David:

This is the BiggerPockets Podcast show 700.

Rob Dyrdek:

The first thing that I did is I began to look at my life as this ongoing daily, weekly, monthly and yearly rhythm and I began to design my time, right? It eventually scaled to the point today where I track every bit of my time and tag it and it pumps into a dashboard so I could tell you exactly where I spend every single hour of my life over the last three years.

David:

What’s going on everyone? This is David Greene, your host of The BiggerPockets Podcast here today with a special edition, our 700th podcast here today with my lovely co-host Rob Abasolo. Rob, how are you today?

Rob Abasolo:

Wow, man, I can’t believe, you and I, we’ve sat behind this microphone 700 times. It’s just crazy, man. It feels like I’ve only been doing this for a year.

David:

Yeah, but with you, a year flies by so fast it’s like it’s only been 11 months.

Rob Abasolo:

That’s right.

David:

Well, the cat’s out of the bag. There’s no shock who our guest is today unless you’ve been living under a rock you’ve seen. We have Rob Dyrdek of MTV’s Ridiculousness, Rob & Big, top skateboarder in the world, business entrepreneur venture, owner of Outstanding Foods, a whole bunch of other stuff that we would use the whole episode if we talked about all of Rob’s accomplishments. And he is here today to talk with us about real estate, wealth building and more importantly, tracking your quality of life. Today’s show is nothing less than stellar epic really. You definitely want to listen all the way to the end because Rob’s last little, I don’t know what you want to call that, his grand finale is an absolute mic dropper.

Rob Abasolo:

His magnum opus.

David:

The magnum opus, that’s exactly what it was. He left us speechless. And I’m just humbled that Rob was here to share so much of what’s going on in his personal life, his philosophy for how he attacks life. He really pulls back the curtain and shares things that most people wouldn’t do. It’s very easy to let yourself just be seen as an incredibly successful person who never struggles with anything. And Rob is very, very humble and transparent and it was a joy to be able to interview. What were some of your favorite parts, Rob?

Rob Abasolo:

Man, just a master, honestly. It’s cool because a lot of people think when you’re super successful and wealthy and you’re crushing it, that you’re just good at this stuff. You’re just naturally born this way. And he actually talks about how when he first started, he knew nothing and he failed. He actually started a bunch of companies. They were making money then not breaking even, then he shut them down. And through all that, he kind of became this master business man, but it didn’t always start out that way. And that’s what I really like about this, is that it’s just honest. It’s a honest look at a true genius.

David:

Yeah, he’s one of those people that doesn’t stumble through life just hoping he figures it out. If life has passed him anything, he’s dissected it, analyzed it, understood it, and then tweaked it and replicated it to a huge level, which is why he’s been able to have so much success with his business ventures, the Dyrdek Machine, all of his production endeavors that he’s put out there, as well as the system he’s come up with that he shares today.

David:

Before we bring Rob in, we have a brief quick tip for you. I just want to ask you a question. What are you tracking? I talked a little bit in this episode about an epiphany I recently had with tracking and the work I’m putting together for BiggerPockets to help you be more successful by utilizing this incredibly powerful force. And Rob expands on that and really hammers it home. So as you listen to the show, you’re going to get exposed to this concept of tracking. And you’re also going to hear Rob Abasolo talk about why he doesn’t do it, which I bet many of you, including he, can relate to. So make sure you ask yourself that question, “What am I tracking and what matters to me?” as you’re listening to today’s show. All right, let’s get to Rob.

David:

Rob Dyrdek, welcome to the BiggerPockets Podcast. It’s great to finally have you here. You’ve been on my wishlist and you came in just in time for Christmas, so thank you for that.

Rob Dyrdek:

No, hey, thank you for having me and making me feel honored and feel like a gift. Thank you for making me feel like a gift.

David:

Well, thank you for being the gift that you are for anybody who’s had insomnia, wasn’t able to sleep, maybe ate too much food and was struggling with some acid reflux, Ridiculous has been there for all of us. And I don’t know how you’ve taken America’s Funniest Home Videos, rebranded it, made it cool and kept it fresh and exciting for as long as you have. So first off, just props for being able to take a show that’s pretty simple and just keeping it cool all the time.

David:

But we’re not here to talk about Ridiculousness. You’ve done so much more than almost every human being on the planet has any idea you’ve accomplished. And that’s what I really want to get into today, is what’s going on in that head of yours, what are you doing, what are some of the things you’ve learned, because I know that’s going to benefit all of us. So let’s start with your journey if you don’t mind sharing us. What was your early days of your entrepreneurial journey like? How did you get into business making money and kind of taking charge of your own life?

Rob Dyrdek:

I like to say I was raised by entrepreneur wolves, right? Because the first move I made at 11 years old is I called the local skate shop that had a ramp in the back that you had to pay to skate. They were having a contest and I said, “If I got 10 people to pay and skate, would you let me skate for free because I didn’t have any money.” And they were like, “What? This is ridiculous. Just come down here, we’ll let you skate.” And so when I skated that ramp, I was able to skate that ramp so good at such an early age that they were telling me I had so much potential and I didn’t even know what the word meant. They sponsored me based off of that very first time when I was 11 years old and went to the skate shop.

Rob Dyrdek:

Now, the person who owned that skate shop was a guy by the name of Jimmy George who was a 19 year old serial entrepreneur. And so not only did I watch him run that skate shop, but then he built a distribution company. Then I started watching him build clothing companies and other retail stuff and then the other influential skaters in Dayton started to build companies. So for me, I just looked at building a company was part of my natural path and that’s what I would do also on top of being a professional skateboarder. So I quit high school, turned pro at 16, moved to California and then started my first company when I was 17. So that’s sort of like what sort raised my mind, if you will, in sort the entrepreneurial mindset in the early nineties when it really wasn’t something that was more broad as it is today.

David:

Yeah, I believe that you talked your parents into letting you drop out of school so you could go become a professional skateboarder as well, right?

Rob Dyrdek:

Yeah, no. And to this day she’s still mad about it. Look, I’m 48 years old, worth hundreds of millions of dollars and she is still angry, still angry that I was able to talk her into convincing the counselors and my father to let me quit high school. You know what I mean? She’s still mad about it.

Rob Abasolo:

Can you tell us a little bit about how that conversation actually came to life? Did you sit them down at the dinner table? Had they seen the writing on the walls previous to that? Tell us about that day.

Rob Dyrdek:

Yeah, and look, we have two different memories or two different versions of it, me and my mother. The truth is I’ve done a lot and a lot has faded in including the details of that exact process. But really I was building a case of like, hey, I was giving the value of long term, I can always go to college. I will take night classes and get my diploma, have enough credits to graduate because I was only a few credits away. And then it really came down to convincing both this counselor, the principal and my parents that this was going to be the better thing for my future. And at the end of the day, it was pure salesmanship that convinced all of them that, “Well, we might as well let him give it a shot.”

Rob Dyrdek:

And I left. That was my last year of school. And then I immediately went to Europe for the world championships and got fourth place in the world championships in Germany. And it kind of validated it for everybody, “Oh look, he was almost a world champion.” So it was an unusual form of salesmanship at a early age.

David:

Now this is just part of the crazy life that you’ve lived up to this point. You went and became one of the best skateboarders in the entire world. This was really at a time where… I was never a skateboarder so don’t let me say anything incorrectly here, but I don’t remember there being a whole lot of opportunity to learn skating at a high level, right? At one point, basketball was a new sport and there wasn’t really anyone to learn from. Now you’ve got so much basketball, you could be in camps from the time you’re five years old learning how to play the game. So you almost had to go out there and figure out, “How do I get better at skateboarding?” without a ton of examples. At least there wasn’t YouTube videos you’re watching every day like you can right now. Did something happen in your mind that you think led to the entrepreneurial journey as you had to learn how to do something as creative as skateboarding without a whole lot of direction that you could follow? Or do you think this was just something that was in you already?

Rob Dyrdek:

Well, I mean, you got to think about what it is as a sport, right? It’s really about failing over and over and over and continuing to make adjustments until you finally get it. Then it turns from this constant failure and adjusting to actually find success. Then it’s about mastery, right? And it goes a step further. So if you can imagine that process, if I began to apply that to a lot of different areas of my life on top of the fact that now you are in this space where you’re thinking entrepreneurial, you’re always thinking about different angles and different ways for things to, whether that be deals for when I was first developing a designing shoes or even the first company that I created, I always put a lens of creativity into the way that I looked at business and deal making that I think for sure is from sort of the creative outlet and the expression side of what skateboarding gave to me at an early age.

David:

I mean, you were very unique in the sense that you didn’t just focus on your craft of skateboarding. You then said, “Now I want to get into business,” and this is all at a super young age. What were some of those initial early business ventures like for you? And then where did you go? How many businesses did you actually have at one time before you realized it gotten out of hand?

Rob Dyrdek:

Oh, I mean, in that era there was a lot of moving parts in that evolution, but it started at below zero. You’re talking about a guy that didn’t understand money in any way, shape or form. He just left high school, was bad in math. I had no even concept of anything other than if you work really hard and have big ideas and they become successful, then the money will come. That’s really the energy I took into everything. The problem with that is that led to making a lot and losing a lot of money because you were never totally sure what was making something successful, right?

Rob Dyrdek:

So some things you would create with a group or partner or start yourself and they would find success or not work and finding what those through lines were was the thing that was most difficult for me I’d say in my 20s into my 30s because I had record labels and skate shops and I had signature products that were super successful and I had skateboard accessories that I would start. I was doing all of these different companies and some were working and some were not and I was confused by it because I never ever thought of myself of like, “Hey, there’s so much you need to learn.” Instead I just thought you could will your way to being super successful that it really wasn’t about this is this incredible process of learning and what you want to do is guide your evolution to building a skill set of building and creating businesses so that long term you get better and better at it. I didn’t discover that even as a concept until I got into my late 30s.

Rob Abasolo:

Man, yeah, I totally get it, man. When you’re in the trenches of a bunch of different companies, it’s sort of like you see what works, you see what doesn’t, and it’s really hard to just prioritize because you’re just trying to get through the mud. But was there ever a moment in the beginning of all of this, like an aha moment or a light bulb moment where you’re like, “This is working.”? Like, this company right here is working where you really wanted to focus on a specific one?

Rob Dyrdek:

Well, it happened in more of a nuanced way, right? So when I was offered to have a Signature Shoes, a signature pro model, so your own signature shoe, Michael Jordan style, when I was 22 years old from my clothing sponsor, Drawers Clothing was going to create this new company DC shoes. And so they offered me a signature shoe. That signature shoe gave me the opportunity now to make a lot more money that I can invest in a lot of different things. But watching the journey of that shoe company be built from an idea stage to being sold for $100 million was probably the bigger aha moment to me of like, “Wow, there’s actually a cycle here where these guys that were just my friends all just made $30 million.” You know what I mean? Like, “I want to be in the business of building assets that are acquirable” is sort of what my mind began to see when I watched that entire process happened.

Rob Abasolo:

I actually have always wondered this. So you got a shoe, your first shoe, right? Did you ask for 20 pairs of that shoe that you could wear for the rest of your life? Do you still have that first model that ever came out?

Rob Dyrdek:

Look, there is nothing as incredible as having a signature shoe. It is the most incredible. And look, I went on to have 36. I have one of every single pair and almost every single color saved to this day. You know what I mean? It never got old. It’s something that I became quite obsessed with, like just the shoe design process. And even in my journey with DC where I made millions of dollars in my 20s and being entrepreneurial, is I did a deal with DC that like, “Hey, if I design shoes and present them to the sales team and they get chosen, can I get a 2% royalty on that one instead of a 5% royalty that I got on my signature shoes?” And so they said, “Sure, no problem.”

Rob Dyrdek:

And at one point I had a-third of the entire line and 30 different shoes that I was getting paid off of, right? That’s one of the first places that I made a ton of money. But yeah, when you get into the world of creating something on paper that ends up on someone’s foot that you see walking around, it’s really special and you want to make sure you have some keepsakes of your signature shoes.

David:

Now I understand, Rob, you didn’t just have a business, you had several businesses. In fact, it seems like once you realized, “Oh, I know how to make money through business,” it sort of became a whole bunch of new skater tricks that you had thrown into your arsal and you’re just like starting businesses all over the place. I don’t know if that’s an accurate reflection of what it was like, but tell me, did you catch a bug and just started like, “I’m going to do this and I’m going to do that”? Was there a greed component? Was there a fear of missing out component? Was it just so much fun that you just wanted to keep doing it? What was motivating you? And then how many businesses did you have at one time?

Rob Dyrdek:

Well, look, I like to say that I was fueled by the joy of creation, right? I’m a creator and I loved creating all these different things. What I was blind to is creating business requires seeing business multi-dimensionally. And it’s beyond the product and the brand and it’s the operations and the financial side and the leadership side and market side, market timing. There’s all these different aspects that I didn’t fully understand. And I didn’t think I needed to know. I just thought I would keep making cool stuff. That trailed into a lot of different areas, right?

Rob Dyrdek:

As I continued to create, then I created Rob & Big and now had this platform and then I started ROGUE STATUS, a clothing company and had all these multiple signature products. The bigger I created my television platform and saw the impact of that, I began to do partnership deals with all these different brands and Monsters and Red Bulls and Chevys. And then I’ve said, “Well, look at this. I should just create a show that’s just about promoting brands that I create and doing brand partnerships.” And then I wrote the concept Fantasy Factory owned my integration rights. So now not only am I building two or three companies a season and promoting them through the platform, I’m doing multiple brand partnerships with the Chevys and the Monsters and Microsoft and all these different companies and I’m getting paid as talent on the platform.

Rob Dyrdek:

So I really began to see what the potential was of being a multi-platform brand as yourself. And then I launched Street League and Wild Grinders on Nickelodeon. I had just done so many different things that it was almost like I was pulling myself tight where I was doing so many different things in so many different directions, but I was basically breaking even with the cost structure of how the entire integrated universe work together. So I’d be making a ton of money on this thing and losing a ton on this thing. And it really just ended up where I got 12, 15 different companies and two different shows and a professional skateboarding league and a cartoon on Nickelodeon and all these brand deals, but I’m basically breaking even.

Rob Dyrdek:

I think that was really more of the epiphany of like, “You’ve got to put structure to why you’re doing all of this. What is the unified theme in all this? And then what are you learning and growing into on a long term basis?” is what I grew into eventually having as sort of my aha moment in my mid 30s.

David:

One of the issues real estate investors have that I’ve noticed is we tend to focus on metrics like the return on investment, which we usually only look at the cash-on-cash return when we talk about ROI. And because we’re only looking at that number, we forget about all the rest of the investment we’re putting into the opportunity.

David:

So for instance, you can say I bought this property and it makes me an 18% return and all the other investors get jealous because they’re only getting a 6% on theirs. But what isn’t talked about is this is a short-term rental that you’re managing yourself and it’s basically become a full-time job and there’s an energy component where you’re dealing with frustrated people and now you’re in a bad mood and you’re taking it out on your relationship or your kids. You’re not focused on what you’re doing because you’re thinking about what could go wrong. Yeah, your return is higher, but there’s time, there’s energy, there’s emotion, there’s other resources that are going into that deal that because we don’t measure, you don’t factor in to the actual thing and it makes it look like you’re doing much better than you are.

David:

I would imagine in a scenario you just described where there’s this much creativity flowing out of you, time, energy, you’ve created an empire and you’re breaking even and that much mental calories are being expended to do it, that that had to be an aha for you, that like, “What I’m tracking isn’t right because I’ve ended up in this wolf… I got the wolf by the ears sort of scenario here.” That had to have an impact on just the way that you structured your life where you valued things. Am I way off with that or was there a moment that you realized, “I’ve been going about this all wrong”?

Rob Dyrdek:

Yeah, and look, I think it’s a great analogy because I think it is the… I preach like try to build a real estate portfolio where your cash pays for your living expenses, right? It’s this beautiful model to live a very peaceful life and be able to hold your property through cycles and never be over leveraged and these sort of fundamentals of real estate investment. Yet that is the optimism, tip of the spear happy version of saying it because it’s like, “Oh of course, I would love to have passive income and live my whole life just chilling.”

Rob Dyrdek:

And so real estate is a perfect example of like, then they go and buy a building, then the pipe breaks, then the renter stops paying rent. It is utter and complete mayhem that sucks the soul out of you that then you get caught in the wrong end of a market cycle, then basically you can’t afford to take the loss anymore and now you got to get out of it and lose your equity that you’ve spent your whole life saving up to get into it. That is when you don’t understand all of the different layers, if you will, what I like to refer to as everything is multi-dimensional and you’ve got to look at everything in your life as an ROI on energy and time.

Rob Dyrdek:

But to your point, what happened to me in that era is I realized above all I just wasn’t happy. I just wasn’t happy. And it’s like I didn’t know what I was doing all of this for. I had accomplished so much, but what was the end game and what did I even want money for in the first place?

Rob Dyrdek:

I ended up finding a book called Start at the End. It was a business book that essentially said if you want to create a company, you should decide what you want out of that company from the very beginning. If you want to build a company and sell it for 25 million, then you need to know how much revenue you got to create and what it trades at and who’s going to buy it. If you want to create a business that does a million and kicks off 200,000 in profit that you live off of, then you got to build the plan backwards from there. That changed my entire view of not only business but then I turned that back on, “I’m going to treat my life like that.”

Rob Dyrdek:

And so then I decided, “What is happiness to me? What is money to me? What do I want money for? What am I doing all these companies and all these shows for in the first place?” And ultimately I realized it was I love to create and I love to take risks, but I want the sustainability and security that comes along with living this lifestyle that I see for myself. And that’s really when I discovered multifamily real estate as sort of, “Hey, this is the perfect balance for me,” is I need real estate that can create this tax efficient cash flow that I don’t operate by doing it with a group and having great operators.

Rob Dyrdek:

And then my goal is to get that grow that takes no time and energy. Then focus on keeping my expenses low as I grow that portfolio and then taking risks in my own ventures and things that are related more to the Start at the End mentality that I’m going to build to sell. Which in turn took me from breaking even to building a company and selling it for 190 million, having two of the companies that I invested in early stage selling for 200 million, it’s like where it’s just in a short amount of time.

Rob Dyrdek:

This wasn’t like some like, “Hey you did this over 20 years.” I had made a few hundred million dollars from being broken even in less than five years. You know what I mean? That’s the significance of the amount that you can accomplish when you design an entire vision for your whole life and then create pathways and plans to achieve the ideal version of your existence and then go chase it with that energy instead of chasing all these things and not knowing what you’re doing them for.

Rob Abasolo:

Yeah. So there was a moment. Because you had a lot going on, you’re breaking even. Obviously, that ends up catapulting you into a lot more success, but there was a moment there where you had to walk away from a few of these companies, right?

Rob Dyrdek:

Oh, look, literally, in that era, I think I had 13 operating companies at the time and I got rid of all of them. I got rid of all anything that I had. I put all my money to cash and then the only thing that I kept was my professional skateboarding league and then the label that was Superjacket Productions where we hadn’t even built the company yet. You’ll see a lot of times where celebrities have a production company and they have a producing title on their show and it’s just for show. You know what I mean? And that’s what ours was. Superjacket Productions. We produced it, but we didn’t. It was just the name of what me and my partner named the company as executive producers.

Rob Dyrdek:

And then what did I do? I looked at, “Okay with the Start at the End mentality, where’s the opportunity here?” Well it’s actually to build and sell a production company because I have the unfair advantage of having a television show on air, right? So what did I do? I looked at the trade value of a production company. It’s six times EBITDA. “Okay, how do you create EBITDA?” You’ve got to own the production, you’ve got to get margin from the producing the show, finishing the show, editing the show and the music in the show. And then if you have three years at EBITDA, someone will buy you for six times EBITDA. And that literally is the plan that we built. And of course, our goal was to sell that business for 50 million. And now that we had that clarity, we were able to focus how we grew that business and ended up selling it for 190 million.

Rob Abasolo:

Okay, so you have 13 companies that actually they’re sustainable, right? They’re just breaking even and then you’re like, out with the old, in with the new. And so then you go on to create this company. Where’s the real estate aspect landing at this point? Are you doing the real estate stuff concurrently with the production company? When did you actually get into that first deal?

Rob Dyrdek:

Yeah, so 2014 would’ve been the first deal, right? So if 2013 was sort of the discovery and the development of the beginning of the end and then the first deals started happening there, then now I’ve wrangled in my core spending and was continuing to grow my ordinary income and then I was literally just investing in new ventures that had that Start at the End structure and real estate, multi-family syndicated real estate only. I didn’t put one diamond in public equities or anything, like strictly chasing that depreciated cash is where I started back then.

Rob Abasolo:

Oh okay. Cool. And so the syndications, that was sort of appealing to you because it was very passive. So you could still, I imagine, focus on the production company but you still of reap a lot of those tax benefits, right?

Rob Dyrdek:

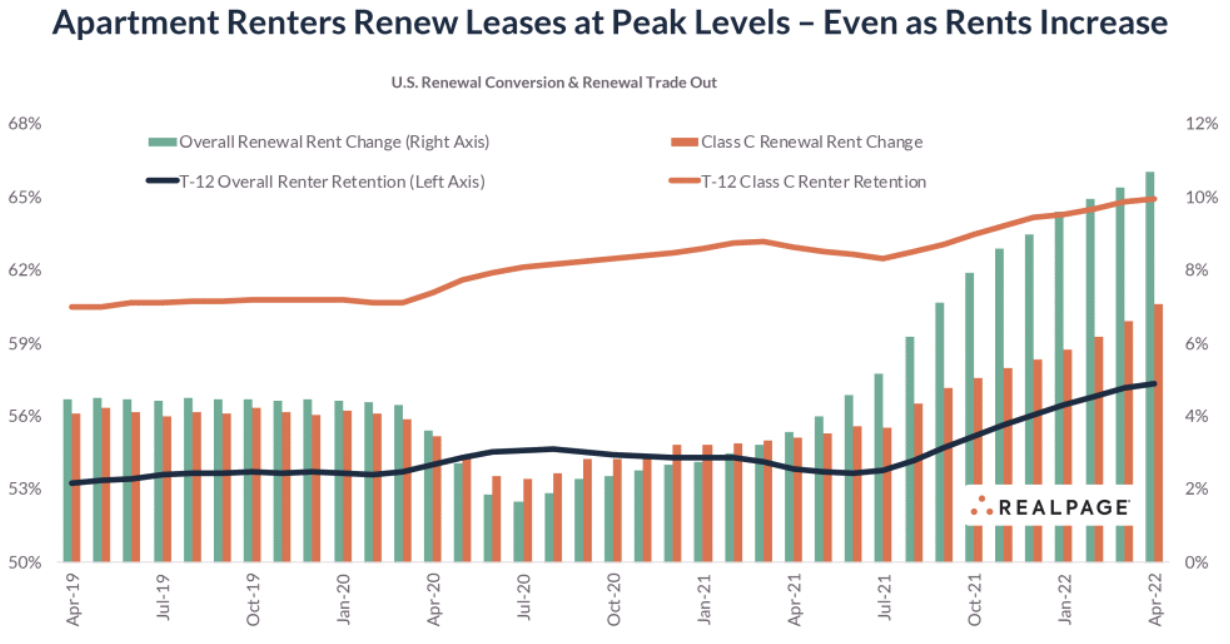

Well yeah. I mean for me, when you look at it, depending on the operator, you can 1031 exchange them, right? In this era over the last seven years, eight years, there have been significant returns, right? We’re talking 42, 43, 35, big IRRs for this sort of wave that multi-family’s been on. But I’ve always been focused on the cash and driving up the cash. But then along the way I really learned what’s a quality operator, right? How do you leverage? How much do you have in each one of the deals yourself? Are you vertically integrated with your management or do you outsource it in your property management?

Rob Dyrdek:

All these things that lead back to the quality of the actual operator. Have you ever lost a product through the cycle? Have you owned through the cycle of 2008? All these things that I began to see. But the appeal of that is I don’t mind giving up management fees in 20% of the carry because I don’t have to… There’s zero effort in energy. That was what was really the most appealing to me because I had had rental properties when I was younger and it just sucked the soul out of me. Sucked the soul out of me.

Rob Dyrdek:

Man, I remember I’m getting a call that the basement had flooded. We were trying to figure out the basement flooding and then there’s floating to the surface, it’s like eight dead rats. It’s like, “What? Now we’re in the rat game?” It’s that type of energy had always kind of turned me off of real estate. And it was only after I had met somebody as I was laying out, “This is the vision that I have for my life. Where do you see me investing in order to support this vision?” And this individual suggested specifically, “You need to do multifamily and you need to do it in syndication and you need these type of operators.” He guided me there in a pretty significant manner that proved to be the anchor of my core philosophy to this day.

Rob Abasolo:

Sure. sure. So obviously you’ve got some pretty specific viewpoints here on your operators. Are there any nonstarters for you for someone running this indication? Is there something that operators kind of offer to their different LPs that you’re like, “Ugh, I don’t want to be a part of this” or, “This isn’t the deal for me”?

Rob Dyrdek:

Yeah. I mean, look, for me, if you don’t own the management, you’re not vertically integrated with management, that’s where the arbitrage is and the quality of keeping those buildings healthy in my mind. I would never do a deal with somebody that over loan the value beyond 65. You know what I mean? Somebody that would get their initial loan and then try to pull cash out by refinance and now being over leveraged, I would never do anything like that. I would never do a deal with somebody above a 20% carry. A lot of these guys that syndicate now have much higher fees than some of the more experienced operators. So for me that’s sort of how I look at it.

Rob Dyrdek:

But I’ve really found when you are regionalized and then you are vertically integrated from a management perspective, that’s when you can optimize for excellence and you really understand how to keep that building occupied and maximize the rent growth and any value add that can be done on an ongoing basis. To drive that rent growth I think is what’s been more clear to me than anything. What I would never do is somebody that has a deal… I have so many people that approach me that are just early in the game because of riding this new wave that’s been hot for the last decade and will be like, “I got this building. We’re going to build it and sell it and it’s going to do a 27% IRR.” Because in this game everybody’s selling you the IRR all day long because they’re like, “It’s never going to go down.” They’re not even thinking about what would happen if you get clipped in the cycle.

Rob Dyrdek:

And it’s really cool. You know what was beautiful about the pandemic as it relates to this sort of world, is it stress test all the operators that I have buildings with, right? Because in that first couple months when the national average was 30% delinquencies and all the buildings that I were in were at like 5%, that gave you a real clear indication of the quality of those operators and the quality of the product if you will versus some of the other people that were holding on for dear life in that first four or five months of the pandemic there before obviously the stimulus kicked in and everything sort of gave us a double bubble, really a triple bubble, gave us a triple bubble kind of where we’re sitting at right now.

David:

I was going to ask you about what you’re tracking and we’ll get to that, but I’m fascinated by what you just mentioned. It’s so odd to me that the economy is this huge, incredibly important thing. The way that the Fed handles money, it just never gets talked about, right? It’s like we’re ignoring the huge macroeconomic forces and we’re just zoomed in on these little tiny details of a deal. And so I always ask this question. Most people aren’t very comfortable answering it, but if you don’t mind, I’d love to get your opinion on how do you look at the way the government intervened with the quantitative easing and the printing of the money when we were… We basically shut our country down for almost a year and minimally were affected for the significance of what we should have been feeling from the impact of what we did. We actually had an incredible run up where everyone felt wealthier, especially if you owned assets, you were raking it in, right? And now we’re getting the first hint of, “Oh, this might not have been that good,” but the decisions are made three years ago.

David:

It’s hard to kind of tie it together so could you share your perspective as someone who is responsible for managing assets and protecting wealth and creating wealth for other people, how you see what happened with the economy, where we are and where we’re going?

Rob Dyrdek:

Yeah. And look, I’m not an economist. I’m a generalist. But when you look at it bigger and what that stimulus did and that double bubble, it needed to be done, in my opinion, right? Sure, there’s a lot of different ways. The same way that putting pressure on everybody and driving up in the rates to put pressure on everybody to fight off inflation. These are all extraordinary circumstances that are already in an already stressed cycle, right? Because you got to think, all the recessions that we’ve lived through, they didn’t talk about the recession for two years coming in like a giant cloud and this continual recession talk. They came out of nowhere. The bubbles popped and now we are in deep dark waters.

Rob Dyrdek:

And to me, I believe what has been happening on the core fear, if you will, of everybody who’s in all of these different asset classes. We are talking even in the venture space, we’re talking in the art world, we’re talking in luxury goods. All of every single asset class inflated to such an unrealistic level that then everybody’s talking the economy tight. Nobody’s talking about their revenue being down, they’re talking about preemptively striking by laying people off now and preparing for just in case revenue is reduced, right? It’s this super unusual way which to me is actually taking pressure off of the bubble that we’re in and the overall sort of inflated asset class on all aspects. We’re naturally sort of easing everything and it’s going to take something extraordinary like a Chinese invasion of Taiwan or Russia with a nuclear weapon. It’s something that shocks the world that then hammers it down into recession in my opinion, not as an eco economist, but through the lens of a broader way of seeing how the previous cycles that I have lived through have gone through.

Rob Dyrdek:

And again, I don’t build my life through the lens of worrying about whether or not a recession is coming or a cycle’s coming. What am I doing? Some of the buildings I’m in now, I did it like 50% leverage. You know what I mean? These are 10, 12 year holds that are going to be through the cycle no matter when it is. And then I keep a substantial amount of cash at all times. I don’t own any public equities.

Rob Dyrdek:

I have all of my buildings, my personal real estate, I still have a lot of capital draining personal real estate to be fancy and then my core venture business. And then I keep a ton of cash always. I have that in whether it’s California tax free munis or other cash efficient ways that kick off cash.But I built my own personal financial system that’s built around weathering any cycle because I believe in the United States’ resiliency in the long term and the economy long term even though if you read Ray Dalio’s latest book, the Principles for the Changing New World Order, you’ll be sad and freaked out. But it’s still the idea that you can control your money, your universe with a lot more probability based off of what you choose to invest and how you choose to deploy that capital that may not be smartest to your traditional money manager or the way that someone would suggest to you, but you’ve got to create it in a way that makes you most comfortable. And to me that is keeping a ton of cash at all times.

David:

Yeah, there’s a dance that you’re describing where you have to have a lot of cash at all times and at the same time you have to recognize inflation’s going to keep coming, America’s resilient. We’ll probably do what we did last time. Again, we’ll probably print more money. It’ll create assets going up. So you also have to invest. And I frequently said this is the challenge of today’s market, is it’s not as simple as do nothing or go all in. You almost have to, in a weird way, be able to do both.

David:

And so what I’ve said is you have to continue earning money. You can’t just stop. This is not the world where you, “I worked for 10 years. I worked for 20 years. I sold my company. I’m just going to ride off into the sunset and do nothing all the time” because things change so fast. So I agree with you. I think Ray Dalio’s video about the Changing World Order is scary. But other countries are still putting their money into American real estate. They’re putting into American businesses. It’s coming here, right? We still are the cleanest shirt in the dirty laundry, so to speak.

Rob Dyrdek:

Hey, but even to that point, think about we’re the only culture in the world where it’s being ambitious and driven and entrepreneurial is part of our DNA.

David:

[inaudible 00:39:13].

Rob Dyrdek:

No, it’s our part of our DNA. The rest of the world is they take siestas and whatever. We’re like, “We could build it bigger, better.” We are that. And our economy is still so much… It’s still by far the biggest economy in the world. And again, I’m not an economist. I’m an economist of the Rob Dyrdek family office and the Rob Dyrdek personal energy. I still look at the way that I invest capital as, “What’s it going to provide me from a mental capacity and mental health perspective?” and owning public equities doesn’t matter if I miss out on the growth of a market. It doesn’t matter to me because I like the stability and comfort of the cash that comes along with the equity growth depending on the cycle and the real estate side, right?

Rob Dyrdek:

And for me, I was investing in buildings that were getting 7, 8, 9% cash. I haven’t even seen any for a long time now since we’re in this deep crunch. But even the last few that I did, we’re talking, they’re 4.5%, 4%, much smaller but I’m still deploying millions of dollars into it as long as it’s not over leveraged and it can still create a, call it 11, 12% IRR over a 10, 12 year period, right? Because at the end of the day, I know that that’s my strategy. And then the other buildings that I’ve had since 2014, ’15, some of those are doing 12% cash right now. So I look at it as each year and every building that I buy or invest in is like a wine, and it’s almost like you see all these vintages of the different eras and those vintages are tied to rates and cap rates and leverage. It’s so fascinating when you look at them from that lens.

Rob Dyrdek:

And then for me, especially when you began to see some of the compounding in the 1031 exchange from your basis standpoint, you really begin to see the snowball effect that can begin to happen if you play this game for 30 or 40 years versus trying to use it as like, “How can I make money off of this and build my wealth quickly in this space?” I think that’s the problem with the real estate flipping market and then even value add rental properties. There’s this dance with like, “I can do this quickly and build up a big basis to get rich off of” rather than looking at it more from this long term sort of compounding lens that a lot of the younger real estate investors today wouldn’t look at it from that lens.

Rob Abasolo:

Yeah, I couldn’t agree more. I mean, definitely it’s never an ideal time to just print cash out the wazoo, right? But to your point, Rob, we didn’t want to the world to collapse during the pandemic, right? Absolutely we’ve had so much time to prepare. We’ve been talking about the recession and the crash and the great crash of 2022 literally for a year and a half now. And so I think that it’s all about going into something. The people that are going all in and trying to get rich quick versus build wealth slowly, I think they’re the ones that are going to get burned, right? Those are the people that are like, as much as I advocate for building your life through real estate, trying to take the quick approach can quickly turn the opposite once those housing correction numbers come in. Because I know a lot of flippers right now that are into a six month flip right now where their ARVs and their comps were based on six months ago and they’re kind of hurting right now. You know what I mean?

Rob Abasolo:

And so I tend to advocate for really trying to never use your cash flow. I mean, when I got started I wanted to subsidize my life with my cash flow just like you talked about. But now I’m just like, “Well, I like the cash flow to just go back into that machine.” And then the equity, that’s really what’s going to matter in 30 years, just like you said, compounding over and over and over again.

Rob Abasolo:

It’s slow. It takes a lot of discipline. A lot of times I do like to… I wish I could use my cash a little bit more, but I’ve been preparing also keeping a lot of cash on hand. I keep a 20 in my wallet every day now.

Rob Dyrdek:

[inaudible 00:43:51].

Rob Abasolo:

I’m just kidding. But yeah, I’ve been really keeping the cards close on my chest for this moment actually, because now sellers are getting kind of nervous. I’ve made several offers that were 300, 400K under in the last two weeks and it hasn’t been a “hell, no” from all the sellers. Whereas a year ago they would effectively not even respond to my realtors. So because I’ve been keeping a lot of that cash, I’m ready.I’m ready to jump in. I’m really excited for it.

Rob Dyrdek:

Yeah. And look, I think for me, I still make a lot of ordinary income, right? And then I make a lot of long term capital gains from these acquisitions and these big sort plays on the venture side and how much money I make from shooting TV from the ordinary side. So when I look at peace of mind, I look at the cash and my living expenses like, I’ll make over a hundred million, but I’ll still keep my personal lifestyle expenses in the 2 million range, right? So then I will pay my blended tax rate that’s long term capital gains, fully depreciated and ordinary income and then deploy that capital into buildings and into cash reserves to just keep cash and/or my venture projects, right? Because I’ll invest, call it between a million and 10 million in each of my venture deals, right?

Rob Dyrdek:

So it’s this sort of piece of mind for me in the system that I’ve created that is always about being able to capitalize on the opportunity but have a system and a principled way of operating that is recession-proof and cycle-proof and pandemic-proof is really what I try to implore in people and as they’re trying to find essentially financial harmony. You know what I mean? You’re really trying to find what is the balance of where money does not disrupt you or stress you out, but actually fuels your balance and the harmony in your life. And that takes you to design a way that you understand and manage it fundamentally in a way that if you do get scared and save extra cash knowing there’s going to be opportunity because you’re an expert in the market, it’s like those are the type of things you got to look at.

Rob Dyrdek:

And for me, I remodeled and sold a house in my neighborhood. I own a ton of houses in this neighborhood and land and I’m building a house. I bought this house for 6.9 and sold it for 9.6 in two years. I got multiple offers and sold that thing in one day and broke a price per square foot in this neighborhood, right? 1,429 square foot for this particular neighborhood. It felt like it was four years ago. You know what I mean? This was last month. You know what I mean? It was like the market had already turned, the rates are through the sky and I’m like, “All right, let me just throw this thing on the market.” Multiple offers above asking and I’m like, “What year is this?” You know what I mean?

Rob Dyrdek:

And in the sense of knowing that the winds has changed, the market had shifted, but back to this idea that the right product and the right area is always going to trade at a premium and at a pace that is different, it’s that fringe product that people get killed on because it’s cheap in and cheap out and gets murdered in a cycle. And that’s the thing in real estate that people just don’t… They know the word location, location, location, but they don’t understand really how important that means in the sense of the quality of the real estate product that you’re even looking at.

David:

I’m so glad to hear what you’re saying. It just goes to show if you understand overall wealth management success in life, that these principles that we talk about in real estate, show up even if you’re not a real estate expert, you’ve mentioned taking the long term view, I could not agree with that more like the vintage of a wine. The best deals that I have are the ones I bought the longest to go. It just works that way. The best returns come on as the oldest stuff you have. And that takes delayed gratification and the avoidance of relying on real estate to create your income, right? It’s like how you sort create icing on the cake, but you still got to work hard. You still have to create, you still have to do hard things for the money that you want right now.

David:

And then the other thing you just mentioned, which is avoid that, the siren song of that $50,000 house and a D class neighborhood, but on a spreadsheet it looks like the ROI would be so great. It’s like that flea market thing that you’re like, “Yeah, I know I’m not supposed to buy from a flea market, but that one might be the one thing. That CD might not be scratched” or whatever the case would be, right? And then you always end up regretting it.

David:

I love your point because when you’re in the right location, the people buying your house did not care what interest rates were. Straight up. It just doesn’t matter to them, right? Money is a different thing to them than it is to other people. You have something to say about that?

Rob Dyrdek:

Yeah. And look, it’s a gated community in Beverly Hills that has a hundred homes. You know what I mean? So to get into one that’s been done really nice and is nearly impossible, right? So you got to fight for it when it pops up. But another thing that I think real estate investors have to be thoughtful of is the way that real estate values spread, right? It goes from the high value areas, the great neighborhoods are where that initial acceleration of value starts. And then it slowly makes it way out to the smaller cities and around the bigger cities. And then it’s like, “Oh, there’s where the value is.” But make no mistake, it seems cheaper because the market’s cheaper, but it’s going to take a bigger hit and have a lot longer road to making it back when you start investing in B class, C class regions that at the top of a cycle that feel cheaper. You know what I mean? I think you can see that happening all the time and then it’s like it’s the first place that takes the biggest hit.

David:

That’s exactly right. Yeah, I’m glad to hear you saying that because especially for the newbie, man, they’re just always tempted by that. “No, it’s safer. It only costs $35,000” and I’m like, “I bet if you look at the title history of that freaking thing, it’s changed hands every 18 months because nobody wants it after they buy it.”

Rob Dyrdek:

That’s it, man. And that world, that’s the world that I think this bigger sort of wave of like, “Real estate. Real estate. Real estate. All great fortunes have been made in real estate.” They haven’t been made flipping $80,000 houses. You know what I mean? It’s been compounded and build wealth over time is how they did it. You know what I mean? I’ve seen so many people go through it.

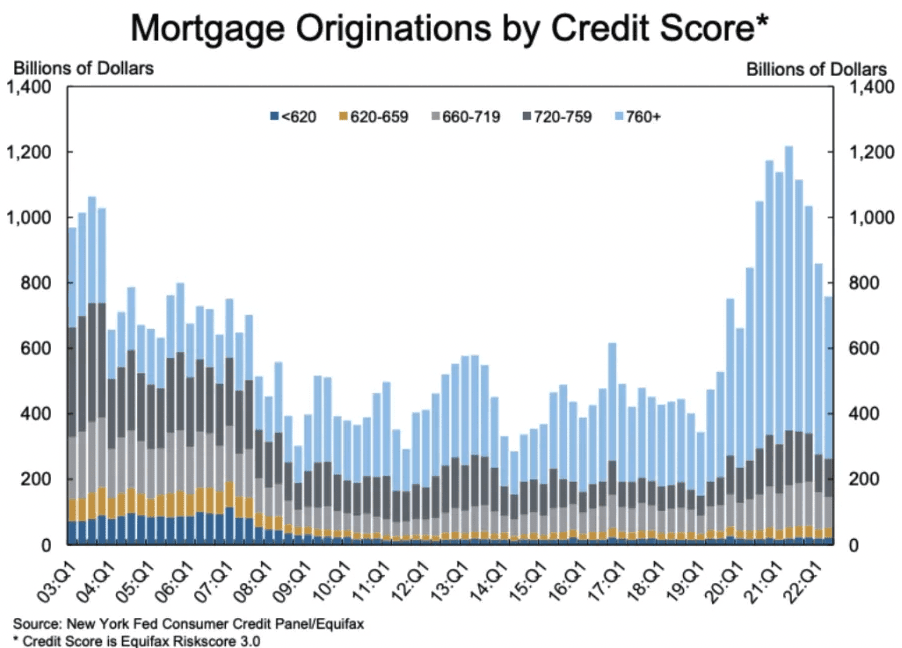

Rob Dyrdek:

Even when you think about the 2008 cycle, right? What was happening in 2008? It was the kid making 40,000 a year had a… Well, at least out in California. The kid making 40,000 a year got an all interest loan and had to put down like 5% for a house for 300,000. He sold it for 450,000 and then bought a $600,000 house. I watched people that had no business owning $800,000, $900,000 houses out here flipping their way into the house and then losing all of it. You know what I mean? Thinking like, “Oh, I’m going to keep doing this over and over.”

Rob Dyrdek:

I watched a friend become worth millions. This particular person was a personal trainer. I watched them begin to get in and over leverage all the assets to keep buying more, be worth millions, and then lost all of them to zero because of not understanding how dangerous that leverage could be. And in that era, everybody was a mortgage broker, right? Everybody was selling mortgages. Everybody had a big house with a ton of equity in it before that thing imploded. The same way now, the big wave for this cycle has been everybody’s a real estate agent. You know what I mean? That’s sort the other arbitrage of the money that’s been being exchanged in sort of the flipping world, if you will.

David:

Yeah, we saw similar patterns happen in the NFT space and the cryptocurrency space. Bitcoin caught on and then there was a whole bunch of other like… I mean I’m not a crypto expert, but there was a bunch of people just made a coin, like, “Let’s just make up a coin and let’s just say it’s worth this.” FTX is in the news right now. That was a huge scandal. When you look at how that thing fell down, it’s almost laughable. This guy made his own coin and then leveraged against the coin that he created that he gave his own value to go borrow money to buy. How on earth did that get this far? His company paid to have the naming rights to I think the Miami Heat or to some stadium. Wild, wild professional things that was just based on a complete sham. And I love the point you’re saying, these fundamentals of building wealth don’t change. You don’t get around it. You can’t cheat your way through this.

David:

Now another thing that you’re very, very big on that I think is incredibly valuable to share, just like what we talked about, is rather than just making sure you invest your money into scarce resources that are not easily replicable, like a coin you could just create on your own, is the understanding that your other scarce resources are your time and your energy. You cannot just create more energy or more time. You have what you have. They have a huge impact on the quality of life you’re living. You’ve mentioned that several times. “How do I optimize my quality of life?” Can you tell us what your system is for making sure that you get the most out of the other resources you have other than just money?

Rob Dyrdek:

I mean, look, I kind of look at my entire life as one big integrated system, right? That system is basically exchanging time and energy for everything. And so the first thing that I did is I began to look at my life as this ongoing daily, weekly, monthly and yearly rhythm and I began to design my time. It eventually scaled to the point today where I track every bit of my time and tag it and it pumps into a dashboard so I could tell you exactly where I spend every single hour of my life over the last three years, right?

Rob Dyrdek:

And what that does is when you get to that level of designing time and then continually optimizing time, time slows down for you and now you understand the value of your time in a very clear and deep manner that it makes it so much easier to say yes and no to things because you’re looking at it through the lens of first, second, third order consequences for committing to something beyond just committing to just going, “I’m going to go to this movie tonight” versus, “I’m going to start this new company. Okay, what is the time long term that this is going to take from me?” But if I design my time, track it all and understand it, that is then calibrated through qualitative and quantitative data.

Rob Dyrdek:

So every single day I track how I feel zero to 10 about my life, my work and my health. And by putting a number to how I feel about my life, my work and health, this now gives me over the long term insight to what things would pull and take energy from the quality of my life through the lens of what’s happening in my work, how I’m taking care of myself and what’s going on in my life. And if you can imagine, I’ve done that since 2014. My numbers used to be so low and I would see these same things that were constantly bringing me down and I just slowly began to get rid of them and optimize my time against my energy and then became a more evolved, happier human being. And then along that way I began to see like, “Oh man, if I stay committed to my health, the results are a much more organized, efficient use of my time and higher qualitative numbers.”

Rob Dyrdek:

So I began to track in my every single day, “Did I get up at 5:00? Did I brain train? Did I meditate? Did I get in the gym? Did I eat clean? Did I take my supplements and did I not drink?” And by tracking that every day, you can imagine when I look at my life, I look at a percentage of how disciplined I was, so quantified discipline. I look at how happy I was through a qualitative numbers. And then I can look at exactly where I spent my time over the time of those triangulated numbers to drive home how truly happy I am when I stay disciplined and focused on an ongoing basis. Way more complex than you expected, but that’s just how far it goes. You know what I mean?

Rob Abasolo:

Okay. So you track things like mental things, you track obviously how long do you spend watching Robuilt YouTube videos, you track your fitness, all that kind of stuff. How do you actually do it? Is there a system? Is it a spreadsheet? Is it a mobile app? How does one get started tracking?

Rob Dyrdek:

Yeah. So for me, I just basically used everything in my Google Calendar. So I tracked all my time. And then in my calendar daily schedule, then I say how long I slept and then I have an aura ring that tells me the quality of that sleep, I have a number. Then it has a readiness score that I track. Then I put in like, “Did I do my core six?” I just say yes or no. And then I ask my wife to give a rating every day so I have insight on her. And then I weigh myself every day so I have body composition to tie against all of that. But I had a programmer come in and write a script over top of my Google Calendar that pulls all of that data and then puts it into a Google Sheet so I have it all in dashboards on an ongoing basis that I just did for myself.

Rob Dyrdek:

And so again, I know how effective this deeply intentional way of living and really using qualitative and quantitative data for motivation and insight to live a better future present experience. And so one of the big projects I’m on now is building a software that anybody can build their version of it and begin to create that discipline by design and be able to create more of a harmonious high quality existence through their own framework, but having the support of a software, because the way that I do it is pretty complex.

Rob Abasolo:

Okay, I have to ask. Do you track how much time you spend time tracking?

Rob Dyrdek:

No. And again, I should because then it’s like, “Oh my God, I just wasted my whole life tracking tracking.” But again, it takes no time, right? It’s about five minutes in the morning when I get up because it’s all fully automated. It seems hard to you because you’re like, “Oh my God, think of what are all those things you just said? How could you even do that?” But it’s effortless, yeah, because it’s systematized and automated. And then just all of these, my entire life, I refer to it as the machine mindset. How can I either design, automate and optimize every single aspect? It’s either create a system or hire a body to get back more time and energy, right? And I just do that over and over in every single aspect of my life.

Rob Dyrdek:

I shoot 252 episodes of television a year. It is 4% of my time. And to give you an idea of how much 4% of your time is on your scale, that would be if you just did one thing a day for an hour, that’s 4% of your time. And for me, I have optimized the way that show is created, ran, shot and delivered to where it takes this very minimal amount of energy and effort. And then I tie that back to the ROI of what I get per hour from an ordinary income standpoint, which I can tell you I will never make that much money per minute in anything I do anywhere in my life for the rest of my life.

Rob Dyrdek:

But if you look at those two together, if I shoot 252 episodes a day for 42 times a year, basically four times a month and for five hours a day, and you then divide that into the amount of income that I make from that, then you look at my real estate income and the amount of time and energy I put into that, those are two extraordinary ROIs on time and energy as it relates to earning money. You know what I mean?

Rob Dyrdek:

And when you think about life through that lens and you think about the energy it takes and time it takes to earn money, it really, really shifts your perspective on where you should be dedicating your time and energy to earning income and how you can continually look for ways to do it in a more efficient, more optimized way regardless of what you do. You know what I mean?

David:

I recently had an epiphany on what you’re talking about, not nearly to the level you are. This is very good and humbling for me, is like every time I start to think I’m doing something good, you see the black belt at this thing. So it helps keep you in perspective, which is also awesome you’re sharing this for all of us because it gives us something to work towards. But it was just on the importance of tracking.

David:

So I’m writing a book for BiggerPockets right now that’s just about how a basic blue collar way anybody can build wealth if they want to, how you can develop the discipline to save money and delay gratification, how you come up with a plan for paying off debt, putting money aside than how you get good at making money. There’s actually a skill and a pattern that you can pick up like what you were describing. You came up with a plan to build this production company. That wasn’t an accident that you came up with working backwards, all right? They sell for six times EBITDA. How do you build EBITDA, right? That’s a great question to ask. Most people don’t put a plan and work backwards. They just keep stepping forward hoping that they step into the right opportunity and it happens for them not knowing where they’re going.

David:

And then you invest the difference. You don’t just like, “Ugh, should I pay $12,000 for this late night infomercial on how to flip $80,000 house program? Because I don’t want to have to learn how to earn money and save money to invest it. I just want to be able to do it without that.” One of the epiphanies I had was how important tracking is, especially if you’re not disciplined naturally in that area. So for me, I make enough money that I don’t really have to track where I spend that money. And I never really thought enough about how important tracking was because it wasn’t a struggle for me. I don’t like spending money. Like you said, you make a hundred million, you live off 2 million. If you stop tracking your money, you wouldn’t go broke. The habits you have would sustain you. But other people are just not naturally good at money or no one’s taught them how money works. This is a huge struggle. They don’t know where their money’s going.

David:

I recently realized that I have struggles in other areas where I do need to track what I’m eating. There’s certain people that just don’t struggle with food. All they ever want to eat is kale and celery and they don’t need to track how much kale they eat that day because that’s all they eat. But if you’re someone who’s struggling in that area, tracking is incredibly important. In fact, I’ll never be in good shape or fit if I’m not tracking what I’m eating, when I’m working out. That’s the thing I have to do.

David:

And Rob, something clicked where I was like, “Oh, if I could get people who are bad with money to track their money, they would see the results that I get when I’m tracking what I’m eating or I’m tracking like… Whatever your struggle is. You don’t spend enough time in your relationship, you got to put more time into it. What you’re describing is you’re tracking everything. You’re like, “If it’s important to me, I freak and track it. I don’t leave it up to fate. I don’t want to wake up having a bad week and I lost seven days of my life and I don’t know why. And I can’t fix it because I don’t know what went wrong.” You’re actually tracking the things that would lead to a better life.

David:

I don’t know. This book I’m hoping will help a lot of people because it’s just focusing on, “Where’s your money going? Do you know what you’re spending money on? Do you look at your credit card statement and know how much of it went to rent, how much of it went to food? How much of it went to dumb (beep) that you didn’t need and didn’t even make you happy anyways? You traded eight hours of your life to get the money that you spent on that pair of shoes that you don’t even think about anymore, whereas that could have been going towards paying off debt or something else.

David:

Is there anything you can share with the audience just on how important tracking has been in the quality of life that you feel you’re leading?

Rob Dyrdek:

Let me say a couple things to this. You see it in the power of tracking and this thing that you need to see it, you need to be motivated by you checking off the box and looking at it. It motivates you, it keeps you honest, it drives you for something that’s more difficult to stay consistent and disciplined at, right? And then your goal through that process is to go from trying to be disciplined to it being a habit, to it being intuitive, right? That is the process we’re trying to drive all aspects of our existence. But you cannot change one part of your life without changing all of it. You are a fully integrated, multi-dimensional being. And having measurement and tracking in all aspects of your existence is the only way that you can grow into the ideal version of yourself that only you can design, define and then build the measurement to get there. That’s the holistic side.

Rob Dyrdek:

Now, from the financial side, it was my Achilles heel. Why I was so lost in breaking even is I never even looked at the money. Money was too hard for me. I just gave all my money to people to invest it for me. I had no idea if there was a rate of return. I knew nothing. I had no plan. I was the person you are writing the book for. And then the moment I learned money, I began to understand my expenses, I began to track it. In my case, I basically hired a CFO consultant to build a personal financial model and began to treat myself like a business and began to build strategies and plans for the money I would earn and then what I would do with it and what it looked like post tax and where was I going to spend it.

Rob Dyrdek:

Once I finally had that clarity, then I finally understood why I was keeping my expenses low and what the purpose of investing this money was and how I expected it to grow to eventually keep me in this place that gave me financial freedom, right? Because at the end of the day, if you can have the hope and the energy that you’re leading to a place of financial freedom, that is what you’re seeking as opposed to earning income till you retire. And you need to design that, track that and measure that because the universe will conspire. When you begin to have that organized thought and begin to put that type of energy and organization into how you’re measuring where you want to get to, man, the universe conspires to bring more opportunity and more income and different things and different investments that come along that help accelerate you towards that end goal that is ultimately financial freedom.

Rob Dyrdek:

And if you can track and know that like, “Okay, it’s 20 years from now” and then you have two good years and now that 20 years just went down to 12 years, guess what’s going to happen? You’re going to be even more motivated to spend less and invest more and get there even faster. And then you’re like, “Oh my goodness, I’m five years away,” right? And then when you get to five years, you have reached financial freedom which gives you financial harmony, personal security, self-worth, belief in the ability to create your own reality and you’re just getting started. You’re not just going to stop right there. You have learned so much into that point about money and about wealth that you are going to continually see where like, “No, I can grow it to here and then I can eventually do this and all these things you never thought possible.” That’s what happens when you build a framework of growth, letting measurement be your guide especially on the financial side and then you grow into it over time.

David:

Wow. I feel like Papa Doc at the end of 8 Mile right now. You just save the best rap for the end. That was really, really good. I’m actually going to spend some time thinking about that. Thank you, Rob. I know you attract every single minute of every single day, so we’re going to be respectful of your time. We’re hoping we can have you back some time. Thank you for being here. Thank you for sharing so much of what’s actually happening in your personal life. This isn’t the stuff people get to hear if they just watch you on MTV or anywhere else that you’re on TV. So we appreciate the transparency and what you’re sharing here. Robbie Abasolo, do you have any last words for we let Mr. Dyrdek go?

Rob Abasolo:

I don’t, man. I’m inspired. I’m horribly bad at tracking because I’m scared of the results, but because of this episode, I’m going to do it. Because every time I track something, I would realize how bad I am at the efficiency side.

Rob Dyrdek:

Hey, but that’s where it is. You also get to begin to see where the growth is. Then you get motivated by getting more and more consistent and seeing your numbers grow. That’s where the motivation is born and grown rather than being afraid where you just let life happen. Live it with intentional, track it, measure it, and grow into it. And you will be extraordinarily disciplined.

David:

Rob Dyrdek for president, everybody.

Rob Dyrdek:

Thank you, guys. [inaudible 01:10:22] it here. Appreciate it.

David:

All right, thank you Rob. Last question. Where can people find out more about you if somehow they’ve been living under a rock?

Rob Dyrdek:

It’s just robdyrdek everything. Dotcom, Twitter, Instagram. It’s just robdyrdek living life in a harmonious high quality way.

Rob Abasolo:

Oh wait, also you have a podcast, Rob, right? What’s the name of your podcast for everyone at home?

Rob Dyrdek:

Yeah, my podcast is Build With Rob. Essentially, it is basically everything that we’ve talked about today. I even recently did a podcast on financial harmony and what it means, but it’s really about living with that machine mindset and learning how to systematically fuse art, science, and magic to manufacture an amazing existence. A little short 25 minute episodes of just sort of my philosophy on an ongoing basis.

Rob Abasolo:

Well, that’s amazing. Well, just don’t ever come for Robuilt that name is taken.

Rob Dyrdek:

I see it. I see it.

David:

All right. Thank you Rob.

Rob Dyrdek:

Appreciate you guys, man.

David:

And that was our show with Rob Dyrdek. Rob Abasolo, the other Rob, what are you thinking?

Rob Abasolo:

Hmm, mine melted several times. I feel like I was watching the podcast out of my body. That’s always when we have a really good guest on the podcast, I always feel like I’m not really here. I’m like floating above my body, watching myself just transform into the next level of Rob. So I’m excited. I’m excited to transform into Rob Dyrdek.

David:

What does your cloth look like from an angle looking straight down at it?

Rob Abasolo:

Honestly, lots of volume, but that’s just mostly because of my conditioning routine.

David:

Yeah. We need to see a YouTube video on that in the future by the way. That’s whatever everybody asks, the one question. By the way, do you make videos where you start off by saying, “Everybody asked me” and then answering the question that no one actually asked but you wanted to make the video at? Have you ever done that before?

Rob Abasolo:

All the time. Are you kidding me? It’s the greatest hook ever. Look, I’d say the most common question that I’m asked is… Blank. And then it’s like… Yeah, I mean it’s probably true. I don’t track it. If I tracked it, it could be true.

David:

I think for some reason I don’t mind the most commonly question I’m asked as, but everyone always asks me, it always gets under my skin. Because it’s always like everyone asks me, “How do you get amazing abs like this?” Everyone always says, “How are you so incredibly better than every other human being?” And you know, “The truth is…” And then they sell you on whatever their course is.

Rob Abasolo:

Yeah. Okay, well now I know. Now I know [inaudible 01:12:32].

David:

But you know who did not do that was Rob Dyrdek. He didn’t have to tell us anything about himself because his actions speak for themselves, the level of success the guy has, the lessons he’s learned. I think a lot of people probably for their first time were being exposed to, he’s not just the funny guy on Rob & Big, right? He’s incredibly smart, brilliant level business acumen.

David:

What’s cool is someone who’s so good at the thing, then doesn’t value it. You never hear Rob talked about how much money he makes as a way of saying, “This is where I get my value from.” He’s almost saying, “Yeah, I have to have financial harmony. Now that I have all this money, it cannot actually affect me negatively.” He’s tracking, “How do I feel about the money that I’m making?” And he’s putting more of his emphasis on did he work out, did he train his brain, did he eat his supplements, did he get enough sleep, did he drink any alcohol that day. It’s not that it has nothing to do with making money, which would be very tempting because he’s so good at making money to always focus on it.

David:

Was there anything that you took away from this that you’re going to implement in your own life moving forward?

Rob Abasolo:

You know what? There’s a couple times in the last year where I looked at my bank account and it was the same and I was like, “Wait, I thought I made money this month.” They were break even months for me. I mean, I don’t want to get into it, but basically it was just like I was investing a lot, I was deploying funds, I was just really trying to grow my businesses and just carelessly doing that. I didn’t realize that I was breaking even. And so that actually kind of lit a fire under my butt to track. And I’ve been more carefully tracking.

Rob Abasolo:

And then now I’ve recently fired a bookkeeper. I just hired Matt Bontrager, we just had him on the pod a couple weeks ago. I just hired him. He’s going to be officially doing… Not him specifically, but his company’s going to be doing my books.I’m actually more wanting to get super in the weeds of financial tracking with real estate a lot more than I have been because it gets a lot harder in the future if you don’t start a lot sooner. So yeah, it’s inspiring to see that there is merit to actually tracking everything else in life too. So yeah, I’m into it.

David:

Awesome, man. Well you did a great job today. Rob gave a fantastic interview. This was just a great time. So hopefully we can have him back and hopefully we can get more great guests like that.

David:

If you enjoyed today’s show, please do us a favor. Leave us a rating or a review. If you can log in to wherever you listen to podcasts, whether it’s Spotify, Apple Podcasts, Stitcher, whatever it is, and leave us a five star review, that’s all that we would ask for. We bring you the content for free and it really, really helps us get guests like Rob, because he’s not going to come on here if we’re not ranked at the top of our genre, and that’s what we got to do to stay there.

David:

Thank you listeners for always being here and spending your time getting your education from us. Rob, if you’re listening to this, thank you for being on the show. And Rob Abasolo, thank you for being such a vibrant thing.

Rob Abasolo:

Thank you. Thank you. Thank you.

David:

All right. This is David Greene for Rob, the other Rob, Abasolo, signing off.

Help us reach new listeners on iTunes by leaving us a rating and review! It takes just 30 seconds and instructions can be found here. Thanks! We really appreciate it!