Is My Property Manager Skimming Off the Top?

Property management is a crucial part of your real estate investing business. They make repairs, take tenant calls, and most importantly, collect rent. But what happens when your property manager stops contacting you, forgets to send signed leases, and doesn’t send you your rent checks? When is it time to start worrying and how do you go about asking a property manager for your money back?

Welcome back to Seeing Greene, where your expert investor, agent, lender, and podcast host, David Greene, answers some of the most commonly asked real estate investing questions. In this episode, we take both video and written submissions and throw them at Dave to get his time-tested take. You’ll hear questions like, whether to pursue a business or buy rental properties, when to sell an investment property to reinvest profits, how to look for joint venture partners, and what to do when you’re concerned about your property manager’s performance.

Want to ask David a question? If so, submit your question here so David can answer it on the next episode of Seeing Greene. Hop on the BiggerPockets forums and ask other investors their take, or follow David on Instagram to see when he’s going live so you can hop on a live Q&A and get your question answered on the spot!

David:

This is the BiggerPockets Podcast show 618.

So how can you do both? Well, you can start off by house hacking. Put 3.5% down, 5% down on a single family home, that puts the seed in the ground for at least one property. And you can do that every single year. You can then put a lot of your time, attention, energy into growing the business and taking the money that comes from that business and reinvesting it until you don’t need to reinvest the money anymore, where you can then take it and reinvest it into real estate.

What’s up everyone? My name is David Greene and I’m your host of the BiggerPockets Real Estate Podcast. If you’re ever wondering why we say things like this and show, it’s because Josh Dorkin, the founder of BiggerPockets, started doing the podcast like that and I just can’t help myself but do it because I listened to Josh for so long. Josh, shout out to you if you happen to be listening to this. Hope you’re doing great out there in Hawaii, you’re getting plenty of sun and things are going well for you.

If this is your first time listening to the podcast, we at BiggerPockets are here to bring you as much information as we can about how you can build wealth through real estate. Today’s show is a slightly different format than what we normally do. It’s called Seeing Greene. That’s why the light behind me is green. In today’s format, people like you submit questions about their real estate careers, specific problems that they’re having, areas they’re getting stuck, or just overall wisdom that they feel like would help them in their journey, and I do my best to answer them.

If you guys would like to be featured on the show, I’d love that. Please go to biggerpockets.com/david and ask your question there for me to answer. And if you’re not listening to this on YouTube, I’m not paid by YouTube to say this, but I will say, I just got the YouTube premium thing where it plays in the background when you close the app. Game changer. Absolutely love it. No regrets about, I think, the $15 I have to pay every month. So consider doing that because you can leave comments about our show as well as subscribe and get notified when BiggerPockets has new shows coming out.

In today’s show, we cover topics like how much of a property you should be fixing up or how much money you should be dumping into a property where the return starts to become marginalized. We talk about how to prioritize owning a business and building your real estate portfolio. Which one should you be putting your money and your time into? We also get into how to evaluate the return on equity of a property. So at what point is your property not earning you enough cash flow for how much equity it has? And how you should move that money around and more. If you guys listen all the way till the end of the show, you’re going to hear the debate about if I should be wearing t-shirts or if I should be wearing collar shirts when I do these. So please chime in on that as well.

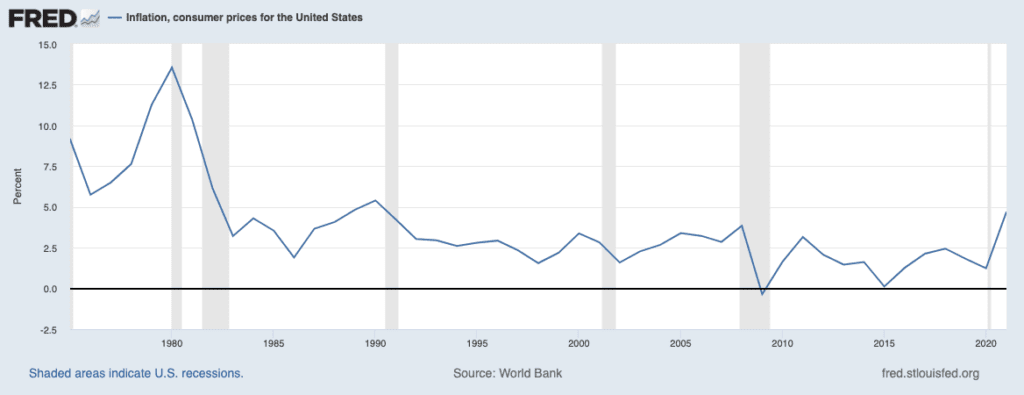

Today’s quick dip is, listen to Episode 620. It’s going to be coming at two episodes after this, where I interview Ed Mylett. We talk about this concept of collective psychology, which is a tendency that human beings have to want to follow the crowd and do what everybody else is doing. But the best investors and the best business people do the opposite. They zig when others zag. In this market with interest rates going up, with the Russia-Ukraine situation, with all these fears of inflation, many people make bad decisions out of fear and there’s a lot of fear going around.

Inflation, in my opinion, is a reason that you should be buying real estate. But as people are seeing inflation happening, many of them are thinking they want to get out of the market for some reason. You’re having a hard time finding deals, I’m sure. There’s not as much inventory out there. So right now is a time to look for sellers who are getting scared, who are nervous or who are following the collective psychology of the group that says you should sell because we don’t know what to do. You might be able to find yourself a great deal by focusing on the emotional state of the seller, not just the asset itself as you see it online.

Hopefully that works out for somebody. If you’re able to pick something up in this market that you think is a great deal, I want to know about it. Tell me in the comments what you got and how so everybody else can learn. All right, without any further ado, let’s get to today’s show.

Shane:

Hey David, I’m looking to begin investing with the goal of having enough wealth and cash flow built up to be able to support running other businesses. Specifically, I want to start a farming business sooner rather than later. I’m concerned that I won’t have enough capital to scale both my real estate and the farming business simultaneously. And I am afraid that picking one business over the other would delay the other one significantly. As somebody with multiple businesses and enterprises and looking to start more, I’m wondering how you decide where to dedicate your resources, your time, energy and capital next, going forward. And specifically wondering if you have any advice about how I specifically can build my bridges effectively and efficiently. Thanks.

David:

Hey Shane. Wow, that was a very good question. I could probably spend the entire episode just answering that. So I’m going to have to try to keep this short. You’re telling me that you want to invest in real estate, but you also want to invest in a business and you don’t think you have enough capital to do both and you want to make sure that you don’t delay either one. Here’s a few things to think about. Businesses tend to generate more cash flow and they tend to have more risk as well as more time and energy put into them, meaning they’re less passive. Real estate tends to generate wealth passively or more passively than a business does, but it doesn’t always do it from a cash flow perspective. And when I say that, I mean the money that that asset is putting into your bank account every single month is what we’re going to call cash flow.

It’s typical when you’re first getting started to buy a single family home, a small multi-family to make a couple hundred bucks a month of cash flow, which is frankly not very much money at all if what you’re looking to do is try to fund a lifestyle or a business. Now, real estate does very well over the long term when it appreciates and you pay down the loan. Cash flow, in my opinion, is best used to make sure you don’t lose a property. It’s a defensive metric. You’re meant to use the cash flow to make sure you can make the payment. And then holding it for a long time is what builds wealth. If you understand the strengths of both asset classes, real estate is very good long term. Business is going to be better short term.

So if you’re looking to create a business, you’re going to want to have to go out there and generate some revenue, put some contracts together, find some way for that business to make money. Then you’re going to hire people. You’re going to train them. You’re going to manage them. You’re going to oversee your clientele. You’re going to have to learn how to keep the books. You’re going to do a lot of work. But if you do it well, it should produce more income. Then real estate is going to be building you wealth sort of slowly and on the side. Think of it like planting a tree. You put the seed in the ground and it slowly starts growing. You don’t have to spend a lot of time worrying about that tree. In the very beginning when it first starts growing, you got to pay a lot of attention to it. Make sure that nothing goes wrong just like with real estate. But once it’s established, for the most part, you’re not thinking about it.

Business is more like crops. You’re putting a lot of effort into tilling the soil. You’re planting lots of seeds, knowing that many of them aren’t going to grow. You’re going to have to take weeds away and stop predators from coming in and ruining your crop. You’re going to have to make sure it gets fertilized. What I’m getting at is there’s a lot of work that goes into planning and harvesting a crop. It’s not passive income. So how can you do both? Well, you can start off by house hacking. Put 3.5% down, 5% down on a single family home, that puts the seed in the ground for at least one property. And you can do that every single year. You can then put a lot of your time, attention, energy into growing the business and taking the money that comes from that business and reinvesting it until you don’t need to reinvest the money anymore where you can then take it and reinvest it into real estate.

That’s really how my whole situation works. I have businesses that I run because I don’t want to depend on real estate to generate the cash flow to buy more real estate. It doesn’t work great for that. Does it generate cash flow? Sure. But I can set up a portfolio that might generate $40,000, $50,000, $60,000 a month in cash flow. Or I can set up a business that generates that month with way less effort. Way, way less effort. So I like to look at the strengths and weaknesses of both. And that’s what I think that you should be doing, especially if your business is somehow connected to real estate. You mentioned farming. Can you figure out a way to buy a property that has a structure and improvement on it that you can use a 30-year fixed rate to get that house and it comes with a lot of land that you can then work your business with? Now you’ve got synergy between the two things and there’s a lot less effort.

If you can’t do that, you still want to look at growing your business to set off a lot of cash flow, saving that cash flow, reinvesting it into real estate. As time passes, that real estate will appreciate in value. You can sell it or you can do a cash out refinance to pull money out of it to either buy more real estate or invest back into the business. And you want to just kind of create this system of going back and forth between the two. Hope that helps. Best of luck to you and make sure that you let us know how it goes.

All right, next question comes from Josh Heeb in Columbus, Indiana. “With the appreciation we have seen in real estate, return on equity has dropped significantly on a lot of properties. At what point does it make sense to consider selling and redeploying that capital? What other factors should it investor consider other than thoughts on return on equity?”

Josh, love the question. This is how smart business people think. You’re on the right path. For those that have never heard of this idea of return on equity, it’s very similar to return on investment. So when you’re calculating your ROI or your return on investment, you’re basically saying “How much money is this asset going to generate?” And then I divide that by how much money I have to put into the deal to make it work. So you have income divided by your expenses like down payment and maybe any other cost like closing costs, improvement, stuff like that, your rehab. And you get a number. That number that you come up with tells you what percentage of your initial investment you’re going to get back every year. So a 10% return on investment just means that every year I get back 10% of what I put into the deal.

Now, what Josh is referring to here is when a property appreciates very quickly, it can look like your ROI is going up because every year you’re making more money than you were making the year before. So you had a 10% return, then a 12% return, then a 14% return because your rents have steadily been going up every single year. But it’s very easy to assume that the money that you put into the deal is still how you should be looking at your investment. It’s not anymore. If you put $50,000 down on this house you bought, but it’s appreciated so now you have $300,000 of equity, it doesn’t make sense to look at the money that you put in the 50,000 five years ago or 10 years ago.

Now you have to say, “This asset is worth 300,000,” or “I have that much equity in it.” So if you take what the cash flow of that property is, and you divide it by 300,000, you’re going to get a way smaller number than if you just divide it by your initial investment. So what I recommend people do when they have an asset that’s appreciating is to look at how much cash flow am I getting for the equity that I have in the house, not for the initial investment that I made in the beginning. And Josh, when you’re asking me at what point does it make sense to redeploy the capital that you initially put into that property, it’s when you want more cash flow or you want to make sure your equity is working harder.

So let me give you an example. If you had $50,000 you put into this property and you’re getting a 10% return on that money, that’s $5,000 a year at a 10% ROI. If that has gone to 300,000 like I mentioned, you have six times as much money as the 50,000 that you put in. But if you’re still only making $5,000 a year, you could be making six times that if you could get a 10% return on the 300,000 that you’ve invested, which would be $30,000 a year instead of $5,000. So that’s when I think people should start looking. And when you have significant equity in a property, you need to be asking yourself, “Is this actually working hard for me, or is my return on equity very low?”

A few other factors to consider because it’s not only about cash flow. If you own an asset in an area that’s appreciating very rapidly and you believe it’s going to continue appreciating, yes, you could sell it and redeploy it to get a higher ROI somewhere else and you could make more cash flow, but you might lose money over the long term because you could be investing into a market with less appreciation. So one thing to consider is, do I think I can get the same appreciation or better if I move this equity from this property into a different one, or from this market into a different one?

I like to look for that. I’m okay to sell a property that’s appreciating to get more cash flow if where I’m going is going to be appreciating at the same rate or better. That’s one of the awesome parts about long distance investing, is you can find the market that you think is going to do better and you can buy assets there while selling them in markets that have sort of cooled off. You can sort of ride the train. Oh, there’s not as much people moving into this area. Let me take it out, put it over here and ride the next level up.

Another thing to consider is the headache factor. If you sell this property and you move the equity somewhere else, is that new property going to because you a lot more time and energy to manage than the one that you had? And the last thing I would say to consider is closing costs. Selling a property is not free. There’s going to be closing costs that are involved with the property. So when that’s the case, if you think, “Hey, I’d like to move the money or I’d like to get out the equity, but I want to keep the house,” consider a cash out refinance. That’s where you would take money out of the property by getting a new loan on it. Take that equity, go put in a new market.

That’s exactly what I just did. I had my first four California properties that I ever bought when I first started investing. They’ve appreciated a ton. My return on equity has become very, very small. But I don’t want to sell them because I believe that the area they’re in is going to continue to appreciate in both value and in rents. So instead, I did a cash out refinance, pulled out about a million bucks from those properties and then put that into two new properties and areas that I also think are going to grow where there’s a value add. If I thought that those California properties were not going to continue appreciating, I would’ve sold them instead of refinancing.

Thank you for that question. Let me know if there’s anything else I can answer by leaving something in the comments and I’ll see if there’s anything that I didn’t address that I can get to.

DJ:

How are you doing? My name is DJ Dubono and I am from the upstate New York market in the capital region. My partner and I just founded our first LLC for real estate investing. My question is, what is the best way to find potential JB Partners and what are some good screening questions to ask to kind of filter through those JB Partners?

David:

Thank you for that, DJ. All right. This is a very subjective question so different people can give you different advice when it comes to picking a partner. The first thing I’ll say is, ask yourself what your motives are. Do I want to partner because it brings emotional security? Or do I want to partner because it makes business sense? In general, I tend to shy away from partnering with somebody for the emotional security that it brings. It always sounds good in the beginning. It always gets complicated later as two people or two groups of people, or maybe several groups of people are all moving in different directions and it becomes very difficult to keep everybody happy with each other and meeting expectations.

So if I’m looking for a partner, I’m looking someone for a complimentary skill set to my own, something they’re bringing that I don’t have. So that could be a brain that works differently than my brain works. It could be resources they have access to that I don’t that I can use. It could be they have a team in place and I can use a team they already have. It could be connections that they have. It could be access to deal flow. There’s a lot of different things that somebody can bring to the table, but they’re typically going to be an experienced investor if that’s the case. So to answer your question of what questions should I be asking, if you’re looking for someone that has a complimentary skill set like I’m recommending, you should be asking how many deals they’ve already done.

And this is the rub. The people who want to partner are typically doing it because they’re afraid to do it on their own, meaning they haven’t already been doing it. They don’t have as much to offer because they’re new. The people you want to be partnering with are someone who are bringing something to the table, but they’re not emotionally scared because they’ve been doing it. And that’s why I say don’t do it for the emotional reasons. You end up getting a partner who doesn’t have a track record, isn’t bringing anything to the table, doesn’t have resources that you can use that would make your enterprise more successful. Instead, I really recommend that you focus on what do they have that would make this business better. And then you ask yourself the same question. What are you bringing to the table that would make it better for them? And look for a situation that’s a win-win for each of you from a practical perspective, not an emotional one.

All right. We’ve had some great questions so far. I love the people that are… You guys are submitting better and better questions every single time we do one of these. If you’d like to submit a question of your own, I’d love you to please go to biggerpockets.com/david where you can do just that. At this segment of this show, we answer comments from YouTube that people have left on previous shows. Sometimes they’re funny. Sometimes they’re insightful. Sometimes they point out something that I didn’t even realize that I missed. So I like to share those with you guys. And I want to highly encourage you if you’re listening to this right now, go to the YouTube and leave a comment for me about what you liked, what you didn’t like, what you thought was funny, what you wish I would’ve asked, whatever we can do to make this show better.

The first question comes from Jenny Lee. “Hey David, I love this show and format. Every morning that I’m able, I watch an episode on YouTube and feel my real estate brain getting smarter. I appreciate the content and how you talk through your thought process.”

Side note, thank you, Jenny. That is actually something I intentionally tried to do on the shows. I could just give people the answer when they say something like, earlier in this show somebody said, “What do you look for in a partner? Or should I buy real estate? Or should I buy a business?” And I could just give you the answer, but if I don’t explain the thought process, then you guys won’t know how I came to the conclusion. You won’t be able to trust it and you won’t be able to solve problems on your own. So I appreciate you noticing that.

“I’m currently reading your book Long-Distance Real Estate Investing, and it’s a well written GAME CHANGER. All caps.” Thank you. “The colored shirt look nice today. The T-shirts are awesome too though.” That’s because I’ve asked questions on previous episodes of how you guys think I should dress. “I’m a bay area local, and I know the East Bay’s weather is about to get real dry, winding and hot. So it’s a good thing you can totally get away with dressing California casual. One of my favorite parts about this podcast is how you always keep it real. It was awesome you even solicited feedback about your fit. My vote is that you keep on slaying in whatever you’re most comfortable wearing.”

Thank you, Jenny. You said a lot of nice things and a pretty lengthy response, but you avoided answering the question of, if you think that t-shirts are better or collared shirts. So the debate remains. Do you guys think that I should be doing these dressed in a more professional manner or a more laid back manner? What do you think is better for the podcast and what makes it easier for you to trust the advice?

Jenny, thank you. You’re a Bay Area local, make sure you reach out to me. I’m on Instagram and everywhere else, @davidgreene24. I want to get you connected to… Anyone else who is interested in attending a meetup or who lives in California, you can go to davidgeenemeetups.com and register to be notified there.

Next comment comes from Sandra. “T-shirt David” with a smiley face. “I really dig the question from Nicole. I’m also interested in the loan side of real estate learning policy and fine print and regulations. To set up efficient systems is my jam. Thank you, BP.” All right. So check one off for the t-shirt column.

And from Cynthia Ibarra. “Hi David, I loved your show. You guys are the best. I would like to see more about second home mortgages. Thank you.” Well, if you guys would like more information about loans, about mortgages, I’m happy to talk about it. I own The One Brokerage, and so I’ve learned a lot about it with my partner, Christian. Submit us questions asking us how this industry works, what happens with loans, what affects interest rates, what you should be looking for. I may bring Christian on the podcast in the future to talk about kind of some of the stuff that he buys, that we buy together, and how the loan game works. So if that’s what you’re interested in, let us know in the comments and leave me a question about it at biggerpockets.com/david.

Michael:

Hi David. Thanks for taking my question. I’m a new investor. I joined BiggerPockets at the beginning of October 2021 and took the 90-day challenge. I closed on my first rental just before new year’s. Besides getting over my own issues as a first time investor, a quick shout out to my rockstar agent, Nick Harris at FIRE team Realty. You can find them on BiggerPockets. I found financing to be my next biggest hurdle. I’m self-employed in the IT field. I make good money for my area, but on paper it looks like a different story. Because of that, my loan terms were less than favorable. So my question is, should I put more focus on improving my financeability? And yes, that is a word. I checked. And if so, what are some of the things that I should look at doing? Or should I simply factor having to pay a higher rate and deal with less favorable terms into my underwriting? Thanks, David. I really like the direction of the channel and I love seeing all of the new content.

David:

Thank you for that, Michael. I’ve got a couple different ways I’m going to address your question because I think it’s very good. First off, it sounds like what you’re describing is because you’re self-employed you can’t use the income that you’re making the same as a W2 person would. So the very best loans that a person can possibly get, which are typically Fannie Mae, Freddie Mac, what we call conventional financing, in the mortgage world are not available to you. If you had a W2 job, they would be. So you’re saying you’re getting less favorable financing terms. It’s important to know it is less favorable than the best terms anybody could ever get. But in our world, that tends to be where we set our baseline is these Fannie Mae, Freddie Mac government subsidized loans, which are the best that anyone could do becomes what we expect, and anything higher interest rate than that or more closing costs automatically is like, “Oh, that stings. I’m not able to do what I wanted to” or “I’m not able to get the rate other people would get.”

You’re probably being offered debt service loans or other loans that use your income that is being claimed on your taxes after several years to get qualified. And you can get qualified. You can still get 30-year fixed rate loans. You’re just usually taking a hit on your interest rate because they’re a little less safe for the lender who’s giving you the loan. The thought with the lender is that, “Hey, this person in a self-employed position is more likely to lose their job or not make the same income. They’re not getting the same security that comes from an employer.”

It’s not like they’re trying to punish people because they don’t have a W2 job. Just a W2 job is considered in that industry with all the data and the metrics they have of whose most likely to default to be the safest bet. It’s the same reason that when your credit score starts to get worse, your interest rate starts to go a little bit higher. It makes you slightly higher risk to the lender. And because the lender doesn’t know you personally, and they can’t know everybody personally that ever applies for the loan, they have to come up with metrics like this to make decisions.

Here’s something I’d think about if I was you. If you’re only looking at how to get a better rate, you’re going to change your entire life to fit that goal. And I’ve said this before, I’ve never heard a successful investor at the end of their career say, “You know, I made all my money by getting the very best interest rates.” It just isn’t as big of a thing when it comes to overall wealth building as it feels in the moment when we’re competitive and we’re trying to get the best rate that we possibly can. But you have to use your higher rate, so instead it’s only going to be $300 a month for you.

Will that $100 a month improve your quality of life more than keeping a job where you’re self-employed? Would you be happier to stop being self-employed, go work for somebody else, have to live under their rules, their regulations on their timetable, conform to company policy? All the reasons you don’t want to work in that industry because you like being self-employed. Would that $100 a month mean more to you than the freedom that you have and the job that you’re at? Because I think we have to remember the goal of investing in real estate is not to build up as much passive income as we can on a spreadsheet so we can tell everybody that we make more than they do.

The goal of real estate investing is not to get your net worth as high as you possibly can get it so you can tell people that you’re better than them. The goal of real estate investing is to fuel the life you want to live. And if the life that you want to live is one where you are self-employed, you own your own business, you can build your own business, you can run your own company, keep doing that and just lose the $100 a month on the property when you buy it. Inflation’s going to make rents go up and that’s not even going to be a thing you think about in the future.

Another thing you’re probably not considering. What if you just put more effort into the business you have so that you made more money? You probably have a lot more influence over making money at your job or at the business that you own than you do in real estate where you’re dependent on rents to go up. So I want to challenge you to look into, what if you hired someone new and leveraged off some of what you’re doing and you went and did more lead generating to get more business? In your business that made you more money. You could get a much higher return on your time than just fighting over an interest rate that might be a percent higher.

Keep in mind, real estate investing is meant to fuel the life that we want to have, not just our egos. And interest rates are typically something that our egos care about the most. Now I can also understand sometimes the deal doesn’t work if the interest rate is a little bit higher. But honestly, if the deal’s that tight, that a point higher on the interest rate makes it not work at all, probably not a deal you should buy. Realistically, it probably just means you cash flow a little bit less in year one or in year two, but in year 10, it’s not going to matter. Thank you very much for the question. I hope my answer gives you a little bit of insight into your situation. Appreciate you.

Next question comes from Arthur in Raleigh, North Carolina. “Dear David, thank you for sharing your expertise. I’m an investor from Raleigh. I have concerns that my property manager in South Carolina is possibly receiving rental income and not sending it to me. I own a triplex in a small town there which has been owned for some time and a second triplex which was purchased recently in Charleston. For the months of December and January, I received nothing from either property. On February 1st, I received a check which appears to be only from the Charleston triplex and I am guessing is for the month of January. As of mid-February, I have not received anything. South Carolina law seems to require that a property manager sent copies of leases, yet I have not received any lease for either. Since these are rental properties owned at a long distance, what could be done to verify that the rent in consent is correct and not understated? Also, how could I verify that a repair bill is not being inflated or entirely made up? Thank you.”

All right, Arthur, let’s dive into this. The first thing just from the vibe I’m getting from your message here is you may be non-confrontational and you don’t want to talk to your property manager about it. The reason I’m saying that is nothing was included in your message that says, “I talked to the property manager and they said this.” So what you’re going to have to do is get them on the phone and say, “Why am I not getting rent checks? What’s going on?” They have to have some kind of answer.

Now I have to give you some hypothetical scenarios about what it could be other than they’re just stealing from you, which may end up being the case as well. Maybe they’re going to tell you that they haven’t collected rent from the tenants. If that’s the case, there’s nothing to give you. That’s probably what the answer is going to be. The only way I can think of that you could verify that the tenants haven’t collected rent would be if you actually asked the tenants yourself, “Have you paid rent?” Now, if the tenants have not been paying rent, your property manager should be starting the process of an eviction.

Every state has different laws, but there’s typically like a three day notice or a 30 day notice that rent was not paid. That’s something that they’re legally required to do. They usually post that on the door. They tell the tenant, “Hey, if you don’t pay in full by this amount, you’re going to have the eviction process started.” That should be going on if they’re not collecting rent. So you should getting updates from them of what they’re doing to start that process and continue that process on your behalf.

As far as getting copies of leases, yeah, you definitely should have that. Did they give you an answer as to why they’re not giving them? That’s another thing that you need to tell them “I want copies of leases.” If this is a company that doesn’t have leases or isn’t setting them to you and they’re not responding to you and telling you why the tenant is not paying their rent, you need to do a little bit of research on this company and find out how reputable they are. Do they have other people whose properties they manage? Is this a real estate agent who is using their license to manage properties and has no idea what they’re doing? Is this a person that got super busy in life and just stopped paying attention and they’re just avoiding you?

Something’s fishy here. A reputable company would not… They wouldn’t be operating this way because their reputation’s going to take a huge hit and no one would use them. So we’re going to have to figure out, “Can you get them on the phone? Can you talk to them and find out what is happening here?” And then after that, you need to be sending emails to them so you have something documented in case you have to take a lawsuit to them for mismanaging your property and breaking their fiduciary duty to you. You have kind of like something evidence a judge can look at.

This is really good advice for everybody out there. When you’re dealing with something and you have a conversation with someone on the phone, I have to tell my real estate this all the time, is they will tell a client on the phone… This is the case with a property, they’ll disclose something but then there’s no email. And they’ll come to me later and say, “Hey, so and so is upset.” And I told them, this was the case and I’ll say, “Well, if you don’t have a paper trail or an electronic paper trail, you didn’t tell them anything. It doesn’t matter what you said. Text messages are okay, but those are still not as good as like something that’s written down or something that’s emailed.”

So send your concerns to them in an email. And if they reply to it, that’s even better for you because it’s evidence that you can show that they saw what you sent. If they just completely ghost you and you’re not hearing anything, you do need to reach out to a lawyer and share with them “This is what I’ve done. Here’s the agreement that I set up. Here’s what I signed with this company.” Maybe you wired them some money in the beginning or transferred it to them. And you’re going to have to start the legal process yourself. But I would advise you, don’t try to figure out what is going on with them if you haven’t just asked them. Be straight up, ask them what’s going on. They’re likely to tell you why you haven’t been getting those rent checks. And then give us an update on what you found out. That would be great if you could leave that in the comments. Thank you very much for this.

Garrette:

Hey David, my name is Garrett. Love your show. I am an investor in the Chicago land area. I have one triplex under my belt. My question for you is how you go about picking which repairs are the most important and finding which ones that you want to fix right away versus maybe holding off for a little while or just completely putting aside and not worrying about. I’m finding myself having a lot of the bills rack up, because I want to fix everything. The roof needs repair. The basement’s leaking so I’m getting it waterproofed. A lot of the windows aren’t sealed or they’re cracked and warped, so new windows. All this stuff is starting to rack up. I’m not sure if I really need to fix all of it. So before I get myself investing too much of my own money into this property, how do you go about picking those ones and knowing what’s going to pay you back later down the line when you decide to sell? Thank you.

David:

Garrette, good question here. Man, you gave me some juicy stuff to get into. I’m going to like this. I’m going to start off with a practical response to your question and then I’m going to get into some deeper, more emotional stuff. So let’s talk about, from a practical perspective, you kind of ended your question by saying, “What’s going to give me the highest return on my money back?” This might be controversial. I’m just going to say in my experience in general, no repairs get you money back. It’s more like if you want to sell your house, the buyer’s going to expect certain things to be done. And if they’re not done, they’re going to ask you for a credit to get it fixed. But I’ve never seen the credit that a buyer gets on a house to be more than what it would cost if you had done the repairs. It’s almost always better if you give a credit instead of make repairs that don’t have to be done.

Now we’re not talking about backed up plumbing, foundation issues. What I’m really getting at here is that every single house that you’ve ever seen driving in your car, walked inside, have been in, owned, someone else owned, every property that exists has something wrong with it. There is an inspector that can find not just one thing, but many things wrong with every single property. The mindset that I need to go in there and make it perfect isn’t actually practical. Many of these problems have existed, and I’m calling them problems because they’re pointed out in a report, for 25, 30, 50 years and things have been okay.

I want to just reframe this question I wanted to ask you. If you own a car, things start to break in the car, okay? The vents that control the airflow sometimes become kind of wobbly and they fall down, they don’t stay up. In my car, you have the little center console, it has little piece that you can pull up to put something in and then push back down to rest your hand on. Well, sometimes it doesn’t click in place when I put it down and I got to jiggle with a little bit to get in there, right? Does it affect my experience driving the car? Hardly nothing. However, if someone inspected my car, they would point that out and many other things. And if I thought it is my job to repair everything on that report, I’d be dumping tons of money into a car that isn’t giving me a better experience.

Real estate can work the same way. Do you need to replace the windows? Well, that depends. Is the dry rot so bad that the windows aren’t working or it’s becoming like a safety thing or a draft is coming in? Probably yes. Is it just like a seal that’s broken in the window? Because I see that a lot. Like anytime you notice that home windows are fogged up, typically that’s because it’s a dual pane window and in between the two panes, they put a gas that helps to keep… It’s like an insulation. Well, if one of the seals breaks on those two panes, the gas can leak out and condensation gets in and that’s what makes windows foggy. Does it mean that they don’t insulate as well as they were originally designed? Yes. Does it mean that you need to spend $40,000 to replace every single window in the entire house? No. It just means it’s a little less energy efficient than it was before.

Now, that’s different than when the framing of the window has been completely corrupted by dry rot and it’s falling apart. That’s what I’m really trying to get at here. Don’t look at it like “I need to fix everything.” Ask yourself, “Well, what’s the purpose of fixing it? Electrical issues that are safety hazards, a leaking roof? Absolutely. At some point, you’re going to have to fix those things, especially if it’s a safety issue. So please hear me say I’m not referring to that. I’m referring to the fact that if you get a roof inspection, there’s a guarantee they will find a broken tile, a piece of wood that could be replaced, something that they’re going to say “This could be a little bit better.” That does not mean those things actually have to be replaced.

Now that’s the practical answer that I’m going to give you. I want to dive deeper into this and ask you, is there a reason you think you have to fix everything because there’s a comfort you get from having a blank slate? Are you one of those people that likes to make a checklist and have every single thing done on it? Do you like to be at what we call email inbox zero where you don’t have any emails that are unread? Are you that person that if you have one notification on your phone, that little red dot, you have to clear it because it feels wrong? If that’s the case, this is probably why your feelings are telling you that you need to do every single thing in the inspection report and fix the house.

You don’t have to live like that. What would be better is if you ask yourself why you’re thinking that way. There’s probably some form of safety that you think you get when you make everything perfect. And that’s not how the world works. So if you can come and kind of reconcile with why you feel like you need to have every single thing done, your experience with real estate investing and ownership will get a lot better because a lot of the anxiety you’re feeling is what you’re putting on yourself thinking you have to fix everything.

So I’ll sum this up by saying safety, health and safety issues, hazards like that, absolutely need to be fixed. If it’s something where someone could be hurt or injured, yes, that needs to be done. If it’s something that just shows up on an inspection report, “Okay, I’ve seen lots of stuff, you have a five burner stove and one of the burners isn’t working,” well, how many tents are needing to use all four burners at exactly the same time? Okay? There are things that you say, “Hey, at some point I might want to replace that or fix that, but it doesn’t have to be done right now.” And know that when you do fix it, you’re probably not getting any of that money back. It’s just coming right out of your cash flow and you’re not going to be improving the value of the property by fixing the small appliance. In fact, you’re going to have to fix it again, because that’s what happens is things like this break.

So grout issues and tile, you’re going to see like sometimes baseboards. You get a report that says that they could be fixed or repaired. I like to pay a lot of attention to anything that’s near water. So stuff near a shower I want to repair, because if I don’t, water can get in between sealants that have become loose and then the floor boards underneath can start to get rot from water. That can be really expensive. But that’s different than just like a faucet somewhere that’s not working super great or a light bulb that could be changed. So look at the nature of what is being asked of you. And if you can look at the practical reason of why it would need to be fixed, I think you’ll get some clarity.

All right. Our next question comes from Derek Rankin. “Hey David, I’m registered for BPCON22 and I have a couple important questions. Number one, will there be open mats for rolling?” That’s a jujitsu question. And should I bring my Gi with me? Also a jujitsu question? I’m a newbie to Brazilian jujitsu and love to learn new techniques. I look forward to seeing you there.”

Well, Derek, I don’t know that BiggerPocket’s going to have a jujitsu area set up because quite frankly that sounds like an absolute legal nightmare with tons of people wanting to jump in there and throw themselves into the ring and getting hurt and then potentially suing BiggerPockets. So I wouldn’t be holding my breath for that. In general, jujitsu is something that you definitely want to do in a supervised manner with instructors in an environment that is being controlled. So at the gym that I go to where it’s called an Academy, they don’t even let you spar with somebody until you’ve got your first stripe, which typically comes after like three to six months or so of going to class learning techniques and learning how to not hurt people.

If anybody lives near me geographically and you like to come train where I do, reach out to me and let me know. I will be happy to get you set up. And if you don’t live near me geographically, go get your tickets to BiggerPockets Conference 2022. It’s going to be in San Diego, one of the best places around as far as weather amenities and beauty. We’re going to have a great time. Every year, BiggerPockets gets better and better with putting this conference together. I don’t see how anyone could possibly regret it. So if you don’t live near me, get your tickets. I’d love to see you there. But please don’t come tackle me or start a fight or do anything crazy like that. Let’s keep it all reasonably healthy. And then if you would like to get into that, go through the appropriate channels.

The next question comes from Preston Garcia in Rochester, New York. “Hey David, I’m looking to get several buy and hold rentals in Cleveland. My agent is investor-friendly and send me deals daily. I want to use private lenders for the down payments of the properties, and in exchange pay them back with interest. However, not many people want to lend out that money for three to seven years depending on the market to receive their money back. In other words, not many people want to private lend for long term. It seems like the best option going that route is if there’s already a decent amount of equity I could refinance after the six month seasonal phase. These are for debt service loans. And I’m mainly looking at the only other alternative that I can think of is to have them become equity partners. Should I keep looking around for private lenders that are okay with lending for three to seven years and use them as equity partners or something else?”

Okay. You’ve made a great observation here, Preston. Nobody wants to lend out money for three to seven years unless the interest rate is higher than you’re going to want to pay. This is one of the reasons that home ownership is made possible for most Americans because the government is giving you a 30 year period of time to pay things back and they’re doing everything they can to keep interest rates low. Now I know that the Fed has been raising rates, so rates have been going higher. But they would be much higher than whatever they are if this was open market capitalism. I just want you to think about that. If you had to lend your money to someone else for 30 years, would you do it for a 3% or 4% interest rate? Would you even do it for a 5% or 6% interest rate? There’s no way that I would. The only reason this happens is because our financing is subsidized by the government in this country.

So you’re probably making the mistake of looking to private people with an expectation similar to what you’d get from a lending institution that’s going to sell this as a mortgage backed security once the loan is originated. And you’ve already answered your own question. Your best bet, if you want someone’s money for that long, is to give them equity in the deal. They’re probably not just going to want interest. And the interest you’d have to pay them would make it so the deal isn’t going to cash flow for you.

So giving away equity would be a much better bet. Now you’re not going to do this for your whole career. You’re just going to do it until you get your own money. You don’t have to borrow it. If you buy a couple properties, if you do it wisely, if you hang onto them, they’re going to grow in equity. At a certain point, you can sell them, get the other person their money back plus whatever their share of the equity was. But now you’ve got capital that you can now use to get into the game without having to borrow money from somebody else. So you’re absolutely right. I would look at giving away equity in the deal, and then I would refinance it when I could to get your money back, or to get your capital to get started and get them their money back.

All right, that’s what we have for today. What a cool collection of questions that people were asking. I mean, we had a little bit of everything there from sort of, should I do a business or should I buy real estate, to how should I borrow money when it comes to real estate investing, to how can I get the best loan possible. I really appreciate your attention and the time that you’ve been able to spend with me and the fact that you are loyal to BiggerPockets and me to get your real estate investing information, because I know there’s a ton of stuff out there.

I also want to let you guys know, this show is only possible if you actually submit questions that I can answer. So all of you that want to DM me on Instagram to ask a specific question about real estate, probably not the best bet. I’m not going to get to it there. But if you go to biggerpockets.com/david and ask your question, you are much more likely to get the answer that you’d like. If you guys would like to follow me on social media, see what I’m up to, communicate with me that way, you could find me @davidgreene24 on Instagram, LinkedIn, Facebook, Twitter, pretty much everything. On Snapchat I am officialdavidgreene. There’s an E at the end of Greene. And then you can follow my YouTube, it’s David Greene Real Estate, so youtube.com/davidgreenerealestate. I’m making content over there as well.

Thank you guys. Make sure that you subscribe, like, and share this episode on YouTube if you’re not watching over there. It’s cool, because you get to see me. I do little things with my hand. You see the light that’s behind my head. It’s a different color when we’re doing Seeing Greene than when we’re doing the regular podcast. You can also see the people that are asking questions and see what they look like. It’s just more of an immersive experience so you feel like you’re involved in the conversation, not just listening from the outside. And why is that important? Because you’re only going to build wealth in this world if you can take action. You got to go do something. Learning about weightlifting doesn’t get you stronger. Learning about jujitsu doesn’t get you better. And learning about real estate doesn’t make you money. It’s taking what you learn and doing something with it.

So that being said, check out another one of our episodes or go to biggerpockets.com and kind of cruise around. Check out the forums. Check out the blog. Go to biggerpockets.com/store and see some of the books that we have for you there to get more information that you can put into action. Love you guys. I will see you on the next one.

Help us reach new listeners on iTunes by leaving us a rating and review! It takes just 30 seconds and instructions can be found here. Thanks! We really appreciate it!