Scott:

All right. And before we bring in today’s guest, I wanted to issue a quick apology and say a quick, thank you to one of our Facebook group members, Carly Rechart. Carly called Mindy and me out, rightly so first spreading misinformation on last week’s episode of the Bigger Pockets Money Show podcast. We stated that Gaines in a 529 Plan would be forfeited if they’re not used for educational purposes. And that’s simply not true. The gains in a 529 Plan are simply subject to tax and, or a 10% penalty when they’re withdrawn and used for things outside of educational expenses or qualified educational expenses. So, they can be a powerful and flexible way to build wealth, save for college, pass money on to future generations and be used for other educational purposes. And there’s lots of other interesting tidbits about 529 Plans. They’re a useful tool in the tax advantaged investment stack for some people.

Carl:

Personally, I don’t use them. I may use them in the future, but I wanted to correct the misinformation that we stated last week. Certainly the gains are not forfeited. They’re just subject to tax and or penalty if, and only if they’re used for non-qualified expenses. So, thank you, Carly, and thank you to the many members of our Facebook group for calling us out. I apologize. We apologize for the misinformation. We have a responsibility to share truth and the correct information on this show. And we appreciate when we do get that feedback, so please keep it coming. And we will link to some resources on 529 Plans in the show notes here at biggerpockets.com/moneyshow308. Thank you so much.

Mindy:

Welcome to the Bigger Pockets Money podcast, show number 308, finance Friday edition, where Carl and I sit down to talk about lifestyle creep, being financially conscious, the shockingly low percentage of camp mustache attendees who use a budget and why tracking our spending in real time is the best choice for us.

Carl:

The tracking is where the real value comes in for us having to enter that and review it every once in a while to see where it goes. And I don’t know.

Mindy:

Well, here’s where I’m going to argue with you because having it set up the way that it is Mr. Waffles on Wednesday set that tracking spender up for me in the Excel sheet. So, that as soon as we go over whatever dollar figure we deemed was that category, the category turns red. And that is very helpful for me to see that in real time. Hello. Hello. Hello. My name is Mindy Jensen and joining me today is my husband, Carl, to talk about what a disaster, our May finances were.

Carl:

Wait, why were they a disaster?

Mindy:

Because we got lazy. We stopped tracking our spending in real time, we just stacked up receipts and then said we were going to do it later. And then we never did it later. And then we had to scramble to do it at the end of the month. And that didn’t work for us.

Carl:

Yeah. I don’t like that because when you’re forced to be accountable to the app on your phone and manually enter it, you really think more about all of your purchases like, ah, do I really need this box of [inaudible 00:03:15] from the grocery store?

Mindy:

No.

Carl:

I guess they don’t make those anymore.

Mindy:

You don’t need them.

Carl:

But yeah, I don’t need them.

Mindy:

They’re an unhealthy choice.

Carl:

Even if they did have them, they’re an unhealthy choice. But yeah. Having to pull off the phone and enter every purchase changes things. And some stuff you can’t help. Like gas is gas. You have to buy that. But I’m trying to think of a good example besides my poor example before. What’s an example of something that you would have to put in that you might reconsider because of the spending app?

Mindy:

Just frivolous things, like food is not something that I reconsider. Gas is not something that I even consider. I need gas. So, I buy it. But frivolous things like clothes and shoes. And like I have shoes, so I don’t need another pair of shoes. I want another pair of shoes. It’s needs versus wants that make me think about it before I put it into the spending tracker. This is our real life story. Yeah. So, we didn’t track our spending. I think on what May 2nd we’re like, oh, I’ll do it later. And then later turned into June 1st, which was … Look, we make a lot of purchases during the month and it can be a little bit tedious to grab your phone and open up the app and enter your spending into the tracker. But it’s so much more tedious to sit there at the end of the month and go through the credit card bills and be like, did I put that in?

Mindy:

No. Okay. Now I have to add it. And if you add it through the app, it’s way easier than if you add it through the computer or it tracks it in a different way. I don’t know. Ray told me to do it that way. But it’s just, it was a disaster. And you can tell if you look at our restaurant spending, it was way up because I didn’t even go into our spending tracker this month. I didn’t even look at how much we were spending because I knew I wasn’t tracking it. So, there was nothing to compare to as opposed to past months, I have it up on my computer all the time and I can just pop in there. Ooh, we’re getting close to our grocery spend this month. I’m going to try and really go through the pantry and shop at home instead of going to the grocery store to try and make it under.

Mindy:

But I have no idea how much I spent this month. So, I’ll just go to the grocery store because it’s easier. It’s not easier. I have to get in my car and go to the grocery store. But the grocery store has all the things and my pantry doesn’t.

Carl:

Yeah. I’m thinking about all this and I think the … So, you called one thing out and that was the restaurant spending. What do you think caused that? I have my own idea. I’m curious to know what your thought is. If it’s the same as mine.

Mindy:

Pure and simple laziness.

Carl:

Well, it’s laziness, but we’ve been working on the house as we have always been doing. And we were trying to wrap up a whole bunch of projects before the girls got out of school. And yeah, sometimes you’re going crazy for the whole day and you’re really trying to knock the stuff off. We try not to work on it when the girls are at home, we try to confine our two while they’re in class. So, yeah, we just got super busy and that’s an easy pressure release valve, I think. But it’s also kind of stupid and contradictory too, because we’re doing all this work on our house to save money. And then if we go out to eat that kind of mixes some of our savings. So, yeah, I put this on myself. I overdo it. Mindy’s [inaudible 00:06:39].

Mindy:

I put it on you too.

Carl:

Yeah. Okay. So, it’s my fault. I’ll take the hit.

Mindy:

I’ll blame you for everything, how about that?

Carl:

But you also mentioned frivolous clothes spending. I don’t know if anyone can see my shorts here. They’re pretty-

Mindy:

Stand up and show everybody your beautiful shorts.

Carl:

Yeah. They’re they’re in rough shape. So, I’m pining the clothes spending on you because clearly I don’t spend money on-

Mindy:

Well and that’s not even where we spent the money this month.

Carl:

Yeah. True.

Mindy:

We spent it on restaurants. We spent it on groceries that we didn’t think about. And going out to eat is not a time save. You have to get in the car and drive to the restaurant. You have to wait for your table. You have to wait for your food. You could make all of your stuff at home. You could have some sort of meal plan in place, which takes time to do, but you plan your meals out and then you’ve got food or all of the ingredients available. So, you can quickly make meals.

Mindy:

You can prep ahead of time so you’ve got freezer meals where you just pull it out of the freezer in the morning and let it thaw all day and pop it into the oven at night and have a delicious home cooked meal. But all of these things take planning ahead of time. And we have lived a very reactionary life instead of a proactive life where for the past several years where we are just reacting to what’s going on instead of trying to plan ahead and that’s not in every circumstance of our life, but in a lot of them and I would that to change.

Carl:

Yeah, you are correct. We took on this huge house project, which I think is bigger than we ever thought it would be. When we purchased it I know our scope expanded. We did things that we didn’t initially planned for. The way I think about it is, it’s very good for the finances, not so good for the life. I had a clever saying around that, but now I forgot what it is. Like money rich, life poor. I think that might have been it. But you have to have a, there has to be a trade off there. You can’t just be hell bent on trying to earn the next dollar. We have to live life in a, you said it perfect, a less reactionary manner. But we’re getting there.

Mindy:

Yeah. We have wrapped up our home projects on this house and for the summer we are taking the summer off. We’re not doing any house projects.

Carl:

Yeah. And we’re almost done with the house too. We have a master bath to do, and that’s pretty much it. One big major project left, the girls’ bath, but that’s pretty simple.

Mindy:

Oh, getting that stupid foil wallpaper off is going to be a nightmare. I’m considering just re drywalling the bathroom.

Carl:

It might peel right off. Who knows? We’ll see.

Mindy:

I know. It won’t. That’s not how foil wallpaper works.

Carl:

So, if we live here long enough, it’ll come back in style. So, I vote maybe we just leave it and then five years that bathroom’s going to look super nice and it’ll be in all those magazines and stuff. So, yeah.

Mindy:

Yeah. That’s not going to happen.

Carl:

We’ll just leave it.

Mindy:

Okay. So, let’s talk about our challenges this month. We didn’t track our spending. That was a big challenge. Our restaurant spending was a big challenge. Our household spending was ridiculous. You can see all of the spending that we did do at biggerpockets.com/mindy’sbudget. And you can see that our household spending went crazy. We went to Ikea and Target a bunch of times.

Mindy:

When your kids say, mom, let’s go to Target. Say no. That’s what you should do. And instead I said yes. And we went to Target a lot. We went to Ikea and bought big things. Those are one time purchases. We redid our older daughter’s bedroom. She has a bed. We bought her a bed. We bought her bookshelves. We painted. So, that was kind of a big undertaking. And that’s a one time expense. But household expenses’ kind of went nuts.

Carl:

It’s interesting, one thought about the Ikea thing is you can always find that stuff on Craigslist or Facebook Marketplace, if you look long enough. And sometimes it’s a little bit beat up or the people smoked or something like that. And I thought about that when she’s like, I want this specific item. I’m like, well, we could wait, but then we’re going to be on Facebook Marketplace every day. When it does come up, we got to go borrow our friends pickup truck. It might not be close when we get there. It might not be what we thought it was. So, in that case, I just decided to bite the bullet and go for it. We could ask her to be a little bit more flexible, but I don’t know. How do you feel about that?

Mindy:

It’s a one time purchase and I didn’t feel bad about making it.

Carl:

Yeah, it was a bookshelf and our other purchase was a solar pool cover. We have a pool in the backyard, which we did not want, but we got a great price on the house. Because people in Colorado do not want a house with a pool. And we actually the pool. It’s not that bad. It doesn’t take a part-time. But if we don’t have the pool cover, it stays very, very cool. So, unless you’re-

Mindy:

Freezing cold.

Carl:

Unless you’re like Wim Hof or you’re a polar bear and like swimming in very cold water, you have to buy this pool cover. And that thing was almost $300. So, that was a one time expense that we did not previously think about when we planned our spending.

Mindy:

That’s an interesting point. We didn’t think about it when we were planning our spending. And this goes back to the reactionary. We don’t really do a lot of forward planning, but we also don’t have the historical spending data to go off of because we haven’t been tracking our spending. So, I think if we had been tracking our spending and knew that the previous pool cover would only last two years, we could have predicted this. And some of this is going to be really, really granular. Like how much time do we want to spend thinking about how much money we’re spending versus just, oh, okay, well now we need a pool cover. So, we’re going to do it. The pool cover is $300 and we get one every two years. So, $150 a year for a pool cover. We can just budget for that in the future.

Carl:

Yeah. And actually I have two thoughts. Theoretically, this could have gone into the slush fund because that’s how I see that category as stuff this that we forgot about, but that we still have to buy on a routine basis. It’s an error in our thinking. But the other thing with this pool of cover, you mentioned every two years, the previous one only did last two years, but I got a cheaper one. Like a lower quality one. But it was still almost 200 bucks. This one was almost 300. But this one has an eight year warranty. And you could tell, you could tell this one is much better.

Mindy:

Oh yeah, it is. It is much thicker. Okay. Eight years, 300 divided by eight is much less than 300 divided by two.

Carl:

What is 300 divided by eight?

Mindy:

Shut up. I don’t know.

Carl:

It’s a little bit less than 48 times 40 is 320. I don’t know. 30. High 30s.

Mindy:

Okay. So, $30 a year is way better than $150 a year.

Carl:

Yeah. It’s going to be worth it. Our friends have a pool and they have a natural gas pool heater. It takes a lot of natural gas to heat up 10,000 gallons. And they’re like, why is our natural gas bill like 300 bucks in May more than it used to be. I’m like, well it’s in your backyard. There’s the answer. So, yeah, this is a better solution.

Mindy:

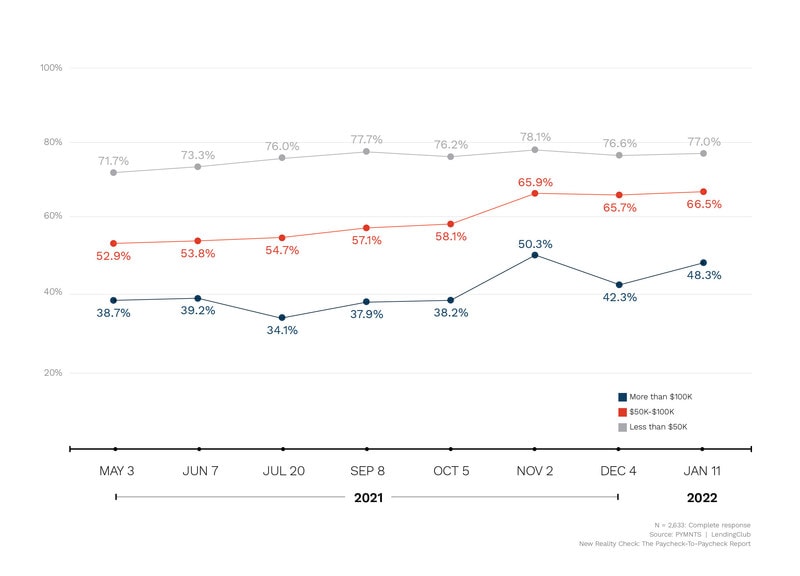

Okay. So, I just mentioned the B word, the budget word. And in my introduction I said the shockingly low number of people who attended camp mustache who use a budget. We just got back from camp mustache last weekend. And we were talking about budgeting because that’s what to do with these camps. And it’s a lot of fun. And we just, show of hands who uses a budget and two people raise their hand out of what, 40 attendees. And I thought that was very interesting that only two people out of all 40 people sit down and write out, I guess three, I didn’t count myself. So, three. Okay. Well that just went up, but sit down and write out every month how much they are going to spend in each category. And then we were talking about how many people, I think didn’t they ask afterwards how many people reconcile their spending afterwards or track it after the fact. And a lot more people, almost everybody raise their hand there.

Mindy:

So, I think that there’s a high percentage of people in the personal finance space who are conscious of their spending, but few people are sitting down and making the actual budget. And I thought that was very interesting because this exercise has showed me that when I am actively tracking my spending, I am actively spending less. I’m thinking about how much I’m spending, I’m looking at what I have spent, what I’ve entered into this spending tracker already for that month. And it’s not an obsessive amount. I have several tabs open on my computer and I just go to this tab and peek at it. Oh, grocery spending is, we’re really doing great on grocery spending this month there. Ooh, we’re not. Because we have basically five categories that we mess up every month. Household, which is ridiculous. Groceries, restaurant, gas. I think we may have figured out gasoline lately. But yeah, I need to track my spending in order to be conscious of where my money’s going.

Carl:

But I think the tracking is different from the budget. Like after this year, our budget, I don’t really think we budget. I think I would call it a loose estimate, loose [inaudible 00:16:42] it hasn’t been super accurate. But I think the track-

Mindy:

A guess.

Carl:

Yeah. The tracking is where the real value comes in for us having to enter that and review it every once in a while to see where it goes. And I don’t know.

Mindy:

Well, here’s where I’m going to argue with you because having it set up the way that it is Mr. Waffles on Wednesday set that tracking spender up for me in the Excel sheet. So, that as soon as we go over whatever dollar figure we deemed was that category, the category turns red. And that is very helpful for me to see that in real time. So, having the budget in there, I don’t want to spend $2,000 a month on groceries. I’m trying really hard to keep it under 750. I’m just not really doing a good job of that. I could try harder. I guess, I’m not really trying really hard. I’m thinking about it sometimes, but I feel bad when I go over.

Carl:

Yeah. We have an excessive amount of food waste in our household, which-

Mindy:

We do. Natalie Kolody said, “Take all of your produce. And instead of putting it in those drawers, put it front and center in the top of your refrigerator so you see it all the time, and then you will eat it all the time.” And in our refrigerator we have a bunch of sauces and things up at the top.

Carl:

Yeah.

Mindy:

We should rearrange the refrigerator.

Carl:

Yeah.

Mindy:

We need to be better at our food waste. That is true.

Carl:

When I was a single male, I would make one big thing and eat it for the next seven days. So, I would have four things in the entire refrigerator and I would … I don’t know. I’m not sure what the root cause of this is, but I wasted kind of zero amount of food. [inaudible 00:18:34] .

Mindy:

Wow. Wow. That sounds you’re blaming me.

Carl:

Well, I guess we have a little bit of a difference of opinion in that the rest of the members of my household do not enjoy leftovers. And if it was up to me, I would eat, I would cook once and then I’d eat leftovers. So, 99% of my meals would be leftovers. I think it’s a little bit more efficient and you get less waste that way, but no judgment. Well, I guess a little bit.

Mindy:

That sounds a whole lot of judgment.

Carl:

Yeah. Well you could judge me for wanting to eat leftovers every day. That’s that’s not really great either.

Mindy:

Yeah. You were eating pasta.

Carl:

I know.

Mindy:

You would make a giant vat of pasta and then just eat pasta the whole time.

Carl:

It was cheap. I had no money. In college you could eat for 10 bucks a week. It was amazing. Or not for your body. Okay. There is a happy medium there that we will search for.

Mindy:

There is. And we need to be more conscious about that. I think consciousness is the whole theme of this episode. Be money conscious, be conscious of what you’re wasting, be conscious of where your money’s going and we’re spending.

Carl:

Yeah, good.

Mindy:

Okay, well let’s talk about our wins.

Carl:

Yeah. We have a huge win, which is pretty cool.

Mindy:

Huge win. So, we have not had Umbrella insurance in the past and I was talking to my friend, Anna, and she said that she was getting an Umbrella Insurance policy. And at the same time I was thinking we really need one. So, I called up her insurance agent and I said, can you just give me a quote on this.

Carl:

Hold on, back up one second. What is an Umbrella Insurance policy? Is that something that ensures the umbrellas in your house? Like those rain protection devices?

Mindy:

An umbrella insurance policy is not for ensuring your umbrellas, you big weirdo.

Carl:

Well, they break all the time though. We really should have that.

Mindy:

We never even use umbrellas.

Carl:

Because they break. The wind comes and that’s the end of that.

Mindy:

We live in Colorado. It’s a desert.

Carl:

Yeah. Yeah. We don’t need them either. Okay. I hijacked the conversation.

Mindy:

You sure did. So, an umbrella insurance policy is like, it covers you, your household, your assets, when you are … It’s over and above your auto policy, your homeowner’s policy. Let’s say you get in a car accident and with me, I am at fault and you Google Mindy Jensen. You’re like, oh, Mindy Jensen is a personality. She’s known in the personal finance space. So, I’m not going to settle for her auto insurance policy. I’m going to go after her. And I now have an Umbrella Insurance policy that covers me in addition to my auto insurance policy or my homeowner’s insurance policy. Should my pit bull bite you, I don’t have a pit bull, so they’re not going to bite you. It’s just extra level of insurance.

Carl:

With that said again, please don’t sue us.

Mindy:

Yes, don’t sue me. But I have an insurance policy. So, they will take care of me now. But anyway. I called it the insurance agent and she said, well, let’s look at your auto policy. And we had the bare bones auto policy because we are very safe drivers. And auto insurance covers you when you are at fault. We had a homeowner’s insurance policy and she looked at both of them and said, “Oh, okay. So, our company can increase your coverage on your car insurance policy, because you really don’t have enough coverage.” And she explained several things to me and I said, “Okay, fine. What you’re saying makes sense.” The homeowner’s insurance policy was for when we bought this house a couple of years ago. And despite having an episode with Steve Longnecker about homeowner’s insurance policies and making sure you have enough coverage, I did not have enough coverage.

Mindy:

We increased our coverage almost twofold on the home and got an Umbrella Insurance policy. And we are paying less for all three policies with more coverage than we were paying for just the auto and the homeowner’s insurance. So, that is a huge win. I now have far more coverage than I used to and it’s costing me less. So, I like that more. If you have not re-quoted your car insurance, your homeowner’s insurance, or if you don’t have an Umbrella policy, you need to reach out to several insurance companies, get quotes and see how much money you can save. Because you probably can. Unfortunately, insurance companies do not have any loyalty to you and they will increase your rates every year. So, you don’t need to feel any sort of loyalty to them by staying with them if they’re not going to give you the same respect.

Carl:

Yeah. There’s a saying around that, insurance is the only business where loyalty is punished.

Mindy:

Oh, that’s a really good saying.

Carl:

Yeah, but I want to emphasize. We did increase our insurance, but we still don’t have our, like cars, we have old ancient cars, they have 200,000 miles on them, both of them. And we don’t have the, I don’t even know the terms. We don’t have the insurance that covers our cars. So, we elevated the insurance that covers other people should we cause an accident. But if we get into an accident with our cars, they’re worth nothing. They’re probably worth a negative amount. We’d have to pay someone to take our cars. [inaudible 00:24:12]. If you have kids, kids are little savages. Oh yeah. Don’t allow food in your cars if you’re-

Mindy:

Or crayons.

Carl:

Yeah. Oh, crayons. They melt. Window stickers. Our cars are rolling biological experiments. We probably have, we’ll either die younger or will live infinitely because a genetic mutation is caused by what’s going on in our cars. So, I still like to have the minimal insurance because what’s the whole point of insurance just to cover something you can’t afford to replace on your own. If one of our cars was lost, well, number one, we wouldn’t have to replace it. Because we have two, we barely need one. But if we did need to buy a car, we could do that. So, I prefer keeping the smallest amount of insurance we need.

Mindy:

Yes. But we increased the amount of medical coverage.

Carl:

Yeah. And that was very, I agree with you there. Because if you get into an accident and we injure someone else, it was small and yeah, that did need to be increased.

Mindy:

And the Umbrella Insurance policy has minimums on your other policies. So, you can’t have the bare minimum on your auto policy and have an Umbrella policy. So, we had to increase the auto policy and the homeowner’s policy a little bit just to be able to get the Umbrella policy. But again, we’re still paying less for now three insurance policies than we were paying for two insurance policies with less coverage.

Carl:

Yeah. I think all of this is under $2,000 a year.

Mindy:

Yeah.

Carl:

Homeowners insurance for a nice house, two cars and the Umbrella policy. So, that’s great. A lot of people-

Mindy:

It was 1,100 for homeowners and 560 for, yeah, it was like 1,500 or 1,600.

Carl:

Yeah. And that’s annual. I know people will pay over 2,000 just for insurance on one car. And that’s why we have not nice cars.

Mindy:

Beaters. Okay. Hey, did we make any big purchases that aren’t on our spending tracker this month?

Carl:

We did make a big purchase.

Mindy:

Oh, oh we didn’t do it in May though. We did it in June.

Carl:

Yeah. That could be a cliff hanger where we announced the big purchase.

Mindy:

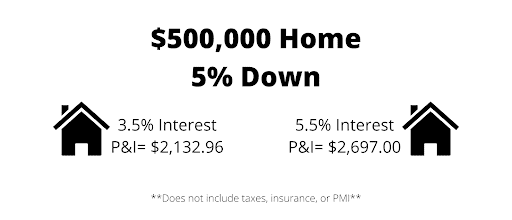

We bought a house, another house. Yay. And it’s a dump, because that’s so on brand for us. We live in a neighborhood that is … How would you describe our neighborhood?

Carl:

It’s pretty nice. It’s an old school neighborhood. It was built 40 years ago. So, we’ve got big trees. It’s kind of, it’s built on a golf course, which I never really wanted to saying we live in a golf course neighborhood seems kind of offbrand and not in line with our values, but we’ve got a lot of good friends here who share the same values. So, we’ve got a really good community here, which is the whole reason we moved here. Yeah. But it happens to be on a golf course too, which is strange. We’re not golfers. We don’t even play tennis. What are another fancy sport? Polo. You did that for a while, right?

Mindy:

Oh, shut up.

Carl:

What was your horse’s name? Yeah, no horses.

Mindy:

So, we had an opportunity to buy a house, another house in this same neighborhood. And it is outdated, it needs some work. But it doesn’t need a ton of work. What we about that house is it has no stairs. Well it’s got a basement, but you don’t need to ever go down to the basement. So, it’s a ranch house and we could potentially retire in that house. The house that we’re in currently is a split level and has stairs everywhere. So, as we get into our 90s and 100s, stairs may become a little bit more difficult to navigate. And this house will be a really great home to retire in. And until we move in there, it’s not a great home to move into right now because our children are still at home. They are 15 and 12 and there’s not all that much space. So, it’s a smaller house than this one.

Mindy:

And this house that we’re in currently really fits our needs. So, we are going to, we closed on June 2nd. We are getting ready to do some rehab to it, starting in September, which will be documented on Bigger Pockets. So, you can see what a real rehab looks like. Not these frivolous rehabs, where everything is neatly wrapped up in 30 minutes. I anticipate some problems just because that’s how it goes with every other rehab. This one’s not going to be smooth as silk either. So, we need to redo the kitchen because their kitchen is this big, it’s the dumbest kitchen ever. And the doors to all of the bedrooms are currently sliding glass doors instead of actual solid doors. What are other, some of quirks on this house?

Carl:

Quirks. It as floors that need to be refinished, that’s not really a quirk. It’s got skylights that have issues.

Mindy:

Leaks.

Carl:

Yeah. They did a weird skylight design, which you’ll see when we do the video series. But yeah, it’s a quirky house. The layout is also a bit strange, but we knew this house has upside too. And we have multiple exit strategies. We might move in there. In the meantime, we might do a furnished rental. And if something changes in the fall, I think we could turn around and sell it and probably make a pretty good profit with probably a month of intense work. A month of 48 hour work weeks with you and I, and maybe another person. Aric with an A might help us, a friend. And you view audience members are local to Longmont and have some skills. We might hire a couple other people, because we’ve lived in [inaudible 00:30:09] our current house.

Mindy:

Oh, oh, oh, oh, oh, I’m sorry. We will hire other people. Not might.

Carl:

Yeah. We want to get through this one fast, current house that we’re sitting in right now is, what are we two and a half years into this and we’re still not done. It is monopolized much of my life. And I do not want that. So, this one is going to be a targeted strike. We’re going to go in there, tear everything out. We’re going to have everything ready to go and we’ll get this one flipped around fast. So, yeah. If anyone wants to help send us an email, do they know how to get ahold of you or me?

Mindy:

[email protected]

Carl:

Yeah. If you don’t have any skills, you can do demolition. There’s a need for everyone. We want, what’s the uncle Sam thing? We want you.

Mindy:

Yeah. I want you to come work on my house.

Carl:

Yeah. Fun.

Mindy:

Yeah. It’ll be super awesome fun. It’s the best thing ever. You could learn how to say bad words.

Carl:

Yeah. I think we’ll have more to say on that. Maybe we should do an … Well, I guess that’s what the video series for that’s for.

Mindy:

That’s what the video series is for. But I think that it’s disingenuous to buy a house and then not mention it. We are taking the summer off. That is still true. It is June, what’s today, June 5th, that we are recording this episode. And we are getting ready to go to Germany in two days, we’re going to Munich and Berlin for 10 days and this episode will air while we are out. Thank you for listening. We’re having a great time in Berlin, probably.

Carl:

Ooh. Maybe we should look at some German design aesthetics to inform us for how we should do this house. We could be all pretentious and have a minimalist thing with stainless steel and white everywhere. The house well one color in the whole thing.

Mindy:

No.

Carl:

Or even less than that.

Mindy:

It still has that stupid fireplace.

Carl:

I am going to get, I really want a cuckoo clock. I’m not a souvenir person, but I don’t know. There’s a special place in my heart for cuckoo clocks.

Mindy:

Is there a special place in the spending tracker for a cuckoo clock?

Carl:

Yeah, maybe the travel, slush fund.

Mindy:

Slush fund. If you look at our June projected spending, it is the highest of any month we have had so far. And that is, a lot of it is the travel. Most of it’s the travel. But that is again, something that’s easily cut out should the stock market tank like it has been for the last month. Which is, again, why we’re tracking our spending in such a granular way, because when there are things that we need to cut, it’s easy to look at where the money’s going and say, oh, well, we don’t have to do this going forward. We don’t have to do that going forward. We can cut out restaurants completely. We can cut out going to tap rooms with our friends and we can cut out parties and we can cut out all these different things.

Mindy:

So, the categories that we put in our spending tracker may not make a lot of sense to you as you look at them, but that’s okay. They don’t have to make sense to you. That’s the beauty of the Waffles on Wednesday Spending Tracker, which we will link to in today’s show notes, which are found at biggerpockets.com/blog/money-308. We have a new way of doing our show notes. But the Waffles on Wednesday spending tracker is a customizable spending tracker. So, you can do all of your spending in the ways that are important to you. So, you can see what categories are easy to cut back on or cut out entirely when you start tracking your spending.

Carl:

Cool. I have nothing to add.

Mindy:

Wow.

Carl:

That’s channeling Charlie Munger. You’re a Warren Buffet. That’s a compliment.

Mindy:

Oh yeah. Wow.

Carl:

I have nothing further to add. If you know who Charlie Munger is.

Mindy:

I have no comment. Is that what he says? I have nothing to add.

Carl:

I think so. Yeah.

Mindy:

It’s been a couple of years since we’ve been to that. We just missed it. Did you even know?

Carl:

Yeah, I knew. I read the letter. We’re talking about the Berkshire Hathaway Conference, Omaha [inaudible 00:34:14].

Mindy:

The Berkshire Hathaway annual meeting. Annual shareholders meeting.

Carl:

Yeah, the Woodstock of Capitalism. It’s pretty cool. You don’t look Warren Buffet though, which is good.

Mindy:

Well, thank you. What a amazing compliment that is. I really appreciate your kind words.

Carl:

I look more Charlie Munger than you look Warren Buffet. This has gone off the rails.

Mindy:

Boy it has. Okay. Well that’s a good place to end. All right. Well we appreciate you listening. We would love to hear comments from you, email me [email protected] Email Carl at, what’s your good email address?

Carl:

What is a good email address, mr1500, the numbers MR 1500, @1500days.com. 1500days.com, which is also the name of the blog. But yeah, seriously, if you’ve got construction skills, hit me up.

Mindy:

Okay. So, I didn’t even say that you are the comedic genius behind the dinosaurs and fart jokes at 1500days.com and the comedic genius behind the dinosaurs and fart jokes at milehighfivepodcast. Sorry, I should’ve said that in the beginning of the show.

Carl:

It’s all right.

Mindy:

And he’s my husband. And he does a lot of the work on this house that you can’t really see, because we’re just aimed in here, but-

Carl:

Put the shelf up.

Mindy:

You’ll see … Yeah, he put this shelf up. You will see him doing work on the new house, the strange house. I’m super excited to do this house.

Carl:

Yeah.

Mindy:

I get to help on this house too.

Carl:

We should put a link to it. We have our Instagram post where we did the little movie. Can we put a link to that in here?

Mindy:

Yes. We will put a link to that in the show notes. Again, show 308, biggerpockets.com/blog/money-308. So, you can see this quirky new house.

Carl:

Yeah. Cool.

Mindy:

Okay. So, thank you for listening from episode 308 of the Bigger Pockets Money podcast. He is Carl Jensen. I am Mindy Jensen saying, auf wiedersehen.

Carl:

How do you say goodbye in German? Was that it?

Mindy:

That was it.

Carl:

Oh, I thought it was Danke. Oh, is that thank you?

Mindy:

That’s thank you.

Carl:

I’m going to suck in Germany.

Mindy:

You really are.

Carl:

It’s going to be an international incident. I’m going to say the wrong thing and …

Mindy:

Okay. Bye.

Carl:

Bye. Danke.