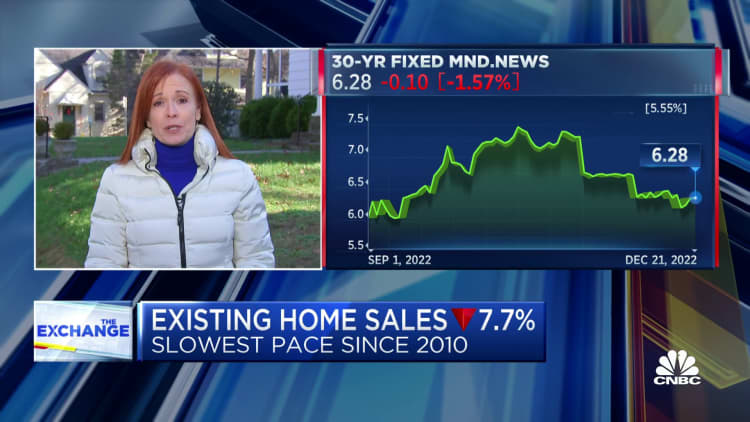

Trajectory for foreclosures will be on the rise next year, says Black Knight’s Andy Walden

Andy Walden, Black Knight VP of enterprise research, joins ‘The Exchange’ to discuss the health of the housing market and headwinds the sector still faces.

Andy Walden, Black Knight VP of enterprise research, joins ‘The Exchange’ to discuss the health of the housing market and headwinds the sector still faces.

Want to become a real estate millionaire? You’re in the right place. No matter how much money you’re starting with, how much experience you have, or how many Seeing Greene episodes you’ve watched, it’s ALWAYS possible to build wealth through real estate. But that’s easy for someone like David Greene and Rob Abasolo to say, right? They’ve already made it big, with millions of dollars in cash-flowing income properties. But they didn’t start like this.

David and Rob have come together to ask themselves, “what would we do if it all came crashing down?” If both of them lost their entire real estate portfolios in one fell swoop, how would they build it back up? Today, we put these two real estate legends in the hot seat and give them the biggest nightmare scenario so they can show you exactly how to build a real estate portfolio from scratch, no matter where you’re starting.

David and Rob will also be given certain dollar amounts to use in rebuilding their portfolio. So, if you’ve only got a thousand bucks on you, David and Rob will show you exactly how to use it best to catapult your wealth forward so you can become a real estate millionaire. If 2023 is going to be YOUR year to get started, get going, and get one step closer to financial freedom, we’d suggest following David and Rob’s plan!

David:

This is the BiggerPockets Podcast, show 706.

Rob:

In my opinion, real estate should… It’s fun making money, but real estate should never be fun because you should never be making that money and using it. You should be reinvesting it. And that’s not fun, that’s actually discipline. It’s like, “Yes, I like making the money, but it really hurt.” I’m like, “Oh, I felt like I could just use that $5,000 I made this month on this tiny house.” That would be really fun, but I have to force myself to say, “Well, sorry, Rob. Got to put it into the next property or into reinvesting in that property.” And it’s fun.

David:

What’s going on, everyone? This is David Greene with my co-host, Rob Abasolo who you just saw trying to match me with the 706, which is harder to do than you would think. And one of the reasons I’m the host of the show because nobody could get the hand gestures right. That’s right. You’re here at the best, the biggest, the baddest real estate podcast in the world for a pretty cool show. It’s going to be Rob and I solo today talking about what we would do if we lost everything and had to start over with no money and no houses in 2023.

Today’s show is very fun, very insightful, and very thought provoking, if you will, and hopefully very inspirational for you. Rob, how are you today?

Rob:

Good. As you were saying all that, it made me think of a show idea. You know how you do the Seeing Greene? What if I did my own version of it called the Robert Abasolo solo show? The solo-solo BiggerPockets show. Solo two.

David:

So you’re trying to get rid of me is what you’re saying?

Rob:

No, no, I’m just saying you do Seeing Greene. I think it’s time for the solo-solo show, the solo two.

David:

Abasolo show?

Rob:

The Abasolo solo show. But maybe you can still be a part of it. I just really like the name.

David:

Yeah, I just want to hear you talking solo that I don’t have to hear you and we’re going to be good. Right?

Rob:

Okay. Let me do this.

David:

Make sure I don’t like…

Rob:

The solo, solo, solo show where I have to talk like this the entire time.

David:

That would be really good. It would only be like a four-minute show because your voice couldn’t handle anything longer than that. That’s good.

Rob:

Not really, no.

David:

All right. Before we get into today’s show, a quick dip. What if I had to do a whole show in the Batman voice? That’d be something else. You’d really think about your words a lot more if it took that much effort to say all of them.

Rob:

Welcome. Welcome to the BiggerPockets show 710.

David:

And had to wear a mask the whole time as if you didn’t know who it was. Quick tip for today, what are your challenges? Write them down and think through solutions for them. You’ll quickly see avenues that you didn’t think about. I want everybody here to actually stress test their own life. What would I do if I lost my job? What would I do if I lost my spouse? What would I do if I lost my money? What would I do if the investments went bad? What would I do if we didn’t have food I could go get at the grocery store? This stuff is scary and cause some anxiety, but that’s okay because coming up with solutions will help build your confidence and help you be prepared for situations that we don’t know could be coming.

We’ve been lucky and blessed in this country to have a long run of a very, very healthy economy, but nothing’s guaranteed. If we learned anything from COVID, it was that. So take some time to stress test your life, your portfolio, and your goals and make sure that you feel good about them if everything doesn’t go perfectly. With that, let’s get into the show.

Rob:

All right. Welcome back to part two of the demise of Rob and Dave. Episode one. That’s right. Hey, you’re doing the mirror thing on the… Okay. I like it. You’re pulling a Rob. I like that. So in the last episode, just to recap everybody and level set and get everyone on the same page… Don’t make my hands…

David:

Kind of fun.

Rob:

Don’t take away my thunder here. So to quickly recap. Last episode, we talked about how our portfolios could basically crumble into oblivion. We talked about the ability to triage, which is a very fancy word of saying, could we sell off part of our portfolio if needed, or how liquid are we in our portfolio if we really needed to exit that? And then also how to actually assemble the architecture of our portfolio and how to strike a good balance between things like cash flow, debt, scalability. Dang it. I already messed up your-

David:

Ease of ownership?

Rob:

Ease of ownership. And then is there anything else?

David:

And liquidity.

Rob:

And liquidity. See, I knew that. I just wanted to throw you a softball. So today, we’re going to be picking up that conversation and talking about part two. What if we lost it all? What if we went down to zero? How could we actually rebuild our entire portfolio? We’re going to set some ground rules here. We still have our mind. We have our current knowledge. We’re still ourselves, but if we lost everything and it was just stripped away from our empires, how could we get back? How could we go from zero to Rob built and David Greene hero? So I’m excited, Dave.

David:

Yeah. This is one of my favorite things to do. I’ve often asked myself the question… You know that show Naked and Afraid? You’re dropped off in the middle of a jungle or something. You have no idea what you’re going to do. I’ve asked myself, what would I do if I had all the knowledge I have now, but none of my resources and you just dropped me into the middle of some city that I’ve never been before. I’m homeless, I don’t have any friends there. Would I be able to build wealth or would I just become addicted to drugs? So these exercises are kind of fun. And so now we’re going to do it with our portfolios.

Rob:

Yeah, man. So let’s get into just the first aspect of this and we’ll build to it. But I wanted to just start today’s show with just asking what are the biggest challenges that you’re facing right now, both emotionally, but specifically from a real estate standpoint, and is there any pitfalls that you’re currently encountering that that might lead to something like this?

David:

Well, this could easily turn into a therapy session for me if we’re not careful, so you’ll have to cut me off. But as far as the pitfalls that I’m going through, we have the market changing incredibly quickly. So pretty much almost all of the sources of income that I have come from some form of real estate. So my real estate sales team not selling nearly as many houses because the market has turned around. Rates are super high. A lot of buyers are wanting to wait to buy and a lot of the investors can’t make deals work because with the rates being high.

Even if you could get in contract, you can’t make a cash flow. Then you got the mortgage company, that’s the same thing. You can only qualify to buy a house off the debt to income ratio. So as rates are going up, it becomes harder to get people to be approved to buy the level of house that they have to get a seller to sell it. So income is going to be down there too. Well, all my employees are now making less money, and as you can imagine, people are not super happy about working harder and making less money.

So a lot of the character flaws that are present and all of us tend to not get exposed until times get hard. That’s one of the quotes that Warren Buffett has. When the tide goes out, you see who’s been swimming naked. So you’ve got all the personnel issues that you’re dealing with as the tide has gone down, the market is not doing good. Then I’ve talked about the 1031 that I was kind of forced into in a very quick timeframe. So I bought almost 20 properties. Maybe there was 20.

At the end of the day, almost all short-term or mid-term rentals across the country, massive problems with the rehabs employees that I had to let go of that quit that were managing these things that weren’t. I had to switch my CPA in the middle of all of this and my bookkeeper. So I’m every single week having to meet with bookkeepers to try to figure out what properties are profitable and what are not. Getting my taxes ready for the next year, and creating equities to hold all these properties in. Those mortgage payments still have to be made over and over and over. Then you throw in neighbors that are complaining about the construction that’s going on or that don’t want a short-term rental next to them. So they keep on calling the city to complain about nothing, which just means we have to now deal with more and more headaches.

And there’s more than that that’s going on as well. There’s a lot of things that are tough in life right now. So this is the perfect time for us to get into the fact that making money, especially making money in real estate is not always fun. In fact, it’s not often fun. It’s not glamorous all the time. You will hear the glamorous side of it when you’ve got a slick marketer trying to convince you to follow them on social media.

They want your attention. They want your subscribes. They want your follows. They’re going to tell you about the part of real estate that’s great. And then people get into it assuming that’s always the way that it works. And then when it doesn’t work that way, they think there’s something wrong with them or they think they weren’t meant for this and they get discouraged. But that is not the case. Even the people that are the best in the world are constantly sloughing through problem after problem to get to that cherry at the top of the sundae.

Rob:

Yeah. I mean, like you said, in my opinion, real estate should… It’s fun making money, but real estate should never be fun because you should never be making that money and using it. You should be reinvesting it. And that’s not fun. That’s actually discipline. It’s like, “Yes, I like making the money, but it really hurt.” I’m like, “Oh, I felt I could just use that $5,000 I made this month on this tiny house.” That would be really fun. But I have to force myself to say, “Well, sorry Rob. Got to put it into the next property or into reinvesting in that property.” And it’s not fun. It isn’t. But in 65 or when I’m 65, I should be having fun on my jet ski and realize my life dream of owning a jet ski on the beach, David.

David:

That’s exactly right. We talk about money being energy or really a store of energy. Energy that you’ve already accumulated from work that you did or previous investments that you made. The more of that energy that you can keep in your portfolio, the faster it will grow. The more of it that you pull out to fund your lifestyle, the slower that wealth will build. Now in your world, Rob, tell me about some of the pitfalls that you’re having with your real estate business.

Rob:

Yes, okay. A lot. I would say right now, this is being solved for thankfully, but a big pitfall that I’ve had is just not having cohesive bookkeeping in accounting. Now we had Matt Bontrager from TrueBooks on. He is my accountant and they are now doing my bookkeeper. That is solved. They’re doing really great. But actually last year for 2022, I had three… Oh, sorry, for 2021, I had three separate CPAs filing all of my taxes. I actually had four technically because I had all these different business partnerships and all of the partners were the ones that handled the taxes.

So my main tax accounting firm needed the taxes from everybody and they needed the tax. Oh, it was a big mess. But I have now fired all of them and Matt is now my sole CPA at TrueBooks. Now, they’re doing all my bookkeeping. So that’s going to solve a lot of the questions that I have day to day on what’s the true profitability? Because the way some bookkeepers track your accounting is just different than others. So that’s a big one. Another one is, this is probably the biggest problem that I face in my entire portfolio and it’s that I don’t have enough people on my team.

I’ve been very, very, very conservative and very slow to hire and that’s probably a good and a bad thing. But it’s been a bad thing for me because it really does slow down how quickly I acquire things. I’ve got a lot of plans to acquire properties and I see properties come across my desk all the time, but I honestly turned them down almost automatically whenever I think about the logistics involved with actually setting them up, just because I’m so busy with all the other miniature empires that I’m working with.

So on the real estate side, we’re a very slim team. On the content side, I’m a very, very, very scrappy team. It’s me and my editor. All the content that you’ve ever seen me post is just two people. It’s me and my editor for the most part. I write my own captions. I make my own Instagram reels. I do all my own posting. I respond to all my DMs. And some people at home might say, “Hey, how is this relevant to real estate?”

Well, my YouTube content, all my content fuel a lot of my real estate because that is my funnel for working with investors that approach me to invest half a million dollars. They find me off of YouTube. So that is a big fuel source for the acquisition part. But then I run into, “Okay. Well who’s my team?” I’m just now finally realizing that the thing that I’ve really needed to come to grips with is I need to force myself to make less money in the way of hiring more people.

Because hiring people are going to… It’s going to cost me a lot of money to hire them, but by that costing me money, it will actually make me a lot more money because I can scale up much, much, much faster. And so the big problem with my empire right now is that if I have a sick day, everything shuts down. If I were to die, it all crumbles. And this is actually a big stress point for me because if I were to not be around, not to get too morbid here, but we should probably talk about it a little bit. My wife doesn’t really know the inner workings of my portfolio and there aren’t that many people to run it.

My wife does not want to run my real estate portfolio where things to go that way. And so I’m having to now really focus and restructure my company to place more, I don’t know, more generals if you will, to run it for me so that if I’m sick I can actually take a sick day. Because right now if I’m sick, I don’t take a sick day. It’s even so bad now that when my wife is sick and I have to take care of the kids, for example, because she watches them on Tuesdays and Thursdays. That’s really tough for me in the business because then there’s no one to answer all the… It’s just a whole thing.

So I’m staffing up. I’m actually hiring a five-person content team. I’m going to have two full-time editors. My full-time editor now I’m promoting him to content director. I’m hiring a social media manager and a content writer. I’m doing that. And then I’m going to have acquisitions people on the real estate side. I’m launching a fund where I’m basically going to have seven to 10 people running the empire for me. It’s a whole thing. I feel like I just rambled here for five minutes, but it is a very real pitfall that I’m facing right now is just scaling and being able to hire and having the confidence to do so.

David:

Okay. So if this is your plan, tell me about some of the ways that this could go wrong and could all crumble around you.

Rob:

Well, I think for me, the reason I’ve been so nervous about hiring is I’m always… I have this very prideful and stubborn thought that I cannot hire someone to do a job that that will be better than me. Right? Because I’ve really good at the things that I do. And so it’s hard for me to hire someone even though I know that there are millions of people out there that are way smarter and more capable of doing the job than I am.

So I think my big fear of something going wrong is hiring someone that will not be able to pick up the slack and carry the torch forward and then that will effectively just cause structural issues within the business, if that makes sense.

David:

Okay. So what about the properties that are going to be buying for you? What are some areas where you think your acquisition team could make some mistakes or the operation side could let things slip to the point that you lose money?

Rob:

Okay. So I will say that for 2023 I am going to be more aggressively purchasing properties. I know a lot of people right now want to take the conservative route on that and that’s totally fine and commendable for those people. I see things a little differently right now. I think that we’re about to see some really huge discounts. I was very busy this year and I did buy properties, but not as much as I wanted to. And now it works out because now I’m seeing all these discounted properties and I’m going to go in and snap them.

So I think probably the pitfalls of this are going to be that I need my team and the acquisitions team that are running this for me. I need them to be really good at comping conservatively. I’m actually comping out all of my properties in an incredibly conservative manner that leaves a lot of room for error basically. I didn’t used to do that. I’ve always been very aggressive with my analysis. Most of the time I’ve been actually relatively correct, but now we’re sort of switching it over. So I’m just more right now weary of trusting the acquisitions team to be as conservative as I want them to because I think we’re actually in a time where we have to be the most conservative we’ve been in probably the last 10 years is my guess.

David:

Yeah, that makes sense. I mean, I wasn’t as upset with people that were riding aggressive offers the last six to seven years as others were because it was pretty clear to see that prices and rents were going to continue to rise. I think that you probably lost out on more gain than you protected yourself from loss if you were riding very aggressive offers when there was this much inflation happening. If you go back five or six years ago, someone would write an offer that a conservative guru could call a fool who made $200,000 and 80 grand a year on that property because they wrote aggressively.

But it’s difficult to see that trend continuing from this point forward with how concerned the government is with trying to slow down inflation. So as long as rates keep going up or stay high, they’re trying to push the cost of assets down versus where they were trying to create to print more money, which makes the cost of those assets go up.

So I do think you got to be able to pivot. You got to be able to be understanding that you need to stay high volume, you need to stay aggressive, but a conservative approach makes sense in this market. You’re not leaving money on the table anymore, being conservative. So I think that’s wise. Do you have any concerns about turning things over to other people in your business as far as who’s going to be doing the acquisitions?

Are you still going to be looking at every single deal before it’s bought and reviewing what they put together? Are they going to have some authority to make moves without running it by you?

Rob:

Yeah, that’s the hard part, honestly. I think I’m probably going to still be relatively involved because like I said, I’m launching Robuilt Capital, my big goal, my stake in the ground or the line that I’m drawing in the sand, I want to raise a hundred million dollars in the next five years. I’m dead set on that. I want to do that. I’m going to do that. And what I plan to do with that $100 million is I want to go and acquire campsite, RV resorts and basically remodel them and juice them up, if you will, to be like high-end glamp sites and unique stays.

So I just don’t think I can turn that over quite yet because I’m still not the RV park glamping assassin that I’m going to be. I’m very good at it, but I’m not good at good enough at it to just hand it over and direct. I think I still need to be in the weeds of this a little bit. But with that said, now that I’m hiring an acquisition person, possibly launching a property management company, I’m going to have the actual, I don’t know, the project manager, the investor relations person, the COO of the operation.

I’m going to have seven to 10 and most of these are already filled, but I’m going to have seven to 10 people that I’m having to actively train. It’s already hard to hire one person and train them for the role. I hired my first COO two or three months ago to run host camp for me and I’m involved. We talk every day. I have not been like, “Oh, here you go.” And I haven’t disappeared.

I’m in the trenches with him to train him to do that. So doing that with five to seven to 10 people at once, that’s going to be a real adventure that I’m a little nervous about, but also really excited about. So I’m looking to basically take an old school traditional approach to funds where you go and deploy them in multi-family or mobile home parks and put the Robuilt spin on it where it’s a little bit more of a glamorous, upscale experience.

I’m really excited to pioneer that. Because my intent is to pioneer that and be the number one fund that does that, then I’m sort of assigning myself sort of the trench digger, if you will. I’m going to be in the weeds of that, but I don’t know if that’s the healthiest approach, but that’s the approach that I’m going to take for now.

David:

I like you going big on something that’s unique. So you’re not saying, “I’m going to go buy a bunch of multi-family apartments that everyone else is buying.” You’re really banking on uniqueness. I’m going to do something other people aren’t doing. If I’m going to scale, if I’m going to be aggressive, I’m going to go big. I’m going to do it in a way where I don’t have as much competition as a form of risk mitigation. I think that that’s pretty wise.

Rob:

I mean, ultimately that’s my dream. I want to go heavy into unique. I think there’s the conservative layer that I’m placing on how I model all these things out. But then there’s also the extremely conservative layer that I’m now going to be working with investor money. So as a fiduciary, I don’t know, intermediary for my investors, I have to be even more conservative than how conservative I am now.

So a lot of is changing about how I’m investing and I’m curious, what about on your end? Is there any change in your risk versus your conservative approach to actually getting into properties now that you’re sort of in the trenches of all these remodels and all these short-term rentals that you’re about to launch?

David:

What I don’t like about the path that my choices took me is there’s a very long period of time from the point where I bought the house to the point where I’m going to get data back to see how the investment worked out. Takes a long time to do the remodels. The cities and the neighbors are causing a lot of problems. Then you get the property up and you don’t know when it’s going to start booking. You got to tweak with it like the different pictures or different design ideas.

It takes a little while for a short-term rental to pick up at speed. So it could easily turn into 12 to 24 months before I have solid data that I can say this strategy worked. And that’s a long time to go without actually having some input to be able to say, where should I pivot? So I’m kind of flying blind for a while.

I don’t love that. So during the period of flying blind, I really just focus on things other than acquiring more real estate. I’m either going to go back to an asset class that I already understand very well that’s much more predictable. This could be a long term rental, an apartment complex, putting money in with somebody else, flipping a house, something like that.

Or I put that energy into business. So it’s very difficult when things change this fast for people who are doing new stuff to figure out if they should scale or if they should go slowly. And I can definitely recognize that’s a challenge a lot of people are having. What are you doing to pivot right now?

Rob:

Oh, man. A lot. I’m a relatively diversified investor in the short-term rental space, but I actually want to do a lot of things in real estate. I have big aspirations. BiggerPockets has always been the golden handcuffs of investing because I’m really good at this one thing and I want to double down and niche down, but I see how many people in the world are crushing it in real estate and I’m just like, “I got to try all these different things.” So that was just me as a listener.

I’m like, “I want to try it all.” And then we interview so many people on the podcast that are amazingly talented and brilliant people that it inspires me to try new things. So I’m actually going to be doing quite a few things. I am going to probably not do so much short term rentals the way I have been where I was buying the one-off homes. But I’m actually going to be doing, like I said, the fund where I’m acquiring a lot more short-term rentals at mass.

I’m going to be doing a lot more medium term rentals. That’s my big push right now. I have two medium term rentals now. I have three and I love them. They’re super easy. I just locked in my biggest reservation ever on Airbnb for 33 grand for a six-month rental on my house in LA. I haven’t even heard from the guests since they checked in. It’s amazing. I absolutely love it.

So I am going to be focusing on getting more medium term rentals and focusing on developing contracts with medical agencies and different people like that. Because I know a lot of people that are crushing it in that space. Oh man, this is a really big pivot for me, but I’m actually going to be doing a little bit more rental arbitrage. I have a few reasons for it. We don’t have to get into it now, but I’m going to be doing a little bit more of that from an exploration and education side of it.

I want to be able to teach people how to get into it like zero money down. And then I want to actually get into reverse arbitrage, which is a new thing that I just thought of two nights ago. [inaudible 00:24:10]

David:

Where You would buy a house and let somebody else do the arbitrage so you don’t have to deal with all the headaches.

Rob:

Dude, you got this instantly. Everyone that I’ve talked to about this, they’re all, “I don’t get it.”

David:

Yeah. You’re getting rid of the worst part of being a short-term rental person. All the emotional ups and downs, the spikes, the headaches, the bad reviews, and you’re getting to own the actual asset, which is where most of the money comes from.

Rob:

Yes. And you get to charge a markup. So if I buy a place that’s 2,500 bucks market rent, I can tell an aspiring host, “Hey, I’ll let you rent it out on Airbnb, but you got to pay me $3,000 a month.” So not only am I ditching the low long-term rental returns, but I’m actually getting a premium on it. I don’t need a property manager. I can just rent it to an aspiring host and let them run their Airbnb journey and I get all the tax benefits.

I was in bed so excited about this two nights ago ’cause I was like, “Why isn’t this talked about more?” Long-term investors should be renting out their places to Airbnb hosts at a premium and you could double your returns.

David:

Yeah. That’s a way that when we talked about in the part one of this episode, how you can diversify risk and how portfolio architecture can help. Having a couple properties like this where you get to own a highly appreciating asset, that’s the market will work best in and it’s going to have to have a lot of meat on the bone for someone to make it worth their while. You’re not going to pull this off in Wichita, Kansas or Toledo, Ohio where the stuff is renting for $80 a night or something. It’s going to have to be a decent amount.

And the operator, it has to be worth their time to do it. But dude, if they’re going to absorb all of the worst parts of the business and pay you higher than market rent and you can own the property without having any of the headache, this is a great way to add some safety and some equity to your property without taking on the ease of ownership issues of a whole bunch of short-term rentals, which is kind of trying to babysit 25 toddlers all at the same time.

Rob:

Yeah. So to sum it up, I’m going to basically be doing long-term rentals, medium-term rentals, short-term rentals. So I’m going to diversify there and then acquiring large 50 to a hundred door properties that will eventually become glance site. So I wouldn’t say I’m necessarily… I guess it’s all pivots. They’re all small pivots, but they’re all pivots in my wheelhouse. That way I can at least still be in my element in some capacity.

David:

I asked you previously about your concerns with some of the mistakes you could be making, but now you have a little bit more clarity on the direction you’re going to pivot to. So do you have any more clarity on the types of mistakes you want to avoid going forward?

Rob:

Yeah. I’m trying to mistake proof myself right now like the way I am with recession proofing myself. All right. So I think the big mistake is the shiny object syndrome of trying to approach everything. I think that becomes a problem whenever you try to approach everything out of your wheelhouse. But everything I just talked about, the reverse arbitrage, medium-term rentals, short-term rentals and glamping, all of those are just different forms of short-term rentals in my mind. Things that I’m actually good at.

And so while I am spreading myself thin on the execution of how I’m doing it, it’s all within my expertise and knowledge. So I’m not super worried about the mistakes of the actual execution of those models. I’m just more nervous about, like I mentioned, not having the team to be able to execute them because I have three… I guess I’m more nervous about the mistakes at scale.

I’ve got three mid-term rentals right now. I don’t know what it’s like to have 30. That’s a lot different. I have 35 doors right now that are effectively all short-term rentals. It’s very different to manage 35 than it was to manage two. So right now, the only mistakes I’m nervous about encountering are going to be the scaling mistakes that I make with scaling like purchasing reverse arbitrage units at scale or medium term rental stuff.

But because I’m already doing most of this, I’m not super worried other than… I think, “Oh, you know what? Personal mistake, I think.” I think I’m going to make the big mistake of putting everything I have into this and that will bleed into family life, dad life and husband life. If I’m just going to lay it out there, I could see that being a big mistake that I make is not prioritizing what actually matters over this thing we call real estate.

David:

That’s very easy to do and it’s very wise of you to be planning for that ahead of time. And even if someone doesn’t have a family like me, sometimes those issues bleed over into just your… I don’t want to say your personal life, but your emotional wellbeing. When you’re up at night worrying about what’s going to happen or you borrowed money from investors and it’s not going as well as you thought, it can have a very big toll on how you’re feeling, the confidence levels you have.

Your mind can easily start to look for an escape and it can tell you crazy, terrible things to do to get out of those scenarios. So I think it’s wise to be considering what could go wrong so you can prepare mentally for how you’re going to handle those types of situations when they come up.

Rob:

Yeah, for sure. Well, what I’d like to do now is assume that we made all the mistakes and everything crumbled, we lost it all, and we went to zero. I want to talk about now how we would go from having $0 a net worth back to where we are today. You cool to jump into that idea?

David:

That’s a great idea. Let’s do it. The broken afraid version at BiggerPockets.

Rob:

All right, Dave, let’s fast forward. Okay. Let’s just say you make some crazy mistake. You’ve lost it all. You’re back to zero. David Greene is no longer green at all. He’s David eed.

David:

Yeah, the red.

Rob:

You’re in the red. Now you got to rebuild and start from square one. How are you going to get started? What’s your first step?

David:

First step? All right. I am probably going to do more than just investing in real estate. I’m going to look to diversify the way that my income is coming in because I’m at lost at all. I probably had too many eggs in one basket. I probably quit my job. I probably got super into investing, maybe one asset class like short-term rentals or something a little bit more risky. And then I had a bad couple months and boom, it was all gone.

So the first thing I wanted to do is to establish a much more solid base. So I want to scale horizontally before vertically. So I’m going to look for an industry where I can make money, where I’m still involved in real estate, which could be being an agent, being a loan officer, working for a construction company, being a contractor, consulting, working for a 1031 company, being a CPA. Anything I could do where I could help other people in real estate while helping myself.

Second thing, when I’m looking for properties to buy, I’m going to look for this stuff with the highest days on market in the best areas, especially if it’s more expensive real estate. Now, I realize this may come as a counterintuitive statement. You’re thinking, “Hey, the market is slowing down. Buy the cheapest properties you can find.” But that’s not what you want to do. That’s actually increasing your likelihood of losing them. I want to go for the stuff that used to sell for a million when the market was at its peak, and now that rates have doubled, it’s going to sell for maybe 650,000.

And it has the potential to go back to the million when the market does turn around and rates come back down. So I’m going to play the long game, not the short, fast game, which is probably what I did that caused me to lose that money in the first place. Is that making sense?

Rob:

It does. I want to ask you how would you choose your market? Is there a strategy for the market entry point that you want to get into?

David:

I want high days on market and I want an area that I believe in the next five to 10 years, more people with higher net worth are going to be moving into. Okay? So I don’t want to go invest in the part of town or the city where newlywed couples that have no money are going to go buy their house. You want to be where, all right, the wealthy people in California, in New York, in the northwest, in New Jersey, in these areas that were traditionally where wealth was gathered, where are they going to move to?

When they want to get out of there for whatever reason they have, high crime, bad weather, whatever it is, where are they going to go? That’s the place that I want to be investing in. Right now a lot of people are moving into Texas. That’s one market I’d look into. A lot of people are moving into Florida. They really liked how things worked out after COVID in Florida and the weather is better than where it is in Maine. That’s where I’m going to be looking into.

You and I bought a property in Arizona in the nicest city in all of Arizona where the wealth goes. You’re probably not going to crush it right off the bat investing in a market like that. You’re going to be like the tortoise coming out the gates. The hair is going to pass you up. The hair of cash flow, they’re going to go buy in Wichita, Kansas or Birmingham, Alabama. Some of these markets where the price points are lower, the price and rent ratios are more solid.

But wealthy people aren’t going to be moving into those spots. I’m going to be playing the long game because there’s opportunity there that I didn’t have when the market was hot. Now that the market’s cooled down, I’m not competing with as many other investors to get into these markets. They’re all doing the opposite. They’re all going after the cheapest property with the highest cash flow possible, not thinking about the future.

Rob:

All right. So if I understand this correctly, you’re going for the highest day on market. That’s going to be a strategy for acquiring good properties at a discount. You’re going to be looking for areas where a lot of people are moving to because of the tax savings, but also people are just moving out of California and going to certain areas. You want to pick up that incoming traffic basically, right?

David:

Before everyone else does. That’s exactly right. I don’t think other people are looking for opportunities there because they’re thinking, “Oh, that’s an expensive property. I want to buy a cheap one at this time. I’m going to be looking at the weather. I think that really matters.” Most people live where they live because that’s where their job is. But as work becomes more and more remote, you don’t have to live in North Dakota. People are going to start to figure that out.

Why am I in Fargo? I could be living in Miami. I could be living in Tampa. I could be living somewhere like Corpus Christi where it’s beautiful outside and I can still make money. So I’m going to go invest in those locations. The other thing I’m going to do is I’m going to utilize all the tools at my disposal when it comes to funding.

So I’m definitely going to use FHA loans. I’m going to house hack a house at least once a year. I’m going to try to do it more if I could get away with it. If I could convince a bank to give me a loan, I’m going to get a primary residence, live in it for nine months, rent that out and move into another one for whatever reason. Maybe my job moved or I had a sick family member, I had to go somewhere else. But I’m going to try to get away with as much 5% down properties as I possibly can in the best areas that I can justify so I can keep more money in reserves because I’m less likely to lose my portfolio again like I did hypothetically last time if I keep more money in the bank. So I don’t want to put 20 or 25% down if I have to.

Rob:

Okay. All right. Al good answers. Last one. How are you going to go about rebuilding your team? Because theoretically, all your current team, they’re gone. They’re out the window, they’re bitter that you lost everything, they lost their job. Now, you got to build a new team. How are you going to assemble those Avengers?

David:

I’m going to look for a property manager in the area that I want to buy the houses first because I don’t like managing property. And to me, that’s the hardest piece in the whole puzzle. This is why so many people manage their own properties. It’s very difficult to find a good property manager. It’s easier to find a good contractor or a good handyman than it is to find your own property manager that’s good.

So that’s the hardest piece. I want to get that first. When I find that property manager, I know they’re going to have contacts around town. They know the good handyman. They know the good contractors. They know the pieces that I’m going to need because all their other clients are sharing that information with them.

I frequently would say, “Hey, talk to my property manager. I don’t want to deal with it.” And then I would find that the property manager is now in cahoots with the rockstar realtor that I was using because when they met them, they realized they’re better.

Or I’d have a property manager that wasn’t that great and they would get me a bid and I didn’t like it, so I found my own person. And I was like, All right. Talk to the property manager. They’ll let you in the house.” So now the property manager is like, “Oh, this person is great.” We’re getting them as our referral person. So the better that you are, the more exposure you have to other people, the higher quality of referrals you start to develop.

From there, I’m going to ask about the top rated agents in town. I’m going to go and I’m going to find the people that either own real estate there themselves or sell a lot of houses. They’re going to help me find the deals. Those two people are going to help me find the loan officer, which is one of the easier spots to find. And then from there, I just need the contractor and I’ve got my core four and I can start buying in that market.

Rob:

All right. Now I want to fire around what you would do with certain amounts of money.

David:

Okay. This is interesting.

Rob:

You ready for this? Okay. So what would you do with a thousand dollars? You lost it all. You got a thousand dollars to your name.

David:

With a thousand dollars, I would probably host a meetup for as cheap as I possibly could. I would definitely cater it with Chipotle because there’s nothing that’s going to get more people to show up for a meetup than having Chipotle. It also shows that you’re a classy person and you can be trusted. Those are all qualities that Chipotle lovers enjoy. I’m going to have as many people come and I’m going to make as many contacts as I can and make as good of an impression as I can. I can probably stretch that thousand dollars into several of these and I’m going to have emails and phone numbers and names of all the people that came. That’s my new database.

I’m going to start off by just pouring into those people, building relationships, finding how I can help them and earning their trust, which I’m then going to turn into revenue through whatever real estate business I developed. If I became a loan officer, an agent, a contractor, a handyman, even, those are people that’s going to fuel my business by saying, “Hey, this guy David over here is a handyman. My buddy needs a new door hang at his house. My buddy needs a leaky pipe fix.”

I’m going to start creating revenue off of those relationships. And now every time I go meet somebody to fix something in their house, I’m going to let them know, “Hey, I’m looking to buy real estate. Let me know if you know anybody who’s looking to sell it?” I’m going to try to get some owner finance deals, some creative financing going on because I don’t have a ton of money, which means I need a ton of people in the network.

Rob:

Okay. How about $10,000?

David:

$10,000 is getting better. Now, I’m in a position I can probably get an FHA loan and I’m going to look for something right around $300,000 where the seller is going to pay the closing costs on that. I’m going to tell my agent they need to write the offers that way. I’m going to try to get the biggest and the best house in the best neighborhood possible that’s as ugly as I could possibly find.

If it’s ugly and it’s big and it’s in a great location, I’m going to want it and I’m going to just house hack that sucker with a grassroots campaign. I’m going to rent the rooms out if I have to rent the rooms out., I’m going to turn rooms into rooms that can be rented out. I’m going to have a person who’s got a trailer that they’re not using parking on my property and I’m going to rent that out to somebody else.

I’m going to scrape and claw to figure out a way to build up some cash flow from that first property that will keep my mortgage as low as possible or maybe even put some money in my pocket to help buy the next house.

Rob:

Perfect. How about $50,000?

David:

50,000, I’m starting to feel really good. I’m still going to house hack and do everything I said, but I’m going to have 30 to $40,000 left over after that to be able to buy another property. So maybe I take some of that extra 30 or 40 and I use that to improve the property I bought. Now, I can house hack a real fixer upper. I can get something that needs a lot of work and I can make it worth more which increases the equity. And then 12 months later I can refinance and hopefully pull out more and turn that initial 50 into more like 80, 90, maybe $100,000 after the refi.

So I’m not going to be able to buy something turnkey. I’m going to have to be very, very clever and put a lot of work into finding the property that needs a lot of work but has the highest upside. Okay? It’s a 2,800 square foot house in a neighborhood with other houses that are also big. But this is the one with the green carpet and the ugly wallpaper and it smells bad. Everybody walks into it and just turns around and says no, because they want something turnkey in that neighborhood and they can afford it. That’s the house that I want to go buy and.

I’m playing the long game. So 12 months later after I fixed it up and I put a little bit of money and some sweat and some tears into it, its values increase the most because the comps were much higher than the price I pay. There’s a bigger spread in the high to the low than some of the other neighborhoods with cheaper homes where the spread just is not that significant. You don’t have as much meat on the bone.

After that refinance, I’ll be able to repeat the same thing again, and at the same time I’ll be able to house hack. So if you do this right, you’ll have one house hack every year and then one fixer upper property like this, and you work those at the same time for several years in a row.

Rob:

No further questions, your Honor.

David:

Thank you very much. All right. If you don’t mind, I’d like to cross-examine the witness.

Rob:

Allowed.

David:

I’ll allow it.

Rob:

I’ll allow it.

David:

Sustained.

Rob:

There you go.

David:

You were going with court language, but you went with The Office’s Michael Scott. That’s what was so funny about that. All right, the year is 2023. You have lost your entire short term rental portfolio, yet you have not lost your fighting spirit. What is the first step that you’re going to take in rebuilding your empire?

Rob:

Well, there’s one thing that I’m really good at and it is marketing, sales and content. So I am going to be rebuilding my content system and ecosystem and platform to just make myself an authority again and really talk about the demise and the mistakes that I made and how those mistakes are going to make me wealthier and richer as a result. So I’m going to get out in front of the bad press of all the mistakes that I made with losing everything. I’m going to own them and I’m going to make really inspiring content that shows anybody that you can build from zero to hero all over again. Okay?

So I’m going to use my content as an opportunity to raise money. There’s no reason for me to scale slowly and build back from zero if I already have my knowledge. I think when you’re starting out in real estate, you have to go very slow because you just don’t know anything. I still retain my skills and knowledge. Right? So theoretically, if I lean on the mistakes that I made, I can go and I can raise money from an investor and use that to get into properties that are going to cash flow.

Now, I want to make money as quickly as possible. I need to be cash flowing. I actually need to make money. So I want to figure out how to get into different properties that make me money right out the get-go. And on top of that, I want to prove a little bit of credibility and reestablish a new track record. So I would probably actually start a property management company and I would manage Airbnbs for other people.

I would help them make a lot of money and I would try to get to 20 as quickly as possible so that I could go to an investor and say, “Hey, look at these 20 properties that I manage. I make all this amount of money for these 20 owners. I can make you that amount of money.” I’m going to do the sweat equity in exchange for equity in that property.

Now, probably what I’m going to do is put in no money, have the investor fund it, have the investor finance it, and I’m going to do everything. I’m going to source the deal. I’m going to work with realtors. I am going to furnish the place. I’m going to manage it. I’m going to do everything. I’m going to work my tail off so that this investor knows that I’m putting everything I have into this house.

Hopefully a strategic investor that will reinvest with me 2, 3, 4, 5, 6, 7 times. That’s going to get me some cash flow, but I also want to be working on appreciation at the same time. So through my different content, through everything that I’m doing, I’m going to do my best to join other syndications and other funds as a general partner, as a small role, whatever I have to do to get into a syndication so that I can have a small little piece of a pie of something that will eventually be a lot bigger.

David:

What role do you see yourself playing in that syndication? How are you going to bring value to them if you don’t have a ton of money?

Rob:

Probably the actual investor relations. I’m going to be the one meeting with the investors, walking them through everything. Not necessarily the number crunching. I’ll let the financial modeler do that, but I’m going to be in charge of the marketing. I’m really good at funnels. I know that I can create a funnel system that effectively reaches a large audience, and then from that funnel, that audience starts going down the funnel and eventually gets to the fund.

So between fundraising and actual marketing, I will be in charge of lead generation effectively for a fund and that will take care of my appreciation. So I want to try to get back appreciation and cash flow as quickly as possible. Equity and cash flow fuel, because those are the two components that are needed for hopefully a relatively sustainable lifestyle in real estate.

David:

Yeah. What I like about this is you’re not just relying on investing, you’re relying on your skills as a human being that you developed over time to give you that little push, that boost to help your building wealth. A lot of the people listening to this have skills they’re not even thinking about. They’re in marketing and they don’t realize that they could be helping a syndication with raising money or putting out better content. Right?

They analyze things for a living as maybe an insurance adjuster or something like that, and they’re not thinking about how they can help analyzing properties for a fund. So that’s very, very clever. Now it sounds like you’re not picking a market to rebuild, right? Because you’re going to link up with someone else who’s already done that.

Rob:

I’m trying to join other ecosystems and build it that way. I mean, if you think about Elon Musk, for example, when he wants to start a company, he’s not the one that’s actually doing it, right? He knows his skillset. His skillset is finding the right team, delegating it, providing the vision and kind of assembling it that way. But he’s never the one that’s in the trenches actually building that company from the ground up from a day-to-day tactical side.

So I don’t want to do that. I don’t want to be the person that’s doing a live-in BRRR and starting that process. I think marketing can solve a lot of those problems for me and get me back to where I was within a year if I really put a lot of time and effort into it. So from a market standpoint, I’m a big fan of national parks. So a lot of what I’m going to be proposing to investors into the people that I’m working with are to heavy up into some of these more recession resistant areas.

National parks are mother nature’s Disneyland, as I always say. So anything that falls within the Grand Canyon, Smokey Mountains, Yosemite, Yellowstone, I know that those are always going to be really rock solid properties and that that’s where I would probably heavy up is if I was going to start somewhere.

David:

All right. Now, if you’re going to source a team here as far as who you’re going to link up with, what are some things that you’d look for in the syndicators or the partners or however this is being structured that would make you think that’s the person I want to hitch my wagon to?

Rob:

So it kind of depends. If we’re just talking about me partnering up with an investor, I want a silent investor to just let me do my thing. I want a silent partner like, “Hey, I know you’re good at this. You’ve wined and dined me. I don’t want anything to do with this. I just need time to work that money, do my thing, embrace my mistakes, and go all in. So from an investor standpoint, I’m always looking for a silent partner. From the team standpoint, that’s a good question. I knew this was coming and I probably should have prepared for it.

David:

Well, you probably haven’t done this before, right? You haven’t found a syndication to throw yourself into?

Rob:

No, it’s just my syndicate. I started it. I started my own fund. I did that today. So I’m probably going to be working. I know what I’m going to do. I’m going to find a project manager type of person. Someone that’s very analytical, someone that’s very driven by logistics and details. That’s probably going to be the first hire on my team because I’m terrible at that. That is not my gig. I’m not good at that. I’m a visionary. I’m not good at detail oriented things.

So I need a counterpart that’s going to keep me on task, keep me on the path to where I want to go. So probably somewhat of a project manager or like a COO who’s willing to start from the ground, from the foundation and build up. Someone that’s like, “Hey, I’m down to be broke with you for the next couple of years. Let’s do this thing.” Someone that’s not focused on the cash flow benefit immediately.

David:

Wonderful. Okay. Let’s say you have a thousand dollars. What are you going to do with it?

Rob:

I’m going to invest that in some kind of course or some kind of education that is going to make me smarter, that’s going to make me money. I’m going to invest in that, or I’m going to change my personality type and I’m going to invest in $1,000 worth of books and read them. I’m going to use that thousand dollars to make myself smarter in some capacity, because you can’t do much with a thousand bucks in real estate. That’s always the advice. “All right. If you have a thousand dollars…”

David:

A thousand dollars gets you a lot of knowledge and wisdom through books.

Rob:

Yes, I agree.

David:

Brandon Turner had a point about this. He talked about how someone could have 10 or 20 years of life’s wisdom condensed into a $10 book and we just dismissed that like it’s not a big deal, but how valuable that actually is.

Rob:

Yeah. I mean, you can infinitely become smarter with one book, right?

David:

Yeah.

Rob:

So whether it’s that or some kind of little curriculum, something that teaches me. I just got to figure out how to make myself know something that I don’t already know.

David:

You also got to figure out how to make yourself spend more than four seconds doing one thing without having something else pop up that you have to go do. Because it’s going to be tough to read these books in your current state. I like that.

Rob:

Yep. Well, theoretically I won’t have a lot to do.

David:

Well, that’s a good point. Yeah. Maybe some of the money can be spent hiring virtual assistant to read you the books or you buy them on Audible. I suppose someone’s already taken that.

Rob:

Audible. Right.

David:

Yeah. All right. Same question with $10,000.

Rob:

$10,000. Like I said, I want to get cash loan as soon as possible. So I’m probably going to do a rental arbitrage deal or some kind of rag tag glamping operation, get into an apartment, pitch a landlord, beg them to let me release it on Airbnb. If they say no, I will say, “Hey, how about this? Let’s rent your apartment on Airbnb and we’ll split the profits that way they get some of the upside as well.

So I’m going to use $10,000 to go out and basically pay my deposit, my first month’s rent. About, let’s call it six to $8,000 on furniture and get it listed on Airbnb as soon as possible. Make some money. That’s option one. Option two would be like buy a $3,000 tent. Go find a property owner that has 50 acres, say, “Hey, can I put my tent on your property? Give you 25% of the cash flow that I make, and basically listed on hip camp Airbnb. I know that this is possible because my $3,000 tent grossed me $142,000 over the three and a half years that it was running.” So 10,000 bucks and get a couple of those, I hope.

David:

Glam pack. I like it. Okay, last question. Now you have $50,000. What are you going to do with that?

Rob:

That’s a really good question. I think I’m going to just go… You said the house hack. So I’m not going to do that because that would be a lame answer, but that was a good answer and I’m jealous that you said it first. I am probably going to try to get a second home loan and rent that property out on Airbnb. So I’ll try to get a 250K, $300,000 property in one of those national parks that we talked about. Probably not the Smokies. I’m going to be pushed out of there, but probably somewhere like Hawking Hills, Ohio.

I’m going to buy a property there and I’m going to get it set up so that I can make some cash flow. Because I lost everything, so I need to pay the bills. I got a family, they’re hungry. I want to make sure that everybody is okay. Equilibrium can be met as soon as possible.

David:

There you have it folks. That’s wonderful. Rob, this is our plan. If you dropped us into the middle of nowhere, broken afraid, without our portfolio, but with the knowledge we have now, what we would do to start over. Rob, anything that you thought of when you were hearing me talk that you wouldn’t have thought of or heard yourself say ’cause you had no idea what you were going to say when I asked you this question that you thought like, “Ooh, that’s really good. I want to hammer that point home”?

Rob:

Yeah. All of it really. But I’ll say this because my immediate thought was, “Oh, I’m going to make content and I’m, I’m just going to raise money that way. I’m going to do the thing that I’m good at and just get people to believe in me via social media. Because I’ve done it before. I do it every day now, right?” However, the thing I hadn’t considered is you’re doing the grassroots approach and you’re going to use your a thousand dollars to hold different meetups and get people there, get their emails, get their contacts, connect with them, network with them, see if you can partner with them, see if they’ll invest in your first deal. They’re exactly the same thing. They’re just different versions of each other and I like that.

David:

Well, I don’t have your rugged good looks so it’s harder for me to create as much attention and content on social media, but if you get me in front of somebody in person, I can work my magic. So I wish I could do what you were doing. You’re going to be holding a meetup in front of like 90,000 people because that’s all the views you get. If I made a video, it’d probably get 14 views.

Rob:

No, you just hit 10,000 subscribers. You’re moving on up in the world, my friend.

David:

How many do you have?

Rob:

550.

David:

That’s the same thing Brandon does. Brandon is like, “Good job. You got to a hundred thousand followers on Instagram and he’s at like 300,000. All right. So if people want to see, if people want to become one of those 200 something thousand subscribers that you have on YouTube, where can they find you?

Rob:

Look, they can find me on the Robuilt YouTube channel, R-O-B-U-I-L-T. I also recently did two videos for the BiggerPockets YouTube channel. So go check out the BiggerPockets YouTube channel. There’s some of the best videos I’ve ever made. I’m really excited about them and I want to make more. What about you?

David:

You can find me @davidgreene24 everywhere, even on YouTube. So if you want to be one of those 10,000 people, which is actually, if you think about it, they’re getting a bigger share of my attention than yours because you’re already so big.

Rob:

That’s true, that’s true.

David:

I’m just this little tiny guy in the space. So you want to go get some individual attention, check me out at youtube.com, @davidgreene24 or whatever your favorite social media is. You can follow me there. You can also check out my website at davidgreene24.com. That kind of shows all the stuff that I can offer you, ways that I can help you. There’s a lot of different things we do, so it’s good to kind of follow us there. And then Friday nights I go live on YouTube where people can come and they can ask questions and they can learn. This is just the best time ever in the world to learn stuff.

If you don’t like learning, this is a crappy time to be alive because there’s no benefit to it. But if you enjoy learning, you could just be learning almost the entire day every single day. Can you imagine living 1400 years ago and just being in the middle of the woods with you and your closest neighbor was God knows how far away and all you had was maybe your spouse to be there with you and you had to learn by doing versus now like the wisest philosophers in the world, the smartest people, the people that have spent years dedicated to just studying one tiny element of life like psychology and then one tiny element within psychology, like cognitive psychology, you can get all of that information basically for free if you just put the time into.

It’s kind of crazy how much information we have access to. I want to encourage everybody to take advantage of that because your life really does change as you learn more stuff.

Rob:

Well, I will say this, the thing that always trips me up about people 1,400 years ago, really up to 100 years ago, they didn’t have AC David. They didn’t have AC. They were just hot all the time. No, thank you. I like 2023. And with that, let me just say if you guys like this episode, if it was a nice twist, if you like the parallel universe of me and David losing it all and we proved ourselves to you on how we could rebuild our economical status, do us a favor, leave us a five star review on the Apple Podcast app or wherever you’d listen to your podcast. It helps us quite a bit. It helps us reach the top of charts. When we are at the top of charts, then that gets served up to new people that maybe wanting to get into real estate.

And if we’ve ever said anything that may have changed the trajectory of your life in a good way, we can do that for other people. If you help us with a little tiny five star review.

David:

We also get better guests for the shows if we’re at the top of the rankings and so we can make better content for you. Thank you very much, Rob. I appreciate you sharing everything you did. Your insight is brilliant as always. I’m going to get us out of here. This is David Greene for Rob “no AC8 for me” Abasolo signing off.

Help us reach new listeners on iTunes by leaving us a rating and review! It takes just 30 seconds and instructions can be found here. Thanks! We really appreciate it!

Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Check out our sponsor page!

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.

How to Build a Real Estate Portfolio from Scratch in 2023 Read More »

Sheryl Palmer, Taylor Morrison CEO, joins ‘Squawk on the Street’ to discuss housing data projections for forward demand in 2023, the mortgage transparency available to consumers, and takeaways from homebuilder sentiment numbers.

A housing recession has been underway for months, says Sheryl Palmer CEO Taylor Morrison Read More »

Financial independence means something different to everyone. For some, it means having enough to not worry about being laid off. For others, it could mean making more money to buy a yacht, but for Ali and Josh (TheFICouple), financial independence means more time together, growing a family, and a community that helps others reach their highest potential. Just four years ago, Ali and Josh were strapped with six figures worth of debt, living paycheck to paycheck, struggling to survive. Now, they’re financially independent, working their jobs just two days a week, and spending the rest of the time building a better life for their future child.

Ali and Josh are tenacious savers and investors, but they weren’t always like this. They were used to spending everything they made, scared to look at their bank accounts, and hoping that the future would somehow become brighter. Once they took the financial blinders off, Ali and Josh saw that the only way to build their ideal life was to deal with their financial hardships head-on. From there, they house hacked, heavily invested, paid off debt, and began publicly posting their wins, and losses, on social media under the @TheFiCouple handle.

They’ve gone from surviving to thriving, and this episode hints at just a portion of what Ali and Josh are building. With a baby on the way, they’ve become even more aggressive with growing their online brand, their real estate portfolio, and their investment accounts. If you want to repeat the four-year path to FI like Ali and Josh, tune in!

Mindy:

Welcome to the BiggerPockets Money Podcast where we catch up with The FI Couple.

Josh:

So we’re really excited because the things that we started doing four years ago are really starting to pay some pretty large dividends so that in July of next year when we welcome our daughter to this world, we will have the thing that we set out to have, and that was the power of choice and control over our time. And that will be the biggest investment that we’ve ever made.

Mindy:

Hello, hello, hello. My name is Mindy Jensen and joining me today is the She-Wolfe of Wall Street, Amanda Wolfe. What’s up Amanda?

Amanda:

Hey, how you doing? Excited to be here.

Mindy:

I am doing great. I’m so excited you’re here. It has been a minute since we’ve talked. Anything new and exciting in Amanda world?

Amanda:

Just traveling the world, trying to see all of it.

Mindy:

So where are you headed to next?

Amanda:

I’m actually going on my honeymoon, so I’m-

Mindy:

Yay.

Amanda:

Yeah, so we are going on a safari in South Africa. So really excited to get away from the cold and see all the animals and all the adventuring.

Mindy:

That sounds super awesome. I’m jealous. Okay. We should finish up this intro. I didn’t even start with the Amanda and I are here to make financial independence less scary part, so we should do that. But I’m just super jealous of your warm weather Southern Hemisphere trip.

Amanda:

I’m very excited. It’s a bucket list item for sure.

Mindy:

Ah, super jealous. Okay, well, Amanda and I are here to make financial independence less scary, less just for somebody else to introduce you to every money story because we truly believe financial freedom is attainable for everyone. No matter when or where you’re started or what kind of fun trips you have on your bucket list.

Amanda:

Whether you want to retire early and travel the world, go on to make big time investments in assets like real estate or start your own business. We’ll help you reach your financial goals and get money out of the way so you can launch yourself toward your dreams.

Mindy:

Amanda, I am super excited to bring Ali and Josh back on the podcast. We haven’t talked to them in a while and their lives have changed a lot in the last two years. They are living the FI dream, having quit full-time employment and generating income in different ways so that they can live their best life.

Amanda:

Yeah, I’m so excited to see them thrive because I remember when they joined social media, it’s kind of a tight-knit community and they had all of the student loan debt and they were working toward financial freedom and now just seeing all of that play out, all their hard work play out for two really good people has just been really fun.

Mindy:

They’re a great example of the FI journey. You can do this. It is possible to become financially independent even if you have massive student loan debt, even if you have seemingly insurmountable odds. They’re not insurmountable, you can do it. And what are the ways that they did it? They lowered their expenses, they increased their income, they put their nose to the grindstone, and they ground it out. That’s how you do it. There’s no secret sauce. There’s no easy button. I have an easy button.

Amanda:

There is an easy button.

Speaker 4:

That was easy.

Amanda:

It’s not easy. It’s work, but you can do it. Anybody can do it. You just have to actually put in the work. So before we bring in Ali and Josh, let’s take a quick break. We want to welcome back Ali and Josh. When we last spoke with The FI Couple on episode 167, almost two years ago, they were both working full-time, had $30,000 in student loan debt and owned two rental properties. Fast forward and things look a little different or a lot different. Ali and Josh, welcome back to the BiggerPockets Money Podcast.

Ali:

Hey, Mindy and Amanda, thank you so much for having us back. We’re really excited to be here.

Josh:

Yeah, this is the best.

Mindy:

So we’ve got a lot to talk about. Things look way different than the last time we talked. Can you give us a high level overview of what has changed for you guys?

Josh:

Yeah. So when we were last on the show, we were both working full-time still. We still had a lot of student loans. We had just recently purchased our second rental property, which was also a house hack. And since then, we acquired another off-market property. We both left our full-time jobs and now work part-time. We have, what started off as kind of a passion project that has turned now into a really nice online business.

Ali:

We also officially paid off our a hundred thousand dollars of student loans and I am pregnant.

Mindy:

Woo. Yay, babies.

Ali:

Yeah.

Mindy:

And I mean, yay, student loan debt too. I mean, yay, no student loan debt. Yay, babies. Well, congratulations. Wow. Okay, so well let’s talk about the baby first and get that out of the way because that’s the most exciting one. Congratulations. When are you due?

Ali:

We are due in July. We’re going through IVF. We actually have been trying to get pregnant since May of 2020. So this is 30 months in the making. We were very fortunate that our first embryo transfer stuck and we are having a little girl and her name is Zoe and we are very, very excited to be parents.

Mindy:

That is so awesome. We just did an episode about having a baby, planning for a baby episode 357 with Jen Narciso from Investor Mama. All the things you need to know about babies and also Costco baby wipes are the best.

Ali:

Well, we’re going to have to listen to it to get all the tips because we are really a little overwhelmed with all of that. But know that we’ll plan and develop systems like we do for everything else. Between having The FI Couple and our rental portfolio, I’m like, “We’ve had multiple businesses together.” A baby is just the next group project that we have to tackle. So we’re going to be just fine.

Mindy:

Okay. Well let’s hit up on that rental property. You said it was off market. When did you purchase it? Because the market has been a little nuts this whole year.

Josh:

Year. No, it’s been crazy. We actually combined two strategies on this. This was our first year ever using private money to acquire real estate and it was a BRRRR property that we acquired back in April before interest rates really took off.

Ali:

We found the deal in February when interest rates were still relatively low, but then we ended up closing as Josh said in April.

Josh:

Yup. And then we’re not overly handy people. So the property was actually in pretty good condition. We’re big problem solvers and we found an owner who really needed to sell quickly so that they could go on to a new phase of life.

Ali:

It was an owner occupant triplex, so it was in really great condition.

Josh:

Yep. So we had found a private money lender two years ago, stayed in touch with them. They saw everything that we were doing online. And so when the time came to buy the property, they walked it with us and they were happy to be the private lenders. We bought it in April. We did some paint, we changed out the locks and then we steadily leased out the property. At that time interest rates really started going up quickly. And so instead of waiting maybe five or six months after closing to refinance, we decided to do it in July and we completed our first successful BRRRR.

Mindy:

So you refinanced in July? That’s right when rates started going up, up, up. What rate did you get?

Josh:

Yeah, so we ended up locking in a 7% 30-year-rate and when we began the refinance process, we were closer to about a 5.5. We thought we had a little bit more time and then everything started going up quick. So we refinance a little bit sooner than we had originally planned.

Mindy:

So you’re locked in at 7% now?

Josh:

Correct, for a 30-year loan.

Mindy:

Okay. You said you found this off market? How did you find it? So everything that we own so far has been off market. We live in a relatively small city and once you get to know maybe six or seven people in this market who do a lot of the real estate, it makes finding off market deals a little bit easier. So we’ve never been people who had a lot of money or a lot of experience and so we’ve always had to be problem solvers. And so I am constantly networking with small business owners and local investors finding ways to maybe solve problems for other people. And that’s how we both found this deal and the private money to buy it.

Ali:

I think for us it’s always just telling people who we are and what we do. So “Hey, we’re Josh and Ali, we invest in this city. We’re small potato landlords. If you know of anyone selling a property, please keep us in mind. And actually a local landscaping company that we met years ago just messaged Josh on Facebook and was like, “Hey, I know someone that’s selling a triplex, would you be interested?” And we’re like, “Yeah, we’re interested.” We met the guy. It was actually really funny because we’d been featured in our local newspaper about The FI Couple and he’s like, “Oh, I know you guys.” And that name recognition was really helpful too because I think it just solidified credibility because we already had that rapport with the person.

Mindy:

Is this another house hack?

Josh:

No. So this is actually our first time not house hacking, which felt kind of foreign, but it was also relieving to not have to move in the middle of winter.

Mindy:

Yeah. That is quite nice. I’ve done that many times.

Ali:

We house hacked the first one, we house hacked the second one, and then it got to the point like, “Are we just going to keep house hacking here? What’s going on?” We knew we wanted to scale our rental portfolio and house hacking felt really safe because you need a place to live. You move into a property and there you go. But we decided that we really needed to advance our strategy and level up a little bit in order to consistently scale the way we wanted to.

So it was definitely a little overwhelming to not only buy an investment property by using private money, but I think it taught us so much really, really good lessons throughout this. So now it will definitely feel less daunting the next time we do it.

Mindy:

So rates are still really high. Are you looking for your next property or are you pulling back?

Josh:

Yeah. We’re always looking. There’s a little bit of the be greedy when others are fearful kind of approach. So we actually have found technically, or I should say tentatively our next two deals. They’re both duplexes side by side. And this time we’re actually making use of seller financing, which we’re really excited about. And again, it’s a retired couple who has a relatively large portfolio.

Ali:

That they own free and clear.

Josh:

And they really want to start enjoying retirement a little bit more and not managing rentals. And so that’s a problem that we’re happy to help them solve early 2023.

Ali:

Yeah.

Amanda:

I love that. Can you talk us through the seller financing?

Josh: