Some agents will thrive while others barely survive in a post-NAR lawsuit world as real estate agent commissions are threatened once again. But it isn’t only agents getting hit hard this week. Banks have been “rocked” by real estate losses, primarily commercial real estate, as loans come due, but investors aren’t able to pay. One bank saw its share price slide by more than fifty percent this month as earnings reports showed a major loss from lending this quarter.

Dave:

Hey, everyone. Welcome to On the Market. I’m your host, Dave Meyer, and today we’re going to be digging into three of the most pressing and important headlines facing the real estate investing industry. And to do that, I have my friends, Kathy Fecke, James Dannard and Henry Washington joining us. Kathy, how are you today?

Kathy:

Doing great. We survived the atmospheric river, so all good.

Dave:

What is an atmospheric river?

Kathy:

Apparently when the clouds open up and just dump a lot of water.

Dave:

Rain? Is that just a fancy term for rain?

Kathy:

Yeah, life-threatening rain in California.

Dave:

Okay. Well, this is maybe why on this episode we’re going to be digging into headlines so that we don’t just see things like atmospheric river and read too much into it when all it is is rain. We’ll be doing the same thing, hopefully, for the real estate market to help you not overreact to any potential headlines that you’re seeing. James, how you’ve been?

James:

I’m good. I took off in the atmospheric river last night. It was a bumpy ride out.

Dave:

It’s almost like it’s a normal weather phenomenon. All right, Henry, it’s good to have you on as well. Hopefully down in Arkansas you don’t have to make up fancy words for just normal weather.

Henry:

Yeah, today I am here despite the atmospheric brightness that we are experiencing. I believe some call it sunshine, but down here in Arkansas we like to get pretty fancy.

Dave:

We got a real meteorology team over here. Thank you for joining us. All right, well, we do have a great show for you all today. We’re going to be covering, like I said, a couple of major headlines facing real estate industry, like what’s going on with the big NAR Sitzer/Burnett lawsuit. Updates on credit markets and what’s happening with banks and are they lending to real estate investors. And we’ll be talking about fresh data about the labor market that we’re seeing here in 2024. Let’s just jump right into our first headline, which is Keller Williams reaches a $70 million settlement.

If you remember, there’s been this ongoing lawsuit against NAR and a lot of the largest real estate brokerages in the country alleging that they colluded to keep their commission structure in place against the best interest of home sellers. We did get a jury verdict back in the fall that found NAR and some of their co-defendants liable. Now we’re seeing Keller Williams, one of the largest brokerages in the country with over 180,000 real estate agents reaching a settlement to address these antitrust claims. Now, it seems like this story just keeps evolving. James, as an agent, what do you make of the updates in this story? How are you thinking about Keller Williams behavior here and what it means for the next few steps that might unfold from this lawsuit?

James:

I feel like we’re going through an evolution of broker fees. I think that happens in every business, every service and what we’re seeing now is the traditional way and the assumption of doing business might be getting changed, where it’s like, “You’re a broker, you just get paid this and you move on.” The fact that they settled does, I think, make a pretty important impression on what’s going on right now and it could open it up for other lawsuits. They did admit to no wrongdoing and they were just trying to get this thing gone. It looks like they settled for the 70 million, they’re trying to move on and now they’ve agreed to change their business practices. I don’t think it’s going to impact us in the next 12 to 24 months, but over the next four to five years we’re going to see this evolution of broker fees, which I don’t have a problem with whatsoever, because if you really look at the history of brokers, back in the ’90s, they didn’t have the internet.

They had books and advertising and brokers would meet together and they would have to go over the inventory and then bring it out to the market. It was a lot of work, and we still get paid the same percentage today with a lot higher numbers. We’re getting paid well and I feel like this is going to be the evolution of the niche broker, and if you’re a niche broker with a high level of service or a specialty, you’re going to get paid well. And if you’re just pushing paper and putting signs in the yard, you might get paid a lot less and it could be going to that Redfin style model. I think people need to brace for it and don’t be delusional about it. I don’t think it’s going to have that much impact over the next 12 to 24 months.

Dave:

Well, I’m curious because, just as a reminder, as of right now we have this jury verdict that held NAR liable, but we haven’t heard from the judge exactly what this means. Kathy, do you think this move by Keller Williams is trying to head off a really big injunction from the judge so that they don’t change everything and they’re saying like, “Okay, okay, we’ll change a little bit.” And that way it won’t disrupt their entire business model?

Kathy:

Yeah, I don’t want to speak for them. I do know that NAR and HomeServices have refused to settle. They are taking a different bet. They think that they’re, I guess, going to get a better deal if they keep fighting. Again, I’m trying to read minds here. I have no idea what’s going on in those boardrooms, but I can tell you from personal experience that we had to settle a case once where we had absolutely nothing to do with it. We weren’t involved, we were just named and our attorney said, “This is just a business decision. You have to look at it just like a business. You could spend a whole bunch more money trying to fight or you just put up your hands and say, ‘We didn’t do anything wrong but go away.’” It could be that’s what they did or they just thought it could be worse if we wait. I don’t know. When you go to a jury, you have a jury who may not know very much about real estate deciding your fate. Again, it was just a business decision.

Dave:

Henry, have you noticed any changes in the way the agents you work with are operating? What are you seeing?

Henry:

No, no changes in the way they’re operating so far. I agree with James. I don’t know that we’ll see any major changes in the next one to two years, but I do think that the industry is going to change and I don’t believe it’s a bad thing. It’s like any other industry. You typically get paid based on performance and level of service and customer service. I think those agents and brokerages who are going to provide exceptional customer service and who are going to go above and beyond in their business practices are going to not just survive but thrive in a market where you’ve got to provide those things in order to make money now. You didn’t have to provide that before, right? You were going to get your percentage as long as you were the named broker, agent on that deal. You have to think about home buyers, especially first-time home buyers. They’re called first-time home buyers.

They have no idea what a good level of service is from a real estate agent, right? They’re just trusting that this person knows what they’re doing and they just have to take what’s given to them. It’s not till they’ve been through maybe their first deal and then they get a better agent on their second home purchase and then they realize, “Oh my goodness, our first agent just really didn’t do much compared to the level of service that we’re getting now.” I think that it’s just going to mean that, like I said, the better agents who provide a good quality of service and operate a better business will do well.

Kathy:

Yeah, my concern is that people won’t get a buyer’s agent and they’ll either try to do the negotiation on their own or they’ll use the listing agent. My message to all you out there who maybe have not bought your first property, be really careful about going to the listing agent and using them to double represent you. That was our very first deal. I didn’t really know back then, this was a long time ago before I knew anything about real estate, and I didn’t know the difference between a buyer’s agent and a listing agent. I just went with a listing agent. In retrospect, they weren’t serving me. They were hired by the seller. They did not negotiate on my behalf because that would be… How do you do that when you’re representing both? It’s like getting an attorney to represent two parties, speaking of the NAR situation.

That’s my concern is don’t be lazy, don’t just use the listing agent because they are not necessarily working in your favor unless you’re an expert. Now I do that just so they get more commission and I get the deal, but hopefully this means that people will get a buyer’s agent and get one who really truly will represent them and understand what that means. What do you even need a buyer’s agent for? Hopefully to help you negotiate. To make sure that you’ve got all the proper inspections. Hopefully someone who knows the area, knows the history. Really, it comes down to that. What does a buyer’s agent do besides have really beautiful marketing and maybe great hair and a great car?

Henry:

Yes, I agree with you, but I think this is moving in a way that every other business operates. Hiring a real estate agent has always baffled me. People don’t do any research. They just pick the family friend or the person at their church or the lady who’s on your kid’s soccer team, other soccer team member, mom, right? That’s the level of research that they put into it. It’s always baffled me that that’s how it was done before. Going forward, it’s just going to be you have to do the same amount of research that you would do for anything else. If you’re going to hire a plumber, you’re not just going to hire some Joe Schmoe off the street. You’re going to go ask people who you trust who are in the industry or ask people who have had plumbing work done recently. Who did you use? What was your experience like? Can I have their phone number? And then you might ask a series of qualifying questions when you get them on the phone. You just have to do this normal now.

Dave:

Yeah, that’s so true. This whole situation reminds me, I guess, it was probably 10 or 15 years ago when Uber came around and certain taxi drivers and drivers got with the times and figured it out, and then there were some that just stuck their head in the sand and were fighting against it and were suing and they were just fighting upstream. To me, it just feels like that’s what NAR is doing. KW, a lot of these other brokerages are settling and, I think, are trying to adapt to the times and maybe ready to move on a little bit. Then there are others who are just really digging in hard when, at least to me, it feels like the winds have changed, are already… What am I saying? Winds have changed. Is that a saying?

Henry:

Atmospheric river has changed path, it’s now flowing upstream.

Dave:

The atmospheric river has changed and now things are changing (beep). This has gone off the rails. Should we do that again?

James:

Yeah, I think it worked. I fully understood what you were trying to say, Dave. The money is stopping flowing for these brokers that don’t offer additional services.

Dave:

Yeah, I think people have to accept that things are changing and there’s still a way to make money, as Henry just pointed out. It’s just you need to adapt to the new time, which is true in every single business.

James:

Every investor does use numerous brokers, right? Depending on whether you’re trying to get the deal or not. I’m a broker, sometimes there’s brokers bringing me deals and they’re off-market and I’m being buyer in this scenario, not my service fee. I don’t really see this changing too much for investors. If anything, it might actually steer more deals their way because they might just go straight calling the listing broker. To Kathy’s point, when you’re going direct to that listing broker, you do want dual representation if you can get it. Then you are protected. They have a fiduciary duty to watch over you. But investors are a lot more savvy than your normal homeowner because they’re doing a lot more transactions. For not having representation, they don’t care half the time because they’re buying it a certain way and that’s what they know to buy, and they’re doing their own feasibility inspections anyways.

I think it actually might push more deals towards investors. The one thing I can see this affecting though is off-market transactions because a lot of times when you’re negotiating direct to seller is you’re looking at, “Hey, this is a cash convenience sale.” You have all this cost when you sell, which is anywhere between 5 and 6%. Many times those sellers will give you that credit to get that discount that you need, right? And it’s that inch game where you’re just trying to get that net number to them where they’re happy and we can [inaudible 00:13:05] it. Now, that’s going down by half. It actually makes a much bigger negotiation for wholesalers and brokers on direct to seller, but I think on-market it’s going to push more deals investors away, but off-market it actually could add a bigger gap and less off-market deals could be getting done.

Dave:

All right. Well, thank you. I appreciate that insight, James. We’ll all just have to wait and see how this goes over the next couple of months, but I think those are some wise things to keep an eye out for. All right, now we’ve covered our first headline and we will be right back with two of the most important headlines impacting the real estate industry after this quick break.

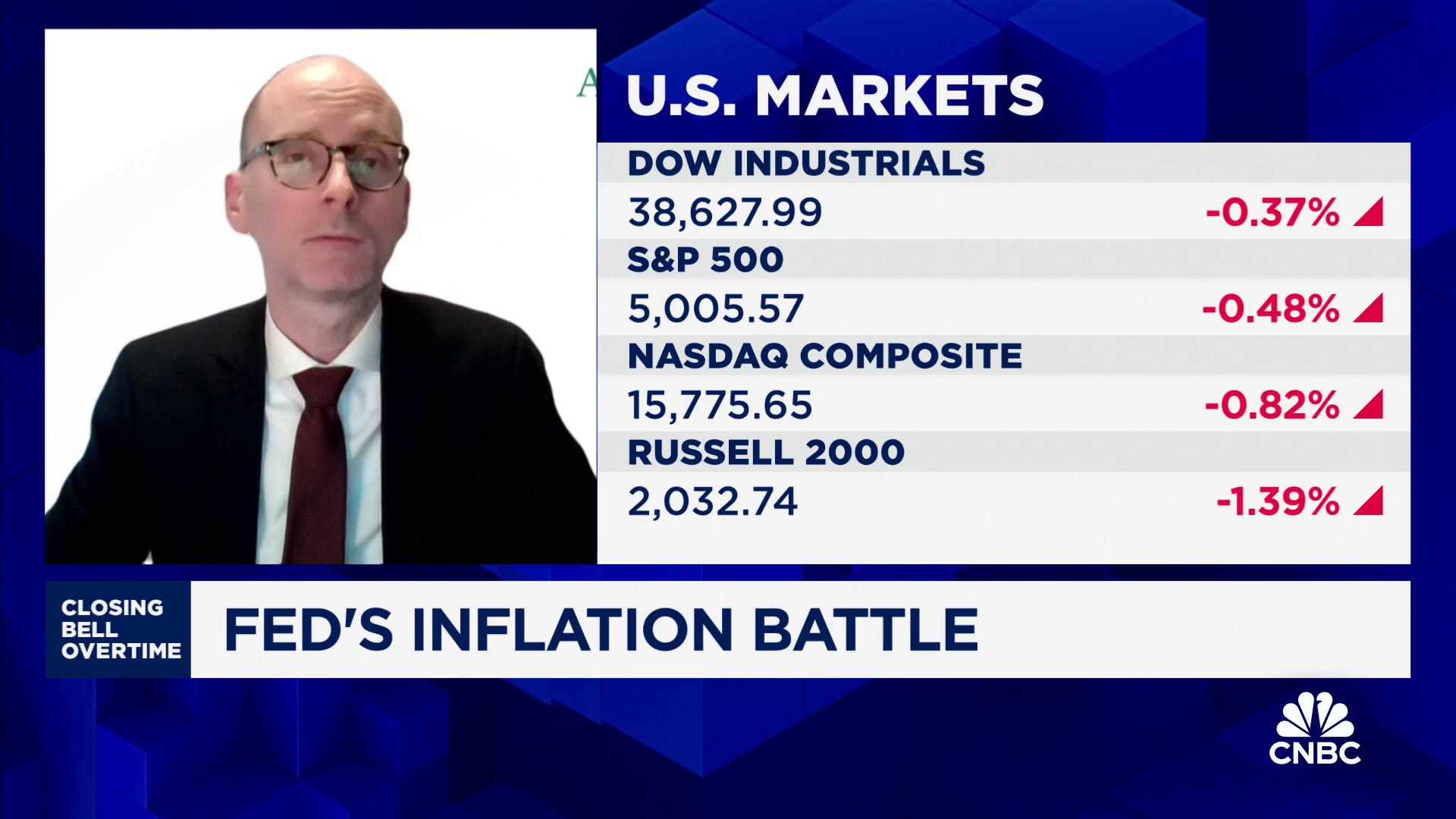

Welcome back to On the Market. Let’s move on to our second headline, which is that, “Banks are being rocked again as real estate losses mount.” This article talks about a specific bank, New York Community Bancorp, where shares plunged a whopping 38% after posting a $252 million loss in just the last quarter. This was higher losses that they were expecting and they were already expecting pretty big losses on commercial real estate. This is a little bit concerning, but at the same time I feel like we keep hearing about this pending apocalypse with commercial lending, but so far it’s been contained to a few banks. Kathy, do you think this is a sign of more trouble to come in the future?

Kathy:

I think it’s a sign of bad business practice, honestly, and lack of diversification. I think in the case of this New York Bank, the bulk of their portfolio was in office. COVID obviously accelerated the work from home environment, but it’s been a trend for a while. With business stay diversified. Make sure you’ve got plenty of reserves on hand and don’t over leverage, and all the things that people should know about. To me it’s like, “I wouldn’t have done that if I were the owner of the bank.”

Dave:

James, with your commercial deals, are you noticing any big change recently in commercial practices? Because I know they’ve changed over the last few years, but in the last three months has anything altered?

James:

It’s funny, I read these headlines and some of it, I believe, is just hype and it’s for a specific type of asset and product in the market and they make it seem doom and gloom with these local commercial banks. But we’ve had the easiest time getting access to capital from commercial banks on townhome sites, apartment deals. It has not been a struggle to get financing. We actually just got a development loan where we perform about 20%. That we were going to leave 20% of the total project in. The banks appraised it. They ended up giving us a 90/10. They gave us 90% leverage with an interest reserve in there for 12 months. And because their loan-to-value position was good and they liked us as a borrower, I think if you have that long-term relationship, don’t always shop your banks guys. Staying with the same bank and getting that consistency with them, they’ll lever you more.

Even all this doom and gloom news that the banks aren’t really lending, they don’t really want to. If they like you, they’re being a little bit more aggressive. I think build those relationships, you can still get debt, especially on residential. Apartments, townhomes, development, single family, you can get that. Office? Yeah, it’s not the most desirable, but even right now we’re about ready to list an office building, small office. We didn’t think it was going to get much traction. We talked to five banks and they all pre-approved it for a purchase. If you have the right product in the right area, banks will still lend you. It’s not as bad as what I’m seeing in the articles. But I will say some of these guys have made some bad moves and lost some serious money, because I was even reading that article, it’s like, “Some small ripples.” I’m like, “33 billion is a small ripple?”

Dave:

It’s another atmospheric ripple.

James:

Yeah.

Dave:

Henry, I know you work a lot with local banks. I’m curious, how would you advise investors who maybe don’t have the track record that you have or James has with local banks? How do you establish those relationships to create that credit worthiness in the eyes of these banks?

Henry:

Yeah, that’s a great question. Well, first I want to piggyback off James and say I completely agree. I’m seeing the exact same thing. I’ve got two deals that I’m closing on at the end of this week, both with local banks, both with creative aspects to them. One, I’m doing an owner carryback for part of the down payment portion. A lot of banks, if they’re being tight, they’re not allowing you to do some of those things, right? But this bank is totally fine with that. Another bank we’re closing on a deal where we’ve got seller credits involved. One of these banks is only my third deal I’ve done with them and the other bank it’s the very first deal I’ve done with them. I think what you’re seeing is these banks who are smarter, who may have some of these office assets are trying to diversify and want people who are doing really good deals to bring those deals to them so that they’ve got some different asset types in their portfolio that have a good amount of equity in them.

To answer your question, Dave, you’ve got to speak to these banks in the what’s in it for them, right? And the what’s in it for them with these small banks when you’re brand new is you want to bring them a deal that’s got equity in it because that’s a lower risk investment for them. They want low risk loans in their portfolio. They have to loan to stay in business and if they’ve got a loan to stay in business, they would much rather take on low risk loans in a residential space because then if they end up with those assets, they’re not really stressing about it. They can sell those assets and recoup their money. They’re not losing their shirt like they are in some commercial spaces or in some office commercial spaces. You’ve got to have a good deal. That’s first and foremost.

If you’re buying off-market, you can go and get a deal and then bring a good deal to them. If you’re buying on-market, you’ve got to get a pre-approval first and a bank can give you a pre-approval, but make sure when you’re going to ask for that pre-approval, you’re talking to them about your strategy. What is it you’re going to look for? “I’m going to look for single and small multifamily that I can get at a 30, 40, 50% discount. I want to bring those assets to you and have you finance those deals.” The second thing that you want to mention to the bank is that you are looking for a long-term relationship. Banks need deposits and they need to loan.

Share with them your plan. “I’m looking to buy these types of assets in these markets with this type of equity in it, and I will bring my business bank accounts here to you and we can have a relationship where I keep my deposits here, you continue to help me grow my business and I’m helping you grow yours.” Right? You’ve got to speak to them in the what’s in it for them. You can’t just go and say, “Hey, give me some money. I’m trying to do some deals.” They need to know what you’re trying to do and what’s in it for them.

Kathy:

100%. Banks are in the business of lending. They’re desperate to lend right now, but it’s the basics. You got to have a good deal. They got to have security. Land development, that’s all riskier, so that’s going to be more expensive or more difficult to get. That always has been… Well, not always. They’re going to look at the risk level and in residential, there’s not a whole lot of risk there right now. Just bring them a good deal, especially if you’re putting money down.

Dave:

This is such a good conversation because I think as Henry just brought up and Kathy reiterated that. If you understand how banks make money, you can very easily work with them. This is so important with any business, any contractor that you work with, any lender, any agent. If you understand what they’re looking for, then you can adjust your own strategy, your own requests, your own proposals to them accordingly. And as Henry and Kathy just stated, there’s this term in finance where people say that banks are either like, “Risk on.” Quote, unquote. Or risk off. That is basically just a shorthand for how much risk financial institutions are taking. Right now most financial institutions are quote, unquote, “Risk off.” Which means that they’re not going to be lending on the type of projects Kathy just said, development or land deals as readily, but they have to make money.

If you can bring them low risk deals, they’re going to be thrilled by it. Thank you both for bringing that up. I think that’s a really important point and really helpful tactical advice here for everyone listening that if you are worried about being able to finance your next project, think about the relative risk, just take a minute and sit, and put yourself in the bank’s position and ask yourself like, “If I were the bank, would I lend on this deal?” And if the answer’s no, maybe bring them a different deal and go find something else. We’ve now hit our first two headlines on Keller Williams settling the antitrust lawsuit and headwinds in the banking sector due to commercial real estate weakness. Stick with us because after this we’re going to be talking about the, spoiler alert, robust labor market.

Welcome back to the show. All right, with that, let’s move on to our third headline, which is about the labor market. We just can’t stop talking about this labor market because it continues to surprise. The headline is that the January jobs report showed US job growth surging. The labor market added 353,000 jobs in January 2024, which is the highest mark in over a year. We’re seeing strength across a lot of industries. High paying sectors like professional and business services accelerated and piled on 74,000 jobs. Healthcare added 70,000, and we’re seeing wages growing faster than traditional historic rates above and beyond the pace of inflation. Spending power, after years of getting pretty hammered is starting to recover slowly. Henry, what do you make of this labor report and what it means for you as an investor?

Henry:

You know what? This is reflecting what I’m seeing here in my local market as well. I think I read that we added like 10,000 jobs last year and we have about the same amount of people moving to the area. It just shows the strength in the jobs market and some strength in the economy. I believe that that’s going to be beneficial for the real estate market. These people need places to live. A lot of these companies are not doing remote work or are lighter on remote work now. That means people have to move to these new places where the jobs are being added. They’ve got to have a place to live. They’re going to be buying homes. They’re going to be building homes. They’re going to be renting homes. We’ve also seen a 9% rise in appreciation here in home prices. I think it all plays in hand in hand. If there are jobs, people are going to need homes, and if they’ve got money to pay for them… It just speaks to a healthy real estate market.

Dave:

Kathy, how do you look at this labor market situation, in particular how it relates to the Fed and interest rates? Do you think this will change their calculus after signaling they may be open to a pivot and cutting rates in 2024?

Kathy:

Yeah, there’s no pivot in sight right now. This was a big miss by economists. They just cannot get a grasp on the job market and why it just keeps expanding and why it just keeps being bigger than expected. I have my theory on that, and the theory is that second stimulus package was probably not needed. It was a ton of money created and put out in the economy and it’s still out there circulating. When you look at a deficit like we have today, we better have job growth. We better have something for all that money printing. That’s, again, my humble opinion on it. Lots of money circulating. It’s creating lots of jobs. How are we going to pay off that debt? Don’t know. Nobody knows how you’re going to pay off the debt, but at least we’ve got job growth.

Dave:

What do you think, James? Are you seeing confidence from buyers right now? Because it felt like for a couple of years, buyers were pulling back a little bit, not necessarily because of affordability, that was obviously a big part of it, but people also want to feel secure with their income before they make a huge purchase. Do you think the continued resilience of the labor market is going to increase in demand for homes?

James:

I think that always is going to be correlated. The one thing about this jobs reports is it’s so up and down every month. It’s like, “Oh, finally cooling.” Then it’s red-hot. Then it goes cooling. I swear two months ago it was saying it was way down. It was going in the right direction. I do feel like buyers are confident, but more, I do feel buyers came to life the last two weeks for sure. I think it has to do more with them just knowing that the Fed is saying, “Hey, look, we’re going to start going in the opposite direction at some point.” They think there’s no free fall. It’s funny because when I do talk to people about the job report, even real estate professionals are like, “Hey, the jobs report came out hot this month.” And they’re like, “Oh, what’s that mean?”

Dave:

Yeah.

James:

They’re focused on the now, right? Most consumers like, “What I experience now?” And at the interest rate, and they’re not looking at all the factors. But I didn’t think this was great news because if it’s this hot and it keeps going, even if it’s pulsated, they need stability. And I don’t think they’re going to start moving rates until there’s stability in the jobs market, the economy in general and not this surging. As investor, as we’re trying to perform out deals, that’s what we’re looking for, consistency and stability. Every time this goes up and down, it makes me a little bit more nervous because it could go the opposite way real fast and cause some market shifts.

Dave:

Yeah, that’s a great point. And just to remind everyone why we as real estate investors should be thinking about the labor market. Few reasons. One, first and foremost, labor market very correlated with overall economic growth. That’s really important. The second thing that I think has become more important over the last few years is thinking about the role of the Federal Reserve. We talk about the Fed a lot, but just as a reminder, they have two different jobs. The first job is to maximize employment. They care a lot about the employment rate, labor force participation, and the many different ways that you can measure and evaluate the strength of the labor market. On the other hand, their second job is to control inflation. Obviously they’ve been really focused on that element of their job the last couple of years because inflation got out of control.

But if you think about this job, you see a paradox here, because maximizing employment can lead to an overstimulation of the economy, which leads to inflation. But if you work too hard to combat inflation, that will slow down the economy and negatively impact the labor market and people’s ways of earning a living. The Fed is constantly on a seesaw. They are just going back and forth and trying to find the right balance between maximizing employment without overshooting and having a lot of inflation. That’s why these labor market reports are so closely watched by people like us and economists because they are trying to read the tea leaves and think about how the Fed is going to react to these labor market reports.

When you see strong labor market reports like the one that we’re seeing here, that, to me, at least signals, “Hey, maybe even though the Fed has said that they do intend to lower rates in the future, it might take a little bit longer because they don’t need to focus so much on preserving the labor market. That’s doing great, and they can keep focusing on the inflation piece, which is still above their target of 2%.” We’re still above 3%. That’s why we’re talking about this and why it’s so important, even though it might feel a little bit abstract from real estate investing.

Kathy:

Yeah. Also, how it affects us is people keep hoping that mortgage rates will go down and mortgage rates don’t go down when the economy’s booming. It doesn’t work that way. I think we can at least expect rates will be where they are, and I’m speaking mortgage rates, probably for a while because my guess is the Fed will keep the Fed fund rate where it is until they see things slow down a bit. But I can tell you in the markets that we invest in like Dallas, Texas in general, Texas was the number one market where that job growth happened, and Florida was pretty close behind. From an investor perspective, I’m going where all those jobs are going and that’s where we’re investing.

James:

This is why we’re in the mess we are now, right? The economy was way too hot. The money was way too cheap and then cut rates. Hopefully, and as much as I hate to say this, they keep rates where they need to be until we get this fixed because if they start cutting rates, things could explode again. And we’re going to be exactly… It’s great in the short term, right? We all make a bunch of money. We’re selling things for a lot. We’re renting things for a lot, but there needs to be some stability for us to move forward over the next five years.

Dave:

Absolutely. Well, thank you all so much for your insights on these latest stories. If you have any ideas of stories you would like to hear us talk about on future episodes of On the Market or these correspondents show, please let us know. You can put that in the comments below on YouTube, or you can always find me on BiggerPockets or Kathy, James or Henry on BiggerPockets as well. And share with us your thoughts or stories that are of particular interest to you. James, Kathy, Henry, thank you for joining us. Thank you all so much for listening and we’ll see you for the next episode of On The Market. On The Market was created by me, Dave Meyer, and Kailyn Bennett. The show is produced by Kailyn Bennett, with editing by Exodus Media. Copywriting is by Calico Content, and we want to extend a big thank you to everyone at BiggerPockets for making this show possible.

Help us reach new listeners on iTunes by leaving us a rating and review! It takes just 30 seconds and instructions can be found here. Thanks! We really appreciate it!