Estimating Rent, “Amplifying” Cash Flow, and DIY Investing

Look up “how to retire early” online and you’ll see some common prescriptions. You’ll hear investors talk about rental properties and index funds more than other options. This is for good reason since even as real estate investors there are ways we can go beyond the scope of buying rentals to amplify our wealth and set ourselves up for early retirement. This is also the exact question that one of our guests asks on this episode of Seeing Greene.

If you’ve ever wondered what you should do with your rental property profits after you’ve paid all your bills, whether or not to flip homes in 2022’s housing market, or simply how to get less nervous on the phone, then you’re in the right place. David Greene, host of The BiggerPockets Real Estate Podcast, runs through a series of different Q&A style submissions from new investors, experienced investors, real estate agents, and everyone in between.

Want to ask David a question? If so, submit your question here so David can answer it on the next episode of Seeing Greene. Hop on the BiggerPockets forums and ask other investors their take, or follow David on Instagram to see when he’s going live so you can hop on a live Q&A and get your question answered on the spot!

David:

This is the BiggerPockets podcast, show 630. When I’m working with an agent, I want an agent that knows the area, that knows what zip codes are better, that knows where development is going in, that knows where demand is strongest. I’m not just using them to write offers, I’m using them to educate me on opportunity out there.

So when you get on that first phone call with the agent, that’s what you should be doing is, tell me about the area, tell me about the kind of people that work here, tell me about the jobs that are moving in here. What part of town is in development? Which part of town is the best place to live? If they can’t answer those questions, that’s probably not the agent that you want representing you, especially if you’re buying out of state.

What’s up everybody, this is David Greene. You are host of the BiggerPockets real estate podcast here today with a Seeing Greene episode. On these Seeing Greene shows, I take questions from you and your contemporaries specific to real estate investing, whether it’s a problem you’re encountering you can’t figure out, an overall question about strategy, or just knowledge that you think will help you get over the hump in building wealth through real estate. And I answer them for everybody to hear. These are very fun shows. They’re also challenging, because I never know what I’m going to be asked when I do these. So buckle your seatbelt and get in for a wild ride.

Before we get into today’s show, the quick tip is going to be, please leave us a rating and review online wherever you listen to your podcast. People won’t hear about these shows, if we don’t have more ratings and reviews. And every single week there’s new competition that’s coming in that wants your attention and wants to be the one educating you. And I want to stay in that seat. And we at BiggerPockets want to make sure that we are giving you the best shows possible.

We are constantly changing up the format, bringing in different guests, finding ways to add more value, including doing shows like this, to stay the best real estate investing podcast in the world. And you can help us to stay there by leaving a rating or review.

All right, in today’s show, we get into some really cool stuff. We talk about if cash on cash is the best metric to consider when determining if you should hold or if you should sell. We get into how to make your investing returns more reliable, how to stabilize the cash flow you’re getting from real estate so that you can quit your job or retire early. And we get into planning how to enter a market, when you don’t know anyone there, if you want to go start a new business or find new investment opportunities. All that and more on today’s show. All right, let’s get to our first question.

Duane:

Hi David. My name is Duane. I am in Long Island, New York, and my wife and I are in the process of closing on our first investment property. My question for you is we have an apartment that we can turn into a possible two or three bedroom apartment with one bathroom.

And what we’re trying to figure out is the best way to go about understanding what the market demands are in the area to make the best decision to ensure we have a property that people truly want, i.e, there’s no point in making a three bedroom apartment, if everybody’s seeking two bedroom apartments or even a one bedroom apartment, simply because of the area that it’s in. Or we make a three bedroom, but it really doesn’t make sense because we can only get another a hundred dollars in cash flow on the property from doing that, versus the cost of making it more than one bedroom might be several hundred dollars. Look forward to hearing your response. Thanks.

David:

Hey there, thank you Duane. I like where your head’s at. You’re reverse engineering success. I hear your question and you’re saying, “Hey, does it make more sense to go for a two bedroom house or a three bedroom house, a two bedroom apartment, three bedroom apartment, maybe even four? How do I make sure that I’m hitting the right supply for the demand that’s out there and how do I maximize my return?” So I like where you’re thinking. Few pieces of advice I can give you.

There’s probably not any area where there’s no one that wants a three bedroom or a two bedroom, they only want a one. In every area you’re going to have families, you’re going to have single people, you’re going to have people that want to go in with a roommate that are going to want two bedrooms. So I don’t think you have to worry about is there demand for a two bedroom or a three bedroom as much as what kind of rent can I get for it.

Now, a few pieces of advice I can give you with that. The easiest thing is you can use the BiggerPockets rent estimator tool. So if you log in a biggerpockets.com and you see the little banner across the top, there’s a section that says tools, hover your cursor over it, and then click on rent estimator. And it basically will run comps in the area and tell you what you can get for a two bedroom or a three bedroom, and then show you the comps that are around it so you can compare your property to theirs. The quickest way that you can figure out what rent to get.

But even more so than that, getting involved with other people in your area, other investors, that own properties, they’ll be able to answer that question for you pretty quick. Because I don’t actually own property in Long Island, I can’t give you specifics on that information. But I can tell you that if I was there, I would be talking to property managers and saying, “Hey, is it hard to find three bedroom properties? What about four? Where is there the least amount of supply? So I can take advantage by creating that supply. And what kind of rents do I think I would get?” Same is true of other real estate investors. I would be asking them, “Hey, what kind of a demand are you seeing for these properties?”

And then the last thing would be looking for floor plans of homes that can easily add bedrooms. So maybe you go after a two bedroom house that has a family room, a living room and a dining room, and you can take the living room and the dining room and turn them both into bedrooms and turn that two bedroom into a four to get more rent. Or even turn it into an ADU situation where now that one property with the four bedrooms can be split into two where you rent one of them out as a single home and the other one out as an ADU, but you have two different rental properties.

I’d be looking at opportunities like that, as far as answering this question, but there’s tons of people out there in your area and they’re almost always happy to share the information. So good news is Duane, this is not going to be a tough problem for you to solve.

Another thing to consider that I’ll throw in here at the end is that if you can get more bedrooms, you can actually rent out by the room. Now, some people aren’t as comfortable with this, but if you really want to maximize return, renting out by the room, becomes a win-win for everybody. You get more rental income, because you’re going to make more renting by the room than you are as it by the unit, and the people who are staying there all get cheaper housing, if they rent a room instead of renting the unit.

The only place where anybody loses is in comfort. It’s not as comfortable to only have a room and rent out the rest of the unit to other people. But especially with the economy getting tougher with inflation hitting, with everything becoming more expensive, I think you’re going to see a lot more demand for people that would rather rent a room than rent an entire unit and save some money. And them saving money will help you make money, which is what we’re all about with real estate investing. Good luck to you and your wife. Let me know how it goes.

Next question comes from Mahru in Malvern, Pennsylvania. During a recent webinar, you mentioned that you know some agents in Florida. How did you select the agent who helped you with a short term rental house, and how can I find an agent like that? That’s a good question, Mahru.

So I’ve talked at length in different shows about what kind of questions I ask real to agents, when I want somebody to be working for me. I’ll give you a couple pieces of advice here and I’ll recap those conversations.

The first thing I would say is BiggerPockets has an agent finder, you can use. If you hover over the tools banner, and then you click on agent finder and type in the city that you’re looking for, you’ll get a list or a directory of different agents in that area. And you can check out their profile on BP, you can see how many other people they’ve sold houses to. You could get a feel for their history when you’re going to choose your agent.

Now I use that tool sometimes, I add those people to the list, but it’s not the only thing that I use. What I’m doing is I’m calling and I’m looking for agents who own the type of property that I want to buy. If I’m buying short term rentals in Florida, I ideally want an agent who also owns a handful of short term rentals because now I’m not only getting their expertise and I’m not only getting their service, but I’m also getting their resources.

They’re going to be able to tell me what property management company they use. They’re going to be able to tell me what properties booked better than other properties. I get the benefit of all of their experience, when I use them. This is the same reason that people come to the David Greene Team. They don’t just want a real estate agent, they want an agent who has worked with me or helped buy properties for me, or has been taught by me because they’re getting all my experience when they use those agents.

So you can call different brokerages out there and you can ask for an agent that specializes in short term rentals or that owns short term rentals. You could call property management companies that would be managing your deal and ask them if they have any agents they recommend that they’ve worked with before, because they know what agents are referring them a lot of business and they’d love to be able to refer business back. But more importantly, if an agent is referring them a lot of business, they’re doing a lot of business in that asset class, so you’re getting a more experienced person.

A lot of people think that what’s important as an agent is responsiveness or handholding. Those are nice, but they’re not the priority. The priority is their experience. When I’m working with an agent, I want an agent that knows the area, that knows what zip codes are better, that knows where development is going in, that knows where demand is strongest. I’m not just using them to write offers, I’m using them to educate me on opportunity out there.

For the most part, I can tell them what I need, what the offer price needs to be. What I need from them is their knowledge of the area. So when you get on that first phone call with the agent, that’s what you should be doing is, tell me about the area, tell me about the kind of people that work here, tell me about the jobs that are moving in here. What part of town is in development? Which part of town is the best place to live? If they can’t answer those questions, that’s probably not the agent that you want representing you, especially if you’re buying out of state.

Nicole:

Hi David. Nicole Eller here from San Diego, California, currently living in Jacksonville, Florida. Our question to you is whether we should cash out on our Orange County, California condo, and allocate those funds into a few properties here in Florida, throughout Florida? We should get about $250,000 if we were to sell today and want to know if you think that is a good idea.

We currently have a few things to consider. Number one, the HOA has pending litigation, so we will need to sell here pretty soon or else be held up without being able to get a loan in that community. So want to strike while the iron’s hot. Also we will avoid capital gains if we sell in the next two years, so we’re thinking of just go ahead and getting our equity out of there and reallocating.

One thing to consider is that we really want to move back to California eventually and it’s a nice little property to have to slide back into. It’s affordable. Also, we have a 10% cash on cash return, which is not bad, and it’s getting us $425 a month. So we could leave it as a long term rental, but not sure what to do. Anything you have would be wonderful for input.

David:

Thank you, Nicole. So in case you didn’t know this, I actually have a real estate team that works in Southern California and they are awesome. So you need to reach out and I’m going to set you up with a consultation with one of them. But for the advice of everybody listening, I’m going to tell you what we’re going to be going into, so that other people know what conversations they should be having with their agent.

Now, if you’re a real estate agent, you might want to check out the book I just had released with BiggerPockets called SKILL, which is all about how to be a top producing agent, because the conversation I’m about to describe here is taught to you how to do in the book. And this is how top producing agents should be having conversations.

So you mentioned some really relevant and pertinent pieces of information that we would need to know during the consultation. You’ve got an HOA situation going on, you want to be able to move back to California at some point and you’re trying to figure out, should you sell, and if so, where should you put the money. You also mentioned something about a cash on cash return of 10%. You said that you’re making $425 a month, I believe is what it was. So let’s do a quick analysis of what your return on equity would be.

So you have $425 a month, times 12 months in a year is 5,100. If we divide that by 250,000, which is what you think you’d walk away from, you’re actually making a 2% return on your equity. You made a very common mistake that everyone makes, you said I’m making a 10% cash on cash return. That means that you’re looking at your return from the money you put into that deal when you bought it, but that’s not accurate because now you have more equity than you did when you first bought the deal.

So you’re actually getting a 2% return on that condo, as well as taking a significant amount of risk, that there could be an assessment that comes your way through the HOA that’s going to take all of that return you think you’re getting and remove it. So at first glance, the answer becomes, yes, you should sell it. And the question now becomes, where should I put the money? And this is why I want you to reach out to one of us because we can walk you through this and handle it all for you.

Now you’ve got a couple things to take into consideration with where you put the money. You want to invest it somewhere that you get more than a 2% return, that becomes a win, and you probably want to buy something in California because you mentioned you want to go back there. Now, if you can’t find anything in California, that’s okay, but we need to make sure when we help you reinvest that money, that we do it in a way that you have access to liquidity, so when you want to move back to California, you can buy something else.

So that’s the two ways we approach this, you either buy something in California now and you keep it and rent it out so that when you move back you’ve got a property, or you keep the cash available so that when you want to move back to California, you can buy something.

Now the question becomes, as far as maximizing efficiency, are prices going to go up in California, go down or stay the same? If you think prices are going down, you should keep the cash set aside or invest in something with a really big down payment where you could get the equity out of it, when you want to buy in California. If you think prices are going up, we would want to help you to buy something in California, so you’re not paying more later. And this is the benefit of having a team that works in the area where you’re talking about.

Ideally, what we would do is we would sell your condo. We would take the money that you say is tax free because you’ve lived in it recently enough that it’s free of capital gains. We would help you buy an investment property in California that had multiple units, a three or a four unit type of a property. You would rent those out and you would make a return, but you’d have a space there available, if you wanted to move back. It doesn’t have to be your dream home, but it’s enough to get your foot in the door, and from there, we would help you to find your dream home.

With the rest of the money that you didn’t have to spend on that property, we would help you buy some other things in Florida or different states. And before I give advice on that, we would have to ask what your goals are. Do you want to own short term rentals, are these long-term rentals or is this something you just want to add equity to, so you can pull it out later and sell it and put that money somewhere else, or do you want to own long term?

When we have our consultation that’s the kind of stuff we’re going to be going over. I really appreciate you asking this question, because it gives me an opportunity to let our audience hear how a good realtor is going to approach the question of, should I sell my condo or not?

What most realtors are going to do is say yes, let me sell it and then you’ve got to figure out what you’re going to do with the money later. The best agents are also consultants. And in addition to being a consultant, they have resources that they can put towards helping you achieve your goal, and they do what I just did, they present options. You could do this, you could do this, you could do this, which of these resonate the most with you?

And then you’ll say, “I really like the 80% of what you said, David, but this 20% doesn’t work and here’s why.” Good let’s adjust how this 20% would work, so it does meet with your goals, then we paint a more clear picture. It starts off very fuzzy and through the consultation, it gets sharper and sharper and sharper until now you know what the right move is. And then it’s just putting you in touch with the right people to help you do it. So thank you very much for the video, Nicole. Please reach out to me. You can either email me. You can hit me up on social media, whatever it is we’ll get you set up.

And for everyone else who is listening, look for a realtor that does this. And if you’re a realtor and you’re not doing this, it’s time you start practicing so you can learn how to have these conversations to really look out for your client’s interest.

All right, we’ve had some great questions so far and thank you everybody for submitting them. We wouldn’t have a show if you didn’t submit questions. So you are the real MVP. If you would like to submit a video or a written question to me to answer on this show, please go to biggerpockets.com/david. I’ll tell you a secret, we were going to do a show like this years ago. We just couldn’t figure out what URL to use to send the questions to.

All right, at this segment of the show, I like to read comments from previous videos that I have done, hosted on YouTube, where people have commented on the show. We often have people that write something that’s funny or silly or provocative or thought provoking. And so it’s cool when I get to read through these and hear what you guys are saying, and this is also my way of saying, go on YouTube and leave me a comment right now about what you like about the show or something you thought was funny so that I can read your comment on a future episode.

All right, first comment comes from Noah Ofisa. Planning for my first investment property in a year. Thank you for your encouragement and wisdom. Love to hear that Noah. Best wishes for you on that and please stay in touch and let us know how it goes.

Next is from Ice Gazer, that’s a very unique name. Hey David, great podcast once again. I have a situation you may have dealt with in your life. I’m a police officer as my day job and when I’m working, I have no issues or qualms about getting on the phone to call someone back. I don’t ever hesitate, but when it comes to real estate, I hesitate every time. I’m very new to real estate, which is most likely the reason. I was wondering if you have any tips or advice that could help me over that hump. Thank you, from Taylor H.

That’s a really good question, because this is the stuff I think about in my own life all the time. Oftentimes when I’m at work and I have to get on the phone and solve a problem, I do it right away, but in my personal life, if I have to call the cable company or DIRECTV or the internet or something, for some reason, my phone starts to weigh 500 pounds and I just don’t want to do it. It all has to do with mindset.

So here’s my guess. When you were first a police officer, you were very nervous about making these same phone calls, but your training officer forced you to do it. They made you go through it, that you had accountability right there. And you did it enough times with supervision that you then got over your fear of doing it and it became second nature and you didn’t worry about it.

You need to find the same thing with real estate. You need a person who’s going to make you make these calls, who’s going to watch you do it, who’s going to listen to you and then tell you what you could have done different. That could be a broker, it could be another agent in your office. If you’re on a team like mine, we provide that to the agents. We make them do the hard stuff until it doesn’t feel hard anymore.

And then last thing I’ll say is don’t beat yourself up, because this is human nature. It is like this all the time. I’ll just be transparent. When I was younger, I was very skinny. You wouldn’t think so from looking at me now, because that’s not a problem that I’m still struggling with, but it was a big problem for me that I was a bean pole and I was very insecure. I thought about my skinniness and my lack of masculinity constantly. It was painful.

I was very intimidated and nervous and would not go to the gym because every time I went, I just saw bigger, stronger guys that made me feel bad. And that pain was so much that I would think about going to the gym, I would drive by the gym, I would look in the window, but I would not go in there because I was too intimidated to go try to learn how to use the machines or lift the weights without any help.

I had a friend named Paul, Paul Cole, and Paul brought me to work out and I still remember him to this day because his oversight, which was a very small thing for him, he just brought me along and taught me the different movements that you’re supposed to do, gave me the confidence to start working out and that is now a pretty big part of my life and my health and my fitness.

The same is true of jujitsu. I knew I wanted to go for a long time, but I just did not want to show up on my own and say, “I’m here.” And my friend, Justin Hoglund got me into doing jujitsu. He went with me, we did some private lessons and eventually I ended up getting into the class. So what I’m saying is if I struggle with this, it’s okay that you do and it’s okay when everyone else does.

When I was a brand new agent, I remember having another agent in the office that would sit there with me and make me call the people from my open house and whisper in my ear what to say when I would get stuck. I was so scared of talking to people that I would not call the people from my open house. Now I can get on the phone, I can jump into any situation and I’m not nervous at all because I know how I’m going to get through it, but it didn’t start that way.

Don’t think it’s weird that you’re going through this right now because everything in life is like this. There’s a lot of people, especially introverts that are not comfortable just throwing themselves into new situations. The secret is to get a friend, a mentor, someone to help you that will do it with you until it becomes habit. Thank you for leaving that comment and giving me a chance to share some of my own struggles with you.

From SF Trail. Buying at market price is bad advice. You need to have a margin of safety in any investment. Okay, so this comment comes from one of the previous videos I did where apparently I gave some advice when I was telling people, hey, you should buy and it’s okay to pay market price, or maybe I was saying that there’s people that are trying too hard to find the best deal ever and they’re buying nothing. And I really like this comment, even though it was written in a way that was confrontational because it gives me a chance to explain what I meant by that.

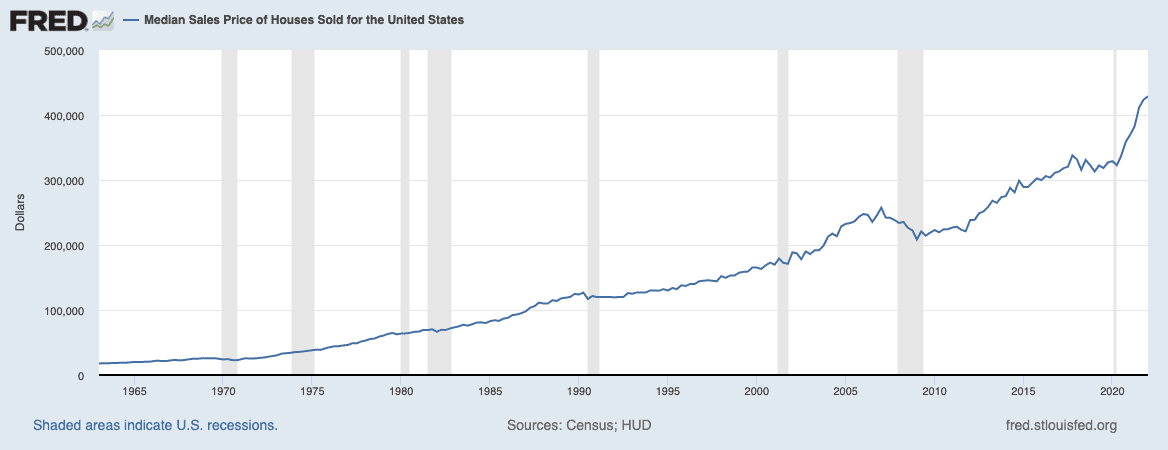

The problem with looking at real estate and saying I want to pay less than market price is that market price is a moving target. What market price was two years ago is different than what it was last year and it’s very different than what it was five years ago.

In my experience, I have seen so many people that five years ago had a chance to buy a house for 500 grand, but the seller wanted 510 and they wouldn’t budge, they said, “I’m not going to overpay.” And so they walked away from the deal and said, “I’m going to wait for a better opportunity.” And five years later, those properties are 800, 900, sometimes a million dollars, okay? To save 10 grand, they lost out on a potential half a million life changing wealth that wasn’t built.

And I’ve seen this happen so many times in my own life. I have what I thought was overpaying, I didn’t feel great, the seller wouldn’t budge. I loved the area, I loved the property, I loved either the rehab plan or the lack of a rehab plan. I loved a lot of things about the deal, but I didn’t love the price. And I went through with it and I look back now and I’m like that property’s gone up $350,000.

I’ll give you an example. I had two properties in Maui that I was trying to buy maybe a year and a half ago, year ago and I wrote offers on 12 deals and I got counters on maybe four or five and two of them I was able to put in contract. And one of them had a problem with the bathroom. There was a lot of mold and it was going to be like 15,000 bucks at best, maybe more to find a person to go in there and to fix it. So they were going to have to rip it apart and put it back together after they fixed the mold.

And I was stuck. I did not like the seller, would not budge at all. The market was somewhat soft out there. The seller had listed their house for about 650. I had it under contract for 550 and I wasn’t sure what it was going to appraise for yet, but I had to make this decision. And ultimately I said, “All right, I’m going to have this property for the next 30 years. I’m sure I’m going to make this $15,000 back at some point, let’s do it.” And I closed on the deal.

That specific property is now just south of a million dollars. The condo right next to it that’s not as upgraded as mine just sold for about $975,000. Mine’s a little nicer, so it could be worth a million. This is over a year and a half. That’s how much money I made in that deal.

Now I was buying at a time when nobody else was buying. Other people didn’t want these properties. Travel was restricted because of COVID, so the Airbnb numbers were very low. I totally understand that I was taking a risk and making a move that other people wouldn’t have done.

But what I’m saying is I was in a mindset that thought, I don’t want to overpay, I don’t want to overpay. And does it look like I overpaid now? Unless I talk about that deal on a podcast like this, I don’t even remember it. I don’t think about the fact that I made $500,000 from one good decision. My brain doesn’t bring that up. It just brings up the times I might have lost. And that’s what I’m getting at.

I don’t want people to overpay, but what I think is that overpaying is a moving target. It’s not the same way that real estate used to be. Values go up so fast and can go down so fast that using whatever today’s current market value as your barometer for good wealth is just unwise. It’s not going to stay at that price forever.

If real estate didn’t go up in value and it just held its value, I’d be saying the same thing, don’t overpay, get it below market value. But to wrap this up, there is no market value. There’s only today’s market value. Tomorrow’s will be different. A year’s will be different.

And this works the other way too. Let’s go back to 2006 and you get a property for $800,000 that appraises for $900,000, you crushed it. You’re telling all your friends how great you negotiated and this awesome deal you had and you’re feeling good about yourself. And then 2008 comes and that property’s worth $300,000. Did you crush it? Were you safe because you got it under market value? Absolutely not.

And all I’m trying to highlight is there’s a false sense of security, a form of a fallacy that if you get your property for less than the list price or less than the appraise price that that inherently means you’re safe, because it doesn’t. When values drop, they drop precipitously. There is no stopping it. Your equity evaporates, before you can do anything. And when prices go up, what you thought was a so-so deal becomes an amazing deal.

So I’m just saying, stop looking at real estate from this perspective of right now at this exact moment, this is what the COPs show that that property is worth. Take a longer term approach and bring some wisdom into what you’re buying and don’t let your ego in the form of, I don’t overpay get in the way of making sound, smart financial decisions that are going to set you up for the future.

All right, so again, please comment on YouTube. Let me know what you thought, but don’t just do that. If you’re listening to this anywhere else, on Apple, on Stitcher, on Spotify, wherever you hear your podcasts, would you please do me a favor and write us a review? The more reviews that we get on this podcast, the more people find it, the more people we can help and the bigger we grow our community. That helps with better questions in the forums, better questions being asked on episodes like this, and more members of BiggerPockets to share more wisdom with.

Salman:

Hey David, this is Salman. We actually met at BPCON in NOLA last year. I think you complimented my shirt. I told you my wife had picked it out, so I couldn’t tell you where to get one.

Anyways, I’m currently in New Jersey. This is where I live. I’m looking to invest. I’m currently looking to flip at the moment so I can regain some capital and throw it into other future rental properties. The problem I’m running into right now is the price of the homes for the acquisition and some of the rehabs are very expensive. And in one instance, a contractor quoted me the rehab was actually more than what the acquisition price was.

I’m finding it more and more challenging right now in this current market to find a deal in a property that’s within my budget and it’s got me thinking whether or not I should be looking to flip right now at the moment, or maybe should I wait, or do I look at a different market or do I look at waiting out a little bit and just acquiring rentals instead? So appreciate your help. Love the podcast.

David:

Thank you for that, Salman. You should have put the shirt on that I commented on that I liked when you made the video, then I probably would’ve remembered. But I do do that sometimes, I’ll see somebody wearing a shirt that I like, and I’ll go up to them and ask them what brand it is or where they got it, because I’m terrible at shopping and I would rather not have to go try to figure out how to find clothes I like. I’d rather just order something that looks good on somebody else.

So I think the problem that you’re running into is a very common one in today’s market. Flipping homes in general is very difficult and finding homes on the MLS is very difficult. Put them together, and it becomes super difficult to do what you’re trying to do.

For a long time, home flippers were solving a problem that other people did not want to solve. They could go on the MLS, they could find the properties that were beat up or not selling, or nobody wanted, and then fix them up and sell them for more. And the reason they made money was because they were solving a problem.

When there’s such a lack of inventory, people become less picky about the house that they get, they just want a house. And so these houses that used to sit forever, that a flipper could go pick up at a great price, now isn’t sitting at all and they’re selling very quick, and that’s why you’re having a hard time finding a deal.

Now, couple that with the fact that there’s so many people that are doing rehabs on their homes, that contractors are very hard to get. It’s not just flippers that are using them. Agents like me that are going to sell a house for somebody else are using contractors to fix it up before we put it on the market to get our clients more money. People that are buying houses that are not fixed up, are using contractors to fix the house up, once it’s been bought. And people that are not even putting their house on the market are having it fixed up because they see it’s adding equity to the deal. Everybody wants contractors right now and that means that they charge a lot more and they’re harder to use. This is a serious problem when you’re trying to flip homes.

So I’m not going to tell you don’t flip, but I am going to say, if you’re going to flip, I would probably not be looking on market. I would be spreading word of mouth to find an off market opportunity for someone that wants to get rid of their house that needs some work, try to flip it that way.

The other piece of advice I’ll give is maybe flipping isn’t worth the juice isn’t worth the squeeze, I’ll say. The amount of work you’re going to have to put in to find the deal and the amount of work you’re going to have to put in to get it ready for the profit you’re going to get is going to be very low. And that’s one reason that home flippers are having a hard time right now. Flipping works better when there’s a lot more inventory to pick from, when there’s more supply and therefore you can pay a better price for the same home.

So maybe look at a different strategy. If you think home prices are going to keep going up, maybe start buying a primary residence with a low down payment in a great area and let appreciation go up and do a live-in flip. Slowly fix the house over time, where you don’t have hard money costs, or you don’t have as high of capital costs and you’re not as dependent on the contractor to be available. You can do it in small pieces while you live there.

While it might not be as sexy as boom, a quick influx of capital, it does reduce risk. It is safer and is usually a smoother ride. Mindy Jensen who hosts the BP Money show is notorious for doing live-in flips. She’s got a really good system together where she’s lowered her risk and has been okay with a more reasonable return on her money, because it’s happening over a couple year period of time, but it’s like a guaranteed win. She’s getting market appreciation as homes go up, then she’s getting forced appreciation from doing the work.

And if it doesn’t work out, if for some reason the bottom drops out of the market, you just keep living in your house and you wait until later. It’s really a safer way to invest and I think in this market that might work out better for you.

All right, next question comes from Fernando in Tokyo. Hey Dave, big fan of the show. I’m 33 years old living in Tokyo with my family. We have two single family rental properties, one in Seattle, one in Nashville. We’re going to sell the Seattle home because we’re no longer comfortable with the business case for the property and would like to redeploy that capital and liability through a 1031 exchange.

I’m considering using a turnkey firm, such as Doorvest or another active wholesaler to find and manage the replacement properties. The reason is that I’m from abroad and I’m not sure I can commit the work needed to find a better deal myself. It would allow for a safer way to use the exchange and I could learn the process since it would be my first 1031 exchange. What is your advice in this situation? Should I take the lower return to try to learn the process by using a turnkey property, or should I try to maximize returns and risk finding the deal and rest myself?

All right, Fernando, good question here. Let’s see how we can tackle this bad boy. 1031 makes sense if you don’t like the area the house is in, so that, you’re good there. Now we’re talking about how we’re going to put the funds into place.

Turnkey, the idea behind that is that it’s a can’t miss, you buy the property, it doesn’t need any work, it’s going to rent well, it’s going to be managed well. It’s hands off, you don’t do anything and you’re going to get less of a return, but still a return, okay? Under those assumptions, I think that could be a good idea for you.

My problem is that it rarely ever works out like that for the investors. Many people’s expectations when they buy a turnkey property, do not turn out as good as what they thought. They often end up paying more than market value and then their return is less than what they thought. And the house has more problems than they thought, and it’s not in as good of an area as they thought, and then they end up wanting to get rid of that home just like they wanted to get rid of the Seattle home, but they can’t because they paid more and the area isn’t appreciating.

You rarely find turnkey company providers finding deals in the hot markets that are going up the most. In fact, the way they make that business model work is that they go to the areas that don’t have as much appreciation, where rents don’t go up as much and there’s less demand from other investors. That makes them able to get more inventory that they get, that they spruce up and then they sell.

So if you’re going to go the turnkey route, I would say, make sure you study the area independently of what the turnkey company provides you. Don’t just look at a picture of the house, use Google Maps and go through the entire neighborhood. You don’t want to be buying the nicest house in a terrible neighborhood. Make sure you have a history of what rents are doing. Are they actually increasing every year or are they staying the same? Look at how much available inventory there is in that market for you to go buy. There’s a possibility that you go find a house that is in just as good a shape as their turnkey option in the same neighborhood, but for less money, and you could just buy it, use a property manager and boom, it’s the same as turnkey.

The other thing to consider is you can do it yourself, but there’s going to be more time that you’re going to put into it. So maybe find a property management company and see if they can function as a turnkey provider for you. Can they go find you a deal and then manage the rehab that’s going to have to happen, whatever handyman has to go in there, paint, carpet and kind of function in the same way as a turnkey company, but maybe get you a better price.

The last piece of advice I’ll throw is that not every turnkey company is the same. There’s probably people listening to me saying, “I bought with this turnkey company and they were amazing and I loved it,” just as much as there’s people saying, “I hate turnkey because they did a terrible job.” So don’t assume all turnkey is equal. If you have a good relationship with a really good company that you really trust, yes, I would say it makes sense to do that. If you don’t know that company very well, don’t assume that they’re going to do a good job for you.

All right. Our next question comes from Brian Schaffer in Cheyenne, Wyoming. I’m active duty Air Force and I’m separating the service in November. I’m becoming a real estate agent following my separation in a market where I have no connections. How am I to build rapport and make connections right now in an out-of-state market so I can hit the ground running regarding both investment opportunities and being an agent. Thank you, David.

All right, so one thing to keep in mind, Brian, and really anybody else who’s listening to this, if you’re in the military and you like BiggerPockets and you’re going to be transitioning out anytime soon, they have a program that at one point was called the SkillsBridge program and now I think has a different name, maybe it’s Career Opportunities program or something like that.

But basically for your last six months of employment, they will allow you to mentor with a different company to learn skills that you can use when you get out of the military. So I’ve had several people that were active duty Air Force or other branches that moved to California and interned with me to learn either how to be an agent or how to be a loan officer or one of the companies that I have. And at the end of their six months, they either kept their job with us or they moved on to go do something else, but it was really a risk free way of learning a new career.

And I would highly encourage you, Brian, if you’re going to be in Southeast Idaho or if you’re going to be staying in the area that you’re living in now, in Wyoming, that you should look for a person that you could intern with through that SkillsBridge program, that would be really helpful for you now.

And also if you’re someone else, please reach out to me if you’re in the military and you’d like to do something like that and we’ll start those talks. If you are looking to build rapport and make connections in a different market, that you’re not, the first thing you need to do is be very active on biggerpockets.com. You need to set up a keyword alert for the area you’re going to be moving to, the different cities there and start answering everybody’s questions that are curious about what to do in that area. You need to start building relationships. You need to go add colleagues from that part of the country. You need to start building relationships with those people.

The more information you get of your own on BiggerPockets, the more you can point people to when you get to that area and you want to have some trust and credibility also built. Not living there, you’re going to be tough on other options. You’re not going to be able to fly there and actually build people and make relationships. So what I would do if I was going to be an agent is I would start researching different brokerages from out there and finding the one you want to work with and then getting to know the leadership in that brokerage so that they can give you books to read or things to study or something to do to prepare yourself for being a real estate agent when you get there.

Another thing you should do. So I’m looking at buying some property in Scottsdale. I bought one with Rob, I’m looking to buy some more. And I started thinking, at some point it might be nice to have a David Greene Team in Scottsdale that could help other people buy properties the same way that I’m buying. My mind started going to, what would I have to do if I wanted to do this? And it reminds me exactly of what the question you’re asking here.

So I started thinking about how I would need to get a map of Scottsdale divided into different zip codes and start studying what each of those zip codes were known for, where the boundaries were. I would need to start getting a feel for the city itself, so if people had questions, I could answer it with confidence.

Now I’m probably not going to be the one doing that, but I would give these marching orders to whatever agent I hired to be my Scottsdale representative out there. I would want to quiz them on different parts of the area and see if they could answer confidently, when people wanted to know what’s going on. I would need to know different zoning restrictions. I would need to know what the political office in that area is doing concerning what type of permits they’re going to be issuing.

I would start learning a lot of the questions that people are going to be asking you when you get there before you actually get there. That way, when it happens, you’re speaking with confidence and you can start educating people that want to buy houses on stuff that they would have no idea they needed to know. You should know which part of town has the higher property taxes and which part has the lower property taxes. You should know where the HOAs are and what type of condition each of those HOAs is in. There’s a lot you can start doing to learn the actual city that will help you when you get there to build rapport with people.

All right, we have time for one more question and it comes from Tyler Mundy.

Tyler:

Hey David, how’s it going? My name is Tyler Mundy. I’m a real estate agent and investor here in Charlotte, North Carolina. Love the BiggerPockets podcast, love what you guys are doing. I’ve been listening for a couple years avidly and my question has to do with financial independence. I know it’s a big theme for the show as well as rental income.

So you said in the last couple episodes that you would recommend not trying to retire on rental income, just because it’s unpredictable, maintenance and tenants and evictions can cause loss of cash flow, which would obviously be huge if you’re depending on that. So I was wondering what your thoughts were on a strategy. I recently read Scott Trench’s book Set for Life, thought it was great. And he mentioned index funds in there. I know it’s a huge theme in financial independence literature in that community.

So I was wondering what your thoughts were on the strategy of trying to amplify wealth through real estate, flips, rentals, BRRRRs, new construction, things like that, build capital. And then once you’ve built some money, say a million dollars or so, whatever that number is, then putting that into index funds. And then at a 10% return, you’d have a hundred thousand a year without the maintenance and evictions and broken water heaters and plumbing like you have, that you could have in a rental. So I was wondering what your thoughts were on that, if you have some insights. Appreciate you. Thank you.

David:

Tyler, I got to say, I like where your head’s at. I like how you’re thinking. Now on the specifics of an index fund, like Vanguard, I really can’t comment because I own very little stocks. So I don’t want to give advice about something that I don’t understand, but that principle, yes, I like where you’re going.

I do think it would be wise to learn how to move money through a conveyor belt. So I have this maybe philosophy that I operate by that I call make it, amplify it, invest it. So I’m all about earning money through a job, through a business, through a side hustle, through something, amplifying that money through a flip or through a BRRRR or through some type of investing strategy where I’m going to add capital and then taking that amplified amount and investing it long term.

Now what you’re describing is something that could be about making money and amplifying it through real estate and then investing the returns into something else like this fund that you’re describing here. I like that. I like looking at how to take money like a snowball and add something to it as it goes downhill. I can’t tell you on the specifics of if you should be doing it through stocks, but I do like what you’re thinking there.

I will clarify about when I said that it’s difficult to live off of cash flow. That is true. Most people that put their numbers into a spreadsheet find that the result that they get is very different. And that problem is when you get a handful of properties and you want to quit your job and live off the cash flow. One property that needs a new roof can mean that you’re not making your mortgage payment now because that money that you thought you were going to live on has to go back into the deal. But I wouldn’t say that cash flow never becomes reliable, it’s mostly in the beginning, early stages and cycle of owning a property.

So I noticed the first three to five years of the stuff that I own, there’s just things that go wrong that I never thought would. I just can’t catch it, but owning a property for a significant period of time where a lot of the stuff that’s going to break gets fixed for the long term, they stabilize over time. If you let that tree grow, eventually the fruit becomes much more reliable and predictable. So the properties that I bought 10 years ago are very stable. The stuff I bought two to three years ago, very unreliable. So over time, your properties will stabilize.

Another thing is that asset classes within real estate tend to operate differently. Short term rentals, super volatile. The cash flow is not something that you can just depend on. Single family homes in my experience, or even small multifamily tends to have things break that you haven’t budgeted well for, but really big commercial multifamily, much more reliable cash flow.

When you hit this point where you have, I can’t remember the fancy economic term, but basically you have a scale, like you have one handyman that can do the work for all of the properties and you budgeted that person’s salary into all the money that’s coming out of that apartment complex … Someone’s going to remember this and they’re going to leave it in the comments, what the economic term I’m trying to remember is … it becomes easier to predict what your cash flow is going to be versus when something breaks and you got to pay 500 bucks for a handyman to figure out how to fix the plumbing or whatever the case may be, or rip apart the foundation to get to something that has to be repaired.

So a good strategy could be, make money, amplify it through single family investing and then sell it and 1031 into multi-family investing where it becomes inherently more stable. So I like what you’re thinking, because you’re thinking about how do I turn something unreliable into something more reliable, but there’s many different ways you can go about doing it.

For everybody listening, just consider that buying that duplex and holding it forever might not be the most stable way to build cash flow, but that doesn’t mean you shouldn’t do it. You should absolutely look at doing that, building equity, then moving that equity into more stable ways of reliable income, if you’re going to retire and stop working.

All right, thank you everybody for your time, for your attention, and for listening to the show. I know that there’s many people that all claim to be real estate experts and gurus, and that you could be listening to any of them, but you’re here with us at BiggerPockets. And I really appreciate the fact that you’re trusting us and me with your real estate investing education.

I would highly encourage you to go to biggerpockets.com/david and submit a question for me, just like all of our awesome guests have done today, so I can answer it on this show, as well as leaving us a review wherever you listen to your podcast, and leaving a comment on YouTube.

If you’d like to follow me, I am davidgreene24 on Instagram, on Facebook, on LinkedIn, on Twitter and everywhere else, and I’m David Greene Real Estate on YouTube. Thank you guys very much. Check out another show and I’ll catch you on the next one.

Help us reach new listeners on iTunes by leaving us a rating and review! It takes just 30 seconds and instructions can be found here. Thanks! We really appreciate it!

Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Check out our sponsor page!

Estimating Rent, “Amplifying” Cash Flow, and DIY Investing Read More »