walking people back and forth between tables. That’s not what you should be worried about how to do well. If you want to get in this business, you have to be thinking about, “How do I get people to want to come to me?” So you need to know a lot about real estate. You need to have a lot of connections. You need to be able to help somebody achieve what their goal would be. And then you have to manage the entire restaurant because you are the business, you’re not an employee in someone else’s business.

Tony:

David, I’m so glad you brought that up. We’ve heard this many, many times, people work with other people that they know, that they like and they trust. It’s an old marketing adage. If you want someone to buy something from you, they’ve got to know and like you and trust you. And the point you just made about all the transactional things of creating a listing and doing the lockbox, those are all the things that happen after all the hard work of building that relationship comes first. So we’re big proponents.

Tony:

Even as a rookie investor, whether you’re an agent or not, you should be out there talking to people about what it is that you’re doing. And whether that’s a podcast, whether that’s a YouTube channel, a blog, whatever it is, find a way to get your journey out in front of other people. Because eventually, you’re going to find someone that’s going to resonate with that story.

Tony:

David, I want to switch gears just a little bit. As a new investor who’s looking to work with an agent, I think one of the biggest mistakes that rookies make is trying to buy everything and anything. They’re just like, “I want a good deal.” How can a rookie investor and an agent work together to tighten up that criteria, and I think do a better job of finding the right deals for the right person?

David:

Man, the first thing that the rookie investor has to understand is when you say the word deal, do you know what that means? In fact, I think this is just something everyone in America could really benefit from. We often find ourselves at odds or arguing with another person over a concept before we’ve even defined what we think that is. So if you think about the hot button topics, like abortion would be one of them, right? Roe vs wade is in there. One side typically believes that what you’re doing is killing a human, and the other side believes that it’s not a human yet. But they scream at each other over what they think that the other person should be doing. But they’re not on the same definition of if it’s a human or not. If they did, they would probably not be at odds with each other. I just see this happen in relationships all the time is we don’t stop to define what we are actually at odds about. You might be on the same page and not realize it.

David:

So we say the word deal, but deal means something very different to me than what it does to somebody who’s new than what it does to somebody who is an agent. And so if you’re buying in a good area, all real estate at some point becomes a good deal. Think about people that bought a house 30 years ago. Are any of them mad about that right now? Even if it wasn’t a good deal or they thought that they’ve overpaid, they’re pretty happy. So the new person has to understand that this is not like other things in life where there’s clearly one better thing than all the others and you’re looking for it. This is more like dating. What’s the right person for you, for your situation? What you might like this personality, for someone else that’s the worst personality ever. You have to understand what you want.

David:

And that’s the thing when rookie investors don’t and they tell an agent, “I want a deal,” the agent doesn’t know what that means. They haven’t defined what that is. They don’t know what to go look for. So the agent spends a lot of time trying to make the person happy, and they don’t because the person doesn’t even know what’s going to make them happy. Then the agent starts ghosting them. Then the investor gets irritated or angry and says, “Agents don’t care, they’re greedy. The industry sucks.” And then they may think real estate itself sucks. I watch this happen all the time.

David:

So what I would say is what an investor should do is sit down and say, “What’s my ultimate goal? I want to have X amount of money. Okay. Well, how many houses am I going to have to get there? It’s going to be about this much. How do I get some momentum moving in that direction? Maybe I should house hack. What does a house hack look like? Well, it’s probably going to be a multi-family or a house with a lot of square footage that can be divided up. All right, let me talk to my agent about if I should get a multifamily or a house with a lot of square footage and see what they have to say.”

David:

The agent is probably going to say, “Well, the lender says if you want to get a multifamily right now, 15% down is the minimum, even for a primary residence.” That might eliminate it. Now you know you’re looking for a bigger house with a basement and you’re asking, do you have enough capital to finish the basement or not? It needs to be a finished basement and a house of big square footage, which area? Now the agent can actually help you, and now you have clarity on what you’re doing. And once you get that first deal, start asking yourself, “What would my second deal look like?” That is a much more practical approach where both sides can work together to be successful than saying, “Send me a deal,” then they run it through a BiggerPockets calculator, they get an ROI that looks good. And they have no idea what to do next.

Ashley:

David talking about that communication between agents and the investor, what are some things that the investor should be telling the agent to set them up for success? I did this leadership training recently with FTX, and it was based off of the book, Extreme Ownership. And in it, it talked about yes, the people following you can fail and it’s not always their fault. It definitely can be the leader’s fault. And these agents are part of the investor’s team.

Ashley:

So if you are an agent and you feel like you are failing this investor, what’s a list of things that a successful agent could give investors and say, “You know what, I want to be the best agent to you that I can be. Here’s a list of things I need from you, and this is how we can make it work.”?

David:

That’s the best question that you could ask. If an agent does that, they will be good. And as the guy running the team, this is my hardest problem because this industry tends to draw the high eye on the disc. They want to be liked. They want to be a waiter. “What would you like? You’d like a glass of wine, I’m on it.” Okay, you want the steak, I’ll go get it for you.” They want the client to tell them, “This is what I want,” and then they just want to deliver it and feel good and be happy. But in this world, the client is looking usually for more leadership than what they understand. They want to be led. A lot of agents are not comfortable leading. They don’t like the responsibility that comes with that. And so then they avoid the difficult conversations.

David:

So we sell a lot of houses in California, Northern California, the Bay area, very hot market, Southern California, Los Angeles, also a very hot market. So people will come to us with an idea and they’ll say, “Hey, I want to do the BRRRR, and I want to borrow money at 0% from somebody else. And it needs to be 70% of ARV minus repairs. And I want to be in Malibu.” They’ll give you this ridiculous list that is never going to happen. And our job is to hear them out, look past what they’re saying and hear what they want.

David:

When they say, “I want to buy in Malibu,” they’re either saying, “I want to be in a really good area that’s going to appreciate,” or they’re saying, “My ultimate goal is to have enough money to live in this part.” That means we need to put a plan together to get them there, not actually go look for a house in Malibu that they can use the BRRRR method on with an FHA loan, which is what they’re going to be thinking. So what we try to do, and we do this well is we say, “That won’t work and here’s why, but here’s what will work.” And if we take what will work and we take your ultimate goal and chop it into maybe four or five steps over a period of time, we can get you to the house in Malibu.

David:

If more realtors did that, they would automatically disqualify the clients that are not going to work with them and not going to buy a house. And they would earn the trust of the ones that are. I firmly believe if you’re looking for an agent, they are the one who should be driving the car because they understand this world.

David:

Now, if you’re an experienced investor, you know that market inside and out, you’re not looking for a person to drive, you’re more looking for a chauffeur. You can tell them, “Take me here, go do what I want. I’m going to work in the back on my computer.” But most people listening to this podcast and most people working with agents are not in that position. They need to be driven. And so you really want to look for the agent that is not afraid to tell you the hard truths, that isn’t afraid to say, “That’s a bad idea. That won’t work. I don’t think you should do it.” And then hear them out on why.

Tony:

I think there’s lessons to be learned on both sides of that conversation, David. As the investor, you need to seek out that kind of tough love and feedback from your agent. And as the agent, you have to have the courage to stop your client from driving off a cliff and trying to do something stupid or something that’s impossible.

David:

Dude, that is exactly what my life is like every day when we’re having training. And an agent goes, “What do you do when the investor says this?” And I have to say the same thing over and over and over. That’s why I’m saying not everybody will do it, but that’s what the right relationship really should look like.

Tony:

And as a savvy investor, you want that. If I’m doing something for my health that’s detrimental, I’m paying my doctor to let me know what I’m doing wrong and how to correct it. So you want that same kind of relationship with your agent as well. Look at me dropping metaphors like David Greene. Where did that come from?

David:

That was awesome. And there’s part of human nature that doesn’t like it, especially when we’re scared we want to be in control, but it’s often the worst thing you could ever do. So if I went into either of your markets, I wouldn’t be going in there telling you two, “Here’s what I’m looking for.” I’ll be going there asking you what works in your market, what do you think I should be looking for and why? And if your answers were sensible, reasonable, supported with facts, and I believed in what you were doing, I would adapt my strategy around what you were telling me would work there, or I would recognize well that isn’t going to work for what I want. That’s not the right market for me.

David:

And so that’s typically how I tell people they should be looking at agents. If you ask that question and the agent can’t answer it, that’s not the right agent. I don’t think most people realize how many agents we have that we don’t need. There is probably 12 times more agents in the market than is actually necessary. In my office, more than half of our agents sell zero houses a year. We have over 100 agents. So more than 50 don’t sell even one house a year. Of the 50 that sell a house, half of them sell somewhere between one to three. And then the top 20% or so actually sells 10 houses a year or more.

David:

So it’s very uncommon to find an agent who actually is really good at what they’re doing. And then when you find one, they’re probably going to be busy, they’re probably going to be more direct. And that often rubs people the wrong way. The one who’s going to be super accommodating, call you back right away, they usually are doing that because they don’t have any other customers in their restaurant because their food sucks.

Ashley:

What do you do though, if your agent is unresponsive?

David:

You have to be direct.

Ashley:

How do you handle that?

David:

You have to say, “Hey, I want to work with you for this reason. I’m having a hard time, because you’re not responding back to me. Can we put some time on the schedule, every day, every three days, whatever, where you and I can touch base.” And then the next thing I say is I say, “How do you prefer to be communicated with?”

David:

So sometimes there’s an agent in a market that has stuff no one else has and I got to deal with their unresponsiveness. All right. So I typically say, “What I’m going to need from you is a response. Do you like texting? Do you like emails? Do you like a phone call? Do you like a voice note?” And if I’m direct, those successful people respond better to that. They’ll be like, “Yep. Let’s put a call on the calendar every day, four o’clock this is what we’ll go at.” And I’ll say, “Great. I will text you what the call will be about 15 minutes before so that we can have it as concise as possible.” Now that person is boom, we’re talking all the time. It’s that lack of directness that everyone gets uncomfortable with that causes all of the frustration between the two parties.

Tony:

And I think a lot of people just have different communication styles as well. And I think understanding how one person likes to communicate versus the other plays an important role in keeping that relationship strong too.

Tony:

David, I want to go back to the marketing funnel that you talked about at the beginning, because it makes me think of the next thing I want to tackle. In order to be good at marketing, you got to be really good at tracking your numbers as well. If you’re really good at tracking your numbers, you know for every 100 leads to come in, this many are going to book an appointment, this many are going to… So what kind of metrics do you think it’s important for an agent to track in their business, both in a long term, short term and everything in between?

David:

We have two that we prioritize tracking. The first is how many conversations you had in a day where you directly ask for business. There’s a book that Gary V wrote called Jab, Jab, Jab, Right Hook. And the idea is if a right hook is a knockout punch, but if you just go out there and throw that right off the bat and you miss, you’re going to get knocked out yourself. So you don’t want to go out and just say, “Hey,” on the very first conversation you have, “I’m a real estate agent. Do you know anyone that wants to sell a house?” That is very distasteful, no one’s going to like it.

David:

So what he says is your jabs are when you give value. So there’s a rhythm of give, give, give, ask. Give, give, give, ask. So I know in every conversation I have, I’m going to want to bring up real estate in some way, because I want be Crest and Colgate in your head. So what I have to do is be very interested in you, in what your goals are, and what matters to you and what your challenges are. Figure out how to give value to you three times, and then on the fourth time, I’m going to ask for what I would want. So we train our agents in how to do that and we track how many of those conversations they have in a day. And the other thing is we have a listing presentation we give, if we want to sell your house, and we have a buyer’s presentation that we give if you are going to buy a house where we spell out, this is what the whole process looks like. Most agents don’t do that.

David:

So what happens is the client feels like they’re driving in the fog and they’re creeping at two miles an hour the whole time because they’re scared to death because they don’t know what’s coming. So we lay out a whole roadmap. Here is everything we’re going to do. Here’s what the layout looks like. Here’s the road. Now they’re not as scared, they’re not as nervous when stuff comes up, we’ve gone over an inspection report with them. They know how an appraisal works. They know what the contract looks like. They know what earnest money deposit is. They know how we’re going to show them homes, what kind of feedback we want.

David:

So I track how many of those presentations our agent given a week. So what I tell the agents is, “If you give three of these presentations a week to anyone, you give it to your mom, your aunts, your cousins, your neighbors, your friend from high school, just say, ‘Hey, can you give me some feedback? This is a presentation I give to buyers. I want to know what you think.’”

David:

A, you get comfortable doing it, which is really important. You sound more confident when you’ve done it a lot. But B, you impress the crap out of them when you give it to them. It associates you as the Colgate or Crest in their head, even if they’re not ready to buy right now. And the problem is human nature never wants to do that. We want to wait till the last minute and then cram in and get through it as fast as we can and then get out there looking at houses. And so that discipline is very difficult to create with real estate agents.

David:

But I look at it like turning a Jack in the box, right? (singing). I don’t know how many times I’m going to do that, but I know if I keep doing it that thing’s going to pop. That’s how real estate agents need to look at their business. Those conversations they’re having is the cranking. And the better, the more smooth, the more value they bring, that’s the faster that they crank. And that’s what your job is, is to crank on that thing all the time. And then it should start popping. And then when it starts popping so much that you can’t keep up, that’s when the third book, Skill would be applicable in the series. That’s when you leverage out getting other people to help you with your job.

Tony:

David, I love that none of the metrics that you tracked were how many properties did you sell? Or what was your commission? So talk about why you focused on these presentations and the conversations over the numbers of volume sold and things like that.

David:

Focusing on volume sold, houses sold, the end result would be like if I wanted to get in shape and you said, “Okay, well, what you need to focus on is weighing yourself every single day.” Because if I miss four days of the gym and I eat bad, do I want to go weigh myself on the fourth day? No, I’m looking for a reason to not do that. And now that I’m not weighing myself, I don’t want to go to the gym at all. It’s very easy to lose that momentum, and then you stop looking at the numbers.

David:

If I wanted to lose weight, I should be tracking what I am eating and how many times I go to the gym and maybe what I do when I’m there. That’s a way… We call those lead measures. These are things that lead to a result. A lag measure is once you’ve already done your lead work, how did it turn out? And focusing on the end result is not a good idea. In general, we call it resulting. Annie Duke wrote a book called, what did she call it? Living Life in Bets, I believe. And she talks about poker where you can make the right call in poker, but the odds go against you and you still lose. You shouldn’t change your strategy based on the fact that the result was you lost. If you made the right move, you need to make it again. And life is a game of averages.

David:

That’s the same thing how this works. Focusing on how many houses I sold will maybe make me complacent. I sell all these houses. Now all my conversations are about how many houses I sell, why I’m better than the next realtor. That turns people off. Focusing on how many reps I’m doing, what the weight I’m pushing is and how many times I get in the gym. It is impossible to not get stronger or better if that’s what you’re focusing on as your lead measure. So if you focus on your conversations, if you focus on your presentations, you will get better by mere fact of doing them, and you will get the word out to more people the more often you do it.

Tony:

David, one example for my personal life, so my W2 job before I became a full-time real estate investor, I worked in supply chain and distribution. And that whole industry is dominated by lead metrics and lag metrics. And one of the things that I was responsible for as leader in that business was how many units we shipped per hour. How many units, how many boxes did we make leave this facility every hour? That was the lag metric that we were graded against. But every day, the things we would hold our team members accountable to had nothing to do with how many boxes they were moving per hour.

Tony:

We would literally like, “How much time are you spending in between each location? If you have to visit 30 locations to pick all these items, how fast are you getting from one spot to another? How many trips is it taking you around the warehouse to finish your picks?” So focusing on those things, if we hit all those boxes that we knew at the end of the day that we’d be able to reach that larger metric of how many units are leaving the warehouse. So I think in any goal that you have, there’s always some kind of lead metric. You can track upstream that if you knock and check all those boxes, there’s a high likelihood that you’ll hit that big goal at the end.

David:

That’s how life tends to work. So if you’re the manager, you’re probably spending more time looking at lag metrics, because you’re making sure that all of the people working for you are doing their job. And if the weight starts going up or in your case, Tony, if the shipping isn’t happening like it should be, that’s a clue, “I need to dig deeper and find out why.”

David:

So the example that I like to give would be I’m a big Golden State Warriors fan, and that team is plagued by turnovers. They just turn the ball over a lot. I don’t think the players should be thinking during the game, “How many turnovers do we have?” That doesn’t make sense, but the coach should be looking at that. And if the coach sees the turnovers are too much, this is stopping us from winning, they need to go create lead measures for the players. “Are we leaving our feet to pass? Are we throwing one handed passes instead of two? Are we getting ourselves into a jam because we made a bad decision and then we’re turning the ball over because we don’t have anywhere to go with it?” And then create practice around how to avoid that. Those lead measures are the players’ responsibility. The lag measures would be management or the coaches’ responsibility.

David:

But the point is it’s lead measures that create the result. And that’s where people should be focusing. It’s just, nobody wants to. Nobody wants to naturally be focused and disciplined when they’re making passes. It’s easier to play casual.

Tony:

Just one last thing before we get off of this, so a lot of you guys that are listening know that I trained for this fitness competition about a month ago, did pretty well, placed first in a few of the divisions that I competed in. And the things that I tracked throughout that competition, I literally have a chart in my bathroom and I would fill it out every day. I printed it out and hung on the wall in my bathroom, and I was tracking how much water I was drinking. It was a yes or no. I had a goal of drinking two gallons of water a day. Was I doing my fast cardio? I was supposed to do cardio twice a day. Was I in the weight room? Did I actually lift weights that day? Did I eat all my meals? I was supposed to be eating five to six times a day. And did I take all my supplements?

Tony:

None of those had anything to do with how I looked or what my weight was or how strong I was. I was just tracking water, food, cardio, supplements. And that was it. And it was tracking those things on a consistent basis that allowed me to reach that goal over time.

Ashley:

David, can you give an example of lead verse lag on the investor side of things?

David:

Yes, that’s really good. A lag measure would be how many houses did I put into contract? What did my net worth increase by? What did my cash flow increase by? A lead measure would be how many conversations did I have about real estate with someone that is likely to come across an off market opportunity? How many names, phone numbers and emails did I get to put into my database for followup to talk to more people? How many conversations did I have with people in the industry that could come across opportunities?

David:

One of the tried and true ways of getting a deal right now that no one could stop would be, if you just called landlords that are advertising something for rent and said, “Hey, do you want to buy?” That’s the perfect Jack in the box. They’re going to say no most likely when you call, but if you call them every month or every two months, you’re going to hit them at that point where they’re sick of dealing with the tenant, they don’t need the money anymore, they want to move. They don’t want to own the property. If you’re the first call they get, that Jack in the box is going to pop. So how many of those people did you add to your database every week? How many phone calls did you make to those people?

David:

And then my belief is as a result of staying disciplined and consistent with doing that, you will naturally get better at doing it. Human beings like to become more efficient at what we do. If Tony goes to the gym enough times, eventually he’s going to get better at lifting the weights. It’s not just he’s lifting them more. Your form’s going to get better. You’re going to get stronger. You’re going to figure out what works for you. You’re going to become more efficient. And that’s why discipline’s so important because if you keep going, it is impossible to not get better.

David:

But I think what stops people is they have this idea, I have to be strong before I go to the gym.

Tony:

David, before we move on, I just want to go back to the presentation piece really quickly because I think that’s a unique thing. I’ve worked with a lot of different agents in multiple different markets, and not a single one has given me any kind of presentation. So can you just share a little bit about what goes into that listing presentation and why you found it to be valuable?

David:

Yeah, that’s really good. So what most agents will do, this is the typical thing is they’ll go in their MLS. And the MLS typically has some kind of software with an algorithm where they will type in, it’s a 1400 square foot house with three bedrooms in this area. And it works similar to what the Zestimate works like on Zillow. And it’ll be like, bing, this house should be listed for somewhere between 580 and $600,000. They will print that out. They will take it to the seller. They’ll say, “We should list your house for somewhere between 580 and $600,000. And let me tell you why I’m so great. I will hold your hand the whole way. I will knock on every door and tell people. I will hold open houses every single weekend. I am amazing. You should trust me.” And that’s what their presentation looks like.

David:

What we do is much more detailed. So I have trained our agents to hold listing presentations the way that I sell my houses if I’m going to go sell it. So we’re going to start off by finding out what the motivation is of the person who’s selling their home. We’re then going to get the address and we’re going to run a comparative market analysis or CMA. This would be like pulling comps. We break them into three categories. There’s active listings for sale, pending listings that are already in contract, and then closed listings.

David:

What I’m looking for ideally is the shape of a pyramid. So the closed listings on the bottom are the widest. Then there’s pending sales that are a little bit less than that. And then there’s hardly any active houses on the market. That is the strength of a seller’s market, because the active homes are going pending super quick, and there’s a lot of pending homes that are selling. So you have a lot of sales.

David:

If it’s the opposite of that, if I see a lot of active houses on top and hardly anything that is sold on the bottom, that’s going to be a buyer’s market. It’s going to be harder for us to be able to sell their home. I then call every single agent that has a pending transaction, and I ask them, “How many offers did you get?” You got to build some rapport before you do it, but we find that out. “How many offers did you get? Do you think you priced it too low? Would you have priced it higher? Do you think you went too high? What were the complaints? What did the buyers say? What was your experience like that you ultimately went into contract?” Because those pendings are the ones you want to know about. That’s the girls that found a date to the dance. You want to find out how did you do that? Because I want to be able to do the same.

David:

Then I call, or I don’t call but someone on the team calls every single active listing, it used to be me. And we say, “How many showings are you getting? How much interest are you getting? Do you feel like it’s softening up? Do you think you priced too high?” And we find out from them what kind of action are they getting? And we take notes on every single one of those conversations on that sheet with all the addresses. We take that with us to the listing presentation, and we sit there, we have a branded folder. We have a pop socket to go on the back of their phone and a pen that says David Greene, a cool brochure that explains what we do. And we start off by giving a PowerPoint presentation that shows this is what makes a house sell. This is where buyers are finding their homes. This is how we market your house to different people. Here’s some of the lies that realtors will tell you.

David:

One of the common ones that a realtor will say is, “I will market your house to X amount of people. I will get it in front of a lot of humans.” That was legit 30 years ago when it was very hard to get a house in front of people. But we live in the online dating age. It’s not hard to find someone online. Every house is everywhere. It’s not hard to find it. Everyone’s looking at it. The goal is to make it stand out.

David:

So we’ll say, “We’re not going to show your house. Some more people. They’re all already going to see it. It’s going to hit all of the portals. What we’re going to do is market it like this. We’re going to use drone footage, we’re going to use this type of staging. We’re going to use these type of cameras. This is what our other listing pictures look like. This is how we’re going to market your home.”

David:

Then we get into how we’re going to follow up with leads. We have a service where if somebody texts a number when they’re near the home, our software will interact with their phone’s GPS, and it will automatically send them a text that says here’s all the information about the phone. It notifies one of our agents. They then call that person and say, “Hey, did you want to set up a showing?” In today’s day and age, people’s attention spans are very short. Nobody is going to go stop at a house, look up the address, Google it, try to find it online. They’re just going to keep going. And no one calls anymore either. They all want a text. Me too.

David:

So we go over what we do to make it easier for buyers to find the house. Then we go over once we get multiple offers, these are negotiation strategies we use to find the buyer that needs the house the most so we can get you the very most. Then we go over. Why they’re going to pay for a home inspection up front. And even though that’s going to cost $500, it’s going to stop the eight to $15,000 request for repairs that’s going to come back our way that happens every time when you make a buyer, get their own inspection. We show them how much money we’re going to save just because we’re better, then how much money we’re going to make them because of how hard that we negotiate.

David:

Then we go over the CMA. We show here’s all your competition. This is what we found. Here’s our edge. Here’s all the pending homes. This is what they said. This is exactly where the market is right now. Here’s where we should list at. Here’s our commission. We sign the listing agreement and then we start the process of getting the house ready.

David:

Then before we even put it on the market, we take that same CMA that we saved in the computer, we run it again, we see what’s new. We call all of those homes and if we see that demand has gone up, we price it a little bit higher than we agreed on the listing agreement. If prices have gone down, we adjust the other way before we even put the house on the market. So there is a lot of work that goes in on our side to being as precise as we can.

David:

And that is something I don’t think if you’re inexperienced with selling homes, because most people sell a house every 10 years, it doesn’t happen all the time. Just looking for the cheapest agent drives me crazy because there’s no way if they’re getting a discounted rate, they’re doing any of that. They’re just going to put a sign in the yard, wait for offers to come in and then give it to you and say, “Hey, what do you want to do?” And that’s another thing that we do different. Before you even get the offer in front of you, we have already talked to listing agent and tried to negotiate up as high as we could possibly get it before we bring it to you.

David:

So I don’t like the, “Here’s three offers. Which one do you want?” That most agents do. Well, here’s where they came in. Here’s what we said. These guys came up 60 grand. These guys came up 40 grand, but I think they got a little more to go. And these people are willing to come in all cash, or whatever the case would be. So we’re trying to make our clients money before they even see the offers that come in.

Ashley:

David, you just gave great examples of how to make yourself an agent that stands out. And I think Tony and I are both sitting here thinking, oh, the next time we sell a house, we want somebody like that.

Tony:

I’m thinking like, I don’t even want to tell a house, but David, can you just take my house please? Anyway [inaudible 00:49:07].

Ashley:

And I think that just also proved the point in the beginning too, is that if you are an investor thinking that you should get your license to become a great investor, are you going to want to learn all that stuff? Are you going to want to take the time to do all that research? And most likely, no. I don’t even want to do the paperwork of a contract, let alone do all of that valuable tools and skillset that your team has, those agents, I don’t want to have to learn to be the best at that like they are.

Ashley:

I think real estate agent is one of the easiest things an investor can outsource for somebody on their team. And I think you just gave the exact reason, a great example of why you should outsource it if you’re not going to take the time to learn those things and become the best at being a real estate agent.

David:

You don’t hear a lot of investors saying, “Should I get a degree in bookkeeping so I can keep my own books? Or should I go get my contractors’ license so I can do my own rehab?” But for some reason the agent thing seems easy and there’s nothing to it, and I can just go do it myself and I can save money. But it’s just like everything else. There’s a skillset that goes into being good at doing this. And what my hope is-

Ashley:

Yeah. And are you really even saving money though? Yes, you’ll get your commission on the back end, which ends up being, what does an agent actually walk away with, would you say is average, David?

David:

Oh, the buyers are getting about two point half percent, but then the broker’s going to get 30% of that, and then they’re going to have to pay for everything that they went in to sell. It’s not what people think.

Ashley:

Right. And their license. And then you even said, you go through the contracts and you help them negotiate and you figure out what the right price point is, all those things where they probably end up getting more money not even being the agent because [inaudible 00:51:00] their experienced agent helped them.

David:

Yeah. I’ll give you an example of a house that I bought. The person I bought it from used a discount real estate brokerage. I won’t say the name of it, but it’s very well known in the industry that people go there to save money. And the agents that work there are the worst. He hired that company to represent him on the selling side. And I had an agent on my team representing me on the buying side. So they listed the house too high, found out from the listening agent, the seller insisted ongoing at 2.15. And she told him, “We need to be closer. We need to be less than that.” She was not strong enough to overcome him and she let him make the decision.

David:

So that house sat there in a very desirable neighborhood in the East Bay, super close to an even better one. Primo area, 5,000 square feet. It sat there for 40 days or so and it didn’t sell. So I went in and I wrote a much lower offer and I asked for $75,000 in closing costs, and I structured it so that we had a very long time that we could get out of the house. And his agent did not explain to him all of the nuances of this offer which I wrote on purpose to where it wasn’t super easy to… she was going to have to read the contract.

David:

So he goes into contract with us and then he’s already mad because I got it for much less than what he was asking for. And not long after that, we saw a rush of buyers come in. And so he was mad because he realized he could have got more. Then at the closing table, he realized we were getting a $75,000 credit. So that was even worse. Then he was under the assumption he was going to get a free rent back. Well, he had to pay the rent back at my mortgage, which was 10 grand a month, not his mortgage, which had been $2,500 a month because he bought that house a really long time ago.

David:

So at every stage he got hammered. He probably lost about 300 to 400,000 on the purchase price. Then $75,000 on the closing cost, then the money he had to pay to rent it back because he wanted to save money on the agent. And that I just frequently see this in our industry where people pat themselves on the back because they beat their own agent in negotiating the listing commission. And I just ask, “Do you want an agent that you can out negotiate negotiating for you with a guy like me who’s coming after you hard?”

David:

And so my hopes are that people that are not agents will still get this book and read it, so they can tell their agent that they’re working with, “This is what I would like you to do,” because most of those agents don’t know this stuff.

Tony:

David man, so much good information. My head’s still spinning from the agent presentation side. But hopefully everyone that’s listening here understands that there’s a tremendous amount of value in working with an agent that really knows what they’re doing.

Tony:

Before we wrap up, David, I just want to ask, if I’m a new investor, what’s a good way for me to connect with an agent that knows all the stuff that you’re talking about?

David:

One thing you can do is go on the BiggerPockets Agent Finder and you can look for agents. I’m a proponent of, you want to find one that has sold some homes. If you’re new, you don’t want the agent that’s sold no homes, unless they’re already an investor and they know real estate from that perspective. But the first several transactions an agent does, they’re screwing up left and right, they don’t even know it. So you don’t want that person learning on your dime.

David:

If you’re in California, obviously I want people to reach out to me. I still, for some reason… Help me understand this, you two. I will get someone that listens to me on the podcast, loves what I say, finds a different agent to sell their house and then DMs me and says, “What should I do? My agent messed this up.” I’m trying to figure out what is it about my presentation that makes people think I don’t want you calling me to sell your house?

Tony:

I don’t know. I think it’s that you’re like a celebrity to people. Maybe there’s this-

David:

Intimidation?

Tony:

Yeah, maybe a little bit.

David:

I’m not too proud to sell your home. I’m writing books about it because I want to sell your home. So please, come to me if you want to sell a house. But when you do find someone in an area that I’m not going to be servicing, you really need to ask questions about if they own real estate. I would rather have an agent that owns real estate and doesn’t know the paperwork side or doesn’t have the best personality, but they’ve done it themselves, so they know what questions they had when they were buying the house. Way more than a really fun, charismatic, energetic agent who is probably broke and rents their own home and just knows how the paperwork side goes, but they’re not going to have the resources you need like a handyman that can fix things, a reputable property management company.

David:

There’s a lot of things as investors that save us a lot of money when we get the right connection or areas of expertise that we can really benefit from. So don’t assume just because they have a license that they’re all the same. We don’t assume every restaurant’s going to be good. You really want to do research if you’re trying to find one place to eat at, that has really good reviews that you feel really good about. And talk to a couple before you make that decision.

Ashley:

David, Thank you for sharing that. And for our Rookies listening, if you want to find more information about finding an agent, you can go to BiggerPockets Agent Finder on biggerpockets.com. It’s basically like a matchmaking website. You can go in and put your market, what strategy you’re looking to do, and be matched with an agent that can help you get your first or your next investment property.

Ashley:

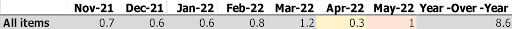

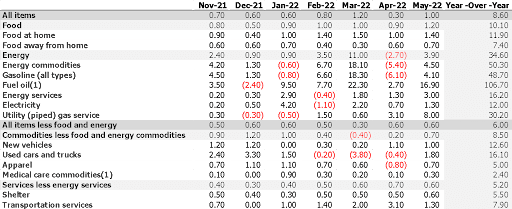

David, we have a segment on here that is called the Rookie Exam, and we actually tailored it to you a little differently than we normally would with a Rookie. So the first question is where do you see inflation going by the end of the year?

David:

Higher and higher. No one knows how to answer this question first off. So I just want to put that out there, but the way I see inflation is it’s like this semi truck that is going down a very steep grade and just picking up steam because it’s been from momentum from the last 10 years or eight years. It’s not like we just started it. It’s just now hitting us. And trying to raise interest rates is like lightly touching a brake pad to the rotor. It is not nearly enough to stop what’s coming.

David:

So I expect this really rough phenomena of inflation continuing to go, asset prices going higher, the cost of food and everything, gas going higher, at the same time that rising interest rates make it so people spend less money. So if you’re on the lower end of the demographic outlook here, you’re getting squeezed hard, because everything you’re buying is going to cost more, and the money you’re making at work isn’t worth as much, and interest rates going up make it when you do want to borrow money, that it’s extra expensive.

David:

So I think it’s going to be a long time before we can slow the semi truck down that’s just barreling down the hill. So if people are saying, “Oh, they’re raising interest rates, they’re going to curb inflation.” It eventually could happen. You don’t just flip your fingers and you can stop that tidal wave that we’ve created from all the stimulus that we made.

David:

But I like you asking that question because I think that not enough investors are looking at the big picture. They’re still looking at by local market and they’re zooming in on the actual spreadsheet and what’s the ROI, and they just don’t see the huge tidal wave that’s coming to crash on them.

Tony:

And if the Rookies who are listening want more information or just a better education on the market at large, BiggerPockets just launched on the Market Podcast with our buddy, Dave Myers, some other great guests on there as well. So be sure to check that out. They’ve got some really, really insightful episodes already about what’s going on in the marketplace.

Tony:

So David, next question. The Fed also just bumped interest rates, I think it was 50 basis points yesterday. So we can all anticipate that’s going to trickle into the world of real estate investing. We’ll continue to see interest rates on homes rise. How are you adjusting your game plan both as an investor and as an agent with that news?

David:

I’m making a video about this very topic on my YouTube channel. It’s youtube.com/davidgreenerealestate. And here is my ultimate take in how it works. There’s a contingent of people that are saying, if rates go up, homes are more affordable. Therefore, prices must come down. And they’re holding very firmly to that belief. And they’re actually getting angry at me because I’m saying I don’t think that’s going to happen. Well, let me explain.

David:

If supply and demand are perfectly, even in a harmonious state, like we all wish they would be, if interest rates go up that makes homes less affordable, what that’s really doing is decreasing demand. It’s bringing less buyers that are able to buy. So in a perfect state, if demand went down prices, meaning the supply side would have to match it to hit that equilibrium. That’s the framework that the people who are saying prices should come down because rates went up, they’re operating from the assumption that we have something close to supply and demand being even because the closer they are to even the more sensitive the market is to interest rates.

David:

We have something more like this. Demand is incredibly high and supply is incredibly low. So rates going up will in fact bring demand down, but it’s not nearly enough to get all the way to where it’s even with supply. So what that means is if you’re in the bottom half of the people, you were barely pre-approved, you’re just trying to fight your way to the market, you get drowned. But all the other people that have plenty of money, there’s still so much demand for housing and they see that it’s still a long term, the best investment you can make. There’s less risk than crypto, than NFTs, than stocks, than everything else. And with inflation continuing to rise, even though your rate went up, the rent you’re going to get is probably going to go up too. That’s the problem.

David:

I don’t think the rate hikes that we’re seeing are going to bring prices down. I think they’re going to wash out people that were barely able to buy. And I’m not happy about that. I don’t like it. What I think we need to do is build a lot more housing and bring some kind of equilibrium so people can figure out what to expect. But unfortunately, I don’t see enough of that going on.

Tony:

So David, say I’m a new agent and I see these kinds of things happening, do I need to adjust my game plan at all? Or can I just ride the same wave that we’ve been riding?

David:

The people that are going to struggle are, I don’t want to say a first time home buyer, but it’s a person with not a lot of income. If you’re living in a market where the average person can afford a $400,000 house and the average house is $400,000, you’re going to have a hard time getting a client that can actually get anything, because those few houses that are 400,000 are going to get snatched up really quick.

David:

What I would be doing is instead of solving the problem of the first time home buyer, which is I will make this comfortable and I will be there for you emotionally, and I will take away the fear, what you need to be looking at is how do I solve the problem of the person with some wealth? How do I get good at explaining a 1031 exchange? How do I learn the tax benefits of real estate ownership so I can share this with people that already have a little bit of wealth? How do I look at the return on equity in a property so I can go to Ashley who maybe has three houses that are cash flowing strong, but she’s getting a 2% return on her equity and say, “Look, if we sell these three houses and reinvest into this thing, I can get you an 8% return on that investment, which means your cash flow will go up times four.”

David:

And painting a picture for people that already have the assets or have a little bit more wealth that would make them feel comfortable using you, especially if they’re not already comfortable with real estate, because they’re not going to know that you’re new.

Ashley:

I think that little thing too, you just dropped right there is being an agent and knowing your client too, that they have other properties and what those properties are and how they can tie into the game plan that you’re helping them put together. Well, David, before we end the show, we do one last segment and it is to feature a Rookie rockstar. This is a Rookie investor that has left us a message either at 1-888-5-ROOKIE or in the Real Estate Rookie Facebook group, or has sent a DM to Tony or I on Instagram.

Ashley:

So this week’s Rookie rockstar is Jorge Gonzalez. He is on property number six in Dallas, Texas, which is a triplex and it is turned out to be a success. He purchased the property about three months ago, did some renovations. The purchase price was $449,000 renovation cost $42,000. And with his down payment, his total money upfront was $152,000. So he ended up with a total monthly cash flow of $2,060 on this property. His mortgage is 2010 a month and he has expected about $430 a month for vacancy and repairs. And the CapEx, he said that everything is all brand new, so he’s not planning on it for the immediate future.

Ashley:

Well, great job, Jorge. And if you want to be featured as our Rookie rockstar, please leave us a message anywhere online, social media, the Facebook group, and we would love to have you featured.

Ashley:

Well, David, thank you so much for joining us again. This book is going to be part of a three part series, correct? So we’re going to have you back a third time.

David:

I sure hope so.

Ashley:

Well, can you let everyone know where they can find out some more information about you and reach out to you? Do you have a podcast or anything?

David:

Yeah, I dabble in the podcast space myself every once in a while. You can follow me online @davidgreene24. That’s where all my social media are wherever you like. We are just now creating a TikTok. I think it’s Official David Greene because some other jerk already took David Greene 24, hoping I would buy it from them.

Ashley:

That would be Tony.

David:

Was it really?

Tony:

Yeah.

David:

It’s a good investment that you two made there. My YouTube channel is David Greene Real Estate. Very boring name, but pretty easy to remember. And then you can catch me at the BiggerPockets Real Estate podcast with Rob Abasolo. And then if you want to get the book Skill, if you know a real estate agent, you’d like to give him a gift, help them to step it up or if your own real estate agent could use a little bit of improvement, go to biggerpockets.com/skill. You could get the book there.

Ashley:

Well David, thank you very much. Everybody I’m Ashley @wealthfromrentals. He’s Tony @tonyjrobinson. Don’t forget to leave us a five star review on your favorite podcast platform. And we will be back on Saturday with A Rookie Reply.